Money

Exact date next week McDonald’s is bringing back the McRib after almost 10 years

MCDONALD’S is bringing back the iconic McRib in just days after an almost 10-year hiatus.

The fast food chain is relaunching the pork-based burger across UK restaurants from Wednesday next week (October 16).

Customers will have to be quick if they want to pick one up as the menu item is only back for a limited time.

The McRib, last seen on menus in early 2015 on a temporary basis, combines a pork patty with tangy BBQ sauce, pickles and onions.

Fast food fans will be able to buy one for £4.49 as an individual item or £6.19 as part of a medium extra value meal.

The burger, which we were one of the first to try ahead of its launch, contains 509 calories.

It comes after rumours started swirling online the McRib was set to make a welcome return following a supposed tech glitch on the MyMcDonalds app.

Dozens of fast food fans took to X and Facebook at the end of September after spotting a series of error messages on their phones.

Some were faced with text that read “McRib Test Notification” while others were hit with “page not found” messages.

Days later, McDonald’s confirmed the burger was in fact making a comeback, although not on a permanent basis.

Customers have since been posting online buzzing that the menu item is back after an almost 10-year wait.

One said on Facebook: “My absolute favourite, welcome back Ribby. Please don’t leave us again.”

Others wrote: “It’s what dreams are made of” and “cannot wait, it’s been way too long”.

Another posted: “I’m so getting one I loved them back in the day.”

And one went so far as to say the McRib was the “greatest burger of all time”.

OTHER MACCIE’S MENU CHANGES

Fans not so keen on the McRib will be able to snap up another new menu item this month.

Maccie’s is launching mini hashbrowns for the first time next Wednesday.

Customers will be able to buy the twist on a classic menu item across more than 1,300 UK restaurants.

Foodies can pick up a five-pack for £1.49 while a 15-piece sharebox will cost £2.99.

Remember though that prices do vary from restaurant to restaurant so you could pay more or less than these prices.

It is not yet clear whether the hashbrowns will become a permanent menu item, so if you want to give them a go, make sure you’re quick.

Six menu items will also be removed next week when the McDonald’s Monopoly game comes to a close.

These are the six items that customers will have to wave goodbye to:

- Philly Cheese Stack

- Chicken Big Mac

- Mozzarella Dippers

- Galaxy Chocolate McFlurry

- Twix Caramel McFlurry

- Twix Latte

If you are curious about how the game works and what prizes you can win, read our article here.

McDonald’s is also adding two new hot drinks to its menus on October 16 just in time for Halloween.

How to save at McDonald’s

You could end up being charged more for a McDonald’s meal based solely on the McDonald’s restaurant you choose.

Research by The Sun found a Big Mac meal can be up to 30% cheaper at restaurants just two miles apart from each other.

You can pick up a Big Mac and fries for just £2.99 at any time by filling in a feedback survey found on McDonald’s receipts.

The receipt should come with a 12-digit code which you can enter into the Food for Thought website alongside your submitted survey.

You’ll then receive a five-digit code which is your voucher for the £2.99 offer.

There are some deals and offers you can only get if you have the My McDonald’s app, so it’s worth signing up to get money off your meals.

The MyMcDonald’s app can be downloaded on iPhone and Android phones and is quick to set up.

You can also bag freebies and discounts on your birthday if you’re a My McDonald’s app user.

The chain has recently sent out reminders to app users to fill out their birthday details – otherwise they could miss out on birthday treats.

CryptoCurrency

Buying Medical Properties Trust Taught Me a Costly Lesson

Medical Properties Trust (NYSE: MPW) is my largest investment in a single real estate investment trust (REIT). I built that position up over a decade and a half by steadily buying more shares of the healthcare REIT. The main draw was its high-yielding dividend.

That investment paid off for a long time. However, the healthcare REIT has come under tremendous pressure in recent years due to an issue I completely overlooked: tenant concentration. Medical Properties Trust leased a significant percentage of its hospital portfolio to two tenants, which cost the company and its shareholders dearly when it ran into financial troubles. That taught me to pay much closer attention to customer concentration and quality when investing in any company.

Not diversified enough

Medical Properties Trust is one of the largest owners of hospital real estate in the world. It owns several hundred facilities leased to many different hospital operators. However, two tenants comprised a meaningful percentage of its total assets and revenues for many years. For example, at the end of 2022, the REIT’s rent roll consisted of:

|

Operator |

Properties |

Percentage of Total Assets |

Percentage of Revenues |

|---|---|---|---|

|

Steward Health Care |

41 |

24.2% |

26.1% |

|

Circle Health |

36 |

10.5% |

11.9% |

|

Prospect Medical Holdings |

14 |

7.5% |

11.5% |

|

Priory Group |

32 |

6.6% |

5.3% |

|

Springstone |

19 |

5% |

5.8% |

|

50 Operators |

302 |

38% |

39.4% |

|

Other investments |

0 |

8.2% |

0% |

|

Total |

444 |

100% |

100% |

Data source: Medical Properties Trust.

While the REIT had over 50 tenants, five supplied more than 60% of its revenue. That became an issue as Steward Health Care and Prospect Medical Holdings ran into financial troubles.

Those issues led the REIT to work with these large tenants to help them navigate their financial problems. For example, in May 2023, Medical Properties Trust reconstituted its $1.6 billion investment in properties leased to Prospect Medical Holdings in a series of transactions. It converted some leases into an equity interest in that company’s managed care business. Meanwhile, it temporarily suspended rents in California, with partial repayments resuming last September and full rent commencing this past March.

Medical Properties Trust also tried to keep Steward afloat by providing financial assistance and temporarily reducing its rent. However, those efforts weren’t enough, and Steward filed for bankruptcy earlier this year. The REIT was finally able to sever its relationship with Steward last month, which enabled it to find new tenants for many of the properties it formerly leased to that company.

The REIT’s issues with two of its largest tenants weighed heavily on its stock price (shares are down nearly 80% from their peak a few years ago). It has had to sell properties leased to financially stronger tenants to repay maturing debt. It also cut its dividend twice.

Lessons learned

The biggest lesson I’ve learned from investing in Medical Properties Trust is to carefully consider customer concentration and quality when investing. The higher the concentration of a single customer, the greater the risk that the client’s issues will become a problem for that investment. Likewise, if a company has a high concentration of financially weaker clients, that could also impact my investment in the future.

Medical Properties Trust has learned this lesson the hard way. That’s led it to focus on diversifying its tenant base by bringing in higher-quality tenants. For example, it agreed to lease its entire Utah hospital portfolio to CommonSpirit Health last year after the healthcare company acquired Steward’s operations at those facilities. CommonSpirit has strong investment-grade credit, which enhances its ability to meet its financial obligations. Securing such a high-quality tenant for those facilities enabled the REIT to sell a majority interest in the real estate to another investor to raise additional cash. Meanwhile, it recently agreed to replace Steward at 15 other properties with four high-quality operators as part of its bankruptcy settlement with Steward.

As a result of that agreement, the REIT has achieved the objectives it laid out in its second-quarter earnings conference call. CFO Steve Hamner stated, “Looking through the calendar to 2025 and into 2026, our expectation is that we will have a stable portfolio of hospital real estate leased to key operators in their respective markets with no exposure to Steward.” With that goal achieved, the REIT can focus on rebuilding its portfolio by adding new properties leased to high-quality operators to continue diversifying its tenant base. That should also enable it to rebuild its dividend.

It’s important to dig a little deeper

I didn’t pay enough attention to Medical Properties Trust’s tenant concentration as I built my position, which proved costly. However, I learned a valuable lesson: Analyze a company’s client base and quality because that could have a meaningful impact on its future results. Medical Properties Trust learned that costly lesson as well. With its tenant quality improving and its rent roll more diversified, it’s in a much better position to deliver the stable income and growth I initially expected as I built my position. That’s why I plan to continue holding, believing it can eventually make a full recovery.

Should you invest $1,000 in Medical Properties Trust right now?

Before you buy stock in Medical Properties Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Medical Properties Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Matt DiLallo has positions in Medical Properties Trust. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Buying Medical Properties Trust Taught Me a Costly Lesson was originally published by The Motley Fool

Money

Neighbours fume over ‘eyesore’ derelict estate as last-man standing locals refuse to leave so block can be flattened

NEIGHBOURS are fuming over an “eyesore” derelict estate – with one defiant local refusing to leave so the block can be flattened.

The block in Swanscombe, Kent has been boarded up and earmarked for demolition after the local council ruled out pricey repairs.

Flats in the building had been dogged by damp, weak foundations and cracked windows and ceilings.

The council gave tenants a one-off payment of £7,800 as compensation for moving out.

Most of them took the money and left – but one resident is staying put.

Demolition plans were confirmed last week but have been postponed because of the last man standing.

Neighbours Miranda Richards told the Kent Messenger: “When I walk past it from my car late at night, it is scary.

“I don’t like walking past a derelict building. There used to be trees there to mask the flats but they have come down.”

Another neighbour said: “It’s an eyesore. There is always fly-tipping there.”

Ward councillor Emma Ben Moussa said: “The uncertainty for the residents around the area has been quite unfair.

“They have been left like that for a while now. Whatever decision is going to be made I would like it to be made quite quickly.

“They should know what is happening as they have been left in limbo.”

Dartford Council said: “The council is currently considering future options for the use of the site.”

A spokesperson added: “We await the final residents to vacate the block.

“Once the block is vacant, a proposal with recommendations will be made to the council’s cabinet.”

CryptoCurrency

3 Dividend Stocks That Reward You Through Thick and Thin

This year, some notable companies have cut or eliminated their dividends. For example, former stalwarts Walgreens and 3M ended decades-long streaks of dividend growth with deep cuts to their payouts. It’s a situation that can make some investors want to give up altogether on income investing.

However, while some formerly reliable companies have disappointed investors on the dividend front in recent years, others have continued to make their payments no matter what. Enterprise Products Partners (NYSE: EPD), Oneok (NYSE: OKE), and NextEra Energy (NYSE: NEE) stand out to a few Fool.com contributors for their dividend stability. Here’s why you should consider adding them to your portfolio.

Enterprise Products Partners is built to pay you well

Reuben Gregg Brewer (Enterprise Products Partners): For 26 consecutive years, midstream energy giant Enterprise Products Partners has increased its distributions. That’s a huge commitment to its unitholders, but there’s more for income investors to like here than just the distribution history. It all starts with its master limited partnership structure, which is designed to pass income on to investors in a tax-advantaged manner. (A portion of the distribution is usually return of capital.) So down to its foundation, Enterprise is about paying its investors well.

Then, factor in its business model. Enterprise owns energy infrastructure like pipelines, storage, refining, and transportation assets that are vital to the energy sector’s operation. However, unlike other segments of the industry, the midstream segment is largely fee driven. Enterprise generates reliable cash flows based on the use of its assets, so the often-volatile prices of oil and natural gas don’t really have that big an impact on its financial results. Demand for energy, which is usually strong even when oil prices are weak, is the key determinant of Enterprise’s success.

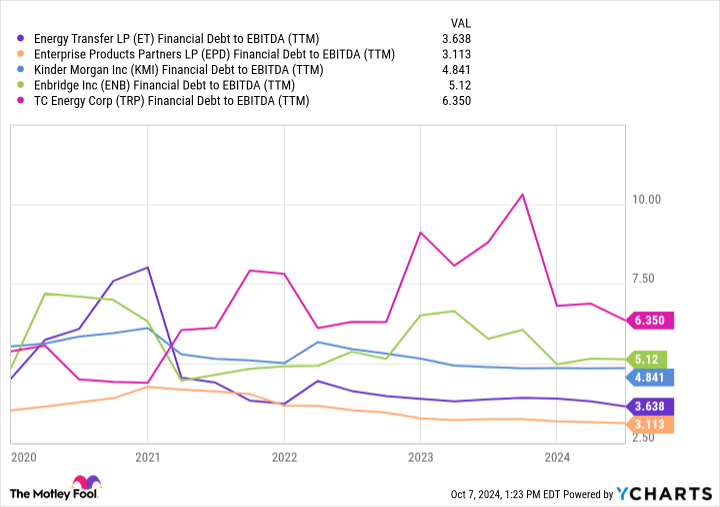

Then there’s the fact that Enterprise has an investment-grade rated balance sheet. Moreover, its leverage is normally toward the low end of its peer group, so it is conservative on both an absolute and relative basis. Lastly, the partnership’s distributable cash flow covers its distribution 1.7 times over.

All in all, a lot would have to go wrong before Enterprise Products Partners would need to cut its distribution. It is far more likely that it will continue to grow those disbursements, albeit slowly, as its capital investment plans pan out. But slow and steady distribution growth combined with a huge 7% yield will probably sound like music to most dividend investors’ ears.

Over a quarter century of growth and stability (and more growth coming down the pipeline)

Matt DiLallo (Oneok): Pipeline giant Oneok has proven its dividend durability over the decades. It has achieved more than a quarter century of dividend stability. While it hasn’t increased its payment every year during that period, it has a strong track record on payout hikes. Since 2013, Oneok has produced peer-leading total dividend growth of more than 150%. That’s impressive, considering that the world experienced two notable periods of oil price volatility during that period.

Oneoke has delivered sustainable earnings growth over the years. Its portfolio of pipelines and related midstream infrastructure generates predictable fees backed by long-term contracts and government-regulated rate structures. Its earnings grow as the volumes flowing through that infrastructure increase due to production growth, organic expansion projects, and acquisitions.

The company has been on an acquisition-fueled expansion binge in recent years. Last year, it bought Magellan Midstream Partners in a transformational $18.8 billion deal that increased its diversification and cash flow. The highly accretive deal will add an average of more than 20% to its free cash flow per share through 2027. That supports management’s view that Oneok will be able to grow its dividend by 3% to 4% annually during that period while also repurchasing shares and reducing its leverage ratio.

Oneok followed that up with a $5.9 billion deal to buy Medallion Midstream and a meaningful interest in EnLink Midstream this August. The transaction will be immediately accretive to its free cash flow and capital allocation strategy. After closing that deal, Oneok plans to buy the rest of EnLink, further boosting its cash flow per share. The company also expects to complete additional organic expansion projects, further enhancing its growth rate.

The midstream giant’s investments will help fuel its dividend growth for the next several years, even if there’s another market downturn. Those features make Oneok a great stock to buy for those seeking reliable dividends.

A steady dividend grower

Neha Chamaria (NextEra Energy): NextEra Energy, which has a yield of 2.6% at its current stock price, has rewarded its shareholders through thick and thin, and management is determined to continue doing so. The utility and clean energy giant has paid regular dividends for decades, but more importantly, increased them steadily over time. Between 2003 and 2023, the compound annual growth rate (CAGR) of NextEra Energy’s dividend was nearly 10%, backed by a 9% CAGR in its adjusted earnings per share (EPS) and an 8% CAGR in operating cash flow during the period.

NextEra Energy operates two businesses — Florida Power & Light Company (the largest electric utility in Florida) and clean energy company NextEra Energy Resources (the world’s largest generator of wind and solar energy). So while its regulated utility business generates stable cash flows, clean energy is where its growth largely comes from.

NextEra Energy expects its adjusted EPS to grow at an annualized rate of 6% to 8% through 2027, and expects annual dividend hikes of around 10% through 2026 as it pumps billions of dollars into both businesses.

More specifically, NextEra Energy plans to spend over $34 billion on Florida Power & Light between 2024 and 2027 and more than $65 billion on renewable energy over the next four years. That’s massive, and if done right, should steadily boost NextEra Energy’s earnings and cash flows to support bigger dividends for years, regardless of how the economy fares.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Matt DiLallo has positions in 3M, Enterprise Products Partners, and NextEra Energy. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in 3M. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool recommends 3M, Enterprise Products Partners, and Oneok. The Motley Fool has a disclosure policy.

Don’t Give Up on Dividends: 3 Dividend Stocks That Reward You Through Thick and Thin was originally published by The Motley Fool

CryptoCurrency

Could Buying SoundHound AI Now Be Like Buying Nvidia in 2023?

Nvidia‘s (NASDAQ: NVDA) stock has been an absolutely incredible performer recently. Since the start of 2023, it rose by more than 800%. Most investors would be thrilled to own a stock that delivered returns like that, but not every company has the potential. It requires a massive growth catalyst to justify such gains.

SoundHound AI (NASDAQ: SOUN) is one company that could have this potential. It’s a key player in one niche of the artificial intelligence (AI) sector, and has a massive backlog for its products.

SoundHound’s product is gaining momentum

SoundHound AI’s technology can parse human speech and perform various tasks based on what it hears. Among the ways it’s already being used most are in processing restaurant orders and improving digital assistants in vehicles, but its capabilities extend far beyond those two use cases.

In the automotive segment, SoundHound partnered with Stellantis; the giant automaker will integrate SoundHound’s tech into its vehicles across Europe and Japan. This will give people access to generative AI functions while they’re driving — an improvement from the voice assistants that are available on vehicles today. If SoundHound can win business with other automakers and break into other regions, this segment of its business alone could provide it with a huge amount of growth.

SoundHound also worked with several companies in the restaurant sector to automate telephone and drive-thru orders, which saves restaurants on wages. According to the company, these AI assistants actually outperform humans in terms of order speed and accuracy, so the customer doesn’t feel like the experience declined. Some of SoundHound’s restaurant customers, among them White Castle and Jersey Mike’s, are fairly big, but there’s serious room for it to grow if it can capture some of the largest fast-food businesses.

SoundHound AI could achieve even greater success if its solutions are utilized in new applications.

But is that potential enough to make its stock the next Nvidia?

Nvidia has one key advantage that SoundHound does not

In the second quarter, SoundHound generated $13.5 million in revenue, which was up 54% year over year. That’s quite small compared to other AI businesses.

However, the key figure investors should focus on is SoundHound’s backlog, which totals $723 million. This figure doubled from a year ago, showing that rising demand has outpaced SoundHound’s capability to integrate its product with its customers’ systems.

This is factoring into SoundHound’s current valuation, as Wall Street has high hopes for the company.

Trading at 23 times sales, SoundHound stock already carries a premium valuation. By contrast, Nvidia traded for around 15 times forward earnings at the start of 2023. That was a dirt-cheap price, and also a far cry from the forward earnings ratio of 47 it trades at today.

SoundHound already has a premium price tag, which detracts from its growth potential from here. But if it can mature into a business that generates $100 million in revenue per quarter, Nvidia-like performance for the stock is still possible.

If SoundHound achieved that and carried a valuation of 20 times sales, it would be worth $8 billion, up 370% from its market cap today. That would be a solid return, but still far less than what Nvidia produced.

SoundHound stock’s premium price tag may prevent it from delivering Nvidia-like returns from here, but that doesn’t mean it won’t be a great investment. However, it’s a bit of a long shot considering the niche use cases for its product and the company’s small size. It could make investors some serious money, but don’t expect Nvidia-like returns.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

Could Buying SoundHound AI Now Be Like Buying Nvidia in 2023? was originally published by The Motley Fool

Money

Morrisons shoppers are just realising an axed chocolate bar is back on sale – but they’re all saying the same thing

MORRISONS shoppers are all saying the same thing about an axed chocolate bar that’s back on sale.

Mars rebranded the iconic bar in 1990 but it has returned to supermarket shelves for a limited time under the old name.

Marathon bars were renamed Snickers over 30 years ago to bring the branding in line with the US.

But Mars has launched a limited edition version of the bar with the old Marathon branding.

Shoppers have been able to pick up the bar, made up of nougat, caramel and nuts wrapped in milk chocolate, from Morrisons for the last few weeks.

A four-pack of the retro 41.7g bars costs £1.95.

But some, commenting on a recent Facebook post by the retailer, have only just realised – and they’re all saying one thing.

Morrisons’ post from yesterday reads: “Feeling nostalgic? The marathon bar is back and exclusive to Morrisons!

“Available in store and online. Limited stock, run don’t walk.”

Commenting on the post, plenty of shoppers have commented questioning the size of the limited edition bar.

One joked “are they the original size too?” while another commented “hope it’s gone back to the original size as well then”.

And a third quipped: “Are they the same original size or snack size.”

Snickers bars have massively shrunk in size since their launch in the UK in 1968.

Even between 2012 and 2017, data from the Office for National Statistics revealed the popular bar had gone from 58g to 45g in size – a 22% drop – while keeping the price the same.

The tactic, known as shrinkflation, has been used by other chocolate makers to keep their profits ticking over.

History of Snickers

Snicker’s history goes back almost 100 years to pre-World War Two times.

1930 – Snickers, named after a horse, launches for the first time in the USA for five cents.

1968 – Snickers launches in the UK under the name Marathon before being re-branded to Snickers in 1990.

2010 – The famous “You’re not you when you’re hungry” campaign and advert is created.

2019 – Snickers Crisps is launched combining puffed rice, chocolate, caramel and peanuts.

2021 – Snickers unveils its Creamy Peanut Butter flavour.

What is shrinkflation?

Shrinkflation is when manufacturers shrink the size or quantity of a product while keeping the price the same.

This means that consumers pay more per given amount.

Rising the price per gram is a strategy used by companies to stealthily boost profit margins or to cement them in times of rising production costs.

Companies will often engage in shrinkflation when their production costs begin to rise.

A heavy hit to profit margins may force the company to simply shrink its products rather than increase the price.

One of the best ways to notice shrinkflation is by spotting a redesign on the packaging or a new slogan.

This may mean the company has made a change and that change may just be the size of the product.

It is mainly seen in the food and beverage industries but can also happen in almost all markets.

It is a form of hidden inflation as shrinkflation often goes unnoticed by customers.

In recent weeks, pet owners have spotted that multipacks of Purina Felix Original cat food shrunk by 15%.

Popular milkshake makers Frijj has also been accused of milking customers by quietly shrinking the size of their milkshakes without slashing the price.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

CryptoCurrency

China warns EU against separate EV price negotiations

BEIJING (Reuters) -China urged the European Union on Saturday not to conduct separate negotiations over the price of China-made electric vehicles sold in the EU, warning that this would “shake the foundations” of bilateral tariff negotiations.

“If the European side, while negotiating with China, conducts separate price commitment negotiations with some companies, it will shake the foundation and mutual trust of the negotiations … and be detrimental to advancing the overall negotiation process,” China’s Ministry of Commerce said in comments published on its website.

It didn’t cite any evidence for the EU carrying out these separate talks beyond saying there had been “relevant reports”.

The comments come days after Brussels rejected a Chinese proposal for EVs made in China to be sold within the bloc at a minimum price of 30,000 euros ($32,000), a move Beijing hoped would avert EU tariffs being imposed next month.

Various manufacturers including European-owned companies in China have authorized the China Chamber of Commerce for Machinery and Electronics to propose a price commitment plan that represents the overall position of the industry, the commerce ministry said.

“This is the basis for the current China-EU consultations,” it added.

(Reporting by Eduardo Baptista; Editing by William Mallard and David Holmes)

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 weeks ago

Technology3 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment3 weeks ago

Science & Environment3 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

News4 weeks ago

the pick of new debut fiction

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNerve fibres in the brain could generate quantum entanglement

-

News3 weeks ago

News3 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum forces used to automatically assemble tiny device

-

Technology2 weeks ago

Technology2 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Business2 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

News4 weeks ago

News4 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News3 weeks ago

News3 weeks agoYou’re a Hypocrite, And So Am I

-

Sport3 weeks ago

Sport3 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News3 weeks ago

News3 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Business2 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

Technology2 weeks ago

Technology2 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Football2 weeks ago

Football2 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoRethinking space and time could let us do away with dark matter

-

News4 weeks ago

News4 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

News3 weeks ago

The Project Censored Newsletter – May 2024

-

Technology2 weeks ago

Technology2 weeks agoQuantum computers may work better when they ignore causality

-

MMA2 weeks ago

MMA2 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Sport2 weeks ago

Sport2 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

News3 weeks ago

News3 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Technology2 weeks ago

Technology2 weeks agoGet ready for Meta Connect

-

Business2 weeks ago

Ukraine faces its darkest hour

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Technology4 weeks ago

Technology4 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

News3 weeks ago

News3 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCardano founder to meet Argentina president Javier Milei

-

Politics3 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

MMA3 weeks ago

MMA3 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMeet the world's first female male model | 7.30

-

News3 weeks ago

News3 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Toning Workout for Women

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists have worked out how to melt any material

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoBeing in two places at once could make a quantum battery charge faster

-

News4 weeks ago

News4 weeks agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoEverything a Beginner Needs to Know About Squatting

-

TV3 weeks ago

TV3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Servers computers2 weeks ago

Servers computers2 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Technology2 weeks ago

Technology2 weeks agoThe best robot vacuum cleaners of 2024

-

News3 weeks ago

News3 weeks agoChurch same-sex split affecting bishop appointments

-

Politics4 weeks ago

Politics4 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Sport3 weeks ago

Sport3 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow one theory ties together everything we know about the universe

-

Business4 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMost accurate clock ever can tick for 40 billion years without error

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBlockdaemon mulls 2026 IPO: Report

-

Business3 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics3 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

News2 weeks ago

News2 weeks agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology2 weeks ago

Technology2 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Technology3 weeks ago

Technology3 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business3 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Travel3 weeks ago

Travel3 weeks agoDelta signs codeshare agreement with SAS

-

Politics2 weeks ago

Politics2 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology2 weeks ago

Technology2 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

You must be logged in to post a comment Login