CryptoCurrency

US Weighs Google Breakup in Historic Big Tech Antitrust Case

(Bloomberg) — The US Justice Department is considering asking a federal judge to force Google to sell off parts of its business in what would be a historic breakup of one of the world’s biggest tech companies.

Most Read from Bloomberg

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or anywhere you listen.

Antitrust enforcers are weighing a breakup to mitigate the Alphabet Inc. business’s dominance in search, the agency said in a court filing on Tuesday, confirming an earlier Bloomberg News report. Judge Amit Mehta could also order Google to provide access to the underlying data it uses to build its search results and artificial intelligence products, it said.

The Justice Department “is considering behavioral and structural remedies that would prevent Google from using products such as Chrome, Play, and Android to advantage Google search and Google search-related products and features,” the agency said.

The 32-page document lays out a framework of potential options for the judge to consider as the case moves to the remedy phase. The agency said it will provide a fuller proposal on remedies next month.

The effort is the most significant move to rein in a major tech company over illegal monopolization since Washington unsuccessfully sought to break up Microsoft Corp. two decades ago. The Justice Department and the US Federal Trade Commission have targeted Big Tech dominance, scrutinizing deals and investments and accusing some of the country’s most powerful companies of illegally dominating markets.

Google shares fell 1% in premarket trading in New York on Wednesday. A breakup of the company “is unlikely at this point despite the antitrust swirls,” said Daniel Ives, managing director and senior equity analyst at Wedbush Securities. “Google will battle this in the courts for years.”

The Justice Department earlier this year sued Apple Inc. for thwarting innovation by blocking rivals from accessing its hardware and software features. The FTC sent inquiries to Alphabet, Microsoft and Amazon.com Inc. about their investments in AI startups as part of a study on how these partnerships are impacting competition.

Antitrust enforcers said Google gained scale and data benefits from its illegal distribution agreements with other tech companies that made its search engine the default option on smartphones and web browsers. Google’s Android business encompasses the operating system used on smartphones and devices as well as apps.

The Justice Department also said it may seek a requirement that Google allow websites more ability to opt out of its artificial intelligence products. The agency said it’s considering proposals related to Google’s dominance over search text ads, such as requirements that the company provide more information and control to advertisers over where their ads appear. The department may also request that Google be restricted from investing in search competitors or potential rivals.

Google criticized the Justice Department’s filing as “radical,” saying it would have “significant unintended consequences for consumers, businesses, and American competitiveness.”

The DOJ’s proposals go “well beyond the legal scope of the Court’s decision about Search distribution contracts,” Lee-Anne Mulholland, Google’s vice president of regulatory affairs, wrote in a blog post.

Antitrust pressure from multiple cases is building against Google. Mehta, who ruled this summer that Google broke antitrust laws in both online search and search text ads markets, plans to hold a trial on the proposed remedy next spring and issue a decision by August 2025. Google has already said it plans to appeal Mehta’s decision, but must wait until he finalizes a remedy before doing so.

European Union watchdogs similarly touted the option of a breakup of Google’s business in order to appease antitrust concerns last year. The bloc’s competition chief Margrethe Vestager said that “divestiture is the only way” to settle worries over how the company favors its own services to the detriment of ad tech rivals, advertisers and online publishers. That EU case – which could come to a final decision by the end of this year – marked the latest escalation in a long-running saga that’s already led to a trio of EU penalties totaling more than €8 billion ($8.8 billion) for abuses across other Google services.

A group of US states that sued Google over its search monopoly separately from the Justice Department said they may seek to have the tech giant pay for a public education campaign about how to switch search engines.

On Monday, a different federal judge ordered Google to open up its app store for the next three years to resolve a separate antitrust case brought by Epic Games Inc. related to its dominance of app distribution on Android smartphones. The company also plans to appeal that decision.

Last month, the Justice Department and Google faced off in a third antitrust suit focused on the company’s dominance over the technology used to buy and sell online display ads. Closing arguments in that lawsuit are scheduled for late November. Antitrust enforcers have said they plan to seek to force Google to sell off parts of its ad tech business if the court finds the company monopolized that market.

–With assistance from Julia Love and Samuel Stolton.

(Updates with share move in sixth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

CryptoCurrency

DOJ’s Google breakup remedy puts tech world on notice

The US Justice Department said in a new court filing that it may recommend a break up of Google (GOOG, GOOGL) as an antidote to unhealthy competition in the search engine market, showing just how far Washington is willing to go to rein in Big Tech.

DOJ lawyers used a 32-page document to outline a framework of options for DC District Court Judge Amit Mehta to consider, including “behavioral and structural remedies that would prevent Google from using products such as Chrome, Play, and Android to advantage Google search.”

Google in a blog post said that “DOJ’s radical and sweeping proposals risk hurting consumers, businesses, and developers.”

Its stock fell slightly in pre-market trading Wednesday.

The proposal is the first step from the Justice Department to break up a tech empire since it tried to do so more than two decades ago with Microsoft (MSFT).

That case — which the DOJ referenced in its Tuesday court filing — resulted in a 2002 settlement that opened the door to broader competition in the internet browser software market.

The move by DOJ also sends a signal to other tech giants currently facing antitrust cases from DOJ and other Washington regulators as part of a wide-ranging effort by the Biden administration to rein in what it views as anticompetitive behavior across a number of industries.

The administration has already alleged anticompetitive conduct against tech giants Apple (AAPL) and Amazon (AMZN) and claimed that Microsoft’s acquisition of gaming giant Activision Blizzard would create a gaming market monopoly.

The case against Google targeting its dominance in search resulted in a landmark decision in August, where DC District Court Judge Amit Mehta sided with DOJ and concluded Google illegally monopolized the online search engine market and the market for search text advertising.

Mehta concluded that Google’s agreements with browser providers and devices powered by Google’s Android operating system stifled rivals from entering and growing within the markets.

It will now be up to Mehta to decide what should happen now in a separate “remedies” phase of the trial that will likely start in 2025.

DOJ is expected to provide a more detailed document by Nov. 20 outlining these remedies. But the 32-page document filed late Tuesday offers several points of focus beyond forcing Google to sell parts of its business.

One has to do with contracts that secure Google’s search engine as a default on internet browsers and internet-connected devices that use Google’s Android operating system.

Google pays as much as $26 billion per year to maintain its position on mobile devices like Apple (AAPL) and Samsung smartphones.

Justice Department lawyers said to prevent further harm they may seek to limit or terminate Google’s use of those contracts that use Chrome, Play and Android to advantage Google search, as well as “other revenue-sharing arrangements related to search and search-related products, potentially with or without the use of a choice screen.”

The DOJ could also ask the judge to force Google to share with rival browsers and search providers the data that it uses to refine its search algorithms, and limit the company’s dominance over search text ads.

DOJ suggested the judge should also consider blocking Google from illegally monopolizing related markets, in addition to the search and search text advertising markets.

It may ask the judge to force Google to give websites more ability to “opt out” of “any Google-owned artificial-intelligence product.”

Google pushed back on the DOJ’s suggestions.

“We believe that today’s blueprint goes well beyond the legal scope of the Court’s decision about Search distribution contracts,” Lee-Anne Mulholland, Google’s vice president of regulatory affairs, wrote in a blog post.

Google has promised to appeal. And Judge Mehta could hold off on any orders to alter Google’s behavior while it challenges his ruling in D.C.’s Circuit Court of Appeals.

The judge would lose the right to impose remedies if Google is found not to have broken the law on appeal.

And even if Google fails and is ordered to change its behavior, Judge Mehta could later adjust his orders to better ensure competition is restored.

Google faces antitrust challenges on other fronts. It is currently defending itself in a separate lawsuit from DOJ alleging a monopoly in the technology used to but and sell online ads.

And earlier this week another federal judge ordered Google to open up its app store as part of the resolution of a suit brought by Epic Games Inc.

DOJ cited that ruling in its Tuesday court filing that outlined a Google breakup as one possible remedy, noting that the judge in the Epic Games case said remedies should “bridge to moat” to combat network effects.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

CryptoCurrency

Everything HBO’s Bitcoin doc got wrong about Peter Todd and Satoshi

HBO’s “Money Electric” suggests Bitcoin developer Peter Todd is Satoshi Nakamoto, but contradictions and timeline errors abound.

CryptoCurrency

Billionaire Ken Griffin Just Bought 7.9 Million Shares of This Beaten-Down Pharmaceutical Stock as It Eyes the Weight Loss Market

Each quarter, hedge funds that manage over $100 million are required to file a Form 13F with the Securities and Exchange Commission (SEC). These filings break down which stocks investment firms bought and sold during the most recent quarter.

Ken Griffin is a billionaire investor who serves as CEO of the hedge fund Citadel. Last quarter, Citadel bought 7.9 million shares of Pfizer (NYSE: PFE) — increasing its stake in the pharmaceutical giant by 63%.

The last few years have featured a lot of ups and downs for Pfizer. While shares have posted break-even returns so far in 2024, Pfizer stock has cratered by more than 30% over the last three years.

Below, I’ll outline some of the bigger factors that have been weighing on Pfizer while also sharing my thoughts on what may have influenced Citadel to load up on the stock.

What is causing Pfizer stock to drop?

I see three major influences that have contributed to Pfizer’s beaten-down stock price.

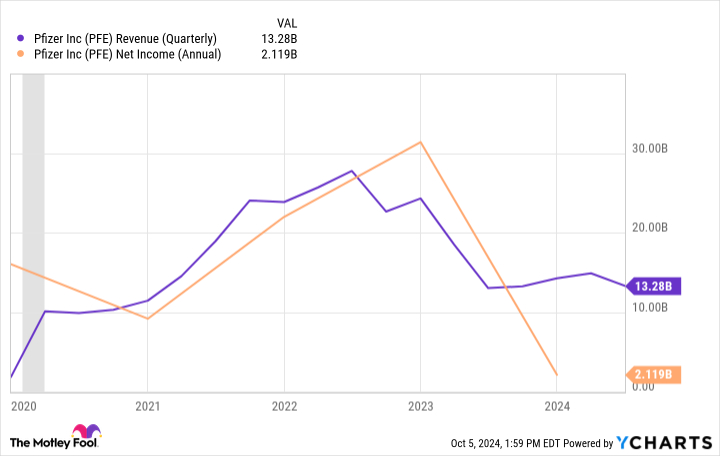

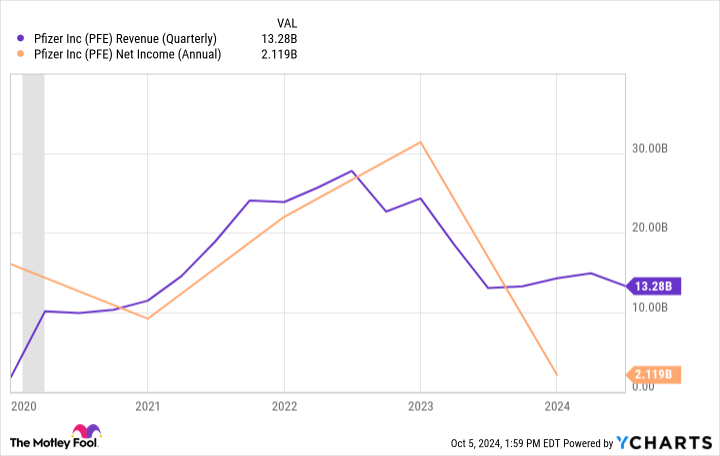

1. COVID-19: Along with Moderna and Johnson & Johnson, Pfizer played an instrumental role in developing vaccines that combated the COVID-19 virus. In the chart below, the grey shaded column represents the short-lived COVID-19 recession.

Between 2020 and 2022, Pfizer’s revenue and profits soared thanks in large part to the company’s COVID-related medications, Comirnaty and Paxlovid. However, since the fourth quarter of 2022, Pfizer’s growth has witnessed a noticeable deceleration due to falling demand for these COVID treatments as the world emerged from peak pandemic conditions.

2. Acquisitions: In an effort to combat stalling growth and diversify its product offerings, Pfizer acquired oncology specialist Seagen for $43 billion back in December 2023. While revenue from Seagen will help offset the declining sales of Comirnaty and Paxlovid, acquisitions often take years of integration efforts before they are fully accretive.

3. Road map: One risk to always keep in mind with pharmaceutical stocks is that these companies face patent cliffs on their medications. Over the next few years, Pfizer expects to face patent challenges over some of its biggest drugs, including Eliquis, Ibrance, Prevnar 13, and Xtandi. Although it’s difficult to know how much Pfizer’s growth will be impacted as generic alternatives to these treatments hit the market, the company could very well lose out on billions in sales.

Something else may be lingering in the background

Considering sales from Pfizer’s blockbuster COVID treatments are declining combined with billions more in revenue at stake thanks to expiring patents, what else can Pfizer do to offset these risks besides inorganic growth derived from acquisitions?

One hot area in the healthcare realm that Pfizer has been eyeing for some time is weight loss. Glucagon-like peptide-1 (GLP-1) agonists such as Ozempic, Wegovy, Rybelsus, Saxenda, Mounjaro, and Zepbound have been transformative growth drivers for their developers, Novo Nordisk and Eli Lilly.

The global total addressable market (TAM) for GLP-1s is expected to reach $100 billion by 2030, according to research from Goldman Sachs. Although Lilly and Novo Nordisk dominate the GLP-1 space at the moment, a number of other pharmaceutical companies of varying sizes are competing to break into the market.

While it’s still early days for Pfizer’s GLP-1 candidate, Danuglipron, recent clinical testing has indicated the drug is well tolerated.

The bottom line

Considering the unknowns surrounding Pfizer’s business as it relates to offset declining sales from COVID medications, the vulnerability presented by patent cliffs, and the multi-year timeline surrounding large-scale acquisitions, I’m not surprised to see Pfizer stock continue sliding.

Right now, Pfizer trades at a forward price-to-earnings (P/E) multiple of just 10.8. To put this into perspective, this is less than half of the S&P 500 index’s forward P/E multiple of 23.2.

I think the current trading activity surrounding Pfizer stock paints a clear picture; many investors are thinking about the short-term risks instead of longer-term prospects. Another way of looking at it is that the potential gains from Danuglipron combined with growth from Seagen could more than offset any losses from other medications in the long term.

Pfizer’s contracting valuation and its potential to enter the new markets may be what is compelling Citadel to continue buying the stock.

With all of this said, it is going to take years before Pfizer hits its stride in the oncology treatment market. Moreover, there is no guarantee that its ambitions in the weight loss realm will ever come to fruition, as much more testing with the Food and Drug Administration (FDA) will be required before Danuglipron potentially hits the market.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $814,364!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Adam Spatacco has positions in Eli Lilly and Novo Nordisk. The Motley Fool has positions in and recommends Goldman Sachs Group and Pfizer. The Motley Fool recommends Johnson & Johnson, Moderna, and Novo Nordisk. The Motley Fool has a disclosure policy.

Billionaire Ken Griffin Just Bought 7.9 Million Shares of This Beaten-Down Pharmaceutical Stock as It Eyes the Weight Loss Market was originally published by The Motley Fool

CryptoCurrency

Bill Gross Recommends Shift to Defensive Stocks as Rally Loses Steam

(Bloomberg) — The rally that’s helped US stocks almost double in value over the past five years is tapering off, and investors should expect low but positive returns on their investments, according to Bill Gross.

Most Read from Bloomberg

The billionaire investor recommends keeping exposure to the stock market at average levels, while focusing portfolios more on defensive stocks with a small position in bonds.

“No bear market, but it’s not the same bull market anymore,” Gross, the co-founder and former chief investment officer of Pacific Investment Management Co., wrote in his latest investment outlook.

Gross’s comments add to a steady drumbeat of warnings the furious rally that’s pushed the S&P 500 to record highs may be running out of steam. A small-but-growing cohort of market watchers have cast doubt on the AI frenzy, which has been one of the biggest contributors to the surge in stocks, while others have warned that the forthcoming US presidential election could test investor optimism.

In the note, Gross lists negative headwinds, such as high valuations, geopolitical risks and an unsustainable government deficit, against positives forces, including inflation nearer to the Federal Reserve’s target and AI investment spending.

Among the negatives, Gross also cited potential increases in corporate taxes if Democrat Kamala Harris wins the election on Nov. 5 and her party takes a majority in Congress. Reports that Warren Buffett is now hoarding a record amount of cash also serve as a warning about the “bumpy road ahead,” Gross said.

Gross retired from the money-management business in 2019 and has since shared investment thoughts and trade ideas on his website and social media.

Gross’s favorite investments include Annaly Capital Management, a high-yielding mortgage REIT, DWS Municipal Income Trust, a close-end muni fund, and master limited partnerships (MLPs), which are tied to oil and gas contracts. He also likes Allete Inc, a utility company that is a buyout target.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

CryptoCurrency

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic

Many companies have witnessed a tremendous increase in their share prices over the past couple of years thanks to the growing adoption of artificial intelligence (AI), which is not surprising as this technology has created massive demand for both hardware and software.

The good part is that AI is currently in its early phases of growth. IDC estimates that global AI spending could increase at an annual rate of 29% over the next five years, hitting $632 billion in value in 2028.

This robust increase in the adoption of AI could help make companies like Nvidia (NASDAQ: NVDA) and Snowflake (NYSE: SNOW) make a parabolic move, which refers to the rapid rise in the stock price of a company in a short time (just like the right side of a parabolic curve).

Nvidia stock has already gained immensely in the past couple of years thanks to its pioneering role in the AI hardware market, but Snowflake has headed south because of its slowing growth. More specifically, Snowflake stock is down over 42% in 2024, while Nvidia has jumped 152%.

Let’s look at the reasons why AI could help one of these names make a parabolic jump and head even higher while also allowing the beaten-down Snowflake to rise rapidly.

Nvidia’s new Blackwell chips could fuel its rally

The robust demand for Nvidia’s data center graphics processing units (GPUs) based on the Hopper architecture has played an instrumental role in the company’s outstanding growth in recent quarters. Demand for its H100 Hopper AI GPUs was so solid that the chip reportedly commanded a waiting period of as long as a year.

The company followed up this chip with the more powerful H200 processor, whose production ramp and shipments started in the previous quarter.

Nvidia points out that the shipments of its Hopper-based GPUs will increase in the second half of the current fiscal year thanks to improved supply and availability, suggesting that the H200 could continue to bring in more business for the company. However, all eyes are set on Nvidia’s next generation of AI chips based on the Blackwell platform.

The company started sampling the Blackwell processors to customers last quarter. Nvidia says that the production ramp of the Blackwell chips will begin in the fourth quarter of the fiscal year. More importantly, Nvidia claims that the “demand for Blackwell platforms is well above supply, and we expect this to continue into next year.”

Additionally, CEO Jensen Huang recently told CNBC that Blackwell is witnessing “insane” demand. That’s not surprising as the company has already lined up multiple customers that include the likes of Microsoft, OpenAI, Meta Platforms, and others for this chip that’s reportedly going to deliver a 4 times jump in performance over the Hopper chips.

Morgan Stanley estimates that Nvidia could sell $200 billion worth of Blackwell-based server systems next year. While that seems like an ambitious target, the pace at which Nvidia’s data center revenue is growing suggests that it could indeed hit that mark. More specifically, Nvidia’s data center revenue has more than tripled in the first six months of fiscal 2025 to $49 billion from $14.6 billion in the same period last year.

The current run rate suggests that Nvidia could end the year with $98 billion in data center revenue. That would be more than double its fiscal 2024 data center revenue of $47.5 billion. Morgan Stanley’s forecast suggests that Nvidia may be able to double its data center revenue once again in the next fiscal year. If that’s indeed the case, the semiconductor giant’s top line could land well ahead of the $178 billion revenue that analysts are expecting from the company next fiscal year.

That could reignite Nvidia’s stupendous rally once again following a flat performance in the past three months and could even help the stock go on a parabolic run.

AI is helping Snowflake build a solid revenue pipeline

Snowflake is a cloud-based data platform provider on which customers store and consolidate data so that they can derive insights using that data, build applications, and even share that data. And now, Snowflake is adding AI-focused capabilities to its data cloud platform.

The company has been renting GPUs so that it can “fulfill customer demand for our newer product features,” suggesting that Snowflake’s AI offerings are gathering momentum. Snowflake enables its customers to develop AI applications using large language models (LLMs) and deploy those models within the secure environment of its data cloud platform.

Snowflake customers can build custom chatbots, use the company’s Copilot feature to speed up their tasks and extract data from documents, among other things. Snowflake management pointed out on the August earnings conference call that more than 2,500 customers were using its AI offerings in its fiscal 2025’s second quarter (ended July 31).

It is worth noting that Snowflake ended the quarter with just over 10,000 customers, indicating that it is well-placed to upsell its AI services to a large customer base. The good part is that the growing adoption of its AI tools is leading to increased spending by existing customers.

The company’s net revenue retention rate stood at 127% in fiscal Q2, a metric that compares the spending by its customers at the end of a particular period to the spending by the same customer base in the year-ago period. So, a net revenue retention rate of more than 100% means that it is winning a bigger share of customers’ wallets.

Even better, the quality of Snowflake’s customer base seems to be improving as well. This is evident from the fact that the number of customers who have generated more than $1 million in product revenue for the company increased by 28% year over year to 510 in the previous quarter, as compared to the 21% growth in the overall customer base.

This combination of higher spending by its existing customers as well as the addition of new customers explains why Snowflake’s remaining performance obligations (RPO) shot up a remarkable 48% year over year last quarter to $5.2 billion. That exceeded the 30% year-over-year growth in the company’s product revenue.

As RPO refers to the total value of a company’s future contracts that are yet to be fulfilled, the faster growth in this metric as compared to its revenue growth suggests that Snowflake’s revenue growth is likely to accelerate in the long run. Of course, the investments that the company is making are weighing on its margins, with its non-GAAP (adjusted) operating margin dropping to 5% last quarter from 8% in the year-ago period.

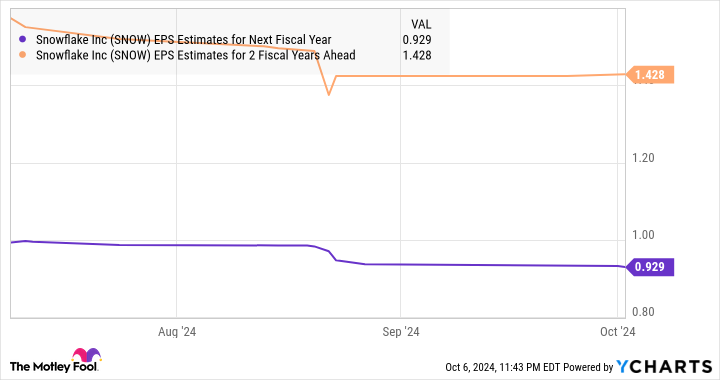

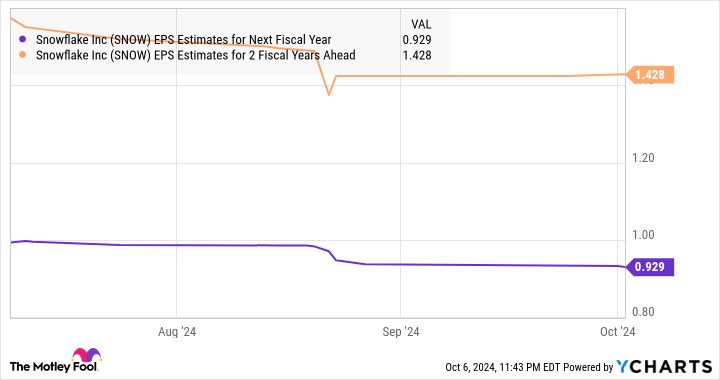

That’s why analysts are expecting Snowflake’s bottom line to shrink to $0.61 per share in fiscal 2025 from $0.98 per share in the previous year. However, it is expected to return to terrific bottom-line growth from the next fiscal year.

As such, investors should consider buying Snowflake stock while it is down, as the emergence of AI and the acceleration in its growth thanks to the adoption of this technology could send the stock flying.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $814,364!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms, Microsoft, Nvidia, and Snowflake. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic was originally published by The Motley Fool

CryptoCurrency

Bitcoin’s compressed $62K price signals ‘a large’ move next

Bitcoin’s consolidating price has a trader suggesting a big move is imminent, though uncertainty remains about the direction of BTC price in the coming days.

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 weeks ago

Technology3 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment3 weeks ago

Science & Environment3 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

News2 weeks ago

News2 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

News3 weeks ago

the pick of new debut fiction

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLaser helps turn an electron into a coil of mass and charge

-

News3 weeks ago

News3 weeks agoYou’re a Hypocrite, And So Am I

-

Sport3 weeks ago

Sport3 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Business2 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNerve fibres in the brain could generate quantum entanglement

-

News3 weeks ago

News3 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology2 weeks ago

Technology2 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Football2 weeks ago

Football2 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoRethinking space and time could let us do away with dark matter

-

News3 weeks ago

News3 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

MMA2 weeks ago

MMA2 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Business2 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA slight curve helps rocks make the biggest splash

-

News3 weeks ago

News3 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

News3 weeks ago

News3 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Technology2 weeks ago

Technology2 weeks agoQuantum computers may work better when they ignore causality

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCardano founder to meet Argentina president Javier Milei

-

News3 weeks ago

The Project Censored Newsletter – May 2024

-

News2 weeks ago

News2 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMeet the world's first female male model | 7.30

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Toning Workout for Women

-

Technology2 weeks ago

Technology2 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Technology2 weeks ago

Technology2 weeks agoGet ready for Meta Connect

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Sport2 weeks ago

Sport2 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe maps that could hold the secret to curing cancer

-

Technology3 weeks ago

Technology3 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Politics3 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoEverything a Beginner Needs to Know About Squatting

-

News2 weeks ago

News2 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

News3 weeks ago

News3 weeks agoChurch same-sex split affecting bishop appointments

-

Sport3 weeks ago

Sport3 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Business3 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBlockdaemon mulls 2026 IPO: Report

-

TV2 weeks ago

TV2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Servers computers2 weeks ago

Servers computers2 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Technology2 weeks ago

Technology2 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

News2 weeks ago

News2 weeks agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology2 weeks ago

Technology2 weeks agoThe best robot vacuum cleaners of 2024

-

Business1 week ago

Ukraine faces its darkest hour

-

Politics3 weeks ago

Politics3 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology3 weeks ago

Technology3 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow one theory ties together everything we know about the universe

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business3 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Business3 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Politics3 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

MMA3 weeks ago

MMA3 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Travel2 weeks ago

Travel2 weeks agoDelta signs codeshare agreement with SAS

-

Politics2 weeks ago

Politics2 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoKeep Your Goals on Track This Season

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists have worked out how to melt any material

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSingle atoms captured morphing into quantum waves in startling image

You must be logged in to post a comment Login