Money

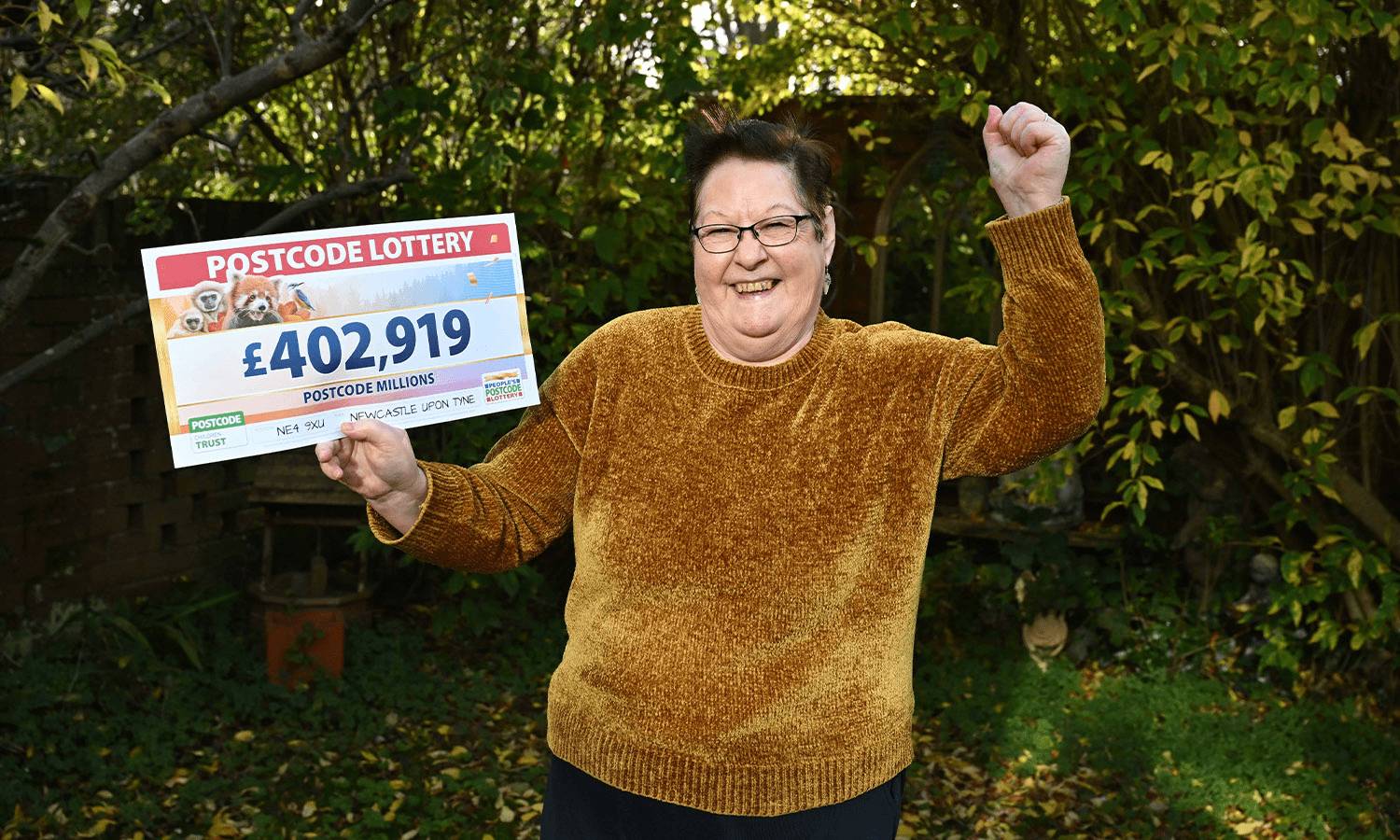

I won over £400k on the Postcode Lottery while my neighbours scooped just £6k with nifty trick – I have a guardian angel

A POSTCODE Lottery player who won more than £400,000 while her neighbours got just £6,000 says she has a “guardian angel”.

Retired antiques dealer Innis Gamble, of Fenham, Newcastle, scooped the largest share of the £3.2million prize.

She and husband Dave are now set on completing their bucket list – starting with trips to New York and Thailand.

Innis said: “The world has opened! I’m walking on air. I’m literally floating at the moment and Dave is holding me down, so I don’t float away.

“This money will change our lives forever. I really do feel like I have a guardian angel now.”

She celebrated after her postcode, NE4 9XU, was announced as the winner of October’s Postcode Millions prize on November 2.

And 390 of her neighbours shared the remainder of the multi-million-pound prize, each netting cash prizes ranging from £6,146 to £36,876, depending on the number of tickets they played with.

She won a substantial amount more by purching a lot more tickets – meaning a higher reward if she struck it lucky.

Innis, who was diagnosed with stage 4 skin cancer last year, couldn’t believe her windfall after already beating the odds as she recovers from melanoma, which was at an advanced stage.

She is waiting on the results of a third scan carried out just days ago – after two previous checks came back clear.

She said: “I’m grateful to be alive. It started with a freckle on my arm which changed shape, so I thought, ‘I’ve got to go to hospital and get it checked.’

“I had surgery to cut out the cancer from my arm but in October last year tests showed it had spread to my armpit, chest and stomach.”

Innis, who bears an S-shaped scar on her left arm, then started immunotherapy treatment for the cancer, which was successful.

She added: “Thankfully, it worked and I’m still here. I had my last scan last Saturday. I haven’t had the results back yet, but my last two scans have been clear.

“And now this has happened. I’m just waiting for the alarm clock to go off because it doesn’t sound real yet.”

Innis, who owned an antiques shop, had looked to the sky while she held her £402,919 cheque.

Later, the mum-of-two said: “Unfortunately, I’ve experienced a lot of loss, and I was simply thanking everybody.”

She also credits her husband Dave for saving her life after eight years of feeling lost following the passing of her previous husband.

Innis said: “My life’s been up and down for years, many years, and Dave has saved it.

“I lost my previous husband 15 years ago, and I was alone for eight years, and I couldn’t have been any lower until I met Dave on a dating website.”

How to enter the People’s Postcode Lottery

- The Postcode Lottery is a subscription-based lottery in which players sign up with their postcode.

- Your postcode is your ticket number – 40p a day ensures entry into all drawers, or £12 a month.

- Once subscribed, they are automatically entered into every draw.

- Prizes are announced every day of the month.

- If your postcode gets luck, every player in your postcode wins.

- 33 per cent of the ticket price will go to charity that is re-funnelled back into the community.

Innis, who married dad-of-one Dave in New York’s Central Park in 2016, added: “It was meant to be. We are going to enjoy this.”

Dave, who works as a complementary therapist, said they wrote a bucket list together and now plan to start ticking it off.

He said: “It’s perfect timing when you get to our age. You build up a little bucket list, and we wrote one together. It can all happen now.

“We got married at Wagner Cove in Central Park and it was the best day ever and we’d love to go back.

“We stayed on Seventh Avenue in a honeymoon suite on the 73rd floor with balconies and its own kitchen. We might even see if we can stay there again.”

Innis, who reminisced about taking a horse and carriage ride on their wedding day, added: “We’ve got to go back to take the horse a carrot. We forgot the carrot the first time round.”

Innis and Dave also plan on taking a once-in-a-lifetime holiday to Thailand, but before then Innis plans on writing a book about her life.

Innis, who ran her antiques shop in Norton called Yesterdays with her late husband, said that much like antiques, her life consists of lots of stories.

Adopted at birth, Innis found her birth mum, brother and sister 52 years later and said she’s always wanted to tell her story.

She said: “I think I’m entitled to write a book.”

The couple both care for Dave’s mum, Marcella Cook, who turned 102 on 2 September, and plan on celebrating together with a bag of chips.

Money

I tested warm wines that are latest drinks craze… winner was packed with spice & will get people talking at Xmas parties

WARM wines are becoming the hot new drink craze this season.

And they don’t have to be super sweet or full of cinnamon – Marks and Spencer has just launched English Mulled White.

So as temperatures drop, drinks expert Helena Nicklin tries out simmering new arrivals and also suggests some of the best non-traditional wine styles ideal for making your own mulled vino all year round.

English Pink Mulled Rose

£25 for 1.5L, englishpink.co.uk

YOU may think that pastel wine is only for drinking poolside or in the summer, so prepare for something very different indeed.

A mulled, posh English pink from a pouch?

I was not expecting to like this – but how wrong I was.

A charming blend of creamy Pinot Blanc with strawberry-scented Pinot Noir.

t’s sweet but beautifully balanced and not at all cloying with subtle, well-judged notes of cinnamon and vanilla.

Fab when it’s chilly out and proof it can be enjoyed near the fire as well as in the sun.

It is a tad pricey, but it is unusual, plus you’ll be buying British.

RATING: 4/5

M&S Mulled White Wine

£6.50, M&S and Ocado

WHO knew mulled wine could be so lovely when white too?

This white warmer has vanilla and mulled spice flavours and the makers suggest it is ideal served with a slice of lemon.

Easy to warm, just empty the contents into a pan and gently heat until hot.

Or you can microwave a mugful for 60 seconds for a nightcap.

I would drink this subtly sweet, rounded white over a red version any day.

Think baked pears in pastry with a dusting of white chocolate.

It won’t be for everyone but it is a guilty pleasure – a great talking point for parties, and it is inexpensive to boot.

RATING: 5/5

Dry Rosé: Specially Selected Corsican Ile De Beauté Rosé

£3.21 on offer, Aldi

IF you want to mimic the style of the hot English pink but would prefer to spend a little less, I would suggest a dry rosé with a bit of texture, some subtle strawberry and a slick of saline.

This Corsican beauty will do the job perfectly.

And it is an absolute steal, costing just over £3 a bottle at the moment.

So if you don’t like the results, you haven’t wasted too much money.

It will certainly stand up to a bit of heat and gentle spice in the pan and can play with whatever mulled wine additions you fancy.

Serve in heat-proof clear mugs to show off the colour.

RATING: 4/5

Fruity Rosé – Nice Drop White Zinfandel

£4.15, Asda

FUN and super fruity – sweeter rosé styles such as white Zinfandel are a great choice for more tropical, mulled pinks.

So, if you want liquid fruit salad in a glass, why not have a go at warming up this unpretentious, Nice Drop Californian cracker with some cinnamon sticks and orange peel?

For a another talking point, you could also garnish with slices of peach then serve.

This would be a great one to serve to guests at any cold-weather gathering or festive party.

It is top value too, so well worth giving it a try.

A proper guilty pleasure!

RATING: 3/5

Spicy Shiraz: Kooliburra Australian Shiraz

£4.15, Aldi

SHIRAZ is a great grape for mulling yourself thanks to its velvety, fruity body and generous notes of plum jam with a kick of peppery spice.

If you happen to have any glasses remaining in an opened bottle, warming this wine up would be a good way to use it.

Stock up to enjoy it for the seasonal parties.

This will give you plenty to go round for your guests, without splashing out too much.

Less sweet than a Primitivo would be but packed full of flavour.

This is one for your classic Christmas do.

Or get practising by drinking it now.

RATING: 5/5

Extra Special Fiano Terre Siciliane

£6.25, Asda

ALWAYS a crowd-pleaser, Fiano is an Italian grape that appeals to all kinds of white wine drinkers.

It is one that seems to suit everyone and this option from Asda, currently with 50p off, is very well priced.

Also, it is “just tropical enough” to cope with a heat injection thanks to its orange and pineapple vibes.

Chilled or warmed, it is ravishingly refreshing and you won’t need to worry about whether it will withstand a little heat.

Adding spice and fruit will bring out that orange peel note too, so serve with a fresh slice of whatever you have to hand.

RATING: 2/5

Cheeky Chardonnay: Andrew Peace Masterpeace Chardonnay

£6.50, Tesco

IF a mulled white sounds like it could be more your thing and you fancy simmering a pan of your own pale plonk to give it a try, this could be a good bet.

To go DIY, I recommend finding a seriously fruity Chardonnay from a warm climate without too much oakiness which will stand up well to being warmed.

This cheeky Chard from Australia fits the brief.

It is ripe and round with lashings of peach and melon.

It will love a bit of cinnamon spice or star anise and will forgive the saucepan treatment.

Give it a try and see how you get on.

RATING: 3/5

Chocolatey Primitivo: M&S Primitivo Puglia

£7, M&S

MORE traditional mulled wines made with red vino do best with bold, fruity styles that do not have too much tooth- drying tannin.

Primitivo grapes, from Puglia in sunny southern Italy, are like this with flavours of Morello cherries, chocolate and spice.

This one has a sweeter, ripe fig-in-chocolate flavour that loves a bit of mulled spice.

A proper, curl-up-by-the-fire red that makes a mulled wine with that similar cosy vibe.

Heat it gently in a pan and throw in all the traditional mulled red trimmings and spices – cinnamon, cloves, oranges and cardamon.

RATING: 4/5

Money

Urgent warning to first-time buyers after Budget tax hike – five ways you can beat soaring costs

FIRST-TIME buyers face paying £1,400 MORE in tax to buy a home after Rachel Reeves’ Budget.

The Chancellor had promised to make it easier to get on the housing ladder – but experts are now warning that the changes to stamp duty will force thousands to delay making the move.

Home movers will also be hit with a £6,400 bill after April next year.

Rosie Murray-West explains what is happening and the impact on the housing market.

THE HIDDEN CHANGE

IN her first Budget, Rachel Reeves revealed a hit to anyone buying a second home by increasing stamp duty charges from 3 to 5 per cent.

But she was less vocal about changes to stamp duty relief for first-time buyers from April 1, 2025.

At present, first-time buyers pay stamp duty on any property over £425,000, but this will dip back to £300,000.

Other buyers pay the tax on properties above £250,000 and this will return to £125,000.

The tax is set at 5 per cent of the property price above the threshold, rising to 10 per cent for any part over £925,000.

First-time buyers will receive no extra relief if the home they buy is worth over £500,000, instead of the current £625,000.

FIRST-TIME BUYERS HIT

DESPITE promises that things would be easier, brokers say the changes will have a negative impact on first-time buyers.

From April next year, a first-time buyer purchasing an average price property worth £328,000 will now face £1,400 in upfront costs.

A home-mover buying the same price property will pay £6,400 in stamp duty from April 2025, up from £3,900 at present.

Mortgage broker John Fraser-Tucker says: “This change could force many to delay their dreams of home ownership.”

The change puts stamp duty thresholds back to the levels they were before Liz Truss’s 2022 “mini-budget”.

Movers buying a £425,000 home will pay an extra £2,500 in stamp duty, a total of £11,250.

First-time buyers, who currently pay no stamp duty, would pay £6,250 on a £425,000 home.

Andrew Greenwood, of Leeds Building Society, says the change means London first-time buyers will need to keep renting for an an extra year to save up for the tax.

“Our country needs to develop a long-term, joined-up plan to improve stability in the housing market if we are to solve the problem,” he said.

Government watchdog the Office for Budget Responsibility says that the amount of stamp duty paid to HMRC per year will go from £14.1billion to £25.4billion in five years’ time.

HOW IT WILL ALSO AFFECT MOVERS

AS well as stamp duty, other costs faced by buyers are also increasing.

Property expert Karen Noye, from wealth manager Quilter, predicts that a rush of buyers trying to beat the stamp duty deadline could cause a hike in house prices, meaning homeowners will need to borrow more.

The Budget also means the cost of borrowing will likely be more expensive, despite this week’s bank rate cut.

Gilt yields — the amount the Government must pay to borrow money — rose after Reeves said she would borrow more cash to fund her Budget, and these can push up mortgage rates.

Mortgage broker David Hollingworth, from London & Country, says that even after the base rate cut, fixed-rate mortgages could still “nudge up” if higher market rates persist, which would make funding a house purchase more expensive in the short-term.

According to financial data service Moneyfacts, the average two-year fixed rate mortgage was at 5.38 per cent this week, up from 5.36 per cent on October 11.

A 25-year mortgage on a £328,000 property with a ten per cent deposit would cost £1,792 a month.

IT’S BAD NEWS FOR RENTERS TOO

THE Budget was also bad news for those who need to rent a property until they can save enough for a deposit, as many believe rents are set to rise too.

Reeves added a stamp duty surcharge on those buying second homes, while the recently announced Renters’ Rights Bill contains protections for tenants that could push up costs.

Stuart Collar-Brown, of estate agency membership body Propertymark, says landlords will exit the market leaving fewer homes and higher rents.

Finally, champions of first-time buyers noted the omission of the Freedom To Buy scheme from the Budget.

The scheme was unveiled before the Labour victory, with Starmer promising it would get 80,000 people on to the housing ladder, with the Government acting as a guarantor for those unable to save big deposits.

“The failure to implement the Freedom To Buy scheme, a cornerstone of their manifesto, is likely to have left aspiring homeowners feeling deeply disillusioned,” says John Fraser-Tucker, from Mojo Mortgages.

The scheme offered a glimmer of hope, particularly for those struggling to save large deposits in high-demand areas.”

ACT FAST TO BEAT THE RISING COSTS

IF you want to save thousands in stamp duty by buying before the April 1 deadline, meticulous preparation and quick thinking are key.

Nicholas Mendes, from mortgage broker John Charcol, gives his top tips for first-time buyers wanting to get a purchase across the line before the stamp duty increase hits.

GET A MORTGAGE IN PRINCIPLE: Before you even view a property, check how much you can borrow by talking to a mortgage broker or lender.

This can strengthen your position as buyers and enable you to act quickly when you find a suitable property.

You should also budget for other costs at this point, including legal fees, surveys and moving expenses, to ensure complete financial readiness.

RESEARCH THE LOCAL MARKET: Knowing how long it takes properties to sell in your area will help with negotiations, while signing up with local agents can help you get in first with the deals.

An agent can help identify suitable properties and alert buyers to new listings as soon as they become available.

ENHANCE YOUR CREDIT SCORE: Banks are often more cautious with first-time buyers, so your credit score – which shows a lender how you manage your money now – is particularly important.

Avoid making new credit applications in the months leading up to your mortgage application, as each inquiry can temporarily lower your score.

Ensuring all bills and debt repayments are made on time is crucial, as missed payments can significantly impact your score.

CUT DOWN ON YOUR SPENDING: Lenders check your recent bank statements for regular outgoings, so now is the time to cut down on anything you can.

This means avoiding large transactions that might be hard to explain.

If you have regular monthly subscriptions, it might also be wise to cancel any unnecessary ones.

HAVE DOCUMENTS READY: Mortgage lenders require a detailed view of your financial health, so getting your finances in order is essential.

“Begin by gathering key documents such as recent payslips, tax returns and bank statements from the last three to six months, and any other evidence of income.

It’s also helpful to have documentation on hand for any other sources of income, such as bonuses, freelance work or government benefits.

Money

M&S shoppers go wild for giant festive tubs branded better than Quality Streets

THERE’S a new favourite chocolate tub and it has sent shoppers into frenzy – with one declaring it would replace Quality Streets.

Shoppers have flocked to M&S to pick up a giant festive tub branded better than all of the Christmas faves.

With Christmas just around the corner, M&S has mixed its iconic Mini Bites into a family sharer for the first time ever.

The epic mix is three times the size of the classic tubs, and includes the bestselling double chocolate mini rolls, caramel crispies, and new festive flavour, cranberry and yoghurt clusters.

An M&S icon since 2001, there are 14 tubs in the range, plus three new tubs for the festive season.

The new tub is set to fly off the shelves, after the brand announced the new festive treats on Instagram, sending shoppers in a frenzy.

On person said: “This will definitely replace Quality Streets this Christmas.”

A second person commented: “This is the best idea EVER. Totally obsessed!.”

While a third summed up the delicious treat with a simple: “Yum”.

M&S is also launching two new festive Mini Bites flavours tMint Choc Chip Mini Bites (£3.75, 215g) and Extremely Chocolatey Yule Log Bites (£3.75, 295g).

The family sized mini bites selection is £10 for a 700g tin and can be found in the M&S food hall and online on Ocado.

Christmas Treats

Everyone loves a sweet treat during the festive season and whether your preference is for Cadbury Heroes, Celebrations or a classic tub of Quality Street these are the cheapest prices.

If you’re partial to a tub of Quality Street, both Aldi and Lidl are selling 600g tubs for £4.49 – making them the cheapest out there.

In comparison Sainsbury’s and Tesco are selling the chocolates for £4.50 for Nectar and Clubcard holders, while Asda has priced them at £6 individually, or £9 for two.

Morrisons is also pricing the tubs at £6, while Ocado is charging £5.

Quality Street was launched in 1936 and has been a favourite with families since.

The selection includes ‘the purple one’ which brings together hazelnut and caramel, the toffee finger, orange chocolate crunch, strawberry delight and ‘the green triangle’.

Cadbury Heroes lovers can also pick up 550g tubs for £4.50 from Sainsbury’s and Tesco if they are Nectar or Clubcard members.

Asda has Heroes tubs included in its two for £9 deal, meaning if you’re happy to double up you can pick them up at the supermarket for the same price as Tesco and Sainsbury’s shoppers.

Meanwhile, Aldi is selling the tubs for £4.99 and Morrisons for £6.

The Heroes selection includes Cadbury Dairy Milk, Twirl and Crunchie.

Celebrations are also available for £4.50 from Tesco for Clubcard members, or as part of Asda’s two for £9 deal.

Aldi is selling the tubs for £4.99, Sainsbury’s for £6 and Morrisons for £6.

The Celebrations selection includes Mars, Snickers, Twix, Bounty and Galaxy.

If you’re sharing chocolates with family this year and want to pick up a selection of tubs Asda’s two for £9 deal, which includes Quality Street, Cadbury Heroes, Celebrations, Cadbury Roses and a Swizzels assortment, may be the way to go.

How to save money on chocolate

We all love a bit of chocolate from now and then, but you don’t have to break the bank buying your favourite bar.

Consumer reporter Sam Walker reveals how to cut costs…

Go own brand – if you’re not too fussed about flavour and just want to supplant your chocolate cravings, you’ll save by going for the supermarket’s own brand bars.

Shop around – if you’ve spotted your favourite variety at the supermarket, make sure you check if it’s cheaper elsewhere.

Websites like Trolley.co.uk let you compare prices on products across all the major chains to see if you’re getting the best deal.

Look out for yellow stickers – supermarket staff put yellow, and sometimes orange and red, stickers on to products to show they’ve been reduced.

They usually do this if the product is coming to the end of its best-before date or the packaging is slightly damaged.

Buy bigger bars – most of the time, but not always, chocolate is cheaper per 100g the larger the bar.

So if you’ve got the appetite, and you were going to buy a hefty amount of chocolate anyway, you might as well go bigger.

Money

Lidl is selling a simple £8 gadget that can slash energy bills by £100s

THOSE concerned about their bills this winter can pick up a simple £7.99 gadget that could slash energy costs by hundreds of pounds.

With Brits facing high energy prices and millions of pensioners missing out on the winter fuel payment, many are looking for help with managing costs this year.

Lidl may have the answer thanks to a plug-in power meter that measures how much energy your appliances are really using.

The £7.99 power meter will measure usage and calculate costs according to your energy tariff and is available in store from Sunday November 10.

It works like a second plug – you slot it into your socket, and then plug your appliance into it.

You can use it for any appliance you plug in, including televisions, freezers, washing machines and dryers.

The information it provides can help households identify which devices are guzzling energy allowing them to change habits to cut their bills.

To take a read simply plug the monitor into the socket, set the unit price and plug in your appliance before using it as normal to see how much energy it uses in a typical day.

Consumer champion Which? said: “Using an energy monitor is one of the best ways to clearly ascertain how much electricity you’re using on individual appliances — hopefully helping you to work out where money can be saved in the long run.”

Low Energy Supermarket estimates that a plug-in power monitor will help you to discover savings of £200 per year.

When selecting a power meter always remember to compare statistics and prices, to ensure you’re getting the best deal.

This can be done using comparison tools such as trolley.co.uk.

A quick internet search showed that Screwfix has a similar model for £18.99 and Amazon is selling a range of devices available for around £10.

Power meters will only measure the energy used from one plug socket, so if you want to know the total amount of energy you’re using around the house you may want to install a smart meter.

But, the benefit of a power meter is that it can help you quickly identify which appliances are using the most power.

A dad-of-two went around every room in his house using the device to see how much his appliances cost to run – and was shocked by the results.

The biggest cost drain was his old freezer, which was costing him around 68p a day to run – amounting to a whopping £250 a year.

With everything he learned he was able to make some changes and save a whopping £750 a year.

It is worth remembering that the energy price cap was considerably higher at that time, so savings are unlikely to be as high now.

The energy price cap is currently £1,568, the lowest figure in two years.

The cap is calculated based on the wholesale price of gas and electricity and what Ofgem thinks an average household will use.

Other ways to monitor energy usage

Smart plugs aren’t the only way to keep track of your energy usage.

Getting a smart meter installed can also help track how much you’re spending on gas and electricity.

These are different to smart plugs as they look at energy usage around the whole home rather than for each device.

The actual smart meter sends the readings to your supplier so you don’t have to, while the in-home display screen shows you how much you’re spending.

Most energy suppliers provide smart meters and displays for free. However, some users have reported issues with their devices, for example when changing providers.

Your supplier should be able to answer any questions you have.

How do I calculate my energy bill?

BELOW we reveal how you can calculate your own energy bill.

To calculate how much you pay for your energy bill, you must find out your unit rate for gas and electricity and the standing charge for each fuel type.

The unit rate will usually be shown on your bill in p/kWh.The standing charge is a daily charge that is paid 365 days of the year – irrespective of whether or not you use any gas or electricity.

You will then need to note down your own annual energy usage from a previous bill.

Once you have these details, you can work out your gas and electricity costs separately.

Multiply your usage in kWh by the unit rate cost in p/kWh for the corresponding fuel type – this will give you your usage costs.

You’ll then need to multiply each standing charge by 365 and add this figure to the totals for your usage – this will then give you your annual costs.

Divide this figure by 12, and you’ll be able to determine how much you should expect to pay each month from April 1.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Martin Lewis’ MSE issues message to all Tesco shoppers ahead of crucial deadline

TESCO shoppers have until the end of the month to spend millions of pounds worth of Clubcard vouchers before they expire.

It comes as the supermarket chain revealed there are millions of points set to expire at the end of the month.

More than £18million in vouchers still need to be used before 11.59pm November 30.

That’s unless you use the handy trick from Martin Lewis‘ MoneySavingExpert to extend the lifespan of the vouchers.

Shoppers on the Clubcard scheme receive vouchers after spending in-store or online, with every 150 points worth £1.50.

These vouchers can be used on your weekly food shop and with any number of Tesco‘s partners including PizzaExpress and Hotels.com.

Any vouchers spent with a Tesco partner are also worth two times their normal value.

The MSE team have revealed three options to extend the rewards beyond the expiry date, they are:

- Make a small purchase on the Tesco Clubcard Rewards page or donate to one of the charities the store partners with. The remaining balance is credited back to your Clubcard account as points. So if you spend 50p on an item using a £5 Clubcard voucher, you’ll get 450 points back, which is worth £4.50.

- Swap your points for vouchers manually or wait for them to be converted with your next statement. It is worth bearing in mind the expiry date for these new vouchers will be two years in the future.

- Shell out as little as possible. A good option might be a 50p restaurant voucher (worth £1 at your chosen restaurant). You’ll need to do this for each individual voucher, so it’s worth weighing up if it’s actually worth it for smaller denominations. For example, if you’ve a £10 voucher it could be worth it.

How does Tesco’s Clubcard work?

You earn points as you shop, which can then be turned into vouchers for money off food or with Tesco’s partners.

You earn one point for each £1 spent, and each point is then worth 1p.

So 150 points gets you £1.50, and you would have to spend £150 to get 150 points.

You need a minimum of 150 points to request a voucher.

Any vouchers are worth their face value when used in-store at Tesco.

But you can double their worth by spending them at one of the supermarket chain’s partners.

There are over 100 partners you can spend your Clubcard points with, including the RAC, Disney+ and Virgin Atlantic Flying Club.

Points spent with partners used to be worth triple value, but Tesco changed this to double last year.

Any vouchers transferred into Reward Partner codes expire after six months.

Loyalty card holders also get access to over 8,000 items for less through Clubcard Prices.

RECLAIM LOST CLUBCARD POINTS

Many people lose or forget to use their Tesco vouchers, but there’s an easy way to claw back the last two years of unused vouchers.

Here’s exactly how to find out if you have any unused vouchers.

The first step is to log into your Tesco Clubcard account on Tesco.com or via the Clubcard app.

You’ll need your name, email address and Clubcard number to hand.

Once you’ve logged in, navigate to “My Clubcard Account” and then click on “Vouchers” to see a full list of any vouchers you still have to spend.

You can use the code included in your voucher to spend online.

If you want to redeem them in-store, you’ll need to print them off and take them with you.

What can I get with Tesco Clubcard?

TESCO’S Clubcard scheme allows shoppers to earn points as they shop.

These points can then be turned into vouchers for money off food at the supermarket, or discounts at other places like restaurants and days out.

Each time you spend £1 in-store and online, you get one point when you scan your Clubcard.

Drivers using the loyalty card get one point for every two litres spent on fuel.

One point equals 1p, so 150 points gets you a £1.50 money-off voucher, for example.

You can double their worth when you swap them for discounts with “reward partners”.

For example, £12 worth of vouchers can be swapped for a £24 three-month subscription to Disney+.

Or you can swap 50p worth of points for £1 to spend at Hungry Horse pubs.

Where you can spend them changes regularly, and you can check on the Tesco website what’s available now.

Tesco shoppers can also get Clubcard prices when they have the loyalty card.

The discounted items change regularly and without a Clubcard you’ll pay a higher price.

These Clubcard prices are usually labelled on shelves, along with the non-member price.

But it’s worth noting that just because it’s discounted doesn’t necessarily make it the cheapest around, and you should compare prices to find the best deal.

You can sign up to get a Tesco Clubcard in store or online via the Tesco website.

Money

Three ways to keep your gadgets sparkly and germ-free without splashing the cash

YOU don’t need fancy kit to keep your screens clean.

With a bit of know-how, you can keep your gadgets sparkly and germ-free without splashing cash.

Clean up with these ideas.

ON THE BUTTONS: TV remotes, gaming handsets, computer mice and keyboards all need a regular wipe.

For keyboards, turn your device off before tipping it upside down to dislodge and loose dirt.

Use a clean, soft make-up brush, paintbrush or toothbrush to dust over the keys, and then wipe gently with a screen wipe.

READ MORE MONEY SAVING TIPS

You can use a cotton bud to dust gently between the keys.

GOOD CALL: How often does your phone need cleaning?

A lot more often than you think.

With nearly half of us taking our phones into the bathroom, experts recommend a daily wipe-over to get rid of any germs.

You can use screen wipes, but they are not essential.

Instead, a dash of washing-up liquid in a bowl of water works wonders.

Dip in a soft microfibre cloth, then wring it out so it is just a little damp.

Turn off your phone, then wipe over the screen and casing avoiding any openings like charging and headphone ports.

Don’t forget to clean inside the case too.

Whatever you do, don’t put your phone in water.

Only the newest waterproof models — which will have an IP7 or IP68 rating — can withstand a dunking.

SCREEN SAVER: A smeary screen can ruin your enjoyment of the latest drama.

First off, try cleaning with a dry soft cloth.

Don’t use anything with a rough surface, or kitchen roll, which could scratch your screen.

Wipe gently in small circles, without pushing on the screen too much.

For stubborn stains, it’s recommended that you switch off your set before using a cloth that has been dampened with a little water.

Use another cloth to dry.

Use a similar method for a laptop screen.

- All prices on page correct at time of going to press. Deals and offers subject to availability.

Deal of the day

HEAD to Tesco to get a five-piece Tefal Titanium pan set, down from £70 to £35 with a Clubcard, in-store only.

SAVE: £35

Cheap treat

BRIGHTEN up weekend breaks with this waterproof bag from rexlondon.com, down from £29.95 to £9.95.

SAVE: £20

What’s new?

GET 20 per cent off at Ernest Jones jewellers with the code available at vouchercodes.co.uk, taking this Swarovski bracelet down from £89 to £71.20.

Top swap

STEP out in the Denno white Chelsea boots, £130 from Jones Bootmakers, or flex your feet in the Off The Hook boots, £35.99 from Debenhams.

SAVE: £94.01

Little helper

ENJOY half-price roasts at Sainsbury’s with a Nectar card. It takes a small pork leg crackling joint down from £7.75 to £3.87.

Shop & save

PADDINGTON is back in cinemas and you can take him home – with this soft toy, down from £22.99 to £12.99 at very.co.uk.

SAVE: £10

Hot right now

WITH a Morrisons More card, a litre of Baileys Original is £8.50 (£11.05 in Scotland) when you spend £45 in-store. It’s usually £22.

PLAY NOW TO WIN £200

JOIN thousands of readers taking part in The Sun Raffle.

Every month we’re giving away £100 to 250 lucky readers – whether you’re saving up or just in need of some extra cash, The Sun could have you covered.

Every Sun Savers code entered equals one Raffle ticket.

The more codes you enter, the more tickets you’ll earn and the more chance you will have of winning!

-

Science & Environment2 months ago

Science & Environment2 months agoHow to unsnarl a tangle of threads, according to physics

-

Technology1 month ago

Technology1 month agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 months ago

Science & Environment2 months agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 months ago

Science & Environment2 months ago‘Running of the bulls’ festival crowds move like charged particles

-

Technology2 months ago

Technology2 months agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoX-rays reveal half-billion-year-old insect ancestor

-

Sport1 month ago

Sport1 month agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Money1 month ago

Money1 month agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Science & Environment2 months ago

Science & Environment2 months agoPhysicists have worked out how to melt any material

-

MMA1 month ago

MMA1 month ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

Science & Environment2 months ago

Science & Environment2 months agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 months ago

Science & Environment2 months agoSunlight-trapping device can generate temperatures over 1000°C

-

Football1 month ago

Football1 month agoRangers & Celtic ready for first SWPL derby showdown

-

News1 month ago

News1 month agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

News1 month ago

News1 month ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Science & Environment2 months ago

Science & Environment2 months agoLaser helps turn an electron into a coil of mass and charge

-

Business1 month ago

how UniCredit built its Commerzbank stake

-

Technology1 month ago

Technology1 month agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment2 months ago

Science & Environment2 months agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment2 months ago

Science & Environment2 months agoLiquid crystals could improve quantum communication devices

-

Technology1 month ago

Technology1 month agoGmail gets redesigned summary cards with more data & features

-

Technology1 month ago

Technology1 month agoSamsung Passkeys will work with Samsung’s smart home devices

-

Science & Environment2 months ago

Science & Environment2 months agoWhy this is a golden age for life to thrive across the universe

-

Sport1 month ago

Sport1 month agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Technology1 month ago

Technology1 month agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Sport1 month ago

Sport1 month ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum ‘supersolid’ matter stirred using magnets

-

Technology1 month ago

Technology1 month agoRussia is building ground-based kamikaze robots out of old hoverboards

-

News1 month ago

News1 month agoMassive blasts in Beirut after renewed Israeli air strikes

-

Entertainment1 month ago

Entertainment1 month agoBruce Springsteen endorses Harris, calls Trump “most dangerous candidate for president in my lifetime”

-

MMA1 month ago

MMA1 month agoDana White’s Contender Series 74 recap, analysis, winner grades

-

MMA1 month ago

MMA1 month agoPereira vs. Rountree prediction: Champ chases legend status

-

News1 month ago

News1 month agoNavigating the News Void: Opportunities for Revitalization

-

Business1 month ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

Technology1 month ago

Technology1 month agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

MMA1 month ago

MMA1 month ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Technology1 month ago

Technology1 month agoSingleStore’s BryteFlow acquisition targets data integration

-

Technology1 month ago

Technology1 month agoMicrophone made of atom-thick graphene could be used in smartphones

-

Technology1 month ago

Technology1 month agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

Sport1 month ago

Sport1 month agoWXV1: Canada 21-8 Ireland – Hosts make it two wins from two

-

News1 month ago

News1 month agoRwanda restricts funeral sizes following outbreak

-

Business1 month ago

Business1 month agoWater companies ‘failing to address customers’ concerns’

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum forces used to automatically assemble tiny device

-

Technology2 months ago

Technology2 months agoMeta has a major opportunity to win the AI hardware race

-

Technology1 month ago

Technology1 month agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

TV1 month ago

TV1 month agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

News1 month ago

News1 month agoCornell is about to deport a student over Palestine activism

-

MMA1 month ago

MMA1 month agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Business1 month ago

Business1 month agoWhen to tip and when not to tip

-

News2 months ago

News2 months ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment2 months ago

Science & Environment2 months agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

News1 month ago

News1 month agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Football1 month ago

Football1 month ago'Rangers outclassed and outplayed as Hearts stop rot'

-

MMA1 month ago

MMA1 month agoPennington vs. Peña pick: Can ex-champ recapture title?

-

Technology1 month ago

Technology1 month agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

-

Science & Environment2 months ago

Science & Environment2 months agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment2 months ago

Science & Environment2 months agoA slight curve helps rocks make the biggest splash

-

Technology1 month ago

Technology1 month agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Travel1 month ago

World of Hyatt welcomes iconic lifestyle brand in latest partnership

-

Sport1 month ago

Sport1 month agoShanghai Masters: Jannik Sinner and Carlos Alcaraz win openers

-

Sport1 month ago

Sport1 month agoPremiership Women’s Rugby: Exeter Chiefs boss unhappy with WXV clash

-

News1 month ago

News1 month ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Money1 month ago

Money1 month agoTiny clue on edge of £1 coin that makes it worth 2500 times its face value – do you have one lurking in your change?

-

Sport1 month ago

Sport1 month agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Football1 month ago

Football1 month agoWhy does Prince William support Aston Villa?

-

Science & Environment2 months ago

Science & Environment2 months agoNerve fibres in the brain could generate quantum entanglement

-

Womens Workouts2 months ago

Womens Workouts2 months ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology1 month ago

Technology1 month agoMusk faces SEC questions over X takeover

-

Business1 month ago

Italy seeks to raise more windfall taxes from companies

-

Sport1 month ago

Sport1 month agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Sport1 month ago

Sport1 month agoURC: Munster 23-0 Ospreys – hosts enjoy second win of season

-

Sport1 month ago

Sport1 month agoCoco Gauff stages superb comeback to reach China Open final

-

Business1 month ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Technology1 month ago

Technology1 month agoQuoroom acquires Investory to scale up its capital-raising platform for startups

-

MMA1 month ago

MMA1 month ago‘I was fighting on automatic pilot’ at UFC 306

-

MMA1 month ago

MMA1 month agoHow to watch Salt Lake City title fights, lineup, odds, more

-

TV1 month ago

TV1 month agoTV Patrol Express September 26, 2024

-

News1 month ago

News1 month agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

News1 month ago

News1 month agoHarry vs Sun publisher: ‘Two obdurate but well-resourced armies’

-

Sport1 month ago

Sport1 month agoNew Zealand v England in WXV: Black Ferns not ‘invincible’ before game

-

Sport1 month ago

Sport1 month agoWales fall to second loss of WXV against Italy

-

Sport1 month ago

Sport1 month agoFans say ‘Moyes is joking, right?’ after his bizarre interview about under-fire Man Utd manager Erik ten Hag goes viral

-

Politics1 month ago

‘The night of the living dead’: denial-fuelled Tory conference ends without direction | Conservative conference

-

Science & Environment2 months ago

Science & Environment2 months agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment2 months ago

Science & Environment2 months agoHow to wrap your mind around the real multiverse

-

Technology4 weeks ago

Technology4 weeks agoNintendo’s latest hardware is not the Switch 2

-

Business1 month ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Technology1 month ago

Technology1 month agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

Technology1 month ago

Technology1 month agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Business1 month ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

Football1 month ago

Football1 month agoFifa to investigate alleged rule breaches by Israel Football Association

-

Business1 month ago

‘Let’s be more normal’ — and rival Tory strategies

-

Technology1 month ago

Technology1 month agoThe best shows on Max (formerly HBO Max) right now

-

Sport1 month ago

Sport1 month agoAmerica’s Cup: Great Britain qualify for first time since 1964

-

News2 months ago

News2 months ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Business1 month ago

The search for Japan’s ‘lost’ art

-

MMA1 month ago

MMA1 month agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

Technology1 month ago

Technology1 month agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

News1 month ago

News1 month agoTrump returns to Pennsylvania for rally at site of assassination attempt

-

MMA1 month ago

MMA1 month agoKevin Holland suffers injury vs. Roman Dolidze

You must be logged in to post a comment Login