CryptoCurrency

Is This Stock-Split a Buying Opportunity or a Trap?

Super Micro Computer (NASDAQ: SMCI) is a pretty complicated investment right now. On one hand, it makes server components and entire servers that are in massive demand thanks to artificial intelligence (AI). On the other hand, there are accounting malpractice accusations and a Department of Justice (DOJ) probe that is investigating those concerns.

Right now, the bear case outweighs the bull one, which is why shares of Supermicro (as the company is known) are down 60% from their all-time high set in March. Furthermore, the company has recently undergone a 10-for-one stock split, a catalyst that usually causes a stock price to rise, not fall.

So, is this a stock to stay away from? Or is it a chance to own an undervalued and potentially massive winner?

Supermicro’s product is at risk of being commoditized

Let’s start with the business itself — and there may be other concerns to consider here, too. The space for Supermicro’s products is rather saturated today as a result of many competitors.

However, Supermicro has one key advantage: It has the most energy-efficient technology available. With energy being a significant operating cost for these servers, companies are considering the total cost of operation for them. This is pushing a massive amount of demand Supermicro’s way.

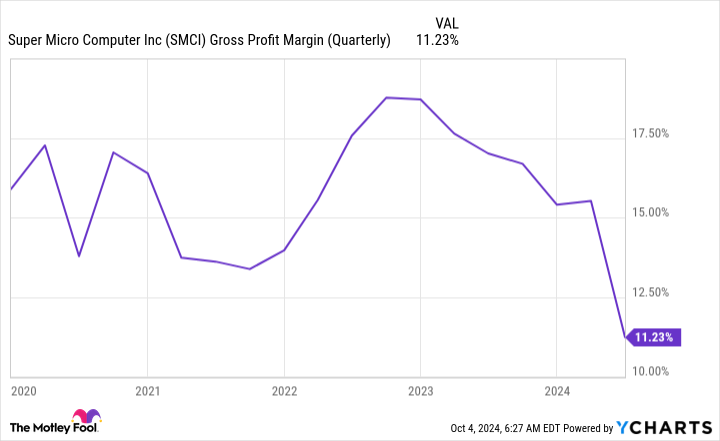

However, this isn’t without its own problems. Supermicro’s gross margin has collapsed due to its new liquid-cooled technology, as its supply chain has been bottlenecked for key components in these new systems. Management expects its gross margins to increase throughout fiscal 2025 (ending June 30, 2025), driven by its customer mix and manufacturing efficiencies as it scales up manufacturing in Malaysia and Taiwan, which should alleviate the bottlenecks it’s currently experiencing.

While this may be true, something else could be happening here. When a product becomes commoditized, companies that make it have to start cutting margins to compete. This could be happening with Supermicro’s business, which wouldn’t bode well for the company, even if it has best-in-class products.

This will be an important trend to watch over the next year as a low gross margin could break the Supermicro investment thesis.

Accounting malpractice allegations have triggered a government probe

Then there are the allegations and government probe. Well-known short seller Hindenburg Research released a report in late August alleging account malpractice at Supermicro, something the Securities and Exchange Commission already fined Supermicro $17.5 million for in 2020. While Supermicro’s management has denied these allegations, it didn’t do itself any favors when it announced it was delaying filing its end-of-year form 10-K with the SEC the day after Hindenburg’s report was published due to assessing “internal controls over financial reporting.”

It’s worth remembering that Hindenburg is a short seller, and so it benefits when the stock price falls. However, these allegations were serious enough that the DOJ initiated a probe into Supermicro to determine whether they had merit. It will be some time before we know the results of this investigation, so investors have a tough choice to make.

I wouldn’t blame anyone for throwing Supermicro into the “too hard to understand” pile. There’s no shame in this conclusion. One of the greatest investors of all time, Warren Buffett, often does this with businesses he doesn’t understand. With shrinking gross margins and an ongoing DOJ probe, there are certainly a lot of negatives surrounding Supermicro.

But there are some positives too. In fiscal 2025 (ending June 30, 2025), Supermicro expects its revenue to grow between 74% and 101% year over year. That’s massive growth, yet the stock is priced at a dirt cheap level.

At just 14.2 times forward earnings, Supermicro may be one of the cheapest companies you’ll ever find that’s posting growth rates like that. So, if Supermicro’s management is right and it improves its gross margin and delivers strong growth throughout FY 2025, the stock has massive upside, as it’s far below where the S&P 500 trades (at 23.7 times forward earnings).

I think there’s enough of a compelling investment thesis here that I bought the dip on the stock. However, I only let it take up around 1% of my portfolio, as there’s a lot of risk involved. Supermicro is all about risk tolerance and management. If you’re not OK with this stock losing money on the potential for strong gains, there are still plenty of other AI stocks that are great picks.

But there’s a strong chance this stock could double — if it works out some of its flaws.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Keithen Drury has positions in Super Micro Computer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Super Micro Computer: Is This Stock-Split a Buying Opportunity or a Trap? was originally published by The Motley Fool

CryptoCurrency

Sam Altman-backed energy stock surges amid AI-driven ‘nuclear power renaissance’

Sam Altman-backed nuclear power company Oklo (OKLO) has boomed on the stock market over the past month as investors look to nuclear energy as the next big AI trade.

Shares in the company, which is designing so-called small modular nuclear reactors (SMRs), have surged nearly 140% over the past month on Big Tech’s growing interest in nuclear power. SMRs are designed to produce cheaper, faster, greener energy than traditional nuclear facilities.

Amazon (AMZN) and Google (GOOG) in mid-October announced substantial investments in SMR projects as they look to balance their climate goals with the growing energy demands of the data centers powering their various AI software. Oracle’s (ORCL) Larry Ellison announced in September that the company intends to build a data center powered by SMRs.

“A nuclear power renaissance is underway with nuclear increasingly viewed as a solution which solves both the increased need for baseload power and the need to decarbonize,” wrote Craig-Hallum analyst Eric Stine in a recent note to investors. Baseload power refers to the day-to-day energy demand on an electrical grid.

Stine said Google and Amazon’s investments are “truly just the beginning of a multi-decade megatrend.”

Goldman Sachs estimates that global data center power consumption will grow 160% by 2030, driven by demand from artificial intelligence. Meanwhile, separate data from the International Atomic Energy Agency shows nuclear power production in North America potentially doubling by 2050.

Stocks of other firms making similar tech to Oklo’s, such as NuScale (SMƒR) and NANO Nuclear Energy (NNE), also surged following news of Google’s and Amazon’s investments on Oct. 14 and Oct. 16, respectively, before paring gains this week.

“The opportunity is so massive here in the market that there’s going to be a good number of folks that are successful,” Oklo CEO Jacob DeWitte told Yahoo Finance.

In fact, the SMR market could grow to $300 billion by 2040, according to research cited by Citi analysts.

Oklo went public in May through a merger with a special purpose acquisition company, AltC Acquisition Corp., which Altman co-founded. In addition to Altman, Cathie Wood and Peter Thiel are on its list of investors.

Sam Altman owned a 2.6% stake in the company, according to a regulatory filing in June. He became chair of Oklo in 2024 after serving as its CEO for three years.

While Oklo was founded in 2013, well ahead of the AI boom, the energy needs of artificial intelligence have been a boon to the firm as it builds its client book, DeWitte said.

CryptoCurrency

Why This Green Bitcoin Miner Could Be the Next Big AI Infrastructure Stock

The artificial intelligence (AI) revolution is driving unprecedented demand for energy-intensive data centers. The International Energy Agency projects that data centers may account for up to one-third of the anticipated increase in U.S. electricity demand through 2026.

Major tech companies, like Microsoft, Amazon, and Alphabet, are racing to secure clean energy power sources, such as nuclear energy, to meet their mounting energy needs. One under-the-radar company with established renewable infrastructure is uniquely positioned to capitalize on this accelerating trend.

TeraWulf (NASDAQ: WULF) operates Bitcoin (CRYPTO: BTC) mining facilities powered by approximately 95% zero-carbon energy sources, primarily hydroelectric power. The company’s revenue surged 130% year over year to $35.6 million in the second quarter of 2024, driven by an 80% increase in operational mining capacity and higher Bitcoin prices.

Moreover, TeraWulf has significantly strengthened its financial position by eliminating its debt ahead of schedule. This clean balance sheet positions TeraWulf to fund its ambitious expansion plans in both cryptocurrency mining and AI infrastructure.

TeraWulf is leveraging its existing clean energy infrastructure to enter the high-performance computing and AI market. The company has already completed a 2.5 megawatt (MW) proof-of-concept project designed for next-generation graphics processing unit (GPU) technology.

Additionally, construction is underway on a 20 MW colocation facility engineered to support AI workloads. The facility includes advanced features, like liquid cooling and redundant power systems typical of premium data centers. It is scheduled to kick off operations in Q1 2025, according to the company.

TeraWulf recently secured $425 million through a convertible note offering at a reasonable 2.75% interest rate, reflecting strong institutional investor confidence. The company plans to use these funds for strategic acquisitions and the expansion of data center infrastructure to support its AI computing initiatives.

Furthermore, TeraWulf’s board recently authorized a $200 million share repurchase program through December 2025, signaling management’s belief that the stock may be undervalued despite rising approximately 165% year to date.

TeraWulf’s clean energy resources give it a unique edge in the rapidly growing AI infrastructure market. Major tech companies are actively seeking sustainable power sources for their energy-intensive AI operations, making TeraWulf’s zero-carbon data centers particularly attractive.

CryptoCurrency

Why I’m Loading Up on These 3 High-Dividend ETFs for Passive Income

I want to become financially independent. My core strategy is to grow my passive income so that it will eventually cover my recurring expenses. To reach that goal, I’m taking a multipronged approach that includes investing in dividend stocks, exchange-traded funds (ETFs), and real estate.

I’m loading up on several dividend ETFs to grow my passive income, including JPMorgan Nasdaq Equity Premium ETF (NASDAQ: JEPQ), SPDR Portfolio High Yield Bond ETF (NYSEMKT: SPHY), and iShares Core U.S. Aggregate Bond ETF (NYSEMKT: AGG). Here’s why I like this trio for passive income.

JPMorgan Nasdaq Equity Premium ETF takes a unique approach to generating income. The fund writes out-of-the-money call options on the Nasdaq-100 Index. That strategy generates options premium income each month that the ETF distributes to investors.

That income has really added up over the past year. The ETF’s dividend yield over the last 12 months is 9.5%. That’s a higher yield than U.S. high-yield junk bonds (7.9%) and the U.S. 10-year Treasury bond (4.4%). However, the payments do ebb and flow based on the options premium income the fund generates, which fluctuates with volatility.

In addition to income, this fund offers price appreciation potential. The ETF also holds a portfolio of stocks the managers select based on data science and fundamental research. The fund’s price rises as that equity portfolio’s value increases. Because of that, the fund offers the best of both worlds: high income and upside potential.

SPDR Portfolio High Yield Bond ETF provides exposure to the high-yield (junk) bond market. These bonds have sub-investment-grade bond ratings because the companies issuing this debt have weaker financial profiles. That puts these bonds at high risk of default.

This fund holds a large basket of these bonds (over 1,900) diversified across sectors, issuers, and maturity. That diversification helps reduce the default risk. If an issuer defaults on its bond, it won’t have a major impact on the ETF. Meanwhile, even if a severe market downturn negatively impacted financially weaker companies, the overall diversification of the fund should help mute the impact on ETF investors.

Investors get paid well to assume the higher risk profile of these bonds. The fund has a distribution yield currently above 7%. While the monthly distribution payments fluctuate based on interest payments received, the fund offers a relatively steady passive income stream.

The iShares Core U.S. Aggregate Bond ETF focuses on the other side of the bond market: investment-grade bonds. These bonds have a lower risk of defaulting, making them ideal for those seeking a very low-risk income stream.

CryptoCurrency

Could Buying This Weight Loss Stock Be Like Investing in Novo Nordisk At The Dawn of The GLP-1 Revolution?

One of the biggest sensations fueling the healthcare space right now is the medication class of glucagon-like peptide-1 (GLP-1) agonists. Even if you aren’t familiar with the term “GLP-1,” you’ve probably heard of Ozempic and Wegovy. Both medications are GLP-1 agonists, used to treat diabetes and obesity, respectively.

These treatments have become blockbuster drugs for their maker, Novo Nordisk, and have helped fuel generous gains for investors in the stock. While Novo Nordisk currently dominates the GLP-1 industry, a number of other players are looking to enter the space.

One leading entrant is Viking Therapeutics (NASDAQ: VKTX). Below, I’ll break down where Viking stands in its pursuit of the weight loss market, and assess whether buying the stock could be like investing in Novo Nordisk at the beginning of the Ozempic revolution.

Viking has several drug candidates in its pipeline. But the one that investors seem most honed in on is VK2735 — a dual GLP-1 and GIP receptor agonist focused on treating obesity. As a dual agonist, VK2735 could wind up being a more optimal treatment for obesity and diabetes than single-pathway GLP-1 medicines such as Ozempic or Wegovy.

In late October, Viking announced that it will be meeting with the Food and Drug Administration (FDA) during the fourth quarter, about the proper steps and protocols to move VK2735 into a phase 3 clinical trial.

Given the information above, you might think buying Viking stock now — prior to phase 3 trials — is a lucrative opportunity. However, there is quite a bit to consider besides anecdotal updates about VK2735.

So far in 2024, shares of Viking have rocketed by a whopping 323% — putting its market cap right around $8.8 billion. Considering that the company doesn’t generate revenue, it’s hard to justify this valuation.

On the bright side, I think Viking is in a pretty solid financial position.

At the end of the third quarter, it boasted $930 million of cash and equivalents on its balance sheet. Furthermore, the company has spent roughly $105 million in operating expenses through the first nine months of the year. This implies an annual run rate of approximately $140 million in spending on research and development (R&D) and other administrative expenses, suggesting that Viking has ample liquidity to continue funding its operations.

I see Viking Therapeutics as largely a speculative opportunity. While data from its clinical trials so far have been encouraging, there are still plenty of unknowns surrounding the phase 3 study.

CryptoCurrency

FTX settles lawsuit against the Bybit exchange for $228 million

The prices of Bitcoin and other digital assets were significantly lower during the 2022 collapse of FTX compared to current market prices.

CryptoCurrency

Is SoFi Stock a Buy?

SoFi Technologies (NASDAQ: SOFI) has done an excellent job expanding its customer base and growing revenue. However, it has contended with sluggish loan growth in the high-interest rate environment, leading to investor skepticism about its short-term prospects. As a result, the stock remains 62% below its all-time high price in 2021.

However, the company has found multiple levers for growth and is seeing encouraging progress in its nonconsumer business. If you’re considering buying SoFi today, here’s what you should know.

In its early days, SoFi focused on helping people refinance their student loan debt. Then in 2020, the pandemic and policies around student loan forbearance forced SoFi to reevaluate its business. One area that helped drive its ongoing growth was personal lending. From 2020 to 2023, SoFi’s personal loan originations grew from $2.6 billion to $13.8 billion.

The higher-interest rate environment of the past couple of years has been a double-edged sword for SoFi. On one hand, consumers have had to grapple with higher interest rates, which could make it harder for them to pay down their debts.

In the second quarter, SoFi charged off $151.8 million in personal loans, giving it a charge-off ratio of 3.84% on its $15.9 billion personal loan portfolio. This is up from 2.94% one year ago and is one metric that investors have kept a close eye on. Charge-offs have risen across the banking sector over the past couple of years, which many attribute to normalizing conditions rather than systemic weakness across the consumer.

Additionally, SoFi projects that its lending segment revenue will decline 5% to 8% compared to last year. CEO Anthony Noto told investors during the first quarter that the fintech is taking “a more conservative approach in light of macroeconomic uncertainty.”

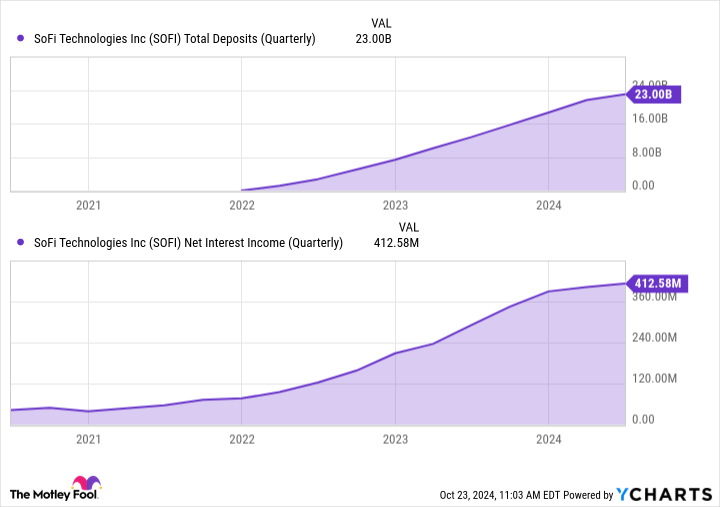

Conversely, higher interest rates have helped SoFi grow its net interest income significantly. One big reason for this was its 2022 acquisition of Golden Pacific Bancorp, which enabled SoFi to hold deposits and thus, more loans on its books. Since acquiring the bank, its total deposits have grown to nearly $23 billion, thanks to its high-yielding savings accounts offering an annual yield of up to 4.5%.

Last year, SoFi brought in almost $1.3 billion in net interest income, up over 400% from 2021. This solid growth continued through the first half of this year, with its net interest income increasing 55% to $815 million.

-

Technology1 month ago

Technology1 month agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Technology4 weeks ago

Technology4 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

TV4 weeks ago

TV4 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

Football4 weeks ago

Football4 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Football3 weeks ago

Football3 weeks agoWhy does Prince William support Aston Villa?

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

MMA3 weeks ago

MMA3 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

MMA4 weeks ago

MMA4 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology4 weeks ago

Technology4 weeks agoGmail gets redesigned summary cards with more data & features

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Technology4 weeks ago

Technology4 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Technology1 month ago

Technology1 month agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Business4 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

Technology1 month ago

Technology1 month agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology4 weeks ago

Technology4 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Technology3 weeks ago

Technology3 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Sport4 weeks ago

Sport4 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

Technology4 weeks ago

Technology4 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

MMA3 weeks ago

MMA3 weeks ago‘I was fighting on automatic pilot’ at UFC 306

-

Sport3 weeks ago

Sport3 weeks ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

MMA4 weeks ago

MMA4 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Sport4 weeks ago

Sport4 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

Business4 weeks ago

Business4 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Technology3 weeks ago

Technology3 weeks agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

Business4 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

News3 weeks ago

News3 weeks agoCornell is about to deport a student over Palestine activism

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

MMA3 weeks ago

MMA3 weeks agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Business4 weeks ago

Business4 weeks agoStocks Tumble in Japan After Party’s Election of New Prime Minister

-

News4 weeks ago

News4 weeks agoRwanda restricts funeral sizes following outbreak

-

Sport4 weeks ago

Sport4 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMarkets watch for dangers of further escalation

-

Football4 weeks ago

Football4 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

Technology4 weeks ago

Technology4 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

Technology3 weeks ago

Technology3 weeks agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

Business3 weeks ago

Business3 weeks agoStark difference in UK and Ireland’s budgets

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

MMA4 weeks ago

MMA4 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

News4 weeks ago

News4 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Politics3 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

Money3 weeks ago

Money3 weeks agoPub selling Britain’s ‘CHEAPEST’ pints for just £2.60 – but you’ll have to follow super-strict rules to get in

-

TV3 weeks ago

TV3 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

Business4 weeks ago

how UniCredit built its Commerzbank stake

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

Technology3 weeks ago

Technology3 weeks agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

-

News3 weeks ago

News3 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

MMA3 weeks ago

MMA3 weeks ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

News1 month ago

the pick of new debut fiction

-

MMA4 weeks ago

MMA4 weeks agoHow to watch Salt Lake City title fights, lineup, odds, more

You must be logged in to post a comment Login