CryptoCurrency

BTC miners are ideal energy consumers, but regulators need to catch up — Hive

According to Hive’s CEO, data centers have the potential to enhance grid stability, especially as the transition to renewable energy introduces more volatility into power systems.

CryptoCurrency

LEGO removes crypto scam from homepage after being hacked: Report

The “LEGO Coin” token appeared on the toy manufacturer’s homepage for roughly 75 minutes before being taken down, onlookers said.

CryptoCurrency

Why Aerospace Might Be Worth the Wait

The last big hurrah for General Electric came under the guidance of Jack Welch, a CEO who was held in very high esteem on Wall Street and throughout the business community. But after his departure the company he built slowly crumbled.

That said, the company that now uses the once iconic “GE” ticker is pretty attractive. Here’s what you need to know.

GE Aerospace, over a decade in the making

General Electric was once a massive and sprawling conglomerate. Although the company’s roots were in the industrial sector, by the time Welch retired in 2001 the company was also in the finance business and the media sector. When the Great Recession hit between 2007 and 2009, GE’s diversification into non-industrial businesses quickly turned into a negative. That was particularly true of its finance push, given the recession was felt most keenly in that sector.

Subsequent leaders attempted to right the ship. Efforts included cutting the dividend, accepting government bailouts, and selling assets. But it wasn’t enough, and after the board had tried letting a couple of insiders mend the company they eventually looked outside, handing Larry Culp the reins.

Culp had previously turned around industrial peer Danaher. The outsider’s big plan ended up being a corporate breakup. That effort has now been completed, with GE’s remaining operations separated into GE Vernova (NYSE: GEV), GE HealthCare Technologies (NASDAQ: GEHC), and GE Aerospace (NYSE: GE). Notably, Culp remained at the helm of GE Aerospace.

GE Aerospace is well-positioned

It is often interesting to watch which company a CEO selects to run when there’s a breakup going on. Usually, but not always, the company the CEO picks is the one that has the best prospects for the future. In this case, GE owned some compelling assets across its portfolio, so it might not be a clear-cut indication of future opportunities. But don’t ignore the fact that Culp picked GE Aerospace.

The company basically serves two broad markets, consumer air carriers and the military and defense sector. They have different dynamics, but both are likely to see material growth in the future.

The most recent quarter was particularly strong, with orders rising 18% year over year. Revenue jumped 4%, with a profit margin improvement of 560 basis points leading to a 37% operating profit advance. That said, the increase in orders is probably more exciting, given that the company has been going through a highly public transformation. That increase shows that customers haven’t lost faith in GE Aerospace.

Longer-term, GE Aerospace’s defense business has a nearly $17 billion backlog. That’s work that should keep the company busy for years. With regard to the company’s commercial-oriented business, growth in air travel over the long term will likely support strong overall performance. The company augments its service and replacement parts income streams with every jet engine it sells. In fact, while the engine sale is clearly important, the income generated after that initial sale might be even more important.

GE Aerospace’s business will obviously wax and wane over time. That’s the norm for cyclical industrial businesses. But with geopolitical tensions seemingly always an issue, defense spending seems likely to remain a robust support. Meanwhile, industry watchers expect a steady climb in air travel among consumers, with nearly 4% annualized passenger growth through 2043. That will lead to an additional 4 billion passengers, an increase that should support continued strength in GE Aerospace’s consumer aviation division.

Is GE Aerospace worth buying today?

All in, GE Aerospace looks like a worthy company to retain the iconic “GE” ticker symbol. But that doesn’t mean it is worth buying right now. The stock price has rocketed higher, more than doubling in value over the past year. Wall Street is clearly pricing in a lot of good news, noting that the price-to-earnings ratio is a lofty 50 times or so compared to an industry average of around 32 times, using the iShares U.S. Aerospace & Defense ETF as an industry proxy.

In other words, GE Aerospace looks like it is well-positioned for the future, but you should probably keep it on your wish list for now. The next bear market (or an industrial sector downturn) will probably prove a better point to add this stock to your portfolio.

Should you invest $1,000 in GE Aerospace right now?

Before you buy stock in GE Aerospace, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and GE Aerospace wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Danaher. The Motley Fool recommends GE HealthCare Technologies. The Motley Fool has a disclosure policy.

The New Face of GE: Why Aerospace Might Be Worth the Wait was originally published by The Motley Fool

CryptoCurrency

2 High-Yield Dividend Stocks Set to Soar

“The true investor… will do better if he forgets about the stock market and pays attention to his dividend returns and to the operation results of his companies.” – Benjamin Graham

Taking that quote to heart, here are two companies with high dividend yields and improving operations or future growth potential that should have income investors paying very close attention: United Parcel Service (NYSE: UPS), and LTC Properties Inc. (NYSE: LTC).

Return to growth

UPS is one of the world’s largest companies. It provides a range of logistics solutions for customers in over 200 countries and territories. While Wall Street might currently have lower expectations for UPS, that doesn’t mean income investors should shy away from a stock that offers a solid dividend and could rebound in the near term. The stock has lagged broader markets because customers have shifted to lower-cost shipping options, and it’s hurt the company’s financials.

In fact, second-quarter consolidated revenues dropped 1.1% compared to the prior year, but consolidated operating profit dropped a staggering 30.1% compared to Q2 2023. Adjusted diluted earnings per share also dropped a brutal 29.5%.

But something else happened that should catch investors’ interest: The second quarter could prove to be a turning point, as UPS returned to volume growth in the U.S. for the first time in nine quarters. While one quarter doesn’t make a trend, it’s certainly a change of pace that’s worth noting going forward.

UPS also made a move in July to acquire Estafeta, a leading Mexican express delivery company. The acquisition is targeting a close by the end of 2024 and will boost UPS’ business as Mexico’s role in global trade continues to rise.

UPS has returned to growth and made key acquisitions. It offers a dividend yield of 4.8% and has maintained or increased its dividend each year since going public in 1999. That makes it a solid dividend stock to buy as it positions itself for a rebound.

Aging population

LTC Properties is a real estate investment trust (REIT) that invests in senior housing and healthcare properties through lease transactions, mortgage loans, and other investments. It’s made itself into an intriguing income investment option, as it maintained monthly dividends throughout the COVID-19 pandemic, when most healthcare REITs cut their dividends.

LTC Properties boasts a longstanding executive leadership team with decades of healthcare real estate experience, and has logged 233 consecutive payments of monthly dividends. It also offers a conservative and strong balance sheet with debt maturities matched to cash flow and portfolio maturities — meaning investors can sleep easier at night.

The growth, however, is what makes this income investment interesting. It specializes in senior housing and skilled nursing properties, and it’s worth noting that America’s population is aging. More than 4.1 million Americans will turn 65 each year through 2027, generating plenty of demand for LTC Properties. Furthermore, the U.S. adult population aged 85 or older is expected to continue growing rapidly — it will hit 11 million by 2035 and pass 17 million by 2050.

While income investors wait for the aging population to boost demand for LTC Properties, the company will pay out a healthy 6.2% dividend yield, making it a smart income play for investors.

Buy now?

UPS offers a potential turnaround story as it returns to volume growth in the U.S. and offers investors a near-5% dividend yield while they wait for financials to return to growth. LTC Properties has a bright future as America’s population ages and boosts demand for its senior housing and skilled nursing properties, and its 6.2% dividend yield is just icing on the cake. Both stocks look like excellent high dividend-yield options and could be set to soar going forward.

Should you invest $1,000 in LTC Properties right now?

Before you buy stock in LTC Properties, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and LTC Properties wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

2 High-Yield Dividend Stocks Set to Soar was originally published by The Motley Fool

CryptoCurrency

2 Top Artificial Intelligence (AI) Stocks to Buy Before 2025

Spending on artificial intelligence (AI) infrastructure has been solid in 2024, which is evident from the terrific demand for data center chips and server solutions that has been driving impressive growth in revenue and earnings for several companies.

The good news for companies benefiting from the AI boom is that infrastructure spending in this area is set to keep growing in 2025 as well. According to Barclays, hyperscale cloud companies are on track to increase their 2024 capital expenditures by 41%, followed by an estimated increase of 15% next year. However, the investment bank added that the increase in capex next year could be much larger than 15%, thanks to higher spending on graphics processing units (GPUs) and custom AI chips being deployed in AI servers.

What’s more, market research firm Dell’Oro Group estimates spending on data center infrastructure is on track to increase at a compound annual growth rate (CAGR) of 24% through 2028.

All this explains why investors would do well to buy shares of Broadcom (NASDAQ: AVGO) and Dell Technologies (NYSE: DELL), two companies that are direct beneficiaries of the surge in AI-focused data center spending.

Let’s look at the reasons why buying these two names right now could turn out to be a profitable move for 2025 and beyond.

1. Broadcom

Broadcom makes application-specific integrated circuits (ASICs), which are custom chips designed for performing specific tasks. While GPUs are currently being deployed in huge numbers to train large language models (LLMs) thanks to their massive parallel computing power, McKinsey estimates that ASICs will be used for performing the majority of AI workloads by 2030.

That’s not surprising, as ASICs are purpose-built chips that are more energy efficient when compared to general-purpose computing chips such as GPUs. And because they are designed to perform specific tasks, ASICs carry a speed and performance advantage over general-purpose chips. This explains why JPMorgan estimates that the market for ASICs, which is currently worth $20 billion to $30 billion, could grow at an annual rate of more than 20% in the long run.

JPMorgan adds that Broadcom is the dominant player in ASICs, with an estimated market share of 55% to 60%. The company is set to generate $12 billion in revenue in the current fiscal year from sales of its custom AI accelerators and Ethernet networking chips deployed in AI servers. That would be nearly triple the $4.2 billion revenue Broadcom generated from selling AI chips last year.

The company expects to finish the ongoing fiscal year 2024 (which will end in early November) with $51.5 billion, which means that AI will account for 23% of its top line. That would be a nice improvement from last year, when AI accounted for 14% of its revenue.

Broadcom’s AI revenue is growing at a much faster pace than the market for custom AI chips, as stated by JPMorgan earlier. That’s because Broadcom’s networking chips are also witnessing healthy demand. The company’s networking revenue increased an impressive 43% year over year in the previous quarter.

Broadcom management said on the September earnings conference call that sales of its Ethernet switches jumped 4x from the year-ago period thanks to demand from hyperscale customers. Investors should note that the data center switching market is getting a nice boost because of AI, with Dell’Oro predicting that it could double in size over the next five years and generate $80 billion in annual revenue.

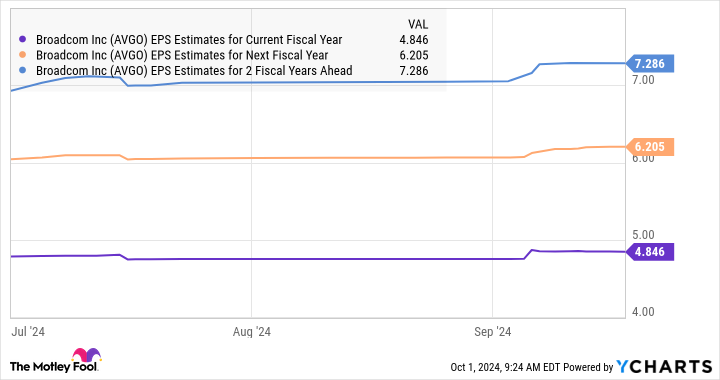

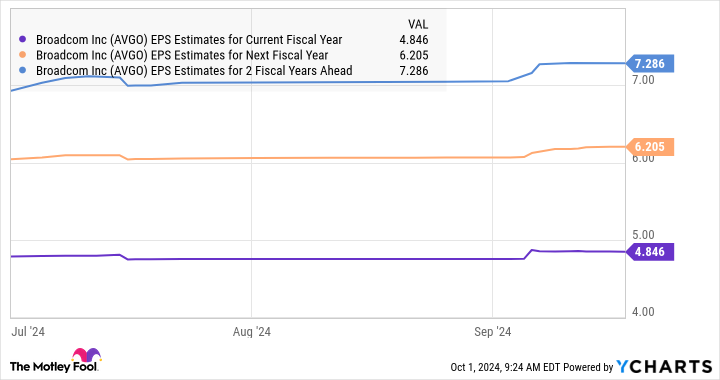

As such, Broadcom seems capable of maintaining an impressive pace of growth in the long run. Analysts are expecting the company’s bottom line to increase at an annual rate of 20% over the next five years. However, they have been increasing their expectations of late.

So, there is a chance that Broadcom’s earnings growth could outpace Wall Street’s expectations in the future, which is why it would be a good idea for investors to buy this AI stock before it jumps higher following impressive gains of 60% in 2024.

2. Dell Technologies

Dell is another company that has witnessed an improvement in its growth thanks to the increased spending on AI infrastructure. More specifically, increasing demand for AI servers has been a tailwind for Dell, driving impressive growth in the company’s infrastructure solutions group (ISG) through which it sells server and storage products.

The company’s revenue in the second quarter of fiscal 2025 (which ended on Aug. 2) increased 9% year over year to $25 billion. However, the company’s ISG business grew at a much faster pace of 38% and delivered a record revenue of $11.6 billion. Within the ISG business, Dell said its servers and networking products witnessed a terrific year-over-year increase of 80% to $7.7 billion.

The company shipped $3.1 billion worth of AI servers last quarter, and received $3.2 billion worth of new orders from cloud service providers (CSPs). More importantly, Dell said its “AI server pipeline expanded across both tier 2 CSPs and Enterprise customers again in Q2 and now has grown to several multiples of our backlog.”

That’s not surprising, as the AI server market is witnessing outstanding growth. This market could clock annual revenue growth of 18% through 2032, generating an annual revenue of $183 billion at the end of the forecast period. Not surprisingly, Dell said it is in the early innings of the AI opportunity, which is why there is a solid chance that the robust growth of its ISG business will start driving the needle in a more meaningful way for the company in the future.

Dell’s fiscal 2025 revenue guidance of $97 billion would be a 10% improvement from the previous year. For comparison, the company’s revenue was down 14% in fiscal 2024. So AI has already started driving an improvement in Dell’s fortunes, and that trend is expected to continue in the future thanks to the additional AI-related opportunity in the form of the personal computer (PC) market.

All this explains why Dell’s earnings are expected to increase at an annual rate of almost 11% over the next five years. That would be a big improvement over the 1.5% annual earnings erosion the company has witnessed in the past five years.

Finally, Dell’s forward earnings multiple of just 15 makes buying the stock a no-brainer right now, as it represents a discount to the Nasdaq-100 index’s forward earnings multiple of 29 (using the index as a proxy for tech stocks). Dell stock has recorded impressive gains of 55% in 2024, and it has the potential to fly higher thanks to the AI-driven turnaround in its business.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool recommends Barclays Plc and Broadcom. The Motley Fool has a disclosure policy.

2 Top Artificial Intelligence (AI) Stocks to Buy Before 2025 was originally published by The Motley Fool

CryptoCurrency

2 Down-on-Their-Luck Dividend Stocks Poised to Rebound

Income investors looking for solid dividends of companies poised to rebound shouldn’t overlook the following two stocks. Both stocks are dealing with headwinds and slowing growth, but offer solid and steady dividends while you wait for headwinds to subside. Here’s a closer look at Genuine Parts (NYSE: GPC) and J.M. Smucker (NYSE: SJM).

Unflattering guidance

Established nearly 100 years ago, Genuine Parts is a leading global service company that specializes in the distribution of automotive and industrial replacement parts with a vast network of over 10,700 locations across 17 countries.

If you’re looking for an income stock that’s currently out of favor with the market, look no further than Genuine Parts. Over the past six months, the stock and the S&P 500 have moved in opposite directions, with the former posting a 9% decline and the latter a 9% gain.

Part of its lagging stock price has to do with recent financial guidance updates, which weren’t flattering. Full-year total sales growth went from a range of 3% to 5% down to a range of 1% to 3%. Adjusted earnings per share (EPS) dropped from a range of $9.80 to $9.95 down to a range of $9.30 to $9.50.

But with Genuine Parts, investors get an incredibly stable business, despite its current slowdown. In fact, between 2013 and 2023 the 10-year compound annual growth rate (CAGR) for revenue was a healthy 7%, and the 10-year CAGR of adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) was an impressive 8%.

The good news for investors is that while the prices for new cars remain high, it pushes demand for replacement parts higher as more consumers repair instead of purchase new. Also impressive is the company’s track record of dividends, with 2024 representing the company’s 68th consecutive year of dividend increases. It boasts a current dividend yield of 2.8%, which is a yield worth taking notice of while waiting for headwinds to subside for the company.

Innovation on deck

J.M. Smucker is a leading retailer of food for both people and pets, and it offers well-known brands such as Folgers, Dunkin’, Café Bustelo, Jif, Smucker’s, Hostess, and Meow Mix, among many others. The company also boasts 95% of U.S. retail channel sales from categories it holds the No. 1 or No. 2 brand position and its products are found in over 90% of U.S. homes.

J.M. Smucker finds itself in a similar position as Genuine Parts: Slower-than-desired growth paired with reduced guidance led to the company’s stock trailing the S&P 500 over the past six months. You might not notice the growth struggle if only glancing at the fiscal 2025 first-quarter results. That’s because net sales increased by $319.9 million, or 18%. However, when you back out the company’s recent acquisition of Hostess Brands and currency exchange, net sales increased a much more modest 1%.

J.M. Smucker also updated its full-year guidance, lowering net sales growth down to a range of 8.5% to 9.5%, from it previous guidance of 9.5% to 10.5%. It also expects lower adjusted earnings per share and free cash flow. The company is hoping its push for innovation will help reverse its slow growth. J.M. Smucker is working to increase market share of Café Bustelo across the U.S. market, introducing new Jif To Go nut spreads, new marketing and merchandising for Crustables, and the first Hostess product that can be microwaved, with its Meltamors.

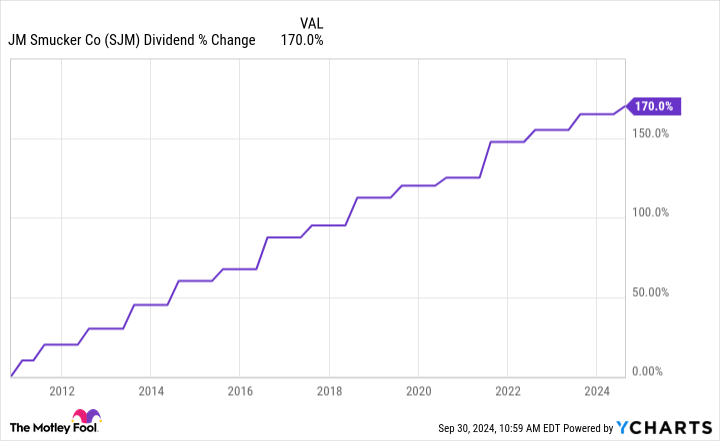

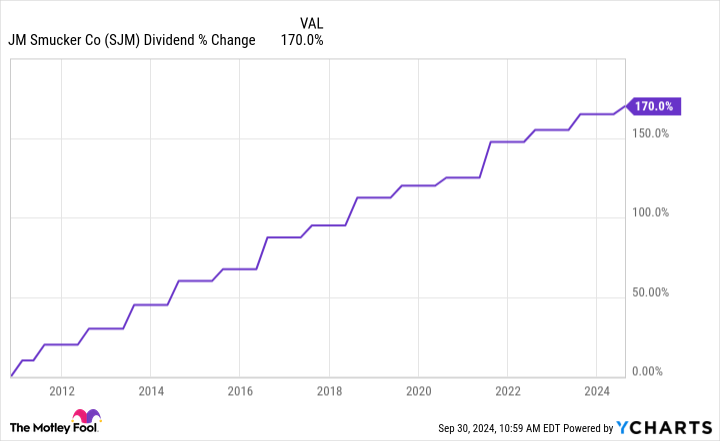

Ultimately, you can see the consistent growth in JM Smuckers’ dividend over time, and it offers a current dividend yield of 3.5% while investors wait for innovation and acquisition synergies to improve the company’s financials.

Buy now

Both of these companies are dealing with retail headwinds that are hindering growth, and that’s why savvy long-term shareholders should largely ignore the cyclicality of the retail industry. Both of these companies have a pathway to growing sales through innovation, and both should get on track over the next year. In the meantime you have two companies with proven track records of delivering value to shareholders through stable dividends.

Should you invest $1,000 in J.M. Smucker right now?

Before you buy stock in J.M. Smucker, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and J.M. Smucker wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends J.M. Smucker. The Motley Fool has a disclosure policy.

2 Down-on-Their-Luck Dividend Stocks Poised to Rebound was originally published by The Motley Fool

CryptoCurrency

Suze Orman On The Risks Of Upgrading To A Swanky Apartment At 40

When you hit 40, the temptation to upgrade your lifestyle can be strong, especially if you’ve worked hard and saved well. However, according to personal finance expert Suze Orman, a swankier apartment in a prime city could be more of a financial burden than a reward – especially if your job situation is unstable.

Don’t Miss:

In a recent episode of her Women & Money podcast, a listener posed a question many can relate to: She’s 40, presumably owns her home outright, and has saved a significant portion of her net worth in cash. With relatively low expenses and the safety net of living with her parents if necessary, she’s considering upgrading to a nicer apartment in the city, using her cash reserves or taking out a small loan. The problem? Her job is unstable, and she knows she might have to retire early.

Orman’s response? A firm “no.”

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

At first glance, upgrading to a nicer place may seem easy, but Orman warns that it could lead to more financial stress in the long run. She explains that moving to a swankier apartment means more than a bigger space. “More expenses, more taxes, more everything,” she says. If your job is shaky, you should focus on accumulating cash, not depleting it.

Her co-host KT quickly jumped in, agreeing with Orman’s assessment. “Why would you do that? I would never do that if I had an unstable job and (was) 40 years old,” she said. “I’d want to accumulate as much cash as possible so then I’d feel free.”

See Also: The average American couple has saved this much money for retirement — How do you compare?

For Orman, the decision is simple: at 40, you should still be focused on building wealth. “These are your compounding years,” she reminds listeners. She suggests investing in your future rather than spending money on a luxury apartment. The more you can save and invest now, the better off you’ll be when it comes time to retire.

Orman also stated that the listener’s logic is flawed regarding interest rates and cash reserves. The listener mentioned that by liquidating her assets and putting them in a bank with 3% interest, she could generate enough income to cover twice her parents’ monthly expenses. However, Orman warns that assuming a steady 3% interest rate is risky.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

“How do you know what interest rates are going to be?” she asks. Orman states that if this listener had made a similar decision in 2007 before the financial crisis, she could have faced significant losses.

So, what’s the solution for someone longing for a more vibrant, city-centered lifestyle? Orman suggests enjoying the best of both worlds without making a financial commitment that could backfire.

“If you want a swankier lifestyle, go there for the weekend and come back,” she advises. Renting a place for short visits allows you to experience the excitement of the city without the long-term financial strain of owning an expensive downtown apartment.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” Here’s how you can earn passive income with just $100.

Orman’s advice is this: prioritize financial security, especially when you’re in an uncertain job situation. “At 40, if you lose your job, you get another job,” she says. But until you’re in a more stable position, stick with the home you own outright, keep saving and investing, and leave the luxury upgrades for another time.

Are you in a similar position and considering upgrading your home to enjoy a better lifestyle? Then you may consider talking with a financial advisor. They can help you navigate your finances and determine the best route that aligns with your long-term financial goals.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article ‘More Expenses, More Taxes, More Everything’: Suze Orman On The Risks Of Upgrading To A Swanky Apartment At 40 originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 weeks ago

Technology3 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 weeks ago

Science & Environment2 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

News2 weeks ago

News2 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum forces used to automatically assemble tiny device

-

News3 weeks ago

the pick of new debut fiction

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy this is a golden age for life to thrive across the universe

-

News3 weeks ago

News3 weeks agoYou’re a Hypocrite, And So Am I

-

Sport2 weeks ago

Sport2 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology1 week ago

Technology1 week ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Football1 week ago

Football1 week agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoRethinking space and time could let us do away with dark matter

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNerve fibres in the brain could generate quantum entanglement

-

MMA1 week ago

MMA1 week agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Business1 week ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

News3 weeks ago

News3 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Business1 week ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

News2 weeks ago

News2 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

News3 weeks ago

News3 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News3 weeks ago

News3 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCardano founder to meet Argentina president Javier Milei

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMeet the world's first female male model | 7.30

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA slight curve helps rocks make the biggest splash

-

Business3 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoBest Exercises if You Want to Build a Great Physique

-

News2 weeks ago

News2 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

News2 weeks ago

News2 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Technology2 weeks ago

Technology2 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoEverything a Beginner Needs to Know About Squatting

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Toning Workout for Women

-

Travel2 weeks ago

Travel2 weeks agoDelta signs codeshare agreement with SAS

-

Technology2 weeks ago

Technology2 weeks agoGet ready for Meta Connect

-

Servers computers2 weeks ago

Servers computers2 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Politics2 weeks ago

Politics2 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology1 week ago

Technology1 week agoThe best robot vacuum cleaners of 2024

-

Health & fitness1 week ago

Health & fitness1 week agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Sport2 weeks ago

Sport2 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Technology2 weeks ago

Technology2 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBlockdaemon mulls 2026 IPO: Report

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Politics2 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News1 week ago

News1 week agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology1 week ago

Technology1 week agoQuantum computers may work better when they ignore causality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow one theory ties together everything we know about the universe

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business2 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Business2 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Politics2 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

News2 weeks ago

The Project Censored Newsletter – May 2024

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoKeep Your Goals on Track This Season

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoWhich Squat Load Position is Right For You?

-

TV2 weeks ago

TV2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News2 weeks ago

News2 weeks agoChurch same-sex split affecting bishop appointments

-

Politics3 weeks ago

Politics3 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology2 weeks ago

Technology2 weeks agoFivetran targets data security by adding Hybrid Deployment

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSingle atoms captured morphing into quantum waves in startling image

-

Politics2 weeks ago

Politics2 weeks agoLabour MP urges UK government to nationalise Grangemouth refinery

You must be logged in to post a comment Login