Money

I was homeless and living in a tent after my parents kicked me out – now I’m worth £5MILLION

A FORMER homeless man who lived in a tent after his parent kicked him out revealed that he is now worth a whopping £5million.

Adam Pope transformed his life after admitting that he often found himself in trouble during his youth.

The now-millionaire would regularly host illegal raves and joyride in cars.

He was no stranger to the police who almost threw him in jail after he was caught driving whilst disqualified several times.

Despite his illegal activities, Adam claimed that his parents did everything they could to keep him on the right path.

He said: “I came from a good background; my parents are still together. It’s not like I came from a broken home.”

However, at the age of 20, he was kicked out of his family home in Bolton after his parents became fed up with his behaviour.

Adam began sofa surfing at friends’ houses, but unfortunately, their parents soon grew tired of his disruptive behaviour as well.

He told Manchester Evening News: “I was on a self-destructive trail.

“I’ve always been a nice person – I was never a bad person – I just never knew why I was going down this path or what the cause was.”

With nowhere left to turn, he was forced to sleep on the streets where he would walk for hours “just to pass the time”.

He added: “By the end of the night, I would have walked 20 miles instead of going to sleep.”

Fearing for his safety on the streets, Adam would sleep in his parents’ back garden, ensuring he was out of sight by the time they woke up.

The millionaire Brit added: “I was paranoid about staying in the same place for any length of time.

“I would rarely stay in the same place every night. It became challenging.”

Eventually, he managed to take a tent from their garage, which he used to camp in a local woodland.

Despite his homelessness, Adam continued to attend college to finish his business course.

Anything and everything would freak you out

Adam Pope

A lecturer confronted him about it after rumours about his living conditions spread.

“I had gone to college and I wasn’t far from finishing,” he said.

“I got there and one of my tutors went, ‘I heard you’re sleeping in a tent in the woods’.

“I got back from college and the very few belongings I had left had been stolen along with my assignments that were due in a few weeks. I couldn’t finish college.”

Adam slept rough for a total of six months, during which he recalled how terrifying “sleeping in the woods” can be.

He added: “All sorts go through your mind. There are all sorts of characters about.

“It was the winter and it was freezing. Anything and everything would freak you out.

“You could hear shuffling about and you would think, ‘What was that?’ and quickly get back in your tent.

“Sleeping was never a thing. You couldn’t switch off properly.

“But I knew I was better off in the tent compared to some of the other places I was in.”

BACK ON TRACK

Fortunately, Adam’s grandma learned about his situation and offered him a place to stay with her.

With a roof over his head, he began trying to get his life back on track and even managed to find employment.

However, it was short-lived after he was fired from several jobs over poor punctuality and other issues.

Failing to hold down jobs, his dad allowed him to work in his business as a tea boy.

This proved to be a humbling moment for the now 43-year-old, who decided he wanted more out of life.

At the age of 27, Adam started a financial services dispute company before going on to launch Spencer Churchill five years later, a law firm based in Bolton.

The company specialises in corporate law, commercial mediation, dispute resolution, employment law, real estate, intellectual property and private client services.

Incredibly, the business now turns over £5million.

Although the business is already hugely successful, Adam has no intention of slowing down – aiming to scale the firm even further in both revenue and size.

But the entrepreneur says he probably wouldn’t be in his position today if it weren’t for the hardships he’s had to overcome in life.

“It’s not where you started, it’s where you finish,” he added

“I’ve had a very difficult early few years. It would have ruined a lot of people.”

Homelessness help

HERE is some useful information if you are homeless or know someone who is experiencing homelessness.

FIRST CONTACT

If you or someone you know is sleeping rough you can use the alert Streelink service to help connect them with outreach services: www.thestreetlink.org.uk/start

FOOD

You can find free food stations via:

The Pavement – for food and soup runs: www.thepavement.org.uk/services

Homeless Link – for day centres: www.homeless.org.uk

The Trussell Trust – for food banks: www.trusselltrust.org/get-help/find-a-foodbank/

Food Cycle – for food services – www.foodcycle.org.uk/free-food-locations/

HOUSING

Councils have a duty to help people who are homeless or facing homelessness. Contact the Housing Options team from the council you have a local connection to and see if they can offer:

- Emergency accommodation – a place in a shelter or a hostel

- Longer-term accommodation including independent or social housing

Visit: www.gov.uk/find-local-council

During times of severe cold or heat, local councils have special accommodation known as Severe Weather Emergency Protocol (SWEP). Find out more here: www.gov.uk/find-local-council.

For advice, support or legal services related to housing visit www.shelter.co.uk or call 0808 800 4444.

You can also contact Crisis: www.crisis.org.uk/get-help/

For housing advice, call Shelter on 0808 800 4444 or visit: www.shelter.org.uk.

DAY CENTRES

Day centres can help by providing internet access, free or cheap food, shower and laundry facilities, safe storage for belongings, phone charging and clothes, toiletries or sleeping bags.

They can also help with services for benefits or immigration advice; health support; finding work; educational or social activities; hostel, night shelter or outreach referrals.

Centres can be found through Homeless Link: www.homeless.org.uk/

BENEFITS

Normally you can claim Universal Credit if you are sleeping on the streets or staying in a hostel. If you are in a hostel, you can claim Housing Benefit to help with rent. You do not need a fixed address or a bank account.

USEFUL CONTACTS

Crisis – visit: www.crisis.org.uk or call 0300 636 1967.

Shelter – visit: www.shelter.org.uk or call 0808 800 4444.

Centrepoint (for people aged 16-25) – visit: www.centrepoint.org.uk or call 0808 800 0661.

St Mungo’s (Bath, Bournemouth, Brighton, Bristol, Christchurch, Leicester, Oxford, Poole and Reading) – visit: www.mungos.org or call 020 3856 6000.

Depaul UK (for young people) – visit: https://www.depaul.org.uk/ or call 0207 939 1220.

Citizen’s Advice (legal advice) – visit: www.citizensadvice.org.uk or call 0345 404 0506.

The Samaritans (health and wellbeing) – www.samaritans.org/how-we-can-help/contact-samaritan or call 116 123.

Money

Such a shame’ cry shoppers as Dobbies Garden Centre set to to close in just a matter of months – see the full list

DOBBIES will shutter one of its sites in Bristol in just a matter of months, devasting shoppers.

Its Little Dobbies store in Clifton is one of the 17 sites the retailer has marked for closure as part of a restructuring plan.

Dobbies will also work with landlords to seek temporary rent reductions at a further nine sites.

The business began a financial overhaul back in August, which it warned would lead to shop closures.

Dobbies has many stores across the South West of England, but it has been confirmed that its location in Clifton, Bristol could now close.

The news has devasted shoppers, with one describing the move as “very sad”.

Another local said the decision to shutter the site was “such a shame”.

While a third said: “A shame that any shops have to close, especially that gardening became more popular during and following lockdown.”

It comes as Bristol locals have had to wave goodbye to a number of retailers in recent years.

House of Fraser shut its site at the Cabot Circus shopping centre back in August, and The Guild department store closed in May.

The full list of Dobbies stores set to close are:

- Altrincham

- Antrim

- Gloucester

- Gosforth

- Harlestone Heath

- Huntingdon

- Inverness

- King’s Lynn

- Pennine

- Reading

- Stratford-upon-Avon

Six Little Dobbies, which are smaller branches selling houseplants located locally rather than out of town, are set to close in these areas:

- Cheltenham

- Chiswick

- Clifton

- Richmond

- Stockbridge

- Westbourne Grove

If the restructuring plan is approved the 17 sites will close by the end of the year.

They will continue to operate as normal until the plan is approved.

The nine sites where its seeking rent reductions from landlords have not been named.

A spokesperson previously told The Sun: “Subject to the restructuring plan being successfully approved, we expect the affected sites to cease trading by the end of the year.

“Thereafter, Dobbies will operate 60 stores and continue to play a key role in the market, working constructively with stakeholders and suppliers, and having an active and committed role in the communities in which it’s based.”

The garden centre chain, which was bought by investment firm Ares Management last year, fell to a £105.2 million pre-tax loss in the year to March 2023, against a £7 million loss a year earlier, according to its most-recently filed company accounts.

Restructuring plans are often launched by businesses when they find themselves in financial difficulty to help shore up extra costs.

It comes as many retailers are struggling to keep their heads above water.

High inflation coupled with a squeeze on consumers’ finances has meant people have less money to spend in the shops.

Garden centres and home improvement businesses also boomed during the pandemic when customers were stuck at home.

But customers have been forced to cut back on spending since.

Back in August, Homebase announced that 10 of its stores would close and be transformed into Sainsbury’s supermarkets.

Homebase’s owner, Hilco Capital, is preparing to sell the company.

The retailer has closed 106 stores since it was taken over by Hilco Capital in 2018.

Why are retailers closing shops?

EMPTY shops have become an eyesore on many British high streets and are often symbolic of a town centre’s decline.

The Sun’s business editor Ashley Armstrong explains why so many retailers are shutting their doors.

In many cases, retailers are shutting stores because they are no longer the money-makers they once were because of the rise of online shopping.

Falling store sales and rising staff costs have made it even more expensive for shops to stay open. In some cases, retailers are shutting a store and reopening a new shop at the other end of a high street to reflect how a town has changed.

The problem is that when a big shop closes, footfall falls across the local high street, which puts more shops at risk of closing.

Retail parks are increasingly popular with shoppers, who want to be able to get easy, free parking at a time when local councils have hiked parking charges in towns.

Many retailers including Next and Marks & Spencer have been shutting stores on the high street and taking bigger stores in better-performing retail parks instead.

Boss Stuart Machin recently said that when it relocated a tired store in Chesterfield to a new big store in a retail park half a mile away, its sales in the area rose by 103 per cent.

In some cases, stores have been shut when a retailer goes bust, as in the case of Wilko, Debenhams Topshop, Dorothy Perkins and Paperchase to name a few.

What’s increasingly common is when a chain goes bust a rival retailer or private equity firm snaps up the intellectual property rights so they can own the brand and sell it online.

They may go on to open a handful of stores if there is customer demand, but there are rarely ever as many stores or in the same places.

Money

I’m a single mum-of-two & and I’ve been forced by council to move home three times in a MONTH – my kids aren’t safe

A SINGLE mum-of-two has been forced to move house three times in one month and fears her kids aren’t safe.

Harlie Swann, 29, has been living in temporary housing for 13 years, along with her kids; Frankie, 8, and Finnlie, 2.

The Croydon resident was first moved into temporary accommodation after having Frankie at 21.

Harlie told MyLondon they lived there for seven years but after Frankie’s ADHD diagnosis, the home was no longer suitable.

Finnlie also has complex learning difficulties and Harlie fears “constantly moving around” is taking its toll on them all.

The family are due to move into a property in Lambeth this week marking the third time in a month Croydon Council have ripped their stability away from them.

Harlie said the constant moves come down to discovering each home is unsafe – for anyone to live in, let alone children.

In a previous home in West Norwood, the family were exposed to sewage spurting up the sink, persistent mould, and damp.

Due to the extent of the problem, environmental health assessors had to get involved.

Luckily the next house and latest home was deemed “fine on the paperwork”, Harlie explained.

However, when they moved in they discovered a major leak problem and improper fire-safe windows.

According to Harlie, the council said “don’t unpack we’ll find you somewhere else, then they found me this place in Streatham this Monday (September 30).

“It’s an absolute nightmare,” she said.

A neighbour even told Harlie that the previous tenants put up with the same problems yet the council still deemed it safe to move into.

Harlie, who experienced being homeless as a teenager said: “I saw things that no 16-year-old should have seen by living in these horrible places, and around a lot of concerning people.”

One night, she even slept in a police cell because she was so young.

She continued: “I feel like I’ve gone through so much but still, nobody is willing to give me and my kids somewhere stable and safe to live.”

Harlie’s eldest, Frankie, who has regular ADHD therapy needs extra care right now as he cannot attend school.

She said: “He needs that permanent stability.

“I go to Child and Adult Mental Health Services (CAMHS) three times a week with him, he is in intense therapy.

“There’s a shortage of ADHD medication at the moment, which means he’s not taking his medication.

“The school have said they can’t have him there any more because he had an issue with the teachers.

“Because of this I’m having him stay with me at home, but this is all going on at home and they’re expecting me to deal with all of this.

“It’s too much.”

Temporary accommodation or interim accommodation is organised by the council and exists for people who are at risk of becoming homeless.

People will live there until a permanent home can be found.

Harlie said: “They can make me move out in 24 hours because it’s classed as interim emergency accommodations.

“It’s not even temporary accommodation, it’s the lowest of the low basically.

“If they then decide I’m moving you again I will have to pack up all my stuff again.

“I’m in a constant state of not knowing what the hell I’m meant to be doing.”

Harlie feels she is experiencing “one problem after another” and the family “need to be in a set routine”.

She continued: “The kids also get a lack of attention as well, because my time feels like it’s constantly filled with emails to the council.”

Harlie feels the council don’t truly understand the trauma her family are experiencing.

She said: “I have so many letters from the GP, CAMHS, the school and social workers.

“Nothing like that seems to make a dent with them, nothing seems to help with me getting a more permanent place to stay.

“I don’t care where they place me, they could place me anywhere.

“However, because I’ve got them it makes it that much bit harder, especially with all of their requirements.”

In an attempt to secure a forever home, for the past nine years Harlie has bid for council housing via the local bidding system.

Each time she has been left empty handed.

She said: “I don’t understand why I haven’t been given that yet.

“I know everybody’s circumstances are different but it hurts.”

Harlie is also a trained teaching assistant and has qualified as a parent group leader for local children’s centres but due to Frankie’s needs and her housing situation, she’s had to put her career on hold.

She told MyLondon that having to move so much is putting pressure on her financially.

Having to pay for three moving vans in two weeks has left her with “no money left”, she said.

She hopes her new home will give the family the stability they need but fears it could result in yet another disappointment.

Harlie said: “I’m a good tenant, I’ve always looked after my properties.

“There just must be a mark against my name, because I constantly feel like I’m at the bottom of the pile.”

Croydon Council have been approached for a comment.

What to do if your temporary housing isn’t safe

TEMPORARY housing is somewhere to live in the short-term. Some people might have to live in temporary accommodation for years before councils make a final offer of housing.

Here are a list of problems which could cause the council to move you.

- You cannot afford it

- You are overcrowded

- It is in need of repairs or in poor condition

- It is hard to access because of a health condition or disability

- It is too far to travel to your workplace or your children’s schools

- You are at risk of things like domestic abuse or racial violence

If this happens, Shelter recommends to:

- Accept the offer for the property even if you don’t want to live there

- Tell the council why your house is unsuitable

Your council should offer your alternative housing if your home is deemed unsuitable.

Money

Brits risk being fined £1,000 by HMRC if they don’t take action TODAY

BRITS have just hours left to tell HMRC if they need to register to make a Self Assessment tax return.

You must tell the tax office by today, October 5 if you need to complete a tax return and have not sent one before.

The assessment is used by the government body to collect income tax.

This tax is usually deducted automatically from people’s wages, pensions and savings.

However, people and businesses with extra income must report it in a tax return.

It is worth noting that this is not the date you need to file your Self Assessment, just the date you need to register your intention to file.

If you are not sure whether you need to register you can complete a simple assessment on the gov.uk website.

It is particularly important to register this year especially if you sell clothes or other items on websites such as eBay or Vinted.

That is because since the beginning of 2024 firms like Vinted have to pass on customer data to HMRC if a user sells 30 or more items, or earns over £1,700, in a year.

While the reporting rules have changed, this is not a new tax.

Those who earn more than £1,000 outside their regular employment were already required to file a Self Assessment tax form with HMRC.

The deadline to submit the return for the 2023/24 tax year – and pay any tax you owe – is January 31, 2025 online.

But there’s an earlier deadline of October 31 this year if you file via post.

It is worth bearing in mind that HMRC will fine you £100 for failing to file your return by the deadline.

Then, a £10 daily fine applies every day you don’t submit your tax return.

When do I need to file a tax return?

It is not just online sellers who are required to fill out a tex return.

The rule applies to the following:

- Your income from self-employment was more than £1,000

- Earned more than £2,500 from renting out property

- You or your partner received high-income child benefits and either of you had an annual income of more than £60,000

- Received more than £2,500 in other untaxed income, for example from tips or commission

- Are limited company directors

- Are shareholders

- Are employees claiming expenses over £2,500

- Have an annual income over £100,000

You can register online via the GOV.UK website.

To register online you must log on to your business tax account on the HMRC website and select ‘Add a tax to your account to get online access to a tax, duty or scheme’.

If you do not already have sign in details, you’ll be able to create them when you sign in for the first time.

If you do not want to register online you must send a form to the following address: Self Assessment, HM Revenue and Customs,

BX9 1AN, United Kingdom.

After you submit your form you will then get a unique taxpayer reference code (UTR) and activation code from the HMRC.

It’s a 10-digit number and it might just be called a tax reference.

This tends to arrive in the post 15 days after you register for a tax return.

Upon receiving the UTR you can then file a Self Assessment tax return online via the GOV.UK website or by post.

If you file by post the deadline is October 31 2024.

However, if you file online you have up to January 31, 2025.

Check out our step-by-step guide on filling out a tax return here.

Do I need to pay tax on my side hustle income?

MANY people feeling strapped for cash are boosting their bank balance with a side hustle.

The good news is, there are plenty of simple ways to earn some additional income – but you need to know the rules.

When you’re employed the company you work for takes the tax from your earnings and pays HMRC so you don’t have to.

But anyone earning extra cash, for example from selling things online or dog walking, may have to do it themselves.

Stephen Moor, head of employment at law firm Ashfords, said: “Caution should be taken if you’re earning an additional income, as this is likely to be taxable.

“The side hustle could be treated as taxable trading income, which can include providing services or selling products.”

You can make a gross income of up to £1,000 a year tax-free via the trading allowance, but over this and you’ll usually need to pay tax.

Stephen added: “You need to register for a self-assessment at HMRC to ensure you are paying the correct amount of tax.

“The applicable tax bands and the amount of tax you need to pay will depend on your income.”

If you fail to file a tax return you could end up with a surprise bill from HMRC later on asking you to pay the tax you owe – plus extra fees on top.

CryptoCurrency

Think Nvidia Stock Is Expensive? These 3 Members of the S&P 500 Trade at Even Higher Valuations.

Is Nvidia (NASDAQ: NVDA) stock overvalued? This question, while simple on the surface, is extraordinarily hard to answer.

Many investors use a valuation metric called a price-to-earnings (P/E) ratio. This popular metric is useful because it measures the stock price against a company’s profits. And in Nvidia’s case, its P/E ratio of 57 certainly looks expensive, considering it’s roughly double the P/E ratio for the S&P 500.

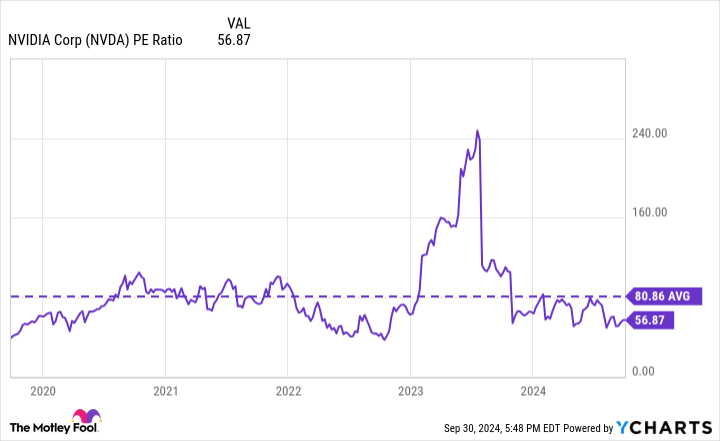

Then again, context is important. Nvidia stock might look expensive now. But it actually trades at a steep discount to its average P/E ratio valuation over the last five years, as the chart below shows.

Many say to avoid stocks with a high P/E ratio. But Nvidia’s high P/E over the last five years didn’t prevent the stock from rising over 2,700%.

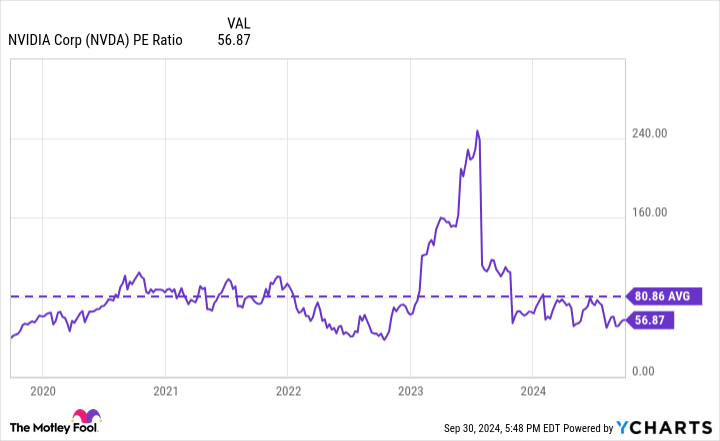

Nvidia stock is now cheaper than its five-year average valuation. Moreover, it’s not even the most expensive constituent of the S&P 500. In fact, Axon Enterprise (NASDAQ: AXON) and CrowdStrike (NASDAQ: CRWD) trade at higher P/E ratios, as of this writing. And even Costco Wholesale (NASDAQ: COST) has been more expensive than Nvidia at times in recent weeks.

Axon provides hardware and software to law enforcement agencies. CrowdStrike is a cybersecurity specialist. And Costco is a grocery and home-goods retail chain known for its membership-business model and low prices. As the chart below shows, none of these companies are necessarily cheap when looking at the P/E ratio.

Should investors sell stocks when their valuations are high? Should they only buy stocks that trade with below-average valuations?

If the path to long-term wealth were this simple, all investors would be rich. The entire investing process could be automated to sell when a P/E ratio was high and buy when a P/E ratio was low. But it’s not that simple. As I said at the start, it’s extraordinarily hard to say when a stock is actually overvalued.

Famous investor Bill Miller succinctly explains why valuing a stock is difficult. Miller has said, “100% of the information you have about a company represents the past, and 100% of the value depends on the future.”

Imagine for a moment a company valued at $10 billion and that has only made $1 million in profit. That stock would look extremely overvalued using the information we have from the past. But Miller reminds us that value has to do with the future. If this same $10 billion company earns $100 billion in profit over the next five years or so, then the stock is a screaming value stock.

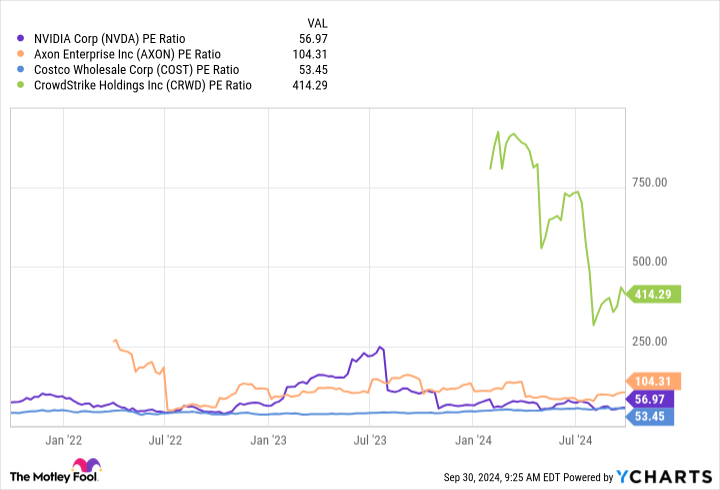

In my opinion, whether Nvidia is overvalued or undervalued today largely depends on how sustainable its profit margins are. As the chart below shows, its margin has soared as artificial intelligence has fueled demand for its hardware products.

I believe it’s reasonable to expect more growth from Nvidia in coming years. And if the company can defend its current profit margins, then the stock likely has more upside. But if its margins drop back down to more normalized levels, the stock might not fare as well. That’s a question that every Nvidia investor needs to answer.

But what about the other three companies that are as expensive or more expensive than Nvidia when looking at the P/E ratios? Well, here’s how I think about their valuations.

Two stocks I’m not so sure about today

Costco is a fantastic business, enjoying stability from 137 million membership card holders with a greater-than 90% renewal rate. But one thing it’s not is high growth. It only had 5% top-line growth in its fiscal 2024, which ended Sept. 1. This led to 14% growth for operating income, which is respectable. But investors shouldn’t expect these growth metrics to materially improve in its fiscal 2025.

That’s why I’m not a fan of the valuation of Costco stock today. Its valuation implies better-than-average long-term growth with the business whereas it’s more likely to be modest.

Turning to Axon, its growth is far superior to Costco, and it should stay robust for quite some time. The company has a competitive advantage because it sells its hardware in a package with its cloud-software services. Agencies are eager to renew their contracts with Axon because they don’t want to find a new solution for all their data. And there are still plenty of places that aren’t using Axon yet that could in the future.

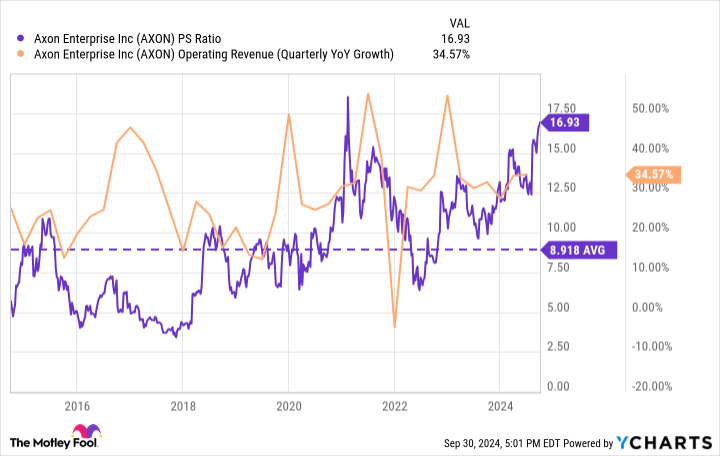

However, I still think there’s room for caution with Axon stock today. Its growth rate has been higher at times in the past. But by contrast, its price-to-sales valuation is almost double its 10-year average.

A clear winner?

CrowdStrike stock is by no means the cheapest stock on this list when using various valuation metrics. But once again, value is about the future. And CrowdStrike’s potential is still so large because of its market. Management projects that the market for its security platform will skyrocket from $100 billion in 2024 to $225 billion in 2028.

For perspective, CrowdStrike only has $3.5 billion in trailing-12-month revenue. In other words, it doesn’t even need to grab a significant portion of this market to have significant growth. Moreover, it has an easy path to growth. Only 29% of its customers use seven or more of its software products, whereas it has more than 20 options to chose from.

Cross-selling to existing customers is an easy path for growth for CrowdStrike. And what’s stunning is that its pipeline for new deals has completely recovered from its catastrophe earlier this year when a software defect caused a massive IT outage. The speed of its rebound strongly implies that its customers love its cybersecurity platform and products.

CrowdStrike stock is quite expensive when looking at the valuation metrics that measure its past results. But when considering its path for future growth, I believe the stock could still be a good value today and perhaps the best value of the four stocks mentioned here.

Should you invest $1,000 in CrowdStrike right now?

Before you buy stock in CrowdStrike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CrowdStrike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Axon Enterprise, Costco Wholesale, CrowdStrike, and Nvidia. The Motley Fool has a disclosure policy.

Think Nvidia Stock Is Expensive? These 3 Members of the S&P 500 Trade at Even Higher Valuations. was originally published by The Motley Fool

CryptoCurrency

IPhone Maker Hon Hai Sustains Revenue Rebound With Help From AI

(Bloomberg) — Hon Hai Precision Industry Co.’s revenue growth accelerated last quarter, sustaining a bounce-back as demand for the servers that drive AI development offset weak smartphone sales.

Most Read from Bloomberg

Apple Inc.’s main manufacturing partner, also known as Foxconn, reported sales rose 20.2% to NT$1.85 trillion ($57.9 billion) for the three months ended September from a year earlier. That compares with the average analyst projection of NT$1.78 trillion compiled by Bloomberg.

The company said the third-quarter sales figure was a record for that period and exceeded its own expectations for growth, without specifying the estimate. Sales increased 19% in the June quarter, the Taiwanese company’s first revenue gain since early 2023.

Foxconn’s sales is helped by a growing business supplying servers containing Nvidia Corp.’s AI chips. In August, it said it expected revenue to grow for the rest of the year. The company’s shares are up more than 85% in 2024.

What Bloomberg Intelligence Says

Hon Hai’s sales growth could accelerate in 2024-25 as the proliferation of AI emerges as the company’s key growth engine and iPhone demand stabilizes. Its vertical integration and global footprint put it in a favorable position as AI server complexity increases and demand for local production rises. More upside could be unlocked in the next few quarters as the supply of Nvidia’s GPUs improves and new models such as Blackwell GB200 are launched. Smart consumer electronics and computing products, which together accounted for 64% of total sales in 1H, could stabilize as smartphone and PC demand bottom out. Its EV contract manufacturing business might be lackluster amid a slowdown in global EV demand, and the contribution to sales could remain marginal.

— Steven Tseng and Sean Chen, analysts

Click here for the research.

Hon Hai and other hardware suppliers are riding a wave of spending on servers and data centers from big tech firms including Meta Platforms Inc. and Alphabet’s Google. But questions are bubbling up about how long the spending will last without a home run AI application that can bring the tech firms a return on the massive infrastructure investment.

As the world’s biggest assembler of the iPhone, the Taiwanese company’s business still remains closely tied with Apple’s. In the second quarter, about 40% of Foxconn’s revenue was still from the Smart Consumer Electronics category including the iPhone, while Cloud and Networking Products including AI servers, contributed to about 32%.

Investors had anticipated a rebound in smartphone demand in 2024, though some analysts warn initial signs suggest the latest iPhone hasn’t spurred as much demand as expected.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

CryptoCurrency

Here’s the Billionaire Investor You Should Be Following — and He’s Not Warren Buffett or Bill Ackman

It’s always a good idea for individual investors to look at what institutional investors, also called the smart money, are choosing. You should never base your decisions solely on others without doing research, but institutional investors have been professionally trained, and they often have decades of experience and the returns to back it up.

Following these successful investors is also a good way to find new ideas and check your thesis. Still, too often, I feel like individuals are only looking at two or three of the best investors instead of casting a wider net.

Warren Buffett and Bill Ackman certainly come to mind. I have nothing against Buffett or Ackman, who are certainly two of the best ever, but here’s the billionaire I think people should be following.

A strong record despite fundamental shifts

David Einhorn manages hedge fund Greenlight Capital, which he launched at the age of 27 after raising about $900,000 from family and friends. Einhorn rose to prominence from betting against — or short-selling — Allied Capital in 2002 when he questioned the company’s accounting practices.

Years after he announced his short position, the Securities and Exchange Commission validated Einhorn’s thesis, finding that Allied did indeed break securities laws due to its accounting practices.

Einhorn also played a key role during the Great Recession when he shorted Lehman Brothers in 2007 due to the company’s underwater securities holdings.

But like many of the greats, Einhorn also is known for his value investing approach, in which he looks for stocks trading below their intrinsic value. Earlier this year, he said that he believes the practice of value investing might be dead due to the broken market structure and the rise of passive investing:

Value is just not a consideration for most investment money that’s out there. There’s all the machine money and algorithmic money, which doesn’t have an opinion about value, it has an opinion about price: “What is the price going to be in 15 minutes, and I want to be ahead of that.”

This shift in market structure has led him to change his investing philosophy for his larger company holdings. Now, he focuses on companies that look cheap in value and return capital to shareholders through repurchases or dividends. It’s always a good sign to see even the best investors adapt, even though Einhorn is probably frustrated by this shift in market structure.

Despite changing his strategy, he has generated strong long-term returns. Greenlight has average annual returns of 13.1% since its launch in 1996, compared to 9.5% for the broader benchmark S&P 500. That equates to a total return of over 2,900% compared to the S&P 500’s 1,117%.

Einhorn’s big winner

The largest position in Greenlight’s portfolio is a homebuilding company called Green Brick Partners (NYSE: GRBK). He founded Green Brick in 2006 with experienced real estate investor and homebuilder Jim Brickman.

In 2008, amid the housing market collapse, Einhorn and Brickman started a real estate equity fund, where they initially began buying land and lending to distressed builders. By 2013, the housing market had bounced back and their fund had amassed a lot of land. Needing capital to grow, the two took the fund public, and it became Green Brick Partners. Brickman became chief executive officer and Einhorn became chairman of the board.

Greenlight Capital began purchasing Green Brick shares in the fourth quarter of 2014 at an average price of $7.20. Its first purchases amounted to roughly $112 million. While Greenlight has been in and out of the stock over the years, the position is currently valued at about $950 million.

Einhorn and Greenlight still owned more than 25% of its shares, according to Green Brick’s most recent proxy. The stock has almost doubled in the past year and is up more than 670% during the past five years.

All of those land purchases since 2006 have been a differentiator for Green Brick in the homebuilding business. At the end of the second quarter of 2024, it owned more than 28,500 lots, most of which are in the growing market of Texas. As inventory and land have become more limited and competitive to acquire, especially in strong and desirable housing markets, this strategy has paid off handsomely.

A value investor with plenty of runway

When I look at Einhorn’s current holdings, I see that he still owns plenty of value stocks, which I always find to be the most interesting to evaluate because they trade at attractive valuations and their futures depend on their ability to pay down debt, generate cash flow, and transform the trajectory of their earnings.

However, Einhorn is cognizant of changing market dynamics and is willing to adapt, an important characteristic for any investor. At just 55 years old, he has plenty of runway left in his investing career, I believe, and is a smart person with a unique viewpoint that individual investors should watch and study.

Should you invest $1,000 in Green Brick Partners right now?

Before you buy stock in Green Brick Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Green Brick Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Green Brick Partners. The Motley Fool has a disclosure policy.

Here’s the Billionaire Investor You Should Be Following — and He’s Not Warren Buffett or Bill Ackman was originally published by The Motley Fool

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology2 weeks ago

Technology2 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 weeks ago

Science & Environment2 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

News2 weeks ago

News2 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy this is a golden age for life to thrive across the universe

-

News2 weeks ago

News2 weeks agoYou’re a Hypocrite, And So Am I

-

News3 weeks ago

the pick of new debut fiction

-

Sport2 weeks ago

Sport2 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology1 week ago

Technology1 week ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNerve fibres in the brain could generate quantum entanglement

-

MMA1 week ago

MMA1 week agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Business1 week ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Football1 week ago

Football1 week agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

News2 weeks ago

News2 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoRethinking space and time could let us do away with dark matter

-

News2 weeks ago

News2 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News3 weeks ago

News3 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCardano founder to meet Argentina president Javier Milei

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMeet the world's first female male model | 7.30

-

Science & Environment1 week ago

Science & Environment1 week agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA slight curve helps rocks make the biggest splash

-

Business3 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoBest Exercises if You Want to Build a Great Physique

-

News2 weeks ago

News2 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

News2 weeks ago

News2 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Technology2 weeks ago

Technology2 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Business1 week ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

News3 weeks ago

News3 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoEverything a Beginner Needs to Know About Squatting

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Toning Workout for Women

-

Travel2 weeks ago

Travel2 weeks agoDelta signs codeshare agreement with SAS

-

Servers computers1 week ago

Servers computers1 week agoWhat are the benefits of Blade servers compared to rack servers?

-

Politics1 week ago

Politics1 week agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology1 week ago

Technology1 week agoThe best robot vacuum cleaners of 2024

-

Sport2 weeks ago

Sport2 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Technology2 weeks ago

Technology2 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBlockdaemon mulls 2026 IPO: Report

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Politics2 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News1 week ago

News1 week agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow one theory ties together everything we know about the universe

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business2 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Business2 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Politics2 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoKeep Your Goals on Track This Season

-

TV2 weeks ago

TV2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News2 weeks ago

News2 weeks agoChurch same-sex split affecting bishop appointments

-

Politics3 weeks ago

Politics3 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology2 weeks ago

Technology2 weeks agoFivetran targets data security by adding Hybrid Deployment

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSingle atoms captured morphing into quantum waves in startling image

-

Politics2 weeks ago

Politics2 weeks agoLabour MP urges UK government to nationalise Grangemouth refinery

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

You must be logged in to post a comment Login