CryptoCurrency

3 Stock-Split Stocks to Buy Before They Soar as Much as 215%, According to Select Wall Street Analysts

Over the past few years, there’s been a resurgence in the popularity of stock splits. The practice was commonplace in decades past, but had fallen out of favor, only to rebound in recent years. Companies will typically embark on this course after years of strong business and financial results, resulting in a surging stock price.

Evidence suggests that the strong performances that precipitated stock splits tend to continue. Companies that conduct stock splits deliver stock price gains of 25%, on average, in the year following the announcement, compared with average increases of 12% for the S&P 500, according to data compiled by Bank of America analyst Jared Woodard.

Here are three stock-split stocks that still have a long runway ahead, with upside of as much as 215%, according to select Wall Street analysts.

1. Broadcom: Implied upside 36%

The first among our stock-split stocks that represents a compelling opportunity for investors is Broadcom (NASDAQ: AVGO). The company offers a host of software, semiconductor, and security products that run the gamut in the mobile, broadband, cable, and data center spaces.

Indeed, the company reports that “99% of all internet traffic crosses through some type of Broadcom technology.” This means that Broadcom’s technology will be instrumental in the adoption of artificial intelligence (AI).

The company’s recent results are telling. In Broadcom’s fiscal third quarter (ended Aug. 4), revenue jumped 47% year over year to $13 billion, driving adjusted earnings per share (EPS) up 18% to $1.24. The company continues to integrate VMWare, which has pressured earnings, but management is expecting a more meaningful contribution in fiscal 2025. Broadcom also increased its full-year revenue guidance to $51.5 billion, which would represent growth of nearly 44%.

The company’s track record of solid, consistent growth led to a 10-for-1 stock split in July. The stock has more than tripled since the start of 2023 — which coincided with the onset of the AI revolution — but many on Wall Street believe the best is yet to come. Rosenblatt Securities analyst Hans Mosesmann maintains a buy rating on Broadcom stock and a Street-high, split-adjusted price target of $240. This represents potential upside for investors of 36% compared to Friday’s closing price.

Mosesmann suggests that management’s guidance is conservative, leaving the potential for upside revisions. He sees particular opportunities in Broadcom’s application-specific integrated circuits (ASICs) and ancillary products that support networking and switching, which will see increased AI-related demand. He also posits that the integration of VMWare will boost Broadcom’s results.

Mosesmann isn’t alone in his bullish prediction. Of the 39 analysts who rated the stock in September, 35 rated the stock a buy or strong buy, and none recommended selling.

Investors might be surprised to learn that Broadcom stock trades for less than 28 times next year’s expected earnings, which I believe is a bargain, considering its long track record of growth and expansive opportunity.

2. Nvidia: Implied upside 85%

The second stock-split stock with a long runway ahead is Nvidia (NASDAQ: NVDA). The company’s graphics processing units (GPUs) have become the gold standard for a variety of applications, including video games, cloud computing, and data centers. This technology is also instrumental in processing generative AI, providing the computational horsepower that makes it possible.

This has, in turn, fueled blockbuster results for Nvidia. For its fiscal 2025 second quarter (ended July 28), Nvidia delivered record quarterly revenue that climbed 122% year over year to $30 billion, while its diluted earnings per share (EPS) soared 168% to $0.67. The results were propelled higher by the company’s data center segment — which includes the chips used for AI — as revenue surged 154% to $26.3 billion.

That marked Nvidia’s fifth consecutive quarter of triple-digit sales and profit growth, while its stock has risen 754% since the start of 2023, leading to a 10-for-1 stock split. The stock has been on a roller-coaster ride in recent months, first losing more than a quarter of its value, then staging a remarkable recovery, and now sits less than 8% off its all-time high.

There’s likely more to come — but don’t just take my word for it. Rosenblatt analyst Hans Mosesmann reiterated his buy rating and Street-high price target of $200 on Nvidia, which represents potential gains of 60% compared to Friday’s closing price.

The analyst believes investors are missing an important element of Nvidia’s success, saying: “The real narrative lies in the software that complements all the hardware goodness. We anticipate this software aspect will significantly increase in the next decade in terms of overall sales mix, with an upward bias to valuation due to sustainability.”

He isn’t the only one who believes Nvidia has further to run. Of the 60 analysts who issued an opinion in September, 55 rated the stock a buy or strong buy, and none recommended selling.

I don’t have any doubts about the potential for Nvidia stock to go higher from here. In fact, I think the analyst’s price target might well be conservative.

3. Super Micro Computer: Implied upside 215%

The last of our trio of stock split stocks is admittedly the most controversial. Super Micro Computer (NASDAQ: SMCI), also known as Supermicro, has been a leading provider of custom-designed servers for more than 30 years.

The company’s secret weapon is the building-block architecture of its rack-scale servers. By designing interlocking major components, Supermicro customers can create the system that’s best suited to their specific needs — and price range — rather than simply taking something off the “rack.” The company is also a clear leader in the area of direct liquid cooling (DLC), which is uniquely suited to handle the rigors of AI. CEO Charles Liang estimates that Supermicro controls between 70% and 80% of the DLC market.

In its fiscal 2024 fourth quarter (ended June 30), Supermicro generated record revenue that climbed 143% to $5.3 billion. At the same time, the company delivered adjusted EPS that jumped 78% to $6.25. While declining profit margins raised eyebrows, Liang blamed a temporary bottleneck of component parts and product mix for the decline and expects a rebound in due course. That said, the company’s track record of strong results preceded a 10-for-1 stock split, which was completed earlier this week.

Supermicro has become a battleground stock in recent weeks, however. In late August, a short report by Hindenburg Research alleged accounting irregularities, sanctions violations, and undisclosed third-party transactions, among other accusations. The following day, Supermicro delayed the filing of its annual report, citing a need to assess the “design and operating effectively of its internal controls.” If that weren’t enough, a report emerged suggesting the U.S. Justice Department was investigating the company, according to the Wall Street Journal.

Despite the resulting uncertainty, some on Wall Street are undeterred. In the wake of these revelations, Rosenblatt analyst Hans Mosesmann maintained a buy rating and a split-adjusted Street-high price target of $130 on the stock. That represents potential upside of 215% compared to Friday’s closing price. The analyst suggests the recent stock price correction “seems over the top when considering the Hindenburg dynamic as old news or inaccurate.”

Not surprisingly, others on Wall Street have taken a “wait and see” approach. Of the 18 analysts who covered the stock in September, nine still rate the stock a buy or strong buy. The rest recommend holding, and none recommend selling.

As a short seller, Hindenburg Research has a vested interest in driving the stocks it targets lower, so its motives are suspect. Furthermore, it has a mixed track record, so its conclusions shouldn’t be considered gospel.

For investors with the stomach for a little risk, I think the opportunity of owning Supermicro stock outweighs the risk represented by the — as yet — unsubstantiated claims by a short seller. And as a Supermicro shareholder, my money is where my mouth is. Finally, at just 21 times earnings, Supermicro stock is a bargain.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Danny Vena has positions in Nvidia and Super Micro Computer. The Motley Fool has positions in and recommends Bank of America and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

3 Stock-Split Stocks to Buy Before They Soar as Much as 215%, According to Select Wall Street Analysts was originally published by The Motley Fool

CryptoCurrency

The Smartest Electric Vehicle (EV) Stocks to Buy With $1,000 Right Now

With proper insight and timing, an investor could have profited mightily from electric vehicle (EV) sector in recent years. For instance, had you invested $1,000 into Tesla (NASDAQ: TSLA) when its shares went public in June 2010, you’d have more than $156,000 today. Nowadays, many investors are looking for the next Tesla. If that’s your goal, pay attention to the two companies on this list.

Looking for the next Tesla? Here it is.

While many investors are looking for the next Tesla, it’s fair to mention that it’s still possible to invest in the original Tesla today. The company has a gargantuan $850 billion market value, but that shouldn’t stop you from jumping in.

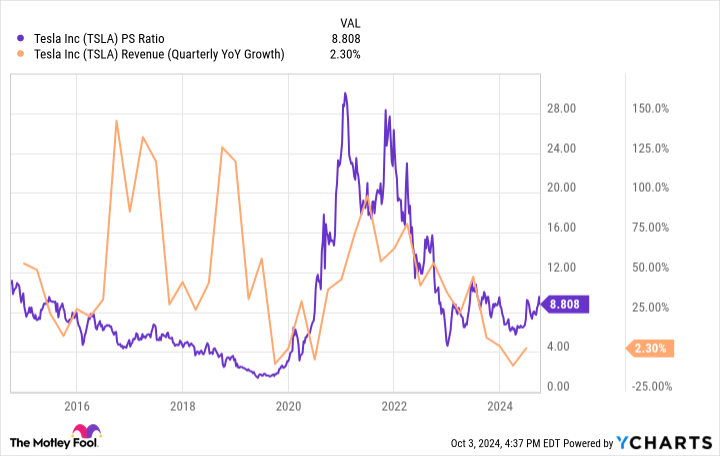

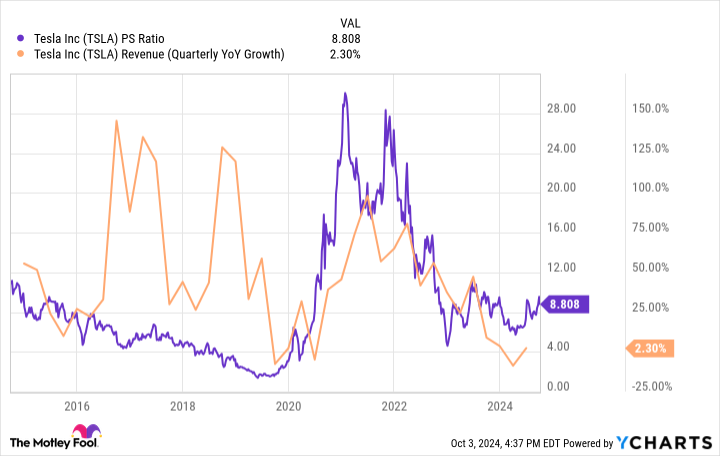

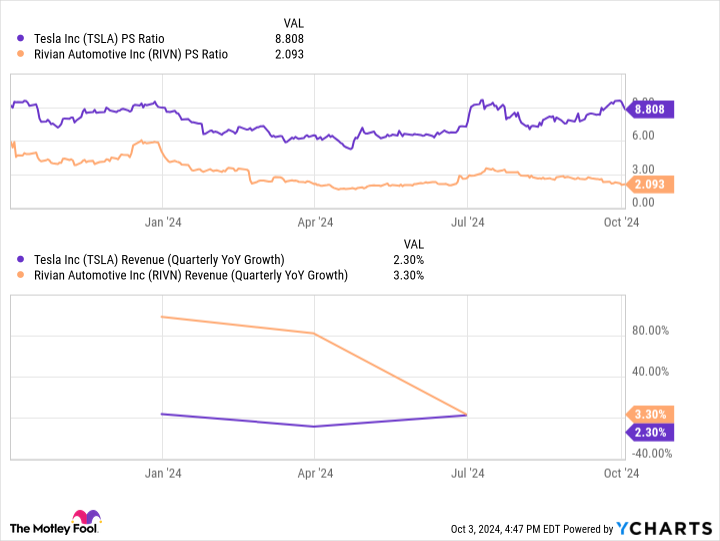

There are two reasons to believe the stock still has plenty of long-term upside. First, shares are cheaper today than they have been in years. That’s due to a massive dip in revenue growth. Earlier this year, Tesla actually experienced a decline in companywide revenue. As a result, Tesla’s price-to-sales ratio has fallen from the mid 20s to under 10. To be sure, that’s still expensive, but it’s a bargain relative to the company’s history.

A cheap valuation on paper, however, is only attractive if you believe the company is about to turn the corner. Take note of the chart below. Tesla has experienced massive dips in revenue growth before, with its valuation usually following suit. A huge reason that things turned around was a jump in electric vehicle sales, as well as the introduction of new models like the Model 3 and Model Y — both of which resulted in sales spikes that persisted for several years.

According to Bloomberg, “Electric vehicle deliveries have been essentially flat since early 2023, and that’s not likely to change anytime soon.” But fortunately, Tesla has something else up its sleeve. “Tesla’s robotaxi event next week,” Bloomberg reports, “will see Musk lean even harder into the narrative of self-driving vehicles, artificial intelligence and robots.”

Am I buying into Tesla’s robotaxi hype? Not just yet. But Musk has dreamed big before. Sometimes he delivers, and sometimes he doesn’t, but it’s often a smart move to back the horse with a winning track record. And despite the company’s recent missteps, Tesla is still the company to bet on if you’re bullish on EV stocks in general. But if you’re looking for the most upside potential possible, the next stock on this list is for you.

This EV stock has huge growth potential

While Tesla is still a great stock to bet on for those bullish on the EV space, its shares are still expensive and the company’s biggest days of growth are likely behind it. Rivian Automotive (NASDAQ: RIVN) is in the opposite situation. Its biggest days of growth are very much ahead of it, and shares aren’t as expensive as you’d think.

Earlier this year, for example, Rivian was posting revenue growth rates above 80% year over year. Those growth rates came at a time when Tesla’s revenue base was actually shrinking. And while Rivian’s growth rates have converged with Tesla’s more recently, most of that has come from industry pressure and the maturation of its models.

This year, EV sales forecasts have been repeatedly trimmed industrywide, and Rivian’s two existing models, the R1T and R1S, have already been on the market for several years. But that’s all about to change.

Earlier this year, Rivian announced three new models: the R2, R3, and R3X. All are expected to be priced under $50,000 — the magic price point that EV makers need to sell beneath in order to market to mass audiences. Also, while EV sales in general have slowed this year, most long-term forecasts still predict massive growth in the years to come. Passenger EV sales are expected to surpass 30 million by 2027, according to a recent report from Bloomberg. And this figure should grow further to 73 million per year by 2040.

Rivian’s new models aren’t expected to hit the streets until 2026. That gives plenty of time for market conditions to improve as most forecasts predict. And in the meantime, investors can lock in a market capitalization of just $11 billion. That results in a price-to-sales (P/S) ratio of only 2.1 for Rivian versus Tesla’s premium P/S multiple of 8.8.

You’ll need to be comfortable with volatility as Rivian attempts to ramp up its manufacturing capabilities, as well as market new models to a consumer base still skeptical of EVs. But if you truly want to invest in the next Tesla, Rivian has all the characteristics you’d want to see.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The Smartest Electric Vehicle (EV) Stocks to Buy With $1,000 Right Now was originally published by The Motley Fool

CryptoCurrency

S&P’s $8 Trillion Rally Will Be Tested by Tricky Earnings Season

(Bloomberg) — Traders are staring down a series of risks after the stock market’s torrid start to the year, from economic fear, to interest rate uncertainty, to election angst. But perhaps the most important variable for whether equities can keep rolling returns to the spotlight this week: corporate earnings.

Most Read from Bloomberg

The S&P 500 Index has soared roughly 20% in 2024, adding more than $8 trillion to its market capitalization. The gains have largely been driven by expectations of easing monetary policy and resilient profit outlooks.

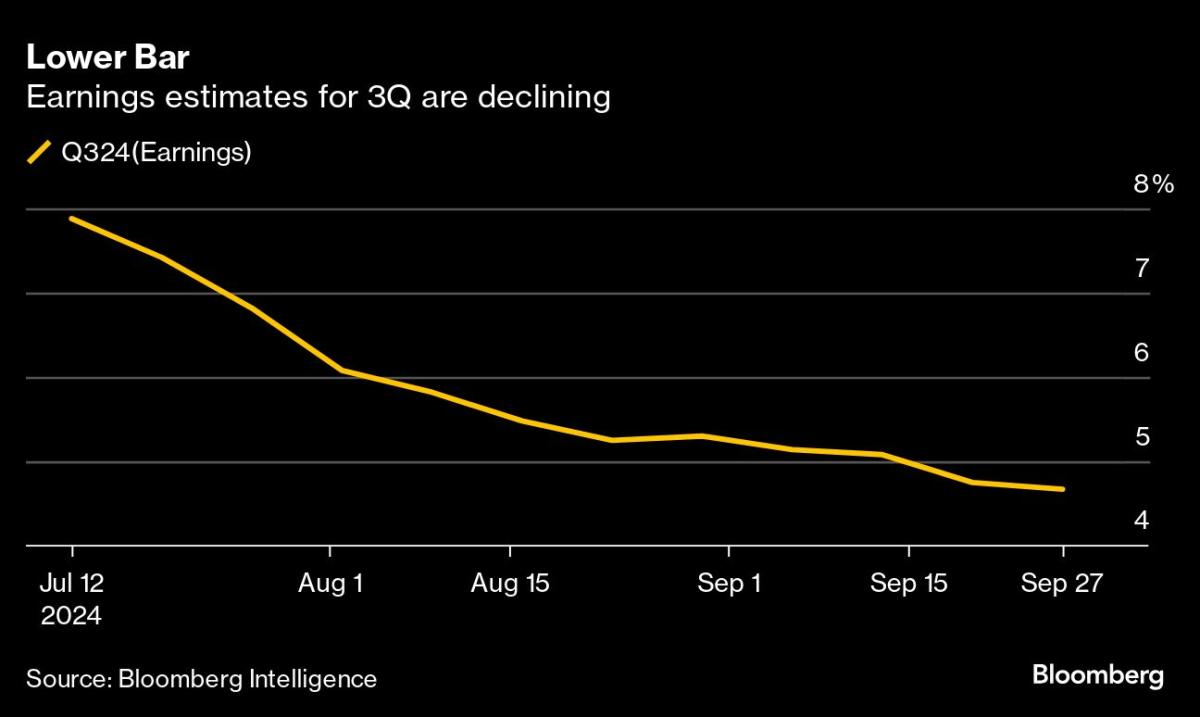

But the tide may be turning as analysts slice their expectations for third-quarter results. Companies in the S&P 500 are expected to report a 4.7% increase in quarterly earnings from a year ago, according to data compiled by Bloomberg Intelligence. That’s down from projections of 7.9% on July 12, and it would represent the weakest increase in four quarters, BI data show.

“The earnings season will be more important than normal this time,” said Adam Parker, founder of Trivariate Research. “We need concrete data from corporates.“

In particular, investors are eager to see if companies are postponing spending, if demand has slowed, and if customers are behaving differently due to geopolitical risk and macro uncertainty, Parker said. “It is exactly because there is a lot going on in the world that corporate earnings and guidance will particularly matter now,” he said.

Reports from major companies start arriving this week, with results from Delta Air Lines Inc. due Thursday and JPMorgan Chase & Co. and Wells Fargo & Co. scheduled for Friday.

“Earnings seasons are typically positive for equities,” said Binky Chadha, chief US equity and global Strategist at Deutsche Bank Securities Inc. “But the strong rally and above-average positioning going in (to this earnings season) argue for a muted market reaction.”

Obstacles Abound

The obstacles facing investors right now are no secret. The US presidential election is just a month away with Democrat Kamala Harris and Republican Donald Trump in a tight, fierce race. The Federal Reserve has just started lowering interest rates, and while there’s optimism about an economic soft-landing, questions remain about how fast central bankers will reduce borrowing costs. And a deepening conflict in the Middle East is raising concerns about inflation heating up again, with the price of West Texas Intermediate oil rising 9% last week, the biggest weekly gain March 2023.

“The bottom line is that revisions and guidance are weak, indicating lingering concerns about the economy and reflecting some election year seasonality,” said Dennis DeBusschere of 22V Research. “That is helping set up reporting season as another uncertainty clearing event.”

Plus, to make matters more challenging, big institutional investors have little buying power at the moment and seasonal market trends are soft.

Positioning in trend-following systematic funds is now skewed to the downside, and options market positioning shows traders may not be ready to buy any dips. Commodity trading advisers, or CTAs, are expected to sell US stocks even if the market stays flat in the next month, according to data from Goldman Sachs Group Inc. And volatility control funds, which buy stocks when volatility drops, no longer have room to add exposure.

History appears to side with the pessimists, too. Since 1945, when the S&P 500 gained 20% through the first nine months of the year, it posted a down October 70% of the time, data compiled by Bespoke Investment Research show. The index gained 21% this year through September.

Bar Lowered

Still, there’s reason for optimism, specifically a lowered bar for earnings projections that leaves companies more room to beat expectations.

“Estimates got a little bit too optimistic, and now they’re pulling back to more realistic levels,” said Ellen Hazen, chief market strategist at F.L.Putnam Investment Management. “It will definitely be easier to beat earnings because estimates are lower now.”

In fact, there’s plenty of data suggesting that US companies remain fundamentally resilient. A strengthening earnings cycle should continue to offset stubbornly weak economic signals, tipping the scales for equities in a positive direction, according to Bloomberg Intelligence. Even struggling small-cap stocks, which have lagged their large-cap peers this year, are expected to see improving margins, BI’s Michael Casper wrote.

Friday’s jobs report, which showed the unemployment rate unexpectedly declined, quelled some concerns about a soft labor market.

Another factor is the Fed’s easing cycle, which has historically been a boon for US equities. Since 1971, the S&P 500 has posted an annualized return of 15% during periods in which the central bank cut rates, data compiled by Bloomberg Intelligence show.

Those gains have been even stronger when rate-cutting cycles hit in non-recessionary periods. In those cases, large caps posted an averaged annualized return of 25% compared with 11% when there was a recession, while small caps gained 20% in non-recessionary periods compared with 17% when there was a recession.

“Unless earnings are a major disappointment, I think the Fed will be a bigger influence over markets between now and year-end simply because earnings have been pretty consistent,” said Tom Essaye, founder and president of Sevens Report Research. “Investors expect that to continue.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

CryptoCurrency

3 High-Yield Dividend Stocks That Are Screaming Buys Right Now

The Federal Reserve’s pivot to lower interest rates will have ripple effects throughout the economy and send investors looking for passive income to new places. As yields fall in vehicles like high-yield savings accounts, investors could turn to high-quality, high-yield dividend stocks. Consumer spending and healthcare are two pillars of the U.S. economy, and great places to look for such stocks.

I’ve identified three stocks with generous yields and the financials to afford their payouts. These companies also boast durable business models that should thrive through recessions, giving income-focused investors peace of mind.

1. Pfizer

Current yield: 5.8%

Pharmaceutical giant Pfizer (NYSE: PFE) was a big winner during COVID-19’s height due to its vaccine and treatment products, which created a temporary growth wave. However, the tide has gone out over the past couple of years, and the stock has plunged to multi-year lows as revenue and earnings contract.

But the company is poised to resume growth, with analysts anticipating 8% to 9% annual earnings growth for the next three to five years. Pfizer has pivoted its business to focus on oncology, using its pandemic profits to acquire Seagen for $43 billion last year.

Management raised Pfizer’s dividend by 2.4% last December, a sign of confidence the payout is safe. The payout ratio is also getting healthier. The dividend is approximately 64% of estimated 2024 earnings, so Pfizer seems poised to continue extending its streak of 15 years of increases. The stock trades at only 11 times its estimated 2024 earnings, a sharp discount to the broader market and an attractive price for a business with high single-digit earnings growth.

Pfizer represents a rock-solid income investment with the potential for capital appreciation ahead.

2. Altria

Current yield: 8%

Tobacco companies are renowned dividend stocks, and Altria (NYSE: MO) is an excellent example, having showered shareholders with cash for decades. The company sells Marlboro cigarettes and leading brands of cigars, chewing tobacco, and smokeless products in the United States. The company is also a Dividend King, meaning that it has raised its dividend for more than five decades, a testament to how durable the tobacco industry is despite declining smoking rates.

The dividend remains in good financial health, with a payout ratio of 80% of estimated 2024 earnings. That dividend is backed by an investment-grade balance sheet and a multi-billion-dollar stake in Anheuser-Busch, which the company could liquidate as needed.

Altria’s cigarette shipments decline almost annually, but a combination of price increases and share repurchases continues inching earnings higher. Analysts estimate that the company will grow earnings by an average of 3% to 4% over the next three to five years, which means the dividend will continue inching higher, too.

Shares trade at 10 times Altria’s estimated 2024 earnings, but I’d hesitate to call the stock a bargain due to its low growth. However, you don’t need much when getting an 8% dividend yield. Those ultimately concerned with investment income will struggle to find a similarly safe yield this high.

3. Realty Income

Current yield: 5%

Real estate is one of society’s oldest industries, and real estate investment trusts (REITs) like Realty Income (NYSE: O) enable people to invest in real estate without directly owning property. REITs acquire and lease real estate, and then distribute most of their income to shareholders. That makes Realty Income an excellent dividend stock.

The company has paid and raised its dividend for 29 consecutive years, and the payout ratio is still just 75% of this year’s estimated funds from operations (FFO). Plus, Realty Income pays a monthly dividend, a perk for investors who want regular cash flow to help pay their bills.

Realty Income has thrived through economic ups and downs because it focuses on renting to retail businesses that people use regardless of what the economy is doing. Think grocery stores, restaurants, convenience stores, and pharmacies. Realty Income leases over 15,000 properties, so it’s a vast and diverse portfolio that generates steady rental income for the company.

Lower interest rates are a bonus for REITs like Realty Income because they often borrow to fund their property acquisitions. Cheaper borrowing costs should make Realty Income more profitable.

Realty Income trades at almost 15 times its estimated 2024 FFO, a fair price given the company’s bright outlook and reliable and growing dividend.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer and Realty Income. The Motley Fool has a disclosure policy.

3 High-Yield Dividend Stocks That Are Screaming Buys Right Now was originally published by The Motley Fool

CryptoCurrency

Is This Company an “Nvidia Killer?” What to Know About Cerebras’ IPO

Conventional wisdom is that Nvidia (NASDAQ: NVDA) will continue to dominate the artificial intelligence (AI) chip market, as it has since the introduction of ChatGPT. Yet, there’s a barrage of competition coming not only from merchant competitors and cloud giants producing their own in-house accelerators but also from AI chip start-ups.

One such start-up, Cerebras, just filed a prospectus ahead of an impending initial public offering (IPO). After reading, I think Cerebras is a name every Nvidia investor should monitor closely. But is it really a threat to the graphics processing unit (GPU) giant?

What is Cerebras?

Cerebras was founded in 2016 by current CEO Andrew Feldman and a group of technologists who had founded and/or worked at a company called SeaMicro over a decade ago. SeaMicro made efficient high-bandwidth microservers and was later acquired by Advanced Micro Devices in 2012.

Cerebras sold its first AI chips in 2019 and has recently seen a big acceleration in demand, leading to this recent IPO filing.

Cerebras’ giant chip

Cerebras’ big differentiator is that its AI chips, which it calls wafer-scale engines (WSEs), are huge. And by huge, we’re talking a chip that takes up an entire semiconductor wafer. A foundry usually produces many chips per wafer, some of which have defects and are discarded. But Cerebras goes for one giant chip per wafer.

The result is a massive processor 57 times larger than an Nvidia GPU, with 52 times more compute cores, 880 times the on-chip memory, and 7,000 times more memory bandwidth. One Cerebras WSE has a remarkable 4 trillion transistors — that’s 50 times the 80 billion transistor count of Nvidia’s H200! Like Nvidia, Cerebras’ chips are produced by Taiwan Semiconductor Manufacturing.

The theory behind making a giant chip is that by doing more processing on the chip, the WSE does away with the need for the Infiniband or Ethernet-based networking connections that string hundreds or thousands of GPUs together. According to Cerebras, this architecture allows WSEs to achieve over 10 times faster training and inference than an 8-GPU Nvidia system.

In a recent interview, Feldman said recent tests showed Cerebras chips were 20 times faster for inference than Nvidia’s. Sound impressive? When Feldman was asked at a summer conference how much market share Cerebras planned to take from Nvidia, he answered, “All of it.”

Financials show a big acceleration

Not only does Cerebras talk a big game, but it’s also shown impressive revenue acceleration and improving profitability this year, as you can see:

|

Cerebras (Nasdaq: CBRS) |

H1 2023 |

H1 2024 |

|---|---|---|

|

Hardware revenue |

$1,559 |

$104,269 |

|

Service revenue |

$7,105 |

$32,133 |

|

Total revenue |

$8,664 |

$136,402 |

|

Gross profit |

$4,378 |

$56,019 |

|

Operating profit (loss) |

($81,015) |

($41,811) |

Data source: Cerebras S-1. H1 = first half of the corresponding year.

As you can see, between the first half of 2023 and the first half of 2024, Cerebras’ revenue jumped a whopping 1,474%. While gross margin technically declined, from 50.5% to 41.1%, that was mainly because virtually all of last year’s revenue came from higher-margin services. Cerebras’ hardware gross margins actually went up over that time. Even better, operating losses narrowed by $40 million, a great indication that the company will be profitable if it scales.

That exponential scaling should continue into next year. According to the filing, Cerebras’ largest customer, Abu Dhabi’s G42, agreed to purchase $1.43 billion of equipment through the end of 2025. That’s sixfold growth over the current 2024 run rate.

Risks to the Cerebras story

There are a couple of risks to the Cerebras story, however. One is that producing one massive chip can lead to lots of defects. Whereas Nvidia or any other chipmaker can throw out all the bad chips on a wafer, Cerebras has to take the whole thing, opening its WSEs to imperfections.

To get around this, Cerebras says it has created “redundant” cores and interconnects on its chips, as Cerebras assumes many chips will have defects. “Flaws are designed to be recognized, shut down, and routed around,” the filing says.

However, building redundancy also means Cerebras can’t get all the potential the surface area of its chip could otherwise get. Obviously, management believes the “big chip” architecture more than makes up for this inefficiency.

A second risk, and likely the biggest, is Cerebras’ customer concentration. Right now, AI company G42 from the United Arab Emirates accounts for 87% of Cerebras’ sales in the first six months of 2024. G42 and affiliated entities are also behind next year’s $1.43 billion order, meaning that concentration will only grow.

Concentration is somewhat expected in the early stages of a company’s growth. But should anything go wrong with the relationship or G42 itself, it could seriously derail Cerebras’ plans. G42’s close affiliation with a foreign government — the UAE’s national security advisor is the company’s founder and largest shareholder — certainly poses a risk should there be a geopolitical flare-up.

Cerebras is one to watch

When it goes public, Cerebras will be a new AI player on the block and will probably sell for a high valuation. So, investors should be cautious about how much they pay for the stock when it comes to market.

Nevertheless, the company has a differentiated architecture from the rest of the pack. Therefore, it’s certainly worth watching whenever it goes public — especially if you’re a big Nvidia or AMD shareholder.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Billy Duberstein and/or his clients have positions in Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Is This Company an “Nvidia Killer?” What to Know About Cerebras’ IPO was originally published by The Motley Fool

CryptoCurrency

China Stock Skepticism Gets Louder as World-Beating Run Extends

(Bloomberg) — The world-beating rally in Chinese stocks is failing to convince many global fund managers and strategists.

Most Read from Bloomberg

Invesco Ltd., JPMorgan Asset Management, HSBC Global Private Banking and Wealth, and Nomura Holdings Inc. are among those viewing the recent rebound with skepticism and waiting for Beijing to back up its stimulus pledges with real money. Some are also concerned many stocks are already reaching overvalued levels.

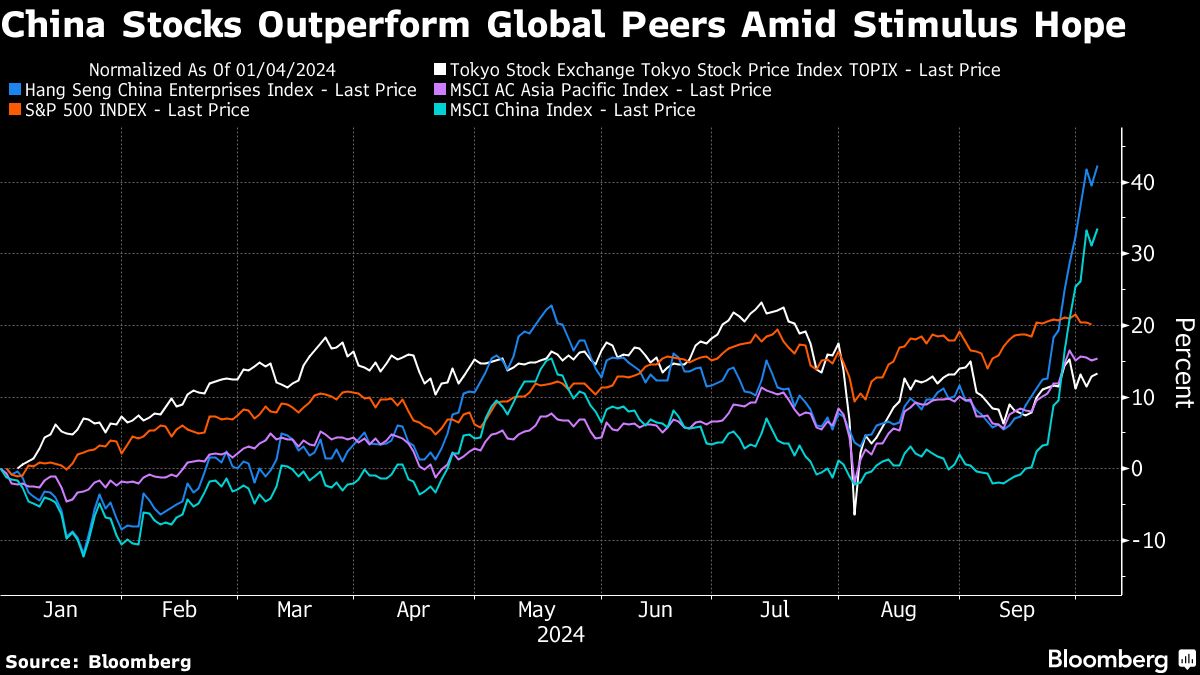

Chinese shares have skyrocketed since late-September as a barrage of economic, financial and market-support measures reinvigorated investor confidence. The Hang Seng China Enterprises Index, which comprises Chinese stocks listed in Hong Kong, has jumped more than 30% over the past month, making it the best performer among more than 90 global equity gauges tracked by Bloomberg.

“In the short term, sentiment could overshoot but people will go back to fundamentals,” said Raymond Ma, Invesco’s chief investment officer for Hong Kong and Mainland China. “Because of this rally, some stocks have become really overvalued” and they lack a clear value proposition based on their likely earnings performance, he said.

Stimulus announced by Beijing has included interest-rate cuts, freeing-up of cash at banks, billions of dollars of liquidity support for stocks, and a vow to end the long-term slide in property prices. While there’s plenty of optimism that could underpin a sustainable equity rally, there have been a number of false dawns before, most recently a rally in February that completely unwound.

The surge in the past two weeks has seen Chinese equities reassert their influence over broader emerging-market gauges, and dented the performance of fund managers who had been running underweight positions in the biggest developing-nation economy. The durability of the rebound will not only matter for the year-end performance of index-tracking funds, but also have direct implications for nations that have trading and investment links with China.

Ma at Invesco, who was one of relatively few China bulls coming into this year, said he’s in no rush to add to his investments now.

“There are a group of stocks whose share prices are up by 30% to 40% and almost at historical highs,” he said. “Whether in the next 12 months the fundamentals will be as good as before their peak, that’s more uncertain to me. That would be the category we would like to trim.”

More Needed

JPMorgan Asset Management is just as cautious.

“Additional policy steps would be needed to boost economic activity and confidence,” said Tai Hui, Asia Pacific chief market strategist in Hong Kong. “The policies announced so far can help to smoothen out the de-leveraging process, but the balance-sheet repairing would still need to take place.”

Hui also pointed to global uncertainties that may crimp the nascent stock rally.

“With the U.S. elections only a month away, many investors would argue that the U.S. view of China as an economic and geopolitical rival is a bipartisan consensus,” he said. Moreover, “foreign investors may choose to wait for economic data to bottom out and for this new policy direct to solidify,’ he said.

Slowing Growth

HSBC Global Private Banking remains concerned the steps China has taken aren’t enough to reverse the nation’s slowing long-term growth outlook.

“More significant fiscal easing is still needed to sustain the recovery momentum and shore up growth to achieve the 5% 2024 GDP growth target,” said Cheuk Wan Fan, chief investment officer for Asia at the private bank in Hong Kong. “For now, we stay neutral on mainland China and Hong Kong equities based on our expectation of China’s GDP growth decelerating from 4.9% in 2024 to 4.5% in 2025.”

‘Go Further’

Still, some remain bullish, saying valuations are cheap due to the three-year selloff.

“The rally can run, there’s a lot of money that still needs to rebalance. especially from global investors,” Matthew Quaife, global head of multi-asset investment management at Fidelity International in Hong Kong, said on Bloomberg Television.

“We know valuations are still below mean and could run further from a technical view. This could have more legs and how much it goes into earnings is a bigger question,” he said.

Potential Bust

Nomura Holdings Inc. is among the most pessimistic, warning the rally may quickly turn from boom to bust.

In the most gloomy scenario, “a stock market mania would be followed by a crash, similar to what happened in 2015,” Nomura economists led by Ting Lu in Hong Kong wrote in a note to clients. That outcome may have a “much higher probability” than more optimistic scenarios, they said.

Bond ‘Challenges’

Some investors and strategists are also wary about what the stimulus blitz means for the nation’s bonds and currency.

China’s bonds have dropped since the stock rally started, ending at least temporarily a period in which yields set successive record lows as investors bought haven assets.

“There are still major challenges to be resolved, and it’s not an easy road,” said Lynn Song, chief economist for Greater China at ING Bank in Hong Kong. “We need to ensure that this policy blitz is effective in stabilizing the downward trajectory of the housing market and not just result in a rush of hot money to equities.”

Bonds may become a beneficiary if the stock market cools, Song said. “There’s certainly a risk we could revert back to the previous months’ environment if anything goes wrong in the next steps ahead.”

Yuan traders will be watching out on Tuesday for the central bank’s daily reference rate, the level around which the currency is allowed to trade. The onshore yuan has strengthened more than 1% in the past month to approach the key level of 7 per dollar. A break of that barrier may trigger a further rally.

What to Watch

-

China publishes FX reserves data for September

-

A swath of countries release inflation data, including Thailand, Brazil, Mexico, Chile and Argentina

-

Central banks in India, Peru and South Korea announce interest-rate decisions

-

Mexico and India release industrial production data

–With assistance from Shulun Huang and Carolina Wilson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

CryptoCurrency

What to know this week

A turbulent five days for markets, featuring rising tensions in the Middle East and a port strike that both started and stopped, was capped off by a better-than-expected September jobs report that helped stocks close marginally up on the week.

For the first week of October the S&P 500 (^GSPC) rose 0.2%, while the Nasdaq Composite (^IXIC) and Dow Jones Industrial Average (^DJI) rose about 0.1%.

An update on inflation and the start of third quarter earnings reports will grab investor attention in the week ahead.

The October Consumer Price Index (CPI) report will headline an economic calendar that will also feature updates on consumer sentiment and the release of the minutes from the Federal Reserve’s September meeting.

On the corporate side, some of America’s largest financial institutions, including JPMorgan (JPM), Wells Fargo (WFC), and BlackRock (BLK), will kick off third quarter earnings season on Friday. PepsiCo (PEP) and Delta Air Lines (DAL) are also scheduled to report earlier in the week.

A small step forward

On Friday, the September jobs report cooled concerns that the labor market is rapidly deteriorating and will prompt another jumbo-sized rate cut.

Data from the Bureau of Labor Statistics released Friday showed the labor market added 254,000 payrolls in September, more additions than the 150,000 expected by economists. Revisions to both the July and August report showed the US economy added 72,000 more jobs during those two months than previously reported.

Meanwhile, the unemployment rate fell to 4.1% from 4.2% in August.

This, Wall Street economists and strategists argued, likely takes another half-percentage-point interest rate cut from the Fed in November off the table.

“We think that the rate descent should continue, but with today’s strong data it’s more likely that the Fed will move in 25 basis point (bps) cut increments,” BlackRock chief investment officer of global fixed income Rick Rieder wrote in a research note on Friday. “For a Fed that is recalibrating to an economy that is operating at a very solid level, it seems more appropriate for the market to price in a small probability of “no cut” at the next meeting, rather than a small probability of a 50-bps cut.”

Price check

While concerns about the Fed’s maximum employment portion of its dual mandate appear to have eased for now, inflation remains above the central bank’s 2% target.

The week ahead will provide a fresh update on how quickly price increases are falling toward that goal.

Wall Street economists expect headline inflation rose just 2.3% annually in September, a slowdown from the 2.5% rise seen in August. August data marked the slowest year-over-year inflation reading since early 2021. Prices are set to rise 0.1% on a month-over-month basis, a decrease from the 0.2% reading seen in May.

On a “core” basis, which strips out food and energy prices, CPI is forecast to have risen 3.2% over last year in September, unchanged from August. Monthly core price increases are expected to clock in at 0.2%, below the 0.3% seen in August.

“Inflation continues to move in the right direction, which will allow further cuts,” Bank of America US economist Stephen Juneau wrote in a research note previewing the release. “However, we continue to think labor data matters more for size of cuts.”

Tesla talk

Tesla will once again be one of the key individual stocks in focus during the upcoming week. The electric vehicle maker is expected to host its highly anticipated robotaxi event on Oct. 10.

Tesla is expected to provide further details on its plans for its full self-driving project. Morgan Stanley analyst Adam Jonas wrote in a note to clients he expects attendees will be shown and given rides in one of Tesla’s “cybercabs.”

As Yahoo Finance’s Laura Bratton reported, RBC analyst Tom Narayan told Yahoo Finance that while he has high hopes for a future of self-driving robotaxis, the event is unlikely to send Tesla stock soaring.

“I think it’s difficult to get excited on a stock on something so high level,” he said, noting that the launch will showcase Tesla’s big-picture vision for AI and autonomous vehicles — a vision that he said will probably take several years to become “financially meaningful” for the EV maker.

Tesla stock fell about 5% last week ahead of the event as the company announced third quarter deliveries that fell short of Wall Street’s estimates.

Enter earnings

Big banks are set to kick off what Wall Street expects to be a subdued quarter for year-over-year earnings growth. Entering the reporting period, consensus projects earnings to grow 4.7%. This would mark the fifth straight quarter of growth compared to the same period a year prior but would also be the slowest year-over-year growth since the fourth quarter of 2023.

“The bottom-up consensus forecasts a sharp and broad slowing,” Deutsche Bank chief equity strategist Binky Chadha wrote in a note to clients.

Chadha added that this should set up company earnings to surpass Wall Street’s expectations as they often do. It does not, however, make Chadha more bullish on how stocks might perform during the reporting period.

“Earnings seasons are typically positive for equities, but the strong rally and above-average positioning going in argue for a muted market reaction,” Chadha wrote. “This earnings season will also take place against a backdrop that could see it overshadowed by geopolitical developments and noise around the US elections.”

Bank of America US and Canada equity strategist Ohsung Kwon told Yahoo Finance that with consensus not expecting a strong third quarter, much of the focus will be on what companies say about the path forward.

“Now that the easing cycle has started, what are companies … going to say about any early indications of improvement given the lower rate environment?” Kwon said.

Weekly calendar

Monday

Economic data: No notable releases.

Earnings: Duckhorn (NAPA)

Tuesday

Economic data:

Earnings: PepsiCo (PEP)

Wednesday

Economic data: MBA mortgage applications Oct. 4 (-1.3% prior), Wholesale inventories month-over-month, August final (0.2% prior); FOMC September meeting minutes

Earnings: Helene of Troy (HELE)

Thursday

Economic data: Consumer Price Index, month-over-month, September (+0.1% expected, +0.2% previously); CPI excluding food and energy, month-over-month, September (+0.2% expected, +0.3% previously); Consumer Price Index, year-over-year, September (+2.3% expected, +2.5% previously); CPI excluding food and energy, year-over-year, September (+3.2% expected, +3.2% previously); Real Average Hourly Earnings, year-over-year, September (+1.4% previously); Real Average Weekly Earnings, year-over-year, September (+0.9% previously); Initial jobless claims, week ended Oct. 5 (237,000 expected, 225,000 prior)

Earnings: Delta Air Lines (DAL), Domino’s (DPZ), Tilray (TLRY)

Friday

Economic data: Producer Price Index, month-over-month, September (+0.1% expected, +0.2% previously); PPI, year-over-year, September (+1.6% expected, 1.7% previously); Core PPI, month-over-month, September (+0.2% expected, 0.3% previously); Core PPI, year-over-year, September (+2.7% expected, +2.4% previously); University of Michigan consumer sentiment, October preliminary (70.3 expected, 70.1 previously)

Earnings: BlackRock (BLK), BNY Mellon (BK), JPMorgan (JPM), Wells Fargo (WFC)

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 weeks ago

Technology3 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 weeks ago

Science & Environment2 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

News2 weeks ago

News2 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

News3 weeks ago

the pick of new debut fiction

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy this is a golden age for life to thrive across the universe

-

News3 weeks ago

News3 weeks agoYou’re a Hypocrite, And So Am I

-

Sport2 weeks ago

Sport2 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology1 week ago

Technology1 week ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Football1 week ago

Football1 week agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Business1 week ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoRethinking space and time could let us do away with dark matter

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNerve fibres in the brain could generate quantum entanglement

-

MMA1 week ago

MMA1 week agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

News3 weeks ago

News3 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Business1 week ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

News2 weeks ago

News2 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

News3 weeks ago

News3 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News3 weeks ago

News3 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCardano founder to meet Argentina president Javier Milei

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMeet the world's first female male model | 7.30

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA slight curve helps rocks make the biggest splash

-

Business3 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoBest Exercises if You Want to Build a Great Physique

-

News2 weeks ago

News2 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

News2 weeks ago

News2 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Technology2 weeks ago

Technology2 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Technology2 weeks ago

Technology2 weeks agoGet ready for Meta Connect

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Politics2 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoEverything a Beginner Needs to Know About Squatting

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Toning Workout for Women

-

Travel2 weeks ago

Travel2 weeks agoDelta signs codeshare agreement with SAS

-

Servers computers2 weeks ago

Servers computers2 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Politics2 weeks ago

Politics2 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology1 week ago

Technology1 week agoThe best robot vacuum cleaners of 2024

-

Health & fitness1 week ago

Health & fitness1 week agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Sport2 weeks ago

Sport2 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Technology2 weeks ago

Technology2 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBlockdaemon mulls 2026 IPO: Report

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

MMA2 weeks ago

MMA2 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News1 week ago

News1 week agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology1 week ago

Technology1 week agoQuantum computers may work better when they ignore causality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow one theory ties together everything we know about the universe

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business2 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Business2 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Politics2 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

News2 weeks ago

The Project Censored Newsletter – May 2024

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoKeep Your Goals on Track This Season

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoWhich Squat Load Position is Right For You?

-

TV2 weeks ago

TV2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

MMA1 week ago

MMA1 week agoRoberto Satoshi compares losses to Francis Ngannou’s boxing run as he finally defends RIZIN title

-

News2 weeks ago

News2 weeks agoChurch same-sex split affecting bishop appointments

-

Politics3 weeks ago

Politics3 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology2 weeks ago

Technology2 weeks agoFivetran targets data security by adding Hybrid Deployment

You must be logged in to post a comment Login