Money

I was stunned after finding almost £40,000 in lost pension cash – how to check if you’re missing out too

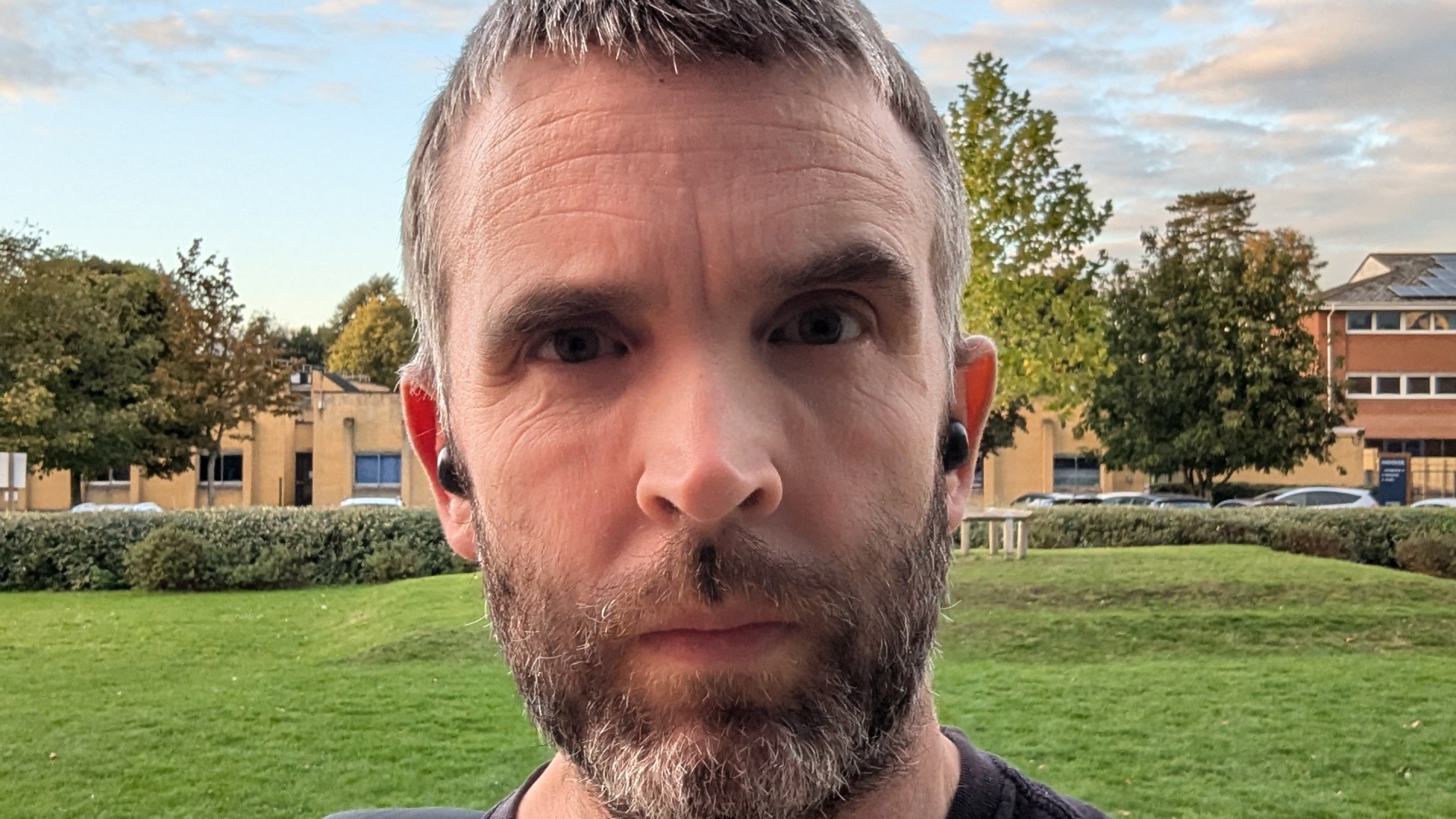

SOFTWARE engineer Alex Fielder could never have imagined unearthing almost £40,000 in pension pots that he’d lost track of.

The 44-year-old, who lives in Andover, Hampshire, with his wife and two children, set about finding any forgotten funds after being made redundant back in 2021, after being furloughed.

Fortunately, Alex was only out of work for a couple of weeks before being hired by another firm – but two years later, he was made redundant again.

He was then with this firm for just shy of two years before being made redundant a second time.

The sudden shock of being made redundant left him feeling the need to get his finances in order.

“A combination of having experienced redundancy [twice] and watching a good friend of mine get sick was a stark reminder to me that ‘life happens,’ and that you never quite know what’s around the corner,” he said.

“That’s when I decided I needed to get my ducks in a row, just in case.”

He started hunting around for old paperwork relating to old pensions but didn’t make much progress.

One day, when he was working out of a co-working space in Andover, he got chatting to someone who knew all about Penny, an app which traces your old pension pots, and decided to give it a go.

After downloading the Penny app in January 2023, Alex realised he had four pots that he’d lost track of, dating back to 2002.

“I first started paying into a pension aged 21,” he said.

“But I’ve moved jobs several times since then. Having worked in different places over more than two decades, it’s really hard to keep on top of everything.

“When I stopped to think about it, I realised I wasn’t sure exactly how many pensions I had.”

The missing pensions problem

Alex’s story is more common that you might imagine.

Recent figures suggest millions of savers are thought to have lost track of old pots worth thousands of pounds.

According to recent findings from the Pensions Policy Institute, a whopping £26.6 billion is sitting in pensions across the UK where the provider is no longer in contact with the saver, affecting around 2.8 million people.

The average lost pension, it found, amounts to approximately £9,500, with those aged 55 to 75 seeing an average of £16,004 in misplaced pots.

A separate report by provider PensionBee earlier this year came out with similar findings, revealing that one in 10 workers believe they’ve lost a pot worth £10,000 or more.

Finding Penny, an app which aims to help workers consolidate their pensions, proved to be a bit of a turning point for Alex.

With the help of the nifty tool, the savvy saver soon found out he had one pot with The People’s Pension, one with Willis Towers Watson, one with Scottish Widows, and one with Standard Life.

Alex said: “There were different amounts in each, ranging up to a huge £16,000 in one.”

Discovering this has been a bit of a game-changer for him.

“It’s given me a much clearer idea of how much I need to save between now and the end of my working life to enjoy a decent retirement.”

According to figures from the Pensions and Lifetime Savings Association, the average level of annual income required for a single person to live a ‘comfortable’ retirement is £43,100. For couples, this figure stands at £59,000.

While using the Penny app has been easy and hassle-free for Alex, getting the pension pots transferred across to Penny from the various other providers in question has not been quite so plain sailing.

Alex said: “The first pot which got moved was the one I’d accrued with The People’s Pension between 2015 and 2021.

“This transfer completed in July 2023 and was totally seamless.”

“The experience with the Standard Life pension was also very straightforward.

“I’d accrued this pot while working for a company which I left in 2023,” said Alex. “Once again, it all happened within weeks.”

The total transferred from these two pots amounted to around £20,000.

However, two of his other pots are taking much longer and he’s made a complaint with the firms.

He said: “Thankfully, Penny has been great at chasing the troublesome providers. I’m now hoping the complaint will help to speed things along.”

Peace of mind from finding the pension pots

For Alex, one of the biggest things to come out of tracking down lost funds – and combining them into one place – is the peace of mind it provides.

He said: “Now that I’m well on the way to having all my pension savings in one place, I can relax a lot more as I know where they are – and how I can access them.

“I can also pass this information on to my next of kin, meaning there’s one less thing for loved ones to worry about.”

Bringing pots together has put Alex back in control.

While the money Alex has found via Penny is not huge, it’s certainly a very welcome boost.

“Finding these missing pots will hopefully make financing my later years a little easier,” he said. “It could really help improve my quality of life when I’m older.”

This is especially important for the hard-working dad, as he doesn’t have any other savings earmarked for retirement.

How to track down your own pensions

With Penny, all you need to do is provide details such as your National Insurance number and any information you have about old jobs. This could be the name of your employer, the dates you worked there, and the name of your pension provider, if you can remember it.

Alex said: “Tracking down lost and forgotten pots really is so easy to do with Penny as the app is really user-friendly.I f you have queries, you get responses very quickly via instant messaging. There’s a real person who can help.”

Once you’ve located forgotten funds, Penny then combines them into one new pot. You can view this via a dashboard on the app.

Penny charges 0.75% for managing your pension and there is no additional fee. The only exception is if you opt to put your money in an ‘ethical fund.’ In this case, you will get charged 0.78%.

If you are someone who has lots of different pensions, you may jump at the idea of bringing them all together as this will mean you have less paperwork to deal with.

You might even be able to save by combining pots into a provider with a lower fee. But you do need to check this is the right move for you.

It’s important to see if there are exit fees or potential penalties that may be incurred for transferring your pots. You must also find out whether you risk missing out on valuable benefits by doing so, such as guaranteed annuity rates.

Other tools to help you track down forgotten pots

If reading this has spurred you to take action, here are some of the tools available

- Be your own detective – try putting in a call to the HR department of your old workplaces. The key is to have as much information as possible to hand when you do, such as your NI number, and the dates you were employed there.

- The Pension Tracing Service – – this Government service is free to use, but only gives details of your pension provider. There is no option to combine and manage pots.

- Moneyfarm recently launched a free ‘Find, check & transfer’ service which does the heavy lifting for you.

- Standard Life has also launched a free tracing tool, powered by pension-finding platform, Raindrop.

- Pension firm AJ Bell has a tracing service to help savers find old pensions – with the option to combine them into one pot. Just be aware that while most providers don’t charge for their tracing service, if you end up opting to consolidate, you will face charges. With AJ Bell, for example, you’ll face a fee of up to 0.6%, to manage your pot.

Money

Over three million workers to get FREE takeaway delivery for a year – see the full list of jobs that qualify

MORE than three million workers are now able to get free takeaway delivery for a year.

Deliveroo and Blue Light Card have teamed up to offer free Deliveroo Plus Silver membership to essential workers in the UK.

In the scheme, Blue Light Card members – which is available to emergency service workers, NHS staff, teachers, social care workers and members of the armed forces – can get free delivery on all Deliveroo orders for 12 months as well as other deals and discounts.

Deliveroo Plus Silver normally costs £3.49 a month. That’s a saving of just under £42 for the entire year.

Under the terms of the deal, those who sign up get free Deliveroo Plus Silver membership for 12 months which gets them free delivery through the app on eligible orders worth £15 or more from restaurants and £25 from retail stores.

Exclusive discounts from major brands such as Nando’s, Wagamama, Pho, Giggling Squid, Kokoro, Gail’s Bakery, Waitrose, Wingstop, Sainsbury’s, Morrisons, Co-op, Boots, and others are also on offer.

Also on offer is access to localised deals and Deliveroo Rewards, where members can earn £8 off their 4th order when they make three orders at the same place within 30 days.

Members can also access exclusive Deliveroo Plus-only offers tailored to their local area all year round.

They’ll also join the Deliveroo Rewards programme, which means if they make three orders at the same place within 30 days, they’ll get £8 off their 4th order.

The scheme is designed to give a helping hand to essential workers, with many of those working unpredictable or long hours, and provides round-the-clock access to meals and essentials delivered right to their door or workplace.

In 2023, the 4.1million existing Blue Light Card members saved more than £330million through various offers and discounts.

Andy Collins, COO from Blue Light Card said: “By offering free Deliveroo Plus Silver, we’re proud to provide Blue Light members not only with a range of exclusive offers, but with greater convenience too – whether they’re ordering to their home or workplace.

“For many shift workers, being able to get their favourite meals or essentials delivered round-the-clock is a game-changer, so this unique partnership with Deliveroo is another way for us to show our hardworking and dedicated community that we’re there for them 24/7.”

Caroline Harris, VP of Marketing at Deliveroo, UKI, said “We are very excited to announce this first-of-a-kind partnership for Deliveroo with Blue Light Card, which aims to give back to their community members by offering them Deliveroo Plus Silver for free.

“We’re proud to reward Blue Light members with free delivery when they order from their favourite neighbourhood restaurants, grocers, and retailers, as well as exclusive members-only discounts.

Who is eligible to get the Blue Light Card?

Only those in certain emergency services or key worker roles can apply for a Blue Light Card.

In 2024, teachers were added to the list of workers who are allowed to join the discount scheme.

A full list of those who are eligible includes anyone in the following roles:

- Ambulance service

- Blood bikes

- Fire service

- Highways traffic officers

- HM armed forces

- HM armed forces veteran

- HM coastguard

- HM prison and probation service

- Home Office (Borders and Immigration)

- Independent lifeboats

- MoD civil servant

- MoD fire service

- MoD police

- NHS

- NHS Dental Practice

- Pharmacy

- Police

- Red Cross

- Reserved army forces

- RNLI

- Search and rescue

- Social care

- St Andrews ambulance

- St John ambulance

- Teachers

“This partnership with Blue Light Card and Deliveroo enables us to give back to essential workers from across the community and express our utmost appreciation for their incredible work every day.

“Whether placing an order to their home or place of work, we can’t wait to make it even more convenient for the UK’s essential service workers to get what they want and need delivered to their doorstep.”

Membership to Blue Light Card for access to market-leading discounts and rewards is quick and easy.

Those employed by organisations and non-government organisations that work directly on homelessness across the UK are also eligible.

Register online at www.bluelightcard.co.uk.

A card costs £4.99 and is valid for two years.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Full list of supermarket Christmas delivery slots – and exact dates to order by revealed

THE high street supermarkets have got their Christmas delivery slots open for bookings already – and here’s all the key information you need to get your festive food sorted.

While the big day is more than 70 days away many households will want to get their preparations underway to avoid disappointment.

Demand for a festive food delivery straight to your door has surged in recent years as it saves time, allowing people to get on with other necessary tasks.

But many are aware that bagging a slot during the festive period is notoriously difficult.

So it is worth being aware of the key dates of your favourite grocer so you are not disappointed.

Asda

The UK’s third-largest grocer has also announced when shoppers could secure their booking.

Asda is giving its delivery pass customers a head start to book their slot.

Customers who pay for this feature can book their slots for Christmas from October 15.

Meanwhile, non-pass holders can book their slot from October 22.

The supermarket said that over one million home delivery and click-and-collect slots will be available in the week leading up to Christmas.

The minimum online spend at Asda is £40 for delivery and £25 for click and collect.

Shoppers can also make changes or additions to their basket up until 11pm the night before their delivery or collection.

Iceland

The major retailer’s service enables shoppers to pre-book and pay for their Christmas dinner and other festive treats in advance, which will then be delivered to their door five days later.

- Slots available from 11/12/2024: Delivery on 16/12/2024

- Slots available from 12/12/2024: Delivery on 17/12/2024

- Slots available from 13/12/2024: Delivery on 18/12/2024

- Slots available from 14/12/2024: Delivery on 19/12/2024

- Slots available from 15/12/2024: Delivery on 20/12/2024

- Slots available from 16/12/2024: Delivery on 21/12/2024

- Slots available from 17/12/2024: Delivery on 22/12/2024

- Slots available from 18/12/2024: Delivery on 23/12/2024

- Slots available from 19/12/2024: Delivery on 24/12/2024

Unfortunately for shoppers, the budget supermarket chain will not be offering its click-and-collect service for Christmas bookings.

And Iceland has unveiled its Christmas 2024 range which comes with a pigs in blankets Yorkshire pudding.

Morrisons

Delivery Pass customers were be able to book their slots from October 2.

Customers without a Delivery Pass can book slots from October 9.

A Morrisons Delivery Pass allows you to shop online as often as you like without having to pay for delivery every time you checkout.

All shoppers need to spend at least £25 before they can check out an online order.

Those without a delivery pass will be charged between £1.50 and £6 to secure a one-hour delivery time slot.

People are advised they shouldn’t get a delivery pass unless they think it will save them money in the long term – not just to get a Christmas slot.

Morrisons has also unveiled its Christmas food range.

Sainsbury’s

Sainsbury’s has today confirmed when customers can book a slot for their Christmas shop to be delivered.

Loyal customers who have the supermarket’s “Delivery Pass” get first dips and will be allowed to book home delivery and click and collect from Wednesday, October 16.

Delivery Pass holders pay a flat rate to Sainsbury’s to get their orders for free at all times of the year.

Meanwhile, non-pass holders will be allowed to book slots from the following week, October 23.

Both can schedule deliveries for between December 18 – 24.

Christmas delivery slots open on October 16 for Delivery Pass customers and 23rd October for all customers.

Customers can amend their baskets until 11pm the day before their order is due.

Tesco

Those already thinking about Christmas preparations can pre-book their Christmas food delivery from the beginning of next month.

However, Tesco is giving customers who pay for an annual delivery pass first dibs.

The supermarket’s delivery plan and click and collect delivery plan customers can book their slots from 6am on Tuesday, November 5.

This gives customers a one-week head start on regular shoppers, who will have to wait until November 12 to nab a slot.

But if you also want to get ahead of the game, you can still sign up to the relevant delivery plan by Monday, November 4.

Tesco delivery plans range from £3.99 a month to £7.99 a month, depending on what level of service you want.

You could save on each plan by paying for 12-months up front.

The click and collect plan costs £2.49 a month.

Waitrose

The posh grocer has already allowed its customers to start booking slots for Christmas.

It costs £4 to book a slot and orders must be over £40.

But if shoppers are keen to get their Waitrose shop delivered to their home they should act fast.

Most of the slots from Sunday, December 22 to Tuesday, December 24 are fully booked.

Dates are still available for Friday, December 20 and Saturday, December 21.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

I’m unable to walk and felt humiliated after TUI staff wouldn’t help – now they won’t pay compensation

Q) I AM struggling to get compensation after TUI failed to pass on my disability needs.

I booked a trip to the Dominican Republic to treat my family in July 2019.

When I booked the trip, I told the agent I have mobility issues and would need special seating and assistance getting around.

But on the flight, I was put in standard seating and there was no ramp to help me get on and off.

Staff then wouldn’t let me use the toilet in the premium section, after being told to go there to avoid queuing.

The whole thing was humiliating and I was in pain after the flight.

I feel I’m owed some compensation as my illness was not accommodated at all. Can you help?

Kevin Carter, Kingston, Surrey

A) Travelling can be a nightmare at the best of times, but if you have a disability, it can be extra difficult.

So, you were relieved when you told TUI about your needs and an agent reassured you that it would pass them on.

Imagine your horror, then, when you came to board your flight and discovered there was no ramp available to help you get on and off.

This meant you had to climb the stairs, which took you a long time and caused you considerable discomfort.

Then, once you got on board, you told me you were put in a standard seat, despite asking for extra legroom seat, causing you even more discomfort.

And during the flight, you said you told an attendant you needed to use the toilet, and they directed you to the premium section of the aircraft to avoid queueing.

But when you followed their directions, another flight attendant said you could not use this toilet and told you you had to wait in the queue.

By the time you arrived at your destination, you felt shaken and confused.

When I spoke with TUI, it apologised for the issues you faced with your flight.

However, it said it couldn’t find your request for accessibility help in its files.

It’s possible the caller you spoke with failed to note this down, but as there are no records, TUI can’t confirm what exactly happened.

Despite this, it has now offered you £200 cash as compensation for your experience.

When it reached out to you, it also told you that your feedback had been taken on board.

If you do have accessibility requirements, it’s really important to tell flight staff in advance to make sure everything is accommodated for, and it’s worth double checking before you arrive that everything is in place.

If you do this and you don’t get the help you requested, you can make a complaint.

Try complaining directly to the airline in the first instance, and ask how you’d like them to put it right.

Put your complaint in writing so you can refer back to it if needed later.

If this fails, you can escalate your complaint to a third party like a dispute resolution service.

Our Squeeze Team has won readers a total of: £183,310

How to contact our Squeeze Team

Our Squeeze Team wins back money for readers who have had a refund or billing issue with a company and are struggling to get it resolved.

We’ve won back thousands of pounds for readers including £22,000 for a man asked to pay back benefits to the DWP, £2,800 for a family who had a hellish holiday and £635 for a seller scammed on eBay.

To get help, write to our consumer champion, Laura Purkess.

I love getting your letters and emails, so do write to me at squeezeteam@thesun.co.uk or Laura Purkess, The Sun, 1 London Bridge Street, SE1 9GF.

Tell me what happened and don’t forget to provide your phone number so I can ring you if I need more information. Share with me any reference number the company has given you relating to your case, or any account name/number if you’re a customer.

Include the following line so I can go to the firm on your behalf: “I give permission for [company’s name] to discuss my case with Laura Purkess at The Sun”.

Please include your full name and location in your email/letter.

Money

Four key pension deadlines coming before Xmas – will you qualify for extra payments worth up to £485?

WINTER is fast approaching, and as the days get shorter and the nights get colder, lots of payments are set to kick in to help you keep the heating on.

But to make sure you qualify, you need to be in receipt of certain benefits, and you need to claim these by specific deadlines to get the bonuses.

Some of the deadlines have passed for benefits aimed at working-aged people, but they are still open to people who might get Pension Credit because this can be backdated.

Others are still available for people who qualify for benefits aimed both at people of working age and those who are past state retirement age, but you’ll need to move quickly.

We’ve rounded up all the key deadlines you need to be aware of.

November 1 – deadline to get cold weather payments – £25 per week of severely cold weather

The Cold Weather Payments scheme pays Brits £25 for each week of below freezing temperatures between November 1 and March 31.

The bonus is designed to help with the additional costs of heating during these periods of severe cold.

To get the bonus, you need to be in receipt of certain benefits and the temperature needs to drop for seven consecutive days.

Every time that happens, if you qualify, you’ll get the extra money automatically. There’s no deadline as such, but as the payments start kicking in from November 1, you need to apply for the relevant benefits before then to take advantage of the scheme.

Benefits that qualify for cold weather payments include:

Pension Credit

Everyone on Pension Credit should get cold weather payments. You can also backdate your claim by three months.

Income Support and income-based Jobseeker’s Allowance (JSA),

If you have any of the following:

- a disability or pensioner premium

- a child who is disabled

- Child Tax Credit that includes a disability or severe disability element

- a child under 5 living with you

Income-related Employment and Support Allowance (ESA)

You should get CWPs f you’re in a work-related activity or support group. Even if you’re not in a group, you might still get them if you have:

- a severe or enhanced disability premium

- a pensioner premium

- a child who is disabled

- Child Tax Credit that includes a disability or severe disability element

- a child under 5 living with you

Universal credit

If both you are your partner (if you have one) are not employed or “gainfully employed” and:

If you have a disabled child amount in your claim, you should be eligible whether you are employed, self-employed, or not working at all.

Support for Mortgage Interest (SMI)

You’ll usually get Cold Weather Payments if you’re treated as getting a qualifying benefit where one of the following applies:

- a severe or enhanced disability premium

- a pensioner premium

- you have a child who is disabled

- you get Child Tax Credit that includes a disability or severe disability element

- you have a child under 5 living with you

You’re usually treated as getting a qualifying benefit if you apply for it but do not receive it because your income is too high.

November 10 – deadline to claim Pension Credit to get the warm homes discount – £150

The Warm Homes Discount is a one-off £150 reduction on your energy bills. You might be able to apply it to your gas bill instead, if your supplier provides you with both.

To get it, you need to be on one of Housing Benefit, income-related Employment and Support Allowance (ESA), income-based Jobseeker’s Allowance (JSA), Income Support, Pension Credit and Universal Credit.

You could also qualify if your household income falls below a certain threshold, and you get either Child Tax Credit or Working Tax Credit.

The deadline for most people passed in August, but if you are above state pension age and would qualify for Pension Credit – there’s still time to apply.

The deadline for doing so is November 10, which will allow you to backdate your Pension Credit claim far enough to still qualify for the Warm Homes Discount.

You need to get something called the ‘Guarantee Element’ of Pension Credit. To qualify, you must live in England, Scotland or Wales and have reached State Pension age.

When you apply for Pension Credit your income is calculated, and must be below £218.15 a week or £11,343.80 a year if you’re single.

For couples the thresholds are £332.95 a week or £17,313.40 a year.

Find out how to claim on the gov.uk website.

December 2 – deadline to qualify for the DWP Christmas bonus – £10

The Christmas Bonus is a one-off, tax-free £10 payment made before Christmas, paid to people who get certain benefits in the qualifying week. This year, that’s the week that starts on December 2.

You do not need to claim – you should get paid automatically, but if you think you might qualify for one of the benefits that gets the bonus, you need to be receiving it before that date.

The benefits that qualify for the £10 bonus include:

- Adult Disability Payment

- Armed Forces Independence Payment

- Attendance Allowance

- Carer’s Allowance

- Carer Support Payment

- Child Disability Payment

- Constant Attendance Allowance (paid under Industrial Injuries or War Pensions schemes)

- Contribution-based Employment and Support Allowance (once the main phase of the benefit is entered after the first 13 weeks of claim)

- Disability Living Allowance

- Incapacity Benefit at the long-term rate

- Industrial Death Benefit (for widows or widowers)

- Mobility Supplement

- Pension Credit – the guarantee element

- Personal Independence Payment (PIP)

- State Pension (including Graduated Retirement Benefit)

- Severe Disablement Allowance (transitionally protected)

- Unemployability Supplement or Allowance (paid under Industrial Injuries or War Pensions schemes)

- War Disablement Pension at State Pension age

- War Widow’s Pension

- Widowed Mother’s Allowance

- Widowed Parent’s Allowance

- Widow’s Pension

December 21 – deadline to claim Pension Credit to get the winter fuel payment – worth up to £300

The Winter Fuel Allowance gives qualifying Brits over State Pension Age up to £300 to help with the cost of paying for heating bills.

This year, controversially, Labour announced that it would no longer be a universal benefit and would instead only be paid to people who get certain benefits.

For most people, you needed to be in receipt of one of the qualifying benefits by September 22 to get the free cash. But because Pension Credit can be backdated, you’ll still get the winter fuel payment, if you’re receiving it by December 22.

You get £200 if the oldest person in your household is between 66-80, and £300 for households with someone aged 80 or over.

It takes between six and eight weeks to process new Pension Credit claims, due to high volumes of applications. But as long as you apply by 21 December and your claim is successful you will get Winter Fuel Payment.

Find out how to claim on the gov.uk website.

Crucial to claim Pension Credit if you can

HUNDREDS of thousands of pensioners are missing out on Pension Credit.

The Sun’s Assistant Consumer Editor Lana Clements explains why it’s imperative to apply for the benefit..

Pension Credit is designed to top up the income of the UK’s poorest pensioners.

In itself the payment is a vital lifeline for older people with little income.

It will take weekly income up to to £218.15 if you’re single or joint income to £332.95.

Yet, an estimated 800,000 don’t claim this support. Not only are they missing on this cash, but far more extra support that is unlocked when claiming Pension Credit.

With the winter fuel payment – worth up to £300 now being restricted to pensioners claiming Pension Credit – it’s more important than ever to claim the benefit if you can.

Pension Credit also opens up help with housing costs, council tax or heating bills and even a free TV licence if you are 75 or older.

All this extra support can make a huge difference to the quality of life for a struggling pensioner.

It’s not difficult to apply for Pension Credit, you can do it up to four months before you reach state pension age through the government website or by calling 0800 99 1234.

You’ll just need your National Insurance number, as well as information about income, savings and investments.

Money

Parent gets paid £677 in compensation after fighting unfair ‘free hours’ nursery fees – could YOU claim money back too?

A PARENT has been awarded £677 in compensation from his local council after complaining that his daughter’s nursery charged him fees for free childcare hours, The Sun can reveal.

Earlier this year, we exposed how nurseries had begun charging parents new fees following the introduction of extra free childcare hours in April, which goes against government guidance.

We have seen evidence of “supplementary fees”, “registration fees” and new “consumables charges” being added, even where parents have offered to provide those consumables themselves.

Under government guidance, nurseries cannot charge so-called top-up fees, non-refundable registration fees or any other fees not clearly identified as for consumables, for free childcare hours.

Charging fees for consumables is allowed, but they should not be made a condition of accessing a free place and an alternative should be offered, such as providing your own items, the guidance says.

The extra free childcare hours in April was the first phase of a plan to offer 30 free hours to all eligible parents of children between nine months and three years old by September 2025.

But at the time, a number of parents reported seeing new fees being added to their invoices.

Nurseries have long argued that they don’t receive enough funding from the Government to offer free hours and need to find ways to make up the shortfall.

But the Government says the funding it provides is adequate.

Following our investigation earlier this year, the Department for Education said it was collecting evidence of nurseries charging extra fees for free hours and would intervene if it believed it was a widespread issue.

The Sun has now learned that one parent has won back £677 from his local council after complaining that his nursery was charging him a “supplementary fee” per hour of free childcare.

Alex Hays* from near Dover in Kent, was awarded £677 by Kent County Council following a five-month battle over the fees.

Alex and his wife only claimed 20 hours of childcare a week for their three-year-old daughter, so all of these hours were funded.

But he said their nursery, Kid Ease in Swingfield, near Dover, charged them £1.50 per hour, or £150 a month, in so-called supplementary fees for those funded hours.

Then in March this year, Kid Ease emailed Alex a letter that let him know these fees would be rising to £1.95 an hour.

The letter from the childcare provider, seen by The Sun, blamed the fee hike on a “turbulent economy” and “inflationary pressures” putting it under financial pressure.

“Together, these factors mean we will need to introduce a fee increase from 1st April 2024,” the letter said.

It went on to say parents would now be charged a supplementary fee of £1.95 per hour of funded childcare.

At this point, Alex began researching whether parents could be charged supplementary fees and discovered this was actually against government guidelines.

“I knew they probably shouldn’t have been charging the fees, but when they increased them I decided I’d had enough,” Alex said.

“I asked for an itemised breakdown of what the fees were paying for, but they just said it was for consumables like food and refused to give me an actual breakdown.”

Alex and his wife then decided to formally complain to Kent County Council, which appointed a third party, The Education People, to investigate.

After 12 weeks with no response, they escalated the case to the Local Government Ombudsman, which gave The Education People 28 working days to provide a final response.

Finally, in September, The Education People found in favour of Alex, and, in an email seen by The Sun, said it was working with Kid Ease to ensure it complies with the Kent Provider Agreement going forward.

Alex and his wife paid a total of £909 in extra fees for claiming free childcare hours to Kid Ease nursery and received back £677 in compensation – roughly 75%.

This was because they had £4 per day deducted for lunches for 58 days, totalling £232.

The family has since moved their daughter to another nursery.

Alex is now urging other parents to complain if they are being charged any extra fees for free hours.

“The guidelines are very clear, working parents absolutely cannot be forced to pay extra fees by providers and shouldn’t feel that they have to in order to receive or continue receiving free childcare,” he said.

“If you are a parent and want to pay fees for additional services, that’s completely up to you, but I’d encourage you to at least ask what it’s paying for.”

A Department for Education spokesperson told The Sun: “We have published statutory guidance for local authorities which makes clear that extra charges for consumables or additional hours should not be made a condition of accessing a free place – and continue to monitor this issue closely.”

The Sun contacted Kent Council for further comment. It is understood that Kid Ease is challenging the decision by The Education People.

Kid Ease states it may charge a “supplementary fee” for funded hours in its most recent terms and conditions available online.

Here’s what Kid Ease said

A spokesperson for Kid Ease said the following:

“Concerning the parent’s complaint, Kid Ease investigated this matter thoroughly and submitted considerable evidence to Kent County Council. Unfortunately, the Council made its initial decision in respect of the complaint without reference to Kid Ease. The decision has been formally challenged, and whilst the Council considers our challenge, we are unable to comment in detail.

“We can, however, confirm Kid Ease is fully aware of and at all times complies with statutory guidance on FEE and supplementary charges for free childcare places. We do not charge top up fees or registration fees. Additional fees are only charged for consumables as well as costs such as trips and specialist tuition, all of which are permissible.

“Permissible charges for consumables and services are communicated to all parents, both verbally and in writing, prior to parents making their choice. By email, this parent confirmed these permissible charges had been explained and requested sessions with supplementary fees.

“All FEE funded sessions are provided free and invoiced at £0 and parents always have a choice of free sessions or free sessions with supplementary fees.

“Kid Ease disagrees with and is challenging Kent County Council’s decision because we consider it to be unlawful and not in accordance with the Government’s and their own Guidance.

“Kid Ease has always followed Government Guidance & the Kent Provider Agreement and is mystified by the Council’s conclusion. The Council has not specified which part of the Guidance Kid Ease has allegedly breached.”

New fees for free childcare hours

Alex is one of a number of parents who has complained that they began being charged new fees when extra free childcare hours kicked in.

Earlier this year, one parent told The Sun they began being charged a compulsory £29 daily “consumables charge”, regardless of whether they were only claiming free hours or not.

They were also charged a £55 “non-refundable registration fee” just for registering for their free hours, which is explicitly against government guidance.

An email to the parent, whose child attended a nursery in West Byfleet, Surrey, said: “All children claiming funding of either 15 or 30 hours per week will be required to pay a daily fee for consumables.

“When claiming a funded-only place, parents are required to pay a non-refundable £50 registration fee.”

Another parent from Huddersfield reported seeing a compulsory consumables charge worth “1x daily rate” appear on her monthly invoice, worth an extra £61. She only claimed free childcare hours.

Unfortunately, many parents are afraid to stand up their nursery because they’re scared of their place being withdrawn – but it’s important to remember these charges actually aren’t allowed to be compulsory under government rules

Martyn James

Since our previous investigation, The Sun has learned the West Byfleet nursery has written to parents informing them it will be removing the compulsory charge for free childcare hours.

But many parents are still faced with these fees – and experts say that parents are too afraid to complain for fear of losing their childcare place.

Consumer expert Martyn James said: “Unfortunately, many parents are afraid to stand up their nursery because they’re scared of their place being withdrawn.

“But it’s important to remember these charges actually aren’t allowed to be compulsory under government rules.”

What fees can nurseries charge?

Nurseries are allowed to charge for consumables, even for free childcare hours. This can cover things like food, nappies or other items used during the day.

However, these fees cannot be compulsory. The nursery must offer a reasonable alternative, such as allowing you to provide your own consumables or forfeiting trips out.

Under government guidance, nurseries are not allowed to charge:

- A top-up fee (any difference between a provider’s normal charge to parents and the funding they receive from the LA to deliver the free place)

- A non-refundable registration fee. (A fee to register for a place that is not returned to you when you take up that place. This may also be called an “enrolment fee”, “admissions fee” or “booking fee”)

- Any additional fees on top of your funded hours that are not specifically identified as being for any consumables – although providing these yourself should be an alternative option

The government advises that parents should speak to their local authority or provider about any additional charges on top of the childcare hours they receive through the entitlement, including any alternative options they offer.

How to complain if you think you’re being charged unfairly for free hours

If you’re unhappy with the fees your nursery or childminder is charging you, your first port of call should be to speak to your provider.

Ask them for a breakdown of what any extra fees are paying for, and remind them of government guidance.

If they refuse to provide a breakdown or offer an alternative, raise a formal complaint.

They should have a formal complaints process they can share with you.

If you don’t agree with the outcome of the complaint, you can speak to Citizens Advice for further assistance or legal advice.

Or, like Alex, contact your local council to start a complaint that way.

It’s best to keep any evidence you can to back up your claim, such as emails detailing any charges, or correspondence refusing to provide a breakdown or alternative options.

Mr James advised: “If you’re worried about losing your place, consider speaking to your local council to let them know anonymously, or ask Citizens Advice if it can intervene without revealing who you are.”

*name changed to protect identity

Do you have a money problem that needs sorting? Get in touch by emailing squeezeteam@thesun.co.uk

Money

Inside the humble three-bed home that could be yours for £290k – but it hides an incredible secret

A CHARMING three-bed flat has come onto the market for an affordable £290,000 – but you’ll have the opportunity to live like a king in a multi-million pound home.

The cosy property is part of a grand castle on the outskirts of Scotland’s Edinburgh – and it’s on sale for the price of a typical home in the UK.

The three-bedroom flat is part of an imposing fortress in Bonaly, an old village just over five miles south west of Edinburgh’s city centre.

The historic building has a high tower and turrets, and sits at the foot of the Pentland Hills, surrounded by stunning grounds that include a stream.

It is called Bonaly Tower and sits on the site of a seventeenth century farmhouse that once stood at the centre of the village of Bonaly.

The farmhouse was the country residence of Lord Henry Cockburn, who extended the property into something with a little more grandeur.

The peel tower was reportedly added to the building in 1839.

Bonaly Tower was said to be the venue for frequent meetings of the ‘Friday Club’, a group of leading Edinburgh literati, which were hosted by Lord Cockburn.

It is certainly an impressive venue for such occasions, being set in beautiful private gardens.

These gardens include a decorative wrought-iron gate and recesses filled with statues.

One of the statues is of Shakespeare, which was reportedly salvaged from the demolition of the Theatre Royal in Shakespeare Square in 1860.

Several other pieces of decorative stonework appear in the garden including urns, some bird baths and a plaque depicting Edinburgh Castle.

The flat is being advertised for sale via Glenham estate agents, which is inviting ‘offers over £290,000’.

The average price of a property in Edinburgh is £349,405, according to Zoopla.

It is around £20,000 higher than the average value of a home in Britain, which currently stands at £329,628.

Daniel Copley, consumer expert at Zoopla, said: “While a lot of us might aspire to live in a castle, it’s rare that the opportunity arises for one to have that happy ever after at such an affordable cost.

“The property is ideally situated, enjoying excellent public transport links that make commuting into Edinburgh fast and convenient while idyllically nestled at the foot of the Pentland Hills.”

The flat for sale comes with three bedrooms and a Victorian-style bathroom.

The entrance is a large wooden door, which leads to a hall, living room, kitchen and a separate shower room.

Natural materials continue to be showcased inside the flat with plenty of wood furniture, painted brick walls and wooden beams on the ceiling.

There are decorative sash windows, and a wood-burner sits in the living room.

Outside, there is a double garage and two allocated parking spaces for the flat at the front of the property.

The flat covers an area of 762 square feet, the equivalent of almost 71 square metres.

It sits beside the 290-hectare Bonaly country park, which has a ski centre, pony trekking and trout fishing nearby.

Bonaly has access to good transport links, with easy community via the city bypass and motorway.

The property is also between 1.5 and 2.3 miles of four train stations, including Wester Hailes, Slateford, Kingsknowe, and Curriehill.

Other facilities nearby include several schools, such as Bonaly primary school, Firrhill high school and Merchiston Castle School.

As well as being well served by amenities, the sale of the flat represents a rare opportunity to live in a historic Edinburgh landmark.

Balmoral Castle

BALMORAL Castle is a large estate house in Royal Deeside, Aberdeenshire, Scotland, near the village of Crathie.

The vast property is situated 6.2 miles west of Ballater and 6.8 miles east of Braemar.

The estate and castle are privately owned by the Royal Family and are not the property of the Crown.

The existing house on site was found to be too small, so the royals purchased the estate in 1852.

In its place, the construction of the current Balmoral Castle was commissioned.

William Smith of Aberdeen was the architect, although his designs were amended by Prince Albert.

Historic Scotland classified the castle as a category A listed building.

The new castle was completed in 1856, with the old castle demolished shortly thereafter.

Successive Royal Family members added to the Balmoral Estate, and it now covers an area of approximately 50,000 acres.

As well as the main castle, there are 150 other buildings on the estate, including Birkhall, the estate of King Charles, Craigowan Lodge, and several other cottages.

Balmoral is a working estate, including grouse moors, forestry, and farmland, as well as managed herds of deer, Highland cattle, and ponies.

Since 1987, an illustration of the castle has been featured on the reverse side of £100 notes issued by the Royal Bank of Scotland.

The crimson-coloured notes are the largest denomination of banknotes issued by The Royal Bank of Scotland and are still in production.

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 weeks ago

Technology3 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment3 weeks ago

Science & Environment3 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

News4 weeks ago

the pick of new debut fiction

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy this is a golden age for life to thrive across the universe

-

News3 weeks ago

News3 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNerve fibres in the brain could generate quantum entanglement

-

Technology2 weeks ago

Technology2 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Business2 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

News4 weeks ago

News4 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News3 weeks ago

News3 weeks agoYou’re a Hypocrite, And So Am I

-

Sport3 weeks ago

Sport3 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News3 weeks ago

News3 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Business2 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

Technology2 weeks ago

Technology2 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Football2 weeks ago

Football2 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoRethinking space and time could let us do away with dark matter

-

News4 weeks ago

News4 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

News3 weeks ago

The Project Censored Newsletter – May 2024

-

Technology2 weeks ago

Technology2 weeks agoQuantum computers may work better when they ignore causality

-

MMA2 weeks ago

MMA2 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Sport2 weeks ago

Sport2 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

News3 weeks ago

News3 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Technology2 weeks ago

Technology2 weeks agoGet ready for Meta Connect

-

Business2 weeks ago

Ukraine faces its darkest hour

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Technology3 weeks ago

Technology3 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

News3 weeks ago

News3 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCardano founder to meet Argentina president Javier Milei

-

Politics3 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

MMA3 weeks ago

MMA3 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMeet the world's first female male model | 7.30

-

News3 weeks ago

News3 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Toning Workout for Women

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists have worked out how to melt any material

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoBeing in two places at once could make a quantum battery charge faster

-

News4 weeks ago

News4 weeks agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoEverything a Beginner Needs to Know About Squatting

-

TV3 weeks ago

TV3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Servers computers2 weeks ago

Servers computers2 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Technology2 weeks ago

Technology2 weeks agoThe best robot vacuum cleaners of 2024

-

News3 weeks ago

News3 weeks agoChurch same-sex split affecting bishop appointments

-

Politics3 weeks ago

Politics3 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Sport3 weeks ago

Sport3 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow one theory ties together everything we know about the universe

-

Business4 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMost accurate clock ever can tick for 40 billion years without error

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBlockdaemon mulls 2026 IPO: Report

-

Business3 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics3 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

News2 weeks ago

News2 weeks agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology3 weeks ago

Technology3 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business3 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Travel3 weeks ago

Travel3 weeks agoDelta signs codeshare agreement with SAS

-

Politics2 weeks ago

Politics2 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology2 weeks ago

Technology2 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Technology2 weeks ago

Technology2 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

You must be logged in to post a comment Login