Money

1.1million people with a disability could claim up to £5,644 extra a year – check if you’re eligible

Around 1.1million people in the UK living with a disability are missing out on £5,644 extra a year in benefit payments.

Attendance Allowance is a payment handed out by the Government to help those above State Pension age living with physical and mental illnesses.

How much you receive depends on the severity of your disability, with the maximum payment working out as £434.20 a month.

However, a recent report by Policy in Practice found that 1.1million people may be missing out on the cash boost.

If there is a chance you or someone you know could claim the benefit then it is important to check your eligibility.

To qualify for the benefit, you must be aged 66 or over and live with either a mental or physical disability, or you require help looking after yourself.

You also must have been experiencing these issues for at least six months.

If you live in a care home, you can only claim Attendance Allowance if you pay for all your care home costs yourself.

If you do need an assessment, you’ll get a letter saying why and where you must go.

During the assessment, a medical professional will need to examine you.

If you are confused about your eligibility, it is worth getting in touch with the Department for Work and Pensions (DWP) to ask for their guidance.

You are still entitled to your state pension even if you claim this benefit.

How much can you get?

Those living with less severe disabilities can get up to £72.65 a week, which works out at £290 a month.

You may be eligible for this if you require help or constant supervision during the day or at night.

The higher rate of £108.55 a week is given to those who require supervision throughout both day and night, or if a medical professional has said you’re nearing the end of life.

This works out as £434.20 a month or £5,644 a year.

If your circumstances change, you could get a different rate, so it is important to report any changes to the DWP.

You could get extra Pension Credit, Housing Benefit or Council Tax Reduction if you get Attendance Allowance – check with the helpline or office dealing with your benefit to see if you quality.

How does the state pension work?

AT the moment the current state pension is paid to both men and women from age 66 – but it’s due to rise to 67 by 2028 and 68 by 2046.

The state pension is a recurring payment from the government most Brits start getting when they reach State Pension age.

But not everyone gets the same amount, and you are awarded depending on your National Insurance record.

For most pensioners, it forms only part of their retirement income, as they could have other pots from a workplace pension, earning and savings.

The new state pension is based on people’s National Insurance records.

Workers must have 35 qualifying years of National Insurance to get the maximum amount of the new state pension.

You earn National Insurance qualifying years through work, or by getting credits, for instance when you are looking after children and claiming child benefit.

If you have gaps, you can top up your record by paying in voluntary National Insurance contributions.

To get the old, full basic state pension, you will need 30 years of contributions or credits.

You will need at least 10 years on your NI record to get any state pension.

How do I claim attendance allowance?

To apply, you’ll need to download the attendance allowance form on the gov.uk website and then send it by post.

It should be sent to the following address: Attendance Allowance Unit, Mail Handling Site A, Wolverhampton WV98 2AD.

If you’re unable to print the form yourself, you can call the attendance allowance helpline on 0800 731 0122 and ask for a copy to be sent to you.

It’s worth applying, as you may get extra pension credit, housing benefit or a council tax reduction if you receive attendance allowance.

The application form is very long and asks for a lot of personal information.

If you think you’ll need help filling in the form, you should get a friend, relative or adviser to help you complete it if possible.

Entitled to has a full list of organisations that can help with claiming disability benefits on its website.

If you want to know if you are receiving the right amount of benefits, you can use a number of online calculators including on the EntitledTo and Turn2us websites.

Money

Quality Street brings back long gone fan-favourite flavour for second Christmas after decades off shelves

NESTLE is bringing back a Quality Street fan-favourite for the second Christmas in a row.

The coffee creme flavour chocolate was last seen in Quality Street tubs over 20 years ago, until the chocolatier reintroduced it last year.

Nestle has confirmed that the sweet treat will be available once again this Christmas.

However, fans won’t find the iconic flavour in the usual Quality Street tubs.

Instead, the coffee-flavour fondant wrapped in dark chocolate will join the 11 other Quality Street sweets at pick and mix stations across selected John Lewis stores in the UK.

The first pick and mix station opened today (September 25) at John Lewis’s flagship store on Oxford Street.

Other participating stores will begin rolling out the sections throughout October.

However, if you don’t live near a John Lewis, you can still get your hands on Quality Street’s coffee creme chocolates.

They will also be available in a limited-edition cracker at Waitrose and John Lewis stores for £5.50.

Shoppers can also buy a bag of coffee creme chocolates to add to their current Quality Street tins for £4.50.

Emily Grimbley, brand manager for Quality Street, said: “It’s a pleasure to share the news that coffee creme will be returning for Christmas 2024.

“This is an absolute fan favourite, and we are delighted to have it on shop shelves for Quality Street fans nationwide.

“We know how passionately Quality Street fans feel about their favourite sweets, so the pick and mix stations at John Lewis are people’s chance to fill up their own bespoke mix with just the sweets that they and their friends and family love.”

Fans of the discontinued chocolate will be delighted to hear it is making a comeback.

LOCATIONS OF JOHN LEWIS’ PICK & MIX

SHOPPERS can create their own bespoke collection of Quality Street favourites to take home, or gift, this Christmas at the pick and mix stations.

These will be located at the following John Lewis stores from September 25:

- Bluewater

- Cambridge

- Cardiff

- Cheadle

- Cribbs Causeway

- Edinburgh

- Glasgow

- High Wycombe

- Kingston

- Leeds

- Leicester

- Liverpool

- Milton Keynes

- Newcastle

- Nottingham

- Oxford Street

- Peter Jones (Sloane Square)

- Solihull

- Southampton

- Trafford

NEW TINS FOR 2024

Nestlé, has launched a new version of its 813g Quality Street tin for sweet-toothed customers this winter.

The £12 tub features all the usual classic flavours and plays on Quality Street’s Halifax heritage – where it was first manufactured in 1936 and still is.

The 813g Quality Street tin is available now across a host of retailers nationwide including Asda, Co-op, Morrisons, B&M and Sainsbury’s.

This is the full list of chains you can get it from:

- Asda

- Co-op

- B&M

- Morrisons

- Nisa

- Ocado

- Sainsbury’s

- Booths

- Spar

- Waitrose

But despite the shiny nature of the new tub, which contains 471 calories per 100 grams, plenty have been left saying one thing in particular – how they want the old wrappers back.

It comes after the chocolatier scrapped its old packaging in October 2022 and replaced it with eco-friendly waxed paper wrappers.

Commenting on the Nestlé post, one shopper said: “Yesterday I bought a box and I was surprised.

“Plastic and the paper (packaging) is so ugly and cheap.”

Another commented: “Please can we also have the old wrappers back. Those ones from last year were truly awful.”

A third added: “Nice tin but sadly the sweets and wrappers are dreadful now.”

But not all shoppers are downbeat about the new tin.

One said “I love the more traditional look” while another added “beautiful tin. Would love one”.

Meanwhile, a third piped up: “Love it!”

Shoppers can pick up the new 813g tin for £12, £1.48 per 100g, which can obviously be reused after all the chocolates have been eaten.

However, if you’re not fussed about the nostalgic tin, you’ll pay less going for a different tub or packet.

Shoppers can pick up a plastic 600g tub from Tesco for £4.50 – 75p per 100g – if you’ve got a Clubcard.

You can also pick up a 357g sharing bag of Quality Street from B&M for just £4 – £1.12 per 100g.

The launch of Quality Street’s new tin comes after a number of other retailers started stocking Christmas bits.

Tesco shoppers have been rushing to get their hands on Celebration tubs with just one iconic flavour in recent weeks.

Meanwhile, customers have been left in shock after B&M launched its new Christmas range.

SAVE MONEY AT THE SUPERMARKET

THERE are plenty of ways to save on your grocery shop.

You can look out for yellow or red stickers on products, which show when they’ve been reduced.

If the food is fresh, you’ll have to eat it quickly or freeze it for another time.

Making a list should also save you money, as you’ll be less likely to make any rash purchases when you get to the supermarket.

Going own brand can be one easy way to save hundreds of pounds a year on your food bills too.

This means ditching “finest” or “luxury” products and instead going for “own” or value” type of lines.

Plenty of supermarkets run wonky veg and fruit schemes where you can get cheap prices if they’re misshapen or imperfect.

For example, Lidl runs its Waste Not scheme, offering boxes of 5kg of fruit and vegetables for just £1.50.

If you’re on a low income and a parent, you may be able to get up to £442 a year in Healthy Start vouchers to use at the supermarket too.

Plus, many councils offer supermarket vouchers as part of the Household Support Fund.

Money

The Morning Briefing: Women favour savings and getting younger people involved

Good morning and welcome to your Morning Briefing for Wednesday 25 September 2024. To get this in your inbox every morning click here.

Women favour savings

Almost half of women (46%) are deciding to hold their long-term savings in a savings account instead of “more tax-friendly options” such as a pension or Isa.

This is according to research by Scottish Friendly and the Centre for Economics and Business Research (Cebr).

The research also found 33% of men opt to use pensions, compared to 24% of women.

Getting younger people involved

Becoming a financial adviser was not a lifelong career wish for me, says Samuel Allen.

Indeed — unlike those who dreamed of growing up to be a doctor or a sports star — few of us, I expect, aspired to be a financial planner.

Perhaps this is to be expected, given the relative profile of advisers. But this observation got me thinking about the visibility of our profession to young people, from the perspective of both the next generation of recruits as well as prospective clients.

In Conversation With Rory Albon

In this In Conversation With… episode, Kimberley Dondo chats with Rory Albon, founder of Albon Financial Planning.

Rory shares his journey to launch his firm and his approach to investment optimisation, retirement planning, and financial well-being.

He offers insights into balancing saving and investing, managing tax efficiency, and safeguarding assets through tailored insurance solutions.

Tune in now:

Quote Of The Day

It would be highly risky to legislate for particular investment allocations.

– Steven Cameron, pensions director at Aegon, comments on the government’s pension investment review, which closes today (25 September)

Stat Attack

New research from GraniteShares, a global issuer of Exchange Traded Products (ETPs) with more than $7bn under management, found IFAs and wealth managers are increasingly positive on the UK stock market.

85%

Predict the FTSE 100 will close higher this year compared with last year

96%

Believe clients will increase their trading in UK shares in the year ahead

67%

Say clients will dramatically increase their level of trading

29%

Say they will slightly increase their level of trading

66%

Believe clients will dramatically increase trading in European shares

28%

Believe they will slightly increase trading

23%

Expect a dramatic increase in levels of trading of US stocks

58%

Predict a slight increase

12%

Expect a dramatic increase in trading of Asian stocks

65%

Expect a slight increase

Source: GraniteShares

In Other News

Benefits Guru has announced its tenth annual Workplace Pensions and Auto Enrolment ratings following Pension Awareness week.

This year’s ratings have a record number of overall gold awards, which demonstrates the industry’s strength within the pensions market.

Benefits Guru’s analysis has over 12,000 data points, and each year it includes ten categories of special interest or relevance.

The annual ratings are designed to assist advisers and employers in their decision-making process and highlight which providers perform strongest in different areas of their pension propositions.

Nine providers have been awarded overall gold awards across 24 product offerings. This includes a new entry for Aegon’s TargetPlan GPP offering.

Standard Life’s Group Flexible Retirement Plan was the only offering to achieve a clean sweep of overall gold awards, and underlying gold awards in all sub-categories across both the Workplace Pension and Auto-Enrolment Ratings.

In addition to benchmarking against existing criteria, such as member app & portals and auto-enrolment functionality, this year saw the introduction of additional benchmarking criteria.

Cushon, Nest and The People’s Partnership asked to not be included in this year’s rating.

PwC UK partner pay falls to £862,000 as growth slows (Financial Times)

Starmer signals Budget welfare squeeze to tackle ‘worklessness’ (Bloomberg)

US accuses Visa of monopolizing debit card swipes (Reuters)

Did You See?

It may be surprising, but it appears more people have considered becoming a senior paraplanner than a financial adviser, says Amanda Newman Smith.

Research from recruitment platform Indeed, with the St. James’s Place (SJP) Financial Adviser Academy, found just 4% of respondents had considered becoming a financial adviser, while 9% had considered becoming a senior paraplanner.

The research looked at attitudes towards careers among over 4,000 UK workers, highlighting a good salary, work/life balance and the opportunity to work from home as factors that create the ideal role.

This data was combined with job searches to produce a list of 10 of the best careers people have never considered. Senior paraplanner was second on the list, while financial adviser was fourth.

Money

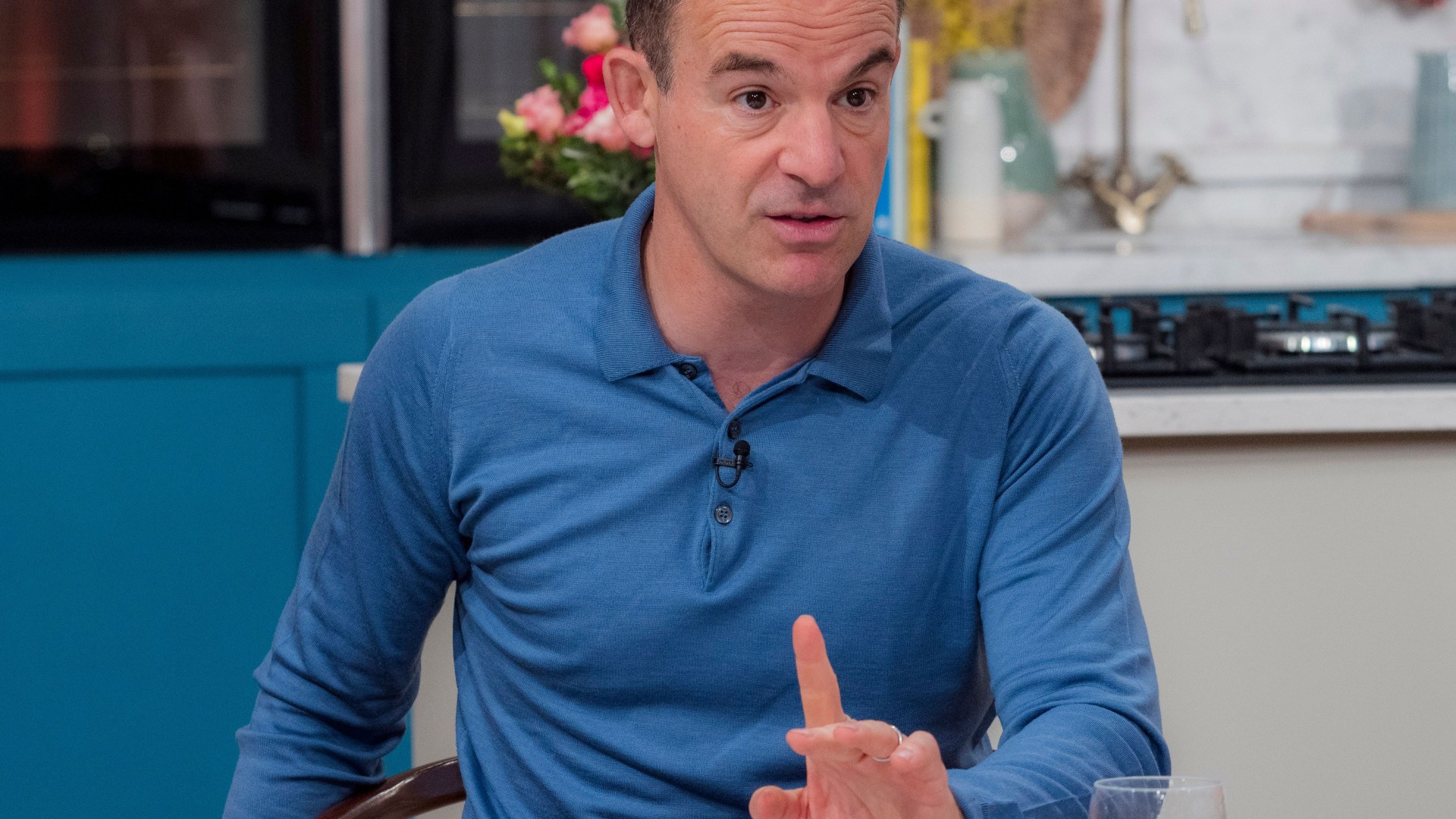

Martin Lewis issues message to all pensioners over winter fuel payments

MARTIN Lewis has issued a message to all pensioners over winter fuel payments.

The MoneySavingExpert (MSE) founder is urging households to check if they could be entitled to Pension Credit and unlock the winter fuel payment.

Pension Credit is a government benefit made up of two parts, with one designed to top up your weekly income to a minimum amount.

Ordinarily, you have to be earning under around £218 a week if you are single or roughly £333 a week if you are a couple to qualify.

However, you can still qualify if you earn over these amounts and meet certain other criteria like being on disability benefits, needing extra money to cover housing costs or having a certain amount of savings stashed away.

In the latest MSE newsletter, Martin is urging pensioners not to assume that they won’t qualify.

He said: “Pension Credit is a critically underclaimed top-up of the state pension for those on lower incomes that I’ve been urging people to check out for over a decade.

“On average it’s worth £3,900 a year. Yet over 800,000 eligible pensioners likely still miss out.”

Martin added that it’s more important than ever check your eligibility for pension credit because it qualifies you for the winter fuel payment.

This is because in July the Government announced that only those who claim Pension Credit will receive the Winter Fuel Allowance, which is worth up to £300 a year.

It comes after one Martin Lewis fan has revealed how a quick check helped her mother realise she was eligible for Pension Credit.

Those who claim are also entitled to a free TV licence, help with NHS dental treatment and glasses.

What is Pension Credit and who is eligible?

Pension Credit is a government benefit designed to top up your weekly income if you are a state pensioner and on a low income.

The current state pension age is 66.

There are two parts to the benefit – Guarantee Credit and Savings Credit.

Guarantee Credit tops up your weekly income to £218.15 if you are single or your joint weekly income to £332.95 if you have a partner.

What will I get when I claim Pension Credit?

SOME people will receive thousands of pounds once they claim Pension Credit, while others will be given just pennies.

But it is still worth making a claim either way as it opens the door to more financial help.

Once you claim Pension Credit you may receive:

- Housing Benefit if you rent – worth thousands a year.

- Mortgage Interest support – on up to £100,000 of your mortgage or loan.

- Council tax discount – worth thousands each year.

- Free TV licence if you are aged over 75 – worth £169.50 a year.

- NHS dental treatment, glasses and transport costs for hospital appointments help.

- Royal Mail redirection service discount – worth up to £48.

- Warm Home Discount if you get Guaranteed Pension Credit – worth £150.

- Cold Weather Payment – worth £25 for every seven day period of cold weather between November 1 and March 31.

- Winter Fuel Allowance – worth up to £300 a year.

Savings Credit is extra money you can get if you have some savings or your income is above the basic state pension amount – £169.50.

Savings Credit is only available to people who reached state pension age before April 6, 2016.

Usually, you only qualify for Pension Credit if your income is below the £218.15 or £332.95 thresholds.

However, you can sometimes be eligible for Savings Credit or Guarantee Credit depending on your circumstances.

For example, if you are suffering from a severe disability and claiming Attendance Allowance, as well as other benefits, you can get an extra £81.50 a week.

Meanwhile, you can get either £66.29 a week or £76.79 a week for each child you’re responsible and caring for.

The rules behind who qualifies for Pension Credit can be complicated, so the best thing to do is just check.

You can do this by using the Government’s Pension Credit calculator on its website.

Or, you can call the Pension Service helpline on 0800 99 1234 from 8am to 5pm Monday to Friday.

Those in Northern Ireland have to call the Pension Centre on 0808 100 6165 from 9am to 4pm Monday to Friday.

It might be worth a visit to your local Citizens Advice branch too – its staff should be able to offer you help for free.

What is the Winter Fuel Payment?

Consumer reporter Sam Walker explains all you need to know about the payment.

The Winter Fuel Payment is an annual tax-free benefit designed to help cover the cost of heating through the colder months.

Most who are eligible receive the payment automatically.

Those who qualify are usually told via a letter sent in October or November each year.

If you do meet the criteria but don’t automatically get the Winter Fuel Payment, you will have to apply on the government’s website.

You’ll qualify for a Winter Fuel Payment this winter if:

- you were born on or before September 23, 1958

- you lived in the UK for at least one day during the week of September 16 to 22, 2024, known as the “qualifying week”

- you receive Pension Credit, Universal Credit, ESA, JSA, Income Support, Child Tax Credit or Working Tax Credit

If you did not live in the UK during the qualifying week, you might still get the payment if both the following apply:

- you live in Switzerland or a EEA country

- you have a “genuine and sufficient” link with the UK social security system, such as having lived or worked in the UK and having a family in the UK

But there are exclusions – you can’t get the payment if you live in Cyprus, France, Gibraltar, Greece, Malta, Portugal or Spain.

This is because the average winter temperature is higher than the warmest region of the UK.

You will also not qualify if you:

- are in hospital getting free treatment for more than a year

- need permission to enter the UK and your granted leave states that you can not claim public funds

- were in prison for the whole “qualifying week”

- lived in a care home for the whole time between 26 June to 24 September 2023, and got Pension Credit, Income Support, income-based Jobseeker’s Allowance or income-related Employment and Support Allowance

Payments are usually made between November and December, with some made up until the end of January the following year.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Digital tools for smarter property sales – Finance Monthly

There’s no escaping the fact that the last two decades have represented a revolution in the way we manage our money. You don’t have to go back far to see transactions made primarily in cash for example, with bills paid via cheques sent through the post.

Technology has had an impact not just on our day-to-day finances, but on the bigger financial landscapes too, changing the way we save and invest, manage our pensions and buy and sell property. Let’s take a look at how technology can be used to streamline our experience of the housing market.

Budgeting and expense tracking

Before you can even think about buying a new home, you’ll need to get on top of your income and expenditure to see how much you can afford to spend and to prepare for any mortgage application you might need to make.

Gone are the days though when personal finance was managed solely with spreadsheets and notebooks. Digital budgeting and saving apps like WithPlum.com have revolutionised how people manage their day-to-day expenses, meaning you can now automatically categorise spending, set financial goals and manage your bills all from your phone.

Once you know where you stand, you can go online to search and compare mortgage deals and work out how much you’ll be able to borrow and where to get the best deal.

Different ways to buy and sell

Technology has created a whole host of new ways to buy and sell property, from online estate agents to cash home-buying services like Sold.co.uk. This platform offers a streamlined process for selling properties, leveraging technology to connect with sellers, and eliminating many of the traditional hurdles associated with property sales, such as lengthy paperwork and prolonged waiting periods.

Digital property marketplaces

Twenty years ago we’d never have imagined that it would be possible to take a tour of a house without even leaving your sofa, yet now we have access to all kinds of amazing tools plus real-time market data, meaning buyers can make much more informed decisions. Digital property marketplaces have simplified the process of buying and selling homes. With so many competing pressures on our time and money nowadays, being able to browse and shortlist potential new homes online is incredibly valuable.

Automating the homebuying process

Automation in property transactions is another way in which technology is helping to reduce the time and effort required to complete a sale. Features such as automated valuation models (AVMs) and electronic document management systems from ThomsonReuters.co.uk streamline the process, making it more transparent and less prone to errors.

Credit: Unsplash

Future trends

With the use of AI increasing exponentially, and the use of blockchain technology becoming more widely accepted, we’re sure to see all kinds of advances and innovations in the property market over the next few years. For instance, AI could provide even more personalised financial advice, while blockchain technology could enhance the security and transparency of property transactions.

The digital revolution is undeniably reshaping the landscape of personal finance and property transactions and as technology continues to advance, embracing these digital tools will be crucial for anyone looking to manage their finances more effectively and make the most of their assets.

Money

I pulled my son out of school aged 14 so he could pursue his business dream & we’ve made £3.6MILLION flogging wax melts

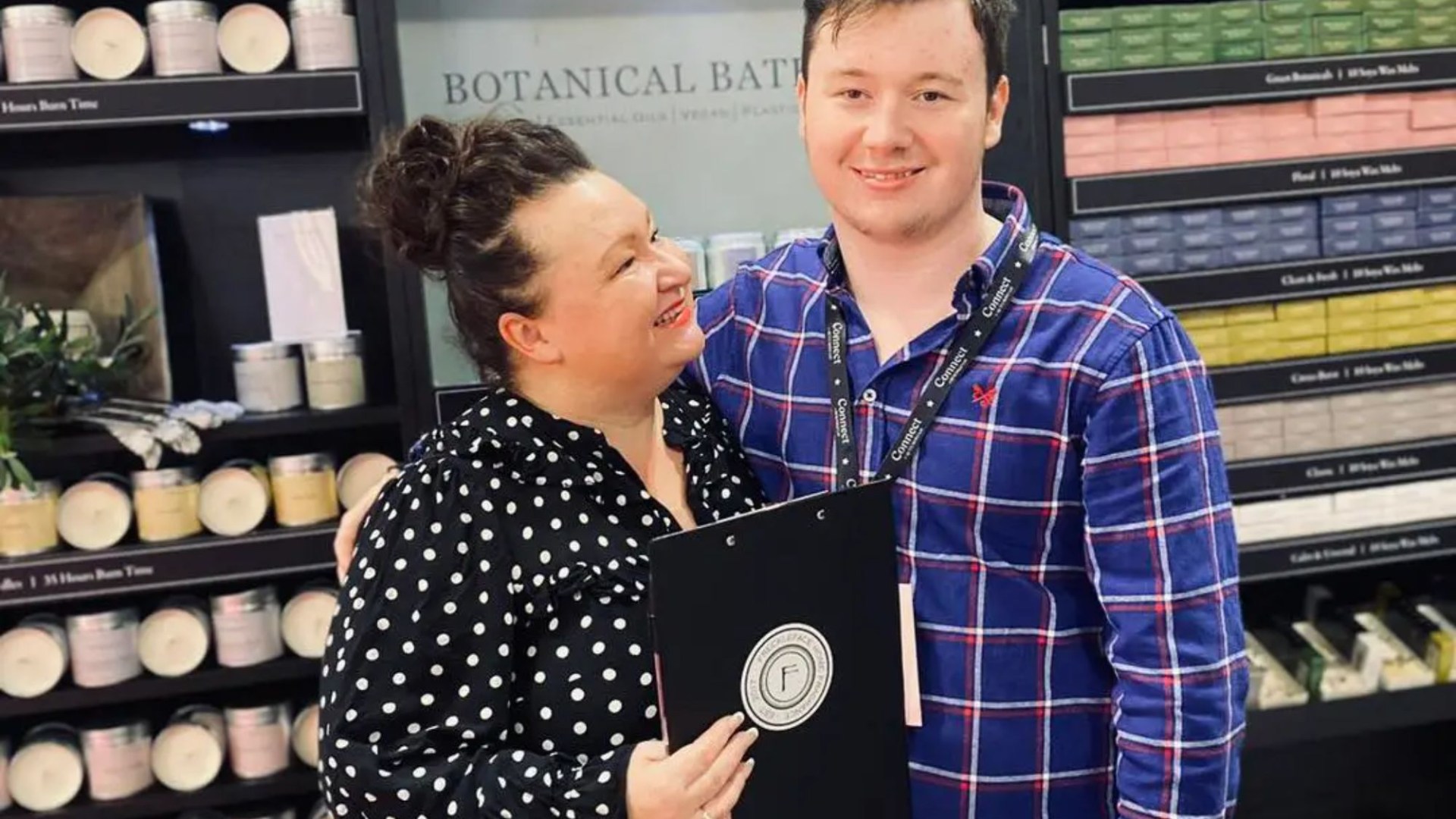

A MUM pulled her son out of school when he was just 14 so he could pursue his business dream – and now the business has made £3.6million.

Noah Carlile-Swift was just a teenager when his mum Tara suggested they start a business together to help build his confidence after his secondary school education left him feeling “stupid”.

When Noah was just 11, he was diagnosed with dyslexia and dyspraxia, effectively meaning, as Tara, 50, says, he was “bright, at the top end of learning ability, but not in the way that school teaches it. So he struggled with exams and with comprehension, which is mainly what school is about.”

So, with the support of Noah’s school, they started Freckleface, a fragrance company selling wax melts – scented pieces of wax that release an aroma into the room when heated on top of a burner – and soon after Noah left his school in Spalding, Lincolnshire.

Tara told The Times: “They [Noah’s school] agreed that he was doing stuff outside of school with the business – building the website, taking computers apart, designing logos – and was much better using his skills on something he got reward from, rather than feeling stupid every day.”

Starting as a kitchen table business, Freckleface now has its own factory in rural Lincolnshire and operates five shops in York, Cambridge, Lincoln and Stamford – with plans to open more outlets next year.

Last year, the company had sales of £3.6million and a pre-tax profit of £600,000.

Tara is the managing director while Noah runs the retail side of things with the long-term plan being that he takes over her role in 10 years’ time.

For Tara, it was certainly an unconventional route into being an entrepreneur as her “only qualification” is a Btec in sign writing.

When she was just six months old her dad died suddenly of a heart attack aged 46 and her mum went on to remarry when Tara was six.

Due to her stepdad’s job in HM Coastguard it meant the family “moved every few years”, including spells in the Isle of Wight and the Gower Peninsula in Wales.

Almost as soon as Tara gained her Btec, it was made virtually redundant due to the march of technology and “the whole signwriting world went digital”.

After she “bummed around for a couple of years” Tara did a course to become a personal assistant.

She chose a college in Nottingham after she met Simon, her husband, on a night out in the city.

Tara said: “I went for the weekend, met Simon, and we moved in together two weeks later. We’ve been together ever since.”

After her PA course she landed a job at Experian, the credit-checking firm, where she spent three years learning about business “through osmosis” as she sat in on meetings with the top team.

Tara added: “At the time, you don’t realise, but you’re absorbing it all, sitting with finance directors taking minutes of all the meetings.”

She and Simon were also trying for a baby, but after suffering a series of miscarriages, decided to take some time out from the corporate life and head to Australia for a year.

As they landed back in England Tara found out she was pregnant with Noah.

Tara then got a temping job with Boots, the high street chemist, which has its headquarters in Nottingham.

CHANCE CONVERSATION

It was while at Boots a chance conversation lead to a dramatic change in her career.

Tara said: “I was sitting in the canteen eating my sandwich and the people next to me were talking about products they were developing for pregnant people and I chipped in and said, ‘I don’t think you should do it like that, I think you should think about this,’ and they offered me a job in the marketing department.”

After a couple of years at Boots, she left as part of a restructuring and retrained as a project manager, taking the Prince2 (Projects in Controlled Environments) project management qualification, before working as an administrator for Siemens on railway bids.

That job though meant long hours and frequent travel, with Tara often being away three night a week, which she and Simon juggled alongside his shifts as an IT worker.

To help Noah make his transition to secondary school, Tara quit her job as Siemens and needing an extra income, became a foster carer.

The couple fostered 23 children in three and a half years.

How to start your own business

Dragon’s Den star Theo Paphitis revealed his tips for budding entrepreneurs:

- One of the biggest barriers aspiring entrepreneurs and business owners face is a lack of confidence. You must believe in your idea — even more than that, be the one boring your friends to death about it.

- Never be afraid to make decisions. Once you have an idea, it’s the confidence to make decisions that is crucial to starting and maintaining a business.

- If you don’t take calculated risks, you’re standing still. If a decision turns out to be wrong, identify it quickly and deal with it if you can. Failing that, find someone else who can.

- It’s OK not to get it right the first time. My experience of making bad decisions is what helped develop my confidence, making me who I am today.

- Never underestimate the power of social media, and remember the internet has levelled the playing field for small businesses.

- Don’t forget to dream. A machine can’t do that!

She decided to start her own business just as the fostering was coming to an end but describes the first few months as “absolute carnage”.

Tara said: “We had a baby who we had from birth and he had gastric problems so he didn’t sleep and was sick constantly, plus I had a teenager who was neurodiverse, all while I was doing the business.

“We were making the products all week and then I was putting them in the car, driving all over the country, sleeping in the car, doing whatever we needed to get the products out there.”

But while it was exhausting, they knew they were on to something.

‘SOMETHING SPECIAL’

She added: “It became obvious really quickly that we had something special.

“We would go to a fair, sell out, come home, make it all again. Go to another show, and sell out. And so on.”

The baby boy was then adopted permanently by “the most super family in the world” and the Carlile-Swifts still see him every six weeks but Tara said the initial separation was “awful” and she threw herself into the business.

Tara said: “We decided, ‘Let’s take the business really seriously’.

“We came up with a business plan that said we wanted to have stores on every UK high street and for the brand to be global within ten years.”

Freckleface moved into its first industrial unit in 2019, just a few months before Covid hit.

The pandemic could have derailed production but sales were boosted by people working from home and “everybody wanting their houses to smell great”.

FIRST SHOP

The firm was also helped by reduced rents and breaks on business rates during the pandemic which helped them open their first Freckleface store in Stamford, Lincolnshire, in July 2020.

Another shop in Cambridge opened the following year.

In order to save money Tara and Simone built the shop interiors for the first three stores, with Noah taking on the responsibility for the last two.

Along with its stores, Freckleface products are also stocked in more than 800 shops nationwide and the brand has run collaborations with the Royal Horticultural Society and Laura Ashley.

Freckleface now has a workforce of 60, including Tara’s husband, who joined in 2020 to run the manufacturing side.

Tara puts a lot of the company’s more recent success down to the initial slog at trade shows and local fairs.

She said: “The customer you meet at a show is a super-loyal customer. They will shop from you online and will seek out your high street stores.

“And our product is a consumable one, so they tend to come back every month or six weeks to stock up.

“So the hard work of schlepping around the country at shows is why the business built so quickly.”

The family has not raised or borrowed any money to finance the business.

At first, they struggled even to buy a kilo of wax, which would have cost “£10 or so”.

Even though working capital is “still the biggest stresser that keeps us awake at night and stops us from growing quicker”, Tara added she’s “not interested” in raising investment.

She said: “We want to be a heritage brand that’s still going to be on the high street in 50 years and we will hand down the generations of Frecklefaces.

“We’re not in it to make a quick buck.”

The company name is Tara’s nickname for Noah was he was tiny, because she had been taunted by playground bullies for being a “freckleface” and wanted to ensure Noah thought the name was a term of endearment.

She said: “We’re very freckly, we’re plastered. And we would call each other freckleface.

“So it was a natural decision when we were naming the business, but we never thought back then we were going to have all these shops.

“And now people shout Freckleface at us across the street, but in a nice way.”

Money

Getting younger people involved in advice

Becoming a financial adviser was not a lifelong career wish for me.

Becoming a financial adviser was not a lifelong career wish for me.

Indeed — unlike those who dreamed of growing up to be a doctor or a sports star — few of us, I expect, aspired to be a financial planner!

Perhaps this is to be expected, given the relative profile of advisers. But this observation got me thinking about the visibility of our profession to young people, from the perspective of both the next generation of recruits as well as prospective clients.

On the recruitment side, we could do more to raise our profile within the wider sector. My first exposure to financial advice was through making some adviser contacts while on a ski season, which led me to pursue a career via some work experience. However, I get the sense there is a lack of visibility of what our industry is and does among people of my generation.

Younger clients respond well to having a peer at a similar life stage involved in their advice. We will need a new generation of young advisers to serve them

Maybe this low profile among younger adults is not surprising, given the lack of routes into wealth management. But, with the average adviser age pushing close to 60, it poses an existential challenge for our profession.

The requirement of further professional qualifications may be one deterrent, but the lack of opportunities for entry, via mentorship or training programmes, is significant. Here at Finura we are fortunate to offer apprentice and non-graduate roles, which are proving successful.

The traditional pathway can be overly complex and may limit opportunities for keen graduates to gain early client-facing experience. When I was seeking a graduate role, most recruiters advised that prior industry experience was required; the age-old conundrum.

To attract and retain top talent, we must create more effective avenues for early client exposure and career progression. Otherwise we risk losing talent to more visible industries, compounding the problems of an ageing cohort.

I get the sense there is a lack of visibility of what our industry is and does among people of my generation

Employers may fear that young advisers may not be taken seriously by clients, but this has not been my experience. Instead, firms should look at the future of financial advice and the types of client we are likely to serve. With the largest ever intergenerational wealth transfer on the horizon, and the alarming statistic that 92% of heirs change adviser once they receive an inheritance, advice firms should look to youth recruitment to capitalise on an advice proposition for the Millennial generation.

Younger clients tend to be more tech savvy and have often had exposure to DIY investing; they may feel they don’t need financial advice. But they respond well to having a peer at a similar life stage involved in their advice.

We will need a new generation of young advisers to serve them.

Samuel Allen is a chartered paraplanner at Finura

This article featured in the September 2024 edition of Money Marketing.

If you would like to subscribe to the monthly magazine, please click here.

-

Womens Workouts2 days ago

Womens Workouts2 days ago3 Day Full Body Women’s Dumbbell Only Workout

-

News7 days ago

News7 days agoYou’re a Hypocrite, And So Am I

-

Sport6 days ago

Sport6 days agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Technology1 week ago

Technology1 week agoWould-be reality TV contestants ‘not looking real’

-

News3 days ago

News3 days agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment6 days ago

Science & Environment6 days ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment7 days ago

Science & Environment7 days agoHow to unsnarl a tangle of threads, according to physics

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment6 days ago

Science & Environment6 days agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment6 days ago

Science & Environment6 days agoLiquid crystals could improve quantum communication devices

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Science & Environment6 days ago

Science & Environment6 days agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment6 days ago

Science & Environment6 days agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment6 days ago

Science & Environment6 days agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment6 days ago

Science & Environment6 days agoHow to wrap your mind around the real multiverse

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoCardano founder to meet Argentina president Javier Milei

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Science & Environment6 days ago

Science & Environment6 days agoWhy this is a golden age for life to thrive across the universe

-

News6 days ago

News6 days agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Technology6 days ago

Technology6 days agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

Health & fitness7 days ago

Health & fitness7 days agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment7 days ago

Science & Environment7 days agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment7 days ago

Science & Environment7 days agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 week ago

Science & Environment1 week agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoBlockdaemon mulls 2026 IPO: Report

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Science & Environment3 days ago

Science & Environment3 days agoMeet the world's first female male model | 7.30

-

Sport6 days ago

Sport6 days agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Science & Environment6 days ago

Science & Environment6 days agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment6 days ago

Science & Environment6 days agoQuantum forces used to automatically assemble tiny device

-

News6 days ago

News6 days agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment7 days ago

Science & Environment7 days agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment6 days ago

Science & Environment6 days agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment6 days ago

Science & Environment6 days agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment6 days ago

Science & Environment6 days agoNuclear fusion experiment overcomes two key operating hurdles

-

CryptoCurrency6 days ago

CryptoCurrency6 days ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency6 days ago

CryptoCurrency6 days ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency6 days ago

CryptoCurrency6 days ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business6 days ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

News6 days ago

News6 days agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts4 days ago

Womens Workouts4 days agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts4 days ago

Womens Workouts4 days agoEverything a Beginner Needs to Know About Squatting

-

News6 days ago

News6 days agoChurch same-sex split affecting bishop appointments

-

Politics1 week ago

Politics1 week agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Politics6 days ago

Politics6 days agoLabour MP urges UK government to nationalise Grangemouth refinery

-

Science & Environment6 days ago

Science & Environment6 days agoHow one theory ties together everything we know about the universe

-

News7 days ago

News7 days agoRoad rage suspects in custody after gunshots, drivers ramming vehicles near Boise

-

Health & fitness1 week ago

Health & fitness1 week agoThe maps that could hold the secret to curing cancer

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoHelp! My parents are addicted to Pi Network crypto tapper

-

Science & Environment6 days ago

Science & Environment6 days agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment6 days ago

Science & Environment6 days agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Science & Environment6 days ago

Science & Environment6 days agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency6 days ago

CryptoCurrency6 days ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

Business6 days ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics6 days ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News4 days ago

News4 days agoBangladesh Holds the World Accountable to Secure Climate Justice

-

News3 days ago

News3 days agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Technology6 days ago

Technology6 days agoFivetran targets data security by adding Hybrid Deployment

-

Money6 days ago

Money6 days agoWhat estate agents get up to in your home – and how they’re being caught

-

Science & Environment6 days ago

Science & Environment6 days agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Fashion Models6 days ago

Fashion Models6 days agoMixte

-

Science & Environment6 days ago

Science & Environment6 days agoHow Peter Higgs revealed the forces that hold the universe together

-

News7 days ago

News7 days ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment6 days ago

Science & Environment6 days agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Science & Environment6 days ago

Science & Environment6 days agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoElon Musk is worth 100K followers: Yat Siu, X Hall of Flame

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoMemecoins not the ‘right move’ for celebs, but DApps might be — Skale Labs CMO

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoETH falls 6% amid Trump assassination attempt, looming rate cuts, ‘FUD’ wave

-

Politics6 days ago

The Guardian view on 10 Downing Street: Labour risks losing the plot | Editorial

-

Politics6 days ago

Politics6 days agoI’m in control, says Keir Starmer after Sue Gray pay leaks

-

Business6 days ago

UK hospitals with potentially dangerous concrete to be redeveloped

-

Business6 days ago

Axel Springer top team close to making eight times their money in KKR deal

-

News6 days ago

News6 days ago“Beast Games” contestants sue MrBeast’s production company over “chronic mistreatment”

-

News6 days ago

News6 days agoSean “Diddy” Combs denied bail again in federal sex trafficking case

-

News6 days ago

News6 days agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

CryptoCurrency6 days ago

CryptoCurrency6 days agoBitcoin options markets reduce risk hedges — Are new range highs in sight?

-

Money5 days ago

Money5 days agoBritain’s ultra-wealthy exit ahead of proposed non-dom tax changes

-

Womens Workouts4 days ago

Womens Workouts4 days agoHow Heat Affects Your Body During Exercise

-

Womens Workouts4 days ago

Womens Workouts4 days agoKeep Your Goals on Track This Season

-

Womens Workouts4 days ago

Womens Workouts4 days agoWhich Squat Load Position is Right For You?

-

News3 days ago

News3 days agoWhy Is Everyone Excited About These Smart Insoles?

-

Womens Workouts2 days ago

Womens Workouts2 days ago3 Day Full Body Toning Workout for Women

You must be logged in to post a comment Login