Money

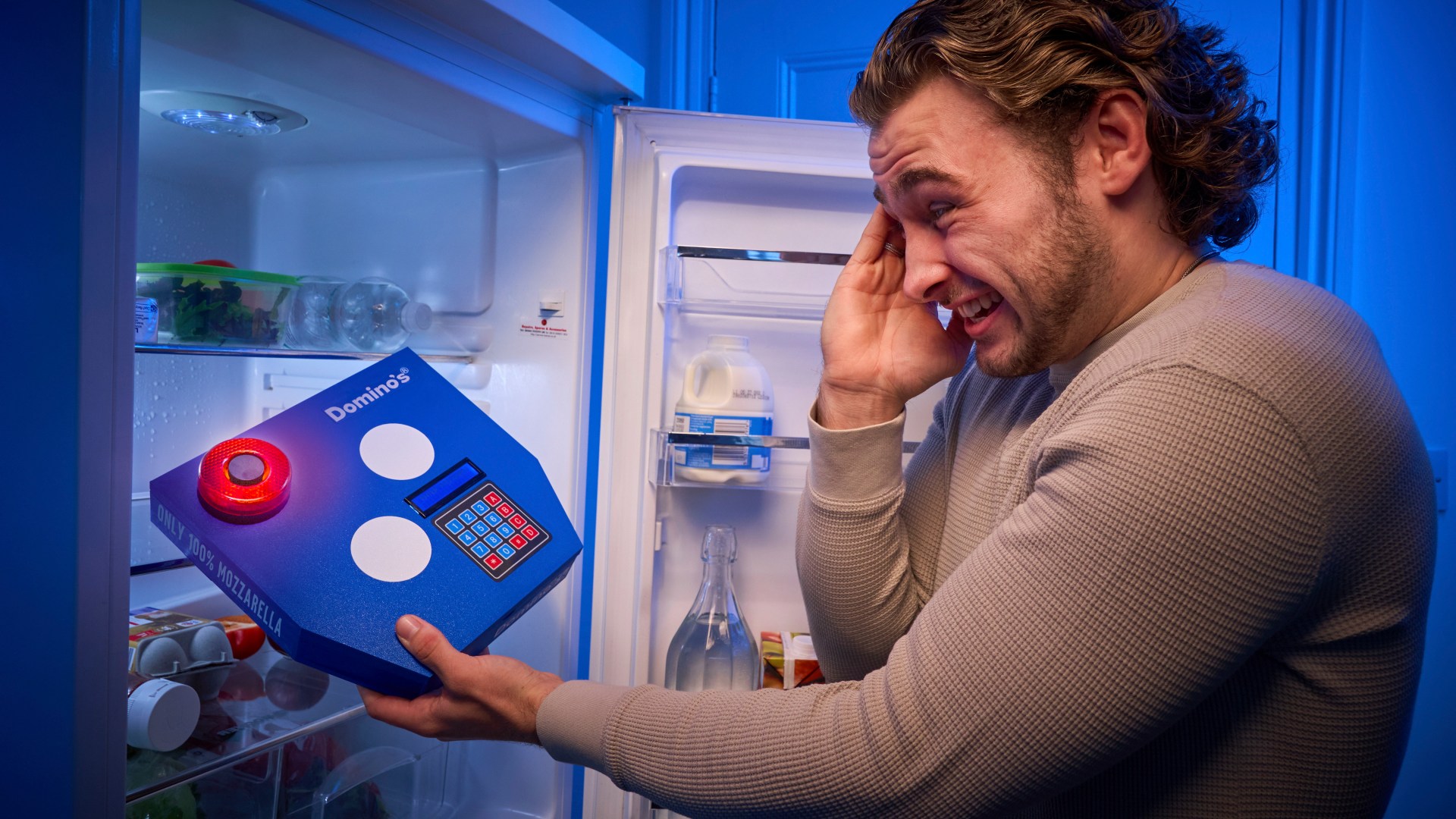

Domino’s are giving out lockable boxes to students – so they can hide their takeaways from hungry housemates

DOMINO’S has created a lockable box to keep leftover pizza safe, as university students head off for fresher’s week.

The pizza chain is giving away the limited-edition safes, which fit perfectly in a fridge and keep pizza secure, away from prying eyes and hungry mouths.

The boxes are available to students or anyone else at risk of fridge thefts through their website.

Melanie Howe from Domino’s said: “There’s nothing worse than thinking you’ve got some tasty leftovers ready for the next day – only to be left fuming when someone has pinched them.

“For most people students, that’s an all-too-common reality.

“To make sure you don’t become a victim to the same misfortune, we wanted to create the Slice Security safe which fits in fridges and keeps precious leftover pizza safe from greedy housemates.”

It comes as research of 400 of university students who’ve lived in student accommodation in last 10 years found 65% have had food stolen during their time at uni.

Milk (45 %) and bread (33%) are the most swiped items, followed by leftover pizza (18%).

And in a bid to stop their goods being stolen, 60% have written their name on items.

It also emerged 46% have caught others in the act of stealing their grub.

While 52% said food theft is one of the biggest causes of arguments as student.

The research also found living with friends (39%) and having your own space (35%) are the best things about living in student accommodation.

While living in messy conditions (48%), having loud roommates (43%), and having food stolen (36%) are the biggest worries.

Those polled also had their say on their favourite takeaway in the research carried out through OnePoll – and pizza (46%) came top.

Motivations for ordering a food delivery include great taste (45%), not having to wash up (40%), and having leftovers for the following day (30%).

How to save money on your takeaway

TAKEAWAYS taste great but they can hit you hard on your wallet. Here are some tips on how to save on your delivery:

Cashback websites– TopCashback and Quidco will pay you to order your takeaway through them. They’re paid by retailers for every click that comes to their website from the cashback site, which eventually trickles down to you. So you’ll get cashback on orders placed through them.

Discount codes – Check sites like VoucherCodes for any discount codes you can use to get money off your order.

Buy it from the shops – Okay, it might not taste exactly the same but you’ll save the most money by picking up your favourite dish from your local supermarket.

Student discounts – If you’re in full-time education or a member of the National Students Union then you may be able to get a discount of up to 15 per cent off the bill. It’s always worth asking before you place your order.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Map reveals nine best places to live where salaries are higher than living costs and you can save £1,000 a month

SAVING money for a rainy day or big purchase is no easy feat at the best of times, let alone when you’re battling against soaring bills with stagnant wages.

By the time food and household costs are met, many of us have barely anything left at the end of the month to save

However, if you can bring your earnings up and the cost of living down, you will start to increase your disposable income which can be used for savings.

It sounds easier said than done, but the cash you earn each month, as well as living costs are heavily influenced by where in the UK you live.

It means that if you choose your location wisely you can start to increase the gap between wages and costs for the better – giving you more free cash to put into savings.

There are nine locations in the UK where the amount you’re paid is on average at least £1,000 more than living costs – see map above – according to research from property site Compare My Move.

The location with the highest gap between the cost of living and earnings is York.

The cost of both buying or renting a flat in the historic city is low compared to other parts of the UK, and you can get on to the property ladder for around £198,093, found Compare My Move.

At the same time, the cost of living comes in at £1,415 while average earnings after tax are £2,846, leaving £1,431 of disposable income each month.

Even if the cost of living is relatively high, you can still save if salaries are higher.

For example, in second place is Cambridge where the average salary is a bumper £3,143 while the cost of living is £1,829 meaning there is still £1,314 leftover.

And in third spot is Reading with the highest employability rate of any city or town in the UK with 86.1% of its residents in employment, according to Compare My Move.

In the South East, means buying a flat is more expensive than other locations at a typical £227,525. However, the average salary is competitive at £2,909 after tax, while the cost of living is £1,714 meaning that disposable income is still high at £1,195.

Wigan, Derby, Bolton and Glasgow are among other spots where there is a sizeable difference between earnings and costs – and some of the most underrated spots in the UK for young adults, according to Compare My Move.

Of course, your earnings in any location will depend on other factors such as the job you do and the company you work for.

However, you can use job sites to see advertised salaries in your field across different locations and compare with your current earnings.

Costs will also depend on exactly where you choose to live but you can use a property site to look up rent or house prices in different locations to try to gauge how to create a bigger disposable income in your budget.

SAVING £1,000 A MONTH

If saving to buy a home is an important achievement for you, living in one of the locations on the list could help.

Putting away £1,000 a month after a year would give you £12,000. And after three years you could have £36,000 – enough for a 10% deposit on £360,000 property.

If you are going to start saving, it’s also important to keep your cash in a spot where it will earn the highest interest.

It’s also important to be able to access at least a month or two’s worth of income in an easy access account for emergency situations – such as a job loss.

You can currently earn as much as 5.2% in an easy access account with Ulster Bank if you have at least £5,000 in savings – you will earn 2.25% if you have less than that.

Or for smaller sums from £1 you can get a rate of 4.84% with app-based provider Chip.

On a lump sum of £12,000 you’d earn £580.80 worth of interest after a year at a rate of 4.84%.

Opting for as high rate of interest as possible helps you to achieve your savings goals faster. It also stops inflation eroding the value of your nest egg.

If you want to save regularly, you can rates of up to 7% with first direct. You will need to hold a current account with the bank but can then put away up to £300 a month over a year at the top rate.

How you can find the best savings rates

If you are trying to find the best savings rate there are websites you can use that can show you the best rates available.

Doing some research on websites such as MoneyFacts and price comparison sites including Compare the Market and Go Compare will quickly show you what’s out there.

These websites let you tailor your searches to an account type that suits you.

There are three types of savings accounts fixed, easy access, and regular saver.

A fixed-rate savings account offers some of the highest interest rates but comes at the cost of being unable to withdraw your cash within the agreed term.

This means that your money is locked in, so even if interest rates increase you are unable to move your money and switch to a better account.

Some providers give the option to withdraw but it comes with a hefty fee.

An easy-access account does what it says on the tin and usually allow unlimited cash withdrawals.

These accounts do tend to come with lower returns but are a good option if you want the freedom to move your money without being charged a penalty fee.

Lastly is a regular saver account, these accounts generate decent returns but only on the basis that you pay a set amount in each month.

Money

I won £166K People’s Postcode Lottery win but husband won’t get a penny… he has his begging letter written

A GREAT gran who won £166,666 says her husband will have to write a “begging letter” if he wants to see a single penny of it.

Gill English landed the cash on People’s Postcode Lottery in Rugby, Warwickshire – and is now planning a slap-up carvery dinner for her big family.

The retired carer also said she is prepared to buy her hubby a new pair of shoes – but only once shes sees his “begging letter”.

Gill said: “Oh my God! Flippin’ heck! I’ll take the family to a carvery. I also said I’d buy Kev a new pair of shoes.

“He’ll have the begging letter written!”

Retired chauffeur Kev laughed: “I’ve already written the begging letter.”

The couple are both recovering from cancer.

Kev had melanoma and Gill is still receiving treatment after having part of her right lung removed.

But Gill said they are more interested in helping family – including her three sons, eight grandchildren and nine great grandchildren – than treating themselves.

She said: “I love buying presents and love doing things for people. It’s lovely when you feel you have done something for somebody.

“I love giving. I get great joy out of it. If you’ve got money, you’ve got it. If you haven’t, you haven’t.

“I’m not money motivated, but I am now! This is so lovely. Thank you.”

Gill also revealed she hadn’t told her hubby that she played Postcode Lottery until she got the call to say she’d won.

She said: “Kev didn’t know I even played; I don’t tell him everything. I hadn’t told anyone except my youngest son.

“I’ll never get any sleep now just working it all out.”

Kev said: “It wasn’t a secret, she just never told me.”

How to enter the People’s Postcode Lottery

- The Postcode Lottery is a subscription-based lottery in which players sign up with their postcode.

- Your postcode is your ticket number – 40p a day ensures entry into all drawers, or £12 a month.

- Once subscribed, they are automatically entered into every draw.

- Prizes are announced every day of the month.

- If your postcode gets luck, every player in your postcode wins.

- 33 per cent of the ticket price will go to charity that is re-funnelled back into the community.

Money

Exact animal to spot on sought after King Charles III 50p coin worth up to £41

IF you pay close attention to your change, you might spot an animal on your King Charles III 50p that could make it worth more than £40.

Coins with a distinctive design could be worth a small fortune because very few make it into circulation.

For this reason, they are very attractive to collectors who are sometimes willing to pay large sums in exchange for one.

One of the most current sought-after coins is the King Charles III Atlantic Salmon 50p, which first entered circulation on November 2023.

The coin was one of eight new special varieties released by the Royal Mint, reflecting the King’s passion for conservation and the natural world.

Despite an estimated 500,000 Salmon 50ps entering circulation in, collectors have been finding them hard to come by, according to ChangeChecker.

The coin is marked with an engraving of salmon fish jumping out of Atlantic ocean water.

It has become much harder to find in change, and prices on online marketplaces such as eBay and Amazon have continued to rise.

Copes Coins previously told The Sun that Atlantic Salmon 50p could become “one of the rarest coins to enter circulation in the last 15 years”.

You can make money from these rare coins by selling them at auction, either online or in person, or through a dealer.

The Sun found that one of these coins recently sold on eBay for £41 on September 22 with 13 bids.

Another sold for £25 on September 20 with 18 bids.

On September 11, one of these coins sold for £28 with nine bids.

The price of a coin varies based on things like demand at the time and how common it is.

It’s important to remember that you aren’t guaranteed to fetch huge amounts if you do choose to sell your change.

Sometimes you’ll get better individual prices if another enthusiast needs your coin to complete their collection.

Anyone can list a coin on eBay and charge whatever amount they wish, but it’s only ever worth what someone is willing to pay.

By checking the recently sold items you will get a more accurate indication of what people are willing to pay for a specific coin.

What are the most rare and valuable coins?

How to sell a rare coin

If, after checking, you realise you’ve come across a rare coin, there’s a number of ways you can sell it.

You can sell it on eBay, through Facebook, or in an auction.

But be wary of the risks.

For example, there are a number of scams targeting sellers on Facebook.

Crooks will say they’re planning to buy the item and ask for money upfront for a courier they’ll be sending around.

But it’s all a ruse to get you to send free cash to them – and they never have any intention of picking your item up.

It’s always best to meet in person when buying or selling on Facebook Marketplace.

Ensure it’s a public meeting spot that’s in a well-lit area.

Avoid payment links and log in directly through the payment method’s website.

Most sellers prefer to deal with cash directly when meeting to ensure it’s legitimate.

The safest way to sell a rare coin is more than likely at auction.

You can organise this with The Royal Mint’s Collectors Service. It has a team of experts who can help you authenticate and value your coin.

You can get in touch via email and a member of the valuation team will get back to you.

You will be charged for the service, though – the cost varies depending on the size of your collection.

Meanwhile, you can sell rare coins on eBay.

But take into account that if you manage to sell your item then eBay will charge you 10% of the money you made – this includes postage and packaging.

The design of the coin, its condition and whether or not the coin is in circulation also affects how much it could be worth.

You can easily figure out how rare a coin is, by checking its mintage figures.

This relates to how many coins were produced by The Royal Mint.

If a coin has a low mintage, it means there are fewer of them in circulation and is therefore rarer and it could potentially be worth more than its face value.

But remember a coin is only ever worth what someone is willing to pay at the time.

Either way, you’ll want to keep an eye out for some in particular which can sell for big numbers.

A rare Blue Peter Olympic 50p has been flogged on eBay for £205 in the past.

The coin shows an athlete doing the high jump and was drawn by nine-year-old Florence Jackson after winning a competition on the kid’s TV show.

Plus, one seller managed to pocket a whopping £63,000 flogging his Battle of Hasting’s 50p too.

So-called ‘error coins’ tend to be worth a lot too, because there’s rarely more than a few thousand of them in circulation.

One 50p that was mistakenly struck twice sold for as much as £510 on eBay because it was rare.

It’s not only 50ps either – a rare error 10p coin sold for over 1,000 times more than its face value on eBay in the past.

Likewise, there are several rare £2 coins in circulation which could be worth just under £50.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Child benefit not paid due to TSB Bank issues leaving hundreds of parents fuming over missing cash

HUNDREDS of parents are fuming after a technical error at TSB Bank has left them unable to access their child benefit payment and other cash.

Upset mums and dads took to social media this morning to raise their concerns, with one sharing how she is now unable to give her son cash for a school trip.

Another said she had a lot of bills due out of her account this morning and has now been left with “mega anxiety” over the issue.

While a third said: “You have ruined my entire holiday. I will take this up when I return. This is absolutely unacceptable.”

A fourth added: “Not been paid, my son’s birthday is tomorrow and my bills are due this is a nightmare bank.”

The high street lender, which has over five million customers in the UK, apologised to customers and said it was working to “fix the issue”.

Around 307 customers logged complaints on Downdetector with 70% of those complaints relating to issues about transferring funds.

TSB spokesperson told The Sun: “We’re aware of an issue with some BACS payments not yet showing on customers’ accounts.

“We are working on fixing this and will provide an update as soon as possible.”

It comes as parents are dealing with extra costs as their children return to school following the summer break.

Child Benefit is usually paid every four weeks on either a Monday or Tuesday by HMRC.

The benefit is worth £25.60 a week for your eldest child, and then £16.95 a week for any subsequent children.

For a family with two children who qualify, this adds up to £2,212.60 a year. For just one child, you get £1,331.20 a year.

HMRC has told claimants on X, formally known as Twitter, that if they have not yet received their monthly payment to contact their bank first.

They added: “We are aware of this and understand this relates to issues certain banking providers are experiencing.”

Back in June, customers faced a similar issue when the tax office flagged an issue with the system that sends the cash directly to bank accounts.

It is important to note that this issue is related to TSB and not HMRC, so any issues relating to a delayed payment should go to the bank.

However, it is not just parents and guardians impacted by the issue with hundreds of other customers also not seeing cash land in their accounts.

How to claim Child Benefit

Child benefit is worth up to £1,331 a year for your first or only child and up to £881 a year for additional children.

This works out at £102.40 every four weeks or £25.60 a week for your first child and £67.80 every 4 weeks or £16.95 a week for their siblings.

There is no limit on the number of children that can be claimed for.

Applying is straightforward and can be done in minutes at gov.uk or through the HMRC app.

Parents with a newborn baby should make a claim online as soon as possible and could then receive their first payment in as little as three days.

You can also backdate claims for up to three months.

Parents can make a claim and then choose to opt out of receiving Child Benefit payments can still receive National Insurance credits if one parent is not working.

National Insurance credits build up your entitlement to the state pension.

Over a million of its customers use online banking with the service becoming increasingly popular as high street banks cut down on the number of physical branches they operate.

TSB is set to close 36 banks over the coming months, leading to the loss of hundreds of jobs.

The first of the 36 sites closed on September 3, when branches in Bedworth, Banff and Stornoway shut their doors for good.

The closures will continue through to May next year.

Can I claim compensation for an outage?

As this is an issue with TSB and not HMRC you must log an issue with the bank.

Banks aren’t obliged to pay compensation to customers if there’s been an outage or if they’ve experienced technical issues.

But you might be entitled to some money back depending on how much the disruption affected you.

You’ll have to present evidence of how the outage negatively impacted you, including any extra costs incurred through late payment fees for instance.

You should make a note of when you were unable to access the services and the names of the people you spoke to at the bank that suffered the outage.

You can find more details about how to complain to TSB on its website.

If your bank doesn’t resolve your complaint, you can take your case to the Financial Ombudsman Service.

It is an independent body which will resolve any issues based on what it thinks is “fair and reasonable” depending on the circumstances of the case.

The service can resolve your issue over the phone, by email or post depending on what best suits you.

In the case of an IT system outage at a bank, the FOS says any compensation you may receive will be dependent on your circumstances and whether you lost any money as a result.

If it finds the bank was at fault, you may see any fees, charges or fines reimbursed.

How to check if your bank is down

THERE are a few different ways to find out if your bank is experiencing an outage.

Senior consumer reporter Olivia Marshall explains how you can check.

If you’re trying to send money to someone, or you just want to check if you have enough cash for a coffee, finding your online banking is down can be a real pain.

Most banks have a dedicated news page on their website to show service problems, including internet banking, mobile apps, ATMs, debit cards and credit cards.

You can also check on any future work they have planned and what it might mean for you.

Plus, you can check websites such as Down Detector, which will tell you whether other people are experiencing problems with a particular company online.

Money

‘We need to try this!’ cry Cadbury fans after launch of new ‘special edition’ bar – but you’d be lucky to get one

SHOPPERS have noticed a brand new flavour of special edition Cadbury’s chocolate – but you’ll be lucky to get your hands on a bar.

The new Tiramisu-flavoured bar is part of the brand’s white chocolate range, Dream.

It was relaunched in 2020 and has seen several exciting editions including Oreo and raspberry.

News of the brand new Tiramisu flavour was shared on the New Foods UK Facebook group – where it received 840 reactions and 110 shares.

Meanwhile, 600 commenters shared their thoughts on the new chocolate.

One said: “Oh my I need this.”

Another said: “I need that.”

A third wrote: “Imagine this as my easter egg!!!”

However, others shared the disappointing update that the bar had already sold out on the specialist Bombon website, where it was originally spotted.

One said: “Just to let you know the bar was £6 plus delivery of £3.50 and it has sold out now that site.”

Another moaned that special edition bars are often hard to find in supermarkets, saying: “It’s pretty funny there’s lots of pictures of these chocolate bars and you go to shops to try and find then but you never can”.

The bar, which is £5.99 for 150g, is currently out of stock on the website.

The new launch comes after Cadbury announced an exciting new opportunity for chocoholics – to be appointed a professional chocolate taster.

However, the brand has not been without controversy in recent weeks, as it was revealed that the beloved Brunch snack bar was getting smaller – but remaining the same price.

It also announced it was axing its Christmas treats Festive Friends, with shoppers claiming “Christmas is ruined”.

However, chocolate-lovers can still get excited about a number of other new chocolatey treats hitting supermarket shelves.

Aldi released a dupe of Cadbury Pots of Joy, while Nestle launched a new flavour of Quality Street Matchmakers – which supposedly tastes. like Nutella.

Money

Exact date millions of customers at UK’s biggest energy supplier must take meter readings – or risk higher bills

A MAJOR energy supplier has issued its deadline for customers to take a meter reading to avoid facing unexpected bills.

Millions of households must submit a meter reading to ensure their bill is accurate ahead of the new energy price cap.

British Gas is the leading supplier of energy in the UK, delivering to millions of households and businesses across the UK.

The energy supplier confirmed that if you want an accurate bill, the final date to submit an energy reading is October 14 – however, it’s better to take the actual reading around the October 1 price cap change.

British Gas customers can technically take and submit meter readings anytime, but doing it any point after October 14 might mean their next bill is estimated.

October 1, otherwise known as Meter Reading Day, is the best time to take a reading – as customers can calculate what they pay before the new price cap is implemented.

The new energy price cap, which limits the amount that can be charged, will be around 10% higher than the current level which has been in place since July.

The price cap makes sure that prices for people on a standard variable tariff are fair and that they reflect the cost of energy.

The way it is calculated is based largely on the current wholesale energy prices, as well as other factors such as network, operating and policy costs, and VAT.

The energy price cap changes every 3 months – in June, the cap fell to the lowest level in two years, from £1,690 to the current rate of £1,568.

However, from October 1, Ofgem, who sets the limit, revealed that bills will rise from £1,568 to £1,717.

Households will have until October 14 to submit the reading from the first day of the month – meaning they must remember to take the reading on October 1.

Customers will be able to submit their readings via their online account, the British Gas mobile app, or an automated line.

If you are concerned about the new price cap, British Gas have also been working to provide support for households through their Families and Individual Support Fund.

This is for British Gas customers and non customers who are in debt over their energy bill.

To apply, go to the British Gas fund or search “British Gas Support Fund” where the eligibility requirements are detailed.

Who should submit a meter reading?

Households who are on an SVT should submit regular meter readings to prevent their supplier estimating their usage.

In total, there are around 28 million SVT users in the UK.

For these households it is especially important to submit a meter reading now, to avoid any disputes when the price cap comes into effect.

If your bill’s not accurate, you could be charged more than you should – and if you’re charged less, you could end up owing money down the line.

Meanwhile, customers with smart meters do not need to submit a reading, as this is automatically sent by the device.

And those on prepayment plans or fixed rates also do not need to worry, as their bill is either predetermined, or their rate is locked in for the duration of their deal.

If you are unsure what plan you are on, go to your suppliers website or revisit paperwork from when you began your energy package.

What is the deadline for other suppliers?

EDF

EDF customers will be able to back date their meter reads at any time up to and including Wednesday October 9.

They can submit meter reads through the EDF App, their online MyAccount, or via telephone, email, text and WhatsApp.

Octopus

If you’re a customer with Octopus Energy, you should register your meter reading on, or close to, the exact date October 1 if you want an accurate figure.

Scottish Power

Scottish Power have no deadline for meter readings. Customers can update meter readings as and when they wish to provide them.

If you are on a standard variable or default tariff with Scottish Power, then the energy price cap will automatically apply.

However, if your prices need to increase as a result, there’s no need to contact them.

Scottish Power have said: “We’ll write to you by letter or email to let you know what your new prices will be before the change takes place.”

Ovo Energy

Ovo Energy customers can submit their meter readings via the app, online account, phone, Whatsapp or webchat at any time, however the closer to the bill date the customer provides their bill date, the less of the bill will need to be estimated.

For accurate bills, Ovo recommends customers opt for a smart meter.

Utilita

When we heard from Utilita, they pointed out that “the vast majority of Utilita customers – in excess of 90% – don’t have to worry about the hassle of submitting meter readings because they have a smart meter”

If you aren’t sure of the deadline for your supplier, review the conditions of your arrangement via the company website or paperwork.

To be safe, we recommend you submit the reading on or before October 1 anyway, so you don’t risk missing the deadline.

How do I calculate my energy bill?

BELOW we reveal how you can calculate your own energy bill.

To calculate how much you pay for your energy bill, you must find out your unit rate for gas and electricity and the standing charge for each fuel type.

The unit rate will usually be shown on your bill in p/kWh.The standing charge is a daily charge that is paid 365 days of the year – irrespective of whether or not you use any gas or electricity.

You will then need to note down your own annual energy usage from a previous bill.

Once you have these details, you can work out your gas and electricity costs separately.

Multiply your usage in kWh by the unit rate cost in p/kWh for the corresponding fuel type – this will give you your usage costs.

You’ll then need to multiply each standing charge by 365 and add this figure to the totals for your usage – this will then give you your annual costs.

Divide this figure by 12, and you’ll be able to determine how much you should expect to pay each month from April 1.

What is the British Gas Support Fund?

If you are concerned about facing the new price cap this winter, British Gas have reopened their Individual and Families support fund.

The trust has helped more than 21,000 British customers in the past, with energy debt write off grants of up to £2,000.00.

Their current package is bigger than ever, with over £140 million set aside to help those who are struggling financially.

Unlike many other supplier grants, The British Gas scheme extends to both British Gas customers and non-customers.

However, there are certain requirements to be eligible for the fund.

Pre-payment meter customers must be within £50 and £1,700 of energy debt.

They must also live in England, Scotland or Wales, and have not received a grant from the British Gas Energy Trust within the last 2 years.

It is recommended that customers from companies with hardship funds first seek assistance from their own schemes.

The applicant must be able to show a sustainable position moving forward.

If you are eligible, British Gas can offer:

- Free energy grants

- Energy advice for vulnerable households

- Tailored support for households and small business customers

- Funding for small businesses and charities

Scottish power, Utilita, EDF, E.ON and Utility Warehouse are also offering support schemes for their customers.

Go to your energy provider’s website to learn what help is available.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

-

Womens Workouts1 day ago

Womens Workouts1 day ago3 Day Full Body Women’s Dumbbell Only Workout

-

News6 days ago

News6 days agoYou’re a Hypocrite, And So Am I

-

Sport5 days ago

Sport5 days agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Technology7 days ago

Technology7 days agoWould-be reality TV contestants ‘not looking real’

-

News3 days ago

News3 days agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment6 days ago

Science & Environment6 days agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment6 days ago

Science & Environment6 days ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment6 days ago

Science & Environment6 days agoLiquid crystals could improve quantum communication devices

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment6 days ago

Science & Environment6 days agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment6 days ago

Science & Environment6 days agoHow to wrap your mind around the real multiverse

-

Science & Environment6 days ago

Science & Environment6 days agoSunlight-trapping device can generate temperatures over 1000°C

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

Science & Environment6 days ago

Science & Environment6 days agoQuantum ‘supersolid’ matter stirred using magnets

-

Health & fitness7 days ago

Health & fitness7 days agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment7 days ago

Science & Environment7 days agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment6 days ago

Science & Environment6 days agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment6 days ago

Science & Environment6 days agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment6 days ago

Science & Environment6 days agoWhy this is a golden age for life to thrive across the universe

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoCardano founder to meet Argentina president Javier Milei

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoBlockdaemon mulls 2026 IPO: Report

-

Science & Environment2 days ago

Science & Environment2 days agoMeet the world's first female male model | 7.30

-

Science & Environment1 week ago

Science & Environment1 week agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment7 days ago

Science & Environment7 days agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

CryptoCurrency5 days ago

CryptoCurrency5 days ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency5 days ago

CryptoCurrency5 days ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

Science & Environment6 days ago

Science & Environment6 days agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment6 days ago

Science & Environment6 days agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment6 days ago

Science & Environment6 days agoQuantum forces used to automatically assemble tiny device

-

Science & Environment6 days ago

Science & Environment6 days agoNuclear fusion experiment overcomes two key operating hurdles

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoRedStone integrates first oracle price feeds on TON blockchain

-

Science & Environment6 days ago

Science & Environment6 days agoHyperelastic gel is one of the stretchiest materials known to science

-

CryptoCurrency5 days ago

CryptoCurrency5 days ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

News5 days ago

News5 days agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Sport5 days ago

Sport5 days agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Technology5 days ago

Technology5 days agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News5 days ago

News5 days agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts4 days ago

Womens Workouts4 days agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts4 days ago

Womens Workouts4 days agoEverything a Beginner Needs to Know About Squatting

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoHelp! My parents are addicted to Pi Network crypto tapper

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

Science & Environment6 days ago

Science & Environment6 days agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Science & Environment6 days ago

Science & Environment6 days agoHow one theory ties together everything we know about the universe

-

Science & Environment6 days ago

Science & Environment6 days agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

News5 days ago

News5 days agoChurch same-sex split affecting bishop appointments

-

CryptoCurrency5 days ago

CryptoCurrency5 days ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

Business5 days ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Business5 days ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Politics5 days ago

Politics5 days agoLabour MP urges UK government to nationalise Grangemouth refinery

-

News5 days ago

News5 days agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

News4 days ago

News4 days agoBangladesh Holds the World Accountable to Secure Climate Justice

-

News2 days ago

News2 days agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Politics1 week ago

Politics1 week agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Health & fitness7 days ago

Health & fitness7 days agoThe maps that could hold the secret to curing cancer

-

News6 days ago

News6 days ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News6 days ago

News6 days agoRoad rage suspects in custody after gunshots, drivers ramming vehicles near Boise

-

Money6 days ago

Money6 days agoWhat estate agents get up to in your home – and how they’re being caught

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoElon Musk is worth 100K followers: Yat Siu, X Hall of Flame

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

-

Science & Environment6 days ago

Science & Environment6 days agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

Science & Environment6 days ago

Science & Environment6 days agoHow Peter Higgs revealed the forces that hold the universe together

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoTelegram bot Banana Gun’s users drained of over $1.9M

-

Science & Environment5 days ago

Science & Environment5 days agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment5 days ago

Science & Environment5 days agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

Technology5 days ago

Technology5 days agoFivetran targets data security by adding Hybrid Deployment

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoETH falls 6% amid Trump assassination attempt, looming rate cuts, ‘FUD’ wave

-

Politics5 days ago

The Guardian view on 10 Downing Street: Labour risks losing the plot | Editorial

-

Politics5 days ago

Politics5 days agoI’m in control, says Keir Starmer after Sue Gray pay leaks

-

Politics5 days ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

Fashion Models5 days ago

Fashion Models5 days agoMixte

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoBitcoin options markets reduce risk hedges — Are new range highs in sight?

-

Business5 days ago

UK hospitals with potentially dangerous concrete to be redeveloped

-

Business5 days ago

Axel Springer top team close to making eight times their money in KKR deal

-

News5 days ago

News5 days ago“Beast Games” contestants sue MrBeast’s production company over “chronic mistreatment”

-

News5 days ago

News5 days agoSean “Diddy” Combs denied bail again in federal sex trafficking case

-

Money5 days ago

Money5 days agoBritain’s ultra-wealthy exit ahead of proposed non-dom tax changes

-

Womens Workouts4 days ago

Womens Workouts4 days agoHow Heat Affects Your Body During Exercise

-

Womens Workouts4 days ago

Womens Workouts4 days agoWhich Squat Load Position is Right For You?

-

Womens Workouts4 days ago

Womens Workouts4 days agoKeep Your Goals on Track This Season

-

News3 days ago

News3 days agoWhy Is Everyone Excited About These Smart Insoles?

-

Womens Workouts1 day ago

Womens Workouts1 day ago3 Day Full Body Toning Workout for Women

-

News1 week ago

News1 week agoDid the Pandemic Break Our Brains?

-

Technology1 week ago

Technology1 week ago‘The dark web in your pocket’

-

Business1 week ago

Business1 week agoGuardian in talks to sell world’s oldest Sunday paper

-

Business1 week ago

Glasgow to host scaled-back Commonwealth Games in 2026

-

Politics1 week ago

Politics1 week agoUkraine missile request for war with Russia under discussion

You must be logged in to post a comment Login