Money

Liam Payne’s Death: What Is Pink Cocaine?

The tragic death of Liam Payne at just 31 years old has sent shockwaves through the music industry and his legion of fans. The former One Direction star was found dead in a hotel in Buenos Aires, Argentina, on October 16, 2024, leaving the world grappling with the loss of a beloved artist. However, the circumstances surrounding his untimely demise have raised even more alarming questions. Reports indicate that a partial autopsy revealed the presence of a dangerous substance known as “pink cocaine” in his system. But what exactly is this drug, and what does it mean for those who encounter it?

The Dark Reality of Pink Cocaine

Despite its misleading name, pink cocaine doesn’t actually contain any cocaine. Instead, it’s a potent powdered mix of various drugs, often including ecstasy, ketamine, caffeine, and a psychedelic called 2-CB, as reported by the National Capital Poison Center. Commonly referred to as “Tusi,” this substance is often dyed bright pink, sometimes with a fruity, strawberry flavor added for appeal.

Primarily found in party and club environments, pink cocaine can lead to a range of unsettling effects. Users have reported experiencing hallucinations, anxiety, nausea, increased body temperature, and elevated heart rates. Even more concerning, the National Capital Poison Center warns that pink cocaine can precipitate physical and sexual assaults, as well as severe injuries when individuals are under its influence.

A Dangerous Cocktail of Drugs

What’s particularly alarming about pink cocaine is that it can often be mixed with other substances, resulting in unpredictable and potentially life-threatening effects. Reports indicate that samples of pink cocaine have been found to contain opioids, bath salts, and hallucinogens, intensifying the dangers associated with its use. Although the National Capital Poison Center states that pink cocaine is less addictive than substances like opioids or fentanyl, the risk of developing an addiction still looms.

Moreover, the lack of regulation surrounding the production and distribution of pink cocaine means users have no way of knowing the exact composition of the drug they’re taking. This uncertainty can lead to overdose or severe health complications, as users may not be aware of the dangerous ingredients mixed in with the primary substances.

Related: Liam Payne 911 Call Transcript Released After Hotel Staff Plea

Liam Payne’s Tragic Final Hours

In the wake of Liam’s death, shocking details from his partial autopsy have emerged. On October 21, 2024, it was revealed that he had pink cocaine in his system alongside other substances, including cocaine, benzodiazepines, and crack. Eyewitness accounts have painted a grim picture of the hours leading up to his tragic fall from a third-floor balcony at the hotel.

A hotel staff member made a frantic 911 call just before the incident, expressing concern over an unnamed guest who had “overindulged on drugs and alcohol.” The audio, obtained by Telemundo, highlights the urgency of the situation. “When he is conscious, he breaks, he is breaking the whole room,” the staff member stated, pleading for police assistance due to fears for the guest’s safety. “The guest is in a room that has a balcony, and, well, we are a little afraid that he might do something life-threatening.”

Witnesses reported hearing loud noises and screams from his hotel room hours before the fall, suggesting that Liam was in distress. As investigations continue, friends and family have called for greater awareness of the risks associated with party drugs and the culture of excess that often accompanies fame.

The Aftermath of Liam’s Death

Liam Payne’s shocking passing has reignited discussions around the dangers of recreational drugs and their devastating impact. The rise of substances like pink cocaine poses a significant threat, especially to young people who might underestimate its dangers. As friends, fans, and fellow musicians mourn the loss of a talented star, the conversation about drug use, mental health, and the pressures of fame takes center stage.

The Celebrity Influence on Drug Culture

Liam Payne’s death highlights the broader issue of substance abuse in the entertainment industry, where excessive partying and drug use can become normalized. Many celebrities, including musicians and actors, have openly discussed their struggles with addiction and the pressures they face in the limelight. The allure of fame often comes with hidden dangers, leading to tragic outcomes that can affect not only the individual but also their fans and loved ones.

As the conversation surrounding mental health and substance abuse continues to evolve, it’s vital to recognize the importance of seeking help. Support systems, both professional and personal, play a crucial role in helping individuals navigate these challenges.

Related: Former One Direction star Liam Payne found dead in suspected suicide

Stay Informed and Stay Safe

As more information surfaces about Liam Payne’s tragic end and the role of pink cocaine in his death, it’s crucial for individuals to educate themselves about the dangers of recreational drug use. If you or someone you know is struggling with substance abuse, help is available. Reach out to local support groups or healthcare professionals for assistance.

Raising awareness about drugs like pink cocaine can empower individuals to make informed decisions and prioritize their health and well-being. Engaging in open conversations about substance use and its effects is essential in breaking the stigma surrounding addiction.

For further details on this tragic story and updates on drug awareness, visit National Capital Poison Center for resources and information.

Money

I know how to buy cheap gig tickets to acts like Coldplay and Sam Fender – and you’ll even beat the queues

COMPETITION for affordable concert tickets has been fiercer than ever this year.

Last month Oasis made headlines when they announced their reunion tour – for all the wrong reasons.

Dynamic ticket prices and lengthy online queues frustrated fans and highlighted problems in the ticket industry.

Coldplay and Sam Fender have also announced big UK tours in recent weeks, leaving concertgoers scrambling for tickets.

Meanwhile, earlier this year fans paid up to £540 to see American songstress Taylor Swift on her hugely popular Eras Tour.

Although most of us are unable to splash that kind of cash on a concert, there are still ways to bag the hottest ticket in town.

Today consumer expert Martyn James explains the best ways to get cheap tickets.

Sign up to fan sites

Martyn said there is no way to guarantee cheap tickets but there are a few options if you can hold your nerve.

One option is to sign up to fan sites, he recommends.

“This won’t get you cheap tickets generally, unless the band isn’t well known,” he said.

“But you will get priority booking and potentially better tickets.”

Some artists will also release tickets early to fans who have bought their CDs and vinyls.

For example, Taylor Swift’s label pre-sale was only open to fans who had pre-ordered a copy of her album Midnights between Monday 29 August, 2022 and Thursday 27 October, 2022.

These fans were given priority access to her concert ticket sale.

Meanwhile, Jorja Smith fans could get their hands on tickets to see the singer at Ronnie Scott’s Jazz Club in London if they pre-ordered her album “Falling or Flying” on vinyl.

Look for unfilled seats

Some artists book big venues or add extra dates to their tour if their first release of tickets have sold well.

How to get Oasis tickets if you missed out

SENIOR Consumer Reporter Olivia Marshall explains how you can still bag tickets to see Oasis.

WHEN I heard the news that Britpop favourites Oasis were reuniting after 15 years, my thoughts immediately turned to the inevitable scramble for tickets to next year’s tour.

Despite playing 17 dates across the UK and Ireland, many will have been left empty handed after yesterday’s general sale.

If you’re one of the unlucky ones who missed out, stop crying your heart out, because there may be hopes of a ticket yet.

Oasis have partnered with resale platform Twickets. The site only allows fans to resell tickets at face value. This means that sellers can’t add more than 15 per cent to the price of the ticket to cover booking fees and they can also reduce the price if they’re not selling.

Delivery is agreed between the buyer and the seller, so Twickets can see who is responsible should a ticket not be delivered on time.

You can also set up alerts on the Twickets app, so you’ll be the first to know if Oasis tickets become available.

Ticketmaster also has its own Fan-to-Fan resale platform, which works on the same premise.

If you’re thinking of just rolling with it and buying from an unauthorised platform, you may want to think again.

The Gallagher brothers have already said that selling tickets through unauthorised resale platforms will breach the terms and conditions and tickets may be cancelled.

You also run the risk of scammers sliding away with your cash by going through unofficial routes.

Scammers will piggyback onto popular events and earlier this year, Lloyds Bank estimated that fans of Taylor Swift had lost more than £1million to ticket scammers ahead of her UK tour.

Don’t feel pressured to pay rip off prices. Keep an eye on official platforms and you may find you’re making memories that will live forever at Oasis after all.

But after doing this they sometimes find that they can’t fill them fully.

“A number of big ticket artists this summer offered reduced prices to fill these seats – often considerably less,” Martyn said.

“Keep an eye on the ticket agencies and ‘last minute’ ticket sites for offers.”

Seattle grunge band Pearl Jam were forced to slash the price of tickets to their Dark Matter World Tour by more than 50% in June.

Premium standing tickets were initially £249.45 but tickets were later available through re-sale for £155.25.

Seventies pop legend Leo Sayer was also forced to halve the price of tickets to his London Palladium show this year.

Some tickets were available for just £20 plus a £4 booking fee.

Meanwhile, a festival which indie rock band Kaiser Chiefs were headlining slashed its ticket prices by half.

The band performed on July 27 at the annual festival in Seaton Reach in Hartlepool.

Grab mates rates

You cannot resell tickets for profit other than to the box office that you bought them from, but there are other ways to work the system, suggests Martyn.

“You are allowed to gift tickets to mates if you can’t go to a concert, so if you know someone who can’t attend then you could get a cut price deal.”

If you are going to go down this route beware, Martyn warns.

Resale tickets are often used by scammers to con fans.

“This is the single most common way people get stiffed by strangers selling tickets,” he said.

“Only give money to ticket holders who you know and trust. Taylor Swift fans alone lost zillions through this scam.”

Join a loyalty scheme

Some credit cards and loyalty programmes come with a range of exclusive offers which are only available to members.

These can include pre-sale access to popular concerts, VIP experiences or discounted ticket prices.

For example, American Express card members can get exclusive access to club seats and terrace suites at the Ovo Arena Wembley.

Prices start at £150 but could end up being cheaper than buying tickets during official sales.

Meanwhile, O2 customers can get access to priority tickets for gigs including Sam Fender and Busted vs McFly.

Make sure you enable notifications from the programmes you join and subscribe to newsletters to avoid missing out.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

That Christmas’ Review: Netflix’s New Holiday Classic

By Louise Rochford: October 20, 2024

‘That Christmas’ Review: A Potential Holiday Classic from Netflix

In the spirit of the season, Netflix’s That Christmas emerges as a delightful animated feature poised to carve its niche among holiday classics. This charming film, penned by the beloved Richard Curtis and directed by Simon Otto in his feature debut, takes audiences on a whimsical journey through the quaint seaside town of Wellington-on-Sea. Voiced by the illustrious Brian Cox, Santa finds himself battling treacherous winter weather on Christmas Eve, navigating the stormy skies while racing against the clock to deliver gifts to eager children.

A Familiar Dilemma

The film opens with Santa facing a familiar yet daunting dilemma: a fierce winter storm threatens to derail his plans. With only one reindeer, voiced by Guz Khan, to pull the sleigh, tensions rise between them—so much so that Santa jokingly considers trading in his sleigh for a self-driving vehicle next year. The stakes are high, and as Santa pushes through snow and strong winds, he must rely on his determination and the spirit of the season to fulfill his mission. Despite these comedic setbacks, Santa’s ultimate goal remains clear: to bring joy to children around the world, especially those in his fictional English coastal town.

A Joyous Celebration of Community

That Christmas premiered at the BFI London Film Festival, and it’s clear that this animation from Locksmith Animation (known for Ron’s Gone Wrong) is destined to become a holiday favorite. Unlike many holiday films that can veer into overly saccharine territory, this story gracefully sidesteps cliché by grounding its whimsical narrative in authentic and relatable emotions.

Otto, renowned for his work on How to Train Your Dragon, adeptly balances playful self-awareness with the required suspension of disbelief inherent in holiday tales. The film manages to evoke the heartwarming charm that Curtis is known for while introducing a fresh animated style. The narrative is rooted in the interconnected lives of its characters, with Santa guiding us through Wellington-on-Sea, a close-knit community where the magic of Christmas unfolds.

The film introduces a diverse array of characters, each adding their own flavor to the holiday spirit. A group of local children, led by the bold 15-year-old Bernadette (India Brown), embarks on a progressive rendition of the traditional Three Kings play, dubbed Three Wise Women. Their imaginative production swaps traditional shepherds for organic vegetable farmers, creating a vibrant tapestry of creativity and joy. The performance becomes a metaphor for the changing times, emphasizing sustainability and community involvement.

At the heart of the story is Danny (Jack Wisniewski), the new kid in town, who finds himself navigating the complexities of childhood friendships and the emotional turmoil of his parents’ divorce. His growing bond with the grumpy yet endearing teacher Ms. Trapper (Fiona Shaw) adds depth to the narrative, showcasing the importance of connection during the holiday season. As Danny struggles with feelings of loneliness and the hope of rekindling a relationship with his estranged father, viewers are invited to reflect on their own familial connections and the importance of community.

Meanwhile, Danny’s crush on the anxious Sam (Zazie Hayhurst) brings a lighthearted, relatable layer to the film, highlighting the ups and downs of young love. Their tentative relationship mirrors the awkwardness of adolescence, with all its hopes and fears, as they navigate school life together.

Comedic Chaos and Emotional Depth

The McNutt family, portrayed by Lolly Adefope and Rhys Darby, injects a sense of comedic chaos as they prepare for the holiday alongside their amusing friends. The plot thickens when Bernadette’s parents leave town for a wedding, leaving their children to fend for themselves amid a snowstorm. This decision spirals into a series of comedic mishaps, culminating in a desperate struggle to return home before Christmas day.

As the parents scramble to find a way back to their families, the film explores themes of sacrifice and the lengths to which people will go for their loved ones. The children, meanwhile, must navigate their own challenges, leading to moments of unexpected bravery and friendship. The McNutts’ quirky antics add a layer of humor, keeping the tone light while still addressing deeper emotional currents.

Throughout its 91-minute runtime, That Christmas skillfully weaves together multiple storylines, ensuring each character receives the attention they deserve. The attention to detail—from the lighthouse keeper’s daily town bulletin updates to the friendly rivalries among residents—creates an immersive experience that breathes life into this fictional village.

A Heartwarming Adventure

What sets That Christmas apart from typical holiday fare is its dedication to portraying the complexities of community life. The film doesn’t shy away from the challenges faced by its characters; rather, it embraces them, presenting a narrative that feels genuine and relatable. The characters’ struggles with love, family, and personal growth resonate with viewers of all ages, offering lessons about resilience and the true meaning of Christmas.

With its rich storytelling, charming animation, and a talented voice cast, the film is set to become a holiday staple for families and fans of all ages. Brian Cox’s Santa, alongside a colorful ensemble, delivers a heartfelt narrative that resonates with the warmth and spirit of Christmas. It reminds us that the holidays are not just about presents but about the connections we make and the love we share with one another.

Full Credits

Venue: BFI London Film Festival (Gala)

Distributor: Netflix

Production Companies: Double Negative, Locksmith Animation

Cast: Brian Cox, Fiona Shaw, Jodie Whittaker, Bill Nighy, Rhys Darby

Director: Simon Otto

Screenwriters: Richard Curtis, Peter Souter

Producers: Nicole P. Hearon, p.g.a, Adam Tandy, p.g.a

Executive Producers: Mary Coleman, Natalie Fischer, Julie Lockhart, Elisabeth Murdoch, Bonnie Arnold, Lara Breay, Sarah Smith, Rebecca Cobb, Richard Curtis, Colin Hopkins

Production Designer: Justin Hutchinson-Chatburn

Editor: Sim Evan-Jones, ACE

Music: John Powell

Rated: PG

Runtime: 1 hour 31 minutes.

With its rich tapestry of characters and heartfelt storytelling, That Christmas is bound to become a cherished addition to holiday movie nights, reminding audiences of the joy, laughter, and love that define the season.

Finance Monthly Star Rating: 8/10

Money

Government urged to ‘keep up the momentum’ after pensions dashboard update

Industry experts have urged the government to “keep up the momentum” after it gave an update on the Pensions Dashboard Programme today (22 October).

Pensions minister Emma Reynolds announced that the MoneyHelper Pension Dashboard service will be made available before commercial dashboards.

Reynolds added that it is too early to confirm a launch date to the public.

The Department for Work and Pensions (DWP) previously said the launch date will only be announced once it is assured most pension schemes have connected and the dashboards are working well.

The Pension Dashboards Programme (PDP) has been given the task of developing the Pension Dashboards ecosystem and organising for most schemes to connect to it.

Pension schemes must connect to the dashboard ecosystem by October 2026 at the latest, but have been urged to connect earlier, starting from April 2025.

The Financial Conduct Authority is expected to publish the final rules of the governance framework for commercial dashboards before the end of the year.

Rachel Vahey, head of public policy at AJ Bell, said: “Pension Dashboards will have the power to dramatically improve pension engagement. They will give people an overall picture of their pension savings, letting them know how much they have saved so far, where it is and, importantly, how to add to it and how to get hold of it.

“It’s therefore reassuring the government is maintaining its commitment to such an important project, especially when the public finance purse strings are so constrained.

“We need to keep up the momentum to develop dashboards and drive this initiative to delivery.”

Vahey said that Pension Dashboards “need to cover most pension schemes, work efficiently and be easy to use”.

“Obviously, the Pension Dashboards Programme (PDP) should concentrate on getting all these elements right. But there is simply no point building dashboards if no-one is going to use them,” she added.

“Restricting the dashboards to a single one – the government’s own version – means not as many people will be aware of the dashboard or use it, potentially missing out on the opportunity to trace lost pension schemes, but also to put their pension savings back on track.

“A ‘soft’ launch could make sense, while dashboards are tested to ensure they are working as expected.

“But for dashboards to be a success it’s essential that commercial dashboards are launched as soon as possible, allowing them to play their role in making sure pension savers are aware of them and use them.”

Scottish Widows head of policy, Pete Glancy, said: “We welcome the government’s commitment to multiple qualifying dashboards, which will support innovation in best meeting these needs of pension savers.

“The public will benefit from being able to see all of their combined pension income, which they are on track to have in retirement, in one place.

“We know that they are much more likely to engage with their pension pots if they can access that information through channels they already visit often.

“We are excited about the difference that dashboards could make but recognise its important to get something as important as this right.

“Let’s maintain the momentum.”

Yvonne Braun, director of policy, long term savings, health and protection at the Association of British Insurers, said: “Pensions Dashboards will be a huge catalyst for positive change in how people engage with their pensions, including helping them find lost pension money.

“We are reassured to see the government’s continued commitment to the programme, and to launching both a state-owned MoneyHelper Dashboard and enabling commercial dashboards.

“Commercial dashboards are vital because they will allow the maximum number of people to find their pension information in the on-line services they use day to day.

“It is therefore crucial both the MoneyHelper dashboard and commercial dashboards are launched as soon as possible, and very closely together, so that this pioneering project can deliver on its enormous potential.”

Money

How to check if you’re eligible for DWP winter cash including cold weather payments and warm home discount

MILLIONS are eligible for free cash from the Department for Work and Pensions (DWP) this winter.

Hard-up households are in line for help through a number of Government schemes and funds.

In some cases you have to apply while in others those who qualify receive payments automatically.

Whether you are eligible for all of them depends on your exact circumstances too.

From the cold weather payment, to Household Support Fund and Warm Home Discount scheme, here’s all the help on offer.

Cold weather payment

Cold weather payments are made to households in areas that experience continual cold temperatures over the winter months.

The payments are usually made between November 1 and March 31 to those on certain benefits.

You get £25 for each seven day period where the temperature is zero degrees celsius or below in your area, with payments usually processed in 14 working days.

That means if you live somewhere where temperatures were sub-zero for two weeks, you would get £50.

You usually qualify for a cold weather payment if you are on one of the following benefits:

Most eligible people don’t need to apply to get cold weather payments.

However, if you are on Income Support, income-based Jobseeker’s Allowance (JSA) or income-related Employment and Support Allowance (ESA) and have had a baby or have a child under five living with you, you need to tell your local Jobcentre Plus centre.

If you don’t, you won’t receive any of the payments despite being eligible.

You can check if you’re eligible for a cold weather payment via gov.uk.

Warm Home Discount Scheme

The Warm Home Discount Scheme sees households on certain benefits receive a one-off discount on their energy bills worth £150.

The discount is automatic for the vast majority of qualifying households and is applied between October and the following March.

You are automatically eligible if you receive the Guarantee Credit part of Pension Credit.

You also qualify if you are on a number of other benefits and live in a home with a high energy cost score.

This is calculated by the Government based on the type, age and size of your property.

You may not qualify for the Warm Home Discount if you live in a more energy-efficient home for example.

The £150 discount is applied to your bill by your energy supplier.

The full list of suppliers who are part of the scheme can be found via https://www.gov.uk/the-warm-home-discount-scheme/energy-suppliers.

Households in Scotland don’t need to apply for the Warm Home Discount if they get the Guarantee Credit element of Pension Credit.

However, you do need to apply via your energy firm if you receive any of the other qualifying benefits.

Household Support Fund

The Household Support Fund has been extended multiple times, first launching in October 2021.

The latest round is worth £421million and has been shared by the DWP between councils in England.

These councils then have to decide who to give money to, and how to distribute it.

That means what you are entitled to depends on where you live and it can be a bit of a postcode lottery.

However, you might be eligible for direct bank transfers, supermarket or energy vouchers.

You may even qualify for discounted white goods.

Households in Birmingham can get £200 cash grants paid into their bank accounts by the city council.

Meanwhile, Nottinghamshire Council is paying tens of thousands of households £200 one-off payments.

You can check if you’re eligible for help by contacting your local council which you can find via www.gov.uk/find-local-council.

Are you missing out on benefits?

YOU can use a benefits calculator to help check that you are not missing out on money you are entitled to

Charity Turn2Us’ benefits calculator works out what you could get.

Entitledto’s free calculator determines whether you qualify for various benefits, tax credit and Universal Credit.

MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto’s data.

You can use Policy in Practice’s calculator to determine which benefits you could receive and how much cash you’ll have left over each month after paying for housing costs.

Your exact entitlement will only be clear when you make a claim, but calculators can indicate what you might be eligible for.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Behind the Headlines: Advice tech is great… when it works

In the summer, I seriously considered replacing my iPhone 14 with an old Nokia 3310 – a phone you can use to text, make calls and play Snake.

But then I remembered how heavily I rely on Google Maps. And how I need email and Microsoft Teams on my phone for work. Also, it’s so much more convenient to keep train and plane tickets on my phone, and use Apple Pay to buy things. And to have a camera to hand at all times. The list goes on and, needless to say, I kept my iPhone.

The (slightly worrying) reality is that technology has become integral to everyday life for most people in the Western world.

And yes, it’s great… when it works.

But last night, I was trying to get an article finished for today and my computer would not play ball.

First, Microsoft Word froze up and wouldn’t let me write anything, then the CMS went down so I couldn’t load anything onto the website.

I regained access to both but my emails wouldn’t open and then the whole laptop shut down without warning (it’s a good thing I’m an obsessive saver).

In the end, it took me about an hour longer than it should have to complete my article.

Obviously, without technology, I wouldn’t have been able to complete the task at all. But that didn’t make it any less irksome when the technology slowed me down.

It’s a frustration shared by advisers.

Currently, only one-fifth are satisfied with their tech stack and not looking to make a change, NextWealth’s latest Financial Advice Business Benchmarks report, published today (22 October), suggests. This is the lowest level since 2020.

A major frustration for advisers is the inefficiency of existing technology in streamlining business processes.

NextWealth managing director Heather Hopkins says innovation in tech can be a “critical driver” of business efficiency. Yet only 21% of respondents are fully confident in technology innovations to make their lives easier.

In the report, respondents express the need for faster systems and better integration capabilities to enhance overall efficiency.

The report suggests that growth firms are those most likely to be looking to make a change. Around 39% of respondents from growth firms are looking to change their tech stack, almost 17% higher than the rest of the market.

NextWealth suggests that, as growth firms are focussed on hiring staff and seeking new clients, it is possible to deduce that these firms are “particularly discerning” of solutions that enable them to streamline activity in meeting growth objectives.

But there is still a long way to go when it comes to using technology to deliver efficient advice.

“In spite of new ways of working and huge advances in tech, there has been no improvement in the time it takes to deliver advice to a new client,” says NextWealth managing director Heather Hopkins.

“It still takes an average of 33 days to deliver the first piece of advice to a new client. This is something I really hope we see change in the near future.”

Many advisers believe that current tech solutions are not effectively addressing these operational challenges. And almost a third say they will add or cease working with a tech partner in the next year.

This change, says NextWealth, is driven by a desire to improve business efficiency and to adopt artificial intelligence.

AI has been in development for some time now and is undoubtedly on the radar of financial advice firms, the report says. But attitudes remain split, and the benefits and limitations of AI can lack clarity.

For example, the Financial Conduct Authority has made it clear that it wants firms to embrace AI, but it hasn’t yet set out how it can use it.

Speaking at The Verve Group’s Evolution 2024 conference last month, Iress head of relationship management – wealth UK Gareth Williams said firms in the financial services sector now face a “Catch-22 situation” when it comes to adopting artificial intelligence due to the messages from the regulator.

At the end of August, research from the CFA Institute showed that the vast majority (85%) of investment professionals believe there needs to be industry-wide standards and ethical guidelines for AI use. 82% said the lack of such standards hinders faster adoption.

Overall, 47% said their business is not well prepared for potential regulatory changes regarding AI.

But they need to get prepared, because this is something the regulator is pushing for.

Last week, it launched the AI Lab – a new initiative, to help firms “overcome challenges” in building and implementing AI solutions and support the government’s work on safe and responsible AI development.

NextWealth’s FABB report suggests the appetite to engage with AI is strong among financial advice professionals, with over a quarter using or implementing an AI solution.

The increase in appetite among respondents is significant, with 28% saying they are currently using AI, up from 5% year-on-year.

In verbatim feedback, almost a fifth of financial advice professionals (18%) explicitly said they had changed their tech stack to incorporate AI-based solutions.

Meanwhile, almost two-thirds of financial advice professionals are not using AI but do consider it an area to watch (up from 44% in 2023).

The view that AI is not fit for purpose has decreased from 29% in 2023 to just 7% this year, reinforcing the overall picture of an increased perception of relevance.

As demonstrated by my nightmare with my laptop yesterday, there is only so far technology will take you. And there is only so much advisers can do to make their own businesses efficient before having to rely on others.

One-third of respondents to NextWealth’s survey said that gathering data from providers is the lengthiest step in the process of delivering advice.

There has been no meaningful change in this metric since 2021. Additionally, 8% more respondents say that getting data from the client is the lengthiest step.

“While tech can make advice businesses more efficient, these firms rely on providers to share data,” says Hopkins. “Tech isn’t the only solution.”

Money

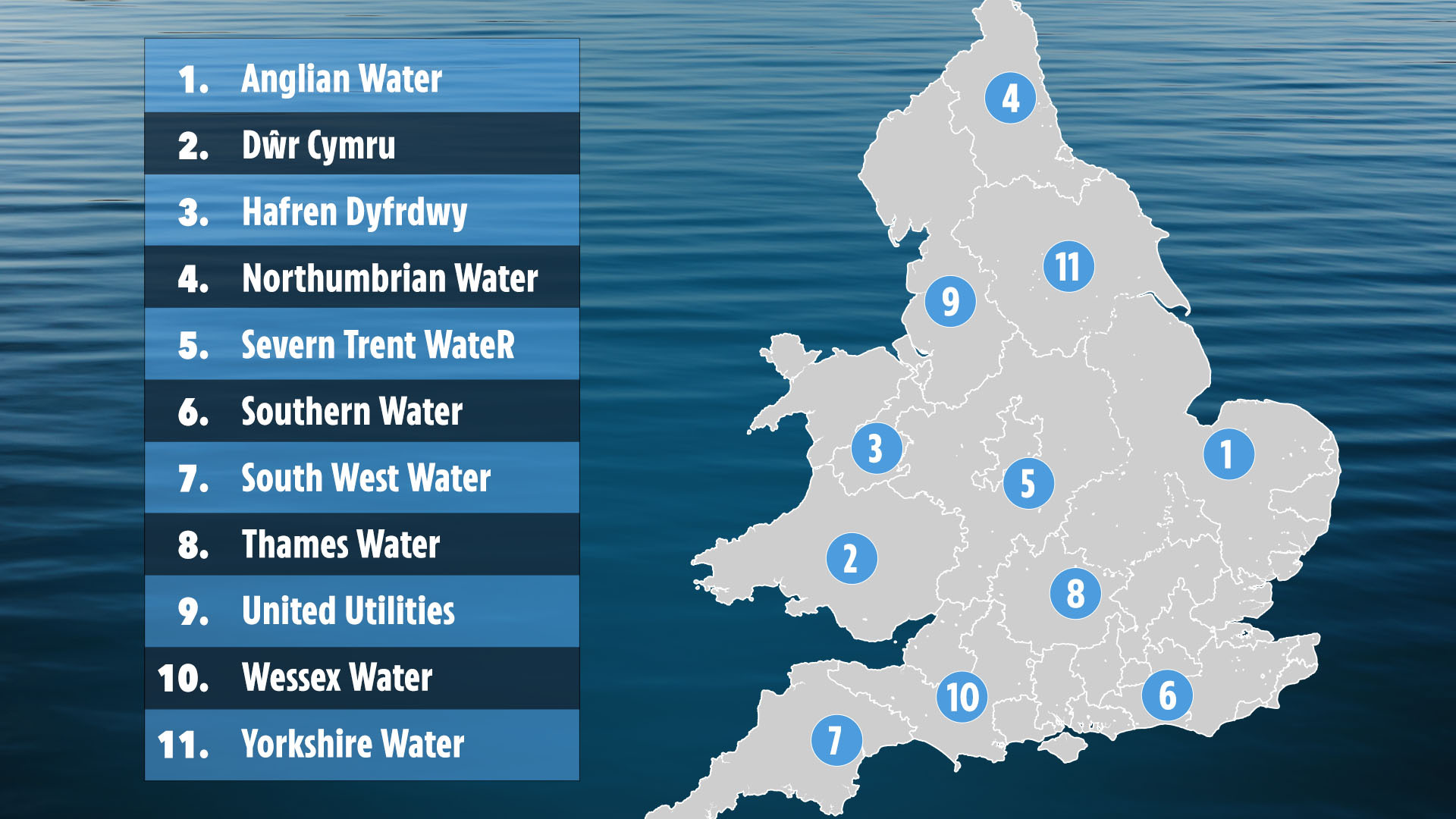

Map reveals how major water firms are planning to hike rates by up to 84%, adding up to £352 to household bills

MILLIONS of water customers could see their bills rise by up to 84% as major firms call for bumper hikes.

According to figures released by the watchdog Ofwat on Tuesday, water companies have requested even higher consumer bill increases than initially proposed.

The Sun was first to reveal the news on Friday.

The latest requests by water firms would see the average customer bill in England and Wales rise by 40% between now and 2030 to £615 per year.

Earlier this year, companies asked Ofwat for bills averaging £585 by 2030, an increase of about one-third from the current average of £439.

This summer, the regulator pared back those requests to an average of £535, in its draft price review in July.

But now, after a consultation period, 10 of the 11 water companies have hit back with even higher requests than before.

The biggest proposed rise is by Southern Water, which would see bills for its customers in Sussex, Kent and Hampshire rise by 84% between now and 2030.

Thames Water, the UK’s biggest provider, which is in emergency talks over a £15 billion debt pile and a worsening financial situation, has asked for a 53% rise.

The next biggest hikes are by Severn Trent Water, of 46% to £580, and north Wales provider Hafren Dyfrdwy, of 45% to £568.

Only one company, Wessex Water, is not demanding higher bills than first requested.

Many argue that they need to spend more on upgrading their pipes, sewers, and reservoirs than originally planned, and therefore, they need bills to go up, too.

Ofwat wrote in an update on Tuesday that this was “mostly to meet the requirements of other regulators like the Environment Agency and Drinking Water Inspectorate”.

However, some of the increases are designed to meet “changes to the proposed rate of return for investors”.

Ofwat is due to make a final decision on bills increases on December 19, with companies going to the negotiating table with regulators before then.

The regulator said: “We will consider this additional expenditure request as part of our final determinations.”

How much is your water company proposing to hike bills?

Here’s how water and wastewater companies are planning to hike bills by 2029-30:

- Anglian Water: £614 (up from £491)

- Dŵr Cymru: £626 (up from £455)

- Hafren Dyfrdwy: £568 (up from £392)

- Northumbrian Water: £415 (up from £501)

- Severn Trent Water: £580 (up from £398)

- Southern Water: £772 (up from £420)

- South West Water: £613 (up from £497)

- Thames Water: £667 (up from £436)

- United Utilities: £584 (up from £442)

- Wessex Water: £658 (up from £508)

- Yorkshire Water: £583 (up from £439)

Here’s how water-only companies are planning to hike bills by 2029-30:

- Affinity Water: £240 (up from £192)

- Portsmouth Water: £143 (up from £111)

- South East Water: £305 (up from £232)

- South Staffs Water: £181 (up from £161)

- SES Water: £238 (up from £221)

The latest string of demands comes amid public and political outcry over sewage spills in the privatised water industry, while companies’ investors receive dividends and top executives get bonuses.

A recent performance report by Ofwat showed there has only been a 2% reduction in pollution since 2019 despite firms committing to cutting it by 30%.

Labour has suggested sweeping new laws that could see bosses face up to two years in jail if they obstruct regulators – but nothing has come into force.

At the begining of October, water companies were ordered to return £157.6million to customers after failing to meet pollution targets.

Each year, Ofwat evaluates the performance of England and Wales’s 17 largest water and wastewater companies against key targets, including sewer flooding, supply interruptions, and water leaks.

For the second consecutive year, no company attained the highest rating, although four companies demonstrated improvement compared to the previous year.

As a result, millions of customers at 13 water companies will see their bills slashed next year as the watchdog issues fresh penalties.

The penalties for each water firm are as follows:

- Thames Water £56.8million

- Anglian Water: £38.1million

- Yorkshire Water: £36million

- Southern Water: £31.9million

- Welsh Water: £24.1million

- South West Water: £17.4million

- South East Water: £8million

- Wessex Water: £5.3million

- Affinity Water: £5.2million

- Bristol Water: £1.9million

- Portsmouth Water: £1.1million

- South Staffs Water: £700,000

- Hafren Dyfrdwy: £200,000

The regulator said that the exact amount that will be returned to customers will be finalised in December and applied to bills from April 2025.

Only four water companies have not faced a penalty from the regulator, meaning customers at the following firms won’t receive a rebate next year.

Instead, the amount they will be allowed to add to bills are as follows:

- United Utilities: £33.2million

- Severn Trent Water: £27.9million

- Northumbrian Water: £7.8million

- SES Water: £200,000

Water companies were set stretching targets for 2020-25 to deliver better outcomes, for both customers and the environment.

Where they fall short on these, the regulator imposes performance penalties resulting in customers being charged less than they would be the following billing year.

Performance penalties have totalled more than £430million since 2020.

Last year, Ofwat forced through bill reductions worth £177.6million.

What water bill support is available?

IT’S always worth checking if you qualify for a discount or extra support to help pay your water bill.

Over two million households who qualify to be on discounted social water tariffs aren’t claiming the savings provided, according to the Consumer Council for Water (CCW).

Only 1.3million households are currently issued with a social water tariff – up 19% from the previous year.

And the average household qualifying for the discounted water rates can slash their bills by £160 a year.

Every water company has a social tariff scheme which can help reduce your bills if you’re on a low income and the CCW is calling on customers to take advantage before bills rise in April.

Who’s eligible for help and the level of support offered varies depending on your water company.

Most suppliers also have a pot of money to dish out to thousands of customers who are under pressure from rising costs – and you don’t have to pay it back.

These grants can be worth hundreds of pounds offering a vital lifeline when faced with daunting water bills.

The exact amount you can get depends on where you live and your supplier, as well as your individual circumstances.

Many billpayers across the country could also get help paying off water debts through a little-known scheme and even get the balance written off.

Companies match the payments eligible customers make against the debt on their account to help clear it sooner.

If you’re on a water meter but find it hard to save water as you have a large family or water-dependent medical condition, you may be able to cap your bills through the WaterSure scheme.

Bills are capped at the average amount for your supplier, so the amount you could save will vary.

The Consumer Council for Water estimates that bills are reduced by £307 on average through the scheme.

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

News2 weeks ago

News2 weeks agoNavigating the News Void: Opportunities for Revitalization

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

News1 month ago

the pick of new debut fiction

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

News2 weeks ago

News2 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Technology4 weeks ago

Technology4 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

MMA2 weeks ago

MMA2 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

TV2 weeks ago

TV2 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

Sport2 weeks ago

Sport2 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

News2 weeks ago

News2 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

MMA2 weeks ago

MMA2 weeks agoPereira vs. Rountree preview show live stream

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

News2 weeks ago

News2 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists are grappling with their own reproducibility crisis

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

Technology2 weeks ago

Technology2 weeks agoThe best budget robot vacuums for 2024

-

Technology2 weeks ago

Technology2 weeks agoA very underrated horror movie sequel is streaming on Max

-

News2 weeks ago

News2 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

Sport1 month ago

Sport1 month agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment1 month ago

Science & Environment1 month agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Business3 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

News1 month ago

News1 month agoYou’re a Hypocrite, And So Am I

-

Science & Environment1 month ago

Science & Environment1 month agoRethinking space and time could let us do away with dark matter

-

Science & Environment1 month ago

Science & Environment1 month agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News1 month ago

The Project Censored Newsletter – May 2024

-

Technology4 weeks ago

Technology4 weeks agoArtificial flavours released by cooking aim to improve lab-grown meat

-

Technology3 weeks ago

Technology3 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Technology3 weeks ago

Technology3 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Money2 weeks ago

Money2 weeks agoWhy thousands of pensioners WON’T see State Pension rise by full £460 next year

-

Technology2 weeks ago

Technology2 weeks agoHow to disable Google Assistant on your Pixel Watch 3

-

Technology2 weeks ago

Technology2 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Technology2 weeks ago

Technology2 weeks agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

Entertainment3 weeks ago

Entertainment3 weeks ago“Golden owl” treasure hunt launched decades ago may finally have been solved

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

Business3 weeks ago

LVMH strikes sponsorship deal with Formula 1

-

Business3 weeks ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

Technology3 weeks ago

Technology3 weeks agoBest iPad deals for October 2024

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Business3 weeks ago

CEOs turn to podcasts to control their message

-

News3 weeks ago

News3 weeks agoHungry customer left gobsmacked as two blokes riding giant HORSES stroll into local chip shop

-

MMA3 weeks ago

MMA3 weeks agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

You must be logged in to post a comment Login