CryptoCurrency

Could These Stocks Be in Trouble If Trump Wins in November?

Everyone knows that elections always have winners and losers. However, the list isn’t limited only to political candidates and their supporters. Stocks can be affected by election results, too.

UBS recently evaluated the potential impact of former President Donald Trump’s proposed tariffs. The investment bank says it expects that U.S. stocks will fall “by around 10%” if Trump is elected and implements his steep across-the-board tariffs.

But some industries could be hit harder than others. Could these three stocks be in trouble if Trump wins in November?

Retail was the first sector identified by UBS as potentially experiencing the biggest effect from Trump’s proposed tariffs. Many retailers import a high percentage of the products they sell, and tariffs are basically a sales tax on these products.

Retailers have two options, neither of which is good. They can absorb the higher costs. Or they can pass the higher costs along to their customers, which could cause the customers to reduce their spending.

Target (NYSE: TGT) could especially feel the sting of Trump’s tariffs. The company ranks as one of the largest U.S. retailers. A large portion of the products it sells are imported, and China is its biggest source of merchandise. That’s problematic because Trump has singled out the country for high tariffs of at least 60%.

What might Target do if Trump wins and implements his tariffs? The company stated in its latest 10-K regulatory filing that additional tariffs could cause it to raise prices and/or look for alternative vendors. It added, “Any of these actions could adversely affect our reputation and results of operations.”

Perhaps the greatest concern for Target in a higher-tariff environment is that its customers could decide to shop elsewhere. Some of its competitors, notably including Walmart, already often offer lower prices than Target.

Auto manufacturing was the second industry singled out by UBS as being especially jeopardized by Trump’s proposed tariffs. Carmakers with operations in Mexico could be hurt more than others because the former president has threatened to impose a 2,000% tariff on vehicles made in the country.

General Motors (NYSE: GM) is one of the Big Three U.S. automakers. Roughly 12% of the company’s long-lived assets (notably including plants and equipment) are in Mexico, the only country that represents more than 10% other than the U.S. The percentage of those long-lived assets in Mexico has increased in recent years.

Could GM shift production to the U.S. to minimize the harm of the tariffs? Yes, but that’s easier said than done. The company would have to spend a lot of money to build new factories in the U.S. This process would also take time.

CryptoCurrency

Bitcoin hits $73.6K as fundamentals suggest new all-time highs are programmed

Bitcoin price rallies within $200 of a new all-time high as several fundamentals point to the crypto bull marking picking up pace.

CryptoCurrency

President Biden thanks Nigerian President for Binance exec’s release

A former IRS special agent and Binance’s head of financial crime compliance, Tigran Gambaryan had been in Nigerian custody with reports of deteriorating health since February.

CryptoCurrency

Travelex undertakes major UAE expansion

UK based foreign exchange brand Travelex has announced that the company has undertaken a major expansion in the UAE, with the launch of 13 new stores across Abu Dhabi and Dubai airports.

At Zayed International Airport, Travelex is doubling its store footprint from seven to 14 stores, including six new on-the-move kiosk (OTM) locations at arrivals baggage, airside departures and pre-immigration, and one new traditional landside store. The new landside store will offer both a cash management service that will enable the airport’s businesses to process cash, as well as traditional consumer cash services, including access to 62 currencies.

Travelex initially entered Zayed International Airport in late 2023 with seven stores and eight ATMs. The new stores reflect the growing passenger demand and customer requirements of the UAE’s newest airport. As a dominant force in the capital’s aviation sector, Zayed International Airport rapidly affirmed itself as a key hub for air travel, solidifying its position as a vital player in the global travel landscape.

At Dubai International (DXB), Travelex is in the process of launching six new stores across all three terminals, including new traditional stores and stores upgraded from OTMS. Two ATMS dispensing AED were also installed at Terminal 3 Arrivals earlier this year. DXB has also seen a considerable post-pandemic growth in pax numbers, reinforcing its status as a leading hub for international travel.

The 13 new stores across Abu Dhabi and Dubai means Travelex will be operating 60 locations across the country. The latest IATA figures show that Middle Eastern airlines saw a 9.6% year-on-year increase in demand for June 2024, while capacity increased 9.4% year-on-year.

Batu Dölay, Managing Director, Travelex Middle East and Türkiye said:

Batu Dölay, Managing Director, Travelex Middle East and Türkiye said:

“We’re delighted to be expanding our presence at two of the most exciting and dynamic airports in the world. This investment reflects the growing global reach and passenger numbers of our UAE airport partners, and our commitment to providing even greater access to international travel money than ever before.”

About Travelex

Founded in 1976 Travelex has grown to become one of the market leading specialist providers of foreign exchange products, solutions, and services, operating across the entire value chain of the foreign exchange industry in more than 20 countries. We have developed a growing network of ATMs and stores in some of the world’s top international airports, major transport hubs, premium shopping malls and city centres.

Travelex has built a growing online and mobile foreign exchange platform, and we also process and deliver foreign currency orders for major banks, travel agencies, supermarkets and hotels worldwide. In addition, we source and distribute sizeable quantities of foreign currency banknotes for customers on a wholesale basis – including central banks and international financial institutions. We also offer a range of remittance and international money transfer products around the world.

CryptoCurrency

Solana price hits 3-month high as data hints at SOL rally above $200

Solana price hits $180 as Bitcoin storms toward a new all-time high. Data suggests SOL can go higher.

CryptoCurrency

Bitcoin miners cut costs, embrace AI post-halving: CoinShares

Miners including Cormint and TeraWulf are among the lowest-cost producers of Bitcoin, an important advantage amid tightening margins, CoinShares said.

CryptoCurrency

Ripple co-founder: Harris will have ‘completely different approach’ to crypto

Having contributed roughly $12 million to PACs supporting Kamala Harris, Chris Larsen said he hoped to see “bipartisan support and weight” for crypto in government starting in 2025.

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Technology1 month ago

Technology1 month agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment1 month ago

Science & Environment1 month agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Technology4 weeks ago

Technology4 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Technology4 weeks ago

Technology4 weeks agoGmail gets redesigned summary cards with more data & features

-

Sport4 weeks ago

Sport4 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Football4 weeks ago

Football4 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

TV4 weeks ago

TV4 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Technology4 weeks ago

Technology4 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Technology1 month ago

Technology1 month agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

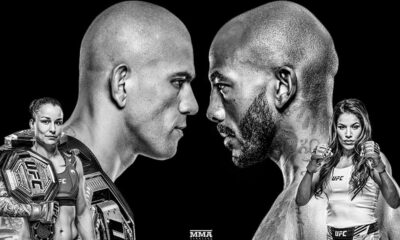

MMA4 weeks ago

MMA4 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

News4 weeks ago

News4 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Sport4 weeks ago

Sport4 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

News4 weeks ago

News4 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

MMA3 weeks ago

MMA3 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Technology4 weeks ago

Technology4 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Football4 weeks ago

Football4 weeks agoWhy does Prince William support Aston Villa?

-

MMA4 weeks ago

MMA4 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Technology1 month ago

Technology1 month agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

News4 weeks ago

News4 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Business4 weeks ago

Business4 weeks agoWhen to tip and when not to tip

-

Technology1 month ago

Technology1 month agoMicrophone made of atom-thick graphene could be used in smartphones

-

News4 weeks ago

News4 weeks agoRwanda restricts funeral sizes following outbreak

-

Technology4 weeks ago

Technology4 weeks agoMusk faces SEC questions over X takeover

-

Sport4 weeks ago

Sport4 weeks agoWales fall to second loss of WXV against Italy

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

Business4 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

News4 weeks ago

News4 weeks agoCornell is about to deport a student over Palestine activism

-

Technology4 weeks ago

Technology4 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Sport4 weeks ago

Sport4 weeks ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Technology4 weeks ago

Technology4 weeks agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

Money4 weeks ago

Money4 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Sport4 weeks ago

Sport4 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

Sport4 weeks ago

Sport4 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

MMA4 weeks ago

MMA4 weeks agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

MMA3 weeks ago

MMA3 weeks ago‘I was fighting on automatic pilot’ at UFC 306

-

Technology4 weeks ago

Technology4 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

News4 weeks ago

News4 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Sport4 weeks ago

Sport4 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

News4 weeks ago

News4 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

MMA3 weeks ago

MMA3 weeks ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

Business1 month ago

Business1 month agoStocks Tumble in Japan After Party’s Election of New Prime Minister

-

Business4 weeks ago

how UniCredit built its Commerzbank stake

-

Business4 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Business4 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

News4 weeks ago

News4 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Business4 weeks ago

The search for Japan’s ‘lost’ art

-

Sport4 weeks ago

Sport4 weeks agoPremiership Women’s Rugby: Exeter Chiefs boss unhappy with WXV clash

-

Technology3 weeks ago

Technology3 weeks agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

Sport4 weeks ago

Sport4 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Entertainment4 weeks ago

Entertainment4 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

Technology4 weeks ago

Technology4 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Football4 weeks ago

Football4 weeks ago'Rangers outclassed and outplayed as Hearts stop rot'

-

Technology4 weeks ago

Technology4 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

Technology4 weeks ago

Technology4 weeks agoThe best budget robot vacuums for 2024

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Business4 weeks ago

Business4 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

MMA4 weeks ago

MMA4 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Business4 weeks ago

Business4 weeks agoWater companies ‘failing to address customers’ concerns’

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Sport3 weeks ago

Sport3 weeks agoWXV1: Canada 21-8 Ireland – Hosts make it two wins from two

-

Technology4 weeks ago

Technology4 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

Business4 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Business4 weeks ago

Business4 weeks agoStark difference in UK and Ireland’s budgets

-

Money4 weeks ago

Money4 weeks agoPub selling Britain’s ‘CHEAPEST’ pints for just £2.60 – but you’ll have to follow super-strict rules to get in

-

Technology4 weeks ago

Technology4 weeks agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

-

Sport4 weeks ago

Sport4 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Politics4 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

MMA4 weeks ago

MMA4 weeks agoPereira vs. Rountree preview show live stream

-

Football4 weeks ago

Football4 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

Business4 weeks ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

Technology4 weeks ago

Technology4 weeks agoSingleStore’s BryteFlow acquisition targets data integration

-

Technology4 weeks ago

Technology4 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

News4 weeks ago

News4 weeks agoSpongerla Rayner’s gift gluttony is worse than Free Gear Keir’s – her freeloading has destroyed working class reputation

-

MMA4 weeks ago

MMA4 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Business4 weeks ago

Champagne days for F1

You must be logged in to post a comment Login