CryptoCurrency

Lam Research (LRCX) Stock Trades Down, Here Is Why

What Happened?

Shares of semiconductor equipment maker Lam Research (NASDAQ:LRCX) fell 9.7% in the afternoon session as semiconductor stocks fell after ASML, the biggest supplier of equipment used in making advanced chips, pre-announced weak earnings. ASML expects fiscal year 2025 sales to come in between 30 billion euros and 35 billion euros, at the lower half of the range it had previously provided. Similarly, bookings for the quarter are reportedly below expectations.

Reuters noted that the quarterly earnings numbers were mistakenly published a day earlier than expected.

Management noted that while the potential in the AI (artificial intelligence) market remained strong, other markets were taking too long to recover, with the observed trend expected to continue into 2025.

Lastly, CFO Roger Dassen projected China’s contribution to overall revenue to be around 20% (down from the recent estimate of 49%), hinting at potential weakness in the region. ASML’s technology is used by chipmakers like Nvidia, AMD, Intel, and Samsung to make advanced chips, including those specially designed for AI workloads.

Given the company’s (ASML) critical role in the semiconductor manufacturing process, the weak earnings and outlook could signal a possible softening in the industry.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks. Is now the time to buy Lam Research? Access our full analysis report here, it’s free.

What The Market Is Telling Us

Lam Research’s shares are quite volatile and have had 17 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 19 days ago when the stock gained 7.5% as semiconductor stocks, especially the memory chip manufacturers, surged after Micron reported impressive fourth-quarter earnings results. Micron beat across most of the key metrics we track, including revenue, operating profit, and EPS. Notably, the company recorded a whopping 93% revenue growth compared to the previous year, showing that the AI party is still ongoing. Micron attributed the outperformance to the growing demand for memory chips that power generative AI applications.

Looking ahead, Micron provided strong sales and profitability guidance for the next quarter, which exceeded Wall Street’s expectations. Overall, the result highlights the abundant growth opportunities for chip makers with technologies to accelerate the booming AI trend.

Lam Research is up 3.3% since the beginning of the year, but at $77.41 per share, it is still trading 31.3% below its 52-week high of $112.73 from July 2024. Investors who bought $1,000 worth of Lam Research’s shares 5 years ago would now be looking at an investment worth $3,198.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

CryptoCurrency

Nasdaq, S&P 500 sink as tech leads losses ahead of Tesla earnings

Sales of existing homes fell in September as house hunters remained on the fence about buying a home despite mortgage rates easing during the month.

Existing home sales slipped 1.0% from August’s tally to a seasonally adjusted annual rate of 3.84 million, the National Association of Realtors said Wednesday. That marked the lowest rate since October 2010. Economists polled by Bloomberg expected a pace of 3.88 million in September.

On a yearly basis, sales of previously owned homes were 3.5% lower in September. The median home price rose 3.0% from last September to $404,500, marking the 15th consecutive month of annual price increases.

“Home sales have been essentially stuck at around a 4 million-unit pace for the past 12 months,” NAR chief economist Lawrence Yun said in a press release.

There have been significant challenges that have weighed on sales activity, including a lack of inventory, escalating prices, and elevated mortgage rates. Last month, however, those factors turned around.

The Federal Reserve cut its benchmark rate by half a percentage point in September. While the central bank doesn’t set mortgage rates, its actions influence their direction of movement.

Mortgage rates hit the lowest level since February 2023 ahead of the Fed decision to ease, while listing inventory picked up.

But overall, that hasn’t been enough to entice buyers.

“Some consumers are hesitating about moving forward with a major expenditure like purchasing a home before the upcoming election,” Yun said.

CryptoCurrency

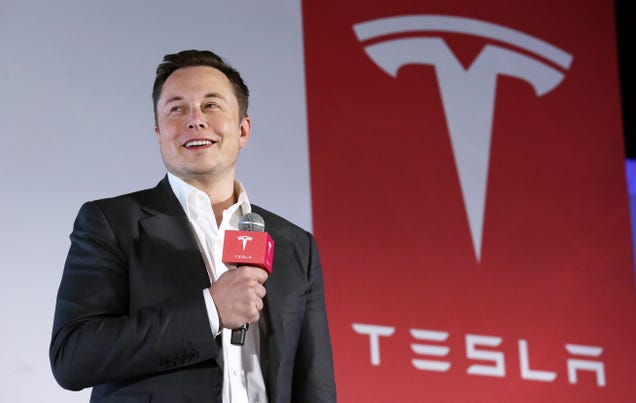

Tesla stock jumps on Q3 earnings beat

Tesla (TSLA) reported mixed third quarter results after the bell on Wednesday, but the stock jumped in after-hours trading as investors cheered the earnings beat, higher gross margins, and news that Tesla’s cheaper EV is on track for production next year.

For the quarter, Tesla reported revenue of $25.18 billion vs. $25.4 billion per Bloomberg consensus, higher than the $25.05 billion it reported in Q2 and also topping the $23.40 billion Tesla reported a year ago. Tesla posted adjusted EPS of $0.72 vs $0.60 expected, on adjusted net income of $2.5 billion and free cash flow of $2.9 billion.

The closely watched gross margin figure came in at 19.8%, much higher than the 16.8% expected.

Tesla shares were up nearly 8% in after hours trade.

“We delivered strong results in Q3 with growth in vehicle deliveries both sequentially and year-on-year, resulting in record third-quarter volumes,” the company said in its earnings deck. “Preparations remain underway for our offering of new vehicles — including more affordable models — which we will begin launching in the first half of 2025.”

Earlier this month, Tesla (TSLA) announced third quarter deliveries that slightly missed expectations, sending the stock lower.

Tesla said it delivered 462,890 vehicles in Q3, up 6.4% quarter over quarter, to mark the first quarter of delivery growth this year. The numbers also came in ahead of the 435,059 EVs the company delivered in the year-ago period. But Wall Street had expected Tesla to deliver closer to 463,897, according to Bloomberg.

“Refreshed Model 3 ramp continued successfully in Q3 with higher total production and lower cost of goods sold quarter-over-quarter. Cybertruck production increased sequentially and achieved a positive gross margin for the first time,” Tesla said in its report.

Tesla said it expects vehicle deliveries to achieve “slight growth” in 2024.

Ahead of Tesla’s Q3 disclosure, shares were down approximately 11% since Tesla revealed its robotaxi, dubbed the Cybercab, at its showy “We, Robot” event from the Warner Bros. studio lot in Burbank, Calif., on Oct. 10.

The debut and release of a cheaper EV is what many analysts and industry watchers believe will spur the next leg higher of EV sales, as even CEO Elon Musk has said before. During its Q2 report, Tesla and Musk said the company remains on track for the production of new vehicles, likely including a cheaper EV, in the first half of next year.

Investors and analysts were left wanting more details from Tesla’s “We, Robot” event on the Cybercab itself and detailed testing plans, along with questions about the development of Tesla’s sub-$30,000 EV, dubbed the Model 2.

CryptoCurrency

Transak hit by data breach, 92K users exposed

Transak disclosed a data breach affecting over 92,000 users after a phishing attack compromised an employee’s laptop.

CryptoCurrency

The Dow plummets more than 600 points and is on track for its worst day in more than a month

The Dow Jones Industrial Average and other major indexes suffered a steep decline Wednesday afternoon as the yield on the benchmark 10-year U.S. Treasury note continued its upward climb, reaching 4.23%—a level not seen since July.

In the afternoon, the Dow dropped 631 points, or 1.4%, heading for its worst day in over a month. Meanwhile, the tech-heavy Nasdaq and the S&P 500 declined by 2.2% and 1.4%, respectively. However, there was some relief for investors as oil prices eased, with West Texas Intermediate (WTI) futures trading around $70.65 per barrel.

The Federal Reserve’s Beige Book, released in the afternoon, reported that economic activity remained largely unchanged across the 12 Federal Reserve Districts, with the Southeast significantly impacted by a harsh storm season.

On Wednesday, all eyes are on Tesla (TSLA) as the company prepares to release its latest earnings report. Analysts expect earnings per share to be 60 cents, down from 66 cents a year ago but an improvement from 52 cents in the previous quarter, according to FactSet estimates. Revenue is projected to hit $25.4 billion, compared to $23.3 billion in the third quarter of 2023 and $25.5 billion in the preceding quarter.

Apart from Tesla, investors are closely monitoring earnings reports from other major corporations, including AT&T (T), Boeing (BA), and Coca-Cola (KO).

McDonald’s stock plunges over 5%

McDonald’s (MCD) shares took a sharp hit, falling over 5% after the Centers for Disease Control and Prevention (CDC) linked the chain’s Quarter Pounder burgers to an E. coli outbreak. The outbreak has led to 10 hospitalizations and one death, driving a significant decline in McDonald’s stock during the afternoon trading session.

As of now, 49 cases have been reported across 10 states between Sept. 27 and Oct. 11, with a majority of illnesses occurring in Colorado, Nebraska, Utah, and Wyoming. The CDC noted that most of those affected had eaten a Quarter Pounder. Investigators are working swiftly to identify the contaminated ingredient.

Spirit Airlines stock soars 30%

After a failed attempt at merging with JetBlue (JBLU-0.80%), ultra-low-cost carrier Spirit Airlines (SAVE+28.01%) is reportedly turning back to a familiar partner. The Wall Street Journal (NWSA-0.34%), citing people familiar with the matter, reports that Spirit and Frontier Airlines (ULCC+3.05%) are in early talks over a potential merger. The news sent Spirit’s stock soaring nearly 30% on Wednesday.

–Francisco Velasquez and Rocio Fabbro contributed to the article

CryptoCurrency

Zanzibar’s new blockchain sandbox aims to drive tech startup growth

The semi-autonomous region of Tanzania is taking advantage of a sandbox regulatory framework adopted in July.

CryptoCurrency

Price analysis 10/23: BTC, ETH, BNB, SOL, XRP, DOGE, TON, ADA, AVAX, SHIB

Bitcoin’s correction ignited selling in altcoins, which are slipping below critical support levels.

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

MMA2 weeks ago

MMA2 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Technology4 weeks ago

Technology4 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

News1 month ago

the pick of new debut fiction

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Technology3 weeks ago

Technology3 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

Technology3 weeks ago

Technology3 weeks agoGmail gets redesigned summary cards with more data & features

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Business3 weeks ago

Business3 weeks agoStark difference in UK and Ireland’s budgets

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

TV3 weeks ago

TV3 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

News3 weeks ago

News3 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Football3 weeks ago

Football3 weeks agoWhy does Prince William support Aston Villa?

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

News3 weeks ago

News3 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists are grappling with their own reproducibility crisis

-

Technology4 weeks ago

Technology4 weeks agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Technology3 weeks ago

Technology3 weeks agoHow to disable Google Assistant on your Pixel Watch 3

-

Business3 weeks ago

Can liberals be trusted with liberalism?

-

Technology3 weeks ago

Technology3 weeks agoA very underrated horror movie sequel is streaming on Max

-

MMA3 weeks ago

MMA3 weeks ago‘I was fighting on automatic pilot’ at UFC 306

-

Sport3 weeks ago

Sport3 weeks ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Entertainment3 weeks ago

Entertainment3 weeks ago“Golden owl” treasure hunt launched decades ago may finally have been solved

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

News3 weeks ago

News3 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Technology3 weeks ago

Technology3 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Travel3 weeks ago

Travel3 weeks agoI transformed into Plague Doctor for horrors that awaited me at London Dungeon… I was still shaking by the end – The Sun

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

You must be logged in to post a comment Login