Money

Ebi launches index-tracking impact range

Evidence Based Investing (ebi) has launched a new index-tracking impact portfolio range “designed to generate positive real-world environmental and social outcomes”.

The Impact portfolio suite is a set of low-cost model portfolios designed for investors seeking a globally diversified impact solution.

They invest in a range of impact equity exchange-traded funds (ETFs) designed to “cover the investible criteria set by the European Union (EU) taxonomy for sustainable activities, and a Global Green Bond solution”.

All funds used in the portfolios are classified as Article 9 under the EU’s Sustainable Finance Disclosure Regulation.

The impact equity portfolio invests in a range of global impact equity ETFs managed by Rize ETF, which track a range of impact-focused indices.

Rize ETF is Europe’s first specialist thematic ETF issuer, and is part of global investment manager ARK Invest.

The Impact bond portfolio invests in a Global Green Bond solution managed by Northern Trust, which tracks the Bloomberg MSCI Global Green Bond Index.

The Impact range includes eleven portfolios, designed for different risk profiles, ranging from 100% bond/0% equity to 0% bond/100% equity allocations.

Ebi’s investment product manager Jonathan Griffiths said: “We are pleased to unveil the latest addition to ebi’s portfolio line-up: the Impact portfolio suite.

“Investing exclusively in Article 9 funds under the EU’s Sustainable Finance Disclosure Regulation, these portfolios provide an exciting new offering for clients seeking to generate positive, measurable, and sustainable social and environmental change, alongside a financial return.”

In July 2024, ebi unveiled Vantage Cash Plus, a money market model portfolio for yield-seeking investors.

Vantage Cash Plus portfolio is a low-cost solution that aims to provide diversified cash-like exposure.

It is designed for investors seeking a combination of yield, liquidity and low capital risk.

It invests in three underlying money market and liquidity-focused funds, managed by Vanguard, Fidelity and Northern Trust, with the latter incorporating ESG considerations at the fund level.

Ebi reached £3bn in assets under management (AUM) in July 2024 and the discretionary fund manager became part of Bristol-based platform Parmenion in 2022.

CryptoCurrency

Coinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

According to data from CryptoQuant, cbBTC circulation supply has outpaced long-established players seven days after launch.

CryptoCurrency

Bitcoin options markets reduce risk hedges — Are new range highs in sight?

Bitcoin options market positioning shifted as BTC price shot through the $60,000 to $63,000 level.

CryptoCurrency

Ethereum is a 'contrarian bet' into 2025, says Bitwise exec

Ether price could be on track for another correction into a triple-bottom, marking the beginning of a big rally into 2025.

CryptoCurrency

Blockdaemon mulls 2026 IPO: Report

CryptoCurrency

SEC asks court for four months to produce documents for Coinbase

The financial regulator requested an extension until February 2025 to review “at least 133,582 unique documents” as part of discovery motions with Coinbase.

CryptoCurrency

‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

Ethereum is still home to the most active crypto developers and is the most attractive chain to build applications on top of for big companies, argues Bitwise’s Matt Hougan.

-

Sport7 hours ago

Sport7 hours agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

News1 day ago

News1 day agoYou’re a Hypocrite, And So Am I

-

News8 hours ago

News8 hours agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Technology6 hours ago

Technology6 hours agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoSEC asks court for four months to produce documents for Coinbase

-

Sport7 hours ago

Sport7 hours agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency6 hours ago

CryptoCurrency6 hours agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment10 hours ago

Science & Environment10 hours agoHow one theory ties together everything we know about the universe

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoSEC settles with Rari Capital over DeFi pools, unregistered broker activity

-

News5 hours ago

News5 hours agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment21 hours ago

Science & Environment21 hours agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment7 hours ago

Science & Environment7 hours agoWe may have spotted a parallel universe going backwards in time

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoArthur Hayes’ ‘sub $50K’ Bitcoin call, Mt. Gox CEO’s new exchange, and more: Hodler’s Digest, Sept. 1 – 7

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoTreason in Taiwan paid in Tether, East’s crypto exchange resurgence: Asia Express

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoLeaked Chainalysis video suggests Monero transactions may be traceable

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoAre there ‘too many’ blockchains for gaming? Sui’s randomness feature: Web3 Gamer

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoCrypto whales like Humpy are gaming DAO votes — but there are solutions

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoHelp! My parents are addicted to Pi Network crypto tapper

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoFive crypto market predictions that haven’t come true — yet

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours ago‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

-

Science & Environment10 hours ago

Science & Environment10 hours agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoFed rate cut may be politically motivated, will increase inflation: Arthur Hayes

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoBinance CEO says task force is working ‘across the clock’ to free exec in Nigeria

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoCardano founder to meet Argentina president Javier Milei

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoMemecoins not the ‘right move’ for celebs, but DApps might be — Skale Labs CMO

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoBitcoin bull rally far from over, MetaMask partners with Mastercard, and more: Hodler’s Digest Aug 11 – 17

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoBlockdaemon mulls 2026 IPO: Report

-

News5 hours ago

News5 hours ago“Beast Games” contestants sue MrBeast’s production company over “chronic mistreatment”

-

News5 hours ago

News5 hours agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

Technology3 days ago

Technology3 days agoYouTube restricts teenager access to fitness videos

-

Science & Environment10 hours ago

Science & Environment10 hours ago‘Running of the bulls’ festival crowds move like charged particles

-

Politics21 hours ago

Politics21 hours agoWhat is the House of Lords, how does it work and how is it changing?

-

MMA7 hours ago

MMA7 hours agoUFC’s Cory Sandhagen says Deiveson Figueiredo turned down fight offer

-

MMA7 hours ago

MMA7 hours agoDiego Lopes declines Movsar Evloev’s request to step in at UFC 307

-

Football6 hours ago

Football6 hours agoNiamh Charles: Chelsea defender has successful shoulder surgery

-

Football6 hours ago

Football6 hours agoSlot's midfield tweak key to Liverpool victory in Milan

-

Fashion Models6 hours ago

Fashion Models6 hours agoMiranda Kerr nude

-

Politics6 hours ago

Politics6 hours agoLabour MP urges UK government to nationalise Grangemouth refinery

-

News4 days ago

News4 days agoIndia Now Moves from Deliberations to Deliverables on Crimes Against Women

-

Science & Environment10 hours ago

Science & Environment10 hours agoRethinking space and time could let us do away with dark matter

-

Entertainment5 hours ago

Entertainment5 hours ago“Jimmy Carter 100” concert celebrates former president’s 100th birthday

-

Science & Environment18 hours ago

Science & Environment18 hours agoSunlight-trapping device can generate temperatures over 1000°C

-

News5 hours ago

News5 hours agoJoe Posnanski revisits iconic football moments in new book, “Why We Love Football”

-

Health & fitness2 days ago

Health & fitness2 days agoWhen Britons need GoFundMe to pay for surgery, it’s clear the NHS backlog is a political time bomb

-

Science & Environment20 hours ago

Science & Environment20 hours agoQuantum to cosmos: Why scale is vital to our understanding of reality

-

Technology3 days ago

Technology3 days agoTrump says Musk could head ‘government efficiency’ force

-

Science & Environment19 hours ago

Science & Environment19 hours agoX-ray laser fires most powerful pulse ever recorded

-

Science & Environment18 hours ago

Science & Environment18 hours agoDoughnut-shaped swirls of laser light can be used to transmit images

-

Science & Environment17 hours ago

Science & Environment17 hours agoWhy we are finally within reach of a room-temperature superconductor

-

Science & Environment16 hours ago

Science & Environment16 hours agoBlack holes scramble information – but may not be the best at it

-

Science & Environment16 hours ago

Science & Environment16 hours agoThe galactic anomalies hinting dark matter is weirder than we thought

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoTelegram CEO cannot leave France, OpenSea receives Wells notice, and more: Hodler’s Digest, Aug. 25 – 31

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoSolana unveils new Seeker device, says it’s not just a ‘memecoin phone’

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

CryptoCurrency7 hours ago

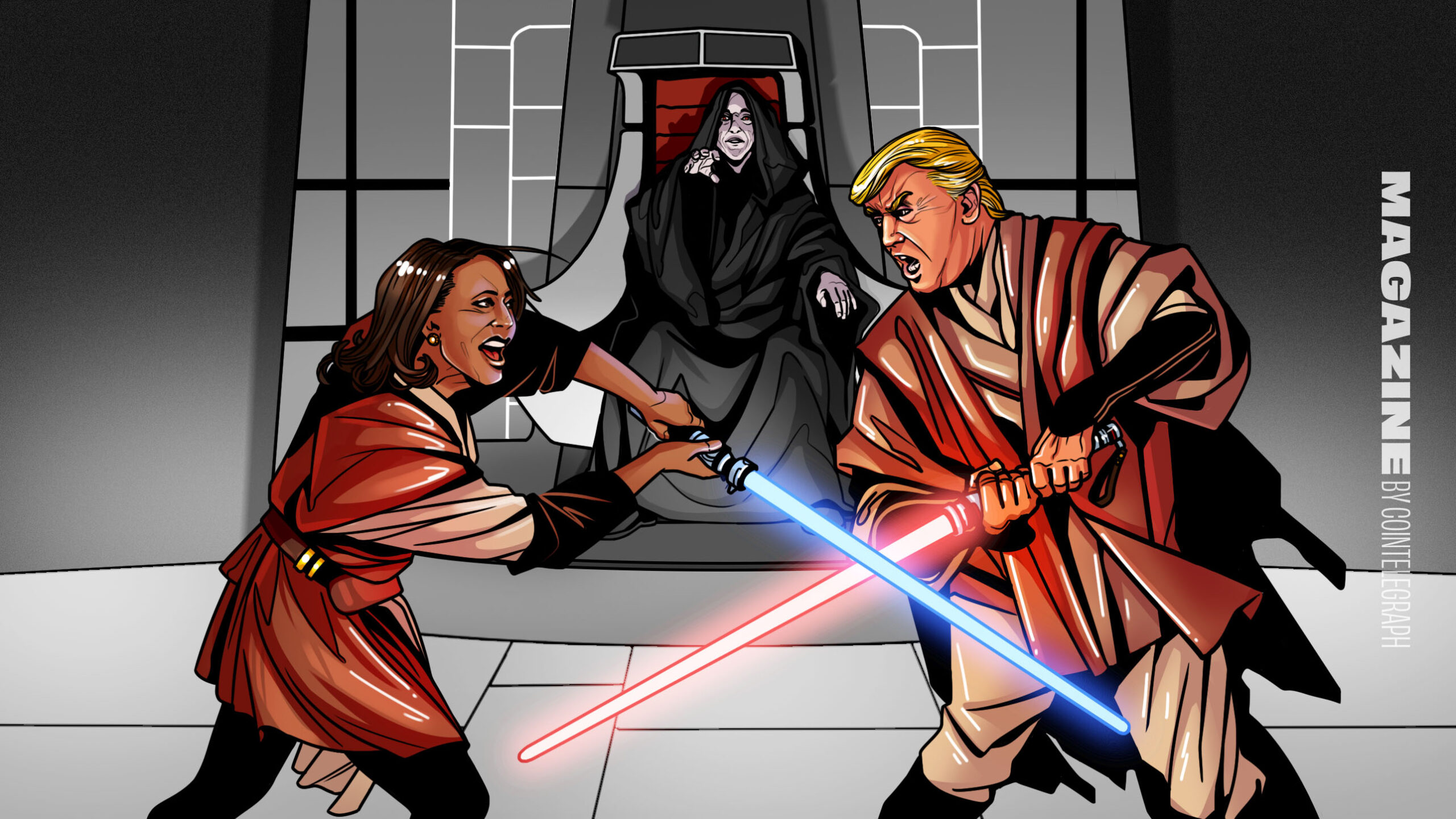

CryptoCurrency7 hours agoBitcoiners are ‘all in’ on Trump since Bitcoin ’24, but it’s getting risky

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoReal-world asset tokenization is the crypto killer app — Polygon exec

-

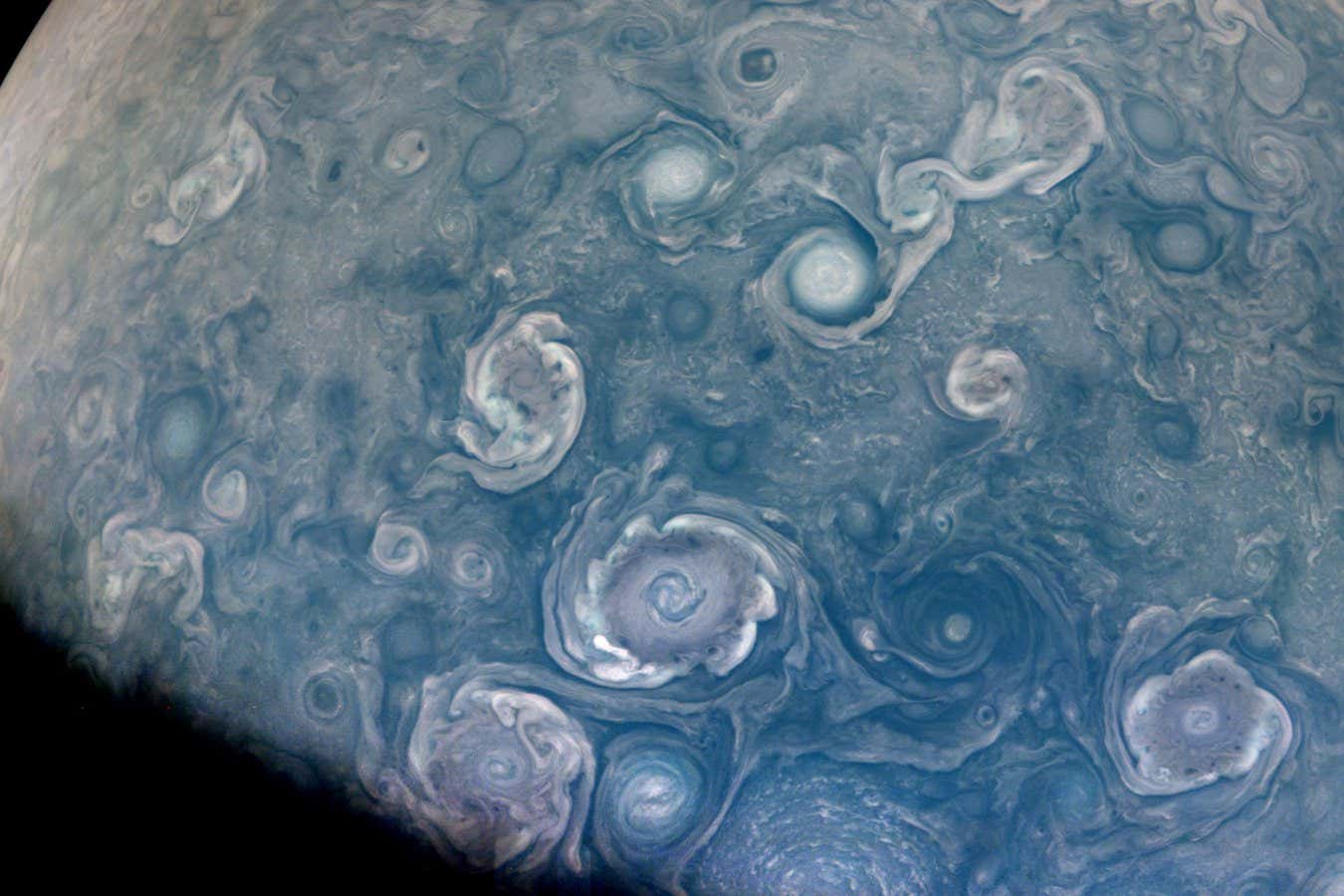

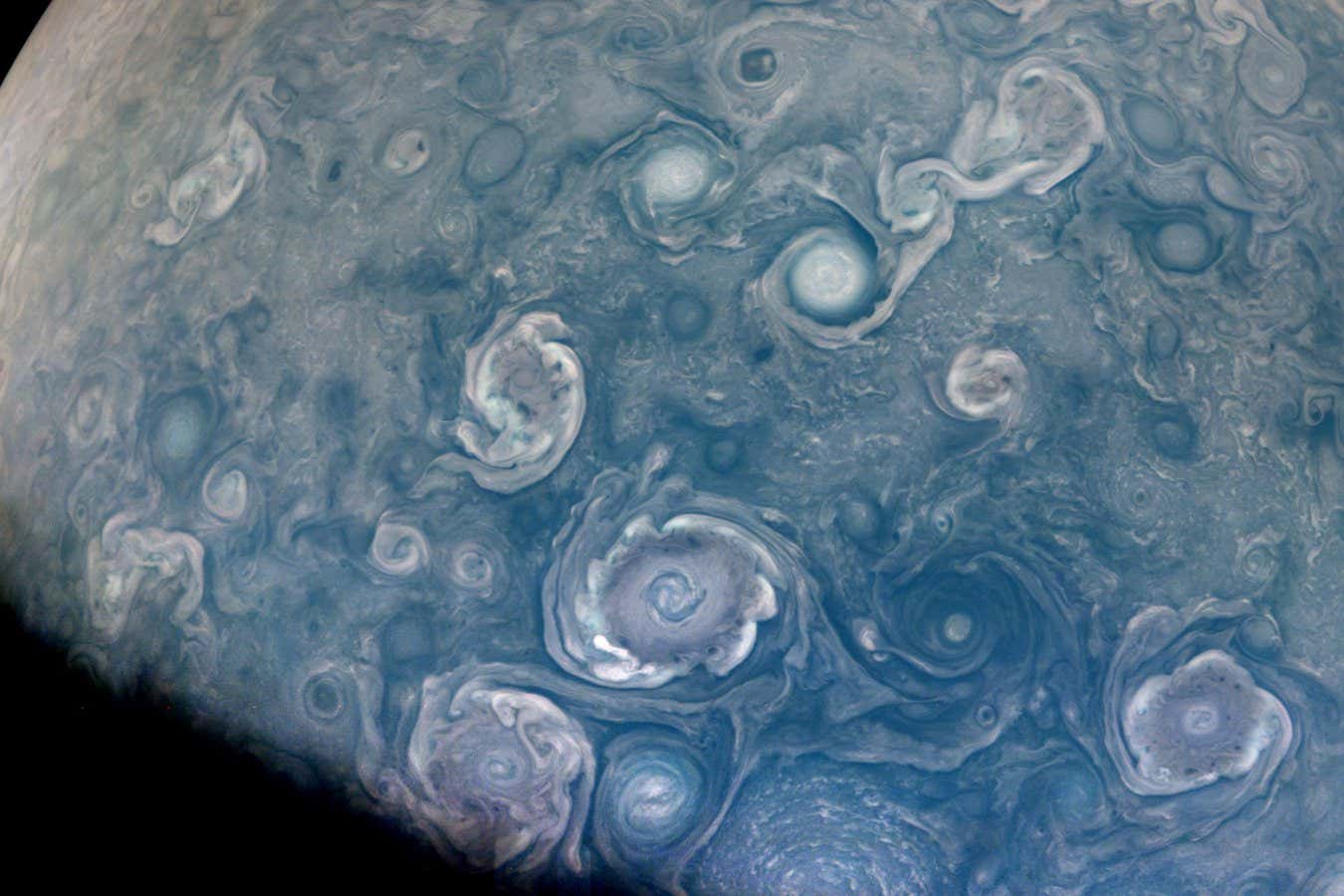

Science & Environment10 hours ago

Science & Environment10 hours agoJupiter’s stormy surface replicated in lab

-

Politics10 hours ago

Owen Paterson loses ECHR appeal against report that preceded downfall | Owen Paterson

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoDuckDuckGo ranks Etherscan phishing websites in top results

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

CryptoCurrency7 hours ago

CryptoCurrency7 hours agoETH falls 6% amid Trump assassination attempt, looming rate cuts, ‘FUD’ wave

-

Business7 hours ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Business6 hours ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Business6 hours ago

UK hospitals with potentially dangerous concrete to be redeveloped

-

Business5 hours ago

Axel Springer top team close to making eight times their money in KKR deal

-

News5 hours ago

News5 hours agoSean “Diddy” Combs denied bail again in federal sex trafficking case

-

News5 hours ago

News5 hours agoSean “Diddy” Combs denied bail again in federal sex trafficking case in New York

-

News5 hours ago

News5 hours agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

News3 hours ago

News3 hours agoWoman sues Florida sheriff after mistaken arrest lands her in jail on Christmas

-

News9 hours ago

News9 hours agoPolice chief says Daniel Greenwood 'used rank to pursue junior officer'

-

News9 hours ago

News9 hours agoChurch same-sex split affecting bishop appointments

-

Technology2 days ago

Technology2 days agoIs carbon capture an efficient way to tackle CO2?

-

Politics2 days ago

Politics2 days agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Science & Environment10 hours ago

Science & Environment10 hours agoPhysicists have worked out how to melt any material

-

Politics22 hours ago

Politics22 hours agoKeir Starmer facing flashpoints with the trade unions

-

CryptoCurrency2 days ago

CryptoCurrency2 days agoBitcoin reclaims $60K and ‘this time is different,’ says analyst

-

Science & Environment1 day ago

Science & Environment1 day agoWho owns the Moon? A new space race means it could be up for grabs

-

Health & fitness2 days ago

Health & fitness2 days agoWhy you should take a cheat day from your diet, and how many calories to eat

-

Technology8 hours ago

Technology8 hours agoFivetran targets data security by adding Hybrid Deployment

-

News2 days ago

Why is XRP price up today?

-

Science & Environment1 day ago

Science & Environment1 day agoElon Musk’s SpaceX contracted to destroy retired space station

-

Science & Environment2 days ago

Science & Environment2 days agoOur reality seems to be compatible with a quantum multiverse

-

Money1 day ago

Money1 day agoWhat estate agents get up to in your home – and how they’re being caught

-

News7 hours ago

Freed Between the Lines: Banned Books Week

-

Money3 days ago

Money3 days ago6 free issues + gift

You must be logged in to post a comment Login