Money

BPF stalwart Ian Fletcher set to retire

Fletcher joined the BPF in 2002 following eight years at the British Chambers of Commerc,e where he was head of policy and chief economist.

The post BPF stalwart Ian Fletcher set to retire appeared first on Property Week.

Money

Abrdn calls on government to incentivise pension allocations to real estate

This could deliver better outcomes for pension savers while also supporting the UK economy, such as by easing housing shortages.

The post Abrdn calls on government to incentivise pension allocations to real estate appeared first on Property Week.

Money

PFS and CII relationship ‘blown wide open’ after latest saga

The already fractious relationship between the Personal Finance Society (PFS) and the Chartered Insurance Institute (CII) has been ‘blown apart’ again.

The CII announced yesterday (1 October) that its chief executive Matthew Hill and three other executives – Trevor Edwards, Mathew Mallett and Gill White – have been appointed to the PFS board.

The move has further increased tensions between members of the PFS and its parent body, the CII.

The debacle started with the ‘Christmas coup’ in December 2022, when the CII imposed its own directors on the PFS board in a highly controversial move.

At the time, the CII said it took action due to “serious and significant” governance failures at the PFS.

The PFS immediately hit back, slamming the CFII’s decision, with former PFS president Sarah Lord condemning the CII’s “aggressive” behaviour.

She also described the move as “disingenuous” and said it had been done without prior consent or warning.

Caroline Stuart resigned from her roles as PFS president and member director of the PFS board on 5 January 2023, saying the pressure was affecting her health.

There were also a series of resignations and appointments in the 12 months that followed.

Last year, the PFS and CII appeared to have resolved the dispute and both parties said they were working together.

However, this week the CII took action to flood the PFS board with its members once again.

In a statement, campaign group Our PFS, set up to ‘save’ the body following the Christmas coup of 2022, blasted the CII’s actions.

“It has been around a year since the last actions of ourpfs.co.uk, with a general feeling that issues between CII and PFS were in the process of being resolved,” it said.

“Unfortunately, this has been blown wide open again thanks to incredibly questionable actions taken by the Chartered Insurance Institute on 1 October 2024.

“OurPFS is urgently investigating and will be writing out with more details as soon as they are known.

“October 2024 may well turn out to be the month that defines the future of our professional body.”

Money Marketing has contacted representatives of the PFS for a comment.

Money

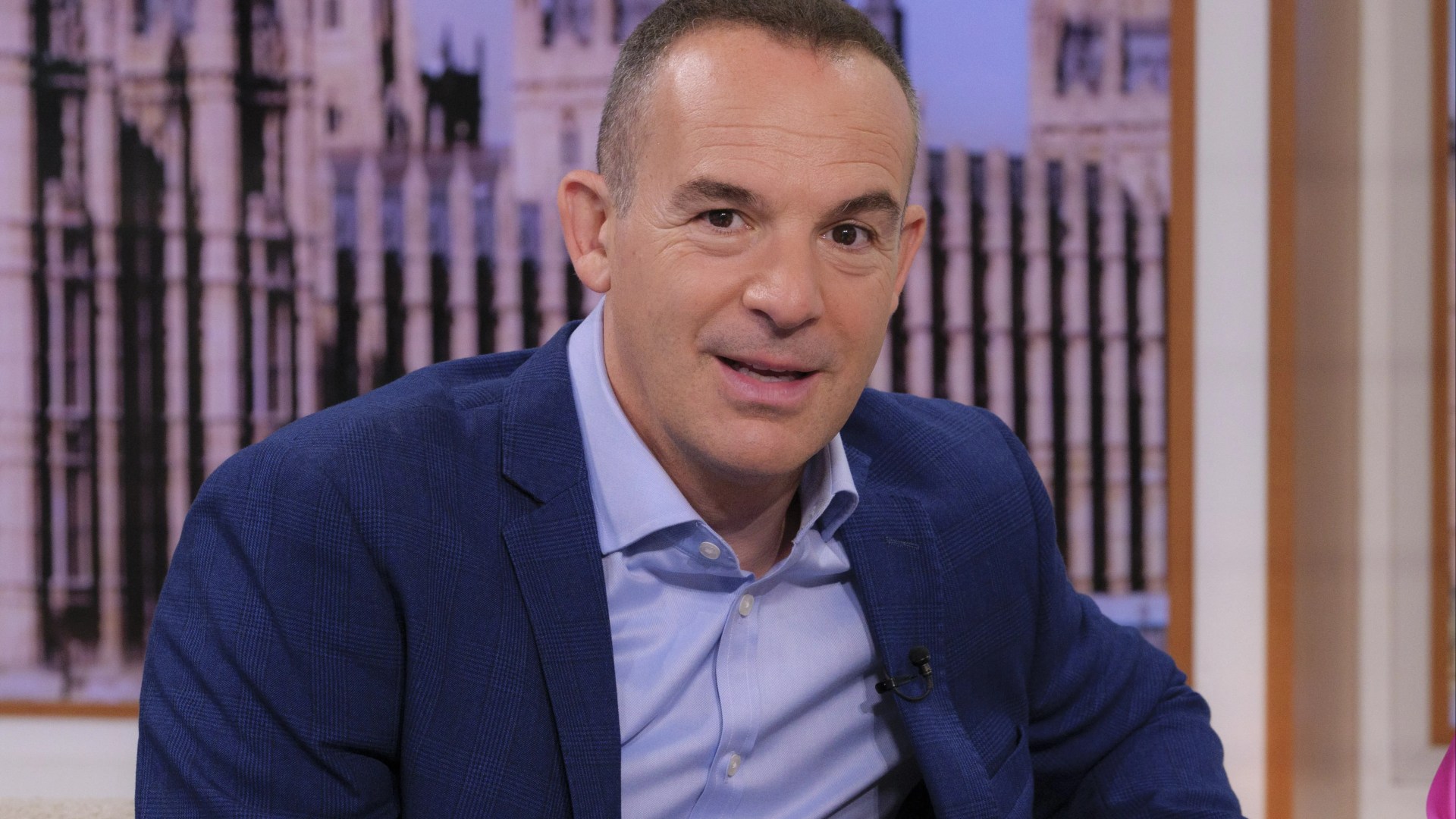

Martin Lewis issues ‘ditch and switch’ warning for customers of huge high street bank

MARTIN Lewis has issued a warning for customers of a major high street bank.

Santander has cut the rate on its easy-access savings account by 1.1%.

The account paid 5.2% interest when it first launched, but was cut to 4.20% in May and has now been reduced to 4%.

This means customers will get 4% interest on balances between £1 and £250,000.

It applies to customers who have a Santander’s Easy Access Saver Limited Edition (Issue 3).

The deal is no longer open to new customers.

When the deal fist launched last September, it was one of the most competitive on the market.

However, experts from the Martin Lewis MoneySavingExpert blog are urging customers to think twice.

They said: “You can easily beat this new rate by switching elsewhere – which you’re allowed to do without penalty.

The blog stated that even though this account has a 12-month term the rate is variable.

This means that savers are not locked into this account and do not have to stick with it.

They explained: “This account works in a slightly unusual way – it initially had a 12-month term, but the rate wasn’t fixed for this period

“Instead, what happens at the end of the term – which has since been extended by 10 months – is that the account ‘matures’ and your money is transferred to one of Santander’s other easy-access accounts with a much lower interest rate.”

“You can ditch and switch,” they added.

The MoneySavingBlog named two saving accounts for customers which offer higher interest.

These include:

Trading 212’s Cash ISA

This is a type of savings account which offers tax free interest on savings up to £20,000.

There is not mimiumn you have to pay in to receive the interest.

You must be at least 18-years old to open this type of savings account.

Trading 212’s deal offers savers 5.1% AER Variable on customers savings.

An AER Variable rate means that your rate is not guaranteed and that it can change over time.

On this deal, savers can withdraw their cash at anytime without any impact on their savings rate.

The interest is also paid daily.

If you want to read more about ISA’s check out our article here.

Oxbury saving account offer

This bank is offering an AER interest rate of 4.76%.

However, the interest will only on balances above £25,000 and up to £500,000.

It is also worth noting that if your balance falls below £25,000 after opening the account, you will not receive interest on the balance.

You will only receive interest on balances above £500,000, where those balances have resulted from interest being accrued to the account.

Unlike Trading 212’s Cash ISA, where interest is paid daily, here it is only paid one a month.

What other options are available for savers?

There are several types of savings accounts available to customers, so you need to make sure you select one that suits your circumstances.

Easy-access accounts and regular savings accounts, which allow greater flexibility when it comes to withdrawing your cash, but they tend to offer slightly lower interest rates.

If you’re happy to leave your cash in your account for longer then you can consider a fixed-bond or notice savings account.

Before opening a new savings account it’s always worth having a browse on price comparison websites.

Moneyfactscompare, Compare the Market, Go Compare and MoneySupermarket will help save you time and show you the best rates available.

These sites let you tailor your searches to an account type that suits you.

Where to find the best savings rates

Many savings accounts offer miserly rates meaning that money is generating little or no return.

However, there are ways to get your cash working hard. Sun Savers Editor Lana Clements explains how to make sure you money is getting the best interest rate.

Easy access savings accounts offer flexibility for customers, meaning they can dip in and out of cash when needed. However, the caveat is that rates can change at any time.

If you’re keeping your money in an easy access account, you’ll need to keep checking whether it’s the best paying account for your circumstances and move if not.

Check in at least once a month to see what is happening in the market.

Check what is offered by your bank – sometimes the best rates are for customers only.

But do search the wider market as often top savings accounts are offered by lesser known providers.

Comparison sites are a good place to check for the top rates. Try Moneyfactscompare.co.uk or Moneysupermarket.

You can search by different account type. You’ll usually get a better interest rate if you can lock your money away for a fixed amount of time, but it’s always a good idea to keep some money in an easy access account in case of emergencies.

Don’t overlook regular savings accounts often pay some of the best rates, but you’ll need to commit to monthly payments. This can be a great way to get into a savings habit while earning top rates at the same time.

Money

Labour’s housebuilding plans could boost economy by £330bn, HBF claims

The report reveals that last year the completion of 240,000 new homes in England and Wales generated £53.3bn of economic output and supported 834,000 jobs.

The post Labour’s housebuilding plans could boost economy by £330bn, HBF claims appeared first on Property Week.

Money

When advisers should don the doctor’s hat

Advisers need to be in contact with clients more than ever, whether that be to meet regulatory requirements or simply because we’re all expected to be more accessible these days.

This regularity of contact keeps us on top of changes to clients’ financial situations – but it also puts us in a prime position to notice any changes to their mental and physical wellbeing, too.

These sorts of changes used to be picked up by doctors, but you only get 10 minutes with them nowadays, and it’s very rare you see the same one over time.

Ok, ok, we’re not going to be getting a stethoscope out, but we can give the little nudge a client needs following some simple observations.

What good is a pile of money and plans detailing a long and well-lived life, if you end up in poor health, unable to fulfil your dreams?

Some reading will think this goes beyond their remit of needing to make clients money. But who will those clients thank and stick with for engagement in their wellbeing? Who are they going to tell their friends and family about?

And, after all, what good is a pile of money and plans detailing a long and well-lived life, if you end up in poor health, unable to fulfil your dreams?

Bad luck can play a part, of course, but reducing the likelihood of poor health before it is too late is something worth sitting up for. Health is wealth.

There might have been a lot of sweat and sacrifice involved in getting your exams and building your technical knowledge, but most clients don’t care how much you know until they know how much you care.

If you do not make time for your wellness, you will be forced to make time for your illness

Wellness educator Joyce Sunada said: “If you do not make time for your wellness, you will be forced to make time for your illness”.

The effect of loneliness is equivalent to smoking 15 cigarettes a day. Not addressing severe hearing loss increases the likelihood of living with dementia fivefold. Unhealthy living, such as stress, poor diet and lack of mobility increases the chances of chronic inflammation which, in turn, increases the likelihood of heart disease, diabetes, cancer, arthritis and bowel diseases.

The need to exercise our hunting and survival mechanisms are hardly met by punching buttons on a computer while reaching for a croissant.

Encouraging change is never too late. A study by Lars T. Fadnes et al, Nature Food (2023), found that 40-year-old men and women who changed from an unhealthy diet to eating healthier food consistently gained almost 10 years in life expectancy.

The need to exercise our hunting and survival mechanisms are hardly met by punching buttons on a computer while reaching for a croissant

Even those without the traditional assets to engage with a financial adviser could find a later opportunity for conversation when needing advice on a lifetime mortgage to help get by, for example.

Even 70-year-olds can manage to extend their life expectancy by four or five years if they make a sustained diet change.

Enduring frailty in later age is very frustrating. Advisers who can encourage some strength training to increase resilience and reduce the chance of fractures caused by bone-thinning conditions could make a big difference to people’s lives.

Just a little bit of wellbeing knowledge and a gentle nudge shows them just how much you care.

If you are concerned not just for your client’s finances, but also for their overall wellbeing, you will have an even better relationship with them.

Mel Kenny is a chartered financial planner at Radcliffe & Newlands Wealth

Money

I’m missing out on £1MILLION payday because I can’t sell my home thanks to council ‘blunder’ – they’ve ruined my garden – The Sun

A HOMEOWNER has claimed he is unable to sell his £1million farmhouse because of an imposing council car park subsiding the property.

Andrew Ewart-James, 78 also said the facility has driven the Gloucestershire gaff’s value down by an eye-popping £600,000.

The pensioner nabbed Home Farm in the sleepy village of South Woodchester in 1977 and claims he has had difficulties retaining wall in his garden since he moved in.

The council erected scaffolding to help support the car park wall until a long term solution is found – but Andrew says the wall has been crumbling for years.

Andrew’s wife recently passed away and the homeowner is eager to sell off the home so that he can move into a more modest home and his children can have his inheritance.

He has now issued a High Court proceeding against Stroud District Council over the wall.

“I feel trapped. I am fed up with the council – they never say anything, never respond to me and never say what they are doing,” he claimed.

“They say they keep the residents up to date but it is not true – they won’t disclose their plans, but I know they are doing the cheapest job they can and they do not really care when they get around to doing it.

“I’m too old to hang around so I have issued instructions to go to High Court proceedings against them for damages!

“I used to be a solicitor, so I know the process won’t be immediate but it will come along – when the council they get the message I’m serious, hopefully they will do something.”

”When we bought the home in 1977 there were only two cars in the car park – but now there are seven to eight!

“My wife died and I don’t want to live in this home on my own. We have been here 47 years and I want to sell it.

“I want to live in a smaller home and give my children the share they are entitled to under their mother’s estate.”

Andrew fears the current situation will drive down the property’s value.

He continued: “Nobody with half a brain would buy a house in this condition. It’s probably worth somewhere over £1m.

“I reckon the fall in the value of this house would mean only an investor would buy it in its current condition for around £400,000.”

Andrew said his surveyor told him in 1977 there was a large retaining wall with a 12ft drop.

The surveyor said at the time that the structure was fine but “retaining walls nearly always cause problems”.

“In 1986, we had a structural survey specifically of the wall because we noticed cracks developing. They weren’t following the outline,” he told the The Local Democracy Reporting Service.

“The cracks were going through the bricks. We knew we had a problem.

“We have had to live through this problem since 1986 when we first notified the council there was an issue.

”At that time we put up marker tags to see if there was going to be any movement in the council’s wall.

“It showed slight movement over the years and then in January 2019, the wall lurched four inches being pushed by the council’s wall.

WHAT ARE MY RIGHTS?

Scaffolding is often not given the attention that it deserves. If scaffolding has been erected on or oversailing a neighbour’s property, without obtaining any consent, then it could be trespass.

Where trespass is established, the party that erected the scaffolding could be required to remove it entirely. They might also be liable for damages and costs.

The consequence of that might be that the intended works might not be able to be completed – even if there is suitable planning consent for those work. Overall potentially making a situation like this a costly mistake.

Source: Moore Barlow Lawyers

“We built buttresses. We were under the impression the whole thing was going to come tumbling straight down down.

“They are using our own wall internal to the land of the property to prop up their wall and its not working and they are all falling down.

“The council didn’t seem to take it particularly seriously and said there was no need for urgency.

“I’m afraid that has been their attitude ever since. They don’t tell us what they are doing and they do when they feel like it.

“I don’t think they are being directed by the elected representatives, it’s the paid officials who are deciding what, if anything, they wish to do, and I don’t think they are doing it properly.”

A Stroud District Council spokesperson said: “We have conducted essential preliminary work to identify the cause of the wall’s movement and determine the appropriate course of action.

“Comprehensive structural and geotechnical surveys are now complete and our structural engineers have finalised the design for the repairs.

“We are waiting for feedback on our plans from the residents’ own structural engineer.

“We understand that living so close to a construction site poses challenges, however this is an unusually complex case due to the scale, construction type and location.

“We have kept the owner of the neighboring property informed of our actions throughout the process.

“Ensuring the safety of the public remains our priority.”

The Sun has reached out to Stroud District Council for comment.

-

Womens Workouts1 week ago

Womens Workouts1 week ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology2 weeks ago

Technology2 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 weeks ago

Science & Environment2 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to wrap your mind around the real multiverse

-

News1 week ago

News1 week agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy this is a golden age for life to thrive across the universe

-

News2 weeks ago

News2 weeks agoYou’re a Hypocrite, And So Am I

-

Sport2 weeks ago

Sport2 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNerve fibres in the brain could generate quantum entanglement

-

News2 weeks ago

News2 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCardano founder to meet Argentina president Javier Milei

-

Science & Environment1 week ago

Science & Environment1 week agoMeet the world's first female male model | 7.30

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoBest Exercises if You Want to Build a Great Physique

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

News2 weeks ago

News2 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoEverything a Beginner Needs to Know About Squatting

-

News1 week ago

News1 week agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts1 week ago

Womens Workouts1 week ago3 Day Full Body Toning Workout for Women

-

Travel1 week ago

Travel1 week agoDelta signs codeshare agreement with SAS

-

Politics7 days ago

Politics7 days agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Sport2 weeks ago

Sport2 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Technology2 weeks ago

Technology2 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBlockdaemon mulls 2026 IPO: Report

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

News1 week ago

News1 week agoWhy Is Everyone Excited About These Smart Insoles?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow one theory ties together everything we know about the universe

-

News2 weeks ago

the pick of new debut fiction

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business2 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoKeep Your Goals on Track This Season

-

Science & Environment7 days ago

Science & Environment7 days agoX-rays reveal half-billion-year-old insect ancestor

-

News2 weeks ago

News2 weeks agoChurch same-sex split affecting bishop appointments

-

Technology2 weeks ago

Technology2 weeks agoFivetran targets data security by adding Hybrid Deployment

-

Politics2 weeks ago

Politics2 weeks agoLabour MP urges UK government to nationalise Grangemouth refinery

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe maps that could hold the secret to curing cancer

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

Business2 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics2 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

Politics2 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoWhich Squat Load Position is Right For You?

-

Science & Environment1 week ago

Science & Environment1 week agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Technology1 week ago

Technology1 week agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

News6 days ago

News6 days agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology2 weeks ago

Technology2 weeks agoIs carbon capture an efficient way to tackle CO2?

-

Politics2 weeks ago

Politics2 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSingle atoms captured morphing into quantum waves in startling image

-

Technology2 weeks ago

Technology2 weeks agoCan technology fix the ‘broken’ concert ticketing system?

-

Fashion Models2 weeks ago

Fashion Models2 weeks agoMixte

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow Peter Higgs revealed the forces that hold the universe together

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

You must be logged in to post a comment Login