Money

Christmas adverts 2024: All the festive TV films released so far rated including M&S, Debenhams and Shelter

THE festive season has kicked off with a bang. There are now so many Christmas adverts on TV in early November that you need both hands to count them.

Whether you love them or aren’t a fan, the commercials are the true sign that the big day is not far around the corner.

While we eagerly await the big reveal of the John Lewis ad, lots of other retailers have already aired their seasonal offerings.

Elizabeth Hurley shows us how to have a stress-free Debenhams Christmas, while Dawn French returns for M&S Food.

Here, we review 11 of these festive mini-blockbusters, giving each a rating out of five for entertainment value.

Debenhams – 4/5

THE 2024 “Duh, Debenhams” advert is a playful take on the festive madness we know all too well.

READ MORE ON FESTIVE ADVERTS

Featuring a star-studded cast including Elizabeth Hurley, Leomie Anderson, Ellie Taylor, and Hannah Cooper-Dommett, this ad suggests how easy festive online shopping can be.

With cheeky nods to the usual Christmas chaos, the celebs hilariously answer the question: “Why does Christmas shopping have to be so hard?” with a sassy, “Duh, Debenhams”.

This ad is sure to bring a smile to your face and remind you that Christmas shopping does not have to be so stressful.

Aldi – 3/5

KEVIN the Carrot is back for the ninth year running, and this time he is on a mission to save Christmas.

In a new adventure, Kevin and pal Katie navigate perilous situations and dodge booby traps to free the Spirit of Christmas and show the humbugs that “Christmas is better when goodwill is returned”.

It’s still a fun watch for the kids, but alas I fear Kevin is fast approaching his expiry date.

Morrisons – 2/5

MORRISONS has brought back its singing oven gloves. Only this time, there’s more of them.

Set to the catchy tune of Bugsy Malone track You Give A Little Love, the music is performed by a choir of 26 Morrisons staff.

The gloves, now fully animated, sing in support of the nation’s family chefs as they prepare an array of indulgent Christmas dishes.

It’s on the mark, but I worry this jingle will become grating.

Greggs – 5/5

GREGGS has set the bar high with its first Christmas advert, which features celebrity chef Nigella Lawson.

Set to an instrumental version of Carol Of The Bells, the ad opens with Nigella in her festive London townhouse.

She calls Christmas her “favourite time of year” and enjoys a Greggs Festive Bake, describing it as a “rapturous riot of flavour” with a “succulent filling”, playfully mimicking her saucy TV style.

Lidl – 3/5

THE Lidl Christmas advert tells a heartwarming tale of a little girl who, after helping an elderly woman, makes a wish to share her Lidl woolly hat with a boy she noticed earlier, who looked cold.

This touching gesture embodies Lidl’s message of sharing the magic this Christmas.

It also highlights the return of Lidl Toy Banks, with the aim of collecting and distributing more than 100,000 toys donated by customers to needy children.

Argos – 3/5

THE Argos Christmas advert features brand mascots Connie the doll and Trevor the dinosaur.

Seen in a dazzling dreamscape, Trevor lives out his rock star fantasy, belting out T-Rex’s classic 20th Century Boy atop a mountain of Marshall speakers.

The scene is electric as Trevor headlines for a crowd of adoring fans, all of whom are his best friend Connie.

This whimsical promo will charm audiences of all ages.

Sainsbury’s – 4/5

THE star here is the Big Friendly Giant from Roald Dahl’s beloved book, voiced by Stephen Fry.

The BFG asks: “Hey Sainsbury’s – how can we make this Christmas a bit more . . . phizz-whizzing?”

Enter Sophie, a Sainsbury’s staffer, who helps him gather food from the supermarket’s trusted suppliers.

The heart-warming promo ends with Fry inviting viewers to, “ask Sainsbury’s” for a truly spectacular festive feast.

M&S Food – 4/5

AUDIENCES are in for a treat as Dawn French and her fairy alter-ego from past ads share the screen for the first time.

As Fairy sprinkles her magic across Dawn’s home, Christmas comes alive with M&S treats, twinkling lights and Christmas cheer.

Six variations will air, with a special cameo by Katherine Jenkins on December 17.

But a second year without Jennifer Saunders does take away some of the magic.

Asda – 3/5

THE ad opens with Asda staff Maggie and Bill gazing out at a massive snowstorm.

Maggie frets: “Every road is closed between here and Sheffield – how are we going to get the store ready for Christmas?”

Enter a team of ceramic gnomes who transform the store into a Christmas wonderland, all set to The A-Team theme tune.

While delightful, it doesn’t top Asda’s previous ads featuring Will Ferrell and Michael Buble.

Shelter – 5/5

GET your tissues ready because Shelter has done it again with its heart-wrenching Christmas ad.

The film opens in an imaginary world where little Mia and her dad are walking across an alien landscape.

They wave to Father Christmas and high-five an alien octopus.

But reality intrudes, revealing their actual life in temporary accommodation and the dad’s efforts to shield Mia from the harsh conditions through make-believe.

Money

Full list of benefits including Universal Credit paid EARLY next month – will you get the cash before Christmas?

THOUSANDS can expect to see their benefit payments land earlier than usual next month.

Households on Universal Credit, child benefit and tax credits are among those affected.

The Department for Work and Pensions (DWP) usually needs to shuffle payment dates around the holiday season.

This means that thousands of benefit payments will be affected to accommodate the bank holidays over Christmas and New Year.

So, if your payment date lands on a bank holiday, you can expect to receive it earlier.

You should receive your money the first working day before the date you are supposed to be paid.

If you are due to be paid on December 25, 26 and 27, your payment will arrive on December 24 instead.

The New Year bank holiday will also affect payments.

If you are due to be paid on January 1, the cash will land in your account on December 31.

The Department for Work and Pensions (DWP) and HMRC have confirmed the following benefits will be affected :

The amount you get paid will not change.

It will be the same as the previous month unless you have had a change of circumstances that has affected how much you are due.

Remember that if you get paid early, you must make that money last, as you will have to wait extra days until your next payment date.

If you expect a payment not paid on time, double-check the date you are usually paid and contact your bank.

Should you need further help, you must contact the DWP.

You can also file a complaint with the DWP regarding any unpaid benefits.

BANK HOLIDAYS IN 2025

- January 1: New Year’s Day

- April 18: Good Friday

- April 21: Easter Monday

- May 5: Early May Bank Holiday

- May 26: Spring Bank Holiday

- August 25: Summer Bank Holiday

- December 25: Christmas Day

- December 26: Boxing Day

UPCOMING BENEFIT CHANGES

Thousands of households on old-style legacy benefits are being moved to Universal Credit via Managed Migration.

The government is transitioning two million people to Universal Credit or pension credit.

The vast majority will be moved by April 2025.

The process started being rolled out in May last year after a successful pilot in July 2019.

Households are being contacted via letters telling them how to move from their old benefit to Universal Credit.

Once you receive a letter, you have three months to move over, or you could lose your current benefits.

You can read more about the process and who is impacted here.

Are you missing out on benefits?

YOU can use a benefits calculator to help check that you are not missing out on money you are entitled to

Charity Turn2Us’ benefits calculator works out what you could get.

Entitledto’s free calculator determines whether you qualify for various benefits, tax credit and Universal Credit.

MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto’s data.

You can use Policy in Practice’s calculator to determine which benefits you could receive and how much cash you’ll have left over each month after paying for housing costs.

Your exact entitlement will only be clear when you make a claim, but calculators can indicate what you might be eligible for.

Money

Thousands of pensioners to get £200 cost of living payment within weeks – see what you can claim NOW

THOUSANDS of pensioners are set to get cost of living payments worth £200 within weeks.

Hard-up retirees are set to receive the payment through the Household Support Fund (HSF).

The aid was set up in 2021 but has been extended a number of times by the government as households struggle to keep on top of rising costs.

It is paid out by local councils and is not exclusive for pensioners to claim.

However, cuts to the £300 Winter Fuel Payment have meant many older people have begun to turn to the aid for extra support.

In East Riding, low-income pensioners, disabled people, care leavers and those who are financially in crisis can claim £200 worth of cost-of-living support.

To meet the criteria the following must apply:

- Be an East Riding resident and in receipt of housing benefit, housing element of universal credit or council tax support

- Be in receipt of a means-tested benefit and have been continuously for a minimum of three months

- Applicant and partner not in employment

- Have less than £1000 in savings

- Not received financial support from the Household Support Fund during the period April 1 2024 to September 30 2024

- Not receiving targeted financial support from the current Household Support Fund.

The local council will pay £200 to eligible households which they can then use for food or energy support.

East Riding Council opened the scheme for applicants in October, and payments will be made until March 2025.

If your claim is successful then you should receive the payment in 20 days.

To apply for the fund you can visit www.eryc.link/fund.

Alternatively, if you do not have access to the internet you can ring the following number, (01482) 393939.

What if I don’t live in East Riding?

It is not only households in East Riding that have access to the Household Support Fund (HSF).

The government has promised to pump a further £1billion into the fund over 2025 and 2026.

This is on top of the £421million top-up up which was announced in September and saw the scheme extended until March 2025.

Some examples of what other councils are doing include Rotherham Council, which is now offering struggling families £250 grants to fight the cost of living.

Rotherham Council says to qualify for the grant, residents must have no more than £150 remaining each month after covering essential expenses like food, rent or mortgage and utility bills.

You do not need to be on benefits to apply for the fund.

How to know if you qualify?

Financial support available to struggling households varies from council to council, so it is worth checking what schemes your local council offers to ensure you get all the support you need.

The benefits you already receive will not be impacted by applying for the HSF.

And, you do not necessarily need to receive benefits in the first place to get vouchers or funds from the HSF.

To get the help, you’ll need to check with your council – as local authorities are in charge of distributing the funding.

Information on how to apply for the funding should be published on your council’s website. Each council will have a different application process.

If there’s no information on your council’s website, then it’s best to ring them up and ask for more information.

Household Support Fund explained

Sun Savers Editor Lana Clements explains what you need to know about the Household Support Fund.

If you’re battling to afford energy and water bills, food or other essential items and services, the Household Support Fund can act as a vital lifeline.

The financial support is a little-known way for struggling families to get extra help with the cost of living.

Every council in England has been given a share of £421million cash by the government to distribute to local low-income households.

Each local authority chooses how to pass on the support. Some offer vouchers whereas others give direct cash payments.

In many instances, the value of support is worth hundreds of pounds to individual families.

Just as the support varies between councils, so does the criteria for qualifying.

Many councils offer help to households on selected benefits or they may base help on the level of household income.

The key is to get in touch with your local authority to see exactly what support is on offer.

And don’t delay, the scheme has been extended until April 2025 but your council may dish out their share of the Household Support Fund before this date.

Once the cash is gone, you may find they cannot provide any extra help so it’s crucial you apply as soon as possible.

Money

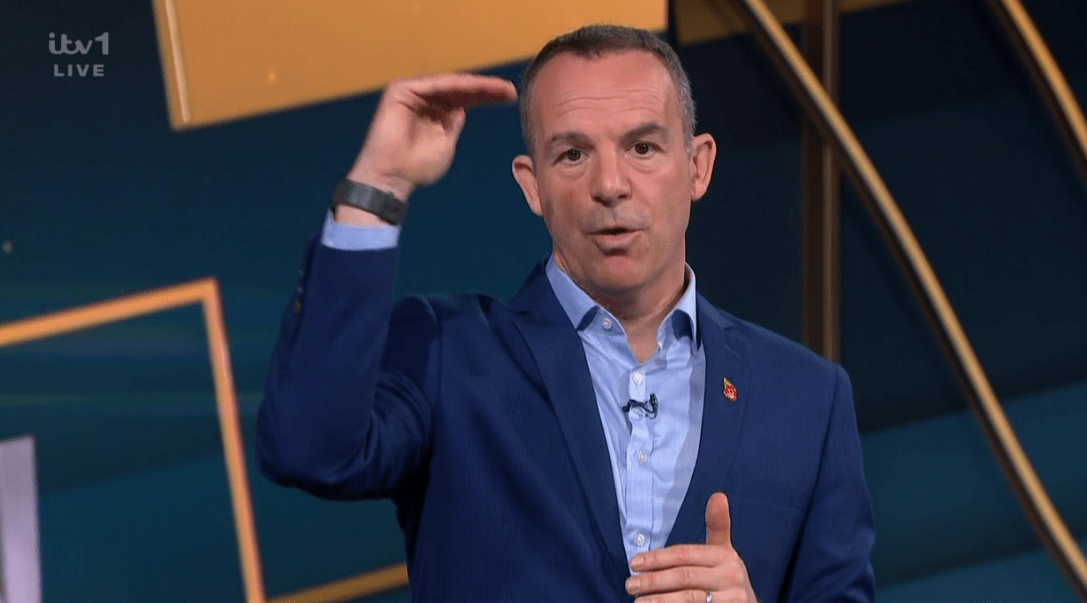

Martin Lewis says it’s a ‘crucial moment to act’ NOW to boost your savings ahead of key decision tomorrow

MARTIN Lewis has urged savers to act now to boost their balances ahead of a key decision tomorrow.

He spoke during Tuesday’s episode of his ITV programme, The Martin Lewis Money Show Live.

Martin urged Brits to check what interest they currently get ahead of an expected fall in the UK base rate this Thursday.

He said: “The UK base rate, this is the Bank of England set rate, obviously was very low and then it’s risen recently and peaked at 5.25%.

“It’s dropped to five per cent now and we are expecting on Thursday that interest rate to drop by about a quarter of a per cent.”

He qualified that this was not guaranteed.

Martin went on: “Now though we are in the position where inflation is substantially lower than we have on interest rates so your money is growing in real terms.

“If you put money away in savings and in a couple of years, you will be able to buy more with it than you could at the point you put it in.

“Saving is finally, at last, paying.”

In the same programme, he also warned that a million people have been overpaying their student loans – and could be owed a refund.

In the last tax year, more than one million university leavers overpaid their student loans, according to figures released by the Student Loans Company (SLC).

Speaking on The Martin Lewis Money Show Live, on ITV on Tuesday, the show host said graduates were able to claim money back if they had overpaid, which was “very easy to do”.

There were four main reasons you may have overpaid your student loan.

Martin said: “The first, and the biggest by a mile, over a million people overpaid this way, is you should only repay if you earn over the annual threshold.”

He added: “For Plan 2, which has the most number of people on it, 2012 to 2022 English starters, you’ve got to understand, if you earn less than that [£27,295] you shouldn’t repay the student loan but because it’s taken via the payroll your student loan is taken monthly.

“A twelfth of that is £2,274 per year, so if you earn more than that in a month, you’re gonna have student loan contributions taken from you.”

He explained that because repayments are taken from your payroll monthly, if your earnings vary through the year, you may be assumed to be over the yearly limit in one month of decent earnings.

This is despite you not earning above the total threshold for the year when earnings are taken as a whole – meaning the money is taken from you despite not being eligible.

A second reason was people were on the wrong student loan repayment plan – in which case you should talk to your employer and tell them what plan you’re on.

The third reason is that you started repaying too early.

If you started university from 1998 onwards and were a full-time student, you should not have begun paying your loan back until the April after finishing your course.

But the latest figures from SLC reveals that 59,251 students had loan repayments taken before they were due to start repayments in 2023/24, according to MoneySavingExpert.com.

The fourth reason is that the loan was wiped – which typically happens after 30 years – but a number were still left paying in error.

A number of case studies of those who overpaid were revealed in an article for Martin’s Money Saving Expert website, published on November 4.

How have student loan repayments changed?

STUDENT loan repayments are based on your earnings and not the size of the debt.

However, when you start making repayments or when your student loan amount is written off will depend on when you went to University.

Plan 1 – 1998-2012

If you took out a student loan between 1998 and 2012, you’ll be bound by the Plan 1 repayment rules.

These students only start repaying their loans when their salary breaches the threshold of £24,990 a year.

You’ll pay 9 per cent back once your salary breaches this threshold.

The interest rate charged on these loans is based on either RPI or the Bank of England rate – whichever is lower – plus one percentage point.

These loans are written off after 25 years.

Plan 2 – 2012-2023

If you took out a student loan between 1998 and 2012, you’ll be bound by the Plan 2 repayment rules.

These students only start repaying their loans when their salary breaches the threshold of £27,295 a year.

You’ll pay 9 per cent back once your salary breaches this threshold.

The interest rate charged on these loans is based on RPI plus up to three percentage points – dependant on your income.

These loans are written off after 30 years.

Plan 5 – 2023-present

If you took out a student loan from 2023 onwards, you’ll be bound by the Plan 5 repayment rules.

These students only start repaying their loans when their salary breaches the threshold of £25,000 a year.

You’ll pay 9 per cent back once your salary breaches this threshold.

The interest rate charged on these loans is based on RPI only.

These loans are written off after 40 years.

Fiona wrote in during October 2023 saying: “I knew something wasn’t right when I lodged my tax returns and reading Martin’s article was the catalyst for a sustained attempt to work out what had happened. I received £3,773 back.”

Lyndsey said: “Thanks to watching Martin Lewis’s programme last night I contacted the SLC and have got a refund of £706 as I had started paying straightaway. Great just before Christmas.”

Melissa said: “Just wanted to say a massive thank you as I read your article on overpaying on student loan repayments and realised there was a chance I had overpaid.

“Turns out I had and I’ve since received a refund of £900! I’ve been doing house renovations this year so this money has been incredibly handy in going towards them.”

Lisa added: “I spent 15 minutes on the phone and got £555 back for overpayments on my student loan.

“Most was because of my maternity leave. Thanks so much, couldn’t have come at a better time.”

Money

Morrisons sells its strongest EVER garlic bread that’s 10 times more powerful than normal – and you’ll have to be quick

MORRISONS is selling its strongest ever garlic bread that’s 10 times more powerful than usual – but you’ll have to get your skates on.

The Dracula’s Devil version of the supermarket’s garlic bread pizza has a whopping 10 extra whole cloves of garlic.

It’s thought to be the most potent garlic bread pizza ever sold in the UK.

The 10-inch pizza costs £2 and made at Morrisons in-store fresh pizza counters.

The limited edition pizza is available now until November 9, so it’s best to rush down to your local store before the offer ends.

The launch of the pizza comes as research revealed around one third (34 per cent) of Brits confessed to hiding from Halloween celebrations by not answering the door to trick or treaters.

Others pull the curtains shut (33 per cent), and make sure lights are not on either at the front or anywhere in the house (both 24 per cent).

It also emerged that more than half the nation (54 per cent) avoid celebrating Halloween on October 31 and consider themselves a “Halloween Hider”, whilst 40 per cent of Brits identify as “Halloween Haunters” and enjoy the festivities.

Two fifths (40 per cent) though have taken steps to celebrate, leaving a pumpkin by the door (27 per cent), prepared Halloween themed food (22 per cent), or thrown a party (17 per cent).

Despite more “Halloween Hiders” than “Halloween Haunters” the majority (66 per cent) would be happy to share their trick or treating treats, with a further 23 per cent sharing these but keeping the majority for themselves.

One in ten (11 per cent) though would not share any, rising to 15 percent of men.

Phillip Wall, Buying Manager of Pizza Counter & Salad Bar at Morrisons, said: “After popular demand, our Dracula’s Devil Garlic Bread Pizza is back and more garlicky than ever.

“We hope all our customers enjoy this limited-edition pizza, whether they’re a ‘Halloween Hider’ and use the extra-garlicky pizza to fight off vampires, or a ‘Halloween Haunter’ and enjoy sharing the pizza at Halloween celebrations with friends and family.

“This pizza is limited edition so customers must be quick to avoid disappointment.”

The Dracula’s Devil Garlic Bread Pizza is available now in-store at the Morrisons fresh pizza counter.

If you’re worried about the smell, scientists found that garlic can apparently make men smell more attractive to women.

It comes as shoppers have been rushing out to nab themselves a suitcase after the supermarket slashed the price to as little as £8.

Morrisons Christmas advert

Morrisons has also unveiled its Christmas advert – which you can watch at the top of the page – and it features a famous movie soundtrack sung by kitchen oven gloves.

The common household item comes to life in this festive clip, singing the showtune “Give a Little Love” from Bugsy Malone.

Morrisons’s 60-second advert will air for the first time on television this evening on ITV during Coronation Street.

It begins with a Morrisons delivery van arriving at a home and then panning to a lone oven glove who suddenly springs life and belts into song.

As the ad progresses, viewers are taken through a series of kitchens to the backdrop of the iconic song, where more and more oven gloves appear.

The gloves, which are voiced by Morrisons workers, are singing to encourage families as they prepare their Christmas dinner.

Viewers can expect to see a number of dining tables filled with Morrisons food, including its classic turkey, salmon and a range of desserts.

Party food from its premium The Best range also makes an appearance, which is available to buy in stores now.

The ad concludes as a family sits down for their meal joined by a host of singing oven gloves.

Morrisons top ten Halloween products for 2024

Dracula’s Devil Garlic Bread Pizza, £2

Giant Pumpkin, £7

Ghost Crumpets (6 pack), £1.25

Skeleton Dog Jumper, £7

Halloween Bouquet, £5

Trick or Treat Dinky Pork Pies, £3

Witch Costume, £8

Swizzels Super Stars Tub, £4.50 (2 for £7 with a More Card)

Decorate Your Own Gingerbread Pumpkins, £2

Halloween Doughnuts (12 pack), £3.75

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Exact code to spot when DWP Christmas bonus lands in bank accounts – are you getting an extra payment?

THE EXACT code to spot for the DWP Christmas bonus has been revealed.

The Department for Work and Pensions (DWP) hands out a tax-free bonus to hard-pressed households ahead of Christmas.

For people who meet the criteria, the money is usually paid into their bank account automatically, meaning you do not have to apply.

If you are not sure if you have received the payment before, check on your bank statements for a code which says “DWP XB”.

To get the money you usually need to be claiming benefits before the qualifying week, which is typically the first week of December.

The full list of benefits which make you eligible for the bonus include:

- Adult Disability Payment

- Armed Forces Independence Payment

- Attendance Allowance

- Carer’s Allowance

- Carer Support Payment

- Child Disability Payment

- Constant Attendance Allowance (paid under Industrial Injuries or War Pensions schemes)

- Contribution-based Employment and Support Allowance (once the main phase of the benefit is entered after the first 13 weeks of claim)

- Disability Living Allowance

- Incapacity Benefits at the long-term rate

- Industrial Death Benefit (for widows or widowers)

- Mobility Supplement

- Pension Credit – the guarantee element

- Personal Independence Payment (PIP)

- State Pension (including Graduated Retirement Benefit)

- Severe Disablement Allowance (transitionally protected)

- Unemployability Supplement or Allowance (paid under Industrial Injuries or War Pensions schemes)

- War Disablement Pension at State Pension Age

- War Widow’s Pension

- Widowed Mother’s Allowance

- Widowed Parent’s Allowance

- Widow’s Pension

If you meet the criteria, you will get £10 from the DWP to help towards costs over Christmas.

The DWP says that if you think you should get it and the money hasn’t come through by January 1, you must contact your local Jobcentre Plus office.

It’s also worth bearing in mind that in some cases you could be entitled to claim even if you are not claiming benefits.

This usually only applies if you are in a partnership, for example a marriage or civil partnership, and are claiming the State Pension.

History of the Christmas Bonus

THE Christmas bonus was first introduced in 1972.

Initially set at £10, the bonus was intended to help with the additional costs that come with Christmas, such as gifts and festive meals.

Despite inflation and the rising cost of living over the decades, the amount of the Christmas bonus has remained unchanged since its inception.

If the payment had risen in line with inflation, it would now be worth a bumper £114.95 – enough to cover the cost of a big shop for the family.

While the value of £10 has significantly diminished over the years, the Christmas Bonus continues to be a small but welcome addition to many people’s incomes during the holiday period.

State Pension loophole

For example, your partner may still get the £10 bonus if you are both over the State Pension age by the end of the qualifying week.

This usually starts on the first Monday of December, so this year it will begin on the 2nd of the month.

In this instance, one of you will need to be claiming a qualifying benefit, such as Pension Credit.

Both of you will also need to be aged either 66 or above by the start of December.

So, for example, a retired husband may be claiming Pension Credit and his wife is not, but his claim makes them both eligible for the bonus.

However, you will not get the money paid out separately – instead a total of £20 will be paid in one account.

And bear in mind that your partner who is claiming must also be entitled to an increase in their qualifying benefit.

So, for example, you can be entitled to an increase in Pension Credit if you start living with your partner.

The benefit tops up your weekly income to £213 if you’re single or your joint weekly income to £332.95 if you have a partner.

If an increase in benefit is paid for an adult partner that should be shown on the benefit award letters sent out annually, or when the benefit was first claimed.

It will usually say something like “extra amount paid for your partner” and give a figure.

If the benefit is pension credit the award letter will say something like “amount for you and your partner”.

Other factors

To get the cash, you also must be present or a resident in the UK, Channel Islands, Isle of Man, Gibraltar or Switzerland during the qualifying week.

If you are concerned about your partner missing out, contact with the DWP for help.

Samuel Thomas, senior policy advisor at anti-poverty charity Z2K, previously told The Sun: “Many people are entitled to more financial support from the social security system than they realise.

“If you’re struggling financially, you should check whether you can claim any additional benefits or seek independent advice.”

If you are worried about costs this winter, make sure you’re aware of different support available to you.

For example, councils are giving out up to £500 in cash and food grants via the Household Support Fund.

How to check your eligibility

For those who are unsure if they can get access to the bonus and other help, you can use an online benefits calculator.

These are free-to-use online tools which can be accessed at a number of websites.

For example, the charity Turn2Us’ has a benefits calculator that works out what you could get.

Entitledto also has a free calculator that determines whether you qualify for various benefits, including tax credits and Universal Credit.

You can also use Policy in Practice’s calculator to determine which benefits you could receive and how much cash you’ll have left over each month after paying for housing costs.

Your exact entitlement will only be clear when you make a claim, but calculators can indicate what you might be eligible for.

If you do not want to use an online calculator there are other options available.

For example, you can also check with a local benefits adviser to find out what you could be entitled to.

The website advicelocal.uk lets you enter your postcode and informs you of your nearest adviser and how you can contact them.

For example, if you enter on the website that you live in Wandsworth, London it will give you the details of the nearest support in the area.

In this instance, it was the borough’s local Age UK and Citizens Advice.

You should be aware that many organisations do not offer an open-door service.

If you are planning to contact an organisation for help or advice you might want to check their website for more information before doing so..

Money

Popeyes reveals Christmas menu including twist on iconic chicken sandwich – and it’s available NOW

POPEYES has revealed its very first Christmas menu in the UK and it includes a twist on the beloved chicken sandwich.

There’s more good news too as fans of the New Orleans-born fried chicken brand can sink their teeth into the festive food from today.

Being served up on the Christmas menu are six new items that combine the flavours of New Orleans with British festive classics, from as little as £1.50:

- The Festive Superstack Sandwich

- The Festive Feastin’ Roll

- The Chicken Festive Feastin’ Roll

- Sage & Onion Hash Brown

- Frostin’ Mint Shake made with Oreo

- Caramel Latte

The Festive Superstack Sandwich is a “next-level” take on the fan-favourite Popeyes chicken sandwich.

It features a juicy, 100% fresh Shatter Crunchin’ chicken breast topped with Emmental cheese, a tasty Sage & Onion Hash Brown, plus fresh pickles and lettuce for extra crunch.

The tasty combo is then stacked inside a soft brioche bun and topped with a swirl of spicy and sweet Cranberry Habanero Sauce and mayo.

It combines the poppin’ flavours of New Orleans with the comfort of a classic Christmas roast – and is the new kid on the block for annual festive sandwich competition.

Popeyes has also revealed its first-ever festive breakfast roll with the launch of the Festive Feastin’ Roll.

A festive version of the much-loved Popeyes Big Cajun Roll, this brekkie treat consists of a sausage patty, four juicy bacon rashers, a free range egg, a Sage & Onion Hash Brown, all topped off with Cranberry Habanero Sauce in a perfectly toasted premium brioche bun.

Fans can wash the festive breakfast roll with the new Caramel Latte, with a sweet kick to start your day.

For those who fancy a bit more cluck for their breakfast, The Chicken Festive Feastin’ Roll will also be launched across select restaurants nationwide – featuring a Popeyes Signature Herby Chicken patty, topped with a free range egg and American cheese, Cranberry Habanero Sauce and finished with a tasty Sage & Onion Hash Brown.

Fans can treat themselves to a Sage & Onion Hash Brown as part of a meal, or as a tasty standalone side.

This New Orleans spin on sage & onion stuffing combines the best-selling Popeyes Hash Brown with the traditional flavours of this iconic festive side.

Fried-chicken lovers can also opt for the Festive Superstack Box Meal to get more chicken and more bang for their buck this holiday season.

Combining the Festive Superstack Sandwich with a choice of two Tenders, three Hot Wings or one-piece Signature Chicken, served with regular fries and regular drink, all from just £11.49.

Fans can round off their meal with the launch of the limited-edition Frostin’ Mint Shake made with Oreo.

An indulgent combo of festive minty flavours, the shake is made using thick Jersey cream, with a fresh minty kick, and topped with crunchin’ Oreo pieces.

Popeyes UK Festive Menu

Festive Superstack Sandwich – From £7.49

Festive Feastin’ Roll – From £3.99

Chicken Festive Feastin’ Roll – From £3.99

Sage & Onion Hash Brown – From £1.50

Frostin’ Mint Oreo Shake – From £4.50

Caramel Latte – From £2.29

Festive Superstack Box Meal – From £11.49

Festive Feastin’ Roll Meal – From £4.99

Chicken Festive Feastin’ Roll Meal – From £4.99

It’s a frosty treat perfect for festive indulgence.

Dave Hoskins, Head of Food at Popeyes, said: “This festive season we want to give our guests a taste of the traditional holiday flavours everyone knows and loves, but with a true Popeyes twist.

“We’re proud to reveal our first ever festive menu in the UK, and what better way to do it than with a nod to our New Orleans heritage.

“We know our fans love when we put a spin on a classic, and our Sage & Onion hash browns are a delicious all-day way to enjoy the flavours of a roast potato – what’s not to love?

“We’ve also snuck one into our new Festive Superstack Sandwich alongside our world-class Shatter Crunchin’ chicken, Emmental, and some cranberry habanero sauce, giving our guests a familiar taste of the holidays with an unexpected Louisiana kick.”

The Festive Feastin’ Menu is available from November 5, in nationwide Popeyes restaurants, drive-thrus and via delivery.

-

Science & Environment2 months ago

Science & Environment2 months agoHow to unsnarl a tangle of threads, according to physics

-

Technology1 month ago

Technology1 month agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 months ago

Science & Environment2 months agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 months ago

Science & Environment2 months ago‘Running of the bulls’ festival crowds move like charged particles

-

Technology2 months ago

Technology2 months agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment2 months ago

Science & Environment2 months agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Money1 month ago

Money1 month agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Sport1 month ago

Sport1 month agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Science & Environment2 months ago

Science & Environment2 months agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 months ago

Science & Environment2 months agoPhysicists have worked out how to melt any material

-

Technology1 month ago

Technology1 month agoGmail gets redesigned summary cards with more data & features

-

Football1 month ago

Football1 month agoRangers & Celtic ready for first SWPL derby showdown

-

Technology1 month ago

Technology1 month agoUkraine is using AI to manage the removal of Russian landmines

-

News1 month ago

News1 month agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

MMA1 month ago

MMA1 month ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

Science & Environment2 months ago

Science & Environment2 months agoLaser helps turn an electron into a coil of mass and charge

-

Sport1 month ago

Sport1 month agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Technology1 month ago

Technology1 month agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Science & Environment2 months ago

Science & Environment2 months agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

News1 month ago

News1 month ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Technology1 month ago

Technology1 month agoSamsung Passkeys will work with Samsung’s smart home devices

-

Science & Environment2 months ago

Science & Environment2 months agoLiquid crystals could improve quantum communication devices

-

Technology1 month ago

Technology1 month agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum ‘supersolid’ matter stirred using magnets

-

Business1 month ago

how UniCredit built its Commerzbank stake

-

MMA1 month ago

MMA1 month agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology1 month ago

Technology1 month agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

MMA1 month ago

MMA1 month ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Science & Environment2 months ago

Science & Environment2 months agoWhy this is a golden age for life to thrive across the universe

-

News1 month ago

News1 month agoNavigating the News Void: Opportunities for Revitalization

-

Technology1 month ago

Technology1 month agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

Sport1 month ago

Sport1 month ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Entertainment1 month ago

Entertainment1 month agoBruce Springsteen endorses Harris, calls Trump “most dangerous candidate for president in my lifetime”

-

News1 month ago

News1 month agoRwanda restricts funeral sizes following outbreak

-

MMA1 month ago

MMA1 month agoPereira vs. Rountree prediction: Champ chases legend status

-

News1 month ago

News1 month agoMassive blasts in Beirut after renewed Israeli air strikes

-

TV1 month ago

TV1 month agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Technology1 month ago

Technology1 month agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology1 month ago

Technology1 month agoMicrophone made of atom-thick graphene could be used in smartphones

-

Business1 month ago

Business1 month agoWater companies ‘failing to address customers’ concerns’

-

News1 month ago

News1 month agoCornell is about to deport a student over Palestine activism

-

Business1 month ago

Business1 month agoWhen to tip and when not to tip

-

News1 month ago

News1 month agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Sport1 month ago

Sport1 month agoWXV1: Canada 21-8 Ireland – Hosts make it two wins from two

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum forces used to automatically assemble tiny device

-

News2 months ago

News2 months ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment2 months ago

Science & Environment2 months agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Business1 month ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

Technology1 month ago

Technology1 month agoSingleStore’s BryteFlow acquisition targets data integration

-

MMA1 month ago

MMA1 month agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Football1 month ago

Football1 month ago'Rangers outclassed and outplayed as Hearts stop rot'

-

Sport1 month ago

Sport1 month agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Football1 month ago

Football1 month agoWhy does Prince William support Aston Villa?

-

News1 month ago

News1 month ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Science & Environment2 months ago

Science & Environment2 months agoA slight curve helps rocks make the biggest splash

-

Science & Environment2 months ago

Science & Environment2 months agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology2 months ago

Technology2 months agoMeta has a major opportunity to win the AI hardware race

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology1 month ago

Technology1 month agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Technology1 month ago

Technology1 month agoMusk faces SEC questions over X takeover

-

Sport1 month ago

Sport1 month agoPremiership Women’s Rugby: Exeter Chiefs boss unhappy with WXV clash

-

Sport1 month ago

Sport1 month agoShanghai Masters: Jannik Sinner and Carlos Alcaraz win openers

-

Sport1 month ago

Sport1 month agoCoco Gauff stages superb comeback to reach China Open final

-

Business1 month ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Sport1 month ago

Sport1 month agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

MMA1 month ago

MMA1 month agoPennington vs. Peña pick: Can ex-champ recapture title?

-

Technology1 month ago

Technology1 month agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

-

MMA1 month ago

MMA1 month ago‘I was fighting on automatic pilot’ at UFC 306

-

News1 month ago

News1 month agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Sport1 month ago

Sport1 month agoWales fall to second loss of WXV against Italy

-

Business1 month ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Business1 month ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

TV1 month ago

TV1 month agoTV Patrol Express September 26, 2024

-

Money4 weeks ago

Money4 weeks agoTiny clue on edge of £1 coin that makes it worth 2500 times its face value – do you have one lurking in your change?

-

Science & Environment2 months ago

Science & Environment2 months agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment2 months ago

Science & Environment2 months agoNerve fibres in the brain could generate quantum entanglement

-

Travel1 month ago

World of Hyatt welcomes iconic lifestyle brand in latest partnership

-

MMA1 month ago

MMA1 month agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

Technology1 month ago

Technology1 month agoThe best shows on Max (formerly HBO Max) right now

-

Technology1 month ago

Technology1 month agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

Technology1 month ago

Technology1 month agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

Technology1 month ago

Technology1 month agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Technology1 month ago

Technology1 month agoQuoroom acquires Investory to scale up its capital-raising platform for startups

-

Business1 month ago

‘Let’s be more normal’ — and rival Tory strategies

-

Business1 month ago

The search for Japan’s ‘lost’ art

-

Sport1 month ago

Sport1 month agoURC: Munster 23-0 Ospreys – hosts enjoy second win of season

-

Sport1 month ago

Sport1 month agoNew Zealand v England in WXV: Black Ferns not ‘invincible’ before game

-

Sport1 month ago

Sport1 month agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

News2 months ago

News2 months ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 months ago

Science & Environment2 months agoHow to wrap your mind around the real multiverse

-

MMA1 month ago

MMA1 month agoHow to watch Salt Lake City title fights, lineup, odds, more

-

Business1 month ago

Italy seeks to raise more windfall taxes from companies

-

News1 month ago

News1 month agoTrump returns to Pennsylvania for rally at site of assassination attempt

-

MMA1 month ago

MMA1 month agoKevin Holland suffers injury vs. Roman Dolidze

-

Technology4 weeks ago

Technology4 weeks agoThe FBI secretly created an Ethereum token to investigate crypto fraud

-

Business1 month ago

Business1 month agoStocks Tumble in Japan After Party’s Election of New Prime Minister

-

MMA1 month ago

MMA1 month agoUFC 307’s Ketlen Vieira says Kayla Harrison ‘has not proven herself’

-

Technology1 month ago

Technology1 month agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Technology1 month ago

Technology1 month agoOpenAI secured more billions, but there’s still capital left for other startups

You must be logged in to post a comment Login