CryptoCurrency

Dividend Investor ‘Feeling Doubly Awesome’ By Earning $11,800 Per Year And Beating S&P 500 Shares Portfolio: Top 11 Stocks

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

The idea that you can’t beat the broader market and see your capital grow by sticking to dividend stocks is becoming outdated. With major tech companies like Meta Platforms, Salesforce and Alphabet, among many others, joining the growing ranks of dividend-paying growth stocks, the opportunities for investors looking for both dividend income and stock price appreciation are expanding.

About a year ago, a dividend investor on Reddit shared his success story, saying he was making over $10,000 in passive income and beating the S&P 500 by investing in dividend stocks. He shared screenshots of his investing portfolio, showing his annual income at about $11,800 a year or $991 per month.

When asked how much he had invested, the Redditor said his total value was $200,000. Since the investor had highlighted in his post that he was feeling “doubly awesome” by making significant dividend income and beating the market, someone asked him whether he had beaten the market for just one year.

Don’t Miss:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Your biggest returns may not come from the stock market. Invest the way colleges, pension funds, and the 1% do. Get started investing in commercial real estate today.

“3 years in a row,” the investor responded.

Let’s examine some of this portfolio’s biggest holdings to see which stocks helped the investor earn significant dividend income and beat the market.

Arbor Realty Trust

Arbor Realty Trust Inc. (NYSE:ABR) is a mortgage REIT with a dividend yield of over 11%. It was the biggest position in the portfolio of the Redditor making about $11,800 a year in dividends. Analysts believe the future is bright for REITs like ABR amid declining interest rates and hopes of a soft landing. Wells Fargo said in a recent note that “less restrictive” policy from the Fed can lay the groundwork for commercial real estate recovery.

Altria

With an over 8% dividend yield and more than 50 years of consecutive dividend hikes, Altria Group Inc. (NYSE:MO) is perhaps one of Reddit’s most popular dividend stocks despite concerns about the declining use of traditional tobacco products. Analysts believe Altria is making a timely shift toward smoke-free products like vapes and nicotine pouches. MO was the second-biggest holding of the Redditor earning $11,800 a year in dividends.

Petroleo Brasileiro

Petroleo Brasileiro ADR (NYSE:PBR) is a state-owned Brazilian energy company. Once famous for its eye-popping dividends, PBR’s dividend yield stands at about 13% amid a decline in payouts after a difference of opinion about cash allocation in management. The Redditor, who posted his income report in October 2023, said Petroleo Brasileiro ADR (NYSE:PBR) was his third-biggest holding.

United Parcel Service

The Redditor making $11,800 a year in dividend income had United Parcel Service Inc. (NYSE:UPS) among his biggest holdings. The stock has a dividend yield of about 5% and 15 years of consecutive payout increases. UPS shares are down 15% over the past year. In July, the company reported second-quarter results that missed Wall Street estimates on both EPS and revenue. However, the company restarting its $1 billion stock buyback program gave investors something to cheer about.

Texas Instruments

Texas Instruments Inc. (NASDAQ:TXN) has a dividend yield of about 2.6% and the stock has gained 28% over the past year. Citi recently published a bullish note on the semiconductor industry following better-than-expected August data driven by dynamic random access memory. The firm has a Buy rating on TXN.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

PepsiCo

PepsiCo Inc. (NASDAQ:PEP) has a dividend yield of about 3.2% and over 50 consecutive years of dividend increases. Like Coca-Cola, it’s considered a defensive stock that investors like for all market cycles. The portfolio screenshots shared by the Redditor making $11,800 annually showed Pepsi among the top holdings.

Apple

When asked which stocks helped him beat the S&P 500, the Redditor named Apple Inc. (NASDAQ:AAPL) among the top companies. Apple shares are up 28% over the past year and the company has raised its dividends for more than a decade in a row.

Broadcom

Broadcom Inc. (NASDAQ:AVGO) was one of the stocks that helped the Redditor beat the S&P 500. The stock is up more than 110% over the past year, thanks to the rising demand for the company’s custom AI chips. The stock has a dividend yield of about 1.1%.

Cisco Systems

Cisco Systems Inc. (NASDAQ:CSCO) yields over 3% and has increased its payouts yearly since 2011. Cisco’s CFO Scott Herren recently said in a conference that the company expects about $1 billion in AI product orders in fiscal 2025, with 30% growth in hyperscalers recorded by the company during the second half 2024 alone.

Home Depot

Home Depot Inc. (NYSE:HD) shares have gained 37% in the past year and the stock yields 2.2%. Home Depot Inc. was among the top holdings of the Redditor making $11,800 a year in dividends. The home improvement retailer has raised its dividends for 15 straight years.

Microsoft

When asked about stocks that helped him beat the market, the Redditor said Microsoft Corp. (NASDAQ:MSFT) was one of the companies that pulled his overall portfolio performance higher than the S&P 500. Microsoft shares are up 26% over the past year and the company announced a 10% bump in dividends last month.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article Dividend Investor ‘Feeling Doubly Awesome’ By Earning $11,800 Per Year And Beating S&P 500 Shares Portfolio: Top 11 Stocks originally appeared on Benzinga.com

CryptoCurrency

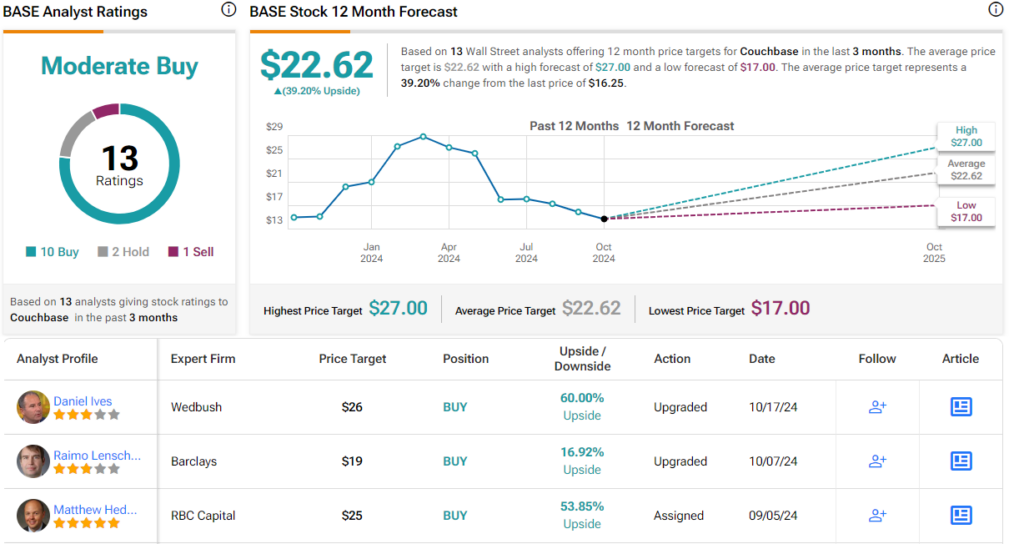

Time to Hit Buy on These 2 Software Stocks, Says Daniel Ives

It’s no secret that tech stocks have been powering the market gains over the past few years, and software stocks were among the biggest drivers of this growth.

Multiple factors are propelling the software industry forward, such as the rapid advancement of AI technology, high demand for IT solutions, and the ongoing expansion of the global digital economy.

Wedbush tech expert Daniel Ives has been watching the tech industry, and his take on it points to continued strength supported by AI and cloud expansion.

“Solid enterprise spending, digital advertising rebound, and the AI Revolution will drive tech stocks higher into year-end in our view,” Ives opined. “We believe 70% of global workloads will be on the cloud by the end of 2025, up from less than 50% today.”

Keeping that in mind, Ives goes on to add that the time has come to hit buy on two software stocks. They may not be household names, but according to the TipRanks data, both stocks are Buy-rated – and Ives sees significantly more upside to each than the consensus on the Street. Let’s take a closer look.

Couchbase (BASE)

We’ll start with Couchbase, a modern database platform provider that offers users and developers everything they need to support a wide range of applications – from cloud, to edge, to AI. Couchbase bills itself as a one-stop-shop for data developers and architects, making its services available through its powerful database-as-a-service platform, Capella. Organizations using the service can quickly create applications and services that deliver premium customer experiences, giving top-end performance at affordable prices.

The Capella platform brings the popular as-a-service subscription model to the database industry. The company can support database services for a wide range of AI applications, including the latest gen-AI tech, as well as database search, mobile access, and analytic functions. Customers can also choose self-managed services through Couchbase’s servers, with on-premises management for both multicloud and community apps.

Couchbase’s database service has found success in a wide range of fields, including the gaming, healthcare, entertainment, retail, travel, and utility sectors. The company’s customer base includes such major names as Verizon, UPS, Walmart, Cisco, Comcast, GE, and PayPal.

Turning to the financial results, we see that Couchbase reported its fiscal 2Q25 figures at the start of last month. The top line of $51.6 million was up almost 20% year-over-year and came in just over the forecast, beating expectations by nearly a half-million dollars. At the bottom line, the company ran a net loss of 6 cents per share in non-GAAP measures, but that was 3 cents per share better than had been anticipated.

CryptoCurrency

Ripple files Form C, appeals SEC ruling on XRP institutional sales

Ripple challenges SEC’s ruling on institutional XRP sales, claiming the Howey test was misapplied.

CryptoCurrency

Bitcoin analyst: $100K BTC price by February 'completely within reason'

BTC price trajectory appears all but destined for six figures in the mid term — despite nearly eight months of Bitcoin market consolidation.

CryptoCurrency

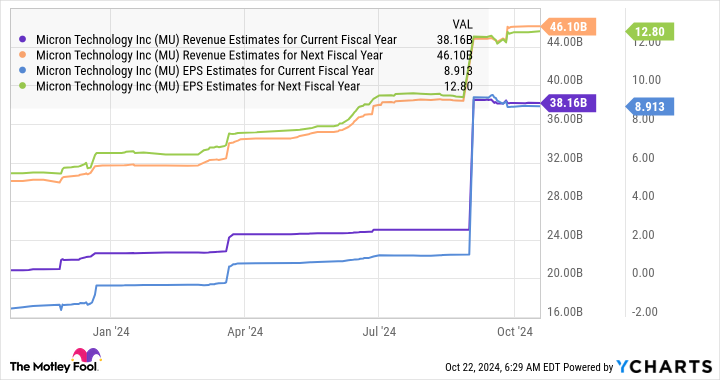

1 Top Stock to Buy Hand Over Fist Before That Happens

2024 is turning out to be a solid year for the global semiconductor industry, driven by multiple catalysts. These include the booming demand for chips that can manage artificial intelligence (AI) workloads, a turnaround in the smartphone market’s fortunes, and a recovery in the personal computer (PC) market.

These factors explain why the global semiconductor industry’s revenue is expected to jump 16% in 2024 to $611.2 billion, according to World Semiconductor Trade Statistics (WSTS). That points toward a nice turnaround from last year, when the semiconductor industry’s revenue fell 8%. Even better, the semiconductor space is expected to keep growing in 2025 as well, with WSTS projecting a 12.5% increase in the industry’s earnings to $687.4 billion next year.

More specifically, WSTS predicts a whopping 25% increase in the memory market’s revenue in 2025 to $204.3 billion. As it turns out, memory is expected to be the fastest-growing semiconductor segment next year as well, following an estimated jump of almost 77% in this segment’s revenue in 2024.

There’s one company that could help investors tap this fast-growing niche of the semiconductor market next year: Micron Technology (NASDAQ: MU). Let’s look at the reasons why buying this semiconductor stock could turn out to be a smart move right now.

WSTS isn’t the only forecaster expecting the memory market to surge higher next year. Market research firm TrendForce estimates that the sales of dynamic random access memory (DRAM) could jump 51% in 2025, while the NAND flash storage market could clock 29% growth. Both these markets are expected to reach record highs next year.

The growth in these memory markets will be driven by a combination of strong demand and improved pricing. TrendForce is forecasting a 35% year-over-year increase in DRAM prices next year, driven by the increasing demand for high-bandwidth memory (HBM) that’s used in AI processors, as well as the growth in DRAM deployed in servers. Meanwhile, the growing demand for enterprise-class solid-state drives (SSDs) and the growth in smartphone storage will be tailwinds for the NAND flash market.

These positive trends explain why Micron is set to begin its new fiscal year on a bright note. The company’s revenue in fiscal 2024 (which ended on Aug. 29) increased 61% year over year to $25.1 billion. The company posted a non-GAAP (generally accepted accounting principles) profit of $1.30 per share, compared to a loss of $4.45 per share in fiscal 2023, driven by a big jump in its operating margin on account of recovering memory prices.

CryptoCurrency

A truly decentralized system would decentralize authority — Cardano exec

Cardano Foundation chief technology officer Giorgio Zinetti told Cointelegraph that centralized authority is good for speed, but decentralized governance would give long-term sustainability.

CryptoCurrency

Intel’s former CEO tried to buy Nvidia almost 2 decades ago

Tech pioneer Intel (INTC) has seemingly missed out on the artificial intelligence boom — and part of it can reportedly be traced back to a decision not to buy the chipmaker at the center of it all almost two decades ago.

Intel’s former chief executive Paul Otellini wanted to buy Nvidia in 2005 when the chipmaker was mostly known for making computer graphics chips, which some executives thought had potential for data centers, The New York Times (NYT) reported, citing unnamed people familiar with the matter. However, Intel’s board did not approve of the $20 billion acquisition — which would’ve been the company’s most expensive yet — and Otellini dropped the effort, according to The New York Times.

Instead, the board was reportedly more interested in an in-house graphics project called Larrabee, which was led by now-chief executive Pat Gelsinger.

Almost two decades later, Nvidia (NVDA) has become the second-most valuable public company in the world and continuously exceeds Wall Street’s high expectations. Intel, on the other hand, has seen its shares fall around 53% so far this year and is now worth less than $100 billion — around 30 times less than Nvidia’s $3.4 trillion market cap.

In August, Intel shares fell 27% after it missed revenue expectations with its second-quarter earnings and announced layoffs. The company missed profit expectations partly due to its decision to “more quickly ramp” its Core Ultra artificial intelligence CPUs, or core processing units, that can handle AI applications, Gelsinger said on the company’s earnings call.

And Nvidia wasn’t the only AI darling Intel missed out on.

Over a decade after passing on Nvidia, Intel made another strategic miss by reportedly deciding not to buy a stake in OpenAI, which had not yet kicked off the current AI hype with the release of ChatGPT in November 2022.

Former Intel chief executive Bob Swan didn’t think OpenAI’s generative AI models would come to market soon enough for the investment to be worth it, Reuters reported, citing unnamed people familiar with the matter. The AI startup had been interested in Intel, sources told Reuters (TRI), so it could depend less on Nvidia and build its own infrastructure.

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Technology4 weeks ago

Technology4 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

MMA3 weeks ago

MMA3 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Technology4 weeks ago

Technology4 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Football3 weeks ago

Football3 weeks agoWhy does Prince William support Aston Villa?

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

Technology4 weeks ago

Technology4 weeks agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Technology3 weeks ago

Technology3 weeks agoGmail gets redesigned summary cards with more data & features

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology1 month ago

Technology1 month agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

Technology3 weeks ago

Technology3 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Sport3 weeks ago

Sport3 weeks ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

Business3 weeks ago

Business3 weeks agoStark difference in UK and Ireland’s budgets

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Sport4 weeks ago

Sport4 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

MMA3 weeks ago

MMA3 weeks ago‘I was fighting on automatic pilot’ at UFC 306

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Politics3 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Technology3 weeks ago

Technology3 weeks agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

TV3 weeks ago

TV3 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

News1 month ago

the pick of new debut fiction

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

News3 weeks ago

News3 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

Money3 weeks ago

Money3 weeks agoPub selling Britain’s ‘CHEAPEST’ pints for just £2.60 – but you’ll have to follow super-strict rules to get in

-

News3 weeks ago

News3 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

News3 weeks ago

News3 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

Technology3 weeks ago

Technology3 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

MMA3 weeks ago

MMA3 weeks agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Technology3 weeks ago

Technology3 weeks agoUlefone Armor Pad 4 Ultra is now available, at a discount

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

-

News3 weeks ago

News3 weeks agoSpongerla Rayner’s gift gluttony is worse than Free Gear Keir’s – her freeloading has destroyed working class reputation

You must be logged in to post a comment Login