CryptoCurrency

Should You Buy Nvidia Stock As Its AI Summit Gets Underway? History Says This Will Happen.

Artificial intelligence (AI) leader Nvidia (NASDAQ: NVDA) is set to host its 2024 AI Summit starting Oct. 7. The event will bring together leaders from across the industry to see and hear from some of the foremost minds in AI. It’s a chance to catch a peek at the future of this potentially revolutionary technology.

With such a big event upcoming, you might be asking yourself: Should I invest in Nvidia now? History may give us a clue. Let’s take a closer look at the company.

Nvidia dominates its rivals

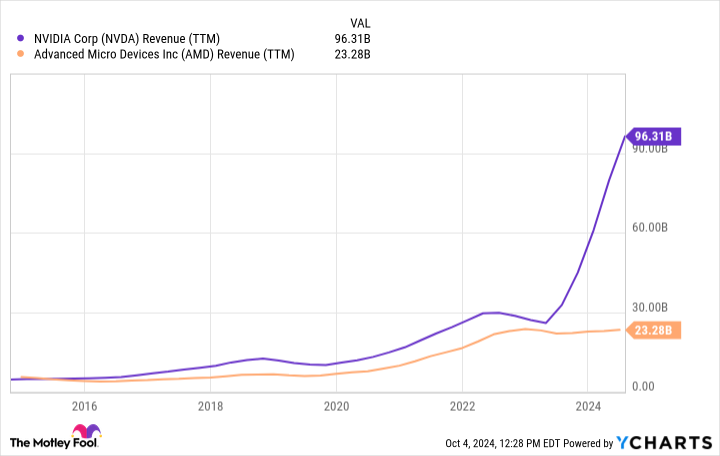

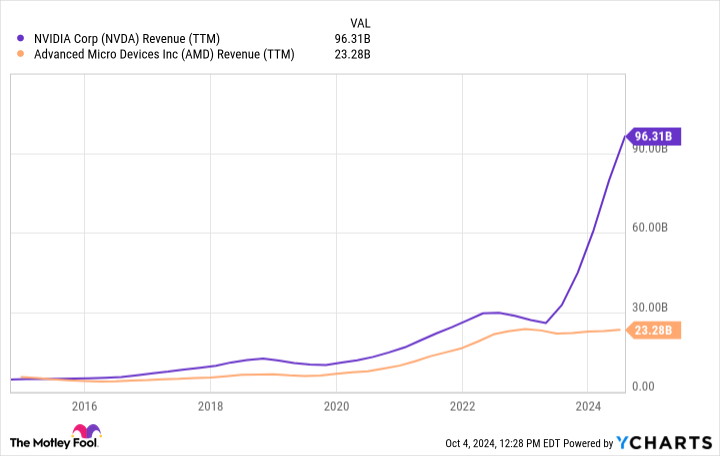

There was a time when Nvidia and its longtime rival, Advanced Micro Devices, were neck and neck in their battle to control the gaming market. By and large, there was parity between both of the company’s income statements. That’s changed. After AI hit an inflection point in late 2022, Nvidia is dominating AMD, earning more in profits than AMD does in total revenue. Take a look at this chart, which shows just how monumental the recent shift has been.

That’s what you get when you control 90% of a market as valuable as AI silicon. The great news for Nvidia is that it doesn’t look like the gravy train will stop anytime soon. The messaging from the rest of big tech, the companies that represent most of its business, is that their spending is likely to accelerate in the near future.

This is a race of sorts, and none of the big players can afford to be left behind. As Alphabet‘s CEO, Sundar Pichai, put it in the company’s latest earnings call: “The risk of underinvesting is dramatically greater than the risk of overinvesting for us here.” Alphabet expects to spend roughly $50 billion this year in capital expenditures (capex), up from $32 billion the year before — and it’s not alone.

At present, the bulk of this spending is still flowing through Nvidia as AMD, Intel, and others struggle to match the power and efficiency of Nvidia’s chips. There is still enormous demand for its current generation, and the company’s next generation will likely ship within the next few months. The massive profits Nvidia has enjoyed means it has large amounts to spend on maintaining its edge. Despite already leading the pack, Nvidia outspent AMD in research and development roughly two to one last quarter.

What history has to say

This will be the third year in a row that Nvidia will host an AI event in this vein. The company began these events in 2022 with a virtual event focused on speech in AI. 2023 was supposed to be the first year of a full-fledged, multi-day AI summit, but the event was moved online for a single day. This year’s event will take place in person over three days.

Despite their more modest meeting formats, both of the previous iterations led to a nice bump-up in Nvidia’s stock price. In the week that followed 2022’s event, shares were up as much as 10%. In 2023, they were up as much as 6.5%. So will this year’s conference also lead to a jump in stock price? Maybe.

I know that might be a disappointing answer, but the truth is that we can’t know for sure. First of all, two years is a very small sample size from which to draw firm conclusions. Also, even if we had more years to reference, correlation is not causation. Just because two things can be linked — like an AI summit and a jump in stock price — doesn’t mean one happens because of the other.

But the event is a chance to remember the power that AI holds. Instead of thinking about possible short-term stock movements, focus on the company’s long-term prospects. Don’t lose sight of the forest for the trees. This is a company at the top of its game, enabling the adoption of a potentially revolutionary technology.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, and Nvidia. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Should You Buy Nvidia Stock As Its AI Summit Gets Underway? History Says This Will Happen. was originally published by The Motley Fool

CryptoCurrency

Crypto-stealing malware discovered in Python Package Index — Checkmarx

According to cybersecurity firm Hacken, financial losses from crypto hacks topped $440 million in the third quarter of 2024.

CryptoCurrency

Boeing will lay off 10% of its employees as a strike by factory workers cripples airplane production

Boeing plans to lay off about 10% of its workers in the coming months as it continues to lose money and tries to deal with a strike that is crippling production of the company’s best-selling airline planes.

New CEO Kelly Ortberg told staff in a memo Friday that the job cuts, which could total about 17,000 positions, will include executives, managers and employees.

The company has about 170,000 employees worldwide, many of them working in manufacturing facilities in the states of Washington and South Carolina.

Boeing had already imposed rolling temporary furloughs, but Ortberg said those will be suspended because of the impending layoffs.

The company will delay the rollout of a new plane, the 777X, to 2026 instead of 2025. It will also stop building the cargo version of its 767 jet in 2027 after finishing current orders.

Boeing has lost more than $25 billion since the start of 2019.

About 33,000 union machinists have been on strike since Sept. 14. Two days of talks this week failed to produce a deal, and Boeing filed an unfair-labor-practices charge against the International Association of Machinists and Aerospace Workers.

As it announced layoffs, Boeing also gave a preliminary report on its third-quarter financial results — and the news is not good for the company.

Boeing said it burned through $1.3 billion in cash during the quarter and lost $9.97 per share. Industry analysts had been expecting the company to lose $1.61 per share in the quarter, according to a FactSet survey, but analysts were likely unaware of some large write-downs that Boeing announced Friday.

The company based in Arlington, Virginia, said it had $10.5 billion in cash and marketable securities on Sept. 30.

The strike has a direct bearing on cash burn because Boeing gets half or more of the price of planes when it delivers them to airline customers. The strike has shut down production of the 737 Max, Boeing’s best-selling plane, and 777x and 767s. The company is still making 787s at a nonunion plant in South Carolina.

“Our business is in a difficult position, and it is hard to overstate the challenges we face together,” Ortberg told staff. He said the situation “requires tough decisions and we will have to make structural changes to ensure we can stay competitive and deliver for our customers over the long term.”

CryptoCurrency

WEF talks DeFi regulation, HKDA stablecoin integrates Chainlink: Finance Redefined

The World Economic Forum has urged policymakers to adopt sandbox-based frameworks to enhance regulatory clarity for DeFi innovations and address key risks.

CryptoCurrency

Billionaire Ray Dalio Is Skeptical Of The Recent Rate Cuts – These Are The Stocks He’s Holding

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

With a net worth of over $14 billion, Ray Dalio is one of the most respected investors on Wall Street. He founded Bridgewater Associates in 1975, which has grown to become the world’s largest hedge fund, with roughly $97.2 billion in net assets under management.

Notably, Bridgewater Associates is the fourth most profitable hedge fund in terms of absolute dollar returns as the fund’s net gains amounted to approximately $55.8 billion between 1975 and 2023.

Don’t Miss:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Commercial real estate has historically outperformed the stock market, but few investors have the capital or resources needed to invest in this asset class. Get started investing in commercial real estate today.

Dalio thinks the U.S. economy is “in a relatively good balance” right now and doesn’t foresee multiple rate cuts. This sharply contrasts with market expectations, which signal at least two more rate cuts in 2024 alone.

Not On Any Preset Course: Powell

Wall Street rejoiced at the September rate cut by 50 basis points, with investors speculating about the magnitude of the next rate cut. However, Fed Chair Jerome Powell has hinted that future rate cuts might be smaller as the central bank cautiously navigates avoiding a recession while bringing down inflation.

“Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance. But we are not on any preset course,” he said. “The risks are two-sided and we will continue to make our decisions meeting by meeting.”

As the risks associated with rate cuts are two-sided, Powell acknowledged, “This [FOMC] is not a committee that feels like it’s in a hurry to cut rates quickly.”

Dalio’s Outlook On The Bond Market

Dalio believes the bond market is in a precarious position and Treasury bonds, particularly, have not been great investments recently.

“Treasury bonds have not been a great investment,” Dalio said at the Greenwich Economic Forum. “We have an interest rate risk in that bond market.”

With institutional investors and central banks holding substantial Treasuries, Dalio thinks the market may be overweighted in these securities.

Furthermore, the erratic fluctuations in Treasury yields this year are a major deterrent as the two-year Treasury yield has swung between 3.5% and 5%, reflecting a market on edge.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Bridgewater Associates’ Top Holdings

Dalio retired as co-CIO in 2022 and gave up control of Bridgewater Associates. However, according to the Bloomberg Billionaires Index, he still owns a 49.9% stake in the company.

The hedge fund has diversified its holdings across multiple sectors as evidenced by its second-quarter 13F filing.

Alphabet

Bridgewater Associates owns 4.54 million shares of Alphabet Inc. (NASDAQ:GOOGL), making it its third-largest holding – accounting for 4.32% of the total portfolio. The Magnificent Seven stock has been an investor favorite for a long time.

While the recent probe by the Department of Justice to break up Google’s dominance in the search engine industry has shocked many, industry experts have not reacted sharply to the news.

“We don’t believe there are any major surprises,” stated Doug Anmuth, an analyst at J.P. Morgan. “We don’t believe the high-level framework changes much for Google shares near term.”

In the wake of the DOJ’s court filing, Google wrote in a blog post that the “DOJ’s radical and sweeping proposals risk hurting consumers, businesses and developers.”

Analysts are mostly bullish on GOOGL stock, with a price target of $201.64. This indicates a potential upside of nearly 25%.

Procter & Gamble

Procter & Gamble Co. (NYSE:PG) stock is Bridgewater’s fifth-largest holding, accounting for 3.1% of the total portfolio. As of June 30, 2024, the hedge fund’s stake in Procter & Gamble was valued at $592.90 million.

The consumer goods giant’s stable dividend makes it a staple investment for defensive plays. The company has increased dividend payouts for 68 consecutive years, making it a Dividend King. Proctor & Gamble pays $4.03 in dividends annually, yielding 2.39% on the current price.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article Billionaire Ray Dalio Is Skeptical Of The Recent Rate Cuts – These Are The Stocks He’s Holding originally appeared on Benzinga.com

CryptoCurrency

Fairdesk crypto exchange to shut down over regulatory concerns

CryptoCurrency

Price analysis 10/11: BTC, ETH, BNB, SOL, XRP, DOGE, TON, ADA, AVAX, SHIB

Bitcoin and altcoins made a strong comeback on Oct. 11, indicating solid buying at lower levels.

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 weeks ago

Technology3 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment3 weeks ago

Science & Environment3 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

News4 weeks ago

the pick of new debut fiction

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNerve fibres in the brain could generate quantum entanglement

-

News3 weeks ago

News3 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum forces used to automatically assemble tiny device

-

Technology2 weeks ago

Technology2 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Business2 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

News4 weeks ago

News4 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News3 weeks ago

News3 weeks agoYou’re a Hypocrite, And So Am I

-

Sport3 weeks ago

Sport3 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News3 weeks ago

News3 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Business2 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

Technology2 weeks ago

Technology2 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Football2 weeks ago

Football2 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoRethinking space and time could let us do away with dark matter

-

News4 weeks ago

News4 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

News3 weeks ago

The Project Censored Newsletter – May 2024

-

Technology2 weeks ago

Technology2 weeks agoQuantum computers may work better when they ignore causality

-

MMA2 weeks ago

MMA2 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Sport2 weeks ago

Sport2 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

News3 weeks ago

News3 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Technology2 weeks ago

Technology2 weeks agoGet ready for Meta Connect

-

Business2 weeks ago

Ukraine faces its darkest hour

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Technology4 weeks ago

Technology4 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

News3 weeks ago

News3 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCardano founder to meet Argentina president Javier Milei

-

Politics3 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

MMA3 weeks ago

MMA3 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMeet the world's first female male model | 7.30

-

News3 weeks ago

News3 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Toning Workout for Women

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists have worked out how to melt any material

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoBeing in two places at once could make a quantum battery charge faster

-

News4 weeks ago

News4 weeks agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoEverything a Beginner Needs to Know About Squatting

-

TV3 weeks ago

TV3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Servers computers2 weeks ago

Servers computers2 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Technology2 weeks ago

Technology2 weeks agoThe best robot vacuum cleaners of 2024

-

News3 weeks ago

News3 weeks agoChurch same-sex split affecting bishop appointments

-

Politics3 weeks ago

Politics3 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Sport3 weeks ago

Sport3 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow one theory ties together everything we know about the universe

-

Business4 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMost accurate clock ever can tick for 40 billion years without error

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBlockdaemon mulls 2026 IPO: Report

-

Business3 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics3 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

News2 weeks ago

News2 weeks agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology2 weeks ago

Technology2 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Technology3 weeks ago

Technology3 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business3 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Travel3 weeks ago

Travel3 weeks agoDelta signs codeshare agreement with SAS

-

Politics2 weeks ago

Politics2 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology2 weeks ago

Technology2 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

You must be logged in to post a comment Login