Money

How thousands of unpaid carers can unlock winter fuel payments and extra £2,370 a year

THOUSANDS of unpaid carers can unlock winter fuel payments, as well as £2,370.

People over the state pension age and who are on a low income can grab the benefits through Pension Credit.

The benefit will also entitle carers to the winter fuel payment this year, worth £300 – as well as the top-up “carer addition”.

Charity Carers UK is encouraging pensioners to check their eligibility, as they could receive up to an extra £2,370 a year as well as housing benefit and council tax support.

Pension Credit is a weekly payment from the government to those over the state pension age who have an income below a certain level.

Unpaid carers may be eligible for a higher minimum amount because the carer addition is factored into the Pension Credit calculation.

But in order to get the carer top-up to Pension Credit, carers must first apply for a Carer’s Allowance.

To claim this benefit, they must be spending at least 35 hours a week caring for someone with an illness or disability receiving a disability benefit such as Attendance Allowance or Personal Independence Payment (PIP) at the right levels.

It’s important to note that current benefit rules state that if someone’s State Pension is more than Carer’s Allowance, they cannot get the benefit.

But, carers still need to apply for Carer’s Allowance to get the addition so they can prove they have an “underlying entitlement”.

This would increase their chances of being eligible for Pension Credit and would increase the award.

Rule changes announced in July mean that only pensioners who claim Pension Credit or certain other benefits will receive the £300 Winter Fuel Payment this year.

Carers UK says it is concerned that pensioners who are unpaid carers and on low incomes will struggle this winter if they don’t get the benefit.

It says that carers often face high social care costs and extra costs, like for travel when accompanying the person they care for to appointments.

The charity’s research shows that 20% of carers aged 65 and over live in poverty, compared to 13% of non-carers.

Just 100,000 unpaid carers who are pensioners get Pension Credit and the Carer Addition, it found.

Carers UK is concerned that there could be many more who could be missing out.

There’s no exact figure for just how many carers are missing out but with half a million missing out on Carer’s allowance and 880,000 on Pension Credit – according to the latest data – we can assume it’s likely thousands of carers.

Emily Holzhausen CBE, director of policy and public affairs, at Carers UK, said: “There’s no time to lose to make sure that carers apply for Pension Credit when we know that so many are struggling in poverty in retirement. With the winter coming, and fuel prices still high, they need every penny they can get.

“For pensioners who are unpaid carers, understanding your entitlements is complicated. We’re worried that many more carers will be missing out, but we just don’t know how many.”

She went on to urge pensioners who are carers to apply for Carer’s Allowance.

While they are very likely to be told it won’t be paid, it is the first step to getting Pension Credit and Carer Addition.

Ms Holzhausen added: “This shines a light on the urgent need for reform of the system when applying for benefits. We’ve seen the devastating impact of Carer’s Allowance overpayments due to poor systems for working-age carers.

“The mind-boggling complexity of benefits for older carers prevents them from getting the help they are entitled to and could be drastically simplified by Government.”

What is the Winter Fuel Payment?

Consumer reporter Sam Walker explains all you need to know about the payment.

The Winter Fuel Payment is an annual tax-free benefit designed to help cover the cost of heating through the colder months.

Most who are eligible receive the payment automatically.

Those who qualify are usually told via a letter sent in October or November each year.

If you do meet the criteria but don’t automatically get the Winter Fuel Payment, you will have to apply on the government’s website.

You’ll qualify for a Winter Fuel Payment this winter if:

- you were born on or before September 23, 1958

- you lived in the UK for at least one day during the week of September 16 to 22, 2024, known as the “qualifying week”

- you receive Pension Credit, Universal Credit, ESA, JSA, Income Support, Child Tax Credit or Working Tax Credit

If you did not live in the UK during the qualifying week, you might still get the payment if both the following apply:

- you live in Switzerland or a EEA country

- you have a “genuine and sufficient” link with the UK social security system, such as having lived or worked in the UK and having a family in the UK

But there are exclusions – you can’t get the payment if you live in Cyprus, France, Gibraltar, Greece, Malta, Portugal or Spain.

This is because the average winter temperature is higher than the warmest region of the UK.

You will also not qualify if you:

- are in hospital getting free treatment for more than a year

- need permission to enter the UK and your granted leave states that you can not claim public funds

- were in prison for the whole “qualifying week”

- lived in a care home for the whole time between 26 June to 24 September 2023, and got Pension Credit, Income Support, income-based Jobseeker’s Allowance or income-related Employment and Support Allowance

Payments are usually made between November and December, with some made up until the end of January the following year.

What is pension credit and who is eligible?

Pension credit is a government benefit designed to top up your weekly income if you are a state pensioner with low earnings.

The current state pension age is 66.

There are two parts to the benefit – Guarantee Credit and Savings Credit.

Guarantee credit tops up your weekly income to £218.15 if you are single or your joint weekly income to £332.95 if you have a partner.

Savings credit is extra money you get if you have some savings or your income is above the basic full state pension amount – £169.50.

Savings credit is only available to people who reached state pension age before April 6, 2016.

Usually, you only qualify for pension credit if your income is below the £218.15 or £332.95 thresholds.

However, you can sometimes be eligible for savings credit or guarantee credit depending on your circumstances.

For example, if you are suffering from a severe disability and claiming Attendance Allowance, as well as other benefits, you can get an extra £81.50 a week.

Meanwhile, you can get either £66.29 a week or £76.79 a week for each child you’re responsible and caring for.

The rules behind who qualifies for pension credit can be complicated, so the best thing to do is just check.

You can do this by using the Government’s pension credit calculator on its website.

Or, you can call the Pension Service helpline on 0800 99 1234 from 8am to 5pm Monday to Friday.

Those in Northern Ireland have to call the Pension Centre on 0808 100 6165 from 9am to 4pm Monday to Friday.

It might be worth a visit to your local Citizens Advice branch too – its staff should be able to offer you help for free.

One additional and major perk of pension credit is that it is known as a “gateway” benefit in that it opens up a host of other freebies and perks.

This includes a free TV licence worth £169.50 a year if you are 75 or over and council tax discounts.

And of course, if you are on the guarantee credit part of pension credit, you also qualify for the Warm Home Discount.

What is Carer’s Allowance and who is eligible?

To be eligible for carers allowance you must be aged 16 or over and not be in full time education.

You also must not be earning over £151 a week from employment or self-employment after tax deductions.

Carers will also not be paid more if they look after more than one person.

If you qualify for the benefit you can choose to be paid weekly in advance or every 4 weeks.

You can apply for the carer’s allowance online by visiting www.gov.uk/carers-allowance/how-to-claim.

You can also request a form by calling the Carer’s Allowance Unit on 0800 731 0297.

Processing time usually takes up to 12 weeks to get a decision on your claim.

Carer’s Allowance can be backdated for up to 3 months if you were eligible during that time.

If your state pension is less than the Carer’s Allowance amount of £81.90, you can claim Carer’s Allowance to top it up to that level.

But if your state pension is more than £81.90, you won’t receive any of the benefit.

This is because the State Pension and Carers Allowance are classed as ‘overlapping’ benefits, which can’t be paid at the same time.

If the government recognises that you are struggling financially as a carer on a pension you can get extra money on other benefits you claim such as Housing Benefit.

Are you missing out on benefits?

YOU can use a benefits calculator to help check that you are not missing out on money you are entitled to

Charity Turn2Us’ benefits calculator works out what you could get.

Entitledto’s free calculator determines whether you qualify for various benefits, tax credit and Universal Credit.

MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto’s data.

You can use Policy in Practice’s calculator to determine which benefits you could receive and how much cash you’ll have left over each month after paying for housing costs.

Your exact entitlement will only be clear when you make a claim, but calculators can indicate what you might be eligible for.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

£2m luxury Devon home with heated pool could be yours in new Omaze House Draw

A STUNNING 3-bedroom coastal home in Devon worth over £2 million could be yours in the Omaze Million Pound House Draw.

One lucky winner will get the keys to this beautiful contemporary home – you can purchase entries from as little as £10.

Devon Omaze Million Pound House Draw

This two-tiered West Country residence comes complete with countryside views, a guest annexe and a heated pool.

In addition to the property itself, the Omaze winner will receive £250,000 in cash to help them settle in.

Along with the prize comes huge financial flexibility: the winner has the option to move straight into this gorgeous Devon retreat, rent it out, or even put it back on to the market.

An estimated monthly rental income of £4,000 means that this home could also serve as a seriously lucrative investment.

One of the most attractive aspects of the Million Pound House Draw is that there are no hidden costs.

Not only will you not have to worry about paying stamp duty, but mortgage fees and conveyancing costs are also covered.

The house also comes with all the furnishing included, so you’re completely free to move in without digging into that quarter-million cash prize.

This luxe three-bed and two-bath home is situated in the scenic town of Exmouth, which is 12 miles from Exeter, Devon’s second-largest town.

It strikes the perfect balance between coastal living and quick city access.

Devon Omaze Million Pound House Draw

You’ll get amazing countryside views thanks to the floor-to-ceiling glass that’s in every room, which fills each space with natural light.

The property is also close to Orcombe Point, a UNESCO World Heritage site famous for its dramatic landscape.

Then there’s the annexe, which contains its own kitchen area and boasts stunning views: the perfect place for guests to stay.

Anyone who works from home will also be happy to find a dedicated study space, with Scandinavian-inspired decor and space-saving ladder shelving.

Devon Omaze Million Pound House Draw

What’s more, by entering early, you’ll give yourself a chance to win not one but two luxury cars.

Alongside the dream Devon home and the £250,000 cash prize, early entrants are also in the running to win BOTH a Porsche Cayenne E-Hybrid and a Porsche Boxster S.

The Cayenne is a perfect family four-by-four, while the Boxster is a sleek sports car. The total cost for both cars totals over £170,000.

The Omaze Draw isn’t just about changing one lucky winner’s life, however, it also makes a significant impact on society.

A minimum donation of £1m from the Devon House Draw will be given to Campaign Against Living Miserably (CALM).

CALM’s mission is to help people struggling with life find hope and a reason to stay.

This substantial contribution will help fund CALM’s suicide prevention helpline for six months, allowing the organisation’s staff to answer over 80,000 calls and provide crucial support to those in their time of need.

Terms and conditions: Over 18s and UK residents only. No purchase is necessary. Visit omaze.co.uk for full terms and to enter. House closes 27/10/2024.

Money

Pre-Budget ‘backdrop of fear’ putting advisers under too much pressure

As the 30 October UK Budget approaches, speculation and uncertainty about potential reforms are rampant.

The Labour government, facing significant political and manifesto constraints, appears to be gearing up for major tax policy announcements, despite not running on a tax reform mandate.

The Office for Budget Responsibility has warned UK debt is on an unsustainable path, and chancellor Rachel Reeves has pledged no return to austerity and no changes to major taxes like income tax, National Insurance (NI) and VAT.

This leaves her with little room for manoeuvre in addressing the daunting task of an apparent £22bn ‘fiscal black hole’.

By focusing on the fiscal black hole without a clear roadmap, the government fostered a backdrop of fear ahead of its first Budget

This approach has created a fertile ground for rumours and conjecture, unsettling clients.

By focusing on the fiscal black hole without a clear roadmap, the government inadvertently fostered a backdrop of fear three months ahead of its first Budget.

Stability and predictability are crucial for sound financial decisions, yet the current approach offers neither. The recent dip in UK consumer confidence, highlighted by the latest British Retail Consortium data, reflects this uncertainty, especially among older generations who fear the Budget’s impact.

Confidence among business leaders in September was also at its weakest since December 2022, according to the Institute of Directors’ Economic Confidence Index.

I have written to the chancellor expressing the immense pressure financial advisers are under

This vacuum has led to speculation about potential policy reforms, particularly regarding pensions. Over the past months, theories have ranged from plausible to alarming, affecting those planning for retirement.

I have written to the chancellor expressing the immense pressure financial advisers are under to second guess potential Budget outcomes due to the lack of government communication regarding pension plans, and to ask that any reforms to pension policy are introduced with a clear roadmap, ensuring the public is well-informed and well-prepared for changes.

Advisers tell me they have been inundated with calls from concerned clients, many of whom are at risk of making knee-jerk decisions that could derail their long-term plans.

Advisers have been inundated with calls from concerned clients, many of whom are at risk of making knee-jerk decisions

Who knows what actions might have been taken by those choosing not to take the counsel of an adviser. The current approach seems likely to result in foreseeable harm to retail customers.

So, where might the ‘tax axe’ fall?

Labour seems to have adopted the Tory strategy of freezing income tax thresholds for at least the next three years, which will continue to raise revenue as earnings increase.

Additionally, the government may reassess inheritance tax reliefs, potentially removing, capping or redefining benefits like agricultural property relief and business relief.

This is all very well but think tanks don’t have the experience of implementation

Alarmingly, given pensions have only recently seen major reforms to the lifetime allowance and tax-free cash entitlement, reports from think thanks and research houses are urging HM Treasury to consider restrictions on the 25% tax-free cash lump sum on pensions or changes to pensions tax relief.

This is all very well but think tanks don’t have the experience of implementation and, without consultation and clear communication, such plans could lead to unintended consequences and ill-considered withdrawals.

The government must provide more clarity on long-term pension policy to prevent speculation and poor decisions. Denying access to previously promised benefits would distress savers who have structured their retirement strategies around existing rules.

Advisers, who are on the frontline fielding calls from anxious and confused clients, need clear assurances about long-term policy

There is more recent speculation that the government may remove the NI exemption on employer pension contributions. While this may be more politically acceptable after the backlash over the winter fuel policy, as it does not directly impact consumers, it is not a pro-growth policy.

In time, the move would risk impacting working people due to employers potentially passing on the increased costs by reducing the level of contributions they make on behalf of employees.

Similarly, the benefit of salary sacrifice arrangements used by employees will yield a lower eventual pension contribution impacting what they put away.

The government must balance managing expectations with encouraging business investment, consumer spending and investor confidence

Financial planners, who are on the frontline fielding calls from anxious and confused clients daily, stopping them from making hasty decisions, such as prematurely withdrawing pension funds, need clear assurances about long-term policy direction ahead of fiscal events.

With the UK showing no growth in June or July and waning sentiment, the government must balance managing expectations ahead of 30 October with encouraging business investment, consumer spending and investor confidence.

Steven Levin is chief executive of Quilter

Money

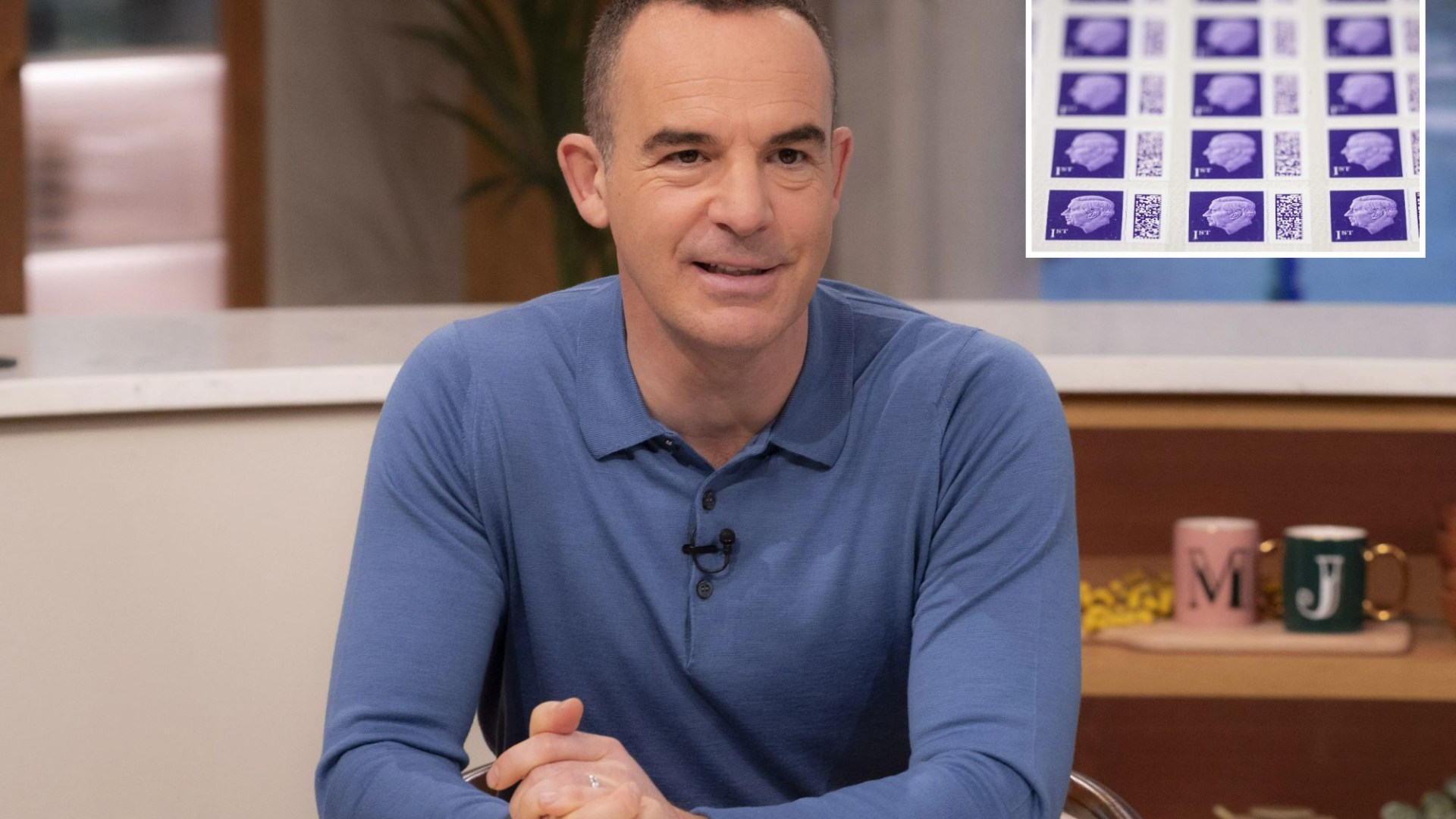

Martin Lewis warns it’s your ‘last chance’ to stock up on stamps before 22% price hike next week

MARTIN Lewis has warned Brits to stock up on first-class stamps before next week’s 22 per cent price hike.

The price of first-class stamps will rise by 30p to £1.65, the second rise in a year, Royal Mail confirmed.

The delivery giant revealed that the price hike will be in effect from Monday 7.

Martin Lewis is urging Brits to bulk-buy first-class stamps in advance as they are “still valid after the hike”.

He said: “For years, every time stamps go up in price I’ve suggested people stock up and bulk-buy in advance, as provided the stamp doesn’t have a price on it and instead just says the postage class, it’s still valid after the hike.

“So you may as well stock up now, even if it’s just for Christmas cards for the next few Christmases.”

The founder of Money Saving Expert has also warned Brits against buying fake stamps when stocking up.

He recommended buying from reputable high street stores and making sure to keep the receipt.

Stamps can also be bought directly from the Royal Mail online shop, but you have to spend £50 to get free delivery.

In April, the UK postal service announced it had paused the £5 penalty for anyone receiving a letter with a fake stamp.

However, you still risk facing charges if caught sending mail with counterfeit stamps.

Royal Mail has introduced a new stamp scanner, available for free via their app, to check if stamps are genuine.

The price increase for first-class stamps is the second one this year after they rose by 10p to £1.35 in April and by 10p to 85p for second class.

The company has frozen the cost of second-class stamps at 85p until 2029 in a bid to keep the sending of letters affordable.

Royal Mail says it has tried to keep price increases as low as possible in the face of declining letter volumes, and inflationary pressures.

When announcing the price rise earlier this month, it also cited the costs associated with maintaining the so-called Universal Service Obligation (USO) under which deliveries have to be made six days a week.

Royal Mail said letter volumes have fallen from 20billion in 2004/5 to around 6.7billion a year in 2023/4, so the average household now receives four letters a week, compared to 14 a decade ago.

The number of addresses Royal Mail must deliver to has risen by 4million in the same period meaning the cost of each delivery continues to rise.

Nick Landon, Royal Mail’s chief commercial officer, said: “When letter volumes have declined by two-thirds since their peak, the cost of delivering each letter inevitably increases.

“The universal service must adapt to reflect changing customer preferences and increasing costs so that we can protect the one-price-goes anywhere service, now and in the future.”

How prices have changed

Royal Mail previously raised the price of first-class stamps from £1.10 to £1.25 last October, before boosting them again in April.

Right now, a first-class stamp costs £1.35, which covers the delivery of letters up to 100g.

Historically, the cost of stamps has seen a steady increase over the years, reflecting inflation and operational costs. For example, in 2000, a First Class stamp was priced at 41p.

A second-class stamp is priced at 85p and also covers letters up to 100g.

The stamps can be bought individually if you buy them at a Post Office counter.

Stamp Price Changes

Royal Mail has announced a price hike by 22 per cent for first-class stamps, with the cost of second-class stamps remaining the same.

First – standard:

Current price – £1.35

Price from Monday 7 – £1.65

Price rise – 30p (+22 per cent)

First – large:

Current price – £2.10

Price from Monday 7 – £2.10

Price rise 50p (+24 per cent)

Second – standard:

Current price: 85p

Price from Monday 7 – 85p

No change

Second – large

Current price: £1.55

Price from Monday 7 – £1.55

No change

Otherwise, you can typically buy them in sets of multiple stamps.

The first class service typically delivers the next working day, including Saturdays, while the second class service usually delivers within 2-3 working days, also including Saturdays.

For larger letters, the cost of a first-class stamp is £2.20 for items up to 100g, and a second-class stamp for the same weight is £1.55.

Parcel delivery prices vary based on size and weight, starting from £3.69 for small parcels.

Additional services include the “signed for” option, which requires a signature upon delivery and adds an extra level of security.

The cost for first class signed for is £3.05, and for second class signed for, it is £2.55.

The “special delivery” service guarantees next-day delivery by 1pm with compensation cover, with prices starting from £7.95.

Royal Mail periodically reviews and adjusts stamp prices, so it is advisable to check the latest rates on their official website or at your local post office.

Other Royal Mail changes

Royal Mail has urged the Government and Ofcom to review its obligations, arguing that it is no longer workable or cost-effective, given the decline in addressed letter post.

In its submission to Ofcom in April, it proposed ditching Saturday deliveries for second-class post and cutting the service to every other weekday.

Lindsey Fussell, Ofcom’s group director for networks and communications, said: “If we decide to propose changes to the universal service next year, we want to make sure we achieve the best outcome for consumers.

“So we’re now looking at whether we can get the universal service back on an even keel in a way that meets people’s needs.

“But this won’t be a free pass for Royal Mail – under any scenario, it must invest in its network, become more efficient and improve its service levels.”

Royal Mail owner International Distribution Services (IDS), which agreed to a £3.57billion takeover by Czech billionaire Daniel Kretinsky in May, said “change cannot come soon enough” to the UK’s postal service.

Royal Mail also ousted old-style stamps and replaced them with barcoded ones last July.

The business said the move would make letters more secure.

Anyone who still has these old-style stamps and uses them may have to pay a surcharge.

How stamp prices have risen over time

The cost of a book of stamps has risen gradually over the past few decades.

First-class stamps were worth 60p in the early 2010s and are now priced at £1.35.

Second-class stamps were also worth 50p in the early 2010s but now sell for 85p.

First-class stamps cost 95p at one point in 2023, before being hiked to £1.10 last April. They were then raised by 15p to £1.25 last October.

The latest hike on first-class stamps to £1.65 in October means they will have risen by a staggering 43% since just last year.

Money

Wilson to step down as Picton chair

After four years in the role at Picton, Wilson will become chair of FirstGroup at the start of February.

The post Wilson to step down as Picton chair appeared first on Property Week.

Money

Best Budgeting Apps for Families in 2024

Best Budgeting Apps for Families in 2024

Managing family finances can be overwhelming with all the daily expenses, savings goals, and unexpected costs that come with raising children. Whether it’s keeping track of grocery bills, school fees, or saving for a family vacation, it’s essential to have a clear and organized system. That’s where budgeting apps can come in handy. These tools offer an easy way to manage household expenses, plan for long-term goals, and ensure everyone in the family is aligned financially.

Why Families Need Budgeting Apps

Budgeting is a key tool for any household and when there are children involved this tool can become even more helpful. With multiple expenses, income streams and the need to plan for the future, keeping your finances in check can become challenging.

Budgeting apps are there to help you;

- Track Shared Expenses: From groceries to utilities, a budgeting app allows families to monitor how much they’re spending and on what.

- Plan for Long-Term Goals: Whether it’s saving for your child’s education, a family vacation, or a new home, apps make it easier to set savings targets and see progress.

- Manage Daily Costs: Families can stay on top of routine expenses like transportation, food, and healthcare while preparing for unexpected costs.

By using a budgeting app, families can collaborate, manage expenses in real-time, and build better financial habits together. Let’s explore some of the top budgeting apps that are perfect for families.

Best Budgeting Apps for Families in 2024

1. You Need A Budget (YNAB)

You Need A Budget (YNAB) is known for its focus on giving every dollar a job. This app allows families to assign money to specific categories like bills, groceries, and savings. Its real-time syncing feature ensures that every family member is on the same page, no matter who is making the purchases.

YNAB encourages correcting prioritizing and is especially useful for families who are trying to pay off debt or build their savings. You can set targets for anything you like and track your progress over time.

YNAB also has educational resources and debt management tools integrated within the app making it easy for families to improve their finances.

2. EveryDollar

EveryDollar follows a zero-based budgeting system, meaning every dollar of income has a purpose. The app is simple and user-friendly, making it a great choice for busy families who want an easy way to manage their finances without complicated features.

EveryDollar allows families to plan for monthly expenses, track spending, and adjust budgets as needed. The free version offers basic budgeting features, while the paid version, EveryDollar Plus, offers automated bank transactions and other premium features.

Use EveryDollar to ensure every penny is accounted for, making it easier to cover all expenses and save for future goals. Its simplicity is ideal for families new to budgeting.

3. Honeydue

Honeydue is a budgeting app designed for couples but works perfectly for families as well. It allows users to track shared expenses, sync multiple bank accounts, and assign different spending categories. Honeydue shoes members exactly where the money is going and avoid confusion or financial disagreements.

Honeydue also sends reminders for upcoming bills, which is great for families managing multiple payments each month. The app’s chat function encourages communication around money, making it easier for family members to discuss finances openly.

4. Goodbudget

If you’re a fan of the envelope budgeting method, Goodbudget is a fantastic digital tool for families. The app helps families allocate money into virtual “envelopes” for categories like food, rent, and entertainment. It’s a great way to visually manage how much you have left to spend in each category throughout the month.

Goodbudget is perfect for families who want a simple, structured way to stay on top of their finances. It also allows multiple family members to track and manage spending across various envelopes, ensuring accountability and coordination.

Goodbudget provides a structured approach to budgeting and will help families manage their finances. The app can also be used to teach children about budgeting, beginning to build healthy habits early on.

How Budgeting Apps Help Families

Budgeting apps not only help families stay on top of their expenses but also provide long-term financial benefits. By using these apps, families can:

- Create Financial Transparency: Budgeting apps offer a shared view of household finances, which encourages open discussions and ensures everyone is aware of spending habits.

- Plan for Big Goals: Saving for future goals becomes more manageable, whether it’s setting aside money for a vacation or a child’s education.

- Manage Day-to-Day Finances: Apps provide real-time updates, allowing families to adjust their budgets on the go, whether for groceries, bills, or unexpected expenses.

Money

Abrdn’s plan to solve ‘vacuum’ caused by cost disclosure rule removal

The recent announcement by the Treasury and the FCA that it will temporarily ban the “double counting of costs” for investment trusts was welcomed by the sector.

However, the immediate removal of the requirement to provide costs disclosures has left a “potential vacuum”, according to Abrdn.

The company has released a ‘Statement of Operating Expenses’ (SOE) template as an interim measure to deal with this issue.

The new template document is for disclosing expenses incurred by investment trusts.

The Treasury also said it will lay out legislation to provide the FCA with the appropriate powers to deliver reform – the new Consumer Composite Investments (CCI) regime.

It said the new CCI regime will deliver more tailored and flexible rules to “address concerns across industry with current disclosure requirements, including for costs”.

The UK’s new retail disclosure regime is expected to be in place in the first half of 2025, subject to Parliamentary approval and following a consultation from the FCA.

Due to the time gap with the new regime not being in place until 2025, Abrdn said that “investors need clarity and consistency among data providers and publishers in the meantime”.

Both Abrdn and industry campaigners have always been clear that the “end objective should be more transparency, not less”.

This is why Abrdn is suggesting the SOE as an interim measure.

Abrdn explained the SOE provides more “relevant and transparent information”, with the added advantage that the underlying data will have been audited, although the SOE itself will not be an audited document.

The SOE is the result of a consultation with data providers and industry participants over recent months.

The rule, to “double counting of costs”, was inherited by the European Union (EU) and makes it appear that investment trusts are more costly to invest in than they actually are.

The disclosure rule required trusts to publish the costs of financing, operating and maintaining real assets.

However, many of these costs were already published in regular company updates and reflected in the value of the share price for all investment companies.

This “double counting of costs” is putting investors off, and an estimated £7bn a year is not being invested due to this issue.

Association of Investment Companies chief executive Richard Stone labelled this issue “misleading” and that the cost disclosure regime was an “unnecessary hindrance to investment trusts”.

Abrdn head of investment companies Christian Pittard said: “The forbearance measures announced on 19 September were a huge leap forward for the investment company sector, but there’s a long way to go yet.

“A potential vacuum has been created by the immediate removal of the requirement to provide costs disclosures.

“There is yet to be agreement on what could and should replace the disclosures, and clarity could be months away.

“Abrdn believes that the sector can and should improve cost disclosure for the benefit of investors.

“That’s why we are proposing a stand-alone cost disclosure template – a SOE, that Key Information Documents (KIDS) and factsheets could refer to.

“While the announcement on exempting investment trusts from cost-disclosure rules was hugely positive, we now see a risk that either an information vacuum on costs develops or conflicting information will emerge – creating confusion and eroding confidence among investors.”

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology2 weeks ago

Technology2 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 weeks ago

Science & Environment2 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

News2 weeks ago

News2 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum forces used to automatically assemble tiny device

-

News2 weeks ago

News2 weeks agoYou’re a Hypocrite, And So Am I

-

News3 weeks ago

the pick of new debut fiction

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy this is a golden age for life to thrive across the universe

-

Sport2 weeks ago

Sport2 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNerve fibres in the brain could generate quantum entanglement

-

Technology6 days ago

Technology6 days ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

MMA6 days ago

MMA6 days agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Football6 days ago

Football6 days agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

News2 weeks ago

News2 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCardano founder to meet Argentina president Javier Milei

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMeet the world's first female male model | 7.30

-

Business6 days ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

News2 weeks ago

News2 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Business2 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoBest Exercises if You Want to Build a Great Physique

-

News2 weeks ago

News2 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Technology1 week ago

Technology1 week agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

News3 weeks ago

News3 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoEverything a Beginner Needs to Know About Squatting

-

News2 weeks ago

News2 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Toning Workout for Women

-

Travel1 week ago

Travel1 week agoDelta signs codeshare agreement with SAS

-

Servers computers1 week ago

Servers computers1 week agoWhat are the benefits of Blade servers compared to rack servers?

-

Science & Environment1 week ago

Science & Environment1 week agoX-rays reveal half-billion-year-old insect ancestor

-

Politics1 week ago

Politics1 week agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology6 days ago

Technology6 days agoThe best robot vacuum cleaners of 2024

-

Sport2 weeks ago

Sport2 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Technology2 weeks ago

Technology2 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBlockdaemon mulls 2026 IPO: Report

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Politics2 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News1 week ago

News1 week agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow one theory ties together everything we know about the universe

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business2 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Politics2 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoKeep Your Goals on Track This Season

-

TV2 weeks ago

TV2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News2 weeks ago

News2 weeks agoChurch same-sex split affecting bishop appointments

-

Politics2 weeks ago

Politics2 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology2 weeks ago

Technology2 weeks agoFivetran targets data security by adding Hybrid Deployment

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSingle atoms captured morphing into quantum waves in startling image

-

Politics2 weeks ago

Politics2 weeks agoLabour MP urges UK government to nationalise Grangemouth refinery

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

Business2 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoWhich Squat Load Position is Right For You?

You must be logged in to post a comment Login