Money

Anyone over 55 could be owed £3,691 by HMRC due to tax trap – are you one of them?

PENSIONERS could be owed money by HMRC as thousands have been over charged.

Anyone from the age of 55 who takes money out of a workplace or personal pension as a lump sum could be owed money back.

New figures from HMRC today reveal that almost £44.3million was refunded to retirees between July and September 2024 alone.

This comes after the record £57million that was refunded last quarter.

In that same period, more than 12,000 claims were processed in total.

It works out that the average reclaim payment was £3,691 per person.

However, how much you overpaid could be higher or lower based on individual circumstances.

Why are pensioners overtaxed?

This is part of a long-running issue caused by emergency tax codes applied to pension withdrawals under the pension freedoms introduced in 2015.

Since the changes, anyone over 55 can access their pension flexibly, but HMRC often taxes large withdrawals as if they will be repeated monthly, resulting in overpayments.

Jon Greer, head of retirement policy at Quilter, expressed concern about the system’s flaws.

He noted that while there has been a slight drop in the number of overpayments this quarter, the issue remains significant.

John said: “The PAYE system is designed for regular income and struggles with the complexities of flexible pension withdrawals.

“As a result, many pensioners are overtaxed, and the refund process can be frustratingly slow.”

For many pensioners the tax bill can come as a unsavoury surprise.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said: “The tax bill can come as a nasty surprise for people expecting to access their savings without a hitch and can throw off financial plans.”

What is pensions auto-enrolment?

Here’s what you need to know about pension auto-enrolement:

What is pension auto-enrolment?

Since October 2012, employers have had to enrol their staff into workplace pension schemes as part of a government initiative to get people to save more for retirement.

When does auto-enrolment apply?

You will be automatically enrolled into your work’s pension scheme if you meet the following criteria:

- You aren’t already in a qualifying workplace scheme.

- You are aged at least 22.

- You are below state pension age.

- You earn more than £10,000 a year

- You work in the UK.

How much do I contribute?

There are minimum contributions that you and your employer must pay.

Your minimum contribution applies to anything you earn over £6,240 up to a limit of £50,270 in the current tax year. This includes overtime and bonus payments.

A minimum of 8% must be paid into the pension, with you contributing 5% and your employer paying at least 3%.

What if I have more than one job?

For people with more than one job, each job is treated separately for automatic enrolment purposes.

Each of your employers will check whether you’re eligible to join their pension scheme. If you are, then you’ll be automatically enrolled in that employer’s workplace pension scheme.

Can I opt out?

You can choose to opt out, but you’ll miss out on the contributions from the government and from your employer. If you do choose to opt out you can opt back in later.

How to get your cash back

For those hit by the tax trap, the process of getting their money back involves filling out specific forms as quickly as possible.

You can wait for HMRC to review your tax code at the end of the tax year and it will process a refund, but obviously, this means you could be waiting a while.

To get the cash back faster, you can fill in one of three forms: a P55, P53Z or a P50Z which can all be found on the Government’s website.

Which form you need to fill out will depend on how you have accessed your retirement pot:

- If you’ve emptied your pot by flexibly accessing your pension and are still working or receiving benefits, you should fill out form P53Z,

- If you’ve emptied your pot by flexibly accessing your pension and aren’t working or receiving benefits, you should fill out form P50Z,

- If you’ve only flexibly accessed part of your pension pot then use form P55.

To avoid having emergency tax deducted in future, try taking smaller amounts out rather than one lump sum.

Provided you fill out the correct form HMRC says you should receive a refund of any overpaid tax within 30 days.

More than £1.3billion has been refunded since the pension freedoms began in 2015, highlighting the scale of the issue.

Experts are urging savers to proceed with caution, especially with speculation around potential changes to pension tax rules in the upcoming budget.

Financial advisers are recommending that anyone considering a withdrawal seek professional advice to avoid falling into this tax trap.

Jon said: “It is vital that those considering pension withdrawals amid these budget rumours seek professional financial advice.

“Advisers can help structure withdrawals effectively, ensuring savers do not fall foul of the tax system’s pitfalls.

“Until the system is changed, we are likely to continue seeing many savers caught out and forced to reclaim significant sums of money.”

With proper planning, pensioners can ensure they don’t face unnecessary tax bills or delay in getting their money back.

What are the different types of pension?

WE round-up the main types of pension and how they differ:

- Personal pension or self-invested personal pension (SIPP) – This is probably the most flexible type of pension as you can choose your own provider and how much you invest.

- Workplace pension – The Government has made it compulsory for employers to automatically enrol you in your workplace pension unless you opt out.

These so-called defined contribution (DC) pensions are usually chosen by your employer and you won’t be able to change it. Minimum contributions are 8%, with employees paying 5% (1% in tax relief) and employers contributing 3%. - Final salary pension – This is also a workplace pension but here, what you get in retirement is decided based on your salary, and you’ll be paid a set amount each year upon retiring. It’s often referred to as a gold-plated pension or a defined benefit (DB) pension. But they’re not typically offered by employers anymore.

- New state pension – This is what the state pays to those who reach state pension age after April 6 2016. The maximum payout is £203.85 a week and you’ll need 35 years of National Insurance contributions to get this. You also need at least ten years’ worth to qualify for anything at all.

- Basic state pension – If you reach the state pension age on or before April 2016, you’ll get the basic state pension. The full amount is £156.20 per week and you’ll need 30 years of National Insurance contributions to get this. If you have the basic state pension you may also get a top-up from what’s known as the additional or second state pension. Those who have built up National Insurance contributions under both the basic and new state pensions will get a combination of both schemes.

Money

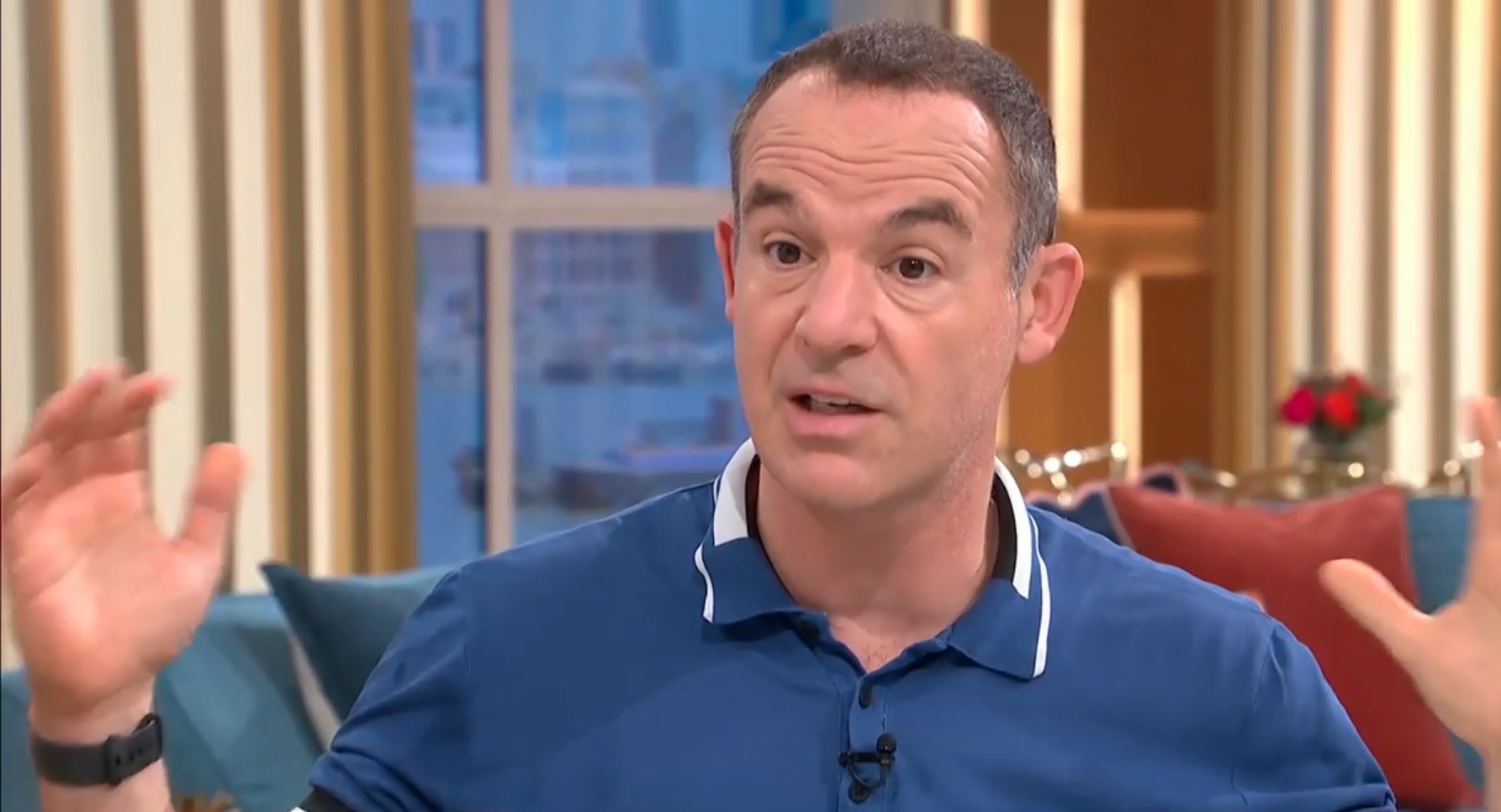

Martin Lewis reveals quick move that can net 2million couples £1,000 cheque in post before Christmas

MARTIN Lewis has revealed a quick trick that could see married couples receive a £1,000 cheque.

Speaking on his website, the money-saving expert reminded those in marriages or civil partnerships that they may be able to claim back money through Marriage Tax Allowance.

This allows eligible people to transfer £1,260 of their personal tax allowance to their spouse or civil partner.

To be eligible, one partner must be a non-taxpayer – earning under £12,570.

The other needs to pay a basic 20% basic tax rate – which applies to earnings between £12,570 and £50,270 in the UK.

If these conditions are met, the non-taxpayer is entitled to transfer 10% of their tax-free allowance to the taxpayer – meaning less tax is paid overall.

This could result in a tax refund of up to £252 for around two million couples across the UK.

And, in even better news, the refund can be backdated up to four years – meaning families could be receiving a cheque of over £1,000.

Mr Lewis said: “Claiming tax allowances isn’t traditional Christmas fare, but it is a quick way for two million eligible couples not currently claiming to get an up to £1,260 tax refund.”

Government figures show that 2.28million couples applied for the benefit in 2022/23 year.

And HMRC estimates that a whopping 2.1 million may be missing out – despite being eligible.

Steve Webb, partner at pension consultants LCP, told The Sun that the benefit is “well worth claiming”.

He added that with personal allowances frozen until 2026, couples should be sure to “access all the tax-free income that they can”.

How to apply for marriage allowance

You can apply for marriage allowance online by visiting the gov.uk website, and it is free to do so.

The person who earns the least should make the claim.

However, if either of you gets other income, such as dividends or savings, you may need to work out who should claim.

You can call the Income Tax helpline if you’re unsure.

Changes to your personal allowances will be backdated to the start of the tax year, which is April 6, if your application is successful.

To be eligible for the allowance the following must apply to your and your spouse:

- You’re married or in a civil partnership.

- You do not pay income tax or your income is below your personal allowance (usually £12,570)

- Your partner pays Income Tax at the basic rate, which usually means their income is between £12,571 and £50,270 before they receive Marriage Allowance

If you only pay income tax at the basic rate and believe you’ve been wrongly denied marriage tax allowance, you can appeal the decision directly to HMRC.

You and your partner will get new tax codes that reflect the transferred allowance.

Your tax code will end with ‘M’ if you are receiving the allowance and ‘N’ if you are transferring the allowance.

You can read more about tax codes and how they work here.

You’ll need to call the marriage allowance enquiries helpline to speak to an agent and explain the issue.

You must cancel your claim for marriage allowance if you and your partner divorce or your income changes. You can do this online.

Are you missing out on benefits?

YOU can use a benefits calculator to help check that you are not missing out on money you are entitled to.

Charity Turn2Us’ benefits calculator works out what you could get.

Entitledto’s free calculator determines whether you qualify for various benefits, tax credit and Universal Credit.

MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto’s data.

You can use Policy in Practice’s calculator to determine which benefits you could receive and how much cash you’ll have left over each month after paying for housing costs.

Your exact entitlement will only be clear when you make a claim, but calculators can indicate what you might be eligible for.

Money

CPP and Kennedy Wilson launch £1bn UK single-family rental housing JV

CPP will initially commit £500m and Kennedy Wilson £56m, as the fund targets an initial asset value of £1bn.

The post CPP and Kennedy Wilson launch £1bn UK single-family rental housing JV appeared first on Property Week.

Money

Advisers warned they must be ‘really on it’ on Budget day

Advisers need to be “really on it” with their clients on Budget day next Wednesday (30 October), Moran Wealth Management founder Nicola Crosbie has warned.

Speaking on a panel at the Money Marketing Interactive conference in Leeds today (24 October), Crosbie insisted advisers “must be proactive” on the day.

“If we’re not, some other adviser will be,” she warned. “And that’s where there is likely to be a breakdown in the relationship [you have with your clients] if you’ve not got your finger on the pulse.”

She said it is important for advisers to “put things into perspective” for clients.

“It’s about saying: ‘Let’s just calm down a little bit’,” she said. “Our job is to calm the situation.”

She emphasised the importance of “being informed” about what could come up in the Budget.

“Don’t fluff your way through it,” she said. “Because it becomes a bit apparent if you don’t know what you’re talking about. And that will unsettle your clients more.”

On the same panel, Triple Point regional business development manager Lucy Dolan said having an “agile plan” for clients is key.

She added there are “many different approaches” that advisers can take to delivering advice around the Budget, but “the key point is that things can change”.

“These unprecedented times demonstrate how quickly legislation can shift,” she said. “Therefore, it’s essential to remain agile.

“I’ve spent considerable time with advisers, accountants and solicitors. Even among solicitors, there’s some apprehension about trusts at the moment because, once a trust is in place, the client loses a degree of autonomy.

She said that, depending on how things progress, advice businesses will focus more on estate planning, which allows clients to maintain control and flexibility.

“This is particularly important because, if legislation changes, clients need to be able to adapt their plans accordingly,” she said.

“Adaptability will be crucial moving forward.”

Also on the panel, Syndaxi Financial Planning managing director Robert Reid said the ability to navigate changes as a result of the Budget is what “keeps advisers relevant, useful and profitable”.

“In fact,” he suggested, “I believe the complexity this budget might introduce could actually widen the appeal of advice.”

Money

What is Poundland Perks and how to register for vouchers

WITH the cost of everything rising, now more than ever are people looking for ways to cover the costs of the essentials.

Poundland Perks is a game-changing app designed to offer exclusive discounts and rewards, as well as the opportunity to earn prizes every week.

Sign up for Poundland Perks

After already successfully piloting the Poundland Perks app in Northern Ireland and the Isle of Wight, a wider rollout for the UK is set to take place on October 17.

Whether you’re a regular shopper or new to Poundland, the app is a must-have for anyone looking to stretch their budgets and snag fantastic offers on everyday needs.

Poundland’s digital loyalty scheme rewards users with discounts on promotional products, which can also be redeemed against purchases in-store by scanning a barcode in the app at checkout.

Wondering how it works and most importantly, how you can start saving today?

We’ve outlined everything you need to know ahead of the app’s launch.

What is the Poundland Perks App?

Sign up for Poundland Perks

Poundland Perks is the all-new loyalty and rewards programme from retailer Poundland.

The simple-to-use app is designed to give customers access to exclusive savings on selected products in stores nationwide.

Downloading the Poundland Perks app means you can unlock vouchers, earn points and enjoy weekly fun and prizes to win.

The app aims to ensure Poundland shoppers can “save more, earn more, and play more”, all while picking up the essentials and their favourite bargains.

Saving money while doing your weekly shopping has never been this rewarding, which is perfect now that the colder weather is starting to set in and the festive season draws nearer.

How does the Poundland app work?

The app offers special discounts on selected products, which means extra savings just for being part of the Perks members.

Every time you shop, you’ll be able to take advantage of lower prices on a wide range of products across the store.

When you buy certain products, you’ll earn Powered Up Points, which can be collected and redeemed for even more rewards.

For every £1 spent in-store, Poundland Perks members will get 100 points in the app, with 5,000 points earning them a £1 voucher for their next shop.

Poundland Perks also features ‘spin the wheel’ competitions.

Every Wednesday, you can log in to the app and spin a virtual wheel for a chance to win extra rewards, but these will be one-off promotions that Poundland will launch at its discretion according to its terms and conditions.

Are Poundland Perks available across the UK?

Sign up for Poundland Perks

A roll-out in the UK is expected on October 17, while it might not be all UK stores for now, we will hear announcements of what stores we can expect to be participating.

To start saving in the UK, head to the App Store or Google Play and search for Poundland Perks.

Download and install the app on your smartphone and create a Perks profile on the app.

Once logged in, customers can explore the Perks Pricing deals available in local stores, and the app will show you which products are eligible for discounts.

When you’re ready to pay at the checkout, you can simply scan your Poundland Perks app QR code to start accumulating points and savings at Poundland.

Sign up for Poundland Perks

Money

AEW reveals positive trading update with strong NAV growth

In its latest update to investors, the group showed NAV stood at £172.76m at the end of the quarter, compared with £167.79m at the end of June.

The post AEW reveals positive trading update with strong NAV growth appeared first on Property Week.

Money

iOS App Development Cost: A Complete Guide

As of early 2024, iOS holds a dominant 60.77% share of the U.S. mobile market, far ahead of Android’s 38.81% (Backlinko). This makes iOS app development crucial for businesses targeting a large and active audience.

In this post, we’ll talk about…money, the biggest driver in the development process. We’ll explore how much it costs to make an app from Purrweb’s perspective, but these estimates will either be relevant for other development companies.

What are the peculiarities of iOS app development?

iOS app development has its own set of unique characteristics compared to Android. What makes it stand out?

App Store only

The only place where iOS apps may be distributed is through Apple’s App Store. No third-party stores, no APKs—developers have to abide by Apple’s rules at all times. These regulations can be strict; before an app is authorized for distribution, it must pass rigorous evaluations and frequently go through many changes.

Limited device range

Apple’s consistent hardware lineup simplifies development. iOS has fewer screen sizes and resolutions to support than the wide variety of Android devices. Because of the simplified testing and optimization process, developers are free to concentrate on creating a polished application rather than worrying about unforeseen problems resulting from subtle hardware variances.

Languages

Additionally, Swift and Objective-C are iOS-specific programming languages. Specifically, Swift is designed to be current and effective, allowing developers to create reliable, high-performing programs.

Enhanced security

Privacy and security come first. Because of Apple’s stringent policies on user data, all apps are required to include strong security features, including data encryption and permissions management. The fundamental design of iOS apps upholds this commitment to privacy, guaranteeing that user data is always secure.

How to build an app for iOS

Building an iOS app involves a series of decisions and steps, each of which can influence the final app development costs and development timeline. Here’s a structured approach:

Define your scope and platform needs

Decide if you need an app exclusively for iOS or if you plan to develop for Android as well.

Cross-platform frameworks allow you to build a single codebase for both platforms, which can save money and time, but native development guarantees the greatest performance and user experience.

Work on UI/UX

iOS users have very high expectations for design and usability. Moreover, the design must be adhere to (HIG).

Develop and test

Use Apple’s Xcode integrated development environment (IDE) for project management, code authoring, and app building.

Extensive testing is essential. To find and fix issues, use physical devices and simulations.

Prepare for App Store submission

Ensure your app complies with all App Store Review Guidelines. This includes content restrictions, user interface standards, and privacy policies. We add different screenshot and keywords to create a list.

Submit to the App Store

Use Xcode or App Store Connect to submit your app for review. Be prepared for multiple review rounds, as Apple may request changes to meet their guidelines.

Post-launch support and updates

Even after release, you should allocate your resources on maintaining and refining the app.

How much money do we spend to build an app?

We spend on various components such as:

Development team costs

| Cost Category | Details | Cost Range |

| Freelancers | Rates depend on experience and location. Suitable for small projects or startups. | $25 – $150 per hour |

| In-house team | Provides greater control but involves higher costs, including salaries, benefits, and infrastructure. | $5K – $25K per month |

| Outsourcing to agencies | Ideal for complex projects with a need for expertise. Costs vary based on project scope and agency reputation. | $20K – $150K+ |

2. App complexity

Most of the apps have minimal functionality and their cost may be between $10K and $30K.

It has database integration, API interactions, and user authentication typically costs between $30K and $100K.

But now, apps that have advanced features such as real-time data sync, custom animations, AI integration, or complex back-end requirements can cost more than $100k.

3. Design costs

Mostly UI/UC design cost between $50k to 30k. It depends on the number of design and screend complexity. If you are budget limited, consider simple UI/UX without complex animations.

4. Backend development

Creating a backend to handle user data, authentication, and other critical features typically costs between $10K and $50K. Third-party services, like analytics tools, social network logins, or payment gateways, can bump up the price by an additional $2K to $10K.

5. App Store costs

Apple’s developer license is $99 per year for individuals. For enterprises, the cost is $299. Additionally, keep in mind that Apple takes a 15% to 30% fee on all in-app purchases and premium software downloads.

6. Marketing and launch costs

Landing pages, press releases, and social media campaigns generally range from $1K to $10K. Of course, marketing is not an obligatory and rigid factor. For example, MVP apps rarely have extensive marketing.

7. Launch costs

App Store optimization costs anything from $1K to $5K, depending on how visible you want your app to be.

8. Maintenance and updates

After launch, bug fixes and small upgrades may run you anything from $1K to $10K a year. Depending on their complexity, adding new features based on user feedback can cost anywhere between $5K and $50K.

How much does it cost to develop an app from Purrweb?

The table below provides approximate pricing for an average project, giving you a general idea of the budget range to consider.

| Stage | Estimated cost | Description |

| Project analysis | $1K | Initial research, feature prioritization. |

| UI/UX design | $5,400 | Wireframes, design concepts, full app design. |

| App development | $36K – $40,500 | Coding and feature implementation. |

| QA testing | $5,400 – $6K | Bug identification and resolution. |

| Project Management | $3,950 – $4,100 | Coordination and oversight throughout the project. |

| App Store submission | $99-$299 | The cost of developer license. |

| Marketing | $1-3K | Depends on the client’s budget and needs, is not strictly regulated. |

| Total cost of app development | $60K+ | Basic functionality app, 4 months development time. |

Of course, this is just an estimate. The actual cost for building an app can vary greatly depending on its specific details. As each app is unique, it’s essential to discuss your requirements with a development company and get an accurate quote.

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Technology4 weeks ago

Technology4 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

MMA3 weeks ago

MMA3 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology4 weeks ago

Technology4 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Technology3 weeks ago

Technology3 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Technology4 weeks ago

Technology4 weeks agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Technology3 weeks ago

Technology3 weeks agoGmail gets redesigned summary cards with more data & features

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

News1 month ago

the pick of new debut fiction

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

MMA3 weeks ago

MMA3 weeks ago‘I was fighting on automatic pilot’ at UFC 306

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Business3 weeks ago

Business3 weeks agoStark difference in UK and Ireland’s budgets

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

News3 weeks ago

News3 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

Sport3 weeks ago

Sport3 weeks ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Football3 weeks ago

Football3 weeks agoWhy does Prince William support Aston Villa?

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

News3 weeks ago

News3 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

TV3 weeks ago

TV3 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Money3 weeks ago

Money3 weeks agoPub selling Britain’s ‘CHEAPEST’ pints for just £2.60 – but you’ll have to follow super-strict rules to get in

-

Business3 weeks ago

Can liberals be trusted with liberalism?

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

News3 weeks ago

News3 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

-

Politics3 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

Technology3 weeks ago

Technology3 weeks agoHow to disable Google Assistant on your Pixel Watch 3

-

Technology3 weeks ago

Technology3 weeks agoA very underrated horror movie sequel is streaming on Max

-

Entertainment3 weeks ago

Entertainment3 weeks ago“Golden owl” treasure hunt launched decades ago may finally have been solved

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists are grappling with their own reproducibility crisis

You must be logged in to post a comment Login