CryptoCurrency

IPhone Maker Hon Hai Sustains Revenue Rebound With Help From AI

(Bloomberg) — Hon Hai Precision Industry Co.’s revenue growth accelerated last quarter, sustaining a bounce-back as demand for the servers that drive AI development offset weak smartphone sales.

Most Read from Bloomberg

Apple Inc.’s main manufacturing partner, also known as Foxconn, reported sales rose 20.2% to NT$1.85 trillion ($57.9 billion) for the three months ended September from a year earlier. That compares with the average analyst projection of NT$1.78 trillion compiled by Bloomberg.

The company said the third-quarter sales figure was a record for that period and exceeded its own expectations for growth, without specifying the estimate. Sales increased 19% in the June quarter, the Taiwanese company’s first revenue gain since early 2023.

Foxconn’s sales is helped by a growing business supplying servers containing Nvidia Corp.’s AI chips. In August, it said it expected revenue to grow for the rest of the year. The company’s shares are up more than 85% in 2024.

What Bloomberg Intelligence Says

Hon Hai’s sales growth could accelerate in 2024-25 as the proliferation of AI emerges as the company’s key growth engine and iPhone demand stabilizes. Its vertical integration and global footprint put it in a favorable position as AI server complexity increases and demand for local production rises. More upside could be unlocked in the next few quarters as the supply of Nvidia’s GPUs improves and new models such as Blackwell GB200 are launched. Smart consumer electronics and computing products, which together accounted for 64% of total sales in 1H, could stabilize as smartphone and PC demand bottom out. Its EV contract manufacturing business might be lackluster amid a slowdown in global EV demand, and the contribution to sales could remain marginal.

— Steven Tseng and Sean Chen, analysts

Click here for the research.

Hon Hai and other hardware suppliers are riding a wave of spending on servers and data centers from big tech firms including Meta Platforms Inc. and Alphabet’s Google. But questions are bubbling up about how long the spending will last without a home run AI application that can bring the tech firms a return on the massive infrastructure investment.

As the world’s biggest assembler of the iPhone, the Taiwanese company’s business still remains closely tied with Apple’s. In the second quarter, about 40% of Foxconn’s revenue was still from the Smart Consumer Electronics category including the iPhone, while Cloud and Networking Products including AI servers, contributed to about 32%.

Investors had anticipated a rebound in smartphone demand in 2024, though some analysts warn initial signs suggest the latest iPhone hasn’t spurred as much demand as expected.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

CryptoCurrency

Think Nvidia Stock Is Expensive? These 3 Members of the S&P 500 Trade at Even Higher Valuations.

Is Nvidia (NASDAQ: NVDA) stock overvalued? This question, while simple on the surface, is extraordinarily hard to answer.

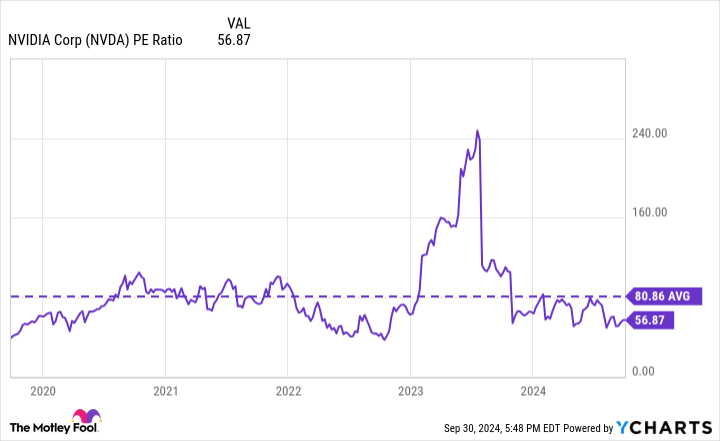

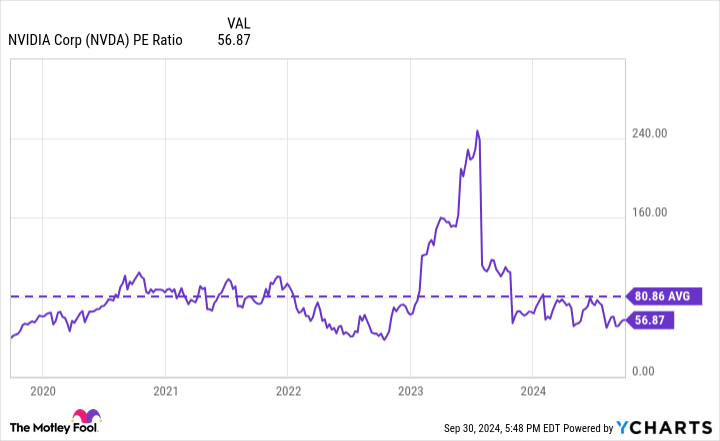

Many investors use a valuation metric called a price-to-earnings (P/E) ratio. This popular metric is useful because it measures the stock price against a company’s profits. And in Nvidia’s case, its P/E ratio of 57 certainly looks expensive, considering it’s roughly double the P/E ratio for the S&P 500.

Then again, context is important. Nvidia stock might look expensive now. But it actually trades at a steep discount to its average P/E ratio valuation over the last five years, as the chart below shows.

Many say to avoid stocks with a high P/E ratio. But Nvidia’s high P/E over the last five years didn’t prevent the stock from rising over 2,700%.

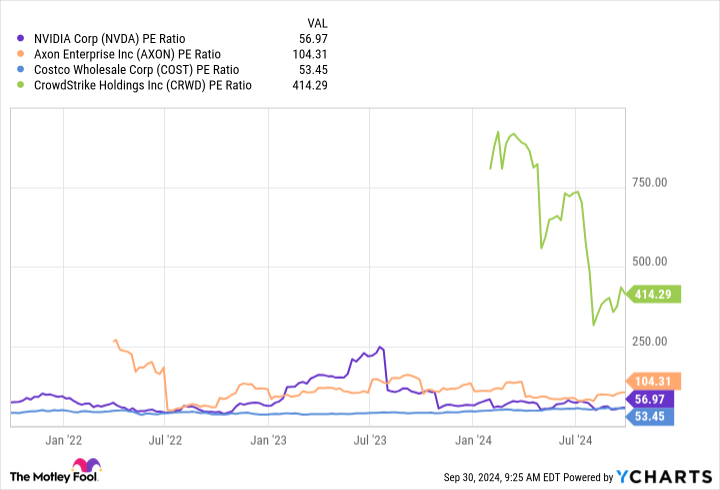

Nvidia stock is now cheaper than its five-year average valuation. Moreover, it’s not even the most expensive constituent of the S&P 500. In fact, Axon Enterprise (NASDAQ: AXON) and CrowdStrike (NASDAQ: CRWD) trade at higher P/E ratios, as of this writing. And even Costco Wholesale (NASDAQ: COST) has been more expensive than Nvidia at times in recent weeks.

Axon provides hardware and software to law enforcement agencies. CrowdStrike is a cybersecurity specialist. And Costco is a grocery and home-goods retail chain known for its membership-business model and low prices. As the chart below shows, none of these companies are necessarily cheap when looking at the P/E ratio.

Should investors sell stocks when their valuations are high? Should they only buy stocks that trade with below-average valuations?

If the path to long-term wealth were this simple, all investors would be rich. The entire investing process could be automated to sell when a P/E ratio was high and buy when a P/E ratio was low. But it’s not that simple. As I said at the start, it’s extraordinarily hard to say when a stock is actually overvalued.

Famous investor Bill Miller succinctly explains why valuing a stock is difficult. Miller has said, “100% of the information you have about a company represents the past, and 100% of the value depends on the future.”

Imagine for a moment a company valued at $10 billion and that has only made $1 million in profit. That stock would look extremely overvalued using the information we have from the past. But Miller reminds us that value has to do with the future. If this same $10 billion company earns $100 billion in profit over the next five years or so, then the stock is a screaming value stock.

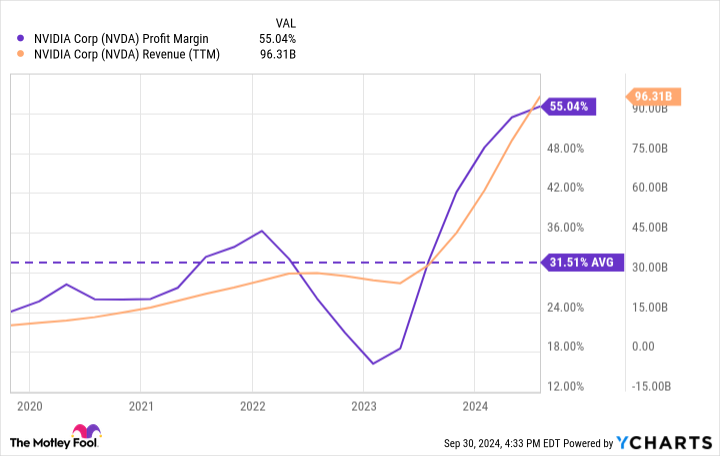

In my opinion, whether Nvidia is overvalued or undervalued today largely depends on how sustainable its profit margins are. As the chart below shows, its margin has soared as artificial intelligence has fueled demand for its hardware products.

I believe it’s reasonable to expect more growth from Nvidia in coming years. And if the company can defend its current profit margins, then the stock likely has more upside. But if its margins drop back down to more normalized levels, the stock might not fare as well. That’s a question that every Nvidia investor needs to answer.

But what about the other three companies that are as expensive or more expensive than Nvidia when looking at the P/E ratios? Well, here’s how I think about their valuations.

Two stocks I’m not so sure about today

Costco is a fantastic business, enjoying stability from 137 million membership card holders with a greater-than 90% renewal rate. But one thing it’s not is high growth. It only had 5% top-line growth in its fiscal 2024, which ended Sept. 1. This led to 14% growth for operating income, which is respectable. But investors shouldn’t expect these growth metrics to materially improve in its fiscal 2025.

That’s why I’m not a fan of the valuation of Costco stock today. Its valuation implies better-than-average long-term growth with the business whereas it’s more likely to be modest.

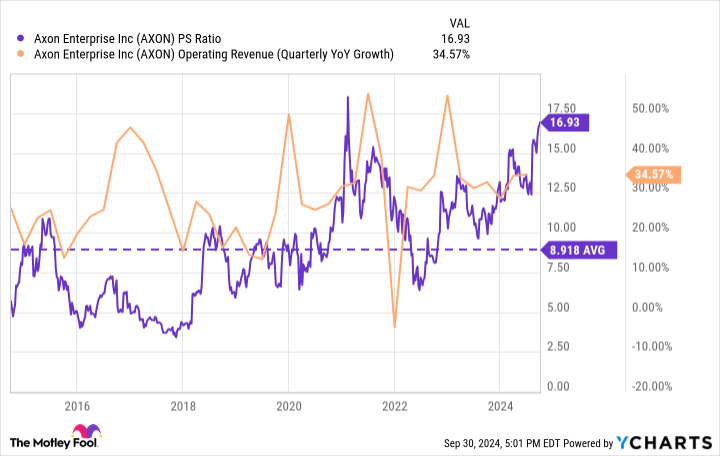

Turning to Axon, its growth is far superior to Costco, and it should stay robust for quite some time. The company has a competitive advantage because it sells its hardware in a package with its cloud-software services. Agencies are eager to renew their contracts with Axon because they don’t want to find a new solution for all their data. And there are still plenty of places that aren’t using Axon yet that could in the future.

However, I still think there’s room for caution with Axon stock today. Its growth rate has been higher at times in the past. But by contrast, its price-to-sales valuation is almost double its 10-year average.

A clear winner?

CrowdStrike stock is by no means the cheapest stock on this list when using various valuation metrics. But once again, value is about the future. And CrowdStrike’s potential is still so large because of its market. Management projects that the market for its security platform will skyrocket from $100 billion in 2024 to $225 billion in 2028.

For perspective, CrowdStrike only has $3.5 billion in trailing-12-month revenue. In other words, it doesn’t even need to grab a significant portion of this market to have significant growth. Moreover, it has an easy path to growth. Only 29% of its customers use seven or more of its software products, whereas it has more than 20 options to chose from.

Cross-selling to existing customers is an easy path for growth for CrowdStrike. And what’s stunning is that its pipeline for new deals has completely recovered from its catastrophe earlier this year when a software defect caused a massive IT outage. The speed of its rebound strongly implies that its customers love its cybersecurity platform and products.

CrowdStrike stock is quite expensive when looking at the valuation metrics that measure its past results. But when considering its path for future growth, I believe the stock could still be a good value today and perhaps the best value of the four stocks mentioned here.

Should you invest $1,000 in CrowdStrike right now?

Before you buy stock in CrowdStrike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CrowdStrike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Axon Enterprise, Costco Wholesale, CrowdStrike, and Nvidia. The Motley Fool has a disclosure policy.

Think Nvidia Stock Is Expensive? These 3 Members of the S&P 500 Trade at Even Higher Valuations. was originally published by The Motley Fool

CryptoCurrency

Here’s the Billionaire Investor You Should Be Following — and He’s Not Warren Buffett or Bill Ackman

It’s always a good idea for individual investors to look at what institutional investors, also called the smart money, are choosing. You should never base your decisions solely on others without doing research, but institutional investors have been professionally trained, and they often have decades of experience and the returns to back it up.

Following these successful investors is also a good way to find new ideas and check your thesis. Still, too often, I feel like individuals are only looking at two or three of the best investors instead of casting a wider net.

Warren Buffett and Bill Ackman certainly come to mind. I have nothing against Buffett or Ackman, who are certainly two of the best ever, but here’s the billionaire I think people should be following.

A strong record despite fundamental shifts

David Einhorn manages hedge fund Greenlight Capital, which he launched at the age of 27 after raising about $900,000 from family and friends. Einhorn rose to prominence from betting against — or short-selling — Allied Capital in 2002 when he questioned the company’s accounting practices.

Years after he announced his short position, the Securities and Exchange Commission validated Einhorn’s thesis, finding that Allied did indeed break securities laws due to its accounting practices.

Einhorn also played a key role during the Great Recession when he shorted Lehman Brothers in 2007 due to the company’s underwater securities holdings.

But like many of the greats, Einhorn also is known for his value investing approach, in which he looks for stocks trading below their intrinsic value. Earlier this year, he said that he believes the practice of value investing might be dead due to the broken market structure and the rise of passive investing:

Value is just not a consideration for most investment money that’s out there. There’s all the machine money and algorithmic money, which doesn’t have an opinion about value, it has an opinion about price: “What is the price going to be in 15 minutes, and I want to be ahead of that.”

This shift in market structure has led him to change his investing philosophy for his larger company holdings. Now, he focuses on companies that look cheap in value and return capital to shareholders through repurchases or dividends. It’s always a good sign to see even the best investors adapt, even though Einhorn is probably frustrated by this shift in market structure.

Despite changing his strategy, he has generated strong long-term returns. Greenlight has average annual returns of 13.1% since its launch in 1996, compared to 9.5% for the broader benchmark S&P 500. That equates to a total return of over 2,900% compared to the S&P 500’s 1,117%.

Einhorn’s big winner

The largest position in Greenlight’s portfolio is a homebuilding company called Green Brick Partners (NYSE: GRBK). He founded Green Brick in 2006 with experienced real estate investor and homebuilder Jim Brickman.

In 2008, amid the housing market collapse, Einhorn and Brickman started a real estate equity fund, where they initially began buying land and lending to distressed builders. By 2013, the housing market had bounced back and their fund had amassed a lot of land. Needing capital to grow, the two took the fund public, and it became Green Brick Partners. Brickman became chief executive officer and Einhorn became chairman of the board.

Greenlight Capital began purchasing Green Brick shares in the fourth quarter of 2014 at an average price of $7.20. Its first purchases amounted to roughly $112 million. While Greenlight has been in and out of the stock over the years, the position is currently valued at about $950 million.

Einhorn and Greenlight still owned more than 25% of its shares, according to Green Brick’s most recent proxy. The stock has almost doubled in the past year and is up more than 670% during the past five years.

All of those land purchases since 2006 have been a differentiator for Green Brick in the homebuilding business. At the end of the second quarter of 2024, it owned more than 28,500 lots, most of which are in the growing market of Texas. As inventory and land have become more limited and competitive to acquire, especially in strong and desirable housing markets, this strategy has paid off handsomely.

A value investor with plenty of runway

When I look at Einhorn’s current holdings, I see that he still owns plenty of value stocks, which I always find to be the most interesting to evaluate because they trade at attractive valuations and their futures depend on their ability to pay down debt, generate cash flow, and transform the trajectory of their earnings.

However, Einhorn is cognizant of changing market dynamics and is willing to adapt, an important characteristic for any investor. At just 55 years old, he has plenty of runway left in his investing career, I believe, and is a smart person with a unique viewpoint that individual investors should watch and study.

Should you invest $1,000 in Green Brick Partners right now?

Before you buy stock in Green Brick Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Green Brick Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Green Brick Partners. The Motley Fool has a disclosure policy.

Here’s the Billionaire Investor You Should Be Following — and He’s Not Warren Buffett or Bill Ackman was originally published by The Motley Fool

CryptoCurrency

Want $1 Million in Retirement? 3 Stocks to Buy Now and Hold for Decades

Do you want to retire a millionaire? Unless you’re one of the lucky few who can build a successful business or who’s born with rich relatives, your best path toward that goal is likely to involve decades of investing, which will allow the power of compound growth to build your nest egg up for you. A diversified portfolio of high-quality stocks can work wonders if you give it enough time.

And what better place to find dominant companies with decades-long growth opportunities than in healthcare? Healthcare isn’t going anywhere, and it’s already a multitrillion-dollar industry in America. With that in mind, here are three of the best healthcare stocks money can buy right now.

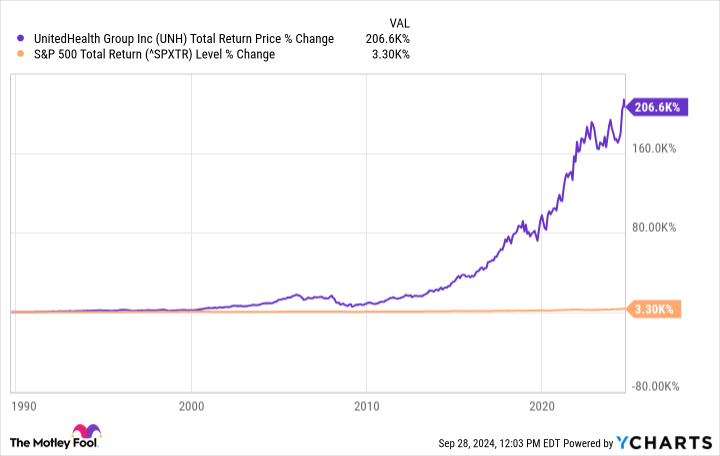

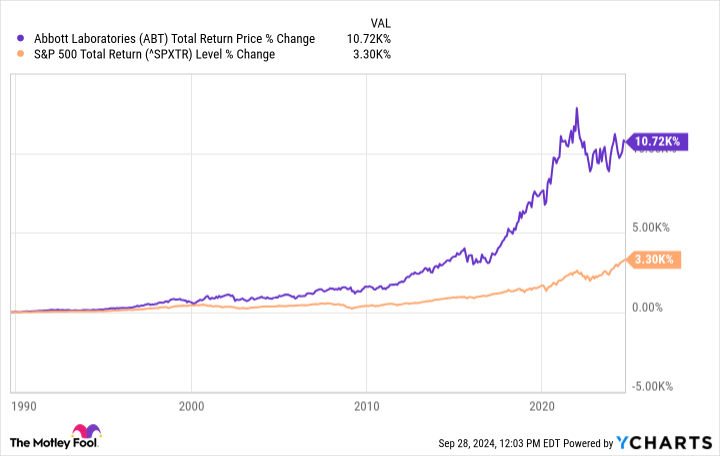

1. UnitedHealth Group

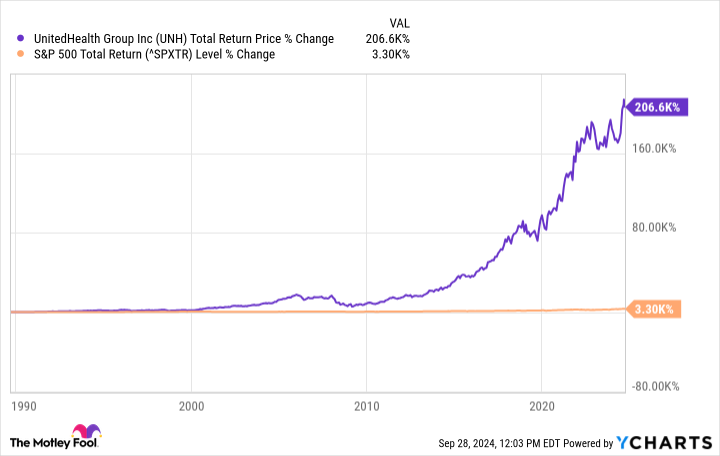

UnitedHealth Group (NYSE: UNH) is a massive conglomerate with two primary units. Its UnitedHealthcare segment provides health insurance and benefits to tens of millions in the United States, and more than 2 million in South America. Its Optum segment provides healthcare and pharmacy services to more than 100 million people, and technology services to hospitals and other healthcare providers.

Over the past four quarters, it generated over $380 billion in revenue. Its size is a competitive advantage for UnitedHealth, as it can offer more value for less money, which in turn helps it continue to take market share. UnitedHealth is a behemoth with a market cap of over $500 billion, yet it keeps growing. Analysts believe UnitedHealth can grow earnings by an average of 13% annually over the long term. The company has also boosted its dividend payouts for 15 consecutive years. The stock is poised to continue delivering stellar returns, assuming the company stays out of antitrust trouble.

2. Abbott Labs

Healthcare products company Abbott Labs (NYSE: ABT) has evolved over the years. It spun off its primary pharmaceutical business over a decade ago into AbbVie, but that hasn’t held the parent company’s stock back from delivering market-beating returns. Today, Abbott Labs sells consumer health products, medical devices, testing equipment, and generic pharmaceuticals to emerging markets.

Abbott Labs is also a Dividend King with a 53-year payout-hiking streak, which investors looking for ever-increasing income from their portfolios should love. Today, it only spends about half its earnings on the dividend, so it should have plenty of room for future increases.

Most importantly, Abbott has positioned itself well for long-term growth. After spinning off AbbVie, the company aligned itself with growth trends in cardiovascular and diabetes care. Analysts covering the company on average believe that it will grow earnings by 8% to 9% annually over the long term, and the dividend adds almost 2% to investors’ returns. Abbott probably won’t provide explosive gains, but years of steady returns in the 8% to 10% range from growth and dividends can add up to life-changing wealth.

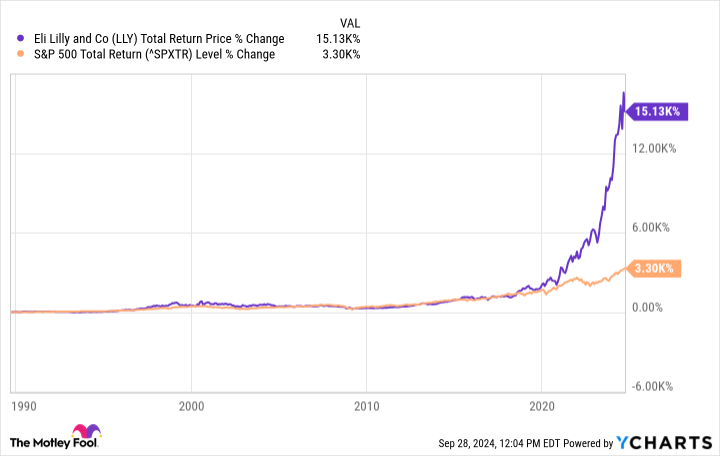

3. Eli Lilly

Pharmaceutical giant Eli Lilly (NYSE: LLY) might be the most explosive stock of these three. The company struck it big with its GLP-1 receptor agonist drugs Wegovy and Zepbound, which are prescribed for diabetes and weight loss, respectively. The combined sales of all GLP-1 drugs worldwide reached approximately $40 billion last year, and some forecasters expect that could nearly quadruple to $150 billion annually by 2032. Eli Lilly is one of a small number of pharmaceutical companies with FDA-approved GLP-1 products. However, Eli Lilly is far more than that: It has a deep pipeline and a broad portfolio that includes numerous products with growing sales.

Analysts believe Eli Lilly will deliver earnings growth that averages 20% annually over the next three to five years. Long-term investors shouldn’t sleep on Eli Lilly’s dividend potential, either. The company has raised its payouts for 10 consecutive years. While it only yields 0.6% today, the payout ratio is just 31% of this year’s estimated earnings. Look for management to ramp up that payout as Eli Lilly enjoys rapid growth over the coming years. That makes the stock a strong candidate for further market-beating total returns.

Should you invest $1,000 in UnitedHealth Group right now?

Before you buy stock in UnitedHealth Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UnitedHealth Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends AbbVie and Abbott Laboratories. The Motley Fool recommends UnitedHealth Group. The Motley Fool has a disclosure policy.

Want $1 Million in Retirement? 3 Stocks to Buy Now and Hold for Decades was originally published by The Motley Fool

CryptoCurrency

Nvidia Stock Could Soar Another 561%, According to a Wall Street Analyst

If you invested $100 in Nvidia (NASDAQ: NVDA) at the beginning of 2023, you would now have $830 thanks to the remarkable surge in the company’s shares fueled by artificial intelligence (AI). Even so, the stock could jump from about $120 now to around $800 by 2030, according to one analyst.

Phil Panaro, a former senior advisor at the Boston Consulting Group, believes that the continuing growth of AI and the arrival of Nvidia’s next-generation Blackwell processors could lead to annual revenue of $600 billion in 2030 from $61 billion in fiscal 2024.

Let’s look at the catalysts mentioned by Panaro and check if they are strong enough to help Nvidia sustain its phenomenal growth in the long run.

The increasing demand for accelerated computing

Nvidia CEO Jensen Huang said on his company’s August earnings conference call that accelerated computing is going to be a long-term growth driver. Huang said the transition from general-purpose computing — using central processing units (CPUs) — to accelerated computing based on graphics processing units (GPUs) could help reduce computing costs by 90%.

Because GPUs speed up demanding workloads in data centers that would have otherwise taken longer using CPUs, Nvidia says, accelerated computing is not only faster, but it is also more sustainable because of its smaller energy footprint.

Huang projected “$1 trillion worth of data centers in a few years will be all accelerated computing” based on their energy efficiency.

Data centers are estimated to account for 1% to 2% of global energy consumption, a figure expected to double by the end of the decade. So the much faster pace of GPUs compared to CPUs is expected to help reduce energy consumption long term.

The demand for data center accelerators is forecast to have a compound annual growth rate (CAGR) of 28% through the next five years. And the massive end market that the transition to accelerated computing is likely to create, Huang said, could mean that his company is at the beginning of a phenomenal growth curve.

That’s because Nvidia is the dominant player in the data center GPU market. It reportedly controlled 98% of this space at the end of last year, so it stands to win big from the secular growth in accelerated computing even if it loses some of that market share.

The outlook for Nvidia’s upcoming Blackwell AI GPUs seems to be solid, with the company saying demand is tracking ahead of supply, a trend that’s likely to continue next year as well.

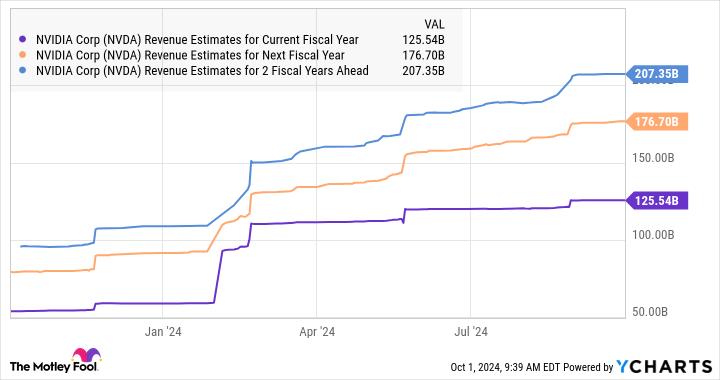

Why a $600 billion top line seems achievable

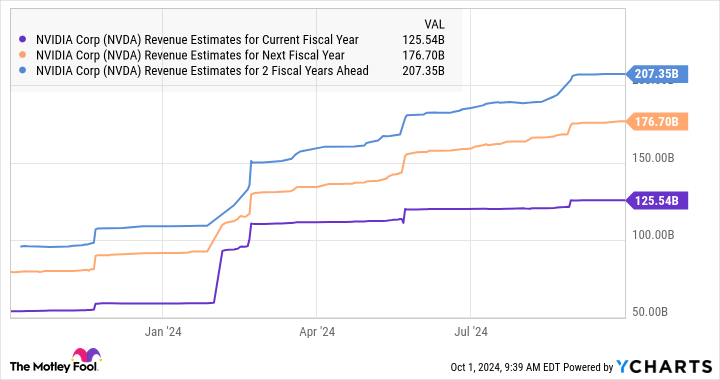

Nvidia’s solid prospects discussed above help explain why the company’s revenue estimates have received a nice bump for the next three fiscal years.

As shown in the chart above, Nvidia’s top line is expected to cross $207 billion in fiscal 2027, more than triple its fiscal 2024 revenue. The company’s fiscal 2027 will coincide with the majority of calendar year 2026. So to hit $600 billion in revenue by calendar year 2030 (Nvidia’s fiscal 2031), it will need an annual growth rate of 30% over a four-year period.

Nvidia serves multiple fast-growing markets such as AI chips (expected to grow at an annual pace of 41% through 2032), digital twins, and cloud gaming, so there is a good chance that it could indeed hit $600 billion in revenue by the 2030 calendar year. But it remains to be seen if that growth translates into the potential upside that Panaro predicts for the stock.

Assuming Nvidia does reach $600 billion in sales in 2030, the stock will have to maintain its current price-to-sales ratio (P/S) of 32 to generate 561% returns from this level. That would translate into a market cap of $19.2 trillion, compared to the current level of just under $3 trillion.

If we don’t give Nvidia such a rich sales multiple and assume that it is trading at a P/S of 8 (in line with the U.S. technology sector’s average) by 2030, its market cap would jump to $4.8 trillion.

So, Nvidia could deliver 61% gains from current levels assuming it trades at a more reasonable valuation. But if the market decides to keep rewarding the company with a rich multiple because of its healthy growth, there is a good chance that it could deliver a much stronger upside in the long run — and might even get close to Panaro’s ambitious estimate.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Nvidia Stock Could Soar Another 561%, According to a Wall Street Analyst was originally published by The Motley Fool

CryptoCurrency

Want Over $5,000 in Annual Dividends? Invest $23,000 in Each of These 3 Stocks

Whether you want to retire early, work less, or just have extra money to fund a vacation, dividend stocks can provide you with the cash flow to help you achieve your goals. The key is to find high-yielding stocks that aren’t too risky to ensure you aren’t setting yourself up for disappointment later on.

Three stocks that can be great dividend-paying investments to build your portfolio around are Pfizer (NYSE: PFE), BCE (NYSE: BCE), and Western Union (NYSE: WU). They all pay you more than four times what you would get with the average S&P 500 yield of 1.3%. Here’s how investing $23,000 into each of these stocks can allow you to receive more than $5,000 in annual dividend income.

1. Pfizer

One of the best dividend stocks you can get right now is Pfizer. The healthcare giant yields about 5.9%, which is unusually high for the stock, and that’s partly due to its struggling share price. Down 13% during the past five years, investors have become worried about the company’s long-term prospects now that it’s not getting a boost from COVID-19-related revenue and with multiple patent expirations looming.

However, Pfizer has been investing in strengthening its growth prospects with many acquisitions in recent years. One exciting opportunity could be slicing out a piece of the lucrative anti-obesity market, which could top more than $100 billion by the end of the decade. Pfizer doesn’t have an approved treatment yet, but it has a once-daily pill that has been generating encouraging results thus far. There could still be a lot of growth on the horizon for the business in the future. With more than 110 programs in its pipeline, investors shouldn’t be too bearish on the stock, as there’s still lots of potential for Pfizer.

The company has posted some underwhelming quarters recently due to asset impairment charges, but Pfizer still has a promising future and the payoff could be significant for investors who are willing to remain patient with the healthcare stock. Investing $23,000 into Pfizer today would give you about $1,360 in dividends during the course of a full year.

2. BCE

Another good and dependable dividend stock to own is BCE. The Canadian telecom company is an industry leader, and what is attractive about its operations is consistency. The company has steadily increased revenue from 22.9 billion Canadian dollars ($16.9 billion) in 2020 to CA$24.7 billion in 2023.

As long as you aren’t expecting fast growth and are primarily investing in the stock for its stability and dividend income, you likely won’t be disappointed with this investment. BCE averages an incredibly low beta value of about 0.50, meaning it doesn’t move much with market fluctuations, making it an attractive option for risk-averse investors.

Telecom stocks haven’t been exciting buys in a high-interest rate environment, but as rates fall, that could change. In the meantime, buying BCE stock for its hefty 8.5% dividend yield could net you a whole lot of recurring income. A $23,000 investment in the company would bring in more than about $1,950 in dividends for a full year.

3. Western Union

Investors can also buy another great dividend stock in Western Union. Although consumer have a growing number of payment options to choose from these days, Western Union remains a trusted international brand. One area where it is doing particularly well is in digital transactions. In its most recent quarter, which ended June 30, consumer money transfer transactions rose by 4% year over year. However, in its branded digital transactions, the growth rate was even higher at 13%.

The company expects to generate solid operating margins of about 20% this year with its per-share earnings expected to be at least $1.62, which is more than enough to cover its annual dividend payments of $0.94 per share. That’s a great sign of resiliency for the business, as Western Union’s revenue has been falling this year due to weakness in some international markets.

Given its modest share price of less than $12, buying the stock today means you can earn a yield of 8%. That would generate $1,840 in annual dividend income from a $23,000 investment. When combined with the other investments on this list, that would put your total annual dividend income at about $5,150 based on a total of $69,000 invested. And with each stock focused on a different sector, you’ll also get some excellent diversification with these investments.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

Want Over $5,000 in Annual Dividends? Invest $23,000 in Each of These 3 Stocks was originally published by The Motley Fool

CryptoCurrency

Is It Too Late to Buy IBM Stock?

This isn’t your great-grandfather’s IBM (NYSE: IBM) anymore. It’s still a great long-term investment, though.

IBM’s pioneering history

The former maker of punch-card calculators evolved into an industrial computing powerhouse, a personal computing innovator, and then an all-you-can-eat buffet of information technology products. And just when everyone else started to copy Big Blue’s successful business model, the company took a sharp turn into cloud computing, consulting services, data security, and artificial intelligence (AI).

It was a tough business transformation, but it’s starting to pay off for longtime investors. About ten painful years after the newfound focus on AI and cloud services, ChatGPT came along to launch a marketwide fascination with AI.

Most investors didn’t see IBM as a player in that explosive market at first, because it wasn’t launching splashy consumer-facing AI apps or showing skyrocketing sales growth.

How IBM captures corporate clients in the AI boom

IBM aims squarely for enterprise-class corporate customers. Other companies can chase consumers all they want, but this company always wants long-term contracts with deep-pocketed clients.

These deals take time, since the potential clients in this class often have to go through many layers of management approvals and technical testing. For that reason, it wasn’t surprising to see other tech giants sprinting ahead of IBM in the AI boom’s early days.

But the approvals have started to come in and IBM is recording robust sales in the AI market. The watsonx generative AI platform has only been around for one year but already has more than $2 billion of signed contracts.

The watsonx service includes the same large language model (LLM) technology as OpenAI’s ChatGPT or Alphabet‘s (NASDAQ: GOOG) (NASDAQ: GOOGL) Gemini, but it’s paired with a large array of machine learning tools. The resulting AI system combines IBM’s decades of market-leading machine learning research with the user-friendly flexibility of LLMs, and the whole bundle connects to the client’s proprietary business data.

While most AI experts wanted to bring something to market as soon as possible, IBM didn’t launch watsonx until it had trackable data sources, ironclad security, and other business-friendly features. This is the solution for companies with valuable operating data and customer information.

I expect that order book to swell in the coming quarters and years. IBM is the AI leader you forgot about, poised to make a mint as the AI market matures.

Big Blue’s future prospects

That’s just one piece of IBM’s technology puzzle. The company also provides enterprise-class data security tools. A wide range of consulting services sets Big Blue apart from other tech titans. It’s even a front-runner in the emerging field of quantum computing with active quantum data centers in the U.S. and Germany.

The times, they are a-changing. IBM is always ready to roll with the punches and explore whatever the next big idea might be. Doubling down on AI years before the ChatGPT boom is one great example of this flexible attitude. IBM’s quantum computing research is another.

The stock has gained a market-beating 56% over the last year, but it still trades at a modest 16 times free cash flow (FCF). By comparison, the average price/FCF ratio among S&P 500 (SNPINDEX: ^GSPC) stocks is a beefy 26x.

So you can buy into a proven innovator with leading roles in high-growth markets such as AI, cloud computing, and quantum computing — all at a very low price. And whatever twists and turns might come in the road ahead, IBM will see them coming and probably already started planning for the next sea change.

In other words, you’re not too late to invest in IBM at all. This stock should deliver solid returns in the long run, often leading the way into new eras and unheard-of technologies.

Should you invest $1,000 in International Business Machines right now?

Before you buy stock in International Business Machines, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and International Business Machines wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet and International Business Machines. The Motley Fool has positions in and recommends Alphabet. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

Is It Too Late to Buy IBM Stock? was originally published by The Motley Fool

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology2 weeks ago

Technology2 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 weeks ago

Science & Environment2 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

News2 weeks ago

News2 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy this is a golden age for life to thrive across the universe

-

News2 weeks ago

News2 weeks agoYou’re a Hypocrite, And So Am I

-

News3 weeks ago

the pick of new debut fiction

-

Sport2 weeks ago

Sport2 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology1 week ago

Technology1 week ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNerve fibres in the brain could generate quantum entanglement

-

MMA1 week ago

MMA1 week agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Business1 week ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Football1 week ago

Football1 week agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

News2 weeks ago

News2 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoRethinking space and time could let us do away with dark matter

-

News2 weeks ago

News2 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCardano founder to meet Argentina president Javier Milei

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMeet the world's first female male model | 7.30

-

Science & Environment1 week ago

Science & Environment1 week agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA slight curve helps rocks make the biggest splash

-

Business3 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

News3 weeks ago

News3 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoBest Exercises if You Want to Build a Great Physique

-

News2 weeks ago

News2 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

News2 weeks ago

News2 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Technology2 weeks ago

Technology2 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Business1 week ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

News3 weeks ago

News3 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoEverything a Beginner Needs to Know About Squatting

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Toning Workout for Women

-

Travel2 weeks ago

Travel2 weeks agoDelta signs codeshare agreement with SAS

-

Servers computers1 week ago

Servers computers1 week agoWhat are the benefits of Blade servers compared to rack servers?

-

Politics1 week ago

Politics1 week agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology1 week ago

Technology1 week agoThe best robot vacuum cleaners of 2024

-

Sport2 weeks ago

Sport2 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Technology2 weeks ago

Technology2 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBlockdaemon mulls 2026 IPO: Report

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Politics2 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News1 week ago

News1 week agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow one theory ties together everything we know about the universe

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business2 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Business2 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Politics2 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoKeep Your Goals on Track This Season

-

TV2 weeks ago

TV2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News2 weeks ago

News2 weeks agoChurch same-sex split affecting bishop appointments

-

Politics3 weeks ago

Politics3 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology2 weeks ago

Technology2 weeks agoFivetran targets data security by adding Hybrid Deployment

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSingle atoms captured morphing into quantum waves in startling image

-

Politics2 weeks ago

Politics2 weeks agoLabour MP urges UK government to nationalise Grangemouth refinery

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

You must be logged in to post a comment Login