Money

Kingswood UK and Ireland assets buoyed by BasePlan acquisition

Despite a drop in assets under advice in its UK business, Kingswood’s UK and Ireland division reported a £200m uptick in the first half of 2024 thanks to the completion of its BasePlan acquisition and “positive market movements”.

In its unaudited interim financial results for the half year ended 30 June 2024, the group said it had experienced AUA outflows in its UK business following the departure of some wealth advisers.

A “swift, diligent recruitment process” has replenished its wealth advisory team, it said.

This includes the addition of a fourth regional manager to support growth across the London and Southeast region.

Kingswood completed the acquisition of Dublin-based advice firm BasePlan in February this year. The acquisition added €130m (£108m) AUA to the group.

UK and Ireland AUA at the period end stood at £6bn and assets under management were £3.7bn. Meanwhile, US AUA was £3.2bn.

Group revenue from continuing operations in the period was £40.6m, an increase of 14% on the restated prior-year figure of £35.6m.

UK&I revenue increased by £300,000 to £23.4m, or 1%, compared to the restated period last year, of which 81% is recurring in nature.

US revenue increased by £4.8m to £17.2m, a 38% rise compared to the restated period last year, driven by growth in authorised representatives.

Kingswood said further progress had been made across the UK&I in “driving organic growth”.

This included onboarding six new IFA firms to IBOSS, in line with 2023 levels over the comparable period.

The group also flagged three new appointments made to the executive team in H1.

In the period, it brought in Bryan Parkinson as managing director of wealth planning, Vinoy Nursiah as chief financial officer and Peter Coleman as chief executive.

“The combination of the new joiners with the incumbents of Rachel Bailey, chief people officer, Paul Hammick, chief risk officer and Lucy Whitehead, chief commercial officer, has already demonstrated its effectiveness and capability,” the report said.

The executive team has delivered in-person presentations of the next strategic phase at all UK locations and overseen the delivery of a major project to enhance regulatory performance and efficiency.

It has also run the design and implementation of a new service operating model to improve client and adviser experience and created five fundamental focus areas to align efforts across the group.

Additionally a major finance transformation project commenced in July and is on track to complete as scheduled in Q4.

Coleman said he is “particularly pleased” with the firm’s strong revenue growth and in particular the growth in recurring revenues.

This, he said, demonstrates that the group’s acquisitions are “beginning to mature”.

“Quite rightly our focus is on providing a first-class experience to all of our clients, with the use of our excellent advice community, technology and range of award investment propositions,” he added.

“In particular, I am pleased with the ongoing development of our IBOSS range of model portfolios and our in-house DFM, both of which continue to flourish within the group.

“Our operating profit continues to grow, enabling our continued investment in people, propositions and processes all focused on delivering a market-leading proposition for our clients.

“In UK&I we continue to be acquisitive with the addition of BasePlan, and we will continue to identify opportunities that enhance our growing business in this market.

“In the US, we continue to expand with the momentum of adviser recruitment and banking growing exponentially.”

Money

Thousands to get free cash or vouchers from £421m cost of living scheme to help with bills – how to apply

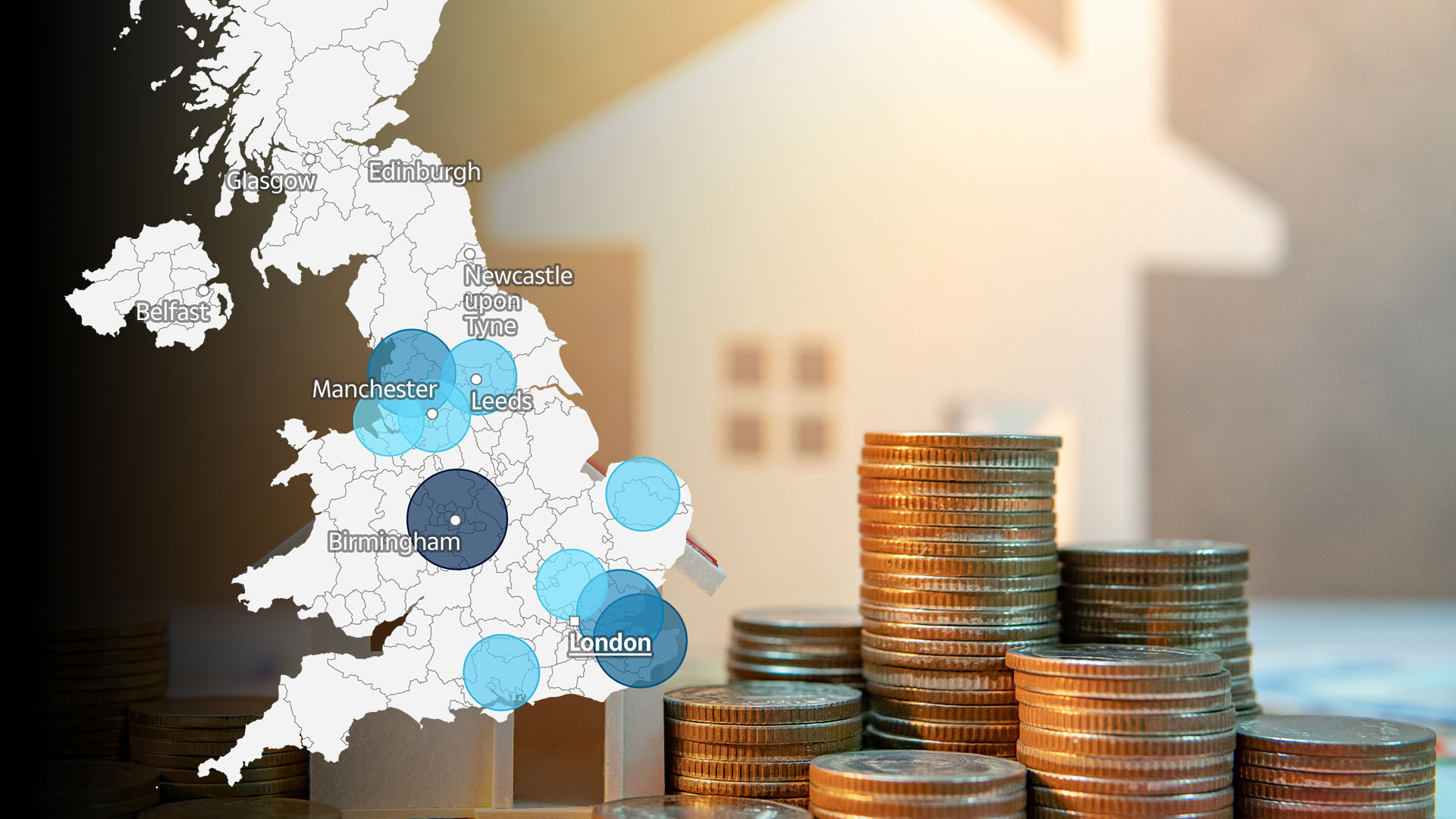

THOUSANDS of households across the UK will be able to claim free cash or vouchers to help tackle the soaring cost of living this winter.

From October 1, households will be able to get fresh help from a new pot of government funding under the Household Support Scheme.

The government has released £421 million which will be distributed between councils and then dished out to vulnerable residents over the colder season.

The pot of cash will be available from October this year until March next year.

This comes as the current scheme closes today, September 30, after the latest round of £421 million was used to help struggling households across the country.

The portion of funding each council gets is based on the size of the population, catchment area, and need.

This time Birmingham will receive the greatest share for instance, worth £12.8million.

Receiving the second largest share will be Kent, with £11million, and Lancashire will get £9.7million.

Not every council will receive as much funding as this.

The Isle of Scilly will receive the least amount of cash, worth £11,130.

The City of London will also be allocated £63,080, and Rutland £157,371.

Councils which have higher numbers of vulnerable households will get more cash based on demand.

Tower Hamlets, for example, is the most deprived area in London, and will get £3million.

How the cash gets distributed will be decided by each council, so what you can get will vary depending where you live.

Around £79million is estimated to be provided to the devolved governments in Scotland, Wales and Northern Ireland for them to decide how best to support their citizens.

What is the Household Support Fund?

The Household Support Fund was introduced in October 2021 by The Department for Work and Pensions (DWP) to support households most in need.

The funding is distributed between councils, and they are then responsible for dishing out the cash on an application basis.

For example, Birmingham City Council have announced they will hand out free £200 cost of living payments to help its residents cope this winter, as one of its approaches to the fresh fund.

How do I apply?

In order to be eligible for help, you usually have to be in receipt of a council tax reduction or show proof of being in financial difficulty.

Each council has a different application process – so you’ll have to ask your local authority or find out via your council’s website.

Not all councils have decided how they will distribute the cash yet, so you may have to wait to get all the information.

To find out how to contact your local authority, use the gov.uk authority tool checker.

In the last round of funding, some residents received their share automatically, while others had to apply.

For example, Haringey London Council is issuing automatic payments to eligible residents, as well as a support fund which can be applied to.

It is also issuing payments to schools, which means they can distribute free school vouchers.

In previous years, other authorities have offered cost of living vouchers – such as Coventry City Council.

This has included a Community Supermarket scheme, where all Coventry residents could pay £5 weekly and receive a basket of food worth up to £25.

Residents of Effingham, near Guildford, have been able to claim up to £300 free cash to help with the cost of living crisis.

Surrey council previously poured £300,000 into food banks, where photo ID and proof of address is required, but no referral needed.

While some schemes, such as the Surrey Crisis Fund, which can offer up to £100 to those immediately in need, are reserved for those who also rely on other means-tested benefits.

What else can we expect from the new government?

The Household Support Fund was introduced by the Conservative government in 2021.

This year, Secretary of State for Work and Pensions, Liz Kendall MP, said:

“We have invested an extra half a billion pounds in the Household Support Fund to give struggling families and the poorest pensioners the help they need this winter.

“As local authorities across England deliver this lifeline support to help households with the costs of feeding children and heating homes, we are continuing our work to fix the foundations of our country, grow the economy and deliver opportunities for people to get work and get on in work, so everyone feels better off.”

The Labour government is set to announce a new scheme which they have named The Child Poverty Taskforce.

The information for this will not be published until Spring 2025, however the government have promised to regularly engage with people, communities, and organisations to help shape the strategy.

Household Support Fund explained

Sun Savers Editor Lana Clements explains what you need to know about the Household Support Fund.

If you’re battling to afford energy and water bills, food or other essential items and services, the Household Support Fund can act as a vital lifeline.

The financial support is a little-known way for struggling families to get extra help with the cost of living.

Every council in England has been given a share of £421million cash by the government to distribute to local low income households.

Each local authority chooses how to pass on the support. Some offer vouchers whereas others give direct cash payments.

In many instances, the value of support is worth hundreds of pounds to individual families.

Just as the support varies between councils, so does the criteria for qualifying.

Many councils offer the help to households on selected benefits or they may base help on the level of household income.

The key is to get in touch with your local authority to see exactly what support is on offer.

And don’t delay, the scheme has been extended until April 2025 but your council may dish out their share of the Household Support Fund before this date.

Once the cash is gone, you may find they cannot provide any extra help so it’s crucial you apply as soon as possible.

What other help can I get?

Many energy companies are offering help to those struggling to pay their bills this winter – especially pensioners, as their Winter Fuel Payments are set to be slashed.

This comes as Rachel Reeves announced a £22bn black hole in public spending, making a controversial cut to winter allowances for pensioners not receiving universal credit or any other means-tested benefit.

Follwing the announcement, Octopus Energy has introduced a new scheme, offering pensioners discretionary credit of between £50 and £200.

As well as this, Scottish Power’s Hardship Fund has handed out more than £60 million to all struggling customers.

Help is available if you receive from a long list of benefit schemes, including Income Related Employment and Support Allowance or Income Based Jobseeker’s allowance.

You may also be eligible if you are facing circumstances impacting your earnings, such as illness.

Another company offering help is Utilita – which offers grants to customers to help clear or minimise energy debt.

The scheme operates through Utilita Giving, which is the company’s charity partner.

Utilita Giving also partners with other charities such as IncomeMax, which helps customers make sure they are claiming what they are entitled to, and Let’s Talk, which provides replacement white goods.

Meanwhile, Utility warehouse offers payments of up to £140 to customers about to go in debt, or are currently indebted.

The team has helped 6,000 customers increase their combined disposable income in the last year by £9 million.

To find out if you are eligible for any of these schemes, visit their websites and review the conditions of applying.

Via the website you will find information on how to apply – saving you huge amounts of cash this winter in just a few steps.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Rightmove urges REA to submit ‘best and final’ offer as it rejects £6.2bn bid

“The last few weeks have been very disruptive as well as unsettling for our colleagues,” said Rightmove chair Andrew Fisher.

The post Rightmove urges REA to submit ‘best and final’ offer as it rejects £6.2bn bid appeared first on Property Week.

Money

Is acting for overseas clients worth it?

Picture the scene. Mrs Smith, a longstanding client, has just announced she’s moving to Japan.

Picture the scene. Mrs Smith, a longstanding client, has just announced she’s moving to Japan.

What do you do? Wish her well and wave sayonara, or continue to manage her investments?

I’m sure most of you will be wondering why on earth you would give up a successful relationship – but have you considered the implications of acting for someone residing outside the UK?

Advising in Europe

Since we left the EU, the ability for UK-based firms to advise clients who live in other countries has essentially been removed.

However, if your client is an EEA/EU resident, there are a couple of exemptions you may be able to utilise to continue to act on their behalf:

- UK soil exemption: Your client may live abroad but if your advice and the regulated activity takes place exclusively during visits to the UK, the exemption is permitted. You need to keep clear records of the client’s location during any contact, as even an email or phone call made while the client was outside the UK could be considered cross-border activity.

- Reverse solicitation: A less common and, in some cases, riskier option is to cite reverse solicitation, which, when used correctly, it is valid under EU and UK law. British firms have every right to provide services to EU clients that act exclusively on their own initiative to seek financial advice. However, this exemption has limitations and seeking legal advice is recommended before proceeding on this basis.

An option for clients moving overseas temporarily is to consider giving a trusted person living in the UK power of attorney. The donor decides who to appoint and when it can be used – for example, only for the provision of financial management when they are living or working overseas.

The regulatory position

While the FCA may regulate the product you want to provide the client, if they live outside the UK, they are not within its jurisdiction in relation to your advice.

Therefore, you need to consider if the service can be justified, in terms of the cost to your firm and the client, and the effort required to comply with local legislation.

The problem is that the ‘characteristic performance’ of the service determines where the activity is seen to be undertaken. For discretionary investment management firms, it is slightly easier, as decisions are made by you in the UK, but advisers act on the instructions of the client and, for regulatory purposes, these activities are determined by the client’s location at the time the advice is given.

As a general rule, you cannot market or solicit for business outside the UK unless:

- You have written evidence of exemption from the host state

- You have been granted the relevant local authorisation

Practical considerations

You may be thinking the need to gain overseas authorisations is a mere technicality, but are you prepared to take the risk? Would you have PI cover if a complaint from an expat was to arise?

Although the chances of being caught may be low for one-off or irregular work, the FCA would hold a dim view of firms knowingly operating overseas in breach of local regulations.

There are other aspects to consider, too. For example, if you are providing an ongoing service, can you meet your Consumer Duty obligations? What would happen if you needed to make an urgent change and the client couldn’t come back to Britain? You really need to consider the outcomes for non-UK clients and whether they will receive fair value when judged against your wider target market.

Do your research

If you find yourself in the unenviable position of having to decide whether to continue acting for an emigrating client, it might be worth seeking the opinion of a solicitor or the financial regulator in the country concerned.

They will be able to confirm if there are local exemptions or if authorisation is needed. You also have to track down providers willing to facilitate an investment for clients without a UK base.

If you determine advice has been provided outside the UK, without the local regulatory permissions, you may need to consider making a declaration to the FCA. You may also need to check if your PI insurer will cover the transaction.

For precise details about serving clients overseas, it is always worth consulting the FCA’s handbook or seeking legal advice.

Vicky Pearce is a director at B-Compliant

Money

My neighbours hate my ‘skyscraper monstrosity’ home but I don’t care – council is on my side so they all need to shut up

SEETHING neighbours have hit out against a homeowner for erecting a skyscraper-style extension in their area.

Locals slammed builder Danny Dare after Bolton council approved the proposal for the Horwich gaff – with one dubbing it a “monstrosity”.

But builder Danny laughed off the complaints, claiming that concerns from residents over an invasion of their privacy are absurd.

He told The Sun: “I’m a builder myself and build dormers all the time.

“I’ve never had any problems until I wanted to build one on my home.

“But at the end of day, the council have approved it. So I don’t see what the problem is.

“I can’t understand what people are complaining about.

“They say it’s a privacy issue and it’ll mean we can see through their windows. But that’s not the case.”

Another resident defended Danny’s extension – arguing the add-on will make little difference to privacy concerns.

One woman said: “I know it’s upset some of my neighbours but I’ve got no objections to it at all.

“I can’t see there’s any loss of privacy because the top windows of the house already overlook our gardens anyway.

“And, as far I’m concerned, the house is some distance away from my home.”

Despite being shockingly compared to a hotel, Danny’s dormer is only 9.4m wide and will give his two-storey property just one other level.

However, Walter Gent, 64, who lives in a nearby bungalow, said he objected to the plans due to four criteria: the loss of privacy, it not keeping with the character of the road, over-development and the impact on parking.

He said: “I feel let down by Bolton Council.

“Initially, the plans were turned down by Horwich Council but they then passed into to Bolton, who took a complete different view.

What are my rights?

IF you’re not happy with your neighbour’s extension plans, there are some things you can do.

Once plans are submitted to the council, locals should be given a period where they can object or comment on the plans.

The plans for anything happening near you should be public once an application is submitted – so you can check on your local council website for these.

If you and a couple of neighbours complain for valid reasons, the council may decided to decline the homeowner the right to go ahead with their plans.

Valid reasons include:

- Loss of privacy

- The project would overshadow your home – blocking natural light

- Impact on the local area

- Traffic and parking

- Impact on neighbours

- Impact on trees and local wildlife

However, if plans have been approved there is little you can do.

You can challenge the decision but again, would need to have a valid reason for doing so with proof.

“They approved it because other dormers had been built in the area – but how can they compare it to ones built three streets away.

“I’ve already had to put up a 14ft high hedge in my back garden, but the dormer will mean less privacy because it will overlook my house and bedroom.

“It’ll feel like were living next to a hotel or a skyscraper.”

Councillor Ryan Bamforth echoed that sentiment, and hit out against the council for greenlighting the extension.

He said: “Another concerning aspect was the home-owner’s decision to start building and then seek retrospective planning permission.

“I was extremely upset it was granted.

“If councillors roll over to builders and developers every time there will be constant development because they will know retrospective applications will be approved.

“They should have the moral fibre to stand up for what is right and wrong.”

Money

Should I use my credit card to pay my rent?

When used wisely, credit cards can be very useful financial tools. This includes knowing what to use your credit card for and when to just use your cash. While credit cards offer convenience and the potential for rewards, they also come with risks, including high interest rates and the potential for debt accumulation. So, deciding whether to put those big purchases like rent, a new car, or even mortgage payments you should explore whether this is always the smartest option.

Is it a good idea to use your credit card for large purchases?

Paying your larger purchases on a credit card may seem like a safe idea but this is often how people fall into debt they can’t come back from. Paying for things like rent, cars, mortgage payments – recurring expenses means that each month you have to pay this back in full or watch as it tips over and builds up each month.

Often, landlords will charge extra fees for credit card payments or won’t accept them at all. Also, with higher interest rates this could make your rent higher overall.

When buying a car or financing a car you could earn points by putting these large purchases on your credit card, however many car dealerships limit how much you can charge or you could pay a higher interest rate. If you need help, then traditional car loans often come with lower rates.

Mortgage lenders may charge processing fees for credit card payments, and, given the size of mortgage payments, failing to pay off the balance could lead to high interest charges. Moreover, many mortgage companies do not even accept credit card payments, making this option impractical for most.

When using your credit card for any of these large purchases you have a higher chance of building debt and having to pay credit card late payment fees, high interest rates and additional payments.

What should a credit card be used for?

Credit cards can be useful and can help you manage your finances but making sure you know when not to use it will be equally helpful to maximise the benefits. Below is a list of uses your credit card should be used for.

You can find various credit cards that offer rewards points or cashback for purchases. With this, using your card for planned and manageable expenses, like groceries or petrol can help you accumulate these benefits without stretching yourself too thin.

Most people use their credit card in order to build a good credit score and report as this will help when you are ready to get a mortgage or other loans. When you use your credit card effectively and pay off your balance on time, in full each month you show lenders you’re a responsible borrower.

While it is not ideal to rely on your credit card for emergencies and it would be best to have a personal savings account for this, you can use your credit card if needed.

The Negatives of using a credit card for big purchases

- Building up debt: Large purchases can quickly max out your credit limit as well as lead to a build up of debt. They will be more challenging to pay off in full every month and you are more likely to get yourself into debt you can’t pay off.

- High interest rates: If the above does happen then your debt will also have higher interest rates than other forms of borrowing such as loans.

- Potential for overspending: People can often get carried away with a credit card as they see it as unlimited funds. This can be dangerous very quickly as you can start spending money you can’t pay back.

If you need help with how to pay off credit card debt then contact your bank and use these guides.

When to avoid using your credit card?

- When you are paying large, recurring expenses

- When you can’t pay off the full balance in time

- When there are additional fees

By following this guide about using your credit card you will be able to use the financial tool effectively. You can make sure you can build up a good credit score and avoid large interest fees and debt accumulation.

Money

Map reveals 50 Primark locations getting new service ahead of Christmas that will help avoid queues

OVER 50 Primark locations across the UK are set to get a new service that will help shoppers dodge queues this festive season.

The budget fashion brand is rolling out click and collect to 54 new stores before the end of the year.

The service, which allows customers to order clothes online and pick them up in-store, was first introduced in November 2022.

There is no fee to use click and collect but you must spend a minimum of £10.

It means shoppers can avoid the disappointment of arriving in stores and not being able to find the product they were looking for.

Fashion-lovers can also skip the queues and choose the day you would like to collect their items.

Unlike traditional online shopping, you must come into a Primark store to pick up your items as they will not be delivered to your home.

It is currently only available across 57 of Primark’s 191 stores in the UK.

However, once the service is fully rolled out before the end of the year some 111 sites will have the feature.

The exact date that customers will be able to use the new click and collect service in stores has not yet been confirmed.

Primark has also increased the number of products customers can buy via click-and-collect to include men’s and homeware products.

This is in addition to women’s and children’s clothing which was first introduced as part of a trial.

Click and collect is not the only new feature which has been spotted in Primark stores.

The budget fashion and beauty brand has also introduced self-scanners at a handful of its locations.

Around 20 Primark stores have the feature which lets shoppers scan and bag items themselves.

However, the service is kept separate from the main tills.

It is also protected by a security door which only opens when you scan a receipt.

The fashion retailer has also set up cafes within ts stores, including a Shrek-themed diner.

Existing 57 Primark stores to offer Click & Collect

- Bexleyheath, Unit 4 131 The Broadway, DA6 7HF

- Bluewater, Upper Thames Walk, DA9 9SQ

- Bromley, 162 High Street, BR1 1HE

- Charlton, Brocklebank Retail Park, SE7 7SX

- Croydon, 5 – 9 North End, High Street, CR9 1SX

- Dartford, 58 – 60 High Street, DA1 1DE

- Ealing, Ealing Broadway Centre, W5 5JY

- East Ham, 51 High Street North, E6 1HZ

- Hackney, 365 – 371 Mare Street, E8 1HY

- Hammersmith, Kings Hall Shopping Centre, W6 0PZ

- Harrow, St Ann’s Shopping Centre, HA1 1AT

- Hounslow, 165 – 169 High Street, TW3 1QL

- Ilford, 129 – 133 High Road, 1G1 1DE

- Kilburn, 54 – 56 High Street, NW6 4HJ

- Kingston, 76 Eden Street, KT1 1DJ

- Lewisham, 180 – 190 High Street, SE13 6JL

- London, 14 – 28 Oxford Street East, W1D 1AU

- London 499 – 517 Oxford Street West, W1K 7DA

- Peckham, 51 – 57 Rye Lane, SE15 5EY

- Romford, 33 – 35 South Street, RM1 1NJ

- Staines, Elmsleigh Shopping Centre, TW18 4QB

- Stratford, 127 – 128 Westfield Stratford City, E20 1EL

- Sutton, St Nicholas Shopping Centre, SM1 1AX

- Tooting, 31 – 39 Mitcham Road, SW17 9PA

- Uxbridge, 1 Chequers Mall, UB8 1LN

- Wandsworth, 32 – 34 Southside, SW18 4TF

- Watford, 109 – 111 High Street, WD17 2TA

- Wembley, 508 High Road, HA9 7BS

- West Thurrock, Unit 425 Lakeside Shopping Centre, RM20 2ZP

- White City, Westfield London Shopping Centre, W12 7GF

- Wood Green, Unit 57 The Mall, N22 6YQ

- Woolwich, 18 – 28 Hare Street, SE18 6LZ

- Birkenhead, 212 – 218 Grange Road, CH41 6EA

- Blackburn, 20 Cobden Court, BB1 7JG

- Blackpool, 50 – 70 Bank Hey Street, FY1 4RY

- Bolton, Crompton Place Shopping Centre, BL1 1EA

- Broughton, 2A Broughton Shopping Centre, CH4 0DE

- Burnley, Charter Walk Shopping Centre, BB11 1BB

- Bury, The Rock Shopping Centre, BL9 0ND

- Carlisle, 1 English Street, CA3 8NX

- Chester, 52 – 60 Foregate Street, CH1 1HA

- Huddersfield, 82 – 86 New Street, HD1 2TR

- Lancaster, Martgate Shopping Centre, LA1 1JF

- Liverpool, 48 – 56 Church Street, LY 3AY

- Llandudno, Parc Llandudno Retail Park, LL30 1PX

- Manchester, 106 – 22 Market Street, M1 1WA

- Manchester, The Trafford Centre, M17 8AS

- Oldham, 37 – 41 Market Place, OL1 3AB

- Preston, Fishergate Shopping Centre, PR1 8HJ

- Sheffield, The Meadowhall Shopping Centre, S9 1ER

- Sheffield, 30 The Moor, S1 4PA

- Southport, 1 Chapel Street, PR8 1AE

- Stockport, Chestergate, SK1 1NT

- Wallasey, 25-28 Liscard Way, CH44 5TL

- Warrington, Golden Square, WA1 1TD

- Wigan, 45-51 Standishgate, WK1 1UP

- Wrexham, 27-29 Regent Street, LL11 1RY

A number of the retailer’s stores now have a Shrek Far Far Away Cafe themed on the green ogre.

Locations across Manchester, Cardiff, Birmingham, Glasgow and Edinburgh now feature the fairytale-themed food and drink spot.

However, if you are keen to check it out you will have to be quick because the collaboration is set to end this November.

How does Primark’s click and collect service work?

The service works very similar to online shopping, but instead of getting the items dropped off at your home, you pick them up in-store.

Primark has over 3,000 products available to shop via its website, including menswear and homeware.

To place an order select a click and collect store, choose the size of your items to add to your bag and head to the checkout.

You can also select a date you would like to visit the store to pick the item up.

Click and collect can be cheaper than a home delivery as many retailers do not charge a fee for the service.

It is always worth looking online to see if your retailer has the option, but make it is at a store which is close to you.

-

Womens Workouts7 days ago

Womens Workouts7 days ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology2 weeks ago

Technology2 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 weeks ago

Science & Environment2 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

News1 week ago

News1 week agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLiquid crystals could improve quantum communication devices

-

News2 weeks ago

News2 weeks agoYou’re a Hypocrite, And So Am I

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Sport2 weeks ago

Sport2 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCardano founder to meet Argentina president Javier Milei

-

News2 weeks ago

News2 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Womens Workouts1 week ago

Womens Workouts1 week agoBest Exercises if You Want to Build a Great Physique

-

Science & Environment1 week ago

Science & Environment1 week agoMeet the world's first female male model | 7.30

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Womens Workouts1 week ago

Womens Workouts1 week agoEverything a Beginner Needs to Know About Squatting

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA slight curve helps rocks make the biggest splash

-

News2 weeks ago

News2 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBlockdaemon mulls 2026 IPO: Report

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

News1 week ago

News1 week agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts7 days ago

Womens Workouts7 days ago3 Day Full Body Toning Workout for Women

-

Travel6 days ago

Travel6 days agoDelta signs codeshare agreement with SAS

-

Politics5 days ago

Politics5 days agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow one theory ties together everything we know about the universe

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC asks court for four months to produce documents for Coinbase

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Sport2 weeks ago

Sport2 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Business2 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Technology2 weeks ago

Technology2 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts1 week ago

Womens Workouts1 week agoHow Heat Affects Your Body During Exercise

-

Womens Workouts1 week ago

Womens Workouts1 week agoKeep Your Goals on Track This Season

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoTelegram bot Banana Gun’s users drained of over $1.9M

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

News2 weeks ago

News2 weeks agoChurch same-sex split affecting bishop appointments

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

Technology2 weeks ago

Technology2 weeks agoFivetran targets data security by adding Hybrid Deployment

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

Business2 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics2 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News1 week ago

News1 week agoWhy Is Everyone Excited About These Smart Insoles?

-

Politics2 weeks ago

Politics2 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology2 weeks ago

Technology2 weeks agoCan technology fix the ‘broken’ concert ticketing system?

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSingle atoms captured morphing into quantum waves in startling image

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow Peter Higgs revealed the forces that hold the universe together

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

Womens Workouts1 week ago

Womens Workouts1 week agoWhich Squat Load Position is Right For You?

-

News1 week ago

News1 week agoBangladesh Holds the World Accountable to Secure Climate Justice

-

TV1 week ago

TV1 week agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Technology2 weeks ago

Technology2 weeks agoIs carbon capture an efficient way to tackle CO2?

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe maps that could hold the secret to curing cancer

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoHelp! My parents are addicted to Pi Network crypto tapper

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoThe physicist searching for quantum gravity in gravitational rainbows

-

Fashion Models2 weeks ago

Fashion Models2 weeks agoMixte

-

Politics2 weeks ago

Politics2 weeks agoLabour MP urges UK government to nationalise Grangemouth refinery

-

Money1 week ago

Money1 week agoBritain’s ultra-wealthy exit ahead of proposed non-dom tax changes

-

Womens Workouts1 week ago

Womens Workouts1 week agoWhere is the Science Today?

You must be logged in to post a comment Login