Money

Fusion appoints Harris as chief investment officer

Harris will focus on the group’s strategic growth and the living sector, as it looks to expand into European markets such as Spain and Germany.

The post Fusion appoints Harris as chief investment officer appeared first on Property Week.

Money

Huge update for 4.1million customers of major supermarket bank after takeover – check if you’re affected

A MAJOR update has been issued to millions of customers affected by a supermarket bank takeover.

In February, Barclays agreed to purchase Tesco’s retail banking division, which included the acquisition of nearly 3,000 employees.

Customers have now been informed that their services will officially be transferred and managed by Barclays from November 1.

This follows the regulator’s approval of the takeover yesterday.

Tesco Bank currently offers a range of personal banking and insurance products, including personal loans and credit cards, to over four million customers.

The supermarket bank will retain some of its insurance services, ATMs, travel money, and gift cards.

However, all other services, including credit cards and personal loans, will be transferred to Barclays next month.

Although Barclays will manage these services, they will continue to be marketed under the Tesco Bank name for now.

Tesco Bank stopped offering mortgages through its bank in 2019 after seven years.

It’s 23,000 mortgage loans were sold to Lloyds Banking Group, which Halifax is part of, for around £3.8billion.

Tesco Bank also offered current accounts, which were closed to all customers in November 2021.

Those affected by the switch to Barclays are not required to take any action before the switch, and there will be no changes to their services after it occurs.

WHAT IT MEANS FOR YOUR MONEY

In the short term, it is likely customers won’t notice much change.

Your credit card and personal loans will still be marketed under the Tesco Bank name, and you won’t need to request a new card or change how you’re repaying any debt.

Barclays has said that it will continue to operate the business under the Tesco Bank brand for at least 10 years as part of a “long-term, exclusive strategic partnership”.

While no staff will transfer to Barclays under the scheme, it is anticipated that “approximately 2,523 employees across the UK and India” will eventually move over to the banking giant.

Tesco Bank will continue to operate its insurance products, ATMs, travel money and gift cards under its own roof.

In the meantime, it’s always worth checking to see if you can get a better credit card or land deal elsewhere.

FIND THE BEST CREDIT CARD AND LOANS

To assess all the available cards and personal loans, visit price comparison websites like MoneySavingExpert’s Cheap Credit Club or Compare the Market.

These sites allow you to tailor the perks you’re looking for, whether it’s cashback, air miles, or other rewards.

You should always use an eligibility calculator before applying, that’s because every credit card application leaves a mark on your credit file and can affect your credit score.

Once you run your details through an eligibility calculator and you’ve been shown that you’re likely to be accepted, make a formal application.

To do this, you will need to provide your name, address and email address as well as details of your income so a provider can assess your eligibility.

You will also need to provide details of how much money you want to transfer to the new card, but you can often do this after you have been accepted.

If your application is approved, you will need to transfer the balances within a set period, usually around 60 or 90 days.

Your old balance will then be cleared and you can start making interest-free repayments on your new card.

CREDIT CARD NEED-TO-KNOWS

NOT using a credit card effectively can wreak havoc on your finances and your credit score.

If you don’t keep up with repayments or default on your debt, you are likely to get a black mark on your credit record, which could affect your ability to get a credit card, loan or mortgage in the future.

It’s important not to let yourself get sucked into overspending.

You should always clear the full balance as soon as possible.

If you have a poor credit score, don’t bank on being approved for a card or getting the 0% deal you’d hoped for.

Card providers only have to give the advertised rate to 51% of applicants, so you could end up paying more interest than you bargained for.

After your 0% period is up, lenders can charge upwards of 40% interest, so if you have not repaid the debt fully by then, try to move the debt onto another 0% deal.

If you’ve got a poor credit record, you’re less likely to get the best rates.

And if you are looking for a new credit card, don’t apply for lots at once.

OTHER BANKING NEWS

Tesco Bank isn’t the only supermarket bank to have been sold in recent months.

NatWest agreed to purchase Sainsbury’s Bank in June 2024.

This follows Sainsbury’s announcement in January that it would wind down its banking division to focus on its retail business.

NatWest said it expects the takeover to be completed by March 2025, and all customers will be moved over by the end of next year.

However, Sainsbury’s will retain some of its banking activities, including insurance and travel money.

Argos Financial Services is also not included in the deal.

Last summer Sainsbury’s Bank offloaded its £479million mortgage book to Co-op Bank.

Elsewhere, Britain’s largest building society announced that it had agreed to a £2.9billion deal to take over Virgin Money in March.

Under the plans, approved by regulators in October, the two companies will run as separate entities.

The Virgin Money brand will be retained for six years before being rebranded to Nationwide.

The move will create a combined group with around 24.5million customers, more than 25,000 staff and nearly 700 branches.

This will make the organisation the country’s second largest mortgage and savings group.

Money

Martin Lewis reveals two reasons why ‘vast majority’ on state pension will see payments rise by LESS than £473 next year

MARTIN Lewis has revealed two reasons why the “vast majority” on state pension won’t get the full £473 boost next year.

The state pension increases every year in a bid to keep up with rising costs, but not everyone sees their payments go up by the same amount.

Under the triple lock, payments rise in line with whatever is highest out of: wages for May to July, 2.5% or September’s inflation figures.

This week the Office for National Statistics published revised figures of 4.1% for July’s wages.

It also confirmed that September’s inflation rate fell to 1.7% – making wages the determining factor for the lock.

The full new state pension will increase from £221.20 a week – £11,502 per year – to £230.30 a week or £11,975 per year.

READ MORE IN MARTIN LEWIS

However, speaking on this week’s The Martin Lewis Podcast, the consumer expert revealed there are reasons millions will not get the full headline figure.

Martin said: “The figure you will see in most places quoted that state pensioners will see a rise of £475 a year, in practical terms that is an unrealistic figure for the vast majority of pensioners who will not see that rise.”

He then went on to explain that this is due to the figure relating to the full new state pension.

This pension came in in April 2016 and is a “totally new” type of pension for anyone who hits state pension age in or after that time.

Martin continued: “But if you look at the numbers, only one in four state pensioners get the new state pension, the rest are on the old state pension because they hit state pension age beforehand.

“The old state pension is less in its basic form than the new state pension, therefore a 4.1% rise in the old state pension is not as much so the vast majority of state pensioners won’t see £475 a year, they will see £363 a year as the full old state pension rise – it’s much smaller than is often quoted.”

The MoneySavingExpert then went on to explain that even those on the new style state pension can only get the full amount if they have the correct amount of qualifying years.

Under current rules, you need 35 “qualifying years” to get the full new state pension.

He said: “If you don’t have your ‘full’ qualifying years which millions don’t, especially many of the poorest – many of those who are eligible for pension credit – then you won’t get the full rise because it is a 4.1% rise on what you got and the £363 a year for the old state pension is if you’re on the ‘full’ old state pension.”

It’s important to bear this all in mind, Martin explained, pensioners need to have “realistic expectations” of what they can get.

He continued: “But also in the debate over winter fuel payment is what’s often quoted is the triple lock increase of £475.

“But only one in four state pensioners get the new state pension which is the higher amount and many of those won’t be on the ‘full’ state pension – so we need to be slightly careful, many people have come to me and said yeah but they get this triple lock of this much extra a year – but the vast majority of pensioners won’t get the full £475 which is what you will see quoted in many media outlets and many government communications.

“The vast majority of pensioners will see an uplift that is far less than that because the vast majority of state pensioners are on the old state pension and many don’t have the full state pension.”

Topping up your state pension

If you think you’re missing National Insurance years, the first thing to do is check your State Pension forecast.

You can check this as well as the State Pension age through the government’s new ‘Check your State Pension’ tool online at www.gov.uk/check-state-pension.

The tool is also available through the HMRC app, which you can download free on the Apple App Store and Google Play Store.

You might be able to buy back years.

But earning back the years isn’t free, so your voluntary contributions come at a price.

If you fill gaps between 2006/07 and 2015/16, you’ll pay the 2022/23 rates for contributions.

It is worth £15.85 a week, which means it costs £824.20 to buy one year of contributions.

As the state pension was £185.15 per week in 2022/23, this boost would add £5.29 per week or around £275 per year.

Although you’d have to pay £8,242 (10 lots of £824.20), the annual state pension boost would be around £2,750.

Someone who was retired for 20 years would get back around £55,000 in total (before tax).

Anyone under 73 can make voluntary pension contributions, as it’s assumed everyone under this age will claim the new state pension.

If you’re below the state pension age, you can check your state pension forecast by visiting www.gov.uk/check-state-pension to determine if you’ll benefit from paying voluntary contributions.

You can also contact the Future Pension Centre by calling 0800 731 0175.

If you’ve reached state pension age, contact the Pension Service to find out if you’ll benefit from voluntary contributions.

You can contact this service in several different ways by visiting www.gov.uk/contact-pension-service.

You can usually pay voluntary contributions for the past six years.

The deadline is April 5 each year.

For example, you have until April 5, 2030, to compensate for gaps in the tax year 2023 to 2024.

The deadline has been extended for making voluntary contributions for the tax years 2016 to 2017 or 2017 to 2018. You now have until April 5, 2025, to pay.

Find out how to pay for your contributions by visiting www.gov.uk/pay-voluntary-class-3-national-insurance.

You could also be eligible for the top-up benefit Pension Credit if you’re 66 or older and your income is below £218.15 a week if you’re single or £332.95 as a couple or if you meet other criteria.

Pension Credit explained

Pension Credit is a benefit which gives you extra money to help with your living costs if you’re on a low income in retirement.

It can also help with housing costs such as ground rent or service charges.

You may be able to get extra help of you’re a carer, have a disability, or are responsible for a child.

It also opens up access to lots of other benefits such as the warm home discount scheme, support for mortgage interest, council tax discounts, free TV licences once you’re over 75, and help with NHS costs.

To qualify, you need to be over state pension age and live in England, Scotland or Wales.

If you have a partner, you need to include them on your claim.

Pension Credit tops up:

- your weekly income to £218.15 if you’re single

- your joint weekly income to £332.95 if you have a partner

However, even if your income is higher, you might still qualify if you have a disability or caring responsibilities.

There is also another element to Pension Credit called savings credit. To get this, you need to have saved some money towards your retirement.

You can get an extra £17.01 a week for a single person or £19.04 a week for a married couple.

If you have more than £10,000 in savings, the government uses a calculation to work out how much it adds to your income.

Every £500 over £10,000 counts as £1 income a week. For example, if you have £11,000 in savings, this counts as £2 income a week.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

NWF and bank duo join forces to deliver £1bn for social housing retrofit

The funding has been enabled by financial guarantees of up to £750m provided by the National Wealth Fund

The post NWF and bank duo join forces to deliver £1bn for social housing retrofit appeared first on Property Week.

Money

A lesson in why recording rationale is key to staying on the right side of the regulator

The Financial Conduct Authority has made it clear its approach to enforcement is changing.

The Financial Conduct Authority has made it clear its approach to enforcement is changing.

It says it’s a change to increase public confidence in financial services and will require cooperation and commitment across the industry “to stop market abuse, keep our markets clean and build trust. This is how we will attract talent to our sector, bring investment to our shores and grow our economy.”

Quite the challenge but one that is necessary.

After almost 40 years of experience in the industry, I fundamentally believe there is now a strong professionalism underpinning the provision of financial advice and wealth management.

However, there are some reoccurring themes I see which undermine this positivity, including the fact there are still a number of people who struggle to really grasp why the FCA felt a need to introduce Consumer Duty.

For example, one of my colleagues was recently speaking to a senior manager within a wealth firm that had been struggling with its annual suitability review function for its clients. Their timescales were under pressure, with a lack of sufficiently proactive and competent advisers motivated enough to undertake appropriate reviews in a timely manner.

The firm needed to act promptly, not wait to see if the FCA would intervene to address the issue.

Its operational function began to look at artificial intelligence (AI) solutions and, through robust research and a strong testing approach, developed a review solution that reduced the time per client suitability review from three hours to 75 minutes, including adviser time to provide a summary of any recommendations.

However, this led the firm to fall down on its fair value assessment undertaken ahead of July.

The assessment acknowledged the improved efficiency it had achieved and the use of the improved technological solution but it had not taken into account the reduced management/adviser time required to undertake each client review and whether that should have an economic impact on the fee the firm charged to the client for its ongoing services.

It could be the case that the lack of actual adviser time on reviewing the portfolio is compensated by increased time in client meetings or conversations both adviser and client find more beneficial. Increased efficiency doesn’t necessarily mean the cost for the service provided should be reduced.

But the critical aspect here is that there has to be consideration. There needs to be evidence of a rationale as to why the service is value for money, fair and that the client genuinely understands what they are paying for.

Sadly, based on what we see at times, the communication is often lacking or convoluted, and the client finds themselves struggling to really understand what they are getting in terms of service.

Simon Collins is managing director, regulatory, at Konexo, a division of Eversheds Sutherland

Money

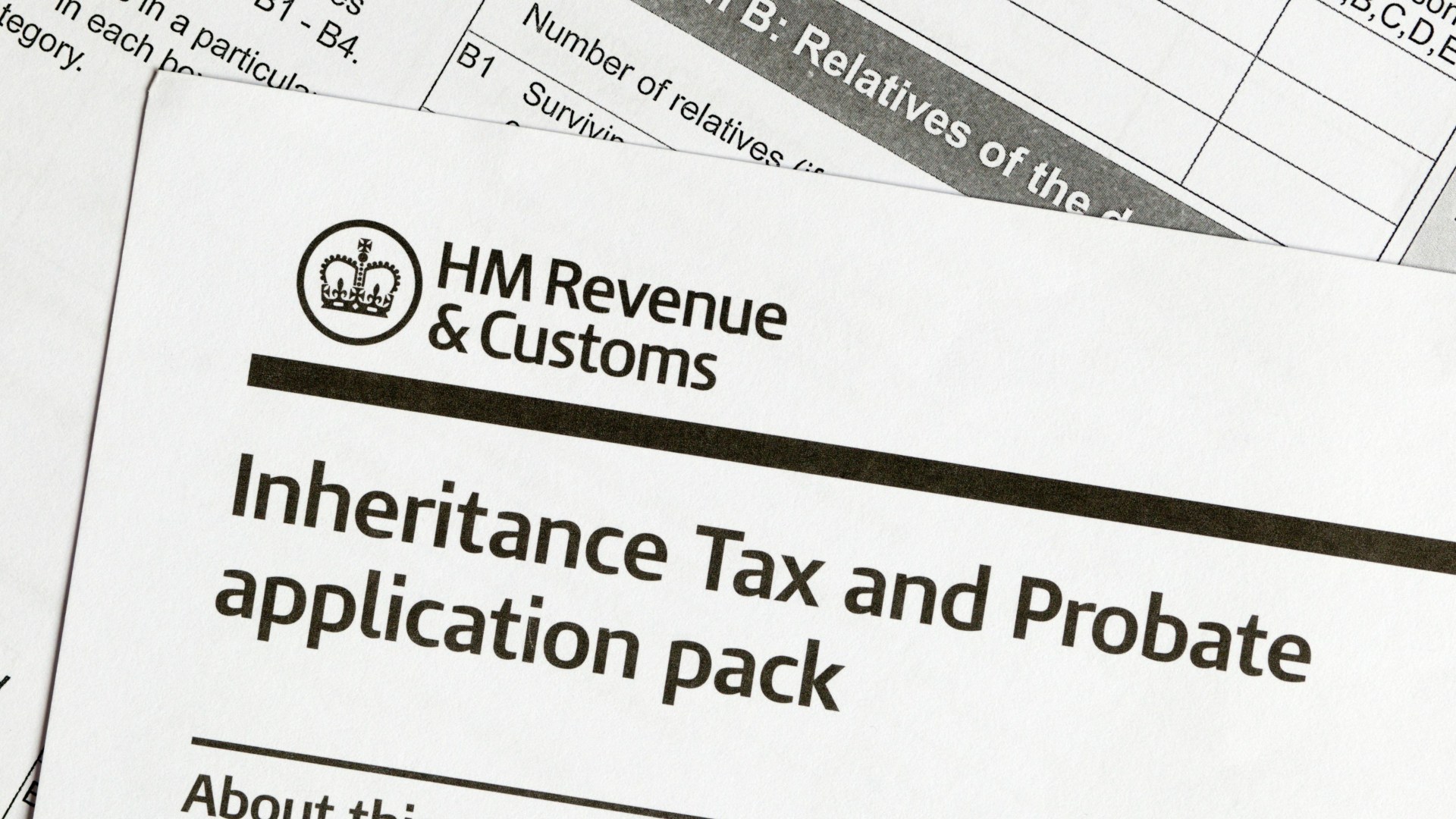

Huge inheritance tax rule changes planned in the Budget as thousands more families could be hit with bills

INHERITANCE tax and stamp duty are both set for a hike at this month’s “painful” Budget.

In a bid to fill a £40bn black hole in the public purse, Rachel Reeves is also eyeing up a raid on vape duties.

Inheritance tax is currently charged at 40 per cent on the homes and cash of somebody who has died, if their belongings are worth £325,000 or more.

Currently only 4% of UK adults pay what has been dubbed the “death tax”.

But the amount they are charged could grow as Ms Reeves considers raising the inheritance tax headline rate – though it isn’t yet known by how much.

Meanwhile, house buyers will be charged up to £2,500 more in stamp duty from next year as the Chancellor ends a £2bn discount introduced by the Tories.

Ms Reeves will move the nil rate threshold back down to £125,000 from £250,00.

For first time buyers the the threshold for paying stamp duty will move from £450,000 to £300,000.

The move is set to save the Treasury £1.8bn.

In a major blow for e-smokers, Treasury mandarins are also looking to vapes as another possible product for a tax raid.

The Chancellor is also expected to slash £3bn from the welfare bill in the Budget – with £1.3bn of that coming from disability benefits.

The changes, first introduced by the Tories, will tighten access to sickness benefits through tough new rules under the Work Capability Assessment.

A spokesman for the Treasury said: “We do not comment on speculation around tax changes outside of fiscal events.”

The Chancellor submitted her final Budget plans to Britain’s economic watchdog, the Office for Budget Responsibility, earlier this week.

She also wants to build up a buffer to help keep the country better protected against economic shocks.

One close ally of the Chancellor said: “If we are having to raise taxes, we want to put the money into the people’s priorities.

“The NHS is the number one priority.”

Predictions for the Autumn Statement

The Sun’s Head of Consumer Tara Evans reveals the top predictions for the Autumn Statement:

Winter Fuel Payments

Chancellor Rachel Reeves has already announced that Winter Fuel Payments will be limited to those receiving pension credit and certain benefits. The benefit is worth up to £300 per year and currently is available to everyone over state pension age and those on certain benefits.

No rises to some taxes

Keir Starmer promised there would be no rises to National Insurance, Income Tax, Corporation Tax or VAT as part of Labour’s manifesto in the election race.

Inheritance Tax

It has been predicted that the Chancellor Racheal Reeves will make changes to inheritance tax rates or thresholds. One suggestion is the potential shortening of the gift period before death for tax exemptions.

Pensions

Pensions featured very high up in the King’s Speech, was this a hint at how high on the agenda it will feature in the budget? Experts say there are a number of options, including reintroducing the lifetime allowance cap. Ms Reeves has previously campaigned to reduce the tax relief that higher earners get on their pensions and to introduce a flat rate of 33% instead. Another possible option is changing the rules around pensions and inheritance tax.

Capital Gains Tax (CGT)

There is speculation that the £3,000 tax-free allowance could be scrapped or there may be an extension of CGT to other assets.

Business Rates

There are rumours of reforms to support small businesses, possibly basing rates on land value.

Fuel Duty

Possible rise in fuel duty, reversing the freeze since 2011 and impacting household costs. The Sun has backed drivers as part of its Keep It Down campaign since the start of 2011.

Money

Huge DWP disability benefit changes in October Budget to save £3bn – but 1,000s could lose £5,000 a year

THOUSANDS of disabled Brits could lose up to £5,000 a year as Rachel Reeves is set to push through brutal welfare cuts.

The Chancellor is expected to slash £3bn from the welfare bill in the Budget – with £1.3bn of that coming from disability benefits.

The changes, first introduced by the Tories, will tighten access to sickness benefits through tough new rules under the Work Capability Assessment.

The Office for Budget Responsibility said the move would save £3bn over four years and the sum is already factored into Treasury spending assumptions.

But the tougher criteria could see 420,000 disabled or ill people lose vital financial support, with experts warning some will face devastating cuts of up to £5,000 annually.

The Resolution Foundation, an independent think tank, has warned that slashing the benefits will leave these people struggling to make ends meet, calling on the Chancellor to rethink the plan.

But Work and Pensions Secretary Liz Kendall yesterday said the benefits system needs the most far-reaching reform in a generation to get millions back into work.

Her department is preparing to roll out a radical overhaul of welfare, promising a pro-work, pro-opportunity agenda.

There are 2.8 million people off work due to long-term sickess, with the cost of benefits for working age people set to reach £64bn by the end of the Parliament.

This figure will be an increase of £30bn on pre-pandemic levels.

Before the election, former Work and Pensions Mel Stride unveiled plans to tighten welfare rules to require an extra 400,000 people signed off long-term to go back to work.

They would automatically lose some of their benefits payments, with the hope being that they would eventually enter the workforce, cutting the welfare bill even further.

Ms Reeves has committed to delivering the £3bn in savings, but it will be up Ms Kendall to determine the specific changes needed to achieve that target.

A Government source said: “We have always said that the Work Capability Assessment is not working and needs to be reformed or replaced alongside a proper plan to support disabled people to work.

“We will deliver savings through our own reforms, including genuine support to help disabled people into work.”

Predictions for the Autumn Statement

The Sun’s Head of Consumer Tara Evans reveals the top predictions for the Autumn Statement:

Winter Fuel Payments

Chancellor Rachel Reeves has already announced that Winter Fuel Payments will be limited to those receiving pension credit and certain benefits. The benefit is worth up to £300 per year and currently is available to everyone over state pension age and those on certain benefits.

No rises to some taxes

Keir Starmer promised there would be no rises to National Insurance, Income Tax, Corporation Tax or VAT as part of Labour’s manifesto in the election race.

Inheritance Tax

It has been predicted that the Chancellor Racheal Reeves will make changes to inheritance tax rates or thresholds. One suggestion is the potential shortening of the gift period before death for tax exemptions.

Pensions

Pensions featured very high up in the King’s Speech, was this a hint at how high on the agenda it will feature in the budget? Experts say there are a number of options, including reintroducing the lifetime allowance cap. Ms Reeves has previously campaigned to reduce the tax relief that higher earners get on their pensions and to introduce a flat rate of 33% instead. Another possible option is changing the rules around pensions and inheritance tax.

Capital Gains Tax (CGT)

There is speculation that the £3,000 tax-free allowance could be scrapped or there may be an extension of CGT to other assets.

Business Rates

There are rumours of reforms to support small businesses, possibly basing rates on land value.

Fuel Duty

Possible rise in fuel duty, reversing the freeze since 2011 and impacting household costs. The Sun has backed drivers as part of its Keep It Down campaign since the start of 2011.

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment4 weeks ago

Science & Environment4 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Technology3 weeks ago

Technology3 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLiquid crystals could improve quantum communication devices

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to wrap your mind around the real multiverse

-

News1 month ago

the pick of new debut fiction

-

News4 weeks ago

News4 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

News4 weeks ago

News4 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology3 weeks ago

Technology3 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

News4 weeks ago

News4 weeks agoYou’re a Hypocrite, And So Am I

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists have worked out how to melt any material

-

Business3 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Science & Environment1 month ago

Science & Environment1 month agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Sport4 weeks ago

Sport4 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Business2 weeks ago

Business2 weeks agoWhen to tip and when not to tip

-

Sport2 weeks ago

Sport2 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Sport2 weeks ago

Sport2 weeks agoWales fall to second loss of WXV against Italy

-

News1 month ago

News1 month agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

News4 weeks ago

The Project Censored Newsletter – May 2024

-

Sport3 weeks ago

Sport3 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Health & fitness1 month ago

Health & fitness1 month agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoRethinking space and time could let us do away with dark matter

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Technology3 weeks ago

Technology3 weeks agoQuantum computers may work better when they ignore causality

-

MMA3 weeks ago

MMA3 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Technology3 weeks ago

Technology3 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Technology2 weeks ago

Technology2 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Business2 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

News2 weeks ago

News2 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Business3 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

Football3 weeks ago

Football3 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

News4 weeks ago

News4 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Politics4 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Politics3 weeks ago

Robert Jenrick vows to cut aid to countries that do not take back refused asylum seekers | Robert Jenrick

-

Technology3 weeks ago

Technology3 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

MMA2 weeks ago

MMA2 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

MMA2 weeks ago

MMA2 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

News2 weeks ago

News2 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Technology2 weeks ago

Technology2 weeks agoA very underrated horror movie sequel is streaming on Max

-

News2 weeks ago

News2 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Business2 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

TV2 weeks ago

TV2 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

Technology2 weeks ago

Technology2 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

TV2 weeks ago

TV2 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

MMA2 weeks ago

MMA2 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Technology2 weeks ago

Technology2 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

News2 weeks ago

News2 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

News2 weeks ago

News2 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

Technology1 month ago

Technology1 month agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

News4 weeks ago

News4 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

News4 weeks ago

News4 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Technology3 weeks ago

Technology3 weeks agoGet ready for Meta Connect

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

News1 month ago

News1 month agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoCardano founder to meet Argentina president Javier Milei

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Sport4 weeks ago

Sport4 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Politics4 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

TV4 weeks ago

TV4 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMeet the world's first female male model | 7.30

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks ago3 Day Full Body Toning Workout for Women

-

Servers computers3 weeks ago

Servers computers3 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Business2 weeks ago

Ukraine faces its darkest hour

-

Business2 weeks ago

Business2 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Sport2 weeks ago

Sport2 weeks agoLauren Keen-Hawkins: Injured amateur jockey continues progress from serious head injury

-

Technology2 weeks ago

Technology2 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

News2 weeks ago

News2 weeks agoNavigating the News Void: Opportunities for Revitalization

-

News2 weeks ago

News2 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

Entertainment2 weeks ago

Entertainment2 weeks agoChristopher Ciccone, artist and Madonna’s younger brother, dies at 63

-

Football2 weeks ago

Football2 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

Business2 weeks ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

Technology2 weeks ago

Technology2 weeks agoMusk faces SEC questions over X takeover

-

Technology2 weeks ago

Technology2 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Entertainment2 weeks ago

Entertainment2 weeks ago“Golden owl” treasure hunt launched decades ago may finally have been solved

-

Business2 weeks ago

Can liberals be trusted with liberalism?

You must be logged in to post a comment Login