Money

Don’t hold out hope for any more game changers in protection

Remember when former Apple chief executive Steve Jobs stood up in 2007 and said, “We are going to launch three revolutionary products?”

Remember when former Apple chief executive Steve Jobs stood up in 2007 and said, “We are going to launch three revolutionary products?”

To cheers from the audience, he revealed the first to be “a widescreen iPod with touch controls.” There were more gasps as he revealed the second as “a revolutionary mobile phone.” And when he announced the third as a “breakthrough internet communicator,” the people in the room almost lost it.

But when he unexpectedly said, “All three of these products are in the same device – the iPhone,” he brought the house down.

With successive generations of iPhones, it’s harder to care about the differences unless you are a true tech geek

Jobs’s speech is legendary, and the iPhone was genuine innovation which has shaped the smart-phone world we live in today. But have we seen something as genuinely innovative since then? The iPhone has evolved through 16 generations and, taking into account the various ‘S’ models over the years, there must be approaching 20 generations now.

I remember the iPhone 4, with its Retina display, was pretty epic. The Apple advertising said, “This changes everything. Again.” But with successive generations of iPhones, it’s harder to care about the differences unless you are a true tech geek. A slightly better camera, a beveled screen, a non-beveled screen, a notch.

Looking back at the history of protection products, I see a similar pattern. In 1996, Scottish Provident introduced the innovative ‘Menu of benefits’ product.

The concept of added-value services was initially met with scepticism, but these are essential complements to the insurance elements

Predating Apple by over a decade, it put three products into one and let advisers and their clients choose any combination to suit their needs. At the time, people used words like “revolutionary” and “innovative” as true descriptors, rather than cliched marketing buzzwords.

In the early 2000s, another company introduced what we now call added-value services to the protection market. The concept of added-value services was initially met with scepticism, but these benefits are essential complements to the insurance elements.

When will the next game-changer emerge in the smartphone and protection markets? Because it seems we are now locked into a cycle of gradual improvements rather than stand out differences.

Don’t get me wrong, we should welcome continuous improvements, especially anything that benefits the customer. But do gradual improvements change customer behaviour in the way we would like?

Are the improvements more motivated by keeping the provider towards the top of the rankings?

Consider the news reports that Vitality has improved its income protection offering. It says it will “…expand its range of deferral periods for a further 280 occupations” and will “…also be moving 349 manual roles and skilled trade occupations to an ‘own occupation’ definition of incapacity, replacing its ‘special definition’ that was previously used.”

These are good improvements but it feels to me like the Apple equivalent of adding more megapixels to the main camera, or giving a choice of wide-angle lens sizes.

Every year we see another round of additions and refinements to the list of critical illnesses. Better definitions and therefore improved cover. We can say the same about added-value benefits.

Again, these are all great but do any of these improvements make it easier to sell protection to people on the street? Or are the improvements more motivated by keeping the provider towards the top of the rankings on all the various comparison engines and product analysis tools?

Will cost of being a first mover in a low margin environment always stifle true innovation?

In my last article, I said: “We know GenZ use TikTok as a search engine. We know they have short attention spans. We know they don’t like complexity. We know they don’t like filling in forms.

“And yet we expect them to get excited by our extremely complicated, generic protection products that have 30 page application forms and that we don’t talk about on TikTok.”

Will our current cycle of product improvements ever start to appeal to new audiences unless we come up with something genuinely revolutionary? Or will cost of being a first mover in a low margin environment always stifle true innovation?

Will we ever see one of the chief executives of protection providers step, Steve Jobs like, onto a stage and make a presentation that’ll be quoted for years to come about a revolutionary protection product that will appeal to a new generation of customers?

Roger Edwards is managing director of Roger Edwards Marketing Ltd and marketing director of Protection Review

Money

Walker takes on CFO role at British Land

Walker, presently COO, will join the board and become CFO from 20 November, replacing Bhavesh Mistry, who is stepping down.

This article is for subscribers or registered users only

Already registered? please Log in to continue

TRY 6 ISSUES FOR JUST £6

Try 6 issues of Property Week for £6 to finish this article.

Sign up now for the following benefits:

- Unlimited access to Property Week and newsletters

- Breaking news, comment and analysis from industry experts as it happens

Don’t want full access? REGISTER NOW for limited access and to subscribe to our newsletters.

Already registered or subscribed? SIGN IN here to continue

Check if you already have access from your company or university

Money

Urban Adventures in Sydney: A Digital Nomad’s Survival Guide – Finance Monthly

Sydney’s blend of urban thrills and natural beauty is a dream for digital nomads. Sydney has it all. Work remotely from its vibrant cafés or sightsee between meetings. It’s the perfect balance of work and play. It has reliable tech, great connectivity, and chances to explore its famous sites and hidden gems. You’ll want to set up an Australia eSIM before arrival to stay connected while on the go. This digital SIM card gives you internet access anywhere. It saves you from the hassle of switching physical SIM cards. Now, let’s explore what makes Sydney great for digital nomads.

Staying Connected with an Australia eSIM

One of the biggest concerns for digital nomads is reliable internet access. Sydney benefits from a strong mobile network. It’s easy to connect with an Australia eSIM. This technology lets you activate your SIM digitally. So, you can avoid buying a physical SIM card upon arrival. I need constant mobile data to stay productive. Whether in a café, navigating the city, or meeting clients. An eSIM lets you explore Sydney without losing internet access.

Best Work-Friendly Cafés in Sydney

When you’re a digital nomad, finding a good workspace is key. Sydney has many cafés for remote workers. They offer free Wi-Fi, comfy seats, and a friendly vibe. Surry Hills, Newtown, and Bondi are popular. They have cafés that are both trendy and suitable for work. These spots serve great coffee and provide the right environment to get work done. Whether you’re looking for a quiet place or a café buzzing with creative energy, Sydney has plenty of options.

Many digital nomads prefer working from cafés because they offer flexibility. You can set your schedule, enjoy a change of scenery, and grab a bite to eat while working on your latest project. These cafés are scattered throughout the city, so you’ll never be far from a good workplace spot.

Co-Working Spaces for Serious Productivity

Sometimes, you need a more professional setting than a café to get through your workload. Sydney boasts a range of co-working spaces designed with digital nomads in mind. They have high-speed internet, private meeting rooms, and quiet areas to help you focus. Some offer networking opportunities. They make it easier to connect with other remote workers or potential clients.

Co-working spaces are great if you want a structured work environment. You’ll have all the tools you need to be productive. This includes printers, meeting rooms, and event spaces. Many of these spaces offer daily or weekly passes. You can use them as needed without long-term commitments.

Balancing Work and Exploration in Sydney

Sydney isn’t just about working—it’s also about exploring. The city is filled with activities for every type of traveller. Whether you’re into the arts or nature or want to relax by the beach, there’s something for everyone. Bondi Beach is a must-visit spot, offering golden sands and a lively atmosphere. It’s the perfect place to take a break from work, soak in sunshine, or even catch a wave.

For culture, visit the Sydney Opera House or the Royal Botanic Garden. These spots provide a peaceful break from the hustle and bustle. They let you recharge before returning to work. Sydney’s mix of relaxation and activity makes it perfect for digital nomads. It helps them balance work and play.

Getting Around Sydney with Ease

Getting around Sydney is simple, thanks to its reliable public transport. The city has a great system of buses, trains, and ferries, making it easy to move between neighbourhoods. Public transport is a good option for both. It can take you to a café to work or to famous spots, like the Sydney Harbour Bridge.

If you prefer walking or biking, Sydney has plenty of bike lanes and walkable paths. A stroll through the city can reveal hidden gems. You can also enjoy its charming neighbourhoods. With an Australia eSIM, you can easily access maps on your phone, ensuring you never lose your way.

Exploring Sydney’s Outdoor Adventures

One of the best things about living in Sydney is enjoying outdoor activities. The city has beautiful beaches, scenic walks, and national parks, making it perfect for a work break. You can stay active and enjoy nature, swimming at Manly Beach or hiking in the Blue Mountains.

For a quicker outdoor experience, visit the local parks or take the coastal walk from Bondi to Coogee. This stunning path offers breathtaking views of the coast. It is a popular choice for both locals and visitors.

Making the Most of Your Sydney Experience

Sydney has everything you need to thrive. Take advantage of the work-friendly cafés and co-working spaces throughout the city. Public transport makes it easy to get around so you can move from one spot to another without hassle. Explore the city’s attractions. Visit cultural landmarks and beach escapes. It’s easy to balance work and leisure here. Excitement waits around every corner.

Conclusion

Sydney is perfect for digital nomads. It offers both productivity and adventure. An Australia eSIM gives you reliable connectivity. You can then stay in touch with clients, navigate the city, and work from anywhere. Sydney has it all for digital nomads. There are cafés for work, co-working spaces, and scenic beaches. Also, there are vibrant cultural hotspots. Explore the city, soak in its energy, and make the most of your time in this urban paradise.

Money

How to address career gaps in your CV

Generations of workers have worried that employment gaps in their career may be perceived in a negative light — particularly women who have been out of the workplace while bringing up children.

Some employers may still take a dim view of career gaps. A 2022 LinkedIn survey found that a fifth would reject candidates who had taken one.

However, while job applicants may be tempted to stretch the dates on their CV to gloss over any gaps, the risk of being found out is probably not worth it.

How should new entrants to the financial advice sector address such gaps and how much detail should they share with prospective employers?

Personal growth and skills

In general, employers have become more accepting of career gaps, particularly since the pandemic. Post-Covid, more firms are taking on board issues such as staff wellbeing and work-life balance. They are more understanding of employees having their own life and personal circumstances that can impact their professional life.

That said, career breaks still need careful handling.

If you’ve taken a career break, you need to put a positive spin on what you did and how you did it

Recruitment experts say job applicants should highlight the skills they have developed during their time away from paid employment.

“Common ones include communication, teamwork, leadership, innovation, and planning and organising,” says Dr George Sik, director of assessment and chartered psychologist at Eras, a psychometric testing consultancy.

“Think about things you did that might demonstrate evidence of these, and also about how you will explain their relevance to working life. This should emphasise your suitability when you are interviewed, or on your CV.”

Career gaps can also be used “to add colour” to a job application, according to Katherine Jackson, senior partner at Page Executive.

“You may have been travelling, or taken extended time off for caring responsibilities. You may have felt burned out or just needed some headspace to help you change the direction of your career,” she says.

Mention how those experiences enhanced your problem-solving abilities and emotional intelligence

“All of these are valid reasons that, when explained in an honest and open way, can demonstrate values, behaviour and ambitions in a way that traditional career paths often can’t.”

Whatever a job applicant has been doing during a career gap, Sophie Bryan, founder at HR consultancy Ordinarily Different, suggests linking the skills learned during those experiences to the requirements of financial planning.

“Clients value advisers who understand diverse backgrounds,” she says.

TopCV careers expert Amanda Augustine points out that unpaid work completed during a career break, such as leading a committee, charity work or an internship, should be mentioned on a CV.

The last thing you want to do is get caught in a lie during the interviewer’s follow-up questions or a background check

“Remember, you don’t need to receive a pay cheque for your work in order to include it in your CV’s employment history section,” she says.

Honesty

There are certain career gaps new entrants to advice could feel uncomfortable discussing with prospective employers.

For example, they may be reluctant to speak about physical or mental health in case this puts them off. Or they may have clashed with a previous employer and finding a new job has taken longer than expected.

Professionals recommend being truthful — but within your own boundaries. In Augustine’s view, honesty with tact is the best policy.

Valid reasons, when explained honestly, can demonstrate values, behaviour and ambitions in a way that traditional career paths often can’t

“A TopCV study found lying during an interview was the surest way to get dismissed,” she says.

“The last thing you want to do is get caught in a lie during the interviewer’s follow-up questions or a background check.”

St James’s Place Financial Adviser Academy senior manager Gee Foottit points out that, if the circumstances that led to a career break — such as poor health — mean more support is required, employers will want to know.

“They need to know if there are any accessibility issues, what this entails day to day and whether any adjustments are required,” she says.

However, this does not mean going into lots of detail about your personal life.

Clients value advisers who understand diverse backgrounds

“Keep your answers brief, stick to the facts and avoid letting your emotions get the better of you,” says Augustine.

“Share any necessary information that communicates the essence of why you took time off and, if it is a personal matter, indicating this to the interviewer will move them off the topic.”

Resilience and solutions

If a career break is the result of personal challenges, such as health issues or caring responsibilities, Bryan suggests focusing on the resilience and perspective this has given you.

“You might mention how those experiences enhanced your problem-solving abilities and emotional intelligence — staying professional while avoiding too much detail,” she says.

You don’t need to receive a pay cheque for your work in order to include it in your CV’s employment history section

It can also help to present solutions if, for example, ongoing caring responsibilities or health issues mean you will need to take time off in the future.

“You can pledge to make up the time if you need to take time off for health appointments,” says Victoria Harris, chief financial officer at The Curve, a financial education platform for women.

She adds it may also help to talk to others who have returned to the workplace after a career break.

“If you’ve taken a career break, you need to put a positive spin on what you did and how you did it.”

This article featured in the October 2024 edition of Money Marketing.

If you would like to subscribe to the monthly magazine, please click here.

Money

Final date £300 Winter Fuel payment will be made confirmed by DWP

THE Department for Work and Pensions (DWP) has confirmed the final date households should receive the £300 Winter Fuel Payment.

The Winter Fuel Payment was previously available to everyone aged 66 and above, the current State Pension age.

But in July the Government announced the payment would become means-tested meaning only those on certain benefits are eligible.

This includes those on income support, tax credits and Universal Credit, but also Pension Credit.

From November, eligible households will receive automatic payments of up to £300.

Payments will then continue to be made throughout December.

Those who are eligible should have either received a letter, or should get one in the coming month, telling them how much they will be paid.

It will also explain which bank account the payment will be paid into – this is usually the same account as where Pension Credit or other benefits are usually paid.

The DWP has advised all those eligible for the cash to expect it to enter their bank accounts by January 29 at the latest.

If the payment does not come through, pensioners are advised to contact the Winter Fuel Payment Centre online or by telephone.

When you contact the Winter Fuel Payment Centre you will need to provide your name, address, date of birth and NI number.

Eligible pensioners should look out for a specific code to double check that the money has been sent.

For those in England and Wales, the payment will appear as the customer’s National Insurance (NI) number followed by “DWP WFP”.

Whereas those in Northern Ireland should look for their NI number followed by “DFC WFP”.

So, if you live in England and your NI number is QQ123456B the payment would show up as QQ123456B DWP WFP.

You should check for this code before consulting DWP.

If you don’t think your winter fuel payment has come through, check for this code in your bank statement before consulting the Department for Work and Pensions (DWP).

And if you haven’t yet checked whether you meet the new criteria for the payment, make sure you’re up to date and know how much you’re be expecting.

What is the Winter Fuel Payment?

Consumer reporter Sam Walker explains all you need to know about the payment.

The Winter Fuel Payment is an annual tax-free benefit designed to help cover the cost of heating through the colder months.

Most who are eligible receive the payment automatically.

Those who qualify are usually told via a letter sent in October or November each year.

If you do meet the criteria but don’t automatically get the Winter Fuel Payment, you will have to apply on the government’s website.

You’ll qualify for a Winter Fuel Payment this winter if:

- you were born on or before September 23, 1958

- you lived in the UK for at least one day during the week of September 16 to 22, 2024, known as the “qualifying week”

- you receive Pension Credit, Universal Credit, ESA, JSA, Income Support, Child Tax Credit or Working Tax Credit

If you did not live in the UK during the qualifying week, you might still get the payment if both the following apply:

- you live in Switzerland or a EEA country

- you have a “genuine and sufficient” link with the UK social security system, such as having lived or worked in the UK and having a family in the UK

But there are exclusions – you can’t get the payment if you live in Cyprus, France, Gibraltar, Greece, Malta, Portugal or Spain.

This is because the average winter temperature is higher than the warmest region of the UK.

You will also not qualify if you:

- are in hospital getting free treatment for more than a year

- need permission to enter the UK and your granted leave states that you can not claim public funds

- were in prison for the whole “qualifying week”

- lived in a care home for the whole time between 26 June to 24 September 2023, and got Pension Credit, Income Support, income-based Jobseeker’s Allowance or income-related Employment and Support Allowance

Payments are usually made between November and December, with some made up until the end of January the following year.

Pensioners who are worried about missing out on the payment this winter can seek support from a long list of schemes – which will also be detailed at the end of this article.

What is the winter fuel payment and who is eligible?

The winter fuel payment is issued to state pensioners on certain benefits to help cover the cost of hiked up energy bills over the colder months.

This is because households tend to use more energy for heating as temperatures drop.

The payment, which is made in November or December, is automatic meaning you don’t need to apply.

Those on Universal Credit with a joint claim where one member was over the state pension age previously had to apply to get the payment.

To automatically qualify this year, you need to be of state pension age and in receipt of one of the following benefits:

- Pension Credit

- Universal Credit

- income-related Employment and Support Allowance (ESA)

- income-based Jobseeker’s Allowance (JSA)

- Income Support

- Child Tax Credit

- Working Tax Credit

You must have an active claim for these benefits during the “qualifying week” which is from September 16 to 22 this year.

You only need to apply this year if:

- you moved to an eligible country before January 1, 2021

- you were born before September 23, 1958

- you have a genuine and sufficient link to the UK – this can include having lived or worked in the UK and having family in the UK

Households can claim by phone from October 28 via the number 0800 731 0160.

They have until March 31, 2025 to do this.

Or to claim by post, you’ll need to fill in the winter fuel payment claim form and post it to the Winter Fuel Payment Centre.

This is available at www.gov.uk/winter-fuel-payment/how-to-claim.

More energy help for pensioners

In response to the government’s slash to the winter fuel payments, Octopus Energy has launched a scheme offering discretionary credit of between £50 and £200 to pensioners.

British Gas has also set aside over £140 million this winter for its Individual and Families Support Fund.

And Scottish Power‘s Hardship Fund has handed out more than £60 million to its struggling customers.

To find out what you can get, check the offers from your own supplier first by going to their website or asking someone on the phone.

Most schemes are exclusive to customers, but the British Gas Individual and Families fund is available to everyone if your own supplier can’t help.

Help can also be accessed from your local council via the Household Support Fund, which has renewed a fresh pot of £421 million finding for vulnerable households.

To find out if you are eligible, go to your council’s website and read over the conditions of the scheme.

If you’re just looking for simple ways to reduce your bill this winter, each of these supplier schemes, as well as the Household Support Fund also offer free electric blankets as part of their deal.

For example, Octopus have said they will distribute 20,000 electric blankets from Dreamland to its most vulnerable customers, keeping them warm for “as little as 3p an hour”.

The “heat yourself not your home” approach is trending fast, with retailers such as B&M introducing ranges of affordable self-heating appliances.

However, it is important to note that the elderly should not avoid turning the heating on if they are cold – for energy help contact your provider or local council, or read our article here.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Barratt Redrow outlines growth strategy to become UK’s largest housing group

The enlarged developer revealed it is targeting 22,000 completions a year in the medium term and also plans to close nine offices.

The post Barratt Redrow outlines growth strategy to become UK’s largest housing group appeared first on Property Week.

Money

Frugal Gift Ideas for Christmas – Finance Monthly

Christmas doesn’t have to be expensive to be memorable. With a bit of creativity, you can give thoughtful, personalised gifts without overspending. Whether you’re on a tight budget or simply looking to simplify your holiday shopping, these frugal Christmas gift ideas will help you show your loved ones you care—without breaking the bank. From DIY holiday gifts to affordable experience-based presents, this guide offers lots of thoughtful, affordable gift ideas that won’t leave you stressed about spending.

DIY Gifts: Personal and Inexpensive

DIY Christmas gifts are not only affordable but also meaningful. By creating something yourself, you’re showing thoughtfulness and effort without the expense of store-bought items. These gifts are perfect for those looking to give something more personal.

Examples:

Homemade Candles or Soaps: Customize scents and colours for a personal touch. These DIY holiday gifts on a budget are sure to be appreciated by the recipient.

Baked Goods: Bake a batch of Christmas cookies, fudge, or bread and package them beautifully in a reusable jar or festive wrapping.

Photo Album or Scrapbook: Compile memories with personalized captions for a sentimental gift that costs little but means a lot.

Knitted or Crocheted Items: If you’re crafty, a handmade scarf, hat, or blanket can be a warm and thoughtful present.

Upcycle and Repurpose Items

Look around your home for items you can repurpose or upcycle into unique gifts. This is not only environmentally friendly but also a cost-effective way to give thoughtful presents.

Examples:

Mason Jar/Preserving Jar Gifts: Fill a jar with homemade hot chocolate mix, bath salts, or a cookie baking kit. These homemade gift kits are easy to make and very affordable.

Customized Picture Frames: Repurpose an old frame and add a personal touch by painting or decorating it to fit the recipient’s style.

Gift Baskets from Home Items: Create a themed gift basket using items you already have. For example, a movie night basket could include popcorn, hot chocolate, Netflix, and cosy socks.

Experience-Based Gifts

Instead of giving physical items, offer experience gift ideas for Christmas that create lasting memories. These gifts can be very affordable and often have more impact than material items.

Examples:

Homemade Coupons: Create coupons offering services like babysitting, cooking a meal, or a movie night. You can design these for free online or make them by hand.

Local Events: Give tickets to a local theatre production, concert, or museum you can enjoy together.

Plan a Day Out: Gift an itinerary for a future day out, such as a hike, picnic, or visit a nearby park.

Subscriptions and Digital Gifts

Digital gift ideas are another great way to save money while giving something that the recipient will enjoy. Subscriptions can be particularly thoughtful gifts that continue to provide value throughout the year.

Examples:

Streaming Service Subscriptions: Gift a month or two of Netflix, Disney+, or Spotify.

E-book or Audiobook Subscriptions: Services like Kindle Unlimited or Audible are great for book lovers.

Online Courses: Offer a course on a subject your recipient is passionate about, such as cooking, photography, or personal development.

Gift Plants or Herbs

For the plant lover in your life, a small potted plant or herb garden kit can be a thoughtful and frugal gift. Many small houseplants, succulents, or herb seedlings are inexpensive and bring a relaxing vibe to any space.

Examples:

Succulents: These low-maintenance plants are perfect for busy people or new to gardening.

Herb Kits: You can find affordable herb-growing kits or assemble your own with small pots, soil, and seeds.

Homemade Mixes or Kits

Gift your favourite recipes by preparing the dry ingredients in a jar or kit form for the recipient to make at their convenience. These homemade gift kits are easy to assemble and cost-effective.

Examples:

Hot Chocolate Mix: Layer cocoa powder, sugar, and marshmallows in a jar for an easy, festive treat.

Soup or Cookie Mixes: Layer dry ingredients for soups, cookies, or brownies, and attach the recipe to the jar.

Craft Kits: Put together DIY craft kits with materials for projects like bracelet-making, painting, or journaling.

Related: How to Have a Debt-Free Christmas: Last-Minute Strategies to Manage Your Holiday Spending

The Verdict

Frugal gift-giving doesn’t mean sacrificing thoughtfulness. With some creativity and personalization, you can make Christmas special for your loved ones while sticking to your budget. Whether you opt for DIY holiday gifts, repurpose items you already have, or offer experience gifts rather than material items, there are plenty of ways to show you care without overspending.

By following these frugal gift ideas, you can have a more affordable and meaningful holiday season that won’t leave you in debt come January.

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

MMA3 weeks ago

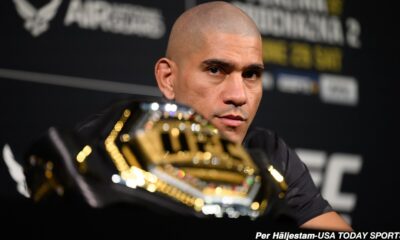

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

MMA2 weeks ago

MMA2 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Technology4 weeks ago

Technology4 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

News1 month ago

the pick of new debut fiction

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

News3 weeks ago

News3 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

TV2 weeks ago

TV2 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists are grappling with their own reproducibility crisis

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Technology3 weeks ago

Technology3 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

Technology3 weeks ago

Technology3 weeks agoGmail gets redesigned summary cards with more data & features

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

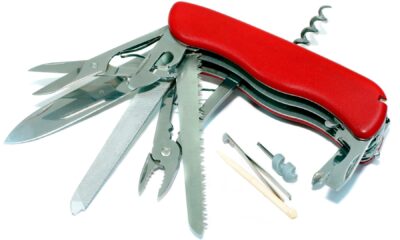

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

News3 weeks ago

News3 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

Entertainment3 weeks ago

Entertainment3 weeks ago“Golden owl” treasure hunt launched decades ago may finally have been solved

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

Science & Environment1 month ago

Science & Environment1 month agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Business4 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Technology3 weeks ago

Technology3 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Sport1 month ago

Sport1 month agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

News1 month ago

The Project Censored Newsletter – May 2024

-

Technology4 weeks ago

Technology4 weeks agoArtificial flavours released by cooking aim to improve lab-grown meat

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

News3 weeks ago

News3 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Technology3 weeks ago

Technology3 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Football3 weeks ago

Football3 weeks agoWhy does Prince William support Aston Villa?

-

MMA3 weeks ago

MMA3 weeks agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

Business3 weeks ago

Maurice Terzini’s insider guide to Sydney

You must be logged in to post a comment Login