CryptoCurrency

Want to Buy Nvidia, Microsoft, and Apple? Consider This Vanguard Growth ETF

The S&P 500 (SNPINDEX: ^GSPC) is home to 500 different companies, but it’s weighted by market capitalization, which means the largest names in the index have a greater influence over its performance than the smallest.

Apple, Nvidia, and Microsoft are the top three companies in the S&P 500, with a combined market cap of $9.8 trillion, which represents 19.7% of the index. Nvidia stock, for example, was up 156% through the first half of 2024, which accounted for one-third of the entire 15% gain in the S&P 500.

In other words, investors who don’t have America’s tech giants in their portfolio are probably underperforming the broader market. But there’s a simple way to buy them without having to predict which ones might deliver the best returns from here.

The Vanguard Mega Cap Growth ETF (NYSEMKT: MGK) is an exchange-traded fund (ETF) with a concentrated portfolio filled with the largest tech stocks an investor could want. Here’s why it might be a great alternative to buying individual stocks.

The world’s highest-quality companies in one ETF

ETFs can hold hundreds, or even thousands, of different stocks. However, the Vanguard Mega Cap Growth ETF holds just 71, so it’s ideal for investors who already have an existing portfolio, but specifically want to add some exposure to the largest growth companies in America.

The ETF holds stocks from 10 different sectors of the economy, but technology has a whopping 61.4% weighting because of the sheer size of companies like Apple, Microsoft, and Nvidia.

In fact, the ETF is highly concentrated toward its top five holdings for that reason. The table shows their weightings in the ETF, compared to their weightings in the S&P 500 index:

|

Stock |

Vanguard ETF Portfolio Weighting |

S&P 500 Weighting |

|---|---|---|

|

1. Apple |

13.52% |

6.97% |

|

2. Microsoft |

12.68% |

6.54% |

|

3. Nvidia |

11.29% |

6.20% |

|

4. Meta Platforms |

4.96% |

2.41% |

|

5. Amazon |

4.54% |

3.45% |

Data source: Vanguard. Portfolio weightings are accurate as of Aug. 31, and are subject to change.

Having a much higher weighting toward these stocks can be a double-edged sword. It means the Vanguard ETF will outperform the S&P 500 when those specific stocks are doing well, but it’s likely to underperform if they hit a rough patch, because it lacks diversity relative to the index.

With that said, these five companies are among the most important players in the fast-growing artificial intelligence (AI) industry. Apple is rolling out its Apple Intelligence software, which it developed in partnership with OpenAI. It’s going to transform the way iPhone, iPad, and Mac users create and consume content. Since Apple has over 2.2 billion active devices worldwide, the company could soon become the biggest distributor of AI to consumers.

Microsoft and Amazon have developed their own AI virtual assistants, which are embedded into their flagship software products. Plus, the Microsoft Azure and Amazon Web Services cloud platforms are two of the largest AI distribution channels for businesses, allowing them to access ready-made models and data center computing power for their development needs.

Nvidia’s graphics processing chips (GPUs) for the data center are at the heart of the entire AI revolution. Its H100 GPU set the benchmark for AI developers last year, and the company is preparing to ship large volumes of its new Blackwell-based GPUs, which will deliver an incredible leap in performance and cost efficiency.

Outside its top five positions, the Vanguard ETF also holds popular megacap stocks like Eli Lilly, Tesla, Costco Wholesale, and McDonald’s — so it isn’t all about technology.

The Vanguard ETF consistently outperforms the S&P 500

The Vanguard ETF has delivered a compound annual return of 13.1% since it was established in 2007, which is much better than the average annual return of 10.2% in the S&P 500.

The ETF has delivered an even stronger compound annual return of 20.2% over the last five years. That’s because of the rapid adoption of technologies like cloud computing and AI, which have propelled stocks like Nvidia, Microsoft, and Amazon to multitrillion-dollar valuations. The S&P 500 has gained 16.7% per year (on average) over that same stretch.

In other words, if technology stocks continue to lead the broader market higher, investors should expect the Vanguard ETF to outperform the S&P 500 because of its enormous exposure to the sector. Some forecasts on Wall Street suggest AI could add anywhere from $7 trillion to $200 trillion to the global economy over the next decade. If that’s true, tech stocks will be one of the best places to invest.

Conversely, if AI fails to live up to the hype, the Vanguard ETF could underperform for a period of time because stocks like Nvidia would lose a chunk of the value they have created over the last couple of years.

This Vanguard ETF is very cheap to own, with an expense ratio of just 0.07% (the portion of the fund deducted each year to cover management costs), which is more than 90% cheaper than comparable funds, according to Vanguard. Therefore, investors seeking exposure to the big end of the stock market without having to pick individual winners and losers should look no further.

Should you invest $1,000 in Vanguard World Fund – Vanguard Mega Cap Growth ETF right now?

Before you buy stock in Vanguard World Fund – Vanguard Mega Cap Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Mega Cap Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Want to Buy Nvidia, Microsoft, and Apple? Consider This Vanguard Growth ETF was originally published by The Motley Fool

CryptoCurrency

Shift Crypto Holdings to ETFs

Robo-advisor Betterment has told investors using its direct cryptocurrency investing service that they have a month to convert those investments into ETFs.

The decision to shutter the two-year-old crypto investing platform, which New York-based Betterment announced to platform users via email on Oct. 16, is seen as a sign of things to come that will likely benefit the crypto ETF space.

“Now that the ETFs are here, Betterment can jettison all that and replace the allocation with a far superior offering,” said Ric Edelman, founder of the Digital Assets Council of Financial Professionals and a member of the etf.com advisory board.

Citing the contrast between Bitcoin ETFs with fees as low as 12 basis points and the 1% investors are charged by the Betterment platform that was linked to Gemini, Edelman said, “It’s a win-win.”

“Clients save money, gain improved convenience and better abilities for portfolio rebalancing, and the company gets to eliminate a cumbersome and expensive internal operations function,” he said. “And those crypto bros who want to keep their positions can do so by working directly with Gemini.”

Betterment Nods Toward Crypto ETFs

Betterment declined to comment for this story, but a spokesperson did confirm the accuracy of a report by RiaBiz.com.

The story didn’t say that Betterment had recommended a particular crypto fund for clients.

Tyrone Ross, chief executive of 401 Financial and Turnqey Labs, said Betterment’s decision to offer access to crypto currency models was innovative and important two years ago, but since the Securities and Exchange Commission this year approved Bitcoin and Ethereum ETFs, that picture has changed.

“I’m a fan of holding the underlying directly, but for most investors who are not crypto savvy, the best choice is investing through an ETF,” said Ross, who added that he would never advise a sophisticated crypto investor to use a crypto ETF.

“I abhor everything about the crypto ETFs,” he said. “There’s the fees, the fact there is no direct ownership, it doesn’t solve a lot of the issue advisors still have in the crypto space, and it’s just a money grab by ETF issuers.”

That said, Ross expects to see more platforms go the Betterment route of offering access to crypto ETF model portfolios, which he sees as a boon for those ETFs.

“I think you’ll see a lot of platforms that were using companies like Gemini start to move over to ETFs,” he said.

Edelman sees a similar evolution.

“Betterment is not just helping its clients and itself, it’s showing all advisory firms how easy this is to do,” he added. “There’s truly no reason anymore for RIAs not to offer bitcoin and Ethereum to their clients.”

Meanwhile, Chris King, founder of the crypto separate account platform Eaglebrook, sees a future where crypto ETFs and direct ownership in crypto become strategies that advisors turn to when customizing client portfolios.

“As crypto continues to evolve as standard portfolio allocations, we expect advisors to utilize crypto ETFs and crypto SMAs based on which best suits their clients’ particular needs,” he said.

CryptoCurrency

These 8 Index ETFs Are a Retiree’s Best Friend

If you’re approaching or entering retirement — and, really, even if you’re far from retirement — consider including a big bunch of dividend-paying stocks in your portfolio. You can expect healthy and growing companies that pay dividends to increase in value over time and to generate cash for you regularly. Their dividend payouts will tend to increase over time, too.

Retirees can use that cash to help support themselves, and pre-retirees might just reinvest those dividends into more shares of stock. (Some good brokerages offer to reinvest your dividends for you automatically.)

Why dividends?

Don’t underestimate the power of dividends. After all, the fact that a company has committed to paying a dividend means that it has grown to a point where management is confident that earnings will support such a payout. Dividend payers tend to outperform non-payers, too.

Check out the numbers for S&P 500 companies below, from a Hartford Funds report:

|

Dividend-Paying Status |

Average Annual Total Return, 1973-2023 |

|---|---|

|

Dividend growers and initiators |

10.19% |

|

Dividend payers |

9.17% |

|

No change in dividend policy |

6.74% |

|

Dividend non-payers |

4.27% |

|

Dividend shrinkers and eliminators |

(0.63%) |

|

Equal-weighted S&P 500 index |

7.72% |

Data source: Ned Davis Research and Hartford Funds.

How to invest in dividend payers easily

One of the best — and easiest — ways to invest in dividend-paying stocks is to do so via exchange-traded funds (ETFs). An ETF is a fund — which often tracks a particular index — that trades like a stock.

Below are seven dividend-focused ETFs to consider, plus a simple S&P 500 index fund for comparison purposes — and also because it’s a darn fine ETF for anyone to consider.

|

ETF |

Recent Yield |

5-Year Avg. Annual Return |

10-Year Avg. Annual Return |

|---|---|---|---|

|

iShares Preferred & Income Securities ETF (NASDAQ: PFF) |

6% |

3.29% |

4.11% |

|

Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD) |

3.6% |

13.6% |

12.4% |

|

iShares US Real Estate ETF (NYSEMKT: IYR) |

2.7% |

4.2% |

6.8% |

|

Vanguard High Dividend Yield ETF (NYSEMKT: VYM) |

2.7% |

11.8% |

10.9% |

|

SPDR S&P Dividend ETF (NYSEMKT: SDY) |

2.3% |

10% |

10.8% |

|

iShares Core Dividend Growth ETF (NYSEMKT: DGRO) |

2.2% |

12.8% |

12.9% |

|

Vanguard Dividend Appreciation ETF (NYSEMKT: VIG) |

1.7% |

13.3% |

12.7% |

|

Vanguard S&P 500 ETF (NYSEMKT: VOO) |

1.2% |

16.4% |

14.1% |

Data source: Morningstar.com, as of Oct. 15, 2024.

Each ETF, in a nutshell

You’ll notice that some of the funds sport hefty dividend yields, while others feature some terrific long-term growth rates over the past five and 10 years. In investing, there’s generally a trade-off between growth and income. Here’s a little more about each of these index funds and the index that each tracks:

-

iShares Preferred & Income Securities ETF: This tracks the ICE Exchange-Listed Preferred & Hybrid Securities Index, which includes a group of U.S. dollar-denominated preferred securities, hybrid securities, and convertible preferred securities. Note that preferred stocks tend to not increase in value much and their dividends aren’t usually big growers, either — but they do tend to feature generous payouts.

-

Schwab U.S. Dividend Equity ETF: This ETF tracks the Dow Jones U.S. Dividend 100 Index of high-dividend-yielding U.S. stocks that have consistently paid dividends. The ETF’s biggest holdings recently were Home Depot, BlackRock, and Cisco Systems.

-

iShares US Real Estate ETF: This ETF tracks the Dow Jones U.S. Real Estate Capped Index and encompasses many real estate investment trusts (REITs) — companies that own many properties and earn income by renting them out. This ETF’s top holdings recently included Prologis, American Tower, and Equinix. Respectively, they specialize in warehouses, telecommunications towers, and digital infrastructure, among other things.

-

Vanguard High Dividend Yield ETF: This ETF tracks the FTSE High Dividend Yield Index and focuses on domestic stocks with high dividend yields (excluding REITs). Its recent top holdings included Broadcom, JPMorgan Chase, and ExxonMobil.

-

SPDR S&P Dividend ETF: This ETF tracks the S&P High Yield Dividend Aristocrats Index, which encompasses companies that have paid dividends for at least 20 years and that meet certain criteria tied to liquidity and size. (The term Dividend Aristocrats® is a registered trademark of Standard & Poor’s Financial Services LLC.) Its top holdings recently included Realty Income, Kenvue, and IBM.

-

iShares Core Dividend Growth ETF: This ETF tracks an index of U.S. stocks with a history of consistently growing dividends. Its top holdings recently were ExxonMobil, Apple, and Microsoft.

-

Vanguard Dividend Appreciation ETF: This ETF tracks the S&P US Dividend Growers Index, which features companies that have increased their payouts for at least 10 consecutive years. The top holdings recently were Microsoft, Apple, and Broadcom.

-

Vanguard S&P 500 ETF: This ETF, which tracks the S&P 500, is here for comparison purposes. It, too, features a dividend yield, but it also includes plenty of non-dividend payers. While the dividend yield isn’t very big, the fund makes up for that with a solid track record of growth. (Note that despite the returns in the table above, the long-term average annual gain of the stock market is closer to 10% than 16%.)

So consider any or all of these ETFs for your long-term portfolio, whether you’re in or approaching retirement or have decades to go before retiring.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Selena Maranjian has positions in American Tower, Apple, Broadcom, Microsoft, Realty Income, and Schwab U.S. Dividend Equity ETF. The Motley Fool has positions in and recommends American Tower, Apple, Cisco Systems, Equinix, Home Depot, JPMorgan Chase, Kenvue, Microsoft, Prologis, Realty Income, Vanguard Dividend Appreciation ETF, Vanguard S&P 500 ETF, and Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool recommends Broadcom and International Business Machines and recommends the following options: long January 2026 $13 calls on Kenvue, long January 2026 $180 calls on American Tower, long January 2026 $395 calls on Microsoft, long January 2026 $90 calls on Prologis, short January 2026 $185 calls on American Tower, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

These 8 Index ETFs Are a Retiree’s Best Friend was originally published by The Motley Fool

CryptoCurrency

This $2.4 Billion Company Is About to Get a $1.2 Billion Payday. Here’s Why I Couldn’t Be More Optimistic

Autozone and O’Reilly are the two giants in the car-parts retail space. These two companies have market capitalizations of $53 billion and $71 billion, respectively. By comparison, Advance Auto Parts (NYSE: AAP) is tiny with its market cap of just $2.4 billion. But this value disparity is somewhat surprising.

Advance has almost 4,800 locations, while Autozone has nearly 7,400 and O’Reilly has around 6,200. So the latter two are bigger, but not by the margin that the market valuations would suggest.

For its part, Advance has problems that can’t be sugarcoated. But it’s working to fix them. And it’s about to get a $1.2 billion payday to help fund its turnaround, which is an unbelievable amount for a company with such a low valuation.

How is Advance getting a big payday?

On top of its namesake retail chain, Advance also owns other businesses, namely Carquest and Worldpac. Last year, the company hired CEO Shane O’Kelly, who’s trying to restructure the business. This restructuring includes selling the Worldpac business.

In August, Advance reached a deal to sell Worldpac for $1.5 billion. Taking transaction expenses into account, the company will net about $1.2 billion — half of its current market cap. The deal is expected to close in the fourth quarter.

Advance says that Worldpac has generated $2.1 billion in trailing-12-month revenue and has earned $100 million in earnings before interest, taxes, depreciation, and amortization (EBITDA). This means that Advance sold it for 0.7 times its sales and 15 times its EBITDA.

That’s more than a fair sales price. For perspective, Advance stock trades at 0.2 times sales and at about 7 times EBITDA. So the sales price for Worldpac represents a significant premium to where Advance stock itself trades today.

How Advance’s windfall can help

O’Kelly says that selling Worldpac gives Advance more “financial flexibility” as it navigates the changes it needs to make. And to be sure, the changes are going to be substantial.

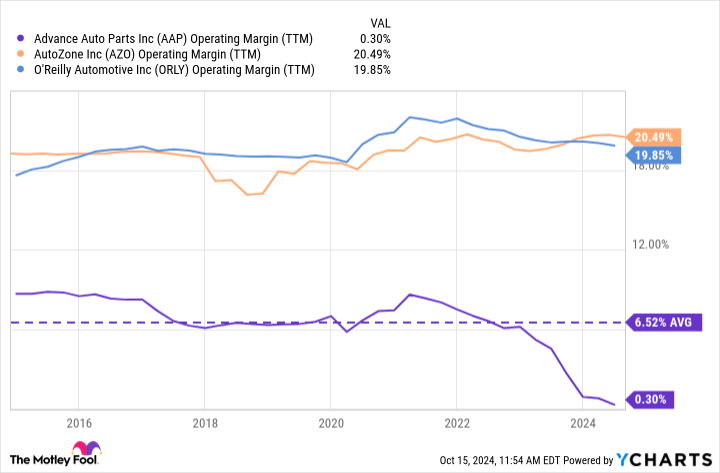

They need to be, considering how poorly Advance has performed relative to its peers. Take one metric: the operating-profit margin. For the past decade, both Autozone and O’Reilly have had operating margins mostly between 18% and 20%. By comparison, Advance has averaged an operating margin of about 6%, and it’s fallen even lower than that lately.

Advance hired O’Kelly to fix this profitability problem. The new CEO is a supply chain expert and quickly realized that Advance is struggling with profitability because of its inefficient supply chain infrastructure.

A multiyear supply chain transformation is already underway for Advance, and I’m optimistic that this will completely transform returns for shareholders.

Consider that if Advance can squeeze a 10% margin from its business — still half of what its peers have — it can generate close to $1 billion in annual profits. After all, even after selling Worldpac, Advance still generates over $9 billion in annual sales. And if the stock is valued at 10 times its operating profit, then shares could quadruple in value in this scenario.

Therefore, restructuring the supply chain is crucial for Advance and its shareholders. But it’s costly, and the company’s balance sheet isn’t the greatest. It has almost $1.8 billion in long-term debt and less than $500 million in cash and equivalents. To be clear, it’s not in danger of running out of liquidity anytime soon. But this is an unattractive net-debt position nonetheless.

Selling Worldpac will even out Advance’s balance sheet and give it just a little more breathing room. And this breathing room will allow management to make the business decisions that will set it up best for long-term success.

This is why I couldn’t be more optimistic about Advance stock now that it’s selling Worldpac. And if the turnaround is successful, the stock is trading at quite the bargain valuation today.

Should you invest $1,000 in Advance Auto Parts right now?

Before you buy stock in Advance Auto Parts, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advance Auto Parts wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Jon Quast has positions in Advance Auto Parts. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This $2.4 Billion Company Is About to Get a $1.2 Billion Payday. Here’s Why I Couldn’t Be More Optimistic was originally published by The Motley Fool

CryptoCurrency

Why I Just Bought This Ultra-High-Yield Dividend Stock

I viewed utilities as boring investments for much of my life. The closer I get to retirement, though, the more I realize the truth of the statement, “Boring is beautiful.”

My portfolio now includes several utility stocks. And I recently added another: UGI Corporation (NYSE: UGI). Why did I buy shares of UGI? Three key reasons rank at the top of the list.

1. A resilient business

The last thing I want to invest in these days is a company that could go under because of a bad move or two. UGI isn’t that kind of company because its business is highly resilient.

UGI owns AmeriGas, the largest retail propane distributor in the U.S. It operates natural gas utilities serving customers in Pennsylvania, Maryland, and West Virginia.

The company’s electric utility serves customers in Pennsylvania, and its Energy Services subsidiary operates natural gas pipelines and natural gas storage facilities. UGI also owns a liquified petroleum gas (LPG) distribution unit that serves several European countries.

The company has been in business for 142 years. It expects to deliver average long-term earnings-per-share growth of between 4% and 6%.

Sure, AmeriGas’ earnings have been highly volatile. Last year, Fitch lowered its outlook on the business to negative from stable.

However, UGI is committed to stabilizing AmeriGas by controlling costs and strengthening its balance sheet. Those efforts seem to be bearing fruit, based on the company’s solid fiscal 2024 third-quarter results.

2. An impressive dividend

I’d be lying if I said UGI’s dividend wasn’t an important part of my decision to buy the stock. Its forward dividend yield is an ultra-high 5.95%. Its payout ratio also stands at a reasonable level of 47.8%.

UGI has paid a dividend for 140 consecutive years, and that’s not a typo. The utility company first paid a dividend way back in 1884 and hasn’t missed a beat since. Few dividend stocks have such a reliable track record.

Over the last 10 years, UGI has increased its dividend by a compound annual growth rate of 6%. Granted, the company won’t give shareholders a dividend hike this year and doesn’t expect to do so in fiscal 2025 or 2026, either, as it focuses on strengthening its balance sheet. However, UGI plans to return to increasing its dividend payout by roughly 4% per year in fiscal 2027 and beyond.

3. An attractive valuation

UGI’s share price has trended mainly downward over the last three years. Its AmeriGas challenges served as a primary culprit behind this disappointing performance. However, there’s a positive side effect of the stock’s decline — an attractive valuation.

Zacks Equity Research gives UGI a grade of “A” on valuation, and the stock trades at only 8x forward earnings. That’s less than half the average forward price-to-earnings ratio of 18.8 for the S&P 500 utilities sector.

I might view UGI as a value trap if I didn’t think its future looked brighter than its recent past, but that’s not the case as the company’s financials are improving. It expects to deliver reliable earnings growth going forward.

Plus one bonus

Some investors like to “bet on the jockey and not the horse.” My take is that if the horse is fast enough, it doesn’t matter much who the jockey is. That said, I want solid, capable management in charge of the companies in which I invest.

It was a nice bonus, therefore, when UGI named Bob Flexon as its new CEO, effective Nov. 1, 2024. Flexon served as UGI’s CFO for roughly six months in 2011 and was CEO of power company Dynegy from July 2011 to April 2018. He’s also been CEO of engineering and construction contractor Foster Wheeler and CFO and COO of NRG Energy.

I didn’t load up on UGI stock because Flexon is taking the helm of the company, but he exemplifies the kind of leadership I like to see. With Flexon as CEO, I expect UGI will deliver the steadiness that investors want.

Should you invest $1,000 in UGI right now?

Before you buy stock in UGI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UGI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Keith Speights has positions in UGI. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why I Just Bought This Ultra-High-Yield Dividend Stock was originally published by The Motley Fool

CryptoCurrency

Down 34%, This AI Stock Is a No-Brainer Buy Stock Right Now

As almost every investor knows by now, artificial intelligence (AI) has been driving the current bull market since its start in 2023.

The launch of OpenAI’s ChatGPT has set off a new arms race in the industry, and generative AI technology could be as transformative as the internet. While stocks with exposure to artificial intelligence, like the semiconductor sector, have generally done well, some stocks have done better than others.

Nvidia, for example, just set another all-time high on soaring demand for its new Blackwell platform, but not every AI stock has kept up with the Nasdaq Composite, which nearly set an all-time high earlier this week. In fact, ASML (NASDAQ: ASML) is now down 34% from its peak earlier this year after the industry bellwether gave a disappointing forecast in its third-quarter earnings report on Tuesday. The stock fell 16.3% on the news.

Why ASML stock just went on sale

ASML occupies a unique position in the semiconductor industry as the only maker of extreme ultraviolet (EUV) lithography machines, which are used to make the most advanced, smallest-node chips.

Investors have been looking forward to a recovery in ASML’s business after an earlier slowdown due to macrochallenges like high interest rates and inflation.

ASML is expected to benefit from the expansion of chip fabs around the world as governments and industries prepare for the AI era. The U.S., for example, is planning to invest tens of billions of dollars through the CHIPS Act to build foundries, and Taiwan Semiconductor, the world’s biggest foundry operator, is looking to diversify away from Taiwan and move closer to its customers.

While that should be a tailwind for ASML, the company just told customers that recovery would take longer than expected. Citing weakness in both the logic and memory segments, which make up two of its three business segments, CEO Christophe Fouquet said, “It now appears the recovery is more gradual than previously expected.” He also noted customer cautiousness.

ASML dialed back the 2025 revenue forecast it gave at its 2022 Investor Day from 30 billion euros to 40 billion euros ($33 billion dollars to $43 billion dollars) to 30 billion euros to 35 billion euros ($33 billion dollars to $38 billion dollars). Not surprisingly, investors were disappointed with the news.

Why it’s a buying opportunity

Companies tend to give disappointing earnings reports and forecasts for one of two reasons: Either there are challenging market conditions at the macrolevel or sector level, or the company itself isn’t executing well and is falling behind the competition.

ASML’s case looks to be safely in the first category. While there’s plenty of excitement about AI, which management nodded to, there are still some challenges in the legacy-chip business, reflected in key customers like Intel and Samsung, both of which are struggling.

Samsung is reportedly delaying mass production at a fab in Texas due to weak yields in its 3-nanometer process, and Intel just announced a massive restructuring, calling into question its foundry expansion. In recent quarters, half of ASML company’s revenue has also come from China, where the economy has been weak since the end of the pandemic.

For comparison, a good recent example of a company that struggled with similar headwinds was Alphabet as digital advertising slowed in 2022 on fears of a recession, as you can see from the chart below.

As you can see, revenue growth dropped to just 1% in 2022’s Q4, but if you had bought the stock then, you’d be up more than 80% now.

ASML retains a significant competitive advantage as the only producer of EUV lithography machines, and it should eventually benefit from the coming boom in chip production due to AI.

Even with its dialed-down guidance, the company is still calling for 16.1% growth at the midpoint and expects expanding gross margins and operating margins.

As profits recover, the stock looks like a good bet to bounce back now that the weak forecast is priced in. With its unique EUV technology, strong margins, and ramping AI demand, ASML looks like a great bet to be a winner over the long term.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Down 34%, This AI Stock Is a No-Brainer Buy Stock Right Now was originally published by The Motley Fool

CryptoCurrency

Bitcoin $233K forecast, SEC X account hacker arrested, and more: Hodler’s Digest, Oct. 13 – 19

Bitcoin is technically on track to hit $233,000, according to analytics data based on the RSI, FBI arrests SEC X hacker: Hodlers Digest

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

News2 weeks ago

News2 weeks agoNavigating the News Void: Opportunities for Revitalization

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

News1 month ago

the pick of new debut fiction

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

News2 weeks ago

News2 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

MMA2 weeks ago

MMA2 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

Technology4 weeks ago

Technology4 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Sport2 weeks ago

Sport2 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

News2 weeks ago

News2 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

TV2 weeks ago

TV2 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

MMA2 weeks ago

MMA2 weeks agoPereira vs. Rountree preview show live stream

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Technology2 weeks ago

Technology2 weeks agoThe best budget robot vacuums for 2024

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment1 month ago

Science & Environment1 month agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

News2 weeks ago

News2 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Technology2 weeks ago

Technology2 weeks agoA very underrated horror movie sequel is streaming on Max

-

Technology2 weeks ago

Technology2 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Entertainment3 weeks ago

Entertainment3 weeks ago“Golden owl” treasure hunt launched decades ago may finally have been solved

-

Sport1 month ago

Sport1 month agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Technology4 weeks ago

Technology4 weeks agoArtificial flavours released by cooking aim to improve lab-grown meat

-

Business3 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

News1 month ago

News1 month agoYou’re a Hypocrite, And So Am I

-

Science & Environment1 month ago

Science & Environment1 month agoRethinking space and time could let us do away with dark matter

-

Science & Environment1 month ago

Science & Environment1 month agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News1 month ago

The Project Censored Newsletter – May 2024

-

Technology3 weeks ago

Technology3 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

Technology3 weeks ago

Technology3 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

Technology3 weeks ago

Technology3 weeks agoUlefone Armor Pad 4 Ultra is now available, at a discount

-

News3 weeks ago

News3 weeks agoReach CEO Jim Mullen: If government advertises with us, we’ll employ more reporters

-

Business3 weeks ago

Maurice Terzini’s insider guide to Sydney

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

Money3 weeks ago

Money3 weeks agoWhy thousands of pensioners WON’T see State Pension rise by full £460 next year

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

Technology2 weeks ago

Technology2 weeks agoHow to disable Google Assistant on your Pixel Watch 3

-

Technology2 weeks ago

Technology2 weeks agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

MMA3 weeks ago

MMA3 weeks agoHow to watch Salt Lake City title fights, lineup, odds, more

You must be logged in to post a comment Login