Money

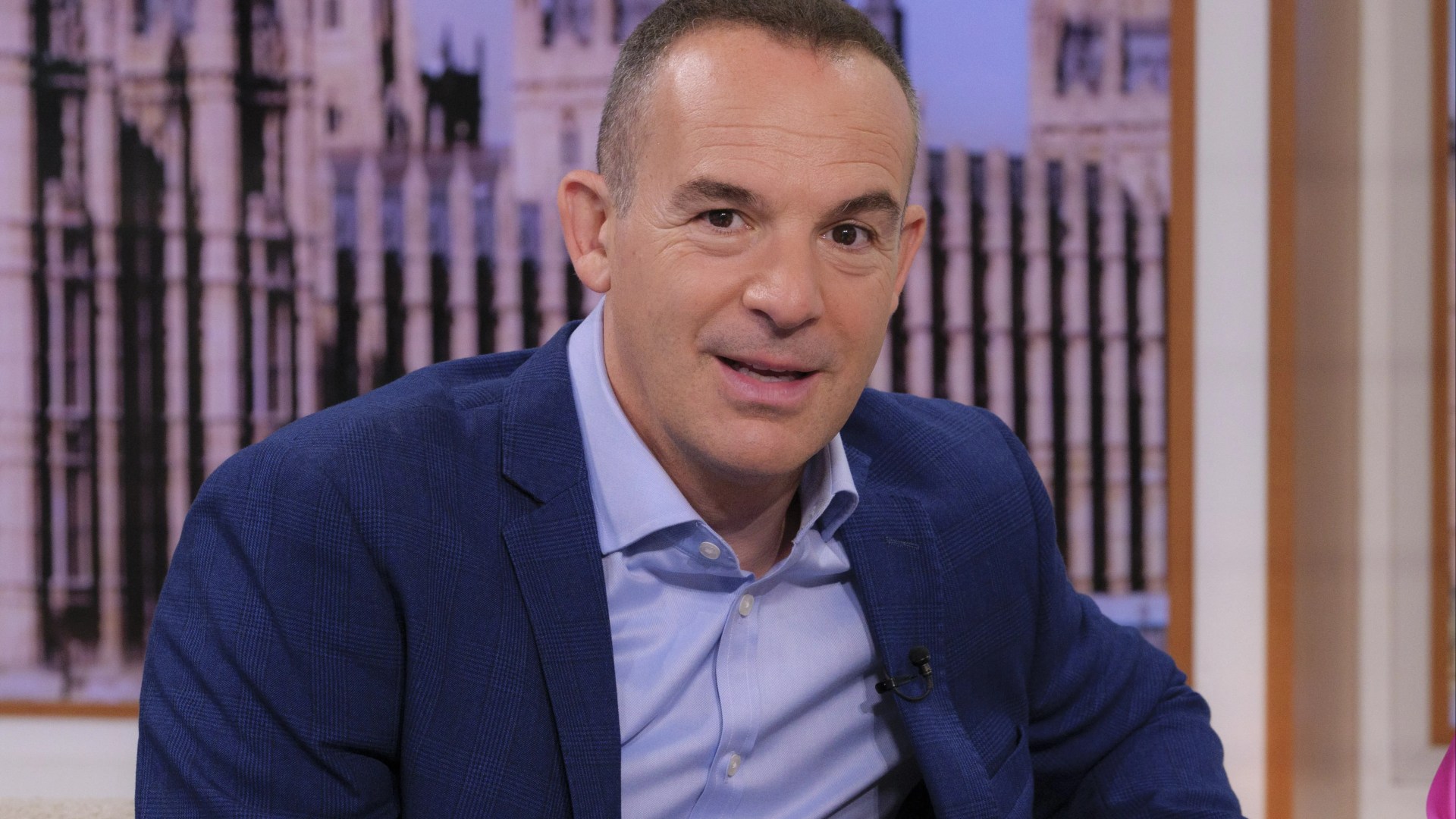

Martin Lewis issues ‘ditch and switch’ warning for customers of huge high street bank

MARTIN Lewis has issued a warning for customers of a major high street bank.

Santander has cut the rate on its easy-access savings account by 1.1%.

The account paid 5.2% interest when it first launched, but was cut to 4.20% in May and has now been reduced to 4%.

This means customers will get 4% interest on balances between £1 and £250,000.

It applies to customers who have a Santander’s Easy Access Saver Limited Edition (Issue 3).

The deal is no longer open to new customers.

When the deal fist launched last September, it was one of the most competitive on the market.

However, experts from the Martin Lewis MoneySavingExpert blog are urging customers to think twice.

They said: “You can easily beat this new rate by switching elsewhere – which you’re allowed to do without penalty.

The blog stated that even though this account has a 12-month term the rate is variable.

This means that savers are not locked into this account and do not have to stick with it.

They explained: “This account works in a slightly unusual way – it initially had a 12-month term, but the rate wasn’t fixed for this period

“Instead, what happens at the end of the term – which has since been extended by 10 months – is that the account ‘matures’ and your money is transferred to one of Santander’s other easy-access accounts with a much lower interest rate.”

“You can ditch and switch,” they added.

The MoneySavingBlog named two saving accounts for customers which offer higher interest.

These include:

Trading 212’s Cash ISA

This is a type of savings account which offers tax free interest on savings up to £20,000.

There is not mimiumn you have to pay in to receive the interest.

You must be at least 18-years old to open this type of savings account.

Trading 212’s deal offers savers 5.1% AER Variable on customers savings.

An AER Variable rate means that your rate is not guaranteed and that it can change over time.

On this deal, savers can withdraw their cash at anytime without any impact on their savings rate.

The interest is also paid daily.

If you want to read more about ISA’s check out our article here.

Oxbury saving account offer

This bank is offering an AER interest rate of 4.76%.

However, the interest will only on balances above £25,000 and up to £500,000.

It is also worth noting that if your balance falls below £25,000 after opening the account, you will not receive interest on the balance.

You will only receive interest on balances above £500,000, where those balances have resulted from interest being accrued to the account.

Unlike Trading 212’s Cash ISA, where interest is paid daily, here it is only paid one a month.

What other options are available for savers?

There are several types of savings accounts available to customers, so you need to make sure you select one that suits your circumstances.

Easy-access accounts and regular savings accounts, which allow greater flexibility when it comes to withdrawing your cash, but they tend to offer slightly lower interest rates.

If you’re happy to leave your cash in your account for longer then you can consider a fixed-bond or notice savings account.

Before opening a new savings account it’s always worth having a browse on price comparison websites.

Moneyfactscompare, Compare the Market, Go Compare and MoneySupermarket will help save you time and show you the best rates available.

These sites let you tailor your searches to an account type that suits you.

Where to find the best savings rates

Many savings accounts offer miserly rates meaning that money is generating little or no return.

However, there are ways to get your cash working hard. Sun Savers Editor Lana Clements explains how to make sure you money is getting the best interest rate.

Easy access savings accounts offer flexibility for customers, meaning they can dip in and out of cash when needed. However, the caveat is that rates can change at any time.

If you’re keeping your money in an easy access account, you’ll need to keep checking whether it’s the best paying account for your circumstances and move if not.

Check in at least once a month to see what is happening in the market.

Check what is offered by your bank – sometimes the best rates are for customers only.

But do search the wider market as often top savings accounts are offered by lesser known providers.

Comparison sites are a good place to check for the top rates. Try Moneyfactscompare.co.uk or Moneysupermarket.

You can search by different account type. You’ll usually get a better interest rate if you can lock your money away for a fixed amount of time, but it’s always a good idea to keep some money in an easy access account in case of emergencies.

Don’t overlook regular savings accounts often pay some of the best rates, but you’ll need to commit to monthly payments. This can be a great way to get into a savings habit while earning top rates at the same time.

Money

Enhancing Efficiency with Accounts Payable Software Across Industries

Today’s quick business environment greatly depends on the optimization of financial processes to secure a competitive edge. Technology has substantially redefined the methods of accounts payable management. Organizations in multiple sectors—including telecoms, IT, manufacturing, education, healthcare, and many others—are implementing accounts payable software to improve their payment workflows, raise accuracy, and heighten overall efficiency. Organizations such as Quadient are leading the way in bringing to market innovative AP solutions that cater to different sector requirements.

Key Features of Accounts Payable Software

Organizations in sectors like distribution, logistics, financial services, and government can revolutionize their payment management by having sufficient AP software in place. Some key features include:

1. Automated Invoice Processing: Software designed for accounts payable automates the procedure for both capturing and handling invoices. The software can retrieve essential data from invoices sent via email, PDF, or worse yet, paper, and start the approval flow.

2. Approval Workflows: All invoices must go through approval before making a payment. The workflow for approval is completely automated with accounts payable software, so the right people can review and authorize each invoice before it receives payment. This lowers bottlenecks and assures that approvals happen on time.

3. Payment Automation: After invoices get approval, the software can program and carry out payments to vendors. Depending on the vendor’s choice, this can be done using checks, electronic transfers, or different payment methods.

Benefits of Accounts Payable Software Across Different Industries

1. Telecoms, IT, and Technology

In the swiftly changing atmosphere of telecommunications and technology, managing payments efficiently is important for providing service and fulfilling supplier obligations. The software from AP allows businesses to deal with considerable amounts of invoices promptly, confirming that payments occur on time and free from errors or delays. Thanks to automating these processes, technology firms are able to focus their energy on innovation, rather than getting bogged down by administrative work.

2. The process of manufacturing and distribution.

For sectors including manufacturing and distribution, accounts payable software keeps supply chain processes operating smoothly. In these sectors characterized by high invoice and payment volumes, AP software can manage it effectively, thereby helping to prevent pricey delays that might disrupt the production process. With automation of payments, both manufacturers and distributors can sustain good supplier relationships and improve cash flow optimization.

3. Healthcare and Education

In sectors such as healthcare and education, where adherence to compliance and maintaining accuracy is vital, accounts payable software serves as a means to ensure financial transactions are carried out with exactitude. Hospitals, clinics, schools, and universities can take advantage of AP software to oversee payments to vendors, control budgets, and maintain transparency in their financial practices. This is of particular significance for non-profit organizations, which count on accurate accounting to preserve trust with their stakeholders.

4. Professional Services and Legal

Prompt payments to vendors and partners are fundamental for legal and accounting firms to run efficiently. Accounts payable software enables a reduction in the time needed for manual invoice processing, so professionals have the opportunity to focus on client service. In areas of the law, where the process of documentation and approvals tends to be particularly tedious, automating these steps can greatly enhance efficiency.

5. Retail, Supermarkets, and Wholesale

The high volume of invoices and payments that retailers, supermarkets, and wholesalers handle makes accounts payable software necessary for improving these processes. The solutions from AP enable retailers to meet payment deadlines, dodge late fees, and make sure suppliers get paid on time, all the while lowering the chance of errors.

6. Government, the Public Sector, and Utilities

Maintaining transparency and accountability in financial transactions is of greatest importance for government agencies and public sector organizations. Accounts payable software gives the capabilities to manage payments safely and effectively, making sure public funds are managed properly. By offering enhanced workflows, AP software can help utilities and energy companies, which typically deal with complex vendor relationships.

Why Choose Quadient for Accounts Payable Solutions?

Quadient has created industry pioneering accounts payable software that meets the specific requirements of different sectors. For medical, educational, telecoms, and retail industries, the AP solutions from Quadient deliver the necessary flexibility and scalability to address multiple financial workflows. Quadient’s AP software offers features including automated invoice capture, payment processing, and ERP integration to provide a thorough solution that boosts efficiency and lowers costs.

Organizations that choose Quadient’s accounts payable software can optimize their payment procedures, reduce manual problems, and fulfill all financial commitments on time. This gives rise to improved relations with vendors, improved cash flow management, and augmented operational efficiency.

Conclusion

Across various sectors, including manufacturing and healthcare, accounts payable software has turned into an important tool for the management of financial workflows. The ability to automate extensively, produce reports efficiently, and integrate seamlessly allows AP software to help businesses enhance their efficiency, lower costs, and guarantee timely payments. Those businesses looking to enhance their financial operations and maintain a lead in a competitive environment can find a powerful platform through Quadient’s accounts payable solutions.

Money

Three ways AI will influence financial decision making

You’ve likely already seen countless headlines proclaiming how artificial intelligence (AI) is poised to revolutionise our lives.

You’ve likely already seen countless headlines proclaiming how artificial intelligence (AI) is poised to revolutionise our lives.

If you were to judge the future based on Nvidia’s soaring market capitalisation, you might wonder whether AI is truly the next big revolution or just a speculative bubble waiting to burst.

The flood of news, ranging from fears of massive job losses to claims of overhyped promises, seems endless.

So, I hope you’ll forgive me for adding my perspective to the burgeoning choir of voices.

In my view, the conversation focuses too much on the “artificial” and not enough on the “intelligence”.

From serving as digital assistants to acting as co-pilots in managing complex systems, AI will drive the industry forward

Any tool, platform or technology that enables better decision making, enhances efficiency, mitigates risks and fosters greater intelligence is worth embracing.

From serving as digital assistants to acting as co-pilots in managing complex systems, AI will drive the industry forward. And it goes far beyond just the capabilities of ChatGPT.

While there will undoubtedly be benefits from automating and customising client content through AI, there are other wins to leverage in achieving better financial decision making.

1. Improved recommendations using interactive analytics

We can use the power of AI to gain intelligent insights into how best to construct client portfolios and monitor how they are performing. AI will enhance data analysis, using algorithms and crunching millions of numbers, to allow you to design and monitor fully customised portfolios that align with your client’s financial goals.

Portfolios benefit immensely from automated health checks, carried out by AI

AI can leverage vast amounts of data to provide tailored investment recommendations. By analysing factors such as income, expenses, savings and investment horizon, an AI-powered advice firm could fine tune personalised investment plans to achieve a client’s unique objectives.

2. Proactive reviews and maintenance through portfolio health checks

Just as preventative healthcare emphasises the importance of proactive measures to maintain wellbeing, portfolios benefit immensely from automated health checks, carried out by AI.

This allows investors to address potential issues before they escalate.

Traditionally, risk management involved laboriously collecting data, manually entering it into cumbersome Excel spreadsheets, often littered with formula errors, and analysing it for potential pitfalls.

Instead of joining the chorus extolling the virtues of AI, we encourage a shift in perspective – think of it as ‘augmented intelligence’

This process was time consuming, prone to human errors and often hindered by data quality issues. Automated health checks leverage a moving window of data, offering a dynamic and real-time evaluation of the portfolio’s condition.

3. Portfolio monitoring with risk alerting

AI can keep a continual eye on portfolios, monitoring market trends and making adjustments in real time.

It can analyse market data, news and economic indicators to provide proactive alerts and recommendations. It’s like having a financial watchdog that never sleeps, guarding investments with unwavering vigilance.

The human factor should always remain central. You are the director, with technology serving as a powerful enabler

Real-time notifications, often delivered through user-friendly apps leveraging interactions with large language models, explain why a portfolio may be deemed unhealthy and can even suggest remedial actions.

Whether it’s a significant deviation from historical patterns, unexpected drifts in holdings that require a rebalance or heightened risk levels requiring an urgent change in portfolio shape, investors are promptly informed and equipped with actionable insights.

These are just a few ways AI can help improve investment decision making and efficiency, while reducing manual work.

We should not fear it. It can never replace the human touch that comes with empathy, intuition and experience. What it will do is free up advisers from routine tasks, allowing them to focus on building deeper relationships with clients.

Instead of joining the chorus extolling the virtues of AI, we encourage a shift in perspective – think of it as “augmented intelligence”.

This approach emphasises the synergy between humans and AI, where technology amplifies human intelligence, particularly in problem solving.

By offering recommendations and insights based on deep data analysis across various scenarios, AI doesn’t replace the human element – it enhances our capabilities.

The human factor should always remain central. You are the director, with technology serving as a powerful enabler.

Tony Wilkinson is investment director, quantitative solutions, at Collidr

Money

Virgin Money issues important update to customers over Nationwide takeover

NATIONWIDE has completed its takeover of Virgin Money and is contacting customers by email to let them know what the merger will mean for them.

Britain’s largest building society announced that it had agreed to a £2.9billion deal to take over Virgin Money in March.

While there are no immediate changes for customers of either bank, they could be introduced in future as the Virgin Money brand is phased out.

Under the plans the two companies will run as separate entities and the Virgin Money brand will be retained for six years before being rebranded as Nationwide.

The deal was completed yesterday after it received the necessary approvals from regulators and Virgin Money shareholders.

But Nationwide members were not given a vote on whether the sale should go ahead.

The move will create a combined group with around 24.5million customers, more than 25,000 staff and nearly 700 branches.

This would make the organisation the country’s second largest mortgage and savings group.

In the email to customers Nationwide chairman Kevin Parry said that the building society is now “stronger and able to deliver even greater value” for its members.

He said: “As we integrate Nationwide and Virgin Money carefully over time, the impact we have in communities across the UK, and the benefits we offer to members and customers, will only increase.

“One in three people in the UK now have a connection to Nationwide – this deal means we can do even more to make their banking fairer, more rewarding, and for the good of society”.

He added that although you will not be able to use Virgin Money branches to do Nationwide banking, over time the range of services on offer will be expanded.

This could mean that as a Nationwide customer you could be able to do day-to-day banking such as paying in money or opening a savings account in a Virgin Money branch.

Nationwide customers will also be able to benefit from Virgin Money’s expertise in personal lending and credit cards, he added.

What does the takeover mean for Virgin customers?

In a statement on its website Virgin Money said that for now it is “very much business as usual”.

There will be no impact to Virgin Money, Clydesdale and Yorkshire bank, which were bought by Virgin Money under previous acquisition deals.

Where to find the best savings rates

Many savings accounts offer miserly rates meaning that money is generating little or no return.

However, there are ways to get your cash working hard. Sun Savers Editor Lana Clements explains how to make sure you money is getting the best interest rate.

Easy access savings accounts offer flexibility for customers, meaning they can dip in and out of cash when needed. However, the caveat is that rates can change at any time.

If you’re keeping your money in an easy access account, you’ll need to keep checking whether it’s the best paying account for your circumstances and move if not.

Check in at least once a month to see what is happening in the market.

Check what is offered by your bank – sometimes the best rates are for customers only.

But do search the wider market as often top savings accounts are offered by lesser known providers.

Comparison sites are a good place to check for the top rates. Try Moneyfactscompare.co.uk or Moneysupermarket.

You can search by different account type. You’ll usually get a better interest rate if you can lock your money away for a fixed amount of time, but it’s always a good idea to keep some money in an easy access account in case of emergencies.

Don’t overlook regular savings accounts often pay some of the best rates, but you’ll need to commit to monthly payments. This can be a great way to get into a savings habit while earning top rates at the same time.

This means that you can continue to sign up for products and services from the bank and contact its customer service as usual.

The two banks will continue to operate as separate entities within the Nationwide Group.

This means that Virgin Money customers will not receive Nationwide’s Fairer Share payments, which gives eligible members £100.

But this could change in the future if Virgin Money customers are transferred to Nationwide.

Virgin Money branches are also now included in the Nationwide Branch Promise.

This means that everywhere there is a Virgin Money branch it promises to still be there until at least the start of 2028.

Customers who have savings with Virgin Money will continue to have their nest eggs protected under the Financial Services Compensation Scheme (FSCS).

This is a program which protects savers and compensates them up to £85,000 if their bank or building society goes bust and is unable to return the funds they have saved with it.

Virgin added that it will continue to update its website with the latest news on the merger.

However, the bank warned that customers should remain alert to scams as fraudsters often take advantage of periods of change to try and persuade people to share key information.

Details such as your address, mobile number, email address and bank details can be used to register credit cards and loans in your name or to steal money from your bank account.

Your bank will never ask you for security details, whether over the phone, by email or by any other means.

If someone asks you for this information do not provide it.

Instead, report the email, call or text message to Action Fraud by calling 0300 123 2040.

What does the merger mean for Nationwide members?

There are no changes for new or existing Nationwide customers for now.

Members can continue to apply for new products such as savings accounts, loans and mortgages as normal.

The building society’s customer service is still available to those who have queries and complaints.

All Nationwide members will continue to be protected under the FSCS scheme on savings of up to £85,000.

Eligible members will also continue to receive Fairer Share Payments as and when they are paid out.

To qualify you must have a current account and a qualifying savings account or mortgage with the building society.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

FCA fines Starling Bank £29m for financial crime failings

The Financial Conduct Authority has fined Starling Bank Limited £28,959,426 for failings related to its financial sanctions screening.

FCA said it identified serious concerns with the anti-money laundering and sanctions framework in place at the bank in 2021. The bank agreed to a requirement restricting it from opening new accounts for high-risk customers until this improved.

However, Starling failed to comply and opened over 54,000 accounts for 49,000 high-risk customers between September 2021 and November 2023.

In January 2023, the bank became aware that its automated screening system for customers had only been used against a fraction of the full list of those subject to financial sanctions.

A subsequent internal review identified systemic issues in its financial sanction framework. The bank has since reported multiple potential breaches of financial sanctions to the relevant authorities.

Starling Bank was founded by Anne Boden, a former Allied Irish Banks COO, in January 2014.

The London-based digital challenger bank grew quickly from approximately 43,000 customers in 2017 to 3.6 million in 2023. However, measures to tackle financial crime did not keep pace with its growth, the FCA said.

Therese Chambers, joint executive director of enforcement and market oversight, said: “Starling’s financial sanction screening controls were shockingly lax. It left the financial system wide open to criminals and those subject to sanctions. It compounded this by failing to properly comply with FCA requirements it had agreed to, which were put in place to lower the risk of Starling facilitating financial crime.”

The regulator said the case took 14 months from opening to achieving an outcome, compared to an average of 42 months for cases closed in 2023/24.

It added that Starling Bank would have been fined £40,959,426 but qualified for a 30% discount after agreeing to settle the case.

Starling has established programmes to remediate these breaches and to enhance its wider financial crime control framework.

Money

The exact dates and designs to spot in your spare change that could be worth £2,500

SOME of the coins in your spare change could be worth up to a whopping £2,500.

A number of coins sells for massive sums due to manufacturing errors or because only a limited amount were struck.

Land on one of these rare pieces and you could fetch a small fortune.

But you might not be aware of the telltale signs that reveal if these coins are worth a hefty sum.

From a Blue Peter 50p to an undated 20p piece, here are some of the rarest pieces to look out for.

Always bear in mind with rare coins though, that one you’ve got is only worth what a seller is willing to pay for it.

That means you might not get the exact amounts we’ve listed below, but they do inform what you could potentially get.

Blue Peter 50p – £216

This Blue Peter 50p, which was first released in 2009 and features a cartoon high-jumper, has sold for £216 on eBay in the past.

The unique piece was designed by nine-year-old Florence Jackson ahead of the 2012 London Olympics.

Florence’s drawing was selected out of 17,000 entries into a Blue Peter competition.

Over 2.2 million of the Blue Peter 50p coins were issued, with most most minted in 2011.

However, this coin was minted in 2009, making it significantly rarer than the piece struck two years later and worth over £200.

King Charles III Atlantic Salmon – £40

The Atlantic Salmon 50p, which entered general circulation just last November, has been known to sell for up to £41 on eBay.

The coin was one of eight special varieties first released by The Royal Mint.

An estimated 500,000 of the coins entered circulation but collectors have reportedly been finding them hard to come by in their spare change.

Error 1983 2p coin – £1,000

The 1983 error 2p coin has been known to sell for up to £1,000 – 2,000 times its face value.

The pieces were struck incorrectly meaning they featured an old “New Pence” instead of “Two Pence” phrase.

The batch of error coins entered circulation as part of commemorative sets in the early 1980s and now they’re fetching giant sums.

If you think you might have one in your spare change, you need to look out for the 1983 date on the coin and if it says “New Pence” on the reverse side instead of “Two Pence”, you’ve got it.

“Fried egg” error £2 coin – £600

This “fried egg” coin has been known to sell for £600 in the past due to an error in the striking process.

A design error on some of the £2 coins leaves them looking like a runny fried egg as the middle has spilt out on to the outer rim.

Because not many of these coins entered general circulation, plenty of buyers are willing to spend over the odds on getting one.

Some have been bought for £600 previously while you could get more depending on the condition and demand.

Olympic swimming 50p – £1,500

The rare “Lines Over Face” error 50p has been known to sell for £1,500 in the past.

The coin is one from the London 2012 Olympic Games series and depicts the image of swimmer.

But this coin in particular is worth lots because it features lines across the swimmers’ face that shouldn’t be there.

Nobody knows how many of the error coins were mistakenly made, although it is believed to be around 600.

Error £1 – £2,500

A “dual-dated” £1 error coin has been known to fetch £2,500 in the past.

Both 2016 and 2017 obverse-dated (when the date is on head of the coin not the tail) £1 coins entered circulation in April 2017.

But an error on some of these coins meant a limited number wrongly ended up with the 2016 date on the Queen‘s head side.

On these coins there is a 2017 engraving on the reverse side in tiny writing.

Undated 20p – £100

Rare coin website Change Checker has previously branded the undated 20p the “holy grail of change collecting”.

Collectors have been known to search far and wide for the valuable coin ever since it entered circulation in 2008.

The Royal Mint decided to change the positioning of the date on every 20p piece in 2008, moving it from the back to the front.

But a batch of between 50,000 and 250,000 coins was released without any date at all as part of the manufacturing process.

Collectors are so keen to pick up one of the rare coins, they have been willing to pay up to £100 for one.

How to spot if your coin is rare

The most valuable and rare coins are usually the ones with low mintage numbers or an error.

A mintage number relates to how many of a certain coin were made, so the lower the number, the rarer and, generally, the more valuable a coin is.

Meanwhile, error coins are pieces that were incorrectly struck during the manufacturing process.

The ultra-rare “lines over face” 50p error coin is one such coin, which has been known to sell for £1,500 in the past.

How to sell a rare coin

There are three ways you can sell rare coins – on eBay, Facebook, or in an auction.

If you’re selling on Facebook, there are risks attached.

Some sellers have previously been targeted by scammers who say they want to buy a rare note or coin and ask for money up front to pay for a courier to pick it up.

But the courier is never actually sent and you’re left out of pocket.

Rather than doing this, it’s always best to meet a Facebook seller in person when buying or selling a rare note or coin.

Ensure it’s a public meeting spot that’s in a well-lit area and if you can, avoid using payment links.

Next, you can sell at auction, which is generally the safest option.

You can organise this with The Royal Mint’s Collectors Service.

It has a team of experts who can help you authenticate and value your coin.

You can get in touch via email and a member of the valuation team will get back to you.

You will be charged for the service though – the cost varies depending on the size of your collection.

You can also sell rare coins on eBay.

But always bear in mind, you will only make what the buyer is willing to pay at that time.

You can search for the same note or coin as you have to see how much the same one has sold for on the website previously.

This can help give you an indication of how much you should sell it for.

What are the most rare and valuable coins?

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Abrdn calls on government to incentivise pension allocations to real estate

This could deliver better outcomes for pension savers while also supporting the UK economy, such as by easing housing shortages.

The post Abrdn calls on government to incentivise pension allocations to real estate appeared first on Property Week.

-

Womens Workouts1 week ago

Womens Workouts1 week ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology2 weeks ago

Technology2 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 weeks ago

Science & Environment2 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to wrap your mind around the real multiverse

-

News1 week ago

News1 week agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy this is a golden age for life to thrive across the universe

-

News2 weeks ago

News2 weeks agoYou’re a Hypocrite, And So Am I

-

Sport2 weeks ago

Sport2 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNerve fibres in the brain could generate quantum entanglement

-

News2 weeks ago

News2 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCardano founder to meet Argentina president Javier Milei

-

Science & Environment1 week ago

Science & Environment1 week agoMeet the world's first female male model | 7.30

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoBest Exercises if You Want to Build a Great Physique

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

News2 weeks ago

News2 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoEverything a Beginner Needs to Know About Squatting

-

News1 week ago

News1 week agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts1 week ago

Womens Workouts1 week ago3 Day Full Body Toning Workout for Women

-

Travel1 week ago

Travel1 week agoDelta signs codeshare agreement with SAS

-

Politics7 days ago

Politics7 days agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Sport2 weeks ago

Sport2 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Technology2 weeks ago

Technology2 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBlockdaemon mulls 2026 IPO: Report

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

News1 week ago

News1 week agoWhy Is Everyone Excited About These Smart Insoles?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow one theory ties together everything we know about the universe

-

News2 weeks ago

the pick of new debut fiction

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business2 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoKeep Your Goals on Track This Season

-

Science & Environment7 days ago

Science & Environment7 days agoX-rays reveal half-billion-year-old insect ancestor

-

News2 weeks ago

News2 weeks agoChurch same-sex split affecting bishop appointments

-

Technology2 weeks ago

Technology2 weeks agoFivetran targets data security by adding Hybrid Deployment

-

Politics2 weeks ago

Politics2 weeks agoLabour MP urges UK government to nationalise Grangemouth refinery

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe maps that could hold the secret to curing cancer

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

Business2 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics2 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

Politics2 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoWhich Squat Load Position is Right For You?

-

Science & Environment1 week ago

Science & Environment1 week agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Technology1 week ago

Technology1 week agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

News6 days ago

News6 days agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology2 weeks ago

Technology2 weeks agoIs carbon capture an efficient way to tackle CO2?

-

Politics2 weeks ago

Politics2 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSingle atoms captured morphing into quantum waves in startling image

-

Technology2 weeks ago

Technology2 weeks agoCan technology fix the ‘broken’ concert ticketing system?

-

Fashion Models2 weeks ago

Fashion Models2 weeks agoMixte

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow Peter Higgs revealed the forces that hold the universe together

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

You must be logged in to post a comment Login