Money

How 1p coin in your change could be worth 20 MILLION times its face value thanks to key details – how to check

A RARE 1p coin sitting in your change may be worth 20 million times its face value because of a few key details.

A penny specialist has urged the public to look out for the 72-year-old specific coin as it could be worth a fortune.

The money fanatic known as CoinCollectingWizard on TikTok opened up about the 1952 proof one penny, marked by an image of George VI.

This particular coin is the “rarest proof penny” of its entire series of copper and bronze pennies, and has left collectors absolutely astounded.

He added: “Jiminy Cricket – £200,000 for this old penny.

“The existence of this unique 1952 proof penny was not known publicly until its initial appearance at Numismatic Auctions in October of 1997, some 45 years after it was struck.

“The British Numismatic world was astonished to see this coin appear and in proof quality as this was not known to exist.”

He also said that the coin remains an enigma as it is the “only unique proof striking” of a pre-decimal penny of the 20th century.

According to BullionByPost, proof pennies are the highest quality coin a mint produces.

Issuers like The Royal Mint generally create just a small number of these per year due to the lengthy process required to make them.

Hand-finished dyes and etching by an expert are a huge part of their creation, meaning it takes around an hour to strike 50 proof coins.

London-based dealer Sovereign Rarities states on its website: “It is perhaps understandable that the George VI 1952 Proof Penny remains a unique piece, as the King died very early in 1952 passing away on 6 February.

“Only the smaller denominations of currency coins that were in great demand were struck for circulation in 1952, with the larger denominations omitted in anticipation of a new reign and a new coinage for Queen Elizabeth II.”

The CoinCollectingWizard added: “A lovely example went up for auction recently and sold for £200,000, so it is 100% a coin to look out for.”

But this is not the only rare penny out there for you to find.

A George V 1p dated 1933 was resold at auction for £127,248 and others have sold in the £70,000 to £80,000 range.

There are thought to be less than 10 of the pennies in existence.

Another rare penny featuring Queen Elizabeth II and dated 1954 is highly coveted. There is only one known version of the coin to have survived from a trial of several hundreds, according to The Royal Mint.

It last sold for £23,100 in 1991, which is the equivalent of £51,638 in August 2024.

What are the most rare and valuable coins?

Money

Another major high street bank is offering new customers £150 free cash – see if you can get the bank boost

ANOTHER major high street bank is offering a big £150 cash incentive – here’s how you can cash in.

The bank is launching a new switch-and-stay offer, as the switch wars between banks trying to poach customers from rivals continues.

The Co-operative Bank has announced eligible customers could receive up to £150.

The first £75 is given when a customer completes a switch to the bank.

Then, the bank is offering three monthly instalments of £25 – another £75 – to make up the £150.

Both new and existing customers can apply to switch to a current account to make themselves eligible for the payment.

Like any good offer, there are a few boxes to tick off before the big payment comes in.

Customers must apply for a Standard Current Account or Everyday Extra account.

To be eligible, customers must not have benefited from a switch incentive at The Co-operative Bank since 1 November 2022.

And to receive the first £75, customers need to follow a series of rules.

They are:

- Deposit a minimum of £1,000 into their new account (this includes balances transferred as part of the switch).

- Have 2 active Direct Debits.

- Make a minimum of 10 debit card or digital wallet transactions (pending payments will not count toward fulfilment of this criteria).

- Register for our online and/or mobile banking service.

- Set up the debit card in a digital wallet (Apple Pay, Samsung Wallet or Google Pay).

That leaves the three £25 instalments – and there are some rules to claim them too.

Bankers need to deposit at least £1,000 into their account, have two direct debits and make a minimum of 10 debit card transactions.

Co-operative Bank director of products John Ward: “We’re really pleased to launch this offer today and hope it will encourage more people to consider switching to The Co-operative Bank – the only UK high street bank with a customer-led Ethical Policy, which guides how we do business.

“This offer allows eligible new and existing customers to benefit from up to £150 for switching and staying with The Co-operative Bank as their main current account provider.”

Nationwide, Lloyds, Santander and others have all been offering incentives over summer, with the switch wars looking set to continue into autumn.

It’s always advisable to check whether an offer is right for your personal circumstances.

Money

Southern Water in talks to import water from Norway — in the event of a severe drought

SOUTHERN WATER is in talks to import water from fjords in Norway — in the event of a severe drought.

The shock plan to bring in supplies from more than 1,000 miles away comes just a month after the firm’s boss Lawrence Gosden complained there was “too much rain”.

The company, which serves 4.7 million households in Sussex, Kent, and the Isle of Wight, is in conversations with a Norwegian firm to ship in 45million litres of water a day into Hampshire.

It stressed it was a “last resort option” amid concerns there would be shortfall while construction on a new reservoir takes place.

The cost would end up being added to customer bills.

It is likely to outrage households further as the average Southern Water bill is already expected to rise from £420 by 43 per cent to £603 by 2030, according to recent Ofwat documents.

The firm is majority owned by MacQuarie. The Australian investor previously came underfire for saddling Thames Water, which it owned between 2006 and 2017, with billions of pounds of debt so it could afford bumper dividends.

Southern Water imposed a hosepipe ban in August 2022, the first such for a decade, after a heatwave caused the driest July since 1935.

It was also ranked as one of the worst for sewage spills, pumping 317,285 hours of sewage from overflows in 2023, the Environment Agency found.

The Norwegian firm that it would use is Extreme Drought Resilience Service.

Its website says it offers to supply “those required to insure against critical shortages to their own water resources due to major outages or extreme drought”.

Tim McMahon, Southern’s managing director for water, said importation would be a “last minute contingency measure”.

He said it would only be used in the event of a drought in the early 2030s and “something considerably worse than the drought of 1976”.

Mike Keil, of the Consumer Council for Water, said that while customers want the security of having a reliable service, that should still come at a good value.

He said: “Water resources in the south of England are under intense pressure and water companies need to have a robust long-term plan, but that must not come at an unreasonable cost to customers or the environment.”

Meanwhile, the owner of South West Water yesterday said it had taken a £16million hit from parasite-contaminated water in parts of Devon.

Around 17,000 households in the town of Brixham had to boil their water for eight weeks because of the diarrhoea-causing bug that was in the supplies.

Pennon had to flush the network and provide bottles of water to affected customers.

It has also said it is paying £3.5million in compensation.

RIOTS HITS SALES

THE owner of All Bar One and Toby Carvery has blamed rioting in city centres for a summer sales slump.

Mitchells & Butler said sales growth slowed from 6.1 per cent in the second quarter to 2.5 per cent in the latest quarter.

Phil Urban, boss of the pub group, which also runs Harvester and Miller & Carter, partly blamed it on “an unseasonally cool summer and disruption caused by riots in city centres”.

The unrest was sparked by the stabbing of three girls in Southport, Merseyside, in July.

BUST AND WIN FOR BRA BOSS

AN ENTREPRENEUR who set up her own lingerie company from her living room has cashed in to the tune of £45.7million.

Sarah Tremellen, 58, launched Bravissimo in 1995 after finding a dearth of big-busted bra options when she was a size 34G during a pregnancy.

She previously said: “You don’t have to have big boobs to work here, but it helps.”

Almost three decades after setting up the firm she and her husband, Mike, have struck a deal to sell to Wacoal Europe, which also owns the bra brands Freya and Fantasie.

The Warwickshire-based firm, which started out with mail order, sells lingerie and swimwear up to L cups online and from 25 stores across the UK.

Mrs Tremellen said. “I have loved creating and growing Bravissimo. It has been an absolute privilege to be able to bring a range of bigger cup size lingerie and swimwear to so many wonderful women.”

AMAZON’S BRAG

AMAZON claims it is one of the top ten biggest payers of business rates in the UK.

It comes ahead of Government reforms set to level the playing field between online and high street shops. The online giant said it made a total tax contribution of £4.3billion, including PAYE contributions by 75,000 workers.

Its own tax bill came in at £932million. The disclosure comes a month before the Budget, with speculation the Treasury could raise the rate on logistics and warehouses, which online retailers use.

AI ADDS A BIT MORR

ARTIFICIAL intelligence cameras have helped keep shelves at Morrisons stocked and boost sales, the store’s chief said yesterday.

The grocer reported a 2.9 per cent rise in sales in the third quarter, which boss Rami Baitiéh said was helped by cameras monitoring stock and reordering when needed.

The supermarket confirmed it had struck a £331million ground rent deal on 76 shops to cut its debtpile from its £7billion takeover.

Money

UK energy firm with 5.22million customers is giving thousands a £150 discount – when you’ll be paid

A MAJOR energy firm with more than five million customers is set to pay thousands of customers a £150 discount on their bills.

EDF Energy is giving eligible customers extra cash through the Warm Home Discount to help lower bills this winter.

The eligibility requirements for the Warm Home Discount are the same as last year.

Between now and December, the government will issue letters to households that are eligible for the scheme.

EDF Energy has now said that it will aim to pay the discount by the end of February 28, 2025.

However, payments could begin being issued as early as next month.

To qualify for the Warm Home Discount, you need to claim either the guaranteed credit element of pension credit or a different qualifying benefit form the list below:

If you weren’t claiming any of the above benefits on August 11, 2024, you won’t be eligible for the payment.

Where someone claims a qualifying benefit, the government will assess their energy costs based on the type, age and size of property.

This means that you may not be considered eligible for the Warm Home Discount if you live in a more energy-efficient property for instance, even if you receive a qualifying benefit.

However, this rule doesn’t apply to recipients of the guarantee credit portion of pension credit.

Around 800,000 pensioners are eligible for pension credit but not claiming it.

As well as missing out on a £300 winter fuel payments, they won’t get the £150 Warm Home Discount payment.

Even if you weren’t getting pension credit on August 11, thousands of pensioners who apply for the benefit now can still qualify for the £150 payment.

This is because pension credit rules allow first-time claimants to backdate their benefit entitlement by three months.

So you’ll need to launch your claim by Friday, October 11 and then successfully get it backdated to cover the August 11 Warm Home Discount qualifying date.

But if you fail to apply before this date you’ll miss out.

What is pension credit and how do I apply?

PENSION credit tops up your weekly income to £218.15 if you are single or to £332.95 if you have a partner.

This is known as “guarantee credit”.

If your income is lower than this, you’re very likely to be eligible for the benefit.

However, if your income is slightly higher, you might still be eligible for pension credit if you have a disability, you care for someone, you have savings or you have housing costs.

You could get an extra £81.50 a week if you have a disability or claim any of the following:

- Attendance allowance

- The middle or highest rate from the care component of disability living allowance (DLA)

- The daily living component of personal independence payment (PIP)

- Armed forces independence payment

- The daily living component of adult disability payment (ADP) at the standard or enhanced rate.

ou could get the “savings credit” part of pension credit if both of the following apply:

- You reached State Pension age before April 6, 2016

- You saved some money for retirement, for example, a personal or workplace pension

This part of pension credit is worth £17.01 for single people or £19.04 for couples.

Pension credit opens the door to other support, including housing benefits, cost of living payments, council tax reductions, the winter fuel payment and the Warm Home Discount.

You can start your application up to four months before you reach state pension age.

We’ve explained everything you need to know about EDF Energy‘s scheme below.

Do I need to apply for the discount?

Households in England and Wales don’t have to apply to get the cash and receive it automatically.

You should look out for a letter between October 2024 and early January 2025 telling you:

- You’re eligible and you’ll get the discount automatically; or

- You might be eligible, and you need to give more information.

- The letter will tell you to call the helpline by 29 February 2024 to confirm your details.

If you don’t get the letter by early January 2024 and you think you’re eligible, you need to call the helpline on 0800 030 9322.

If you’re eligible, your electricity supplier will apply the discount to your bill by 31 March 2025.

Some Scottish households do have to apply for the discount.

In Scotland there’s a “core group” that’ll receive an automatic payment and a “broader group” which has to apply for the scheme with their energy provider.

You’ll need to check with your energy supplier directly to see the eligibility requirements and details on how to apply.

The scheme will have more applicants than places, so make sure you apply as soon as possible.

EDF Energy customers can apply by visiting edfenergy.com/help-support/whd-application-form.

How will I receive the discount from EDF Energy?

If you pay by direct debit or on receipt of your bill the £150 Warm Home Discount will be added to your electricity account as a credit.

Once it has been applied, it will show on your next bill.

If you have a traditional prepayment meter, EDF Energy will send you a letter explaining how you’ll get your discount.

You’ll receive a Post Office voucher in the post and instructions on redeeming it.

If you have a smart prepayment meter, EDF Energy will automatically credit your meter with the discount.

What energy bill help is available?

THERE’S a number of different ways to get help paying your energy bills if you’re struggling to get by.

If you fall into debt, you can always approach your supplier to see if they can put you on a repayment plan before putting you on a prepayment meter.

This involves paying off what you owe in instalments over a set period.

If your supplier offers you a repayment plan you don’t think you can afford, speak to them again to see if you can negotiate a better deal.

Several energy firms have grant schemes available to customers struggling to cover their bills.

But eligibility criteria varies depending on the supplier and the amount you can get depends on your financial circumstances.

For example, British Gas or Scottish Gas customers struggling to pay their energy bills can get grants worth up to £2,000.

British Gas also offers help via its British Gas Energy Trust and Individuals Family Fund.

You don’t need to be a British Gas customer to apply for the second fund.

EDF, E.ON, Octopus Energy and Scottish Power all offer grants to struggling customers too.

Thousands of vulnerable households are missing out on extra help and protections by not signing up to the Priority Services Register (PSR).

The service helps support vulnerable households, such as those who are elderly or ill, and some of the perks include being given advance warning of blackouts, free gas safety checks and extra support if you’re struggling.

Get in touch with your energy firm to see if you can apply.

Money

Exact amount of time homeowners have to to lock in mortgage rates early as another major lender shortens window

BARCLAYS has become the latest major lender to make significant changes to its mortgages.

The high-street bank has shortened the amount of time customers have to lock in a new interest rate ahead of their current deal ending.

So, if you are a mortgage holder nearing the end of your fixed term, the clock is ticking to negotiate a new offer.

The length of time a borrower with Barclays has to secure a new fixed term deal has dropped from six months to three.

This is in line with similar moves by Halifax, Lloyds, Nationwide, and Santander in recent months.

The changes at Barclays will come in from September 25, and apply to customers who already hold a mortgage product with the bank and are looking to switch to another deal.

Choosing a new deal before your current ones ends means you can secure a good deal now in case interest rates rise later on.

If at the end of your current deal you find a better rate, you can choose that instead as there’s no penalty for ditching the one you chose before the end of the term.

Barclays said the move was down to greater stability in the mortgage market, and that over 70% of Barclays customers applying for product transfers did so within the last three months of mortgage terms meaning the extended window was no longer necessary.

A Barclays spokesperson, says: “In a more stable mortgage market and with rates coming down, the majority of our customers are choosing to apply for transfers within 90 days before their mortgage matures.

“In response, we will be moving back to a product transfer window of 90 days, as we continue to deliver the best value and product range to our customers.”

At the start of the month, Halifax and Lloyds reduced the time frame for those remortgaging from six to four months.

Nationwide and Santander made the same move in June.

Other lenders, such as HSBC, NatWest and Virgin Money still offer customers six months to lock in their new deal.

An estimated 700,000 loans are up for renewal in the second half of 2024, says industry body UK Finance.

A real concern for borrowers needing to remortgage is how much fixed rates have risen in the last few years.

The average two-year fixed rate deal has increased from 2.34% in December 2021, to 5.56% as of September 2024.

Meanwhile, the average five-year deal has risen from 2.64% to 5.20%, according to the latest data from Moneyfacts.

Different types of mortgages

We break down all you need to know about mortgages and what categories they fall into.

A fixed rate mortgage provides an interest rate that remains the same for an agreed period such as two, five or even 10 years.

Your monthly repayments would remain the same for the whole deal period.

There are a few different types of variable mortgages and, as the name suggests, the rates can change.

A tracker mortgage sets your rate a certain percentage above or below an external benchmark.

This is usually the Bank of England base rate or a bank may have its figure.

If the base rate rises, so will your mortgage but if it drops then your monthly repayments will be reduced.

A standard variable rate (SVR) is a default rate offered by banks. You usually revert to this at the end of a fixed deal term, unless you get a new one.

SVRs are generally higher than other types of mortgage, so if you’re on one then you’re likely to be paying more than you need to.

Variable rate mortgages often don’t have exit fees while a fixed rate could do.

The second half of the year has also been marked with repossessions, highlighting the financial struggles many are under right now.

UK Finance says that 980 homeowner mortgaged properties were repossessed in the second quarter of 2024.

This is an 8% increase compared to the previous quarter, and a 31% uplift on the same quarter in 2023.

But it’s not all doom and gloom. There is in fact a positive outlook on the housing market.

The Bank of England reduced the base rate for the first time since March 2020 in August, dropping the rate from 5.25% to 5%.

As a result, lenders have already started to follow suit and drop their fixed rates.

In fact, Nationwide is leading the way, currently offering a 3.74% home purchase plan deal.

Rachel Springall, finance expert at Moneyfacts Compare, said: “Each lender will have their own processes and timescales for getting applications through, so they can change the window of opportunity from time to time to cope with demand, but also as a reflection on changing interest rates.

“Interest rates have been falling, so condensing the window can help lenders avoid re-applications. The same window can extend, depending on the situation of the market.

“Borrowers would be wise to seek out independent advice from a broker to navigate the deals available, but ensure they allow a couple of months to refinance before their current deal ends.”

The move also comes as Barclays announced a reduction in rates by as much as 0.34% for new buyers and those remortgaging.

Meanwhile a major building society is now lending first-time buyers up to six times their income for a mortgage.

HOW FAR AHEAD CAN I LOCK IN A NEW FIX?

- Barclays – three months

- Halifax – four months

- Lloyds – four months

- Santander – four months

- Nationwide – four months

- HSBC – six months

- NatWest – six months

- Virgin Money – six months

How to get the best mortgage deal

If your mortgage deal is nearing the end of its term, you should start to compare rates now and speak to a mortgage broker to assess your options.

It is then worth speaking with your current lender to see what deal they might be able to offer you.

Getting the best rates depends entirely on what’s available at any given time.

There are several ways to land the best deal.

Usually the larger the deposit you have the lower the rate you can get.

If you’re remortgaging and your loan-to-value ratio (LTV) has changed, you’ll get access to better rates than before.

Your LTV will go down if your outstanding mortgage is lower and/or your home’s value is higher.

A change to your credit score or a better salary could also help you access better rates.

And if you’re nearing the end of a fixed deal soon it’s worth looking for new deals now.

You can lock in current deals sometimes up to six months before your current deal ends.

Leaving a fixed deal early will usually come with an early exit fee, so you want to avoid this extra cost.

But depending on the cost and how much you could save by switching versus sticking, it could be worth paying to leave the deal – but compare the costs first.

Expert’s view on reducing time to lock in new rates

By David Hollingworth, associate director of communications at L&C Mortgages.

Many lenders extended the timeframe when existing customers could lock in a new rate because interest rates were climbing so quickly and market conditions were so volatile.

The market is now much more stable and mortgage rates have been falling as the outlook improves and inflation has eased.

As a result, there’s less need for customers to rush to take a rate six months before their deal ends, so lenders have started to return the window for their borrowers to pick a new deal to where it was.

It’s still possible to lock a rate in sooner with a new lender if you want to, as mortgage offers are still typically valid for up to six months.

It makes sense to shop around the entire market anyway, but starting the process three or four months ahead should give you ample time to prepare for a smooth switch.

To find the best deal use a mortgage comparison tool to see what’s available.

You can also go to a mortgage broker who can compare a much larger range of deals for you.

Some will charge an extra fee but there are plenty who give advice for free and get paid only on commission from the lender.

You’ll also need to factor in fees for the mortgage, though some have no fees at all.

You can add the fee – sometimes more than £1,000 – to the cost of the mortgage, but be aware that means you’ll pay interest on it and so will cost more in the long term.

You can use a mortgage calculator to see how much you could borrow.

Remember you’ll have to pass the lender’s strict eligibility criteria too, which will include affordability checks and looking at your credit file.

You may also need to provide documents such as utility bills, proof of benefits, your last three month’s payslips, passports and bank statements.

Once you have taken a look at all your different options, you will want to consider the most important aspects.

These include your current rate, the terms and length and any exit fees, as well as your loan-to-value (LTV).

When your fixed rate ends you will automatically roll on to your lender’s standard variable rate (SVR), and these often are considerably higher than a standard fixed rate.

These can be as high as nearly 8% so switching before the end of your current term is a high priority.

Money

Exactly how much MORE you’d have to pay per pint under Labour’s ‘sin tax’ raid

PUNTERS could soon be hammered by a hefty price hike on a pint of beer following Labour’s ‘sin tax’ raid.

Chancellor Rachel Reeves is reportedly considering lifting the price of a pint of beer or cider, and a shot of spirits, as well as increasing the levy on a packet of cigarettes.

The move would be a crushing blow for beleaguered boozers as well as tight-fisted pub goers.

The potential five per cent beer duty hike would lift the cost of a pint by 2.45p.

If struggling publicans take on the burden their profit per pint drops from 12p to 9.55p.

The average price for a pint in the UK currently costs £5, a report previously found.

Unsurprisingly, London has the most expensive pint in the country, with the average one costing a frightening £7.15, meaning residents in the Big Smoke could soon be set back close to a tenner for a pint of lager or cider.

Belfast, at £6.71, and Brighton and Hove, at £6.60, came in at second and third respectively, according to recent research.

Currently 35 per cent of hospitality businesses are not making a profit and some 500 pubs shut for good last year alone.

Meanwhile, the pub and brewery sector contributes £26.2billion to the UK economy and also generates £15.1billion in tax.

Emma McClarkin, chief of the British Beer and Pub Association, said any plan to further hurt pubs will be a “bitter blow”.

She said: “After the Chancellor’s pre-election promise of a five point plan for pubs, it is impossible to see how this will be fulfilled if the price of a pint is increased by the Government.

“The cost of doing business has soared in recent years and, with potentially new punishing burdens, this tax increase is the last thing pubs and beer drinkers need.”

On the other hand, the BBPA estimates a five per cent drop in beer duty would create an extra 12,000 jobs.

Ms McClarkin also wants Ms Reeves to maintain 75 per cent business rates relief and said: “Anything less will be a total betrayal of the great British pub that this Government promised to protect, and the one million jobs that depend on them.”

Brian Perkins, CEO of Budweiser Brewing Group UK, said: “Rather than increasing beer duty, the new Government should support our struggling brewing and hospitality sectors by cutting beer duty.

“The average British pint is already taxed twelve times more than on the continent.”

Mark Kent, of the Scotch Whisky Association, said: “A further duty increase would be a hammer blow.”

“It would serve no economic purpose to increase duty on spirits, with a £300m reduction in revenue since the duty increase last year by the outgoing government.

“We need a change in direction from the new Chancellor.”

Tough on NHS

WES Streeting has defended his recent criticism of the NHS, insisting only urgent reform can save the struggling service.

The Health Secretary made it clear he will not be swayed by critics, after anonymous NHS insiders told the BBC of “growing unease” over the Government’s messaging.

He told the Labour Party conference yesterday that not acknowledging the problems in the NHS would result in “killing it with kindness”.

Mr Streeting said: “I know the doctor’s diagnosis can sometimes be hard to hear.

“But if you don’t have an accurate diagnosis, you won’t provide the correct prescription.

“And when you put protecting its reputation above protecting patients, you’re not helping the NHS, you’re killing it with kindness.

“I won’t back down. The NHS is broken, but it’s not beaten, and together we will turn it around.”

His comments come after senior people in the health service expressed unease over Labour’s tough talk.

One hospital chief told the BBC harsh rhetoric could spook patients and crush staff morale. He added: “Hope is important.”

In recent weeks, the Government has claimed cancer is a “death sentence” due to NHS failings, while maternity services “shame” Britain.

By Martina Bet

Ahead of the election Ms Reeves championed local pubs.

She said: “Brits love our locals. Let’s back our landlords to keep our pubs going. We want to save the British pub because I know what an important institution they are in so many communities.”

At the Budget in March, then Tory Chancellor Jeremy Hunt said alcohol duty — which was due to rise by three per cent in August — would stay frozen to February 2025.

But tobacco duty went up by £2 per 100 cigarettes in a one-off increase which ensured vaping was cheaper.

Sir Keir Starmer has vowed to act to reduce 88,000 smoking-related deaths every year.

There is already anger at proposal to ban smoking in pub beer gardens.

Mr Streeting told Sky News yesterday: “We definitely want to see smoking phased out in our country, we committed to that in our manifesto. I’m considering, and I’m up for a national debate on this issue.

“We’re becoming sicker sooner and there is a heavy price being paid for that in our economy, our public finances and our health.”

Addressing a booze and fag duty hike, a Whitehall source told The Sun: “The budget has not been decided, there’s a long way to go before the package is finalised.”

One Treasury source tried to play down the move saying: “Sounds like a load of classic pre-Budget speculation to me.”

And a Treasury spokesman added: “We do not comment on speculation around tax changes outside of fiscal events.”

Money

Winter fuel payments could return for millions as new legal fight launched against cuts

WINTER fuel payments could return for millions after a legal challenge was launched against cuts to the benefit

If it succeeds, over 10million households that have lost the £300 a year top-up could see the help return.

Two pensioners, Peter and Florence Fanning, are seeking to take the Scottish and UK governments to court over the cut to the winter fuel payment.

Mr and Mrs Fanning of Coatbridge, North Lanarkshire, have raised proceedings with the help of the Govan Law Centre (GLC).

In the past the winter fuel payment, worth up to £300, was available to everyone aged 66 and above.

However, after Labour’s election victory, Chancellor Rachel Reeves introduced cuts limiting winter fuel payment eligibility to those on pension credit or other means-tested benefits.

The decision led to the Scottish Government to follow suit.

Mr and Mrs Fanning have now raised a judicial review at Scotland’s highest court, the Court of Session, asking it to rule on whether the decision was unlawful.

If the cuts are found to be unlawful, the petitioners could ask the court to set aside the policy and restore the winter fuel payment to all.

However, there’s no guarantee that such legal action will succeed.

Speaking at a press conference in Edinburgh on Thursday, Mr Fanning, 73, said: “We intend to sue both the London and Scottish governments, since both are guilty through action and inaction, of damaging the welfare of pensioners.

“We are hoping to be successful, given the manifest injustice involved, however, my work as a trade unionist and shop steward has taught me that some battles are worth fighting regardless of the outcome – I believe this is one such battle.”

A spokeswoman for the UK Government said: “We are committed to supporting pensioners, with millions set to see their full new state pension rise by £1,700 this Parliament through our commitment to the triple lock.

“Given the dire state of the public finances we have inherited, it’s right we target support to those who need it most.

“Over a million pensioners will still receive the winter fuel payment, while many others will also benefit from the £150 warm home discount to help with their energy bills over winter.”

What does the case argue?

The case rests on the accusation that both governments failed to adequately consult with those of pension age on the change and did not release an equality impact assessment on the changes.

The GLC claims that the government did not adhere to the requirements of the Equality Act 2010.

According to the Act, public bodies are obligated to consider how their decisions and actions will impact individuals with various “protected characteristics”, such as age and disability.

However, on September 13, the DWP did release its own equality impact assessment on target winter fuel payment, after receiving a Freedom of Information request on the matter.

In response to the request, the DWP said: “The government has followed its legal and statutory duties before introducing these changes and will continue to do so.”

However, GLC claims that there was no “proper assessment” and that the research included in the impact assessment was inadequate.

Separately, the GLC also argues that the government had a legal duty to consult people of state pension age about the changes but failed to do so.

Will it succeed?

These court battles can often take many months, if not years and the chances of reaching a verdict before the winter is very slim.

However, if the Court determines that the government failed to meet its obligations under the Equality Act 2010 or consult pensioners properly, the decision to limit the payments could be deemed unlawful.

In such a case, the Court could annul the regulations that implemented the changes and mandate the Government to conduct a comprehensive impact assessment.

This would revert the situation to its state before the policy was introduced, and winter fuel payments could be reinstated for all pensioners.

Again, the likelihood of this happening before winter is low.

It’s not the first time people have challenged benefit rules.

Back in April 2021, two Brits launched a claim against the DWP on behalf of the 1.9million households on legacy benefits who did not receive a £20 a week uplift given to those on Universal Credit during the pandemic.

They argued that those on legacy benefits should have been granted the same uplift.

However, the court ruling that followed in February 2022 dashed hopes of a payout that could have been worth £1,500 in backdated benefits.

How have winter fuel payments changed?

Winter fuel payments are now limited to retirees on pension credit or those receiving certain other means-tested benefits.

Only individuals claiming the following benefits will be eligible for a winter fuel payment this year:

- Pension credit

- Universal Credit

- Income support

- Income-based jobseeker’s allowance (JSA)

- Income-related employment support allowance (ESA)

- Child tax credit

- Working tax credit

To be eligible for this year’s payment, you must have an active claim for the benefits mentioned above during the “qualifying week,” which runs from 16 to 22 September (this week).

Most households automatically receive the winter fuel payment, including those on pension credit.

Over 800,000 households are thought to be missing out on pension credit, which unlocks their eligibility for this year’s winter fuel payment.

If you don’t apply for this year’s payment by the end of the week, you might assume that you won’t qualify.

However, thanks to a little-known loophole, this is not the case.

This is because new claims for pension credit can be backdated by up to three months.

This means that the absolute deadline to claim the benefit and qualify for this year’s winter fuel payment is December 21.

Of course, if you fail to apply for the benefit before this date, you won’t qualify for this year’s £300.

What is pension credit and how do I apply?

PENSION credit tops up your weekly income to £218.15 if you are single or to £332.95 if you have a partner.

This is known as “guarantee credit”.

If your income is lower than this, you’re very likely to be eligible for the benefit.

However, if your income is slightly higher, you might still be eligible for pension credit if you have a disability, you care for someone, you have savings or you have housing costs.

You may get extra amounts if you have other responsibilities and costs.

Pension credit opens the door to other support, including housing benefits, cost of living payments, council tax reductions, the winter fuel payment and the Warm Home Discount.

You can start your application up to four months before you reach state pension age.

Find out more by visiting gov.uk/pension-credit/how-to-claim.

-

Womens Workouts3 days ago

Womens Workouts3 days ago3 Day Full Body Women’s Dumbbell Only Workout

-

News4 days ago

News4 days agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

News1 week ago

News1 week agoYou’re a Hypocrite, And So Am I

-

Technology1 week ago

Technology1 week agoWould-be reality TV contestants ‘not looking real’

-

Sport1 week ago

Sport1 week agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment1 week ago

Science & Environment1 week agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 week ago

Science & Environment1 week agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment1 week ago

Science & Environment1 week agoHow to wrap your mind around the real multiverse

-

Science & Environment1 week ago

Science & Environment1 week agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 week ago

Science & Environment1 week ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 week ago

Science & Environment1 week agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 week ago

Science & Environment1 week agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 week ago

Science & Environment1 week agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment1 week ago

Science & Environment1 week agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 week ago

Science & Environment1 week agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment1 week ago

Science & Environment1 week agoPhysicists are grappling with their own reproducibility crisis

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCardano founder to meet Argentina president Javier Milei

-

News1 week ago

News1 week agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Womens Workouts6 days ago

Womens Workouts6 days agoEverything a Beginner Needs to Know About Squatting

-

Science & Environment1 week ago

Science & Environment1 week agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 week ago

Science & Environment1 week agoNuclear fusion experiment overcomes two key operating hurdles

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

News1 week ago

News1 week agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Womens Workouts6 days ago

Womens Workouts6 days agoBest Exercises if You Want to Build a Great Physique

-

Science & Environment4 days ago

Science & Environment4 days agoMeet the world's first female male model | 7.30

-

Science & Environment1 week ago

Science & Environment1 week agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment1 week ago

Science & Environment1 week agoNerve fibres in the brain could generate quantum entanglement

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoSEC asks court for four months to produce documents for Coinbase

-

Sport1 week ago

Sport1 week agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBlockdaemon mulls 2026 IPO: Report

-

Business1 week ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Technology1 week ago

Technology1 week agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

Womens Workouts6 days ago

Womens Workouts6 days agoKeep Your Goals on Track This Season

-

News4 days ago

News4 days agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Travel3 days ago

Travel3 days agoDelta signs codeshare agreement with SAS

-

Science & Environment1 week ago

Science & Environment1 week agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment1 week ago

Science & Environment1 week agoLaser helps turn an electron into a coil of mass and charge

-

News1 week ago

News1 week agoChurch same-sex split affecting bishop appointments

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

Business1 week ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics1 week ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News1 week ago

News1 week agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts6 days ago

Womens Workouts6 days agoHow Heat Affects Your Body During Exercise

-

Womens Workouts3 days ago

Womens Workouts3 days ago3 Day Full Body Toning Workout for Women

-

Health & fitness1 week ago

Health & fitness1 week agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment1 week ago

Science & Environment1 week agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment1 week ago

Science & Environment1 week agoBeing in two places at once could make a quantum battery charge faster

-

Science & Environment1 week ago

Science & Environment1 week agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Science & Environment1 week ago

Science & Environment1 week agoHow one theory ties together everything we know about the universe

-

Science & Environment1 week ago

Science & Environment1 week agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment1 week ago

Science & Environment1 week agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

Science & Environment1 week ago

Science & Environment1 week agoTiny magnet could help measure gravity on the quantum scale

-

Technology1 week ago

Technology1 week agoFivetran targets data security by adding Hybrid Deployment

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

News1 week ago

News1 week agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

Womens Workouts6 days ago

Womens Workouts6 days agoWhich Squat Load Position is Right For You?

-

News4 days ago

News4 days agoWhy Is Everyone Excited About These Smart Insoles?

-

Politics1 week ago

Politics1 week agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology1 week ago

Technology1 week agoCan technology fix the ‘broken’ concert ticketing system?

-

Health & fitness1 week ago

Health & fitness1 week agoThe maps that could hold the secret to curing cancer

-

News1 week ago

News1 week ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment1 week ago

Science & Environment1 week agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 week ago

Science & Environment1 week agoSingle atoms captured morphing into quantum waves in startling image

-

Science & Environment1 week ago

Science & Environment1 week agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoHelp! My parents are addicted to Pi Network crypto tapper

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

-

Fashion Models1 week ago

Fashion Models1 week agoMixte

-

Politics1 week ago

Politics1 week agoLabour MP urges UK government to nationalise Grangemouth refinery

-

Money7 days ago

Money7 days agoBritain’s ultra-wealthy exit ahead of proposed non-dom tax changes

-

Womens Workouts6 days ago

Womens Workouts6 days agoWhere is the Science Today?

-

Womens Workouts6 days ago

Womens Workouts6 days agoSwimming into Your Fitness Routine

-

News6 days ago

News6 days agoBangladesh Holds the World Accountable to Secure Climate Justice

-

News1 week ago

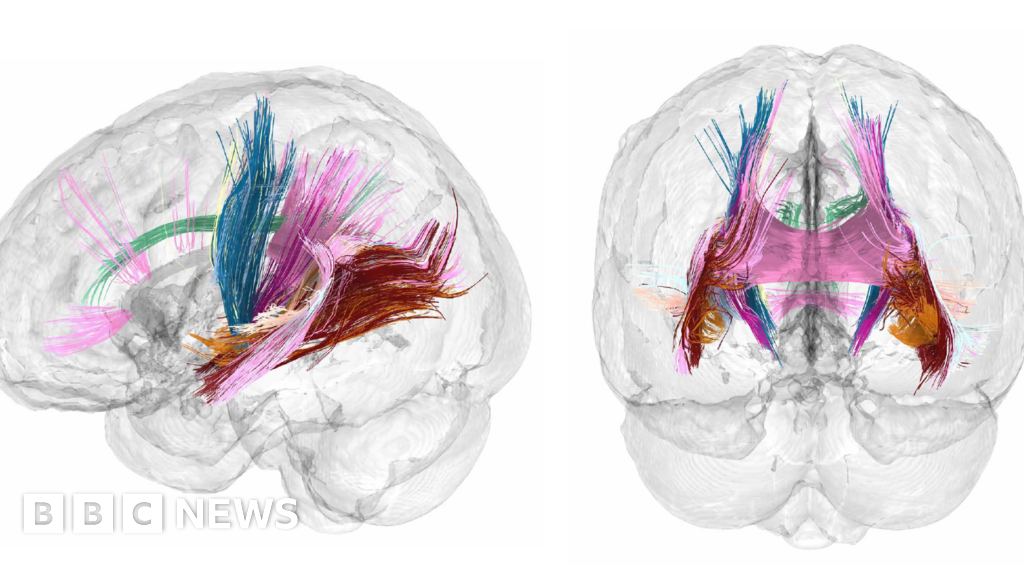

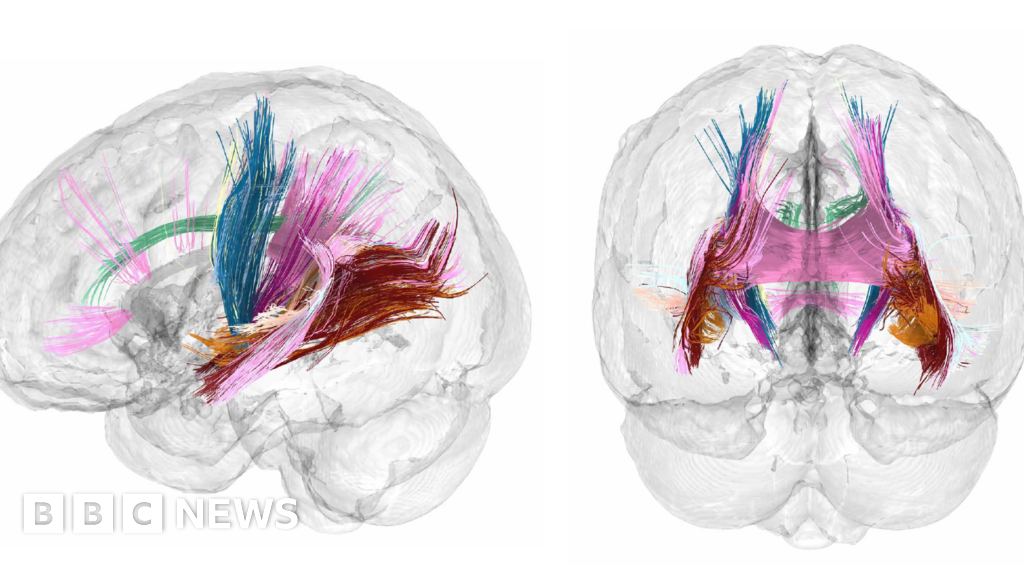

News1 week agoBrain changes during pregnancy revealed in detailed map

-

Science & Environment1 week ago

Science & Environment1 week agoA slight curve helps rocks make the biggest splash

-

News1 week ago

News1 week agoRoad rage suspects in custody after gunshots, drivers ramming vehicles near Boise

-

Science & Environment1 week ago

Science & Environment1 week agoHow Peter Higgs revealed the forces that hold the universe together

-

Science & Environment1 week ago

Science & Environment1 week agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Politics1 week ago

Politics1 week agoLib Dems aim to turn election success into influence

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoDecentraland X account hacked, phishing scam targets MANA airdrop

You must be logged in to post a comment Login