CryptoCurrency

VW, BMW and Mercedes Are Getting Left in the Dust by China’s EVs

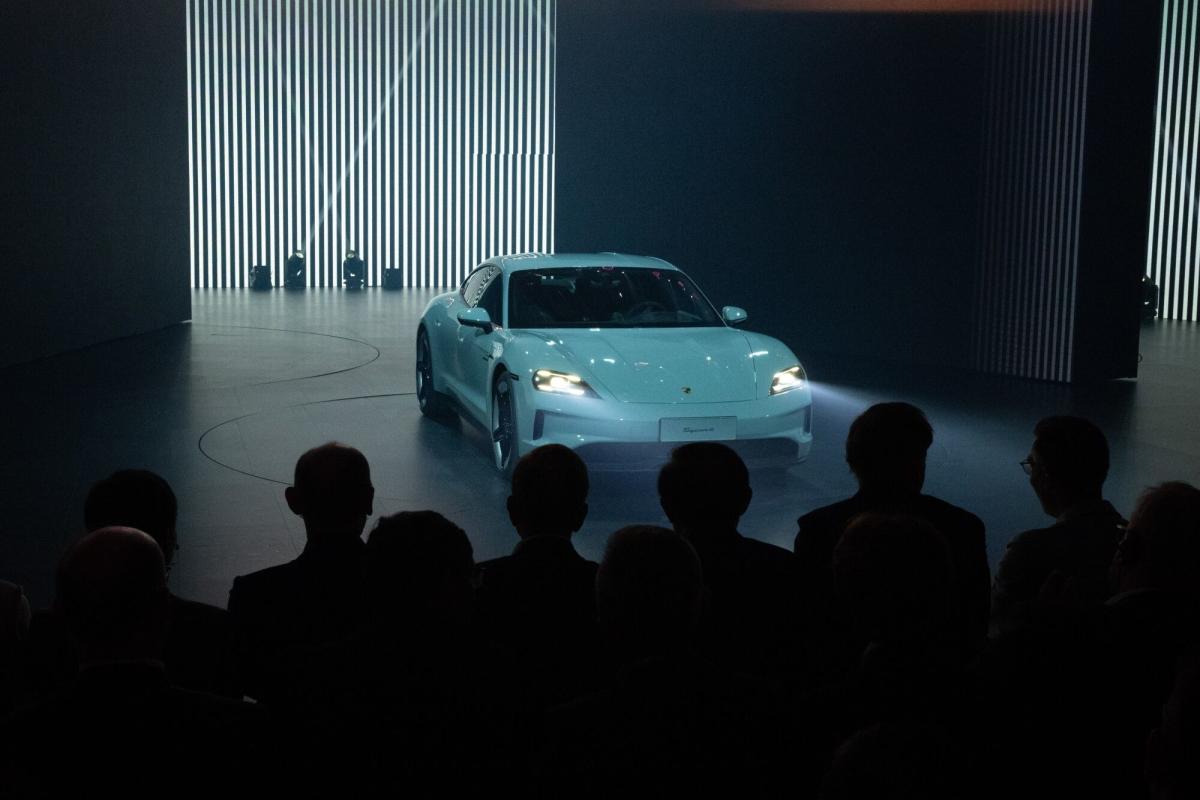

(Bloomberg) — Ryan Xu was a dream customer for Germany’s automakers. The Guangdong-based entrepreneur and her husband own a Porsche 911 and a Mercedes-Benz G-Class and were among the first buyers of the electric Porsche Taycan.

Most Read from Bloomberg

But her views on German cars have soured as Chinese consumers increasingly favor tech refinement over traditional selling points like horsepower and handling. The software systems in the Taycan, which costs well over $100,000, were “terrible,” the 36-year-old mother of three said. It was “just an electrified Porsche — and that’s it.”

Her assessment isn’t isolated. As China moves away from combustion-engine cars, Volkswagen AG, Mercedes-Benz Group AG and BMW AG are struggling to offer electric vehicles that appeal to customers in their largest and most lucrative market, putting €35 billion ($38 billion) of investment on the line.

The latest warning signs came last week, when all three German manufacturers reported slumping third-quarter sales in China. BMW posted its steepest sales drop there in more than four years, a 30% plunge, and Mercedes’ deliveries declined 13% amid poor demand for its priciest cars, including S-Class and Maybach limousines.

Porsche’s sales in China tumbled 19% to its worst third-quarter performance in a decade as global demand for the Taycan nearly halved. Volkswagen — the parent of Porsche and Audi — reported a 15% decline. “The competitive situation in China is particularly intense,” said Marco Schubert, who oversees sales for VW.

After dominating the gas-guzzler era, German manufacturers became complacent, underestimating the threats posed by new rivals and reluctant to abandon the profits generated by big-engine cars. That allowed Tesla Inc. and local manufacturers led by BYD Co. to speed by with tech-savvy and affordable plug-ins, and now China no longer needs or wants them there.

“The turning point is happening now for these automakers,” said Stephen Dyer, a Shanghai-based managing director at consultant AlixPartners. “They need to dramatically change their strategy in the market.”

The next challenge is already on display at this week’s Paris auto show, where Chinese manufacturers are stepping up their efforts to take market share in Europe. Companies including BYD and Xpeng Inc. will showcase their latest technology at the biggest European car event this year.

At least one response effort didn’t go as planned. The microphone and slide show cut out for several minutes in the midst of Volkswagen’s presentation about future electric vehicles, leaving sales and marketing chief Martin Sander visibly frustrated.

It’s an emotion shared by drivers in China. After dealing with braking and other quality issues, the Xu family sold their Taycan and bought an ET5 from Chinese brand Nio Inc. The car was about a third cheaper than a Mercedes EQE, which Xu also considered, but offered a more luxurious interior design, smooth voice controls, and greeted their kids by name as they climbed in.

“German cars can hardly match” that level of technology, said Xu, who runs a business with her husband. Mercedes, BMW and Audi “can hardly be seen as luxury cars now.”

While German automakers still control nearly 15% of the Chinese market, that’s down from a quarter before the pandemic and worse yet, their share of EVs is less than 10%. Without a quick turnaround, the slump risks turning into a rout and tipping German’s Big Three into an existential fight. As it is, VW, Mercedes and BMW are each only worth about half of BYD’s stock-market value.

Even more than other international peers, Germany’s automakers have gone all in on China. While some rivals have cut their losses, the Germans aren’t giving up, shifting more resources in an effort to claw back market share. But it looks like an uphill fight as Beijing actively seeks to build up its own manufacturers.

Volkswagen plans to play the long game. A spokesperson for the Wolfsburg-based company said the Chinese car market has been marked by steep discounts, and it wouldn’t buy market share at the expense of profitability.

The company plans to continue its “in China, for China” strategy to protect its long-term prospects. BMW and Mercedes are also planning to stick with a localization approach to appeal to buyers there.

The reasons for doubling down are clear. With Europe’s auto market probably past its peak and the US saturated, there’s no viable alternative to China for a similar level of volumes and profits.

That raises concerns given their massive footprint in China. As a group, Germany’s carmakers operate a network of over 40 factories — more than in their homeland. That’s too much investment to simply give up on — and explains why they oppose the European Union’s plans to levy tariffs on China’s cheap electric cars.

Pulling out of China — as General Motors Co. and smaller Japanese brands Suzuki Motor Corp. and Mitsubishi Motors Corp. have done — is almost unthinkable. And any restructuring would be complicated, given the operations are caught in a complex web of relations with government entities. That puts the focus on developing the kinds of features that Chinese customers want.

Urgency started to intensify in late 2022. After Volkswagen’s China chief Ralf Brandstätter warned the supervisory board that Chinese carmakers had leaped ahead, the company then chartered flights to send hundreds of staff to the Shanghai auto show in April 2023 — the first installment after years of Covid lockdowns — to see for themselves.

It was a sobering reality check. The German executives were confronted with a rapid rollout of affordable Chinese models, tech-loaded products and an intensified price war. There was also a slew of gimmicky innovations like a hopping sports car and in-car karaoke, which may have been quirky but reset the bar for Chinese consumers about the source of automotive trends.

Since then, there has been an intense competitive response. A few weeks after the auto show, VW Chief Executive Officer Oliver Blume ousted the head of software unit Cariad in the latest effort to accelerate and improve technology. Alongside new Chinese partnerships for autonomous driving, infotainment and user experience, VW also invested in Guangzhou-based Xpeng to underpin a plan to build cars using the startup’s EV expertise.

After a profit warning in September, one of the first actions by Mercedes CEO Ola Källenius was to fly to China to check on progress in reshaping its presence there including tapping CATL for batteries and Tencent Holdings Ltd. for digital services. BMW responded by joining forces with Great Wall Motor Co. to build EVs for its Mini brand.

The cumulative result is that German cars will become progressively less German in their largest market. The expansion is also exactly the opposite of the government’s aim to reduce exposure to China, according to Gregor Sebastian, an analyst at Rhodium Group.

Clinging to their position in China is “a huge gamble,” he said, noting that the German state might need to bail them out if it all goes wrong. “They’re hoping they’re too big to fail.”

While China eagerly bought up German cars for years, the market has changed and reclaiming that enthusiasm from a clientele that’s younger, more tech-oriented than in Europe is a major challenge. With the switch to electrics, local brands have shown they can match VW, BMW and Mercedes on quality and beat them on price and technology.

What that means for Germany can be seen inside a production hall at Mercedes’ Sindelfingen site near Stuttgart. It’s home of the flagship S-Class, long a favorite of China’s nouveau riche. But demand has slumped and production has been reduced to a single shift for the first time.

While cost-cutting has started to roll over Germany’s auto industry — most notably with VW’s threats to close factories in its homeland — Chinese operations are still insulated. It’s a sign that executives are hopeful for a turnaround. But they also have little choice.

Downsizing operations in China is difficult because large-scale job cuts often need to be discussed with domestic partners and approved by local authorities, which have little incentive to be cooperative. More drastic changes like shutting a plant is even harder.

Land in China is owned by the government and that means a factory can’t simply be shuttered and sold — even if a buyer could be found. The case of Hyundai Motor Co.’s exit from a plant in Chongqing illustrates the risk. After several attempts to sell the factory building and the machinery, the Korean carmaker ultimately accepted an offer from the local state-operated industrial zone for a fifth of its investment.

That puts pressure on Germany’s carmakers to revive sales, but the playing field has tilted in favor of domestic players. Beijing has directed several key state-owned automakers, including VW partner FAW Group, to prioritize technology and market share over profitability. That’s hardly an option for Germany’s publicly-listed carmakers.

Despite the structural headwinds, the downturn might have been prevented by more forward-looking investment in the Chinese market. But after decades at the pinnacle of the auto industry, Chinese rivals weren’t taken seriously and local insight was bypassed as decisions were funneled through boardrooms thousands of miles away.

There also wasn’t enough attention paid to the fact that the switch to EVs was about more than swapping out one powertrain for another, and early software was buggy. For instance, VW only managed to turn on over-the-air updates years after launching its its first Chinese electric model in 2020.

That meant owners had to send their cars to dealers for in-store upgrades — which could at times take days. To overcome resistance, some dealers offered cash incentives to encourage customers to fix faults.

Zhou, an IT engineer living in Wuhan, had to endure the frustration after buying an ID.4 in early 2022. With screens going black several times in the middle of driving, he got glitches instead of German quality. Updates were also regularly behind schedule or available only via the dealer.

He’s now seeking a replacement. It will be another EV, but this time “I won’t visit any German dealerships,” he said. “I’ll only go for local brands, or Tesla.”

–With assistance from Stefan Nicola and Monica Raymunt.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

CryptoCurrency

Thailand’s oldest bank announces stablecoin remittance services

The Siam Commercial Bank Public Company, founded in 1907, was the first bank established in the South Pacific country.

CryptoCurrency

Price analysis 10/16: BTC, ETH, BNB, SOL, XRP, DOGE, TON, ADA, AVAX, SHIB

Bitcoin bulls are keen to hit $70,000, but a selloff at this level could trigger a sharp downside in BTC and altcoins.

CryptoCurrency

Trump Media stock plunges after weekslong rally

After a weekslong rally that saw shares of Trump Media & Technology Group (DJT) roughly triple in value, the stock took an 8% nosedive Tuesday afternoon.

Shares of the company behind former President Donald Trump’s right-wing social media platform Truth Social fell to $26.60 apiece after having been up roughly 10% that morning. Tuesday’s volatility led to the Nasdaq briefly halting trading.

The company’s stock has fluctuated wildly in value in the nearly seven months since it went public under the ticker DJT. Late last month, shares dropped as low as $12.15 each. Since Oct. 1, however, Trump Media shares are up 70%.

This see-sawing comes just weeks before the presidential election, which will see Trump face off against Democratic presidential candidate and Vice President Kamala Harris at the ballot box.

Trump is a majority shareholder of Trump Media, holding roughly 57% of the company’s stock — and he has said he has no plans to let go of his holdings. The stock’s recent rally has added some $2 billion to Trump’s net worth.

Trump Media has been widely considered a “meme stock” or “affinity stock,” with shares trading largely on sentiment about the former president by retail and individual investors, regardless of the company’s actual operating results or prospects.

“It’s purchasing his brand,” John Rekenthaler, vice president of research at Morningstar (MORN), previously told Quartz. He warned that the company’s stock could “go to zero” or close to it if Trump loses the coming election.

Trump Media has said in regulatory filings that its “success depends in part on the popularity of its brand and the reputation and popularity” of Trump and that “adverse reactions to publicity relating to [Trump], or the loss of his services, could adversely affect TMTG’s revenues and results of operations.”

CryptoCurrency

Why Semiconductor Stocks Micron, Applied Materials, and KLA Corporation Plunged Today

Shares of memory leader Micron (NASDAQ: MU), Applied Materials (NASDAQ: AMAT), and KLA Corporation (NASDAQ: KLAC) plunged on Tuesday, down 4.3%, 10.9%, and 15.5%, respectively, as of 3:28 p.m. ET.

Semiconductor stocks largely sold off across the board today after equipment leader ASML Holdings (NASDAQ: ASML) accidentally leaked its third-quarter results and outlook, which were supposed to be published tomorrow.

The results and guidance were highly disappointing, sending fears across the sector.

ASML disappoints on a “slower than expected” recovery

In the leaked press release, ASML showed 11.2% revenue growth and 9.1% earnings-per-share (EPS) growth, which aren’t terrible growth figures by any means, with the top line exceeding the company’s guidance last quarter.

However, the bookings figure and outlook for 2025, also contained in the press release, were more worrisome. Net bookings, which reflect revenue plus or minus the change in orders in backlog, were only 2.6 billion euros (~$2.8 billion), far below expectations of 5.39 billion euros (~$5.87 billion).

Moreover, management gave preliminary revenue guidance for 2025 of between 30 billion and 35 billion euros (~$33 billion to $38 billion). While that still portends mid-teens growth above expected 2024 figures of 28 billion euros (~$30 billion), it was below the 36.3 billion euros (~$39.5 billion) analysts were expecting.

Management noted in the press release:

While there continue to be strong developments and upside potential in AI, other market segments are taking longer to recover. It now appears the recovery is more gradual than previously expected. This is expected to continue in 2025, which is leading to customer cautiousness.

ASML is likely referring to Intel, which has seen lower near-term demand, and Samsung, which has been beset by operational issues and is pushing out its fab expansions. ASML management also noted limited capacity additions for DRAM memory suppliers, as most are converting unused equipment for non-artificial intelligence (AI) memory to production lines for HBM and DDR-5 for AI.

The semiconductor capital equipment sector is very linked. So, if a large fab is pushed out, not only will ASML see slower growth, but so will the etch and deposition equipment supplied by Applied Materials and the metrology and inspection equipment provided by KLA Corporation along with it. Thus, it’s no surprise to see each of those stocks sell off to ASML today by a similar amount.

Micron is also down, given that ASML indicated softer end-demand across non-AI markets. However, it may also be positive for Micron that memory rivals are scaling back their investments in memory capacity. Unlike that of advanced logic chips, memory pricing can fluctuate a lot based on supply and demand. So, the discipline to pull back investments could be a good thing for memory pricing. That’s likely why Micron’s stock is holding up better than the others.

The sell-off may be a good opportunity

This sell-off may be an opportunity for chip investors since the recovery in non-AI markets is very likely to happen at some point, even if a full recovery doesn’t happen as fast as some forecast. After all, the midpoint of ASML’s guidance still points to 16% growth next year. And pushing fab buildouts from 2025 to 2026 should entail more sustained growth beyond 2025.

It seems that 2024 corporate budgets may have been dominated by expensive AI spending, crowding out refreshes of non-AI servers and PCs. However, this aging equipment will have to be refreshed eventually, especially since Windows 10 support will be phased out in October 2025. Furthermore, as more AI-enabled devices come to market, that should be a boon for chip content across all devices in PCs, smartphones, and auto markets that are still lagging today.

So, for those investors with a long-term view, this sell-off based on the medium-term outlook may be an opportunity to pick up high-quality semiconductor names, such as these three, for the long haul.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,122!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,756!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $384,515!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Billy Duberstein and/or his clients have positions in ASML, Applied Materials, Intel, KLA, and Micron Technology. The Motley Fool has positions in and recommends ASML and Applied Materials. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Why Semiconductor Stocks Micron, Applied Materials, and KLA Corporation Plunged Today was originally published by The Motley Fool

CryptoCurrency

Can You Guess What Percent Of People Have $4 Million? Here’s A Look At How Many Reach This Major Wealth Milestone

When you hear “$4 million,” does it sound like a dream retirement nest egg or an actual goal? If you’re thinking, “Yeah, right!” you’re not alone.

Most people are curious about how they compare to others in terms of savings, but few can fathom hitting such a high target. So, how many people have $4 million saved? And more importantly, do you need that much to retire comfortably? According to a study, many people believe you need even more than this for retirement!

Don’t Miss:

The $4 Million Reality

According to data based on estimates from the Federal Reserve, having a net worth of $4 million places you in the top 3% of American households. That’s an elite group, for sure.

Leigh Baldwin & Co. Advisory Services reports about 4,473,836 U.S. households have amassed $4 million or more in wealth. This figure represents roughly 3.44% of all households in the country.

While this is a slim percentage, a recent survey from New York Life found that today’s workers believe they would need an average of $4.3 million to retire comfortably. The idea of having millions tucked away for your golden years might sound ideal, but the reality for most people is quite different.

See Also: Can you guess how many retire with a $5,000,000 nest egg? – How does it compare to the average?

Where Do Americans Stand?

Let’s get real: most Americans are nowhere near that kind of savings. Having $1 million in tax-advantaged retirement accounts could put you in the top 3.2% of retirement savers, but most people find themselves far behind this mark.

According to the Federal Reserve Survey of Consumer Finances, Americans’ average retirement savings is $334,000, while the median – a more accurate picture – is just $86,900. Although people may feel they need millions to retire, they aren’t actually saving millions.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

The question of how much you need to retire comfortably pops up for savers again and again. In a Forbes article, Michelle Richter-Gordon, co-founder of Annuity Research and Consulting in New York City, explained, “People don’t know how much they need at all. They also don’t know when they will retire.”

The problem is compounded by many people relying on online retirement calculators to figure out their savings needs. While these tools can be helpful, they often overestimate the amount of money required, leaving people feeling overwhelmed or discouraged.

Some of these calculators are provided by investment firms, which may want to boost your contributions to grow their revenues. It’s no wonder that retirement feels like an uphill battle for many.

What Do You Need for Retirement?

It’s important to consider your retirement goals. The amount you need depends on various factors, such as where you plan to live, lifestyle choices and health care costs.

Many experts suggest that aiming for around $1 million to $2 million in retirement savings may be more realistic for most Americans, especially when factoring in Social Security benefits and other sources of income.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

Even if saving millions of dollars seems like a distant dream, losing hope is unnecessary. Start by setting achievable goals, saving consistently and monitoring your long-term financial health. The road to retirement doesn’t have to be intimidating. Ultimately, it’s about making smart financial choices that allow you to live comfortably, not just chasing big numbers.

It’s always a good idea to consult with a financial advisor to ensure you’re on track to retire where you want, without the pressure of hitting some magic number.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Can You Guess What Percent Of People Have $4 Million? Here’s A Look At How Many Reach This Major Wealth Milestone originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CryptoCurrency

Bitcoin open interest soars to one-year high as BTC price rallies toward $68K

Demand for leverage in BTC futures jumped to $38 billion, but traders appear well-positioned enough to avoid surprise price swings.

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 weeks ago

Technology3 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

News1 month ago

the pick of new debut fiction

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

News4 weeks ago

News4 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology4 weeks ago

Technology4 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Technology2 weeks ago

Technology2 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Business2 weeks ago

Business2 weeks agoWhen to tip and when not to tip

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Business2 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

TV2 weeks ago

TV2 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Sport2 weeks ago

Sport2 weeks agoWales fall to second loss of WXV against Italy

-

TV2 weeks ago

TV2 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

MMA2 weeks ago

MMA2 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

News2 weeks ago

News2 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

Sport2 weeks ago

Sport2 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Business3 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

News1 month ago

News1 month agoYou’re a Hypocrite, And So Am I

-

News2 weeks ago

News2 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Football2 weeks ago

Football2 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

News2 weeks ago

News2 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

News2 weeks ago

News2 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

News2 weeks ago

News2 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

Science & Environment1 month ago

Science & Environment1 month agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment1 month ago

Science & Environment1 month agoRethinking space and time could let us do away with dark matter

-

Science & Environment1 month ago

Science & Environment1 month agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Sport1 month ago

Sport1 month agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

News1 month ago

News1 month agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Health & fitness1 month ago

Health & fitness1 month agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

News4 weeks ago

The Project Censored Newsletter – May 2024

-

Technology3 weeks ago

Technology3 weeks agoQuantum computers may work better when they ignore causality

-

Sport3 weeks ago

Sport3 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Technology3 weeks ago

Technology3 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Technology2 weeks ago

Technology2 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

News2 weeks ago

News2 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

MMA2 weeks ago

MMA2 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology2 weeks ago

Technology2 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Technology2 weeks ago

Technology2 weeks agoA very underrated horror movie sequel is streaming on Max

-

News2 weeks ago

News2 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

Servers computers3 weeks ago

Servers computers3 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

MMA3 weeks ago

MMA3 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Technology4 weeks ago

Technology4 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Politics3 weeks ago

Robert Jenrick vows to cut aid to countries that do not take back refused asylum seekers | Robert Jenrick

-

Technology3 weeks ago

Technology3 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Business3 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

Football3 weeks ago

Football3 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Business2 weeks ago

LVMH strikes sponsorship deal with Formula 1

-

TV2 weeks ago

TV2 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

Technology2 weeks ago

Technology2 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Politics2 weeks ago

Politics2 weeks agoHochul’s careful conversations

-

Money2 weeks ago

Money2 weeks agoWhy thousands of pensioners WON’T see State Pension rise by full £460 next year

-

Technology2 weeks ago

Technology2 weeks agoMusk faces SEC questions over X takeover

-

Politics2 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

Business2 weeks ago

CEOs turn to podcasts to control their message

-

MMA2 weeks ago

MMA2 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Technology2 weeks ago

Technology2 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

Sport2 weeks ago

Sport2 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

News2 weeks ago

News2 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Technology2 weeks ago

Technology2 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Technology1 month ago

Technology1 month agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment1 month ago

Science & Environment1 month agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

News1 month ago

News1 month agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Football1 month ago

Football1 month agoMike Williamson: Carlisle United appoint MK Dons boss as head coach

-

Politics4 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Technology3 weeks ago

Technology3 weeks agoArtificial flavours released by cooking aim to improve lab-grown meat

-

News1 month ago

News1 month agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

Science & Environment1 month ago

Science & Environment1 month agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency1 month ago

CryptoCurrency1 month agoCardano founder to meet Argentina president Javier Milei

-

Sport1 month ago

Sport1 month agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Technology4 weeks ago

Technology4 weeks agoMeta has a major opportunity to win the AI hardware race

-

News4 weeks ago

News4 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMeet the world's first female male model | 7.30

You must be logged in to post a comment Login