Money

Can the UK’s bold gamble on capital market regulation steer it to success?

Proponents of the latest changes are betting that easing the hurdles for companies, even in ways investors dislike, will pay off

Proponents of the latest changes are betting that easing the hurdles for companies, even in ways investors dislike, will pay off

Team GB should be proud of its haul of 65 medals at the 2024 Paris Olympics – more than any country besides China and the US.

However, with 14 of those 65 medals being gold, GB may well feel like it took the runner-up prizes a few more times than it would have liked.

Unfortunately, there are parallels here with the British capital markets, currently lamenting a dearth of new and exciting IPOs – a field in which we’re also trailing the US.

It is widely agreed radical changes are needed. That’s just what is happening. Yet still not everyone is excited.

New proposals in July to amend rules governing disclosures and investor access to capital raisings were announced as part of the government’s ongoing plans to rehydrate the country’s capital markets.

The key proposal, if enacted, would eliminate the need for companies to issue a new prospectus in most circumstances other than for initial listings on public markets. The proposals also outline measures to increase retail participation in both public and private market investments.

These proposals are intended to complement the recently introduced UK Listing Rules, which came into effect last month. The rules aim to remove the barriers on the road to UK investment recovery by relaxing restrictions on dual class share structures, which allow managers and founders to exercise control over companies in which they may only hold a minority stake.

They also remove requirements to seek shareholder approval for a number of significant corporate transactions, or those with related parties.

Pedalling ahead

Although measures to encourage a broader base of investment are a largely welcome boost to UK companies in need of an edge, several of these moves are perceived to come at the expense of investor protections valued by UK shareholders.

On balance, this proposed regulation looks like a bold gamble, which hinges on the idea the UK can build a more competitive capital market by streamlining the requirements for listed companies, even if that means introducing features their investors largely dislike.

Pushing forward market features that many of the largest investors oppose will require a careful eye on the detail if we are to attain the leading capital market everyone seeks.

Whether reducing investor protections and required disclosures is the right route to go down will depend on the UK’s ability to attract high-performing and well-governed companies. Any perception that the new rules represent a race to the bottom – in which investors place their capital in lower quality businesses, subject to weaker transparency and greater management control – will need to be fought against.

Overall, while not everyone is happy with the changes, investors and companies appear to have accepted the current regulatory direction of travel is not about to alter, having just been confirmed as one of the first acts of the new Labour government.

So, the strategy has been set and the big call has been made. Let’s hope that when the figurative tyres are changed, it turns out to be a stroke of genius which puts UK companies on a winning streak rather than setting up investors for a fall.

Lindsey Stewart is director of stewardship research and policy for Morningstar Sustainalytics

Money

BNP Paribas Real Estate hires Biss as head of occupier business development

Former Devono associate has 10 year’s experience in the London market.

The post BNP Paribas Real Estate hires Biss as head of occupier business development appeared first on Property Week.

Money

How will the U.S. Interest rates cut affect you?

How will the U.S. Interest rates cut affect you?

The recent announcement from the US Federal Reserve as they made a significant cut to interest rates of 0.50% points marks the largest reduction in interest rates since 2020. Typically, the Federal Reserve adjusts rates by just 0.25 percentage points at a time, so this half-point cut is a substantial move designed to have a noticeable impact on the economy.

The cut brings the federal funds rate to a range between 4.5% and 4.75%, the lowest it has been in two years.

Their goal with this cut is to stimulate the US economy, encourage businesses to and consumers to borrow more money at lower rates. This should lead to more spending and in turn economic growth.

Why have interest rates been so high?

Interest rates in the US and globally have been at a record high over recent years due to a combination of pressures. COVID-19 caused economic disruptions and the supply chain issues that followed caused a surge in inflation in the US and globally. Consumer prices have been rising for goods like groceries, fuel and housing which has prompted the Federal Reserve to act.

They raised interest rates in several increments, hoping to cool down spending and borrowing, which in turn could help bring inflation under control. When borrowing costs increase, both consumers and businesses tend to spend less, slowing economic growth and reducing inflationary pressures. Over the past year, the federal funds rate had been raised to around 5%, one of the highest levels in decades.

This has had a substantial effect on the economy, the housing market has begun to cool due to higher mortgage rates and businesses pulling back on investments. Inflation has began to moderate as the Federal Reserve begins their balancing act to ensure inflation doesn’t reignite whilst avoiding a recession.

Why have they cut interest rates now?

While inflation has eased in recent months, there are concerns that the high interest rates were beginning to stifle growth too much. By making borrowing cheaper through this significant 0.50 percentage point cut, the Fed aims to boost both consumer spending and business investment. This recent cut should support economic growth in the US for 2025.

Lower interest rates can make it cheaper for businesses to expand, hire more employees, and invest in new technologies. For consumers, this can mean more affordable loans for things like homes, cars, and education. As borrowing costs decrease, individuals are more likely to take out loans, which in turn can drive up demand for goods and services, helping to boost the economy.

With reduced interest rates, consumers might feel more confident about making big-ticket purchases, such as homes or cars, knowing their monthly payments will be lower. In turn, this renewed confidence and spending can have a ripple effect, encouraging businesses to expand and invest more heavily, further stimulating the economy.

How the rate cuts affect the typical US family

This rate cut has several implications for US families, particularly when it comes to managing everyday expenses. One of the most immediate effects will be felt in mortgage rates. Families looking to buy a home or refinance their current mortgage may see lower interest rates, which can significantly reduce monthly payments. A 0.50% reduction in interest rates can translate to thousands of dollars saved over the life of a mortgage, making homeownership more affordable.

Those with credit card debt or personal loans may notice lower interest rates on their outstanding balances making it easier to manage repayments. Financing a new car or making large purchases will become more affordable as loans will be more accessible. This will allow families to have an increase in spending money which will be poured into the economy through purchases and days out.

How global markets are affected

Changes in U.S. monetary policy often ripple through global markets, and countries like the UK could be affected. For instance, the UK’s financial markets often move in tandem with the U.S., particularly in terms of bond yields and currency exchange rates. If U.S. interest rates decline, it can weaken the dollar, making other currencies like the British pound stronger in comparison. This can affect UK exports, making British goods more expensive for U.S. consumers.

US rates can also promote central banks such as, the Bank of England to consider their own policy adjustments.

The next announcement

the next major Federal Reserve decision is set for November 7th, just after the U.S. elections. The timing of this announcement has sparked debates about how political and economic factors will intersect. Many are questioning whether future rate cuts will continue or if the Fed will pause to reassess the state of inflation and economic growth post-election.

Money

Money Marketing Weekly Wrap-Up – 16 Sept to 20 Sept

Money Marketing’s Weekly Must-Reads: Top 10 Stories

Stay ahead with our curated list of this week’s top 10 financial news stories.

Gain exclusive insights into pressing topics such as Tony Wickenden’s take on advising pre-emptive action to shield clients from CGT. Also, get the scoop on Sesame Bankhall’s latest hire to lead their adviser network.

Read more below:

Tony Wickenden: Should you advise pre-emptive action to save clients from CGT?

Tony Wickenden discussed the potential impact of rising capital gains tax (CGT) following Budget warnings. He noted the government’s reluctance to increase income tax, National Insurance, or VAT, leading to speculation about CGT increases. Wickenden suggested that if clients are already planning disposals, they should consider completing them sooner. He highlighted concerns that higher CGT rates might prompt wealthy individuals to defer gains. He also mentioned potential mid-year changes and the importance of balancing tax considerations with investment decisions.

Sesame Bankhall hires new director to lead adviser network

Phoenix Group scraps plans to sell protection business

Phoenix Group cancelled plans to sell its SunLife protection business, citing uncertainty in the protection market. Instead, the company will focus on enhancing SunLife’s value, as it remains a key asset serving the UK’s over-50s market. Phoenix had acquired SunLife from AXA in 2016. The decision was announced in Phoenix’s 2024 interim results. CEO Andy Curran highlighted growth in the Workplace business and the expansion of the Group’s retirement offerings, including a fixed-term annuity launched by Standard Life.

Close Brothers sells asset-management business

Steven Cameron: Is it time? What flat-rate pensions tax relief would look like

Steven Cameron explored potential pension tax reforms ahead of the 30 October Budget, speculating that Chancellor Rachel Reeves might introduce a flat-rate tax relief system. Currently, tax relief is given at an individual’s marginal rate, benefiting higher-rate taxpayers. A move to a 30% flat rate would favour basic-rate taxpayers but reduce relief for higher earners. Employer contributions could also face changes, possibly affecting defined benefit schemes. Cameron urged advisers to discuss possible changes with clients and consider making extra pension contributions before the Budget.

Andy Bell: Where will Labour find £22bn?

Andy Bell discussed how Labour might address the UK’s £22bn fiscal deficit without raising VAT, income tax, or National Insurance. He suggested potential reforms to capital gains tax (CGT), pension tax relief, inheritance tax (IHT), and the introduction of a wealth tax. Aligning CGT with income tax rates and introducing a flat-rate pension tax relief could raise revenue but may face backlash. A wealth tax and IHT adjustments also carry challenges, including political risks and administrative complexity. Bell stressed the need for balanced, fair policy design.

Brooks Macdonald to acquire Norwich-based financial advice firm

Brooks Macdonald announced the acquisition of Norwich-based Lucas Fettes Financial Planning, subject to regulatory approval by early 2025. Lucas Fettes manages £890m in assets across 1,600 personal clients and £300m from corporate clients. The acquisition aims to enhance Brooks Macdonald’s financial planning capabilities and expand its presence in East Anglia. Lucas Fettes, one of Brooks’ top introducers since 1996, will integrate into Brooks Macdonald’s direct wealth business, aligning with the group’s strategy to focus on UK investment management and financial planning.

Octopus Investments launches IHT and estate planning helpdesk

Octopus Investments launched ‘Ask Octopus,’ a helpdesk offering technical support on inheritance tax (IHT) and estate planning for financial advisers. The service, accessible via their website, provides answers to advisers’ queries and allows direct meetings with experts. It covers IHT rules, estate planning, wills, and probate. Octopus aims to assist advisers, particularly those without technical team support. This launch comes as IHT receipts have surged, prompting calls for reform ahead of Chancellor Rachel Reeves’ 30 October Budget.

Skerritts buys Harrogate-based advice firm

Skerritts Group acquired Harrogate-based Ellis Bates Financial Advisers, adding over £1bn in assets under management and strengthening its presence in Northern England. The deal, backed by Sovereign Capital Partners, was set to complete in September 2024. Skerritts, aiming for national expansion, has made 11 acquisitions since Sovereign’s £55m investment in 2021. Skerritts CEO Paul Feeney praised the acquisition, while Ellis Bates’ managing director Michael Cope highlighted shared values and ambitions for growth within the partnership.

Advisers tweak processes in light of retirement income review

Following the Financial Conduct Authority’s (FCA) thematic review of retirement income advice, most financial advisers adjusted their processes, according to Wesleyan. The FCA’s March 2024 review highlighted areas for improvement, including income withdrawal strategies and advice suitability. Wesleyan’s poll revealed that 91% of advisers familiar with the review reassessed their practices, with 66% already implementing changes. Common adjustments included advice file record-keeping and client screening. Over three-quarters of advisers agreed the review heightened the focus on providing better retirement advice.

Money

Investec reports growing optimism on housebuilder recovery

Firm sees “growing consensus and confidence that recovery will gain traction from 2025”, as national indices show house prices edging up.

The post Investec reports growing optimism on housebuilder recovery appeared first on Property Week.

Money

Next warns it could close stores and halt openings over equal pay claim appeal

Retailer faces possible financial hit from equal pay claim brought by former and current store employees seeking equal pay with warehouse staff.

The post Next warns it could close stores and halt openings over equal pay claim appeal appeared first on Property Week.

Money

IHT receipts continue to rise as speculation mounts ahead of Budget

The Treasury collected £3.5bn in inheritance tax receipts between April to August, latest figures from HMRC published this morning (20 September).

This is £300m higher than the same period last year.

Another record-breaking year for IHT receipts is being predicted and experts believe this upward trajectory will continue year on year and hit £9.7bn in 2028/29.

However, there are rumours that IHT will be increased next month when the new Labour government unveils its first Budget.

The current £325,000 nil rate band has been at that level since 2009.

The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

Nucleus technical services director Andrew Tully, said: “The ever-increasing IHT tax take may give the government food for thought as we approach next month’s Budget.

“Changes could be made such as scrapping or updating the rules on agricultural land and business relief.

“Currently, a person can claim up to 100% relief on the inheritance of agricultural land if it is being actively farmed.

“This could be reduced, or certain limitations placed on the maximum value of the relief.

“There could be a tightening of qualifying criteria for business relief, perhaps relating to unlisted shares and AIM portfolios.

“Although that could be difficult to implement and may not tie in with the desire to increase investment in the UK.”

Shaun Moore, tax and financial planning expert at Quilter, is calling for the IHT system to be simplified to make it easier for people to gift during their lifetime.

He said: “The complexity of the current system often leads to confusion and inequities.

“A simpler system could help reduce the administrative burden for both taxpayers and HMRC, while also making it fairer.

“Similarly, increasing the gifting threshold would encourage earlier wealth transfer, reducing future IHT liabilities, and could boost consumer spending.”

The number of families being caught out by tax bills after death on gifts made in lifetime has been surging, according to figures from HMRC obtained recently by wealth management firm Evelyn Partners show.

Tax Partner at professional services and wealth management firm Evelyn, Laura Hayward, said: “The number of estates that paid IHT on gifts made less than seven years before death more than doubled from 590 in 2011/12 to 1,300 in 2020/21, according to the data.

“Meanwhile, the total sum of IHT paid on gifts also more than doubled from £101m in 2011/12 to £256m in 2020/21 – an increase of 153% in monetary terms and 119% in real terms.

“The data suggests the average tax charge payable by beneficiaries on lifetime gifts was £171,186 in 2011/12 and £196,923 in 2020/21.

“That suggests some very significant tax bills are being delivered to unprepared beneficiaries after their generous relative has died, and this might be another reason for those contemplating making big lifetime gifts to start the seven-year clock ticking sooner rather than later.

“Even if the gifter were to pass away within seven years, there is a chance the IHT bill could be reduced by taper relief.”

-

Sport19 hours ago

Sport19 hours agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

News2 days ago

News2 days agoYou’re a Hypocrite, And So Am I

-

Science & Environment22 hours ago

Science & Environment22 hours ago‘Running of the bulls’ festival crowds move like charged particles

-

News20 hours ago

News20 hours agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment1 day ago

Science & Environment1 day agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment1 day ago

Science & Environment1 day agoSunlight-trapping device can generate temperatures over 1000°C

-

Sport19 hours ago

Sport19 hours agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Technology18 hours ago

Technology18 hours agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

Science & Environment2 days ago

Science & Environment2 days agoWhy this is a golden age for life to thrive across the universe

-

CryptoCurrency18 hours ago

CryptoCurrency18 hours agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment22 hours ago

Science & Environment22 hours agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 days ago

Science & Environment2 days agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment22 hours ago

Science & Environment22 hours agoHow one theory ties together everything we know about the universe

-

News17 hours ago

News17 hours agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment2 days ago

Science & Environment2 days agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 day ago

Science & Environment1 day agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment1 day ago

Science & Environment1 day agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment1 day ago

Science & Environment1 day agoNuclear fusion experiment overcomes two key operating hurdles

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoCardano founder to meet Argentina president Javier Milei

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Business18 hours ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

News21 hours ago

News21 hours agoChurch same-sex split affecting bishop appointments

-

Politics2 days ago

Politics2 days agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Politics1 day ago

Politics1 day agoKeir Starmer facing flashpoints with the trade unions

-

Technology20 hours ago

Technology20 hours agoFivetran targets data security by adding Hybrid Deployment

-

News19 hours ago

Freed Between the Lines: Banned Books Week

-

MMA18 hours ago

MMA18 hours agoUFC’s Cory Sandhagen says Deiveson Figueiredo turned down fight offer

-

MMA18 hours ago

MMA18 hours agoDiego Lopes declines Movsar Evloev’s request to step in at UFC 307

-

Football18 hours ago

Football18 hours agoNiamh Charles: Chelsea defender has successful shoulder surgery

-

Football18 hours ago

Football18 hours agoSlot's midfield tweak key to Liverpool victory in Milan

-

Science & Environment22 hours ago

Science & Environment22 hours agoHow to wrap your head around the most mind-bending theories of reality

-

Technology2 days ago

Technology2 days agoCan technology fix the ‘broken’ concert ticketing system?

-

Fashion Models18 hours ago

Fashion Models18 hours agoMiranda Kerr nude

-

Fashion Models18 hours ago

Fashion Models18 hours ago“Playmate of the Year” magazine covers of Playboy from 1971–1980

-

News3 days ago

News3 days agoDid the Pandemic Break Our Brains?

-

Science & Environment1 day ago

Science & Environment1 day agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Politics17 hours ago

Politics17 hours agoLabour MP urges UK government to nationalise Grangemouth refinery

-

Science & Environment1 day ago

Science & Environment1 day agoHow Peter Higgs revealed the forces that hold the universe together

-

Science & Environment20 hours ago

Science & Environment20 hours agoOdd quantum property may let us chill things closer to absolute zero

-

Science & Environment1 day ago

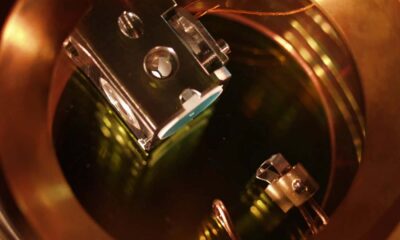

Science & Environment1 day agoQuantum forces used to automatically assemble tiny device

-

Science & Environment22 hours ago

Science & Environment22 hours agoRethinking space and time could let us do away with dark matter

-

Science & Environment2 days ago

Science & Environment2 days agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 day ago

Science & Environment1 day agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 day ago

Science & Environment1 day agoHow to wrap your mind around the real multiverse

-

Science & Environment1 day ago

Science & Environment1 day agoX-ray laser fires most powerful pulse ever recorded

-

Science & Environment19 hours ago

Science & Environment19 hours agoWe may have spotted a parallel universe going backwards in time

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoArthur Hayes’ ‘sub $50K’ Bitcoin call, Mt. Gox CEO’s new exchange, and more: Hodler’s Digest, Sept. 1 – 7

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoTreason in Taiwan paid in Tether, East’s crypto exchange resurgence: Asia Express

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoLeaked Chainalysis video suggests Monero transactions may be traceable

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoAre there ‘too many’ blockchains for gaming? Sui’s randomness feature: Web3 Gamer

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoCrypto whales like Humpy are gaming DAO votes — but there are solutions

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoHelp! My parents are addicted to Pi Network crypto tapper

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours ago‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

-

Science & Environment20 hours ago

Science & Environment20 hours agoA single atom could drive a piston in a quantum engine

-

Science & Environment21 hours ago

Science & Environment21 hours agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment22 hours ago

Science & Environment22 hours agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Science & Environment22 hours ago

Science & Environment22 hours agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoFed rate cut may be politically motivated, will increase inflation: Arthur Hayes

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoMemecoins not the ‘right move’ for celebs, but DApps might be — Skale Labs CMO

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

CryptoCurrency19 hours ago

CryptoCurrency19 hours agoBlockdaemon mulls 2026 IPO: Report

-

Business18 hours ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics18 hours ago

The Guardian view on 10 Downing Street: Labour risks losing the plot | Editorial

-

Politics18 hours ago

Politics18 hours agoI’m in control, says Keir Starmer after Sue Gray pay leaks

-

Politics18 hours ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

Business17 hours ago

UK hospitals with potentially dangerous concrete to be redeveloped

-

Business17 hours ago

Axel Springer top team close to making eight times their money in KKR deal

-

News17 hours ago

News17 hours ago“Beast Games” contestants sue MrBeast’s production company over “chronic mistreatment”

-

News17 hours ago

News17 hours agoSean “Diddy” Combs denied bail again in federal sex trafficking case

-

News17 hours ago

News17 hours agoSean “Diddy” Combs denied bail again in federal sex trafficking case in New York

-

News17 hours ago

News17 hours agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

News17 hours ago

News17 hours agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency17 hours ago

CryptoCurrency17 hours agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Technology4 days ago

Technology4 days agoYouTube restricts teenager access to fitness videos

-

Science & Environment22 hours ago

Science & Environment22 hours agoPhysicists have worked out how to melt any material

-

Politics1 day ago

Politics1 day agoWhat is the House of Lords, how does it work and how is it changing?

-

CryptoCurrency3 days ago

CryptoCurrency3 days agoBitcoin reclaims $60K and ‘this time is different,’ says analyst

-

Health & fitness2 days ago

Health & fitness2 days agoWhy you should take a cheat day from your diet, and how many calories to eat

-

Fashion20 hours ago

Fashion20 hours agoWomen 's Fashion Trends 2022 Ft. Nikita Jain | #Shorts – Myntra

-

News4 days ago

News4 days agoNathan Simpson appears in court over murder of Rachelle Simpson

-

Science & Environment2 days ago

Science & Environment2 days agoElon Musk’s SpaceX contracted to destroy retired space station

-

Science & Environment1 day ago

Science & Environment1 day agoSingle atoms captured morphing into quantum waves in startling image

-

Politics3 days ago

Starmer ally Hollie Ridley appointed as Labour general secretary | Labour

-

Technology3 days ago

Technology3 days ago‘The dark web in your pocket’

-

Business3 days ago

Business3 days agoGuardian in talks to sell world’s oldest Sunday paper

You must be logged in to post a comment Login