Money

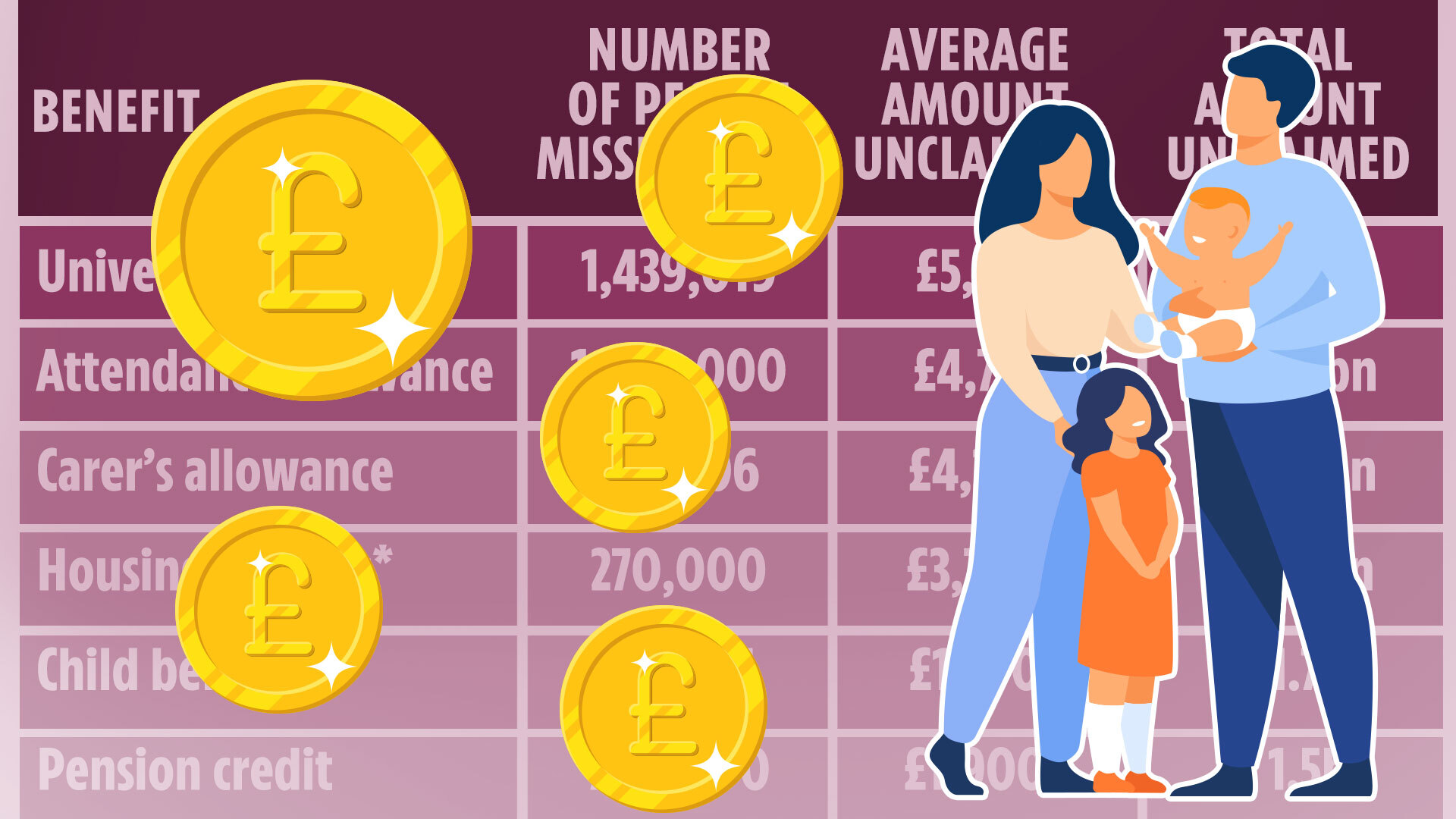

How millions are missing out on unclaimed cash – could you get up to £5,772?

MILLIONS of households could be forfeiting up to £5,772 a year in cash to help with bills.

Struggling families are collectively missing out on a staggering £27billion in means-tested benefits and social tariffs.

Some households could be up to £5,772 better off if they were to apply for Universal Credit, according to Policy in Practice.

A further 760,000 individuals eligible for pension credit but not applying stand to miss out on this year’s winter fuel payment, which is worth up to £300.

Of the £27billion in unclaimed benefits, over £8.3billion is attributed to Universal Credit, £5.2billion to attendance allowance, nearly £2.3billion to carer’s allowance, more than £1.5billion to pension credit, and £1.7billion to child benefit.

How much could you be missing out on?

We’ve explained your chances and how to apply for extra support below.

Universal Credit

- You could be missing out on £5,772 a year

Policy in Practice estimates that a staggering £8.3billion of Universal Credit goes unclaimed by more than 1.4million people, who could claim an average of £5,772 a year.

Universal Credit is a monthly payment to help with your living costs.

How much money you’ll get depends on your circumstances, but the monthly standard allowance is £393.45 for a single person over 25 and £617.60 for a couple who are both over that age.

If you have a disability or health condition, or if your child does, there are extra top-ups you can get in your Universal Credit award.

If you rent, you can also get help towards those costs and any service fees you might pay.

Universal Credit can also open the door to other support including free school meals or social tariffs.

Everything you need to know about Universal Credit

Attendance allowance

- You could be missing out on £4,727 a year

Around 1.1million people in the UK living with a disability are missing out on £5.2billion worth of attendance allowance payments.

Those living with less severe disabilities can get up to £72.65 a week, which works out at £290 a month.

You may be eligible for this if you require help or constant supervision during the day or at night.

The higher rate of £108.55 a week is given to those who require supervision throughout both day and night, or if a medical professional has said you’re nearing the end of life.

This works out as £434.20 a month or £5,644 a year.

To apply, visit gov.uk/attendance-allowance/how-to-claim.

Carer’s allowance

- You could be missing out on £4,259 a year

Nearly £2.3billion worth of carer’s allowance is going unclaimed each financial year, with around 530,000 full-time, low paid carers missing out.

Carer’s allowance is a UK benefit designed to help people who have caring responsibilities for more than 35 hours each week.

Those eligible get £81.90 a week paid directly into bank accounts.

To qualify, the person you care for must already get one of these benefits:

- Personal independence payment (PIP) – daily living component

- Disability living allowance – the middle or highest care rate

- Attendance allowance

- Constant attendance allowance at or above the normal maximum rate with an Industrial Injuries Disablement Benefit

- Constant attendance allowance at the basic (full day) rate with a war disablement pension

- Armed forces independence payment

Your earnings must also be £151 or less a week after tax, National Insurance and expenses.

Carer’s allowance payments will stop if your income breaches this level, but this may not happen automatically.

In recent months, thousands of carer’s allowance claimants have been unknowingly hit by the hard stop figure and been chased to pay their benefits back.

To avoid falling into this trap, you need to report a change in circumstances to the DWP as soon as your weekly income hits this threshold.

You can apply for the carer’s allowance online by visiting www.gov.uk/carers-allowance/how-to-claim.

Your earnings must also be £151 or less a week after tax, National Insurance and expenses.

Carer’s allowance payments will stop if your income breaches this level, but this may not happen automatically.

In recent months, thousands of carer’s allowance claimants have been unknowingly hit by the hard stop figure and been chased to pay their benefits back.

To avoid falling into this trap, you need to report a change in circumstances to the DWP as soon as your weekly income hits this threshold.

You can apply for the carer’s allowance online by visiting www.gov.uk/carers-allowance/how-to-claim.

Housing benefit

- You could be missing out on £3,700 a year

Almost 270,000 pensioners are missing out on £1.1billion in pension age housing benefit, according to the new figures, going without £3,700 a year on average.

The benefit is for pensioners who pay rent, are on a low income and have savings under £16,000.

New claims for housing benefit are strictly reserved for those over the state pension age.

Universal Credit‘s housing element has replaced housing benefit for those under 66 years old.

You can apply for housing benefit directly with your local council.

Find yours by visiting gov.uk/apply-housing-benefit-from-council.

You can also apply for housing benefit as part of a pension credit claim.

Are you missing out on benefits?

YOU can use a benefits calculator to help check that you are not missing out on money you are entitled to

Charity Turn2Us’ benefits calculator works out what you could get.

Entitledto’s free calculator determines whether you qualify for various benefits, tax credit and Universal Credit.

MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto’s data.

You can use Policy in Practice’s calculator to determine which benefits you could receive and how much cash you’ll have left over each month after paying for housing costs.

Your exact entitlement will only be clear when you make a claim, but calculators can indicate what you might be eligible for.

Child benefit

- You could be missing out on £1,970 a year

One in ten of those entitled to child benefit do not claim, meaning the parents of 838,000 kids may be missing out.

Child benefit is worth up to £1,331 a year for your first or only child and up to £881 a year for additional children.

This works out at £102.40 every four weeks or £25.60 a week for your first child and £67.80 every four weeks or £16.95 a week for their siblings.

There is no limit on the number of children that can be claimed for.

Applying is straightforward and can be done in minutes at gov.uk or through the HMRC app.

Pension credit

- You could be missing out on £1,900 a year

The latest Department for Work and Pension (DWP) statistics reveal that up to 760,000 families entitled to pension credit did not claim it during the financial year ending in 2023.

Pension credit, a means-tested benefit designed to top up the income of the poorest pensioners, is becoming increasingly important as it is now linked to other crucial support.

In particular, those claiming pension credit are eligible for the winter fuel payment, which has become more restrictive following recent government changes.

The benefit goes to those who’ve reached state pension age, which is currently 66, whose weekly income is less than £201.05 if you’re single, or £306.85 for couples.

Those who have a higher income may still be eligible if they have a higher income but have others costs like housing, a disability, or even savings.

Claiming pension credit can also unlock extra help, including, a free TV licence if you’re over 75, help with council tax and support with household costs such as ground rent.

Claiming pension credit

TO qualify for pension credit, you need to be over state pension age and live in England, Scotland or Wales.

If you have a partner, you need to include them on your claim.

Pension Credit tops up:

- your weekly income to £218.15 if you’re single

- your joint weekly income to £332.95 if you have a partner

However, even if your income is higher, you might still qualify if you have a disability or caring responsibilities.

There is also another element to Pension Credit called savings credit. To get this, you need to have saved some money towards your retirement.

You can get an extra £17.01 a week for a single person or £19.04 a week for a married couple.

If you have more than £10,000 in savings, the government uses a calculation to work out how much it adds to your income.

Every £500 over £10,000 counts as £1 income a week. For example, if you have £11,000 in savings, this counts as £2 income a week.

Council Tax Support

- You could be missing out on £1,513 a year

Almost 2.3million people miss out on £3.4billion of Council Tax Support.

The unclaimed amount includes almost a £1million in pension age council tax support. The rest is for those of working age.

The average claim for working age council tax support is £1,464, while the support for pensioners is worth an average of £1,670.

Given out by local councils, claiming can be a postcode lottery, depending where you live, your income, dependents and other benefits.

Scotland and Wales have their own national schemes, but in England the amount differs by local authority.

To find out what’s on offer in your area, visit gov.uk/find-local-council.

Healthy Start vouchers

- You could be missing out on £726 during pregnancy and early years

New parents can claim an average of £726 of Healthy Start support during pregnancy and early years, with £132million going unclaimed.

Overall, 180,000 people are missing out.

Healthy Start food vouchers are for parents who are pregnant or have a child under four years old.

The vouchers are worth £4.25 a week, or £221 a year.

But those with a child under the age of one get two vouchers, worth £8.50 a week, which adds up to £442 a year.

Warm Home Discount

- You could be missing out on £150 a year

Half of people entitled to the Warm Home Discount are not claiming, meaning up to 2.5million are missing out on £150 a year.

This is largely due to eligible people not claiming pension credit as the “gateway” benefit.

The support is a one-off deduction off your electricity bill made between October and March each year.

The money isn’t paid to you, but is applied as credit on your bill.

It’s automatic in the vast majority of cases, but due to the way the scheme operates, certain households have to apply for the rebate.

Free school meals

- You could be missing out on £490 a year

More than 471,000 families may be going without £490 worth of free school meals, with £231million going unclaimed.

This could be due to not claiming Universal Credit.

Eligibility criteria for free school meals varies depending on where you live.

Currently, all children from reception to year two qualify for free school meals in England.

In Scotland, all students between reception and year five can get help regardless of their parent’s income.

In Wales, pupils in reception get free school meals.

Whether you are eligible for free school meals after that depends on whether you get certain benefits and your income.

Contact your child’s school or local council for more information.

Social tariffs for water and broadband

- You could be missing out on £360 a year

Social tariffs help lower-income households pay for essential water or broadband costs.

But more than nine in ten families entitled to help with their broadband costs aren’t claiming it.

Almost £1.7billion of the broadband support available isn’t claimed, with 95% of households – more than 8.4million – who may be eligible missing out on an average of £200 a year.

For water bills, only one in five households take advantage of the support available, with families missing out on an average claim of £160 a year.

People on means-tested benefits, or anyone struggling to pay their bills, should check with their water company or telecoms firm.

Funds may also be available through energy companies to help with bills.

TV licence

- You could be missing out on £170 a year

Of those eligible to claim a free TV licence – mainly people over 75 claiming pension credit – only one in four do so.

The remaining six in ten – up to 1.5million – miss out on a saving of £170 a year.

You can apply for your free licence online or by calling 0300 790 6117.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

How product providers should offer advice

Reading about M&G’s troubles, I can’t help putting them down to the obsession with running an expensive fund platform. But what do I know?

What I do know about is 21st century advice – something I believe is built on the shoulders of giants, such as the Man from the Pru.

These advisers door-knocked, cold called and worked evenings to get families started on a lifetime of saving and self-preservation.

So, why is offering advice so hard these days?

It’s a real shame such a historical institution as M&G cannot remain committed to solving the challenges of advice regulation while making a profit.

It’s a real shame such a historical institution as M&G cannot remain committed to solving the challenges of advice regulation while making a profit

There remains a huge advice gap opportunity for any company who can de-mystify the world of investment and help the man in the street access the wonder of compound interest, just like they used to.

Providing advice seems to terrify those around the board table. Is it impatience from shareholders, short termism on the part of directors or just fear of liability? Probably all three.

I have previously voiced support for a simplified advice regime which could be a gateway to the markets for low value investors taking advice.

To those providers pondering on leaving or entering the advice market, here are my suggestions for making it work:

- Reduce the hurdle of cash savings: Three months spending in cash can take five to seven years for people to save and it is not mandatory as emergency provision. This restriction serves the anxiety of compliance staff more than it serves the interest of investors, and it can be done better.

- Know the outcomes of what you are offering: Charges need to be competitive, and easily justified. Funds need to be liquid, transparent and dependable in their expected returns. Projections need to be realistic and not woefully cautious.

- Think about the liabilities: How will they arise? How is the compensation calculated? Which investors complain? What triggers the complaint? By looking at this in full detail, you can inform the quality of your messaging and have more investors with confidence.

- Get the box tickers out from their desks: Give them sales training, teach them to advise, make them talk to clients.

- Focus on service: Of £198,798 complaints to the Financial Ombudsman Service in 2023/24, £1,459 (0.7%) of them were against advisers. Why fixate so much on the nuances of suitability? With a simple and reliable product proposition, 90% of advice can be algorithmic – making it both efficient and profitable.

- Know your target market and sell to them: Financial services have been a huge contributor to prosperity in the UK. We should believe in the benefit of what we do.

The regulation of financial services in the UK has been a been a huge success in improving the rights and security of consumers. But it is nothing to fear. Our faith in delivering advice to all must endure alongside the products and the markets that will deliver for investors.

Greg Neall is chartered financial planner at Wake Up Your Wealth

Money

State pension warning as hundreds of thousands ‘edge closer’ to having money knocked off payments

HUNDREDS of thousands of retirees are set to pay tax on their state pension for the first time next year.

This is due to a combination of hefty state pension rises and frozen tax thresholds.

It is expected that more than 300,000 pensioners will be told that they need to pay tax when the state pension rises by £473 in 2025.

The figures released this week have confirmed that the state pension is now expected to rise from £11,502.40 to £11,975 per year under the triple lock.

With tax thresholds frozen until 2028, this increase will drag even more pensioners into paying tax for the first time, it has been warned.

This is because the total annual amount of income they receive will be more than their personal allowance.

The allowance is the amount of money you can earn before you have to pay tax on your income.

Under the current rules, this is up to £12,570 each tax year.

It was previously expected that around 140,000 pensioners would receive a letter for the first time this year.

But because of the proposed increase in the state pension, more than 300,0000 people are now likely to get one.

Alice Haine of Bestinvest said: “Add in frozen tax thresholds, with the full new state pension gaining ground on the standard personal allowance of £12,570 and pensioners are edging closer to the point at which their state pension income becomes liable for tax.

“Retirees already receiving a higher state pension may already be paying tax on the benefit, while those receiving a private pension income will see more of that swallowed up by tax.”

Helen Morrissey, head of retirement analysis, Hargreaves Lansdown also pointed out that while rising state pensions are good news, the tax threat is “a hidden sting in the tail”.

She said: “While the full new state pension is currently set at £11,502 and is set to get close to £12,000 from next April it’s conceivable that in the next two years we could see it breach the £12,570 threshold and see pensioners landed with a tax bill.

“It’s also worth saying that many pensioners on the basic state pension system receive more than this as they get a top-up to their income in the form of the state second pension so receive a tax bill even if they have no other income.”

Many pensioners have other pensions – personal or workplace – and HMRC will usually take the income tax due through these pensions, Helen pointed out.

She said: “Those pensioners wholly reliant on the state pension who face paying tax will receive a simple assessment letter from HMRC telling them how much they owe.

“There have been concerns about pensioners being chased for small amounts of tax though HMRC has said they would not look to chase tax amounts that would cost more to collect than is actually owed.”

Why is this happening and is there anything I can do to avoid it?

High inflation rates mean more people in work are getting pay rises to try and keep pace with rising prices.

However, with income tax bands frozen, it means many are being pushed into the next tax bracket.

Laura Suter, director of personal finance at AJ Bell, previously told The Sun: “Pensioners looking to reduce their tax bill need to think about how they can maximise their tax-free income.

“For example, any withdrawals made from their ISAs will be free of any tax. so they can use that pot of money to boost their income without impacting their tax bill.”

An ISA is a type of savings account in which you can save up to £20,00 a year tax-free.

Laura also suggested that couples can organise their finances so they ensure they are each making use of their tax-free allowances, which might involve moving money or assets between themselves.

Helen also added that pensioners might want to use some of their pension to top up their income.

She said: “Most people can access 25% of their pension as a tax-free lump sum so they may decide to use this to top up their income without pushing up their tax bill.”

However, she also warned that pensioners below the personal allowance are going to find it increasingly difficult to avoid paying income tax in the coming years.

The finance expert added: “A full new state pension hits just over £11,500 per year and even relatively modest 3.5% annual increases would see people pushed over the threshold by the time the threshold freeze ends.”

How does the state pension work?

AT the moment the current state pension is paid to both men and women from age 66 – but it’s due to rise to 67 by 2028 and 68 by 2046.

The state pension is a recurring payment from the government most Brits start getting when they reach State Pension age.

But not everyone gets the same amount, and you are awarded depending on your National Insurance record.

For most pensioners, it forms only part of their retirement income, as they could have other pots from a workplace pension, earning and savings.

The new state pension is based on people’s National Insurance records.

Workers must have 35 qualifying years of National Insurance to get the maximum amount of the new state pension.

You earn National Insurance qualifying years through work, or by getting credits, for instance when you are looking after children and claiming child benefit.

If you have gaps, you can top up your record by paying in voluntary National Insurance contributions.

To get the old, full basic state pension, you will need 30 years of contributions or credits.

You will need at least 10 years on your NI record to get any state pension.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Kennedy Wilson appoints Harris to oversee industrial and logistics investment

He joins from Paloma Capital, where he deployed capital from value-added funds and its UK industrial joint venture.

The post Kennedy Wilson appoints Harris to oversee industrial and logistics investment appeared first on Property Week.

Money

Britons Boost Pension Withdrawals Before Upcoming Budget

Britons Increasing Pension Withdrawals Ahead of Budget Announcement

As the budget announcement on October 30 approaches, Britons are withdrawing more money from their pensions, according to insights from an investment platform. Michael Summersgill, CEO of AJ Bell, highlights that many savers are opting to increase their tax-free cash withdrawals. Currently, individuals can withdraw 25% of their pension, with a maximum limit of £268,275. While there’s no definitive evidence suggesting a reduction in this percentage, left-leaning think tanks have advised the government that the 25% rule mainly benefits wealthier individuals.

Understanding Pension Withdrawals

Summersgill stated, “Pensions serve as the main savings tool for retirement in the UK, and it’s natural for customers to be concerned about any potential tax changes. With the heightened media focus leading up to the budget, we’ve observed a significant shift in both pension contributions and tax-free withdrawals.”

Conversely, Ross Lacey, a director and chartered financial planner at Fairview Financial Management, advises clients against making hasty decisions. “Given the increasing emphasis on self-funding retirement and the existing challenges pensions face in terms of public perception, it would be unwise to implement changes that could make pensions less appealing,” he noted. It’s worth mentioning that immediate tax changes are not uncommon but are still unexpected.

Should You Increase Your Pension Contributions Before the Autumn Budget?

With the Autumn Budget approaching, many are pondering whether to increase their pension contributions. There are speculations that higher- and additional-rate taxpayers might receive a reduced rate of tax relief on their pension contributions. However, specific details and implementation dates will only be revealed during the Budget.

While it’s generally wise to avoid hasty decisions, if you’re already considering boosting your pension and fall into a higher or additional-rate tax bracket, now might be the time to strategize for maximizing your contributions.

Potential Changes to Tax Relief

Currently, contributions to personal pensions receive tax relief based on the highest income tax rate. For instance, a contribution of £80 to a personal pension automatically includes an extra £20 in basic-rate (20%) tax relief. Higher-rate (40%) and additional-rate (45%) taxpayers can reclaim additional amounts through their self-assessment tax return.

However, rumors suggest the Chancellor may consider a flat rate of tax relief between 20% and 30% for all individuals. This change would aim for more equitable benefits across income levels but would result in lower advantages for those currently receiving higher rates of tax relief.

Related: More young home owners gamble their retirement with mortgages lasting past state pension age

Maximizing Your Pension Benefits

If the proposed changes are implemented, higher- and additional-rate taxpayers may miss out on certain tax perks. Nevertheless, most UK taxpayers will still benefit significantly. If you’re in a higher tax bracket, it may be wise to consider advancing your pension contributions before any potential changes take effect. This strategy allows you to maximize the higher relief rates currently available.

For those in workplace pension schemes, consulting with your employer about increasing contributions can also be beneficial. Many employers match contributions, significantly enhancing pension savings over time.

As of now, tax relief on pension contributions is available up to 100% of your gross relevant earnings, with a cap of £60,000 for the 2024-25 tax year. This cap, known as the ‘annual allowance,’ includes both your contributions and those from your employer before tax. Note that the annual allowance may be reduced if you have a high income or have accessed your pension pot flexibly.

Considerations Before Boosting Your Pension

While increasing your pension may seem like a prudent choice, it’s not suitable for everyone. First, assess whether you can comfortably afford to increase your contributions. Remember that you won’t be able to access these funds until at least age 55, rising to age 57 in April 2028. If you anticipate needing access to your funds before retirement, consider an Individual Savings Account (ISA) instead. Although ISAs don’t offer tax relief on contributions, you can withdraw your money whenever without incurring tax penalties.

For the 2024-25 tax year, you can contribute up to £20,000 to ISAs. Increasing your ISA contributions might also be timely, as there are rumors of a potential lifetime cap on ISA savings that could be introduced in the Autumn Budget or by a future government.

Diversifying investments across various accounts, including ISAs and pensions, can help mitigate risks associated with changes in tax laws or personal circumstances. Regularly managing contributions and withdrawals from different accounts can enhance tax efficiency, ultimately reducing your overall investment costs.

Conclusion

Regularly reviewing your monthly savings and ensuring you’re investing tax-efficiently is crucial as you work toward your retirement goals. By maintaining a long-term perspective and considering your financial objectives, you can set yourself up for a brighter financial future.

Please note that the tax rates and allowances mentioned in this article are based on information as of September 2024.

Money

A £2 B&M find can help keep homes warm without putting heating on and keep energy bills low

AS THE nights draw in many of us could benefit from insulating our homes to keep draughts out.

One way to do so is to install B&M’s Bubble Wrap, which can help your home feel warmer while saving you money on your energy bill.

It costs just £2 and can help to protect your home from cold gusts of air which can enter through cracks or gaps around your windows.

The bubble wrap has a diameter of 500mm by 5m, which is enough to insulate several windows.

The air pockets in the surface create a barrier which traps heat inside and keeps the cold out of your home.

Plus by stopping cold air from entering your house you could also save precious pounds off your energy bill.

Read more on energy bills

Draught-proofing is one of the cheapest and most effective methods to save money, irrespective of what type of building you live in.

Reducing draughts around windows and doors could save you around £40 a year if you live in Great Britain, or £50 in Northern Ireland, according to the Energy Saving Trust.

Draught-free homes may also be more comfortable at lower temperatures, which could mean that you are able to turn down your thermostat.

Doing so could save you even more money on your energy bills.

To the bubble wrap to insulate your home, simply measure your windows and cut the bubble wrap to fit.

Next lightly spray your windows with water, which acts as an adhesive and allows the bubble wrap to stick directly to the glass.

Place the bubble wrap onto the window with the bubble-side facing into your home and gently press it to secure it in place.

If your home is particularly draughty then you can also double up the bubble wrap for extra insulation.

Bubble wrap is also easy to remove in the warmer months and doesn’t damage your windows as it is not permanent.

Make sure to seal draughty doors and windows with insulation tape to stop draughts getting in.

5 ways to keep your house warm in winter

Property expert Joshua Houston shared his tips.

1. Curtains

“Windows are a common place for the outside cold to get into your home, this is because of small gaps that can let in air so always close your curtains as soon as it gets dark,” he said.

This simple method gives you an extra layer of warmth as it can provide a kind of “insulation” between your window and curtain.

2. Rugs

“Your floor is another area of your home where heat can be lost and can make your home feel chilly,” he continued. “You might notice on cold days, that your floor is not nice to walk on due to it freezing your feet.

“Add rugs to areas that don’t already have a carpet, this provides a layer of insulation between your bare floor and the room above.”

3. Check your insulation

Check your pipes, loft space, crawlspaces and underneath floorboards.

“Loose-fill insulation is very good for this, and is a more affordable type of insulation, with a big bag being able to be picked up for around £30,” Joshua explained.

4. Keep your internal doors closed

“Household members often gather in one room in the evening, and this is usually either the kitchen or living room,” Joshua said.

“This means you only have to heat a small area of your home, and closing the doors keeps the heat in and the cold out.”

5. Block drafts

Don’t forget to check cat flaps, chimneys and letterboxes, as they can let in cold air if they aren’t secure.

Before you install the bubble wrap make sure to shop around to get the best deal.

Sainsbury’s is selling 8 metre large rolls of bubble wrap for £4.25.

Meanwhile, The Works has a 5m x 300mm roll for £1.

Always check the length and width of the roll before you make a purchase to ensure that you are getting a good deal.

Never draught proof areas of your home that need good ventilation such as rooms where lots of moisture is produced such as the bathroom, utility rooms or kitchen.

Also avoid blocking up areas where there are open fires or open flues.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

The Morning Briefing: AJ Bell and SJP publish results; CGT rise top of advisers’ minds

Good morning and welcome to your Morning Briefing for Thursday 17 October 2024. To get this in your inbox every morning click here.

AJ Bell platform business grows

AJ Bell’s platform business has continued to grow, with customer numbers increasing by 66,000 to 542,000.

This represents an increase of 14% in the past year.

AJ Bell CEO Michael Summersgill said its dual-channel platform, which serves both the advised and D2C platform markets, has maximised the growth opportunity.

SJP records quarterly net inflows of £890m

St James’s Place (SJP) recorded net inflows of £890m in the past quarter.

These sustained inflows, together with “positive investment performance”, have resulted in record funds under management of £184.4bn as of 30 September.

The UK’s largest wealth manager also recorded gross inflows of £4.4bn in the third quarter, 20% higher compared to the same period last year.

CGT rise top of advisers’ minds

An increase in capital gains tax (CGT) is top of mind for advisers, the majority of whom think it is one of the most likely announcements in the upcoming Budget, research by Royal London has revealed.

In a survey, the life, pensions and investment mutual asked advisers their thoughts on the most talked about Budget in recent years.

Overall, 78% said they believe CGT changes are the most likely outcome.

Quote Of The Day

The US presidential elections on November 5 will have implications for China. Both Democrats and Republicans recognise the importance of reducing the trade deficit with China and reducing reliance on Chinese imports.

– Christopher Mey, head of emerging market credit at Candriam, comments on China’s economic outlook in the context of the US election and the potential threats

Stat Attack

ETFGI has reported assets invested in the ETFs industry in the US reached a new record high at the end of September.

$10trn

The amount of assets invested in the ETFs industry in the US at the end of September.

$9.74trn

This beat the previous record of $9.74trn at the end of August 2024.

23.2%

The amount by which assets have increased year-to-date in 2024.

$8.11trn

The amount they stood at at the end of 2023.

$97.29bn

Net inflows recorded in September 2024.

$740.81bn

YTD net inflows – the highest on record.

Source: ETFGI

In Other News

Royal London has appointed Iain McLeod as director of investment proposition.

Reporting to chief commercial officer Julie Scott and heading up the Investment Proposition team, McLeod joins to lead the development of investment solutions for advisers across individual and workplace pensions, working closely with Royal London Asset Management.

He joins from M&G Wealth as head of investment proposition, following over 35 years at Abrdn and Standard Life in a variety of investment, saving and proposition roles.

His experience includes working closely with the UK adviser community to develop and deliver client-centric investment solutions.

The Chartered Institute for Securities & Investment (CISI) has announced the winners of its Financial Planning Awards 2024.

- Certified Financial Planner Professional of the Year Award

WINNER: Nicholas Grogan, PWS Financial Consulting

- Paraplanner of the Year Award, sponsored by The Association of Investment Companies

WINNER: Brad Sheridan, BRI Wealth Management

- CISI Accredited Financial Planning Firm™ of the Year Award, sponsored by Glascow Consulting

WINNER: Acumen Financial Planning

- Tony Sellon ‘Good Egg’ Award Memorial Prize

WINNER: Barry Horner, Paradigm Norton Financial Planning

- The Paul Etheridge Financial Planning Future Leader Award, sponsored by Lexington Wealth Management

WINNER: Emmelia Powell, Premier Wealth Solutions

CISI head of financial planning policy and engagement Chris Morris said: “Congratulations to all of our winners.

“These awards recognise both individual and firm excellence along with those who have made an outstanding contribution to the financial planning profession.”

Millionaire business owners urge Rachel Reeves to raise £14bn from rise in capital gains tax (Guardian)

Jamie Dimon charts JPMorgan expansion plan into Africa (Reuters)

European shares little changed ahead of expected ECB rates cut (Bloomberg)

Did You See?

Last week you joined us in London for Money Marketing Interactive London and what a day it was.

A huge thank you to all our incredible delegates. Your energy and participation made this year’s conference unforgettable.

We’re excited to see how you’ll take the knowledge shared and continue shaping the future of financial advice.

You can view a range of photos from the event here.

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment4 weeks ago

Science & Environment4 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology3 weeks ago

Technology3 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to wrap your mind around the real multiverse

-

News1 month ago

the pick of new debut fiction

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLaser helps turn an electron into a coil of mass and charge

-

News4 weeks ago

News4 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists are grappling with their own reproducibility crisis

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology3 weeks ago

Technology3 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

News4 weeks ago

News4 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News4 weeks ago

News4 weeks agoYou’re a Hypocrite, And So Am I

-

Business3 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Sport4 weeks ago

Sport4 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Technology2 weeks ago

Technology2 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News1 month ago

News1 month agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoRethinking space and time could let us do away with dark matter

-

Technology3 weeks ago

Technology3 weeks agoQuantum computers may work better when they ignore causality

-

Sport3 weeks ago

Sport3 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Business2 weeks ago

Business2 weeks agoWhen to tip and when not to tip

-

Technology2 weeks ago

Technology2 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Sport2 weeks ago

Sport2 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists have worked out how to melt any material

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

News4 weeks ago

The Project Censored Newsletter – May 2024

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Business3 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

MMA3 weeks ago

MMA3 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Football3 weeks ago

Football3 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Technology3 weeks ago

Technology3 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Technology3 weeks ago

Technology3 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Sport2 weeks ago

Sport2 weeks agoWales fall to second loss of WXV against Italy

-

Technology2 weeks ago

Technology2 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Business2 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Technology2 weeks ago

Technology2 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

News2 weeks ago

News2 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Politics3 weeks ago

Robert Jenrick vows to cut aid to countries that do not take back refused asylum seekers | Robert Jenrick

-

News4 weeks ago

News4 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Sport4 weeks ago

Sport4 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoBeing in two places at once could make a quantum battery charge faster

-

Technology4 weeks ago

Technology4 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoCardano founder to meet Argentina president Javier Milei

-

Politics4 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

TV4 weeks ago

TV4 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News4 weeks ago

News4 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Toning Workout for Women

-

Technology3 weeks ago

Technology3 weeks agoGet ready for Meta Connect

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Business2 weeks ago

Ukraine faces its darkest hour

-

Business2 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Entertainment2 weeks ago

Entertainment2 weeks agoChristopher Ciccone, artist and Madonna’s younger brother, dies at 63

-

Sport2 weeks ago

Sport2 weeks agoLauren Keen-Hawkins: Injured amateur jockey continues progress from serious head injury

-

TV2 weeks ago

TV2 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News1 month ago

News1 month agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

Business4 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics4 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMeet the world's first female male model | 7.30

-

News4 weeks ago

News4 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Servers computers3 weeks ago

Servers computers3 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Politics4 weeks ago

Politics4 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoThe maps that could hold the secret to curing cancer

-

Business4 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMost accurate clock ever can tick for 40 billion years without error

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoBlockdaemon mulls 2026 IPO: Report

-

MMA4 weeks ago

MMA4 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks agoEverything a Beginner Needs to Know About Squatting

-

Travel3 weeks ago

Travel3 weeks agoDelta signs codeshare agreement with SAS

-

News3 weeks ago

News3 weeks agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology3 weeks ago

Technology3 weeks agoArtificial flavours released by cooking aim to improve lab-grown meat

-

Sport2 weeks ago

Sport2 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Business2 weeks ago

Business2 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

You must be logged in to post a comment Login