Money

Deliveroo DOWN as hundreds locked out of app and website

Deliveroo is currently down – with hundreds locked out of the app and website.

Around 3,200 Deliveroo outages have been reported in the past 24 hours, according to Down Detector.

Deliveroo said: “We’re currently experiencing an issue with our app and website.

“We’re working hard to get back up and running ASAP. Thank you for your patience.”

It comes after The Sun investigated how Uber Eats and Deliveroo could cost you 74% extra if you use one of their services.

Shoppers are increasingly using delivery apps to order groceries from supermarkets.

The number of people turning to Uber Eats to get their shopping from stores such as Sainsbury’s, Co-Op and Waitrose has nearly doubled over the last two years.

Deliveroo has seen “strong growth” in the number of people ordering medium-sized baskets through the app, from stores including Asda, Morrisons, Sainsbury’s, Co-Op and Waitrose.

Many find it quicker and easier than ordering online directly with supermarkets as there is no need to book a delivery slot and the groceries usually arrive within an hour.

But apps often charge delivery and service fees, and supermarkets are also hiking the prices of their products if you order them this way.

To see how grocery costs compared, we first ordered a basket of 11 everyday items from Asda through Uber Eats, Morrisons through Deliveroo, and via Tesco’s instant delivery Whoosh service.

Although we expected some prices to be higher when ordered through apps, we were shocked to find some popular supermarket products cost up to three quarters more through apps such as Uber Eats and Deliveroo, compared with ordering a home delivery direct from the supermarket.

Overall, shoppers are paying around a quarter more — up to around £7.42 extra per basket — for exactly the same goods if ordered through a delivery app.

Buying the basket cost £27.62 direct from Morrisons, plus a £5 charge for a home delivery — a total of £32.62.

But the exact same items cost £34.05 if ordered from Morrisons via Deliveroo, plus £3.78 in service and delivery fees and charges, which took the total to £37.83.

It was even more expensive to order Morrisons groceries via Deliveroo HOP, where drivers pick up items direct from a Deliveroo warehouse instead of the store.

The groceries cost £35.26 — 28 per cent more than the in-store price — and the fees and charges added £4.78, taking it to a total of £40.04.

It was then a similar picture with Asda.

In total, ordering the basket of groceries through Asda’s website cost £27.38, plus a home delivery charge of £4.50 and a £3 fee for ordering less than £40 worth of shopping. In total, it cost £34.88.

But exactly the same products cost £33.95 when ordered through the Uber Eats app, which was £6.57 more — a price increase of 24 per cent.

Including service and delivery fees and charges of £7.38, our shopping cost £41.33 on the app — 18 per cent more overall.

Want to save money on your Deliveroo purchase? Then head to Sun Vouchers where you can get discounts and voucher codes from Deliveroo.

Money

Three reasons why you could be asked to pay back Winter Fuel Payment by DWP – and how to avoid falling foul of rules

HOUSEHOLDS eligible for the Winter Fuel Payment may have to pay some or all of it back for three particular reasons.

The up to £300 payment is being made to those on certain benefits this winter to cover the extra cost of energy over the colder months.

It was previously available to all state pensioners but the Government has now made the annual payment means-tested.

The changes by Chancellor Rachel Reeves mean that around 10million aged 66 or over will no longer receive the benefit.

But there may be other circumstances where you receive the Winter Fuel Payment this financial year and have to repay some or all of it back to the Department for Work and Pensions (DWP).

The Government’s guidance states that you have to pay it back if you did not report a change of circumstances straight away.

For example, if you moved address or stopped receiving a benefit that qualified you for the payment.

You could also be docked the payment if you gave the wrong information out in your application such as the incorrect age.

Or, you may have to pay it back if you were overpaid by the DWP by mistake.

It’s crucial that you tell the DWP of any changes in your personal circumstances and make sure you enter your personal details correctly as it can impact your eligibility for the Winter Fuel Payment.

You can do this by contacting the Winter Fuel Payment Centre on 0800 731 0160 or +44 (0)191 218 7777 if you’re outside the UK.

Who is eligible for the Winter Fuel Payment?

It is worth taking note of the eligibility criteria for this year’s Winter Fuel Payment as if a change in circumstances means you fall outside of it, you will need to contact the Winter Fuel Payment Centre.

You qualify for a Winter Fuel Payment for Winter 24/25 if you were born before September 23, 1958.

If you live alone and were born between September 23, 1944, and September 22, 1958 you will get £200.

You will receive £300 if you were born before September 23, 1944.

If you and your partner jointly claim any of the benefits, one of you will get a payment of either:

- £200 if one or both of you were born between September 23 1944 and September 22 1958

- £300 if one or both of you were born before September 23 1944

You must also live in England or Wales and get one of the following:

- Pension Credit

- Universal Credit

- income-related Employment and Support Allowance (ESA)

- income-based Jobseeker’s Allowance (JSA)

- Income Support

- Child Tax Credit

- Working Tax Credit

You’ll also need to have been getting a benefit during the qualifying week of September 16 to 22, 2024.

In some circumstances, you might be eligible for the Winter Fuel Payment if you live abroad, for example if you live in:

- Austria

- Belgium

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- Germany

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Netherlands

- Norway

- Poland

- Romania

- Slovakia

- Slovenia

- Sweden

- Switzerland

You aren’t eligible for the Winter Fuel Payment if you live in Scotland or have been in hospital getting free treatment for more than a year.

You also don’t qualify if were in prison for the whole of the week of September 16 to 22, 2024, or you were living in a care home for the from June 24 to September 22, 2024.

You will qualify for a Winter Fuel Payment if you have lived in a care home for less than 13 weeks including the week of September 16 to 22, 2024, though.

Hundreds of thousands of households are not claiming Pension Credit which could qualify them for this year’s Winter Fuel Payment.

You can use this benefits checker made in partnership with poverty charity Turn2Us to see if you’re eligible.

Are you missing out on benefits?

YOU can use a benefits calculator to help check that you are not missing out on money you are entitled to

Charity Turn2Us’ benefits calculator works out what you could get.

Entitledto’s free calculator determines whether you qualify for various benefits, tax credit and Universal Credit.

MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto’s data.

You can use Policy in Practice’s calculator to determine which benefits you could receive and how much cash you’ll have left over each month after paying for housing costs.

Your exact entitlement will only be clear when you make a claim, but calculators can indicate what you might be eligible for.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

I transformed boring garden shed into colourful home office for FREE… haters say it’s too bold but it brings me joy

A WOMAN has transformed a dull garden shed into a colourful home office for free.

Tattoo artist Nic Smith, 47, from Andover, Hampshire, up cycled furniture and made her own curtains to turn her boring “white box” into a home studio.

Nic designed the building to her ideal specifications and the curtains were either gifted or handmade.

While she already owned the furniture and just polished up the pieces she wanted to include.

It’s now her dream workspace with the unique look that she wanted.

She did though fork out £800 to a local upholster to get some work done on the existing furniture.

Nic has been tattooing for 13 years and has always been attracted to the maximalist style of design which inspired her colourful studio oasis.

She said: “I wanted to create a smaller, private studio on our property here, so I could work from home.

“We had a wooden building constructed at the end of our garden.

“I mainly work in an ornamental, illustrative style, lots of mandalas (circular designs), and shade with dot work.

“I love working in this style and am lucky that it’s pretty much all I do these days.”

Nic has had her own studio Songbird Tattoo for over a decade but just last year she made the switch to working from home and she created the studio of her dreams in her garden.

She added: “We had the building out in January 2022 at a cost of around £30,000.

“I haven’t spent anything on the renovation, the furniture was already mine.

“I had a local upholsterer redo the sofa and I made the curtains.

“It was really just the decoration that came down to me as I’d had it built to my exact specifications with the bathroom in one corner and the windows where I needed them.

“It was always going to be a maximalist style.

“My eyes are always happiest with patterns, be that on me, on my walls or in the tattoos I create.

Studio Costs:

Purpose Built Building: £30,000

Furniture: Free (already owned)

Curtains: Free (gifted and hand made)

Wallpaper, Fabric and Cushions: Free (gifted)

Upholstery Work: £800

“Everyone loves it, I think it’s an unexpected hit of colour.

“Truly I love every single part of it, I designed it so what’s not to love for me, it may not be everyone’s cup of tea but walking up the garden towards it brings me joy.

“The only part of the build I struggled with was my own impatience.

“Once I had the idea I just wanted to get going but there was a four month wait on the building.

“Looking at it now I am amazed, how it went from a white box to what it is now, colour makes such a difference.

“My family and friends love it too, it is my sanctuary for work but it also doubles as a summer house so it’s a fabulous multi-use space.”

CryptoCurrency

Buying Medical Properties Trust Taught Me a Costly Lesson

Medical Properties Trust (NYSE: MPW) is my largest investment in a single real estate investment trust (REIT). I built that position up over a decade and a half by steadily buying more shares of the healthcare REIT. The main draw was its high-yielding dividend.

That investment paid off for a long time. However, the healthcare REIT has come under tremendous pressure in recent years due to an issue I completely overlooked: tenant concentration. Medical Properties Trust leased a significant percentage of its hospital portfolio to two tenants, which cost the company and its shareholders dearly when it ran into financial troubles. That taught me to pay much closer attention to customer concentration and quality when investing in any company.

Not diversified enough

Medical Properties Trust is one of the largest owners of hospital real estate in the world. It owns several hundred facilities leased to many different hospital operators. However, two tenants comprised a meaningful percentage of its total assets and revenues for many years. For example, at the end of 2022, the REIT’s rent roll consisted of:

|

Operator |

Properties |

Percentage of Total Assets |

Percentage of Revenues |

|---|---|---|---|

|

Steward Health Care |

41 |

24.2% |

26.1% |

|

Circle Health |

36 |

10.5% |

11.9% |

|

Prospect Medical Holdings |

14 |

7.5% |

11.5% |

|

Priory Group |

32 |

6.6% |

5.3% |

|

Springstone |

19 |

5% |

5.8% |

|

50 Operators |

302 |

38% |

39.4% |

|

Other investments |

0 |

8.2% |

0% |

|

Total |

444 |

100% |

100% |

Data source: Medical Properties Trust.

While the REIT had over 50 tenants, five supplied more than 60% of its revenue. That became an issue as Steward Health Care and Prospect Medical Holdings ran into financial troubles.

Those issues led the REIT to work with these large tenants to help them navigate their financial problems. For example, in May 2023, Medical Properties Trust reconstituted its $1.6 billion investment in properties leased to Prospect Medical Holdings in a series of transactions. It converted some leases into an equity interest in that company’s managed care business. Meanwhile, it temporarily suspended rents in California, with partial repayments resuming last September and full rent commencing this past March.

Medical Properties Trust also tried to keep Steward afloat by providing financial assistance and temporarily reducing its rent. However, those efforts weren’t enough, and Steward filed for bankruptcy earlier this year. The REIT was finally able to sever its relationship with Steward last month, which enabled it to find new tenants for many of the properties it formerly leased to that company.

The REIT’s issues with two of its largest tenants weighed heavily on its stock price (shares are down nearly 80% from their peak a few years ago). It has had to sell properties leased to financially stronger tenants to repay maturing debt. It also cut its dividend twice.

Lessons learned

The biggest lesson I’ve learned from investing in Medical Properties Trust is to carefully consider customer concentration and quality when investing. The higher the concentration of a single customer, the greater the risk that the client’s issues will become a problem for that investment. Likewise, if a company has a high concentration of financially weaker clients, that could also impact my investment in the future.

Medical Properties Trust has learned this lesson the hard way. That’s led it to focus on diversifying its tenant base by bringing in higher-quality tenants. For example, it agreed to lease its entire Utah hospital portfolio to CommonSpirit Health last year after the healthcare company acquired Steward’s operations at those facilities. CommonSpirit has strong investment-grade credit, which enhances its ability to meet its financial obligations. Securing such a high-quality tenant for those facilities enabled the REIT to sell a majority interest in the real estate to another investor to raise additional cash. Meanwhile, it recently agreed to replace Steward at 15 other properties with four high-quality operators as part of its bankruptcy settlement with Steward.

As a result of that agreement, the REIT has achieved the objectives it laid out in its second-quarter earnings conference call. CFO Steve Hamner stated, “Looking through the calendar to 2025 and into 2026, our expectation is that we will have a stable portfolio of hospital real estate leased to key operators in their respective markets with no exposure to Steward.” With that goal achieved, the REIT can focus on rebuilding its portfolio by adding new properties leased to high-quality operators to continue diversifying its tenant base. That should also enable it to rebuild its dividend.

It’s important to dig a little deeper

I didn’t pay enough attention to Medical Properties Trust’s tenant concentration as I built my position, which proved costly. However, I learned a valuable lesson: Analyze a company’s client base and quality because that could have a meaningful impact on its future results. Medical Properties Trust learned that costly lesson as well. With its tenant quality improving and its rent roll more diversified, it’s in a much better position to deliver the stable income and growth I initially expected as I built my position. That’s why I plan to continue holding, believing it can eventually make a full recovery.

Should you invest $1,000 in Medical Properties Trust right now?

Before you buy stock in Medical Properties Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Medical Properties Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Matt DiLallo has positions in Medical Properties Trust. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Buying Medical Properties Trust Taught Me a Costly Lesson was originally published by The Motley Fool

Money

Neighbours fume over ‘eyesore’ derelict estate as last-man standing locals refuse to leave so block can be flattened

NEIGHBOURS are fuming over an “eyesore” derelict estate – with one defiant local refusing to leave so the block can be flattened.

The block in Swanscombe, Kent has been boarded up and earmarked for demolition after the local council ruled out pricey repairs.

Flats in the building had been dogged by damp, weak foundations and cracked windows and ceilings.

The council gave tenants a one-off payment of £7,800 as compensation for moving out.

Most of them took the money and left – but one resident is staying put.

Demolition plans were confirmed last week but have been postponed because of the last man standing.

Neighbours Miranda Richards told the Kent Messenger: “When I walk past it from my car late at night, it is scary.

“I don’t like walking past a derelict building. There used to be trees there to mask the flats but they have come down.”

Another neighbour said: “It’s an eyesore. There is always fly-tipping there.”

Ward councillor Emma Ben Moussa said: “The uncertainty for the residents around the area has been quite unfair.

“They have been left like that for a while now. Whatever decision is going to be made I would like it to be made quite quickly.

“They should know what is happening as they have been left in limbo.”

Dartford Council said: “The council is currently considering future options for the use of the site.”

A spokesperson added: “We await the final residents to vacate the block.

“Once the block is vacant, a proposal with recommendations will be made to the council’s cabinet.”

CryptoCurrency

3 Dividend Stocks That Reward You Through Thick and Thin

This year, some notable companies have cut or eliminated their dividends. For example, former stalwarts Walgreens and 3M ended decades-long streaks of dividend growth with deep cuts to their payouts. It’s a situation that can make some investors want to give up altogether on income investing.

However, while some formerly reliable companies have disappointed investors on the dividend front in recent years, others have continued to make their payments no matter what. Enterprise Products Partners (NYSE: EPD), Oneok (NYSE: OKE), and NextEra Energy (NYSE: NEE) stand out to a few Fool.com contributors for their dividend stability. Here’s why you should consider adding them to your portfolio.

Enterprise Products Partners is built to pay you well

Reuben Gregg Brewer (Enterprise Products Partners): For 26 consecutive years, midstream energy giant Enterprise Products Partners has increased its distributions. That’s a huge commitment to its unitholders, but there’s more for income investors to like here than just the distribution history. It all starts with its master limited partnership structure, which is designed to pass income on to investors in a tax-advantaged manner. (A portion of the distribution is usually return of capital.) So down to its foundation, Enterprise is about paying its investors well.

Then, factor in its business model. Enterprise owns energy infrastructure like pipelines, storage, refining, and transportation assets that are vital to the energy sector’s operation. However, unlike other segments of the industry, the midstream segment is largely fee driven. Enterprise generates reliable cash flows based on the use of its assets, so the often-volatile prices of oil and natural gas don’t really have that big an impact on its financial results. Demand for energy, which is usually strong even when oil prices are weak, is the key determinant of Enterprise’s success.

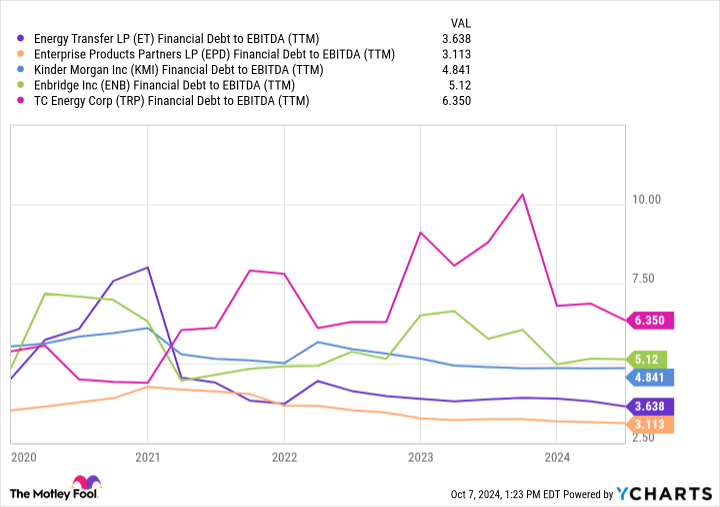

Then there’s the fact that Enterprise has an investment-grade rated balance sheet. Moreover, its leverage is normally toward the low end of its peer group, so it is conservative on both an absolute and relative basis. Lastly, the partnership’s distributable cash flow covers its distribution 1.7 times over.

All in all, a lot would have to go wrong before Enterprise Products Partners would need to cut its distribution. It is far more likely that it will continue to grow those disbursements, albeit slowly, as its capital investment plans pan out. But slow and steady distribution growth combined with a huge 7% yield will probably sound like music to most dividend investors’ ears.

Over a quarter century of growth and stability (and more growth coming down the pipeline)

Matt DiLallo (Oneok): Pipeline giant Oneok has proven its dividend durability over the decades. It has achieved more than a quarter century of dividend stability. While it hasn’t increased its payment every year during that period, it has a strong track record on payout hikes. Since 2013, Oneok has produced peer-leading total dividend growth of more than 150%. That’s impressive, considering that the world experienced two notable periods of oil price volatility during that period.

Oneoke has delivered sustainable earnings growth over the years. Its portfolio of pipelines and related midstream infrastructure generates predictable fees backed by long-term contracts and government-regulated rate structures. Its earnings grow as the volumes flowing through that infrastructure increase due to production growth, organic expansion projects, and acquisitions.

The company has been on an acquisition-fueled expansion binge in recent years. Last year, it bought Magellan Midstream Partners in a transformational $18.8 billion deal that increased its diversification and cash flow. The highly accretive deal will add an average of more than 20% to its free cash flow per share through 2027. That supports management’s view that Oneok will be able to grow its dividend by 3% to 4% annually during that period while also repurchasing shares and reducing its leverage ratio.

Oneok followed that up with a $5.9 billion deal to buy Medallion Midstream and a meaningful interest in EnLink Midstream this August. The transaction will be immediately accretive to its free cash flow and capital allocation strategy. After closing that deal, Oneok plans to buy the rest of EnLink, further boosting its cash flow per share. The company also expects to complete additional organic expansion projects, further enhancing its growth rate.

The midstream giant’s investments will help fuel its dividend growth for the next several years, even if there’s another market downturn. Those features make Oneok a great stock to buy for those seeking reliable dividends.

A steady dividend grower

Neha Chamaria (NextEra Energy): NextEra Energy, which has a yield of 2.6% at its current stock price, has rewarded its shareholders through thick and thin, and management is determined to continue doing so. The utility and clean energy giant has paid regular dividends for decades, but more importantly, increased them steadily over time. Between 2003 and 2023, the compound annual growth rate (CAGR) of NextEra Energy’s dividend was nearly 10%, backed by a 9% CAGR in its adjusted earnings per share (EPS) and an 8% CAGR in operating cash flow during the period.

NextEra Energy operates two businesses — Florida Power & Light Company (the largest electric utility in Florida) and clean energy company NextEra Energy Resources (the world’s largest generator of wind and solar energy). So while its regulated utility business generates stable cash flows, clean energy is where its growth largely comes from.

NextEra Energy expects its adjusted EPS to grow at an annualized rate of 6% to 8% through 2027, and expects annual dividend hikes of around 10% through 2026 as it pumps billions of dollars into both businesses.

More specifically, NextEra Energy plans to spend over $34 billion on Florida Power & Light between 2024 and 2027 and more than $65 billion on renewable energy over the next four years. That’s massive, and if done right, should steadily boost NextEra Energy’s earnings and cash flows to support bigger dividends for years, regardless of how the economy fares.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Matt DiLallo has positions in 3M, Enterprise Products Partners, and NextEra Energy. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in 3M. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool recommends 3M, Enterprise Products Partners, and Oneok. The Motley Fool has a disclosure policy.

Don’t Give Up on Dividends: 3 Dividend Stocks That Reward You Through Thick and Thin was originally published by The Motley Fool

CryptoCurrency

Could Buying SoundHound AI Now Be Like Buying Nvidia in 2023?

Nvidia‘s (NASDAQ: NVDA) stock has been an absolutely incredible performer recently. Since the start of 2023, it rose by more than 800%. Most investors would be thrilled to own a stock that delivered returns like that, but not every company has the potential. It requires a massive growth catalyst to justify such gains.

SoundHound AI (NASDAQ: SOUN) is one company that could have this potential. It’s a key player in one niche of the artificial intelligence (AI) sector, and has a massive backlog for its products.

SoundHound’s product is gaining momentum

SoundHound AI’s technology can parse human speech and perform various tasks based on what it hears. Among the ways it’s already being used most are in processing restaurant orders and improving digital assistants in vehicles, but its capabilities extend far beyond those two use cases.

In the automotive segment, SoundHound partnered with Stellantis; the giant automaker will integrate SoundHound’s tech into its vehicles across Europe and Japan. This will give people access to generative AI functions while they’re driving — an improvement from the voice assistants that are available on vehicles today. If SoundHound can win business with other automakers and break into other regions, this segment of its business alone could provide it with a huge amount of growth.

SoundHound also worked with several companies in the restaurant sector to automate telephone and drive-thru orders, which saves restaurants on wages. According to the company, these AI assistants actually outperform humans in terms of order speed and accuracy, so the customer doesn’t feel like the experience declined. Some of SoundHound’s restaurant customers, among them White Castle and Jersey Mike’s, are fairly big, but there’s serious room for it to grow if it can capture some of the largest fast-food businesses.

SoundHound AI could achieve even greater success if its solutions are utilized in new applications.

But is that potential enough to make its stock the next Nvidia?

Nvidia has one key advantage that SoundHound does not

In the second quarter, SoundHound generated $13.5 million in revenue, which was up 54% year over year. That’s quite small compared to other AI businesses.

However, the key figure investors should focus on is SoundHound’s backlog, which totals $723 million. This figure doubled from a year ago, showing that rising demand has outpaced SoundHound’s capability to integrate its product with its customers’ systems.

This is factoring into SoundHound’s current valuation, as Wall Street has high hopes for the company.

Trading at 23 times sales, SoundHound stock already carries a premium valuation. By contrast, Nvidia traded for around 15 times forward earnings at the start of 2023. That was a dirt-cheap price, and also a far cry from the forward earnings ratio of 47 it trades at today.

SoundHound already has a premium price tag, which detracts from its growth potential from here. But if it can mature into a business that generates $100 million in revenue per quarter, Nvidia-like performance for the stock is still possible.

If SoundHound achieved that and carried a valuation of 20 times sales, it would be worth $8 billion, up 370% from its market cap today. That would be a solid return, but still far less than what Nvidia produced.

SoundHound stock’s premium price tag may prevent it from delivering Nvidia-like returns from here, but that doesn’t mean it won’t be a great investment. However, it’s a bit of a long shot considering the niche use cases for its product and the company’s small size. It could make investors some serious money, but don’t expect Nvidia-like returns.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

Could Buying SoundHound AI Now Be Like Buying Nvidia in 2023? was originally published by The Motley Fool

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 weeks ago

Technology3 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment3 weeks ago

Science & Environment3 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

News4 weeks ago

the pick of new debut fiction

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum forces used to automatically assemble tiny device

-

News3 weeks ago

News3 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Technology2 weeks ago

Technology2 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Business2 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

News4 weeks ago

News4 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News3 weeks ago

News3 weeks agoYou’re a Hypocrite, And So Am I

-

Sport3 weeks ago

Sport3 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News3 weeks ago

News3 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Football2 weeks ago

Football2 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

News3 weeks ago

The Project Censored Newsletter – May 2024

-

Business2 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

Technology2 weeks ago

Technology2 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

MMA2 weeks ago

MMA2 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoRethinking space and time could let us do away with dark matter

-

News4 weeks ago

News4 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Technology2 weeks ago

Technology2 weeks agoQuantum computers may work better when they ignore causality

-

Sport2 weeks ago

Sport2 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Technology2 weeks ago

Technology2 weeks agoGet ready for Meta Connect

-

News3 weeks ago

News3 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Technology4 weeks ago

Technology4 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Business2 weeks ago

Ukraine faces its darkest hour

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

News3 weeks ago

News3 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists have worked out how to melt any material

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCardano founder to meet Argentina president Javier Milei

-

Politics3 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

MMA3 weeks ago

MMA3 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoEverything a Beginner Needs to Know About Squatting

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMeet the world's first female male model | 7.30

-

News3 weeks ago

News3 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Toning Workout for Women

-

Servers computers2 weeks ago

Servers computers2 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Politics4 weeks ago

Politics4 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Sport3 weeks ago

Sport3 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoBeing in two places at once could make a quantum battery charge faster

-

News4 weeks ago

News4 weeks agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBlockdaemon mulls 2026 IPO: Report

-

Business3 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoBest Exercises if You Want to Build a Great Physique

-

TV3 weeks ago

TV3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Technology2 weeks ago

Technology2 weeks agoThe best robot vacuum cleaners of 2024

-

News3 weeks ago

News3 weeks agoChurch same-sex split affecting bishop appointments

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Technology3 weeks ago

Technology3 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow one theory ties together everything we know about the universe

-

Business4 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMost accurate clock ever can tick for 40 billion years without error

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Politics3 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Politics2 weeks ago

Politics2 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

News2 weeks ago

News2 weeks agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology2 weeks ago

Technology2 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Technology2 weeks ago

Technology2 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business3 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Travel3 weeks ago

Travel3 weeks agoDelta signs codeshare agreement with SAS

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

You must be logged in to post a comment Login