Money

Credit Card Companies Secretly Adding Fees – How to Avoid Hidden Charges

Hidden Fees Alert: How Credit Card Companies Are Charging You Without Warning: Credit Card Fees Under Fire – How to Avoid the $1.99 Paper Statement Charge

Two major credit card companies are facing backlash for quietly imposing a $1.99 fee on consumers opting for paper statements. In a push to encourage customers to switch to digital statements, these companies are penalizing those who still prefer traditional paper billing. However, there are ways to avoid this fee—by opting into electronic statements or contacting your card issuer for potential exceptions.

The Shift to Digital Statements and the $1.99 Fee

Credit card issuers, including Synchrony Bank and Citibank, have introduced this fee for customers who choose paper statements instead of going digital. Synchrony Bank, which offers more than 100 co-branded and store-affiliated credit cards—such as Sam’s Club Credit Card, Lowe’s Store Card, and Amazon Store Card—is one of the key players imposing the charge. Citibank followed suit in late 2022, requiring customers to switch to paperless billing to access their accounts online or through the Citi Mobile App.

Despite the shift, legally, credit card companies must still offer paper statements, but customer consent is required for paperless billing. Many customers, like Alicia Galowitsch, find themselves facing additional costs. “It’s very tight for us,” she told NBC, explaining how these fees have impacted her household finances. “We had to start going to a food bank. It’s going to be $11.94 [in fees],” she shared, highlighting how small fees can quickly add up for families managing multiple accounts.

For some, paper statements are essential for organization, particularly when managing multiple credit card accounts. Ms. Galowitsch added, “If I’m not here, the payments are going to be late because [my husband] Mark’s not going to know what to do.” For people who rely on paper statements to stay organized, these new fees feel like an unfair burden.

Related: Should I use my credit card for big purchases?

Growing Consumer Frustration and Security Concerns

Beyond the financial strain, many customers are also concerned about the security risks associated with digital statements. Those who aren’t comfortable with online banking worry that going paperless could leave them vulnerable to fraud. In response, frustrated credit card holders have taken to forums like Reddit to voice their discontent.

One Reddit user shared, “I received a letter today about my PayPal Mastercard. Starting in April, they will impose a charge if you don’t opt for electronic statements.” The fee in this case is $2.50—slightly higher than Synchrony’s—but still a source of frustration. Another user mentioned they were closing their account entirely due to the fee.

This latest wave of fees follows recent changes by credit card giants Visa and American Express, which subtly reduced the value of rewards points. With Americans sitting on millions of credit card points for flights, hotels, and cash-back options, the impact of inflation has caused these points to lose value. Once worth roughly one cent per point, their purchasing power has dropped by 20% since 2018, according to data from the Bureau of Labor Statistics.

How to Avoid the Paper Statement Fee

If you’re being charged for paper statements, here’s how you can avoid paying unnecessary fees:

- Switch to electronic statements: Opting for digital billing is the simplest way to sidestep the fee.

- Request an exception: In some cases, particularly for elderly or disabled customers, credit card companies may waive the fee upon request.

- Track your statements online: Even if you prefer paper, familiarizing yourself with online banking can help you stay on top of your finances.

Signs Your Credit Has Been Compromised

Amid concerns about switching to online statements, it’s crucial to keep an eye out for signs that your credit may have been compromised. According to Michael Bruemmer, vice president of Experian Global Data Breach Resolution, these warning signs should not be ignored:

- Unrecognized charges on your credit card or bank account

- Unexpected credit checks appearing on your report

- Receiving unfamiliar bills

- A sudden drop in your credit score

“If you notice any of these, it could be a red flag that someone is using your identity,” Bruemmer warns. Early detection is key to minimizing potential damage to your credit.

Conclusion

As credit card companies push customers toward digital billing, it’s important to stay informed about fees and how they can impact your finances. Whether you’re holding onto paper statements for organization or security reasons, knowing how to avoid fees can save you money. Stay vigilant about your accounts, and keep an eye out for any signs of fraud to protect your financial health.

Money

Don’t hold out hope for any more game changers in protection

Remember when former Apple chief executive Steve Jobs stood up in 2007 and said, “We are going to launch three revolutionary products?”

Remember when former Apple chief executive Steve Jobs stood up in 2007 and said, “We are going to launch three revolutionary products?”

To cheers from the audience, he revealed the first to be “a widescreen iPod with touch controls.” There were more gasps as he revealed the second as “a revolutionary mobile phone.” And when he announced the third as a “breakthrough internet communicator,” the people in the room almost lost it.

But when he unexpectedly said, “All three of these products are in the same device – the iPhone,” he brought the house down.

With successive generations of iPhones, it’s harder to care about the differences unless you are a true tech geek

Jobs’s speech is legendary, and the iPhone was genuine innovation which has shaped the smart-phone world we live in today. But have we seen something as genuinely innovative since then? The iPhone has evolved through 16 generations and, taking into account the various ‘S’ models over the years, there must be approaching 20 generations now.

I remember the iPhone 4, with its Retina display, was pretty epic. The Apple advertising said, “This changes everything. Again.” But with successive generations of iPhones, it’s harder to care about the differences unless you are a true tech geek. A slightly better camera, a beveled screen, a non-beveled screen, a notch.

Looking back at the history of protection products, I see a similar pattern. In 1996, Scottish Provident introduced the innovative ‘Menu of benefits’ product.

The concept of added-value services was initially met with scepticism, but these are essential complements to the insurance elements

Predating Apple by over a decade, it put three products into one and let advisers and their clients choose any combination to suit their needs. At the time, people used words like “revolutionary” and “innovative” as true descriptors, rather than cliched marketing buzzwords.

In the early 2000s, another company introduced what we now call added-value services to the protection market. The concept of added-value services was initially met with scepticism, but these benefits are essential complements to the insurance elements.

When will the next game-changer emerge in the smartphone and protection markets? Because it seems we are now locked into a cycle of gradual improvements rather than stand out differences.

Don’t get me wrong, we should welcome continuous improvements, especially anything that benefits the customer. But do gradual improvements change customer behaviour in the way we would like?

Are the improvements more motivated by keeping the provider towards the top of the rankings?

Consider the news reports that Vitality has improved its income protection offering. It says it will “…expand its range of deferral periods for a further 280 occupations” and will “…also be moving 349 manual roles and skilled trade occupations to an ‘own occupation’ definition of incapacity, replacing its ‘special definition’ that was previously used.”

These are good improvements but it feels to me like the Apple equivalent of adding more megapixels to the main camera, or giving a choice of wide-angle lens sizes.

Every year we see another round of additions and refinements to the list of critical illnesses. Better definitions and therefore improved cover. We can say the same about added-value benefits.

Again, these are all great but do any of these improvements make it easier to sell protection to people on the street? Or are the improvements more motivated by keeping the provider towards the top of the rankings on all the various comparison engines and product analysis tools?

Will cost of being a first mover in a low margin environment always stifle true innovation?

In my last article, I said: “We know GenZ use TikTok as a search engine. We know they have short attention spans. We know they don’t like complexity. We know they don’t like filling in forms.

“And yet we expect them to get excited by our extremely complicated, generic protection products that have 30 page application forms and that we don’t talk about on TikTok.”

Will our current cycle of product improvements ever start to appeal to new audiences unless we come up with something genuinely revolutionary? Or will cost of being a first mover in a low margin environment always stifle true innovation?

Will we ever see one of the chief executives of protection providers step, Steve Jobs like, onto a stage and make a presentation that’ll be quoted for years to come about a revolutionary protection product that will appeal to a new generation of customers?

Roger Edwards is managing director of Roger Edwards Marketing Ltd and marketing director of Protection Review

Money

Full list of companies paying Real Living Wage as half a million workers get pay rise of up to £13.85 an hour

HUNDREDS of thousands of workers will get a pay rise as the Real Living Wage increases today.

Employees of companies including Nationwide, Oxfam and Ikea will all see their hourly rate increase to almost £14 an hour.

As of today, the real living wage will rise by 60p to £12.60 an hour across the UK or by 70p to £13.85 if you live in London.

The real living wage is different from the government-set minimum wage – it is the only UK pay rate based on the cost of living.

Employers have the right to choose whether they want to offer the real living wage to workers – they are not legally required to do so.

The government’s national living wage is based on recommendations from trade unions and small businesses, and is set this year at a minimum hourly rate of £11.44 for workers over the age of 21.

Across the UK there are over 15,995 companies which pay the real living wage following a campaign on workers’ rights in 2001 by Citizens UK.

Big and small companies across the charity, public and private sectors have pledged to pay the Real Living Wage to their employers.

Here are some well-known examples:

- Nationwide

- Burberry

- Chelsea Football Club

- Everton Football Club

- Liverpool Football Club

- Ikea

- Lush

- The Royal Albert Hall

- ITV

- Saga

- University of Cambridge

- Transport for Greater Manchester

- Thames Water

- Scottish Power

- Ring Go

- Jamie Oliver

- National Express

- Insignia Technologies

- Santander

- Unifrog

- Which?

More than 100 independent businesses, such as coffee shops, pubs and restaurants are also signed up to the fair pay scheme.

For example:

- Twenty Coffee Company, Bristol

- The Three Chimneys, Isle of Skye

- The Swan, York

- St Canna’s Ale House, Cardiff

- Brixton Blend Coffee Shop, London

If you want to browse the full list of companies and find out more, you can visit the Real Living Wage Foundation website.

Here you can use searching filters to sift through the companies by region, industry and sector.

There is also an interactive map which you can use to find out which ones on the list are near you.

Just type in your postcode or the type of business you are looking for and it will show you local employers which are on the scheme.

Katherine Chapman, director of the Real Living Wage Foundation said low-paid workers have been “hardest hit by the cost of living crisis.”

She said: “The real living wage remains the only UK wage rate calculated based on actual living costs, and the new rates announced today will make a massive difference to almost half a million workers who will see their pay increase.”

What is the difference between the National Living Wage and the National Minimum Wage?

The National Living Wage and the National Minimum Wage are two different things.

They are both set by the government – so are separate from the Real Living Wage.

The National Living Wage is the legal minimum employers have to pay workers aged 21 and over and is £11.44 an hour.

Before 1 April 2024 the National Living Wage was for those aged 23 and over and was £10.42 an hour.

The National Minimum Wage is the minimum amount that workers under 21 are entitled to.

Exactly how much you get depends on how old you are.

So if you are 21 or over you are entitled to at least £11.44 an hour.

While if you’re 18 to 20, the minimum wage is £8.60 an hour.

And if you’re under 18 or an apprentice this is £6.40 an hour.

When was the minimum wage introduced?

THE first National Minimum Wage was put in place in 1998 by the Labour government.

It originally applied to workers aged 22 and over, and there was a separate rate for those aged 18-21.

A separate rate for 16-17-year-olds was introduced in 2004, and in 2010, 21-year-olds became eligible for the adult rate of the National Minimum Wage.

The rate is set by the Government each year based on recommendations by the Low Pay Commission (LPC).

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Home REIT to pay off Scottish Widows loan as it raises £27m in auctions

The group expects to repay its remaining loan amount of £72m before the end of the year.

The post Home REIT to pay off Scottish Widows loan as it raises £27m in auctions appeared first on Property Week.

Money

Walmart’s $5,497 Two-Story Tiny Home: Affordable Living

Walmart’s Affordable Two-Story Tiny Home: The $5,497 Housing Solution

As housing costs continue to rise, more people are looking for affordable alternatives that don’t sacrifice comfort or functionality. Tiny homes are a booming trend, offering a compact and efficient living solution. Walmart is joining the movement with an exciting and budget-friendly offering—a two-story tiny home priced at just $5,497. This could be your ticket to owning a home without breaking the bank.

Whether you’re a first-time homebuyer struggling to enter the housing market, someone seeking a minimalist lifestyle, or just looking for a cost-effective rental property, Walmart’s tiny home could be exactly what you need. Its simple yet versatile design makes it an excellent option for a variety of uses—from a guest house, Airbnb rental, or even a home office or studio space.

On the outside, the small house resembles a straightforward but functional garage shed.

Tiny Living, Big Benefits

Tiny homes like Walmart’s Best Barns Geneva 12×16 Wood Shed Kit offer more than just a place to live—they’re a lifestyle choice. Embracing tiny living allows homeowners to minimize their carbon footprint, reduce energy consumption, and save money on utilities. For those tired of the burden of large homes and hefty mortgages, a tiny home provides a refreshing alternative.

This specific model is perfect for those who need extra space on their property, whether it’s a single-car garage, a place to store tools, or a cozy living space for guests. From the outside, it resembles a high-quality garage shed, but inside, it’s built to maximize space with a second-floor loft, adding valuable storage or an extra sleeping area.

What’s more, tiny homes are customizable. The Best Barns Geneva model comes pre-primed, so you can easily paint it in your preferred color, making it truly your own. And if you’re a fan of DIY projects, this tiny home provides a hands-on opportunity to enhance your skills, as assembly is required.

In fact, Walmart’s priciest tiny home currently stands at a whopping $29,990. So, if you’re looking for a more budget-conscious option, this $5,497 model offers fantastic value.

Related: Top 3 survey platforms to earn extra cash 2024!

A Quick and Easy Purchase

One of the standout features of this tiny home is its ease of purchase and delivery. Walmart offers delivery in less than a week, meaning your tiny home could be on your property in just a few days. The current listed price is $5,947, slightly above the $5,497 price point, so be sure to check Walmart’s website for up-to-date pricing, availability, and potential promotions.

While the home is available online, availability may vary between in-store, online, and app purchases. Walmart is currently offering free shipping for this product, with a delivery date as early as Tuesday, October 29. However, stock availability is subject to change, so it’s always a good idea to check back regularly if the item is out of stock.

Who Should Consider Buying Walmart’s Tiny Home?

- First-time buyers: Entering the housing market can be tough, but Walmart’s tiny home offers an affordable alternative to skyrocketing home prices.

- Airbnb hosts: For those interested in generating rental income, a tiny home is a low-maintenance option that can serve as a cozy retreat for travelers.

- Homeowners needing extra space: Whether it’s for guests, storage, or a home office, this tiny home offers additional living space without the hassle of a major home renovation.

- DIY enthusiasts: If you love working with your hands, assembling this home could be an exciting project that adds value to your property.

Additional Considerations

While Walmart’s tiny home is an appealing choice, there are a few additional factors to keep in mind before purchasing. First, although the home is designed to be a cost-effective housing solution, it doesn’t come with flooring, so you’ll need to budget for this separately. Second, because it’s sold as a shed kit, you’ll need to be comfortable with a DIY assembly or hire a contractor to help put it together.

Moreover, while the home can handle wind speeds of up to 90 mph and snow loads of up to 45 lbs per square foot, it’s important to check local zoning laws and building codes to ensure the structure is compliant in your area. This will help avoid any legal complications and ensure that your tiny home is built to last.

Fast Delivery, Lasting Value

One of the best features? Walmart offers delivery in under a week—meaning your tiny home could arrive in just a few days. The current price is listed at $5,947 online, but it’s always a good idea to double-check Walmart’s website for the latest pricing and availability. While shipping is free at the moment, this is subject to change, so act fast if you’re ready to dive into tiny home living.

Ready to make a move? Visit Walmart’s website to see if this tiny home is in stock and to explore delivery options in your area.

Product Specifications:

Best Barns Geneva 12×16 Wood Shed Kit

| Feature | Details |

|---|---|

| Dimensions | 192 x 144 x 163 inches |

| Garage Door | 8’W x 7’H swing-open with transom windows |

| Side Wall Height | 8′ 1″ |

| Roof | Wind load: 90 mph; Snow load: 45 lbs/sq ft |

| Materials | Pre-cut pine trim boards; Louisiana Pacific Smart Siding (3/8″) |

| Extras | 2nd-floor loft with 4′ headroom |

| Pre-Primed | Ready for painting |

| Flooring | Not included |

Money

AHR Group’s transparency is its ‘USP’, says co-founder

The success of AHR Group is due to the “transparency of the whole business” while the financial sector has been “historically opaque”, which has given the international financial advice firm a “USP”.

This is what AHR Group managing director & co-founder William Burrows told Money Marketing when explaining how the firm first came about.

AHR Group was founded in 2020 following the merger of UAE-headquartered Arlo Wealth and Harrison Rowe, an international advisory business.

Founders Burrows, Tyla Phillips, Asad Sheikh and Daniel Waterman were at Harrison Rowe, while Daniel Dickinson and Marc Beattie were at Arlo Wealth.

Phillips is AHR Group executive director, Sheikh is AHR Group chief commercial officer, Waterman is AHR Group executive director and Dickinson is AHR Group CEO. Beattie is now Wealth Management Partners director, which is also based in the UAE.

AHR now has a significant presence in the UAE and offices in Mauritius, Malaysia, Cyprus, the UK and Australia.

Burrows recalled how in just eight weeks the two companies became one: “We realised Harrison Rowe was missing something that Arlo Wealth had and Arlo Wealth was missing something that Harrison Rowe had.”

Despite financial advice being very well established in the UK, “there are a number of nuances that change advice abroad”.

Burrows added that the perception of the international advice space has always been of concern in the UK as there have been international advisers “who have bent the rules”.

The main client base of AHR Group is British expats, with it being more likely when someone from the UK moves to another country, they will stay there, Burrows said.

He said that being an expat has a “huge impact on the advice given”. Once someone moves to another country, it usually means they have money saved in another jurisdiction, which adds another layer of “complexity” to the client.

For every five advisers AHR Group has, it also has a specialist working in a certain area.

In August and September this year, AHR Group received both International Professional Partner Firm (IPPF) recognition from the Chartered Insurance Institute (CII) and Chartered Institute for Securities & Investment (CISI) chartered status.

AHR Group is the first and only international financial advice firm in the Middle East and Central South Asia regions to receive IPPF recognition from the CII.

AHR Dubai is the second firm in the Middle East to receive CISI recognition.

Burrows said “we are the only international firm that has both [CII &CISI] recognition”, which is “more meaningful” for British expats.

Also in July 2024, Titan Wealth announced it had bought AHR Group.

Burrows said this started with a conversation in early 2023.

He said: “We were happy to be bought by Titan as we believe in the objective of Titan, the firm is on a clear mission and wants to deliver better outcomes.”

The Titan acquisition “means we can fast track our business goals from 10-15 years to two or three”.

Upon completion of the acquisition, AHR will be rebranded as Titan Wealth International, which Burrows said will happen this side of the year (2024).

As Burrows added: “We want to evolve, and a name change and a rebrand is the way forward.”

Money

Martin Lewis issues urgent warning to check if you’re missing out on free government cash

MARTIN Lewis has issued an urgent warning to millions of households who are missing out on vital benefits to make a claim.

Every year, people lose out on an estimated £23 billion in benefits and support due to stigma or the assumption that they are not eligible.

In the MoneySaving Expert newsletter Martin Lewis said: “Billions in benefits goes unclaimed each year – most by workers or pensioners who have paid into the system for yonks and are in need of help.

‘Even some with higher incomes are due – don’t assume ‘it’s not me’.”

The consumer champion has rounded up seven benefits that are massively underclaimed.

Here we explain whether you are eligible.

Universal Credit

Around 1.4 million people miss out on an average of up to £5,800 in Universal Credit each year.

The monthly benefit is a “catch-all” for those of working age who have low or no income and living and housing costs.

Households with incomes of up to £35,000 a year are the most likely to be missing out.

But if you have kids then high childcare costs and rent could mean you may still be eligible if your household income is up to £60,000 a year.

You can make a claim through the Government’s website or by calling the Universal Credit Helpline on 0800 328 5644.

Attendance Allowance

Up to 1.1 million pensioners are missing out on at least £3,778 a year in Attendance Allowance.

This benefit is not mean-tested and gives a fixed payout of £3,778 a year, or £5,644 a year to cover some of the cost of providing care to someone who needs it.

Those who needed help with day to day tasks such as washing or eating and have done so for more than six months could be missing out.

You can make a claim if you need this support during the day or at night.

If you have a condition such as Parkinson’s, dementia, terminal illness or blindness then you could be missing out.

Crucial to claim Pension Credit if you can

HUNDREDS of thousands of pensioners are missing out on Pension Credit.

The Sun’s Assistant Consumer Editor Lana Clements explains why it’s imperative to apply for the benefit..

Pension Credit is designed to top up the income of the UK’s poorest pensioners.

In itself the payment is a vital lifeline for older people with little income.

It will take weekly income up to to £218.15 if you’re single or joint income to £332.95.

Yet, an estimated 800,000 don’t claim this support. Not only are they missing on this cash, but far more extra support that is unlocked when claiming Pension Credit.

With the winter fuel payment – worth up to £300 now being restricted to pensioners claiming Pension Credit – it’s more important than ever to claim the benefit if you can.

Pension Credit also opens up help with housing costs, council tax or heating bills and even a free TV licence if you are 75 or older.

All this extra support can make a huge difference to the quality of life for a struggling pensioner.

It’s not difficult to apply for Pension Credit, you can do it up to four months before you reach state pension age through the government website or by calling 0800 99 1234.

You’ll just need your National Insurance number, as well as information about income, savings and investments.

You can apply for Attendance Allowance through the Government’s website or by post.

For help with your application, contact the Attendance Allowance helpline on 0800 731 0122.

Council Tax Support

Up to 2.25 million people miss out on up to £1,500 a year in council tax support.

Each council runs its own scheme, so the amount you can get will depend on where you live.

In some regions it can cut your Council Tax bill by up to 100%.

If you qualify for means-tested benefits such as Universal Credit or Pension Credit then you are often due a Council Tax reduction.

But these are not made automatically and you must apply, which is why so many people miss out.

To apply you will need to contact your local council.

You can find your local council here.

Carer’s allowance

Approximately 530,000 carers miss out on up to £4,250 each year.

Carer’s allowance is a specific payment for people who act as unpaid carers.

This can include a family member, spouse, child or even someone that you are not related to.

You are likely to be missing out if you care for someone who usually gets Attendance Allowance, a Personal Independence Payment or Disability Living Allowance.

You may also be eligible if you spend more than 35 hours a week helping with everyday tasks such as washing or cooking and earn less than £151 a week or have a low State Pension.

If you care for someone for less than 35 hours a week then you may be able to claim Carer’s Credit, which helps build National Insurance years to give you a greater State Pension.

You can also back-date it, which could boost the amount you receive even more.

To apply visit the Government website.

Pension Credit

The Government estimates that around 760,000 pensioner households are missing out on Pension Credit, which is worth £3,900 a year on average.

Pension credit tops up your income.

It is still worth claiming even if you are only due 50p a week as it opens the door for other support such as the Winter Fuel Payment, Council Tax Reduction and free TV licence.

It’s worth checking if you could claim it if you are aged over 66 and have a weekly income of below £235 (£350 if you are a couple and are both State Pension age).

You can apply through the Government’s website or by calling the Pension Credit claim line on 0800 99 1234.

Housing Benefit

Around 294,000 pensioners miss out on an average of £4,400 a year in help with their rent.

For those who are eligible and aged under 66 support for housing costs forms part of Universal Credit.

This is not the case with those of State Pension age.

Renters who are eligible for Pension Credit and are on a low income are likely to be missing out.

When you apply for Pension Credit you can usually make an application for Housing Benefit at the same time.

You can apply for Pension Credit online or contact the Pension Service to claim.

You can call the Pension Service on 0800 99 1234.

The Pension Service will then send details of your claim for Housing Benefit to your council.

If you already get Pension Credit you can apply through your local council.

Free School Meals

Approximately 470,000 families are missing out on free school meals, which are worth £490 a year.

Free school meals are served to eligible under-18s who are still in school or college.

Many people on Universal Credit with very low or no income are missing out as they do not realise they can only apply once they have received their first benefit payment.

Others lose out as they do not know they may need to re-register at the start of every year for each one of their children.

You can check if your child can get free school meals in England here.

To apply you will need to contact your local authority.

Can I get other support through my benefits?

Claiming benefits often opens the door to other discounts such as broadband social tariffs.

If you are successful in claiming any of these benefits then you should check if you are eligible.

If you are on a low income but do not qualify for benefits then help is still available.

You may still qualify for a water social tariff, so check with your supplier.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

News2 weeks ago

News2 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

MMA2 weeks ago

MMA2 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Technology4 weeks ago

Technology4 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

News1 month ago

the pick of new debut fiction

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

News2 weeks ago

News2 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

TV2 weeks ago

TV2 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

MMA3 weeks ago

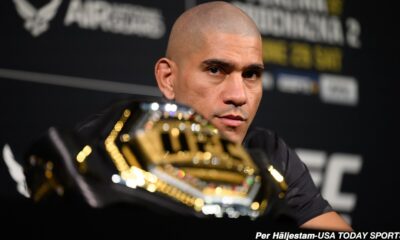

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists are grappling with their own reproducibility crisis

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

Technology3 weeks ago

Technology3 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

News3 weeks ago

News3 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

Entertainment3 weeks ago

Entertainment3 weeks ago“Golden owl” treasure hunt launched decades ago may finally have been solved

-

Science & Environment1 month ago

Science & Environment1 month agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Business4 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Sport1 month ago

Sport1 month agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

News1 month ago

The Project Censored Newsletter – May 2024

-

Technology4 weeks ago

Technology4 weeks agoArtificial flavours released by cooking aim to improve lab-grown meat

-

Technology3 weeks ago

Technology3 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

News3 weeks ago

News3 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Technology3 weeks ago

Technology3 weeks agoGmail gets redesigned summary cards with more data & features

-

MMA3 weeks ago

MMA3 weeks agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

Business3 weeks ago

Maurice Terzini’s insider guide to Sydney

-

Politics3 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

Technology3 weeks ago

Technology3 weeks agoHow to disable Google Assistant on your Pixel Watch 3

-

Business3 weeks ago

Business3 weeks agoStark difference in UK and Ireland’s budgets

You must be logged in to post a comment Login