Money

Huge change to rules for millions holidaymakers from today – will you save on your mobile bill?

HOLIDAYMAKERS are set to benefit from new rules which could save them £100s on their phone bill.

From today (October 1), Ofcom has imposed new regulations for energy providers which will help protect mobile phone users from being unexpectedly charged while abroad.

Under the new rules, providers must warn customers when they start roaming in the EU or elsewhere to protect them from what’s known as “inadvertent roaming“.

This is when you are travelling across a border and connect to another country’s network without meaning to.

For many major UK networks, roaming can cost as much as £6 per MB – which is the equivalent of listening to two minutes of music.

This means spending just 20 minutes on your phone could cause you to rack up a £60 bill without you even knowing.

But from today, providers will need to alert customers when they begin roaming or reach their spending caps.

They will also have to signpost customers to free information on the roaming costs of where they are visiting.

Before Brexit, phone users could use existing call, data and text allowances in Europe at no extra cost.

But now it is a very common experience to face unwanted charges. Ofcom said in March that 14% of UK customers had experienced inadvertent roaming in the previous 12 months.

This also rose to 22% of customers in Northern Ireland, where devices inadvertently roamed signals from the Republic of Ireland.

In cases such as this, people have even reported facing roaming charges from their own home.

Sue Davies, head of consumer protection policy at Which?, has previously criticised the lack of regulations which were in place for holidaymakers.

She said: “The new rules do fall short by not suggesting that providers should give compensation to UK residents who have inadvertently fallen foul of roaming charges, and failing to outline what this looks like.

“When the UK negotiates future trade deals, it must seize the opportunity to lower the cost of roaming for consumers travelling around the world.

“The UK and EU should also agree a deal on roaming charges that stops people facing extortionate bills from providers.”

From today further prevention of unexpected bills is possible, however there has been no mention of those who have been previously charged gaining compensation.

Uswitch’s mobiles expert Ernest Doku pointed out that “while this is good news there is still inconsistency between providers – meaning a lack of clarity for consumers, who were hit with £539 million in unexpected roaming charges in 2023.”

How much does it cost to roam in the EU?

The amount you will be charged varies depending on your network provider.

Inadvertent roaming rates can also vary extortionately, so it’s important to let your provider know before you travel.

When managed correctly, here is what you will have to pay when roaming abroad:

- EE: £2.47 a day for contract customers, or if you have a plan with Inclusive Extras, you can purchase a Roam Abroad Pass for £25 a month. £2.50 a day, or £10 for seven days, if you are pay-as-you-go. 50GB “fair use” limit.

- Three: £2 a day for contract customers, no charge for pay-as-you-go. You can buy a Data Passport for £5 for unlimited data in 89 countries. 12GB “fair use” limit.

- Vodafone: £2.42 a day, or buy a European Roaming pass for £12 for eight days or £17 for 15 days, if you’re a contract customer. From £7 for eight days if you are pay-as-you-go. 25GB “fair use” limit.

- Sky: £2 a day. No “fair use” limit.

- Voxi: £2.45 a day for one day, £4.50 for two days, £12 for eight days, or £17 for 15 days. 20GB “fair use” limit.

O2 doesn’t charge customers roaming charges for using their phones abroad although it does have a 25GB “fair use” data cap.

To review your roaming charges before you travel, visit your provider’s website and either get in touch using the phone number or via your online account.

If you don’t want to pay for roaming and want to stick to Wi-Fi, go to your phone settings, then Mobile Data, and switch off Mobile Data Roaming.

You won’t be able to connect to data while abroad, but you’ll also have the peace of mind that you’re not being charged.

How to avoid roaming charges

Simrat Sharma, a mobiles expert at Uswitch, said switching to an eSIM – short for embedded SIM – can be cheaper than using international roaming.

“eSIMs make it easier to change networks,” she said.

“So for example, if you’re abroad you can quickly connect to the local network to pay local rates – without having to add or swap a physical local SIM card for your device.

“This means travel eSIMs are almost always cheaper than using international roaming, as users are effectively tapping into the same network plans as locals.

If you’re regularly switching numbers or travelling to different locations, you’ll be able to keep them all safely in digital format rather than carrying around a number of small cards.

“The software can easily be accessed via your device’s app store and uploaded to your phone in a few quick steps.”

How to cut mobile costs

If you want to save on extra roaming costs, it’s always best to connect to Wi-Fi whenever you can.

Most hotels and cafes now offer wireless internet free of charge – if there’s a password, go up and ask the staff.

You should also check before you join your provider whether they offer a roaming add-on, which automatically provides you with a small allowance for data roaming free of charge.

Mobile users often set their budget for the month by installing a cap on their data usage.

UK networks now enforce automatic caps on data usage worldwide, which is usually between £40 and £49 – although you can set your cap much lower.

One quick way to cut the cost of your mobile phone contract is by going SIM-only.

You can get one of these deals if you have already paid for your handset.

They come with a certain amount of minutes, texts and mobile data.

Since you are not paying for the cost of the mobile with a SIM-only package, you can save a hefty amount of money.

We also recommend you dedicate a good amount of time to shopping around and speaking to other providers.

Comparison sites like Uswitch, MoneySuperMarket and Compare the Market are good places to start, but it’s also useful to ask personal opinions and experiences of people you know to work out what will suit you.

Once you’ve found the best deal for you, you can use it to haggle with your current provider if it is offering you a worse price or package.

If your provider refuses to reduce its price, you can always walk away and take the different deal with the new provider.

Ofcom‘s coverage checker is also a useful tool to find out what provider network is strongest to use based on the signal in your area.

And if you’re on certain benefits, you could also be eligible for a social mobile tariff, which could save you £100s a year.

To find out whether you might be eligible, visit the government website or contact your local council.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Standard Life launches free pension-finding tool

Standard Life has partnered with Raindrop and launched a free-to-all pension-finding tool to help Britons track down their missing pensions.

This comes as Standard Life research has shown that 19% of people with multiple pensions believe they have lost track of at least one pension pot.

Standard Life, part of Phoenix Group, said that despite the benefits of consolidating pensions, such as a greater ability to track performance and boost understanding of how much is being saved for the future, 73% of those with more than one workplace pension said they have not consolidated.

Just under a third (32%) are unsure of how to start consolidating and 12% find the process too difficult.

It has been estimated that 2.8 million pension pots in the UK, valued at over £26.6bn, remain unclaimed. Additionally, the average person has at least 11 employers in their working lifetime.

In order to find a lost pension, a user just needs to provide their former employer’s name and the time period they worked for the company. This is in contrast to supplying details of the pension provider “as is often the case when consolidating pension pots”.

Raindrop’s technology then begins the tracing process, which on average takes just 4-6 weeks. During this time, a dedicated case manager is on-hand to provide updates on the process.

Once a person’s lost pensions have been traced, they will be better informed about their income prospects and able to take the necessary steps to prepare for their retirement.

Standard Life managing director of retail direct Dean Butler said: “We know that people who actively plan for their retirement are more confident and financially secure but if you don’t know where all your savings are, you can’t begin to calculate their value, making planning unnecessarily difficult.

“Sometimes people have a vague idea of having a pension with a previous employer, but just don’t know how to go about finding it. Our new pension-finding service removes the major hurdles that people face and allows them to regain control of their pensions savings. We want to help them trace any missing pensions, so they don’t ever lose them again and are better prepared to organise their retirement savings.”

Raindrop co-founder Vivan Shridharani added: “Millions of UK savers have lost pensions, often unsure of how to begin their search. As each new generation has more jobs than the last, the number of lost pensions continues to grow. We’re committed to helping savers, with a simple solution to easily find their lost pensions and help them better prepare for their financial future.

“By partnering with Standard Life, one of the UK’s largest pensions providers, we hope to empower savers to locate lost pots and take control of their long-term financial planning.”

Since the launch of Raindrop, a pension-finding platform, in 2021, it has located over £325m in lost pension savings across more than 27,000 pots.

In order to obtain these results, Standard Life commissioned Opinium to conduct research among 2,000 UK adults between 6 and 10 September 2024.

Money

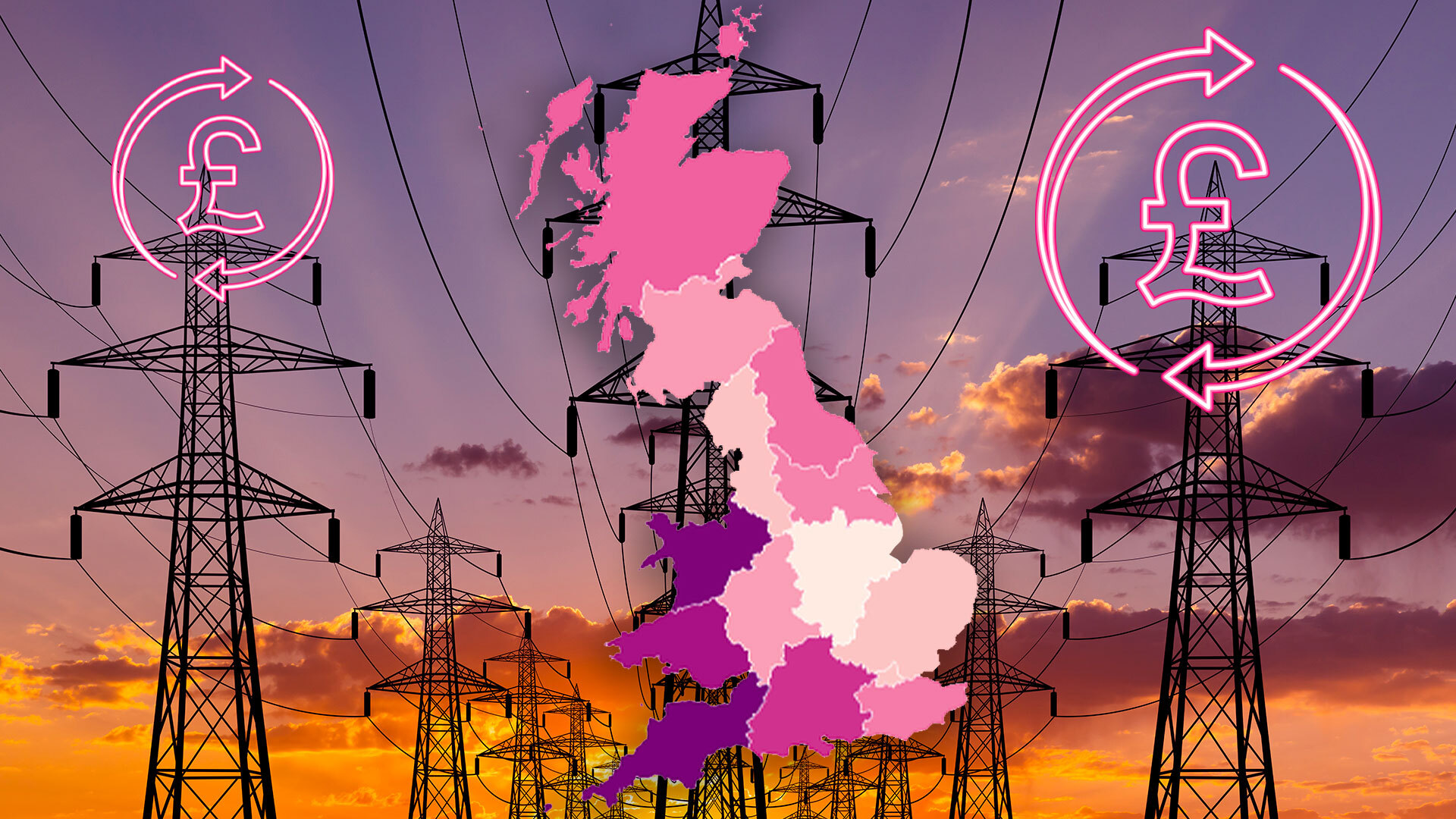

Map reveals how much energy bills will rise in your area from today – and why you could pay MORE than the price cap

MILLIONS will see their energy bill rise by £149 as Ofgem’s new price cap comes into force today, Tuesday, October 1.

Households previously paid £1,568 a year but the figure is now set to rise by nearly £150 to £1,717.

Around 29million customers on their energy providers’ standard variable tariff (SVT) are expected to see their bills rise.

Ofgem updates its price cap every three months, setting a ceiling on how much suppliers can charge for each unit of gas or electricity.

It was created five years ago to protect customers from being overcharged by suppliers.

This includes your standing charge which is a daily fixed amount you have to pay no matter how much electricity you use.

But it is worth bearing in mind that the £1,717 figure is just an estimation given by the energy regulator.

It is calculated assuming that a typical household uses 2,700 kWh of electricity and 11,500 kWh of gas over a 12-month period.

Those who use less electricity will pay less, while those who use more will have to pay more.

The exact amount you pay is based on several factors, including where you live, your supplier and how you pay for your gas and electricity.

There are 14 different “Distribution Network Operators” across Britain, who can dictate your energy costs.

For example, those in Northern Scotland will see their bills rise to £1724.47 up from £1577.66 starting today.

While households in North West of England will see their bills increase to £1,689 up from £1,533.

Those in the South West will pay the most, with the average annual bill costing £100 more at £1,766 a year.

These varying prices occur because generating gas or energy is cheaper in some areas than others.

Your regional standing charge, which is how much you pay to stay connected to the grid, also varies depending on where you live.

For example, those living in the northern region (North East England) pay the highest standing charge in the country.

A typical household here will now be charged £379 as of today.

While prices are expected to be high for the next three months, experts are predicting a fall come January.

Cornwall Insight has published a new forecast predicting a £20 drop in the new year to £1,697.

Dr Craig Lowrey, principal consultant at Cornwall Insight said October’s rise is a “temporary blip”.

He said: “Typically some of the coldest months of the year, often bring with them the biggest energy bills, and – while our latest forecast is welcome news – it remains subject to the volatile wholesale gas and electricity markets.”

Why you could be charged more

If you are worried about the price of the regional standing charge in your area, it is worth being aware of these tips.

For example, taking regular meter readings can let you update your supplier on your energy usage so you are not overcharged.

It is important to take a meter reading around the time of the price cap change to make sure all your energy usage up until that point is charged at the lower rate.

If you are confused about how to take a meter reading you can read our article here.

How do I calculate my energy bill?

BELOW we reveal how you can calculate your own energy bill.

To calculate how much you pay for your energy bill, you must find out your unit rate for gas and electricity and the standing charge for each fuel type.

The unit rate will usually be shown on your bill in p/kWh.The standing charge is a daily charge that is paid 365 days of the year – irrespective of whether or not you use any gas or electricity.

You will then need to note down your own annual energy usage from a previous bill.

Once you have these details, you can work out your gas and electricity costs separately.

Multiply your usage in kWh by the unit rate cost in p/kWh for the corresponding fuel type – this will give you your usage costs.

You’ll then need to multiply each standing charge by 365 and add this figure to the totals for your usage – this will then give you your annual costs.

Divide this figure by 12, and you’ll be able to determine how much you should expect to pay each month from April 1.

If you have a smart meter then you do not need to take a reading as this does it automatically.

You should contact your supplier if you are keen to install one as it is usually done free of charge.

There are also a number of government support packages available to those who are struggling financially.

The Sun recently published an article on all the bill help worth over £5,000 which you can check out here.

Make sure you pay the lowest rates

There are two types of rates that you can pay on your energy bill, fixed or a standard variable rate.

A fix is when you lock in a set price for a certain period which is usually 12 months.

That is different to a standard variable rate which can go up or down depending on Ofgem’s price cap, which changes every three months.

A number of energy suppliers have reduced the rate of their fixed deals, meaning customers have a chance to save if they switch.

For example, EDF has launched a 1,568-a-year fixed deal for a typical energy user paying by direct debit.

This deal is £149 cheaper than the upcoming cap.

It is worth bearing in mind that you will still be charged more if you use more energy.

You check out the best fix rate deals below:

Money

Five minutes with…Flagstone | Money Marketing

With rising interest rates and inflation driving a resurgence in cash, financial advisers are increasingly recognising its importance within client portfolios.

As Claire Jones, head of strategic relationships and new business at Flagstone, points out, 66% of advisers now guide their clients’ cash decisions. They are also adapting their processes, using platforms such as Flagstone, to optimise returns on cash savings while mitigating risks like inflation erosion and limited FSCS protection.

Claire Jones will be speaking at Money Marketing Interactive London on Tuesday 8 October.

What is behind the resurgence in cash? Why are more planners now advising on it than three years ago?

Sixty-six per cent of financial advisers and wealth managers now guide their clients’ cash decisions*. One of the main reasons is due to sustained high rates. Since 2022, increasing inflation has pushed the base rate from around 0.1% in 2021 to 5% today – 50x higher. This surge has also impacted savings, with 12-month fixed-term interest rates jumping from an average of 0.96% in December 2021 to nearly 5% now.

As a result, advisers recognise cash as a valuable asset class. Ninety per cent of advisers say the ability to access cash for emergency and short-term use is appealing to their clients, as well as 85% of advisers saying volatility in investment portfolios is a major driver.

How are you seeing advisers adjust their processes in light of the cash comeback?

Advisers are increasingly incorporating cash into their clients’ portfolios, recognising its potential to deliver meaningful returns. They’re also helping clients overcome the inertia around cash savings by using platforms like Flagstone, which simplifies managing cash by offering access to multiple savings accounts with a single application.

Additionally, advisers are seeing cash as a key part of a balanced portfolio, offering both attractive interest rates and protection under schemes like the FSCS.

What are the key opportunities for advisers and their clients when it comes to cash in the current market?

Advisers can help clients make the most of high interest rates by moving them out of low-yield accounts into market-leading, higher-paying options. Platforms like Flagstone make it easy to access exclusive rates, get the best return on their cash savings, and manage multiple accounts seamlessly.

of household wealth held in cash, especially among those nearing retirement, advisers have the ideal opportunity to integrate cash into a diverse portfolio that balances return and risk. In order to take a holistic approach to their clients’ wealth, advisers must consider cash.

What are the main risks of neglecting cash?

One of the biggest risks is inertia. Clients may leave funds in low-interest accounts, missing out on better returns. In the UK, over £1trn sits in easy-access accounts, often earning little to no interest. Neglecting cash can also expose clients to unnecessary risk if they hold more than £85,000 in one bank, meaning they miss out on full FSCS protection.

Additionally, if clients aren’t proactive in managing their cash to take advantage of current interest rates, inflation could erode their savings, leaving them with disappointing .

*From Flagstone’s latest survey of 100 independent financial advisers and wealth managers in the UK

Money

B&M shoppers rush to buy cheap gadgets to avoid putting heating on including heated slippers – prices start from £12

THOUSANDS of Brits are facing concerns about how to keep warm this winter – but with the right kit, they won’t even need to turn the heating on.

Shoppers are rushing to B&M to buy its bargain heated gadgets which will keep them toasty for as cheap as £12.

The new range of cosy products boasts a Restore massaging foot warmer (£20) and rechargeable hot water bottle (£15).

There are also multiple heated products from Naeo, including a body cushion (£12), lumber belt (£20), neck vibrator (£12) and slippers (£29).

The new range comes just in time for October 1, as the new energy price cap is implemented and bills begin to peak this winter.

The new energy price cap, which limits the amount that can be charged, will be around 10% higher than the current level which has been in place since July.

Ofgem, which sets the limit, revealed that bills will rise this month from an average of £1,568 to £1,717.

This means the average household paying by direct debt for dual fuel (electricity and gas) will see their annual bill go up by £149, or around £12 a month.

Therefore it’s a great idea to find alternative ways of keeping yourself warm, before heating your home.

By heating yourself instead of your home, you could save £100s off your energy bill – for example, electric blankets cost as little as 3p an hour.

These products are effective in the same way, and if battery powered, costs 0p to run – besides the cost of the batteries, which cost £8 for 12 on Amazon.

Let’s say that’s 2 batteries a month, you’ll be spending £1.30 a month on heating where the average household pays £400-500 a month (according to Plumr.com).

The shoes, and neck and waist warmers, also mean you can keep warm all over your body, while on the move around the house.

The range is not yet visible on the B&M website, but is available to hunt down in store.

This is according to B&M who posted images of the new cosy products on Facebook and said: “Everything I’ve ever need and more! Cosy season, we’re ready for you!”

Others commented: “I need these!” and “This will be a good idea for Nan”.

Heated items could also be a great tool for pensioners this colder season, who have had their Winter Fuel allowances stripped from them in new cuts by the new Labour government.

Following Chancellor Rachel Reeves‘ announcement of a £22bn black hole in public finances, winter fuel payments will now only go to pensioners who are receiving pension credit or any other means-tested benefit.

By spending £20 on a Restore massaging foot warmer, and £12 on a body cushion, a pensioner could be sufficiently heated for the evening, spending a one off payment of £32 but saving £100s over the winter.

However, it is also important to note that the elderly should not avoid turning the heating on if they are cold – for energy help contact your provider or local council, or read our article here.

To find your nearest B&M store, visit the website and use the Store Locator tool.

Products vary site to site, and as the items are brand new, they may not have hit your local yet.

Naeo neck vibrator – £12

The vibrating neck wrap is the cheapest item of the range, costing only £12 and coming with a lavender and sea salt eye mask.

On the box it is described to be “weighted for comfort” with “comfortable fabric” and “relaxing vibration”.

The item is not heated, but great for relaxation when paired with the other products on this list.

The product is battery-powered so you simply place the product around your neck and turn it on.

Similar items are retailing in John Lewis and Argos, such as the Dreamland Neck vibrator which costs £59.

A William Morris at Home lavender eye mask also costs £14, meaning the B&M punter saves spending £61 with their singular purchase.

Naeo heated cushion – £12

Shoppers are also going crazy for the £12 heated body cushion, which can also serve as a hand warmer.

The product is also battery-powered so requires just a simple installation and to be turned on.

Reusable hand warmers cost as much as £20 in Boots, and heated cushions £100 – meaning you could be saving £88 on this one item.

Restore rechargeable hot water bottle – £15

What makes this water bottle different to others is its smart charging port, which allows it to be ready to turn on whenever you need it.

It is ready to use in just under 25 minutes, and has automatic temperature control to prevent it getting too hot.

With the Restore rechargeable hot water bottle for £15, you could be making a save of up to £17, with Argos selling a similar product for £32 – double the price.

Other places which sell electric heat pads include Currys and Electrical World, for prices of £24 to £35.

Restore massaging foot warmer – £20

For £20, the Restore massaging foot warmer can keep you cosy and relaxed for bargain price.

You simply plug the warmer in and turn it on, put your feet inside and wait for it to heat up.

This is compared to the Well Being heated foot massager in Sports Direct, which costs £32.

Similar products are also selling fast on Amazon for £40, meaning you’re beating the crowd with a 50% save.

Naeo lumber belt – £20

Heated lumber belts are often pretty pricey to get your hands on.

The battery powered belt wraps around your waist and warms your lower back and stomach.

The John Lewis Dreamland Revive Me belt is selling for £48.53, and on Amazon, as much as £49.99.

This means almost a £30 save on the Naeo product.

Naeo heated slippers – £29

The slightly pricier B&M heated slippers are £29, but compared to other retailers, it’s a steal.

These work via battery-power, meaning you can use them again and again.

On Amazon, the Heated Slippers Amiable Foot Warmer is selling for £59.

However, in The Range, you can secure USB Electric Heated Plush slippers for £13 – though this means you can’t wear them walking around the house.

B&M’s Naeo product is battery operated, with “anti-slip soles” and “smooth heating”, so you can keep warm while doing everything you usually get done at home.

5 ways to keep your house warm in winter

Property expert Joshua Houston shared his tips.

1. Curtains

“Windows are a common place for the outside cold to get into your home, this is because of small gaps that can let in air so always close your curtains as soon as it gets dark,” he said.

This simple method gives you an extra layer of warmth as it can provide a kind of “insulation” between your window and curtain.

2. Rugs

“Your floor is another area of your home where heat can be lost and can make your home feel chilly,” he continued. “You might notice on cold days, that your floor is not nice to walk on due to it freezing your feet.

“Add rugs to areas that don’t already have a carpet, this provides a layer of insulation between your bare floor and the room above.”

3. Check your insulation

Check your pipes, loft space, crawlspaces and underneath floorboards.

“Loose-fill insulation is very good for this, and is a more affordable type of insulation, with a big bag being able to be picked up for around £30,” Joshua explained.

4. Keep your internal doors closed

“Household members often gather in one room in the evening, and this is usually either the kitchen or living room,” Joshua said.

“This means you only have to heat a small area of your home, and closing the doors keeps the heat in and the cold out.”

5. Block drafts

Don’t forget to check cat flaps, chimneys and letterboxes, as they can let in cold air if they aren’t secure.

Other retailers which sell affordable home heating appliances include Dunelm and The Range

Dunelm is selling a Cream Borg Heatable Foot Warmer for £15 – though keep in mind this does not include delivery charges if you are ordering online.

The Range is also selling a larger Cosy Heat Portable Heater for £24, which can be lied on to keep you extra warm.

Electric blankets are also a great option, and can be found on Wowcher for the low price of £19.99.

As always, we recommend you compare prices by going to retailer websites such as B&M and and choosing the “sort by” tool – you can then browse the “cheapest items first”.

Or for a more specific search look up in the search bar “heated appliances”.

Some energy support funds are also offering free electric blankets to customers who are struggling this winter.

OVO and Octopus Energy are both suppliers who have aimed at “heating the human, not the home”.

Octopus have said they will distribute 20,000 electric blankets from Dreamland to its most vulnerable customers, keeping them warm for “as little as 3p an hour”.

While OVO Energy has launched a £50 million Extra Support Package which includes complimentary energy-conserving items.

Electric blankets are also sometimes available from your council under the Household Support Fund, which renews a fresh pot of £421 million today.

To find out if this is available with your supplier or council, and whether you are eligible, go to their websites and read the terms and conditions of the scheme.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Praxis appoints Hulme and Isaacs to boost investment team

New capital markets and investor relations MDs are latest in series of appointments as the firm seeks to expand into new areas.

The post Praxis appoints Hulme and Isaacs to boost investment team appeared first on Property Week.

Money

Preparing for the ‘great adviser retirement’

Financial services is set for a seismic shift, as the ‘great adviser retirement’ gets closer.

Financial services is set for a seismic shift, as the ‘great adviser retirement’ gets closer.

Recent research from the Financial Conduct Authority revealed the number of younger advisers has fallen in the past 18 months, while the number of advisers aged over 60 has grown nearly 30%.

To ensure a smooth transition for clients, advice firms must think carefully about succession planning.

Without the right structure in place to give clients the needed reassurance, they risk losing credibility – or, worse, business.

The drivers

There are several catalysts driving advisers into early retirement, including increased regulation, emerging technologies and market volatility.

The regulatory landscape’s rapid evolution is perhaps the most pressing.

Over a year on from Consumer Duty coming into effect, there is growing recognition the regulation will require a real ongoing effort – a burden that has prompted some advisers to rethink their futures in the industry.

The number of younger advisers has fallen in the past 18 months, while the number of advisers aged over 60 has grown nearly 30%

The ever-growing demand for hyper-personalisation across the wealth management experience is also fueling this trend, particularly as we continue to see wealth transfer between generations.

Coupled with market volatility, inflationary pressures, high interest rates and geopolitical tensions, advisers are faced with challenges in how they interact with and support clients – all while delivering outcomes that meet their financial goals.

Investment flexibility will be a cornerstone for meeting the diverse needs of all generations, and technology will be key to delivering that. As advisers evaluate their value propositions for the future, considerations for scaling their businesses should be at the forefront.

The solutions

As firms plan to get ahead of the great retirement, there are two key factors to consider: talent and business strategies.

First, attracting new talent should be an industry-wide focus. Many advice firms are leveraging new technologies to attract new recruits and establish training and development schemes to ensure they’re equipped with the skills and knowledge to pursue a career in advice.

Firms looking to solve the needs of the future generation of investors and advisers must act now

Secondly, as balancing client needs with business needs has become increasingly difficult, advisers must look to solutions that can help them drive their strategic growth agendas.

Building a digital-led solution will not only remove the need for manual administration but enable the modern adviser to engage with clients in a personalised and dynamic way.

Elsewhere, while the adviser-as-a-platform solution has been much discussed, the adviser-as-DFM is increasingly being considered. Obtaining permissions and launching a discretionary investment management business can enable better client and adviser experiences – and better client and business outcomes.

Owning a DFM can help improve alignment across clients’ needs and investment advice by giving advisers more control over their advice implementation, while also providing increased flexibility around charging structures.

Without the right structure in place to give clients the needed reassurance, they risk losing credibility – or, worse, business

Consent to make tactical changes to client portfolios may not be required, improving efficiency. In addition to potentially boosting enterprise value and the potential sale prices of advisers’ businesses, launching a DFM can create new revenue streams that provide capital to invest in developing the next generation of advisers.

Firms looking to solve the needs of the future generation of investors and advisers must act now.

Having the right technology, products and propositions in place will allow them to foster deeper relationships with clients, reduce administrative burden and focus on what really matters most: providing quality advice.

Ben Cooper is head of asset management partnerships, IFA and wealth, at SEI

-

Womens Workouts1 week ago

Womens Workouts1 week ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology2 weeks ago

Technology2 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment2 weeks ago

Science & Environment2 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

News1 week ago

News1 week agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

News2 weeks ago

News2 weeks agoYou’re a Hypocrite, And So Am I

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum forces used to automatically assemble tiny device

-

Sport2 weeks ago

Sport2 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNerve fibres in the brain could generate quantum entanglement

-

News2 weeks ago

News2 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCardano founder to meet Argentina president Javier Milei

-

Science & Environment1 week ago

Science & Environment1 week agoMeet the world's first female male model | 7.30

-

Womens Workouts1 week ago

Womens Workouts1 week agoBest Exercises if You Want to Build a Great Physique

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Womens Workouts1 week ago

Womens Workouts1 week agoEverything a Beginner Needs to Know About Squatting

-

News1 week ago

News1 week agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts1 week ago

Womens Workouts1 week ago3 Day Full Body Toning Workout for Women

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA slight curve helps rocks make the biggest splash

-

News2 weeks ago

News2 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Sport2 weeks ago

Sport2 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBlockdaemon mulls 2026 IPO: Report

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Travel1 week ago

Travel1 week agoDelta signs codeshare agreement with SAS

-

Politics6 days ago

Politics6 days agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoBeing in two places at once could make a quantum battery charge faster

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow one theory ties together everything we know about the universe

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTiny magnet could help measure gravity on the quantum scale

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC asks court for four months to produce documents for Coinbase

-

Business2 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Technology2 weeks ago

Technology2 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoKeep Your Goals on Track This Season

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

News2 weeks ago

News2 weeks agoChurch same-sex split affecting bishop appointments

-

Technology2 weeks ago

Technology2 weeks agoFivetran targets data security by adding Hybrid Deployment

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

Business2 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics2 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

Science & Environment1 week ago

Science & Environment1 week agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News1 week ago

News1 week agoWhy Is Everyone Excited About These Smart Insoles?

-

News5 days ago

News5 days agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Politics2 weeks ago

Politics2 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology2 weeks ago

Technology2 weeks agoCan technology fix the ‘broken’ concert ticketing system?

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSingle atoms captured morphing into quantum waves in startling image

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow Peter Higgs revealed the forces that hold the universe together

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoWhich Squat Load Position is Right For You?

-

News1 week ago

News1 week agoBangladesh Holds the World Accountable to Secure Climate Justice

-

TV1 week ago

TV1 week agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Technology1 week ago

Technology1 week agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Science & Environment6 days ago

Science & Environment6 days agoX-rays reveal half-billion-year-old insect ancestor

-

Technology2 weeks ago

Technology2 weeks agoIs carbon capture an efficient way to tackle CO2?

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoThe physicist searching for quantum gravity in gravitational rainbows

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoHelp! My parents are addicted to Pi Network crypto tapper

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

You must be logged in to post a comment Login