Money

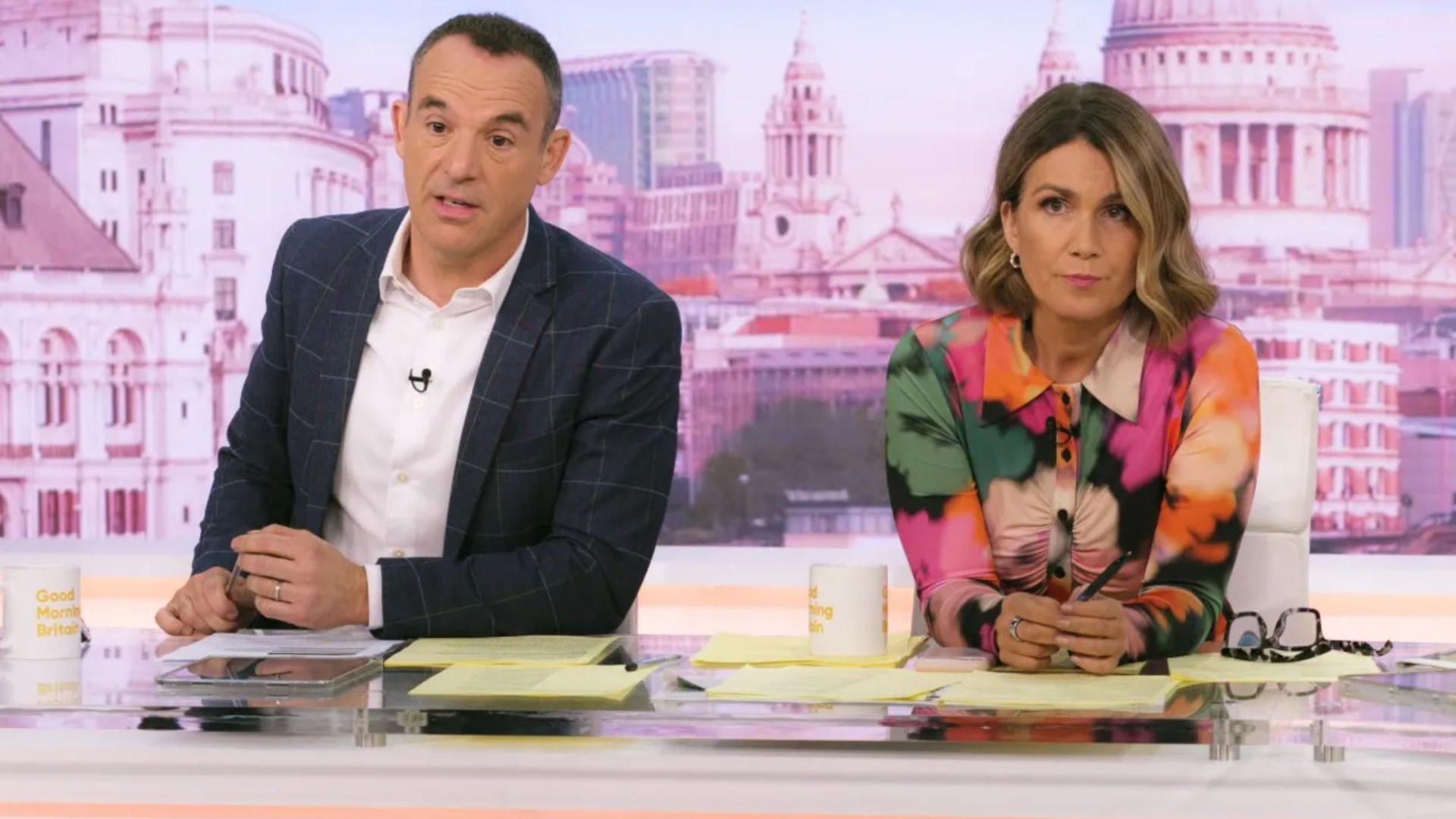

Moment Martin Lewis slams ‘you’re taking money from pensioners’ in clash with cabinet minister over Winter Fuel Payments

MARTIN Lewis has clashed with government minister Lisa Nandy over the decision to scrap the £300 Winter Fuel Payments for millions of pensioners.

The fiery exchange on Good Morning Britain today saw the Money Saving Expert founder slam the move as “indefensible” and call out the government for failing to reach the poorest pensioners.

Speaking directly to the Culture Secretary, Lewis didn’t hold back.

The money-saving guru said: “Why are you defending this?

“You’ve been a campaigner for the poorest in society for so long, yet you’re sitting there defending a policy that charities like Age UK are pulling their hair out about.”

The row comes after AgeUK urged the government to scrap the policy, warning that the poorest pensioners, some earning under £11,000 a year, will be left without support.

Read more on martin lewis

Lewis was especially concerned that many of the elderly eligible for pension credit wouldn’t apply for it – and therefore miss out on the vital £300 Winter Fuel Payment.

The argument heated up as Lewis continued to press Nandy on the government’s failure to reach those most in need, describing the policy as a “huge flaw.”

He said: “You believe they should get pension credit and the Winter Fuel Payment, but you’re not doing enough to make sure they do.

” You’re not writing individual letters to the hardest-to-reach pensioners.

“‘There’s lots you could do. So to try and talk about it, ‘we’re targeting the poorest’… The truth is you’re not targeting them. Why aren’t you writing them bloody letters?’

“You have to accept that there are hundreds of thousands of pensioners earning under £11,400 who will not get this payment this year.”

In response, Nandy defended the government’s efforts, pointing to the rise in pension credit claims, claiming that a “huge drive” had resulted in a 115 per cent increase in applications.

But Lewis wasn’t convinced, he added: “It will take four years for everyone to be signed up. And what’s the solution now? Why aren’t you writing them bloody letters?”.

Despite the tension, Nandy stuck to her guns, stressing that the government was writing letters to eligible pensioners, but acknowledged the frustration from campaigners like Lewis.

The Sun’s Winter Fuel S.O.S Campaign

WORRIED about energy bills? The Sun’s Winter Fuel SOS crew are taking calls on Wednesday.

We want to help thousands of pensioners worried about energy bills this winter, with tips and advice on how to make cash go further.

Our Winter Fuel SOS crew will be able to help answer your questions on whether you can get Pension Credit and the Winter Fuel Payment.

Ten million OAPs are set to lose the £300 Winter Fuel Payment due to government cutbacks.

It comes in the same month that millions of households are hit by a ten per cent rise in bills as the Energy Price Cap shoots up.

We can help with advice on how else to save money.

Our phone line is open 7am to 7pm Wednesday October 9 – you can call us on 0800 028 1978.

Or you can email now: WinterfuelSOS@the-sun.co.uk

Nandy said: “We are working with a wide range of people to reach those who need help.

“I just want to make it clear, we are not leaving anyone high and dry.”

What’s at stake for pensioners?

With changes announced in July, the government confirmed that from this winter, only pensioners who claim pension credit or certain other means-tested benefits will be eligible for the Winter Fuel Payment.

Previously it went to around 11million of state pension age regardless of income.

But around 880,000 eligible pensioners on the lowest incomes may miss out on the energy help because they haven’t claimed pension credit.

Lewis pressed further, saying: “You’re taking money out of their hands.

“Are you willing to accept the collateral damage of pensioners, many with dementia, not getting the Winter Fuel Payment?”

Nandy responded, insisting the cut-off point for pension credit applications had been extended to April 2025.

This means pensioners who are eligible, but have yet to apply, can still receive backdated payments.

Typically claims for pension credit can be backdated up to three months.

As the qualifying week for the payment is September 16 to 22, It means the last date for claiming the benefit is December 21.

We’ve asked the government which date applies and will update when we hear back.

DON’T MISS OUT

The message is clear: if you’re eligible for pension credit, it’s crucial to act fast.

Applications are still being accepted, but pensioners must apply by December 21 to receive this year’s Winter Fuel Payment.

Lewis, however, remains sceptical that many of the most vulnerable will get the help they need.

With Christmas just around the corner, time is running out, and the pressure is on for the government to ensure no one is left out in the cold.

How to apply for pension credit

YOU can start your application up to four months before you reach state pension age.

Applications for pension credit can be made on the government website or by ringing the pension credit claim line on 0800 99 1234.

You can get a friend or family member to ring for you, but you’ll need to be with them when they do.

You’ll need the following information about you and your partner if you have one:

- National Insurance number

- Information about any income, savings and investments you have

- Information about your income, savings and investments on the date you want to backdate your application to (usually three months ago or the date you reached state pension age)

You can also check your eligibility online by visiting www.gov.uk/pension-credit first.

If you claim after you reach pension age, you can backdate your claim for up to three months.

Money

Arc & Co secures £25m from Coutts for Ability Hotels

TRY 6 ISSUES FOR JUST £6

Try 6 issues of Property Week for £6 to finish this article.

Sign up now for the following benefits:

- Unlimited access to Property Week and newsletters

- Breaking news, comment and analysis from industry experts as it happens

Don’t want full access? REGISTER NOW for limited access and to subscribe to our newsletters.

Money

Adviser-client digital experience ‘compromised by crap technology’

The chief executive of Seccl has claimed that “crap technology” has compromised the adviser-client digital experience.

David Ferguson said most of the technology in the advice sector “is quite old” and not “built for connectivity”.

He said: “We now talk about API, but if you look at the end-to-end thing, the adviser client digital experience has been compromised by crap technology and their business efficiency has been constrained by that as well.”

Ferguson made his comments at Money Marketing Interactive in London yesterday (8 October).

He was speaking as part of an industry panel for advisers on how they can choose the right systems and tech stack for their business.

He noted that though technology has grown in leaps and bounds over the last 20 years, the advice sector technology still lags in several areas, including integration.

Ferguson said the issue is affecting adviser businesses.

“One thing that troubles me is a lot of the cost in adviser businesses is [because] they are dealing with providers that can’t do the job properly. “And that’s technology not speaking to each other even in the inside of these provider companies. The idea that they’re going to magically speak together outside with other systems – that’s just completely nuts,” Ferguson said.

Speaking on the same panel as Ferguson, Timeline founder and CEO Abraham Okunsanya, dispelled the myth about a ‘best of breed’ technology stack.

He said: “This idea of best of breed versus all in one doesn’t exist.

“There aren’t many technology stacks in the market today that will do everything you want and equally the idea that you bring together all these various tools, and you will get the same level of efficiency or effectiveness as you do with an all-in-one [system] is just not true.

“Ultimately you have to figure out what you want to achieve with your business and try to find the technology solution that does that.

“I would argue that the direction of travel is that we’re moving towards more joined up technology, more integrated ecosystem than multiple tools that just don’t talk to each other.”

Zerokey co-founder and CEO, Joseph Williams, said that advisers should have the choice of the technology solutions they want to adopt.

“They shouldn’t be faced with the compromise of choosing best of breed [and] the inefficiencies that it brings.

“If they wish to use an all-in-one solution and that’s what they believe is best for them and their clients, then that’s the route they should go down,” Williams said.

He said that whatever route advisers chose, their tech stacks should “talk to one another”.

“There are ways that we can solve this solution other than the traditional approach to integration that we’ve always forged and clearly it hasn’t worked,” he added.

Williams cited the Lang Cat report, published five years ago, that showed 85% of advisers blamed lack of integration for major cause of inefficiency.

The figure has risen to 94% in Intelliflo’s latest adviser efficiency survey.

On addressing the integration question, Okunsaya said he believes the sector needs to address the trust issue between institutions and regulated entities.

“Unless we can remove the lack of trust between regulated entities, we’re always going to find ourselves in this position,” he said.

“This is why I gave up hope on this idea of multiple third-party integration being the primary way that we drive efficiencies within financial planning firms.

“I strongly believe that the solution is you have an integrated ecosystem being probably 70, maybe 80% of what you want as a firm and then you plug one or two other things on top of that.”

Benchmark Capital CEO, Ed Dymott, said the problem is due to too many players in the advice space trying to outcompete each other.”

He said: “When I look at the adviser ecosystem, there are too many people trying to be in the same space. I think that’s not a trust thing. I think that’s everyone trying to compete in the same area. I think that’s a big challenge.

Dymott blamed regulation, particularly the Consumer Duty, for not addressing this issue.

“The Consumer Duty should have mandated better service levels and better access to providers,” he said.

Money

From Nationwide to RBS: the 5 banks charging new £100 fee amid major rule change and those waiving it

BANKS including Nationwide and RBS are now charging a new £100 fee amid a major rule change.

New rules, which came in earlier this week, mean banks must now reimburse authorised push payment (APP) fraud victims.

A reimbursement limit of £85,000 has been applied under the rules, although banks can choose to go further than this and repay higher amounts.

But banks now have the power to impose a £100 excess fee when settling claims, a policy that five banks have now adopted.

So, if your claim is for a payment of £100 or less, trying to recover the money may not be of any benefit.

Excess fees will not apply to vulnerable consumers due to guidelines by the Payment Systems Regulator.

THE FIVE BANKS CHARGING THE FEE

The five banks implementing this fee are HSBC, First Direct, Lloyds, Halifax and Bank of Scotland.

A HSBC spokesperson told The Sun: “All of us have a role to play in preventing fraud and scams – we want to encourage customer caution, particularly when it comes to lower value purchases made online.”

The Sun reached out to the other banks mentioned above for comment, and we will update readers if we get any further responses.

Liz Edwards, a money expert at Finder previously told The Sun: “£100 is a lot of money to many people.

“Based on 2023 fraud figures, more than 58,000 cases would have resulted in no refund if all companies had applied the excess, and now only four of the major providers have confirmed they won’t.”

THE BANKS WHICH ‘MIGHT’ CHARGE THE FEE

Others have said they ‘may’ apply an excess or judge each case independently.

For example, Starling Bank has said it may apply an excess of £50 rather than £100.

A Natwest spokesperson also confirmed that they would assess claimants on a case-by-case basis and with regard to the specific circumstances of each customer.

The only way to avoid this caveat is to switch to one of the four banks which have pledged not to apply these charges.

THE BANKS NOT CHARGING THE FEE

Meanwhile, Nationwide, Virgin Money, TSB and AIB have said they will not implement the excess fee.

A Virgin Media spokesperson said: “Where customer circumstances result in a reimbursement under the rules, we are not planning to apply the voluntary excess, and this includes claims under £100.”

While a TSB said that the bank is “prioritising fraud protection for customers”.

They said: “Charging £100 could exclude a third of all victims from claiming refunds – and it’s not right to penalise people for scams that take place largely due to weaknesses on social media platforms.”

Last year there were 232,429 cases of APP fraud in the UK – a 12% jump since the year before.

Overall, £459.70 million was lost in 2023 to this type of scam.

Two-thirds of the total APP cases in 2023 were also down to purchase scams – which is when someone pays for goods or services which are never received.

This usually happens when purchasing off social media, as more than three-quarters of authorised fraud starts online.

Banks such as TSB emphasise that these scams are not the fault of the customer, while HSBC claims that by implementing the excess it will encourage shoppers to exercise more caution.

Shoppers should now be extra wary of dodgy deals when browsing online.

What to do if you think you’ve been scammed

IF you’ve lost money in a scam, contact Action Fraud on 0300 123 2040 or by visiting Actionfraud.police.uk.

You should also contact your bank or credit card provider immediatley to see if they can stop or trace the cash.

If you don’t think your bank has managed your complaint correctly, or if you’re unhappy with the verdict it gives on your case you can complain to the free Financial Ombudsman Service.

Also monitor your credit report in the months following the fraud to ensure crooks don’t make further attempts to steal your cash.

HOW CAN I PROTECT MYSELF FROM SCAMMERS?

When shopping online, always be cautious about where you’re buying from and what you’re buying.

If a price looks too good to be true, sometimes it actually is.

It’s much safer to stick to reputable websites where you know people in the UK usually shop from.

If you’re not sure about a website, it’s worth googling customer reviews and asking friends for their experiences.

Fraud cases which begin through phone conversations or emails are typically less common, but can lead to scammers getting hold of larger amounts of your cash.

Always check the source of the phone call by googling the number, or making sure the email is from an official domain.

Scammers can pose as banks and other trusted sources to get the information from you which they need to enter your bank account.

Always be sceptical not to provide any personal details over the phone – do not give away your PIN or full password as your bank will not need this and you are likely being scammed.

If you’re unsure, end the call and ring the trusted number of the organisation so that you definitely know you’re talking to the right people.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Celebrity chef CLOSES seafront restaurant today after just three years as fans cry ‘we didn’t see it coming’

A CELEBRITY chef’s seafront restaurant is set to close today after three years of business.

Michael Caines has shocked fans after announcing he is selling not just one but two of his popular restaurants.

Mickeys Beach Bar and Restaurant in Exmouth opened in April 2021 but tonight after dinner, it will close for good.

It offered all-day coffee, drinks, afternoon tea, and casual dining with glorious views of Torquay to Berry Head and the English Channel.

The restaurant was one of the first businesses in Sideshore and loved by many.

Customers on Google Reviews described it as having “a lovely atmosphere”, with “great views”, “seamless” service and “delicious” food.

Now, after three and a half years, it has been sold to someone else.

And not only this, Cafe Patisserie Glacerie, owned by Michael Caines and Sylvian Peltier will close too.

It is believed both restaurants have been sold to another local business, DevonLive reports.

Both venues will close in preparation for the site being sold.

In a statement Michael said: “On behalf of all the team we would like to thank our customers and suppliers for your support, we have thoroughly enjoyed serving each and every one of you and making Mickeys and the Café a special place to meet by the sea.

“I would also like to thank my team for their unwavering support and dedication, despite the challenging times we have had, I am proud of what we have been able to create.

“We are however delighted to announce the sale of the business to another local business operator who shares a similar passion, for fun relaxed dining.”

The Michael Caines Collection of restaurants said it will make another announcement once the sale is completed.

Customers have been redirected to Pool House Restaurant at Lympstone Manor hotel “for casual and relaxed dining”.

Disappointed locals took to Facebook to share their disappointment.

One person said: “Shame. Only decent place on the beach front.”

While a second wrote: “Good job we grabbed a drink when we did.”

A third person said: “A sad reflection of Exmouth, falling further into poverty.”

And a fourth commented: “Well! We didn’t see that coming!…”

Money

Government ‘doing its best to scare people’ into bad decisions

The Labour government “seems to be doing its best to scare people” into making bad decisions, according to Strategic Wealth Partners managing director and chartered financial planner Amyr Rocha Lima.

Speaking at Money Marketing Interactive in London yesterday (8 October), he told advisers to expect more phone calls ahead of the Budget.

“Even our most well behaved and responsible clients will reach out to us,” Lima said.

However, “if your clients do not reach out to you in the run-up to the Budget, you should reach out to them,” he added.

Triple Point retail strategy director Diana French, speaking on the same panel as Lima, said the backdrop for this Budget includes tax at its highest level since 1949.

“The tax environment is hard at the moment and is likely to get harder,” she said. “I do really feel like tax is a big conversation right now.”

Lima said regardless of what is announced in the Budget, it is “important we treat people as human beings.”

During the panel discussion, French also spoke positively about venture capital trusts (VCTs).

VCTs are investment vehicles that were set up to promote investment in small UK businesses that meet certain criteria.

To encourage support for these businesses, the government offer generous tax benefits..

In September 2023, French told Money Marketing that VCTs “are becoming a part of regular [financial] advice”.

French added that VCTs give investors access to companies that can grow very quickly.

Triple Point is a purpose-led investment management house that supports financial advisers, but does not actually provide advice to investors itself.

Industry duo Lima and Ian Cooke launched Strategic Wealth Partners, a financial planning practice targeted at high-net-worth clients across the UK.

CryptoCurrency

DOJ’s Google breakup remedy puts tech world on notice

The US Justice Department said in a new court filing that it may recommend a break up of Google (GOOG, GOOGL) as an antidote to unhealthy competition in the search engine market, showing just how far Washington is willing to go to rein in Big Tech.

DOJ lawyers used a 32-page document to outline a framework of options for DC District Court Judge Amit Mehta to consider, including “behavioral and structural remedies that would prevent Google from using products such as Chrome, Play, and Android to advantage Google search.”

Google in a blog post said that “DOJ’s radical and sweeping proposals risk hurting consumers, businesses, and developers.”

Its stock fell slightly in pre-market trading Wednesday.

The proposal is the first step from the Justice Department to break up a tech empire since it tried to do so more than two decades ago with Microsoft (MSFT).

That case — which the DOJ referenced in its Tuesday court filing — resulted in a 2002 settlement that opened the door to broader competition in the internet browser software market.

The move by DOJ also sends a signal to other tech giants currently facing antitrust cases from DOJ and other Washington regulators as part of a wide-ranging effort by the Biden administration to rein in what it views as anticompetitive behavior across a number of industries.

The administration has already alleged anticompetitive conduct against tech giants Apple (AAPL) and Amazon (AMZN) and claimed that Microsoft’s acquisition of gaming giant Activision Blizzard would create a gaming market monopoly.

The case against Google targeting its dominance in search resulted in a landmark decision in August, where DC District Court Judge Amit Mehta sided with DOJ and concluded Google illegally monopolized the online search engine market and the market for search text advertising.

Mehta concluded that Google’s agreements with browser providers and devices powered by Google’s Android operating system stifled rivals from entering and growing within the markets.

It will now be up to Mehta to decide what should happen now in a separate “remedies” phase of the trial that will likely start in 2025.

DOJ is expected to provide a more detailed document by Nov. 20 outlining these remedies. But the 32-page document filed late Tuesday offers several points of focus beyond forcing Google to sell parts of its business.

One has to do with contracts that secure Google’s search engine as a default on internet browsers and internet-connected devices that use Google’s Android operating system.

Google pays as much as $26 billion per year to maintain its position on mobile devices like Apple (AAPL) and Samsung smartphones.

Justice Department lawyers said to prevent further harm they may seek to limit or terminate Google’s use of those contracts that use Chrome, Play and Android to advantage Google search, as well as “other revenue-sharing arrangements related to search and search-related products, potentially with or without the use of a choice screen.”

The DOJ could also ask the judge to force Google to share with rival browsers and search providers the data that it uses to refine its search algorithms, and limit the company’s dominance over search text ads.

DOJ suggested the judge should also consider blocking Google from illegally monopolizing related markets, in addition to the search and search text advertising markets.

It may ask the judge to force Google to give websites more ability to “opt out” of “any Google-owned artificial-intelligence product.”

Google pushed back on the DOJ’s suggestions.

“We believe that today’s blueprint goes well beyond the legal scope of the Court’s decision about Search distribution contracts,” Lee-Anne Mulholland, Google’s vice president of regulatory affairs, wrote in a blog post.

Google has promised to appeal. And Judge Mehta could hold off on any orders to alter Google’s behavior while it challenges his ruling in D.C.’s Circuit Court of Appeals.

The judge would lose the right to impose remedies if Google is found not to have broken the law on appeal.

And even if Google fails and is ordered to change its behavior, Judge Mehta could later adjust his orders to better ensure competition is restored.

Google faces antitrust challenges on other fronts. It is currently defending itself in a separate lawsuit from DOJ alleging a monopoly in the technology used to but and sell online ads.

And earlier this week another federal judge ordered Google to open up its app store as part of the resolution of a suit brought by Epic Games Inc.

DOJ cited that ruling in its Tuesday court filing that outlined a Google breakup as one possible remedy, noting that the judge in the Epic Games case said remedies should “bridge to moat” to combat network effects.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 weeks ago

Technology3 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment3 weeks ago

Science & Environment3 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

News2 weeks ago

News2 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

News3 weeks ago

the pick of new debut fiction

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy this is a golden age for life to thrive across the universe

-

News3 weeks ago

News3 weeks agoYou’re a Hypocrite, And So Am I

-

Sport3 weeks ago

Sport3 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Business2 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNerve fibres in the brain could generate quantum entanglement

-

News3 weeks ago

News3 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology2 weeks ago

Technology2 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Football2 weeks ago

Football2 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoRethinking space and time could let us do away with dark matter

-

News3 weeks ago

News3 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

MMA2 weeks ago

MMA2 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Business2 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA slight curve helps rocks make the biggest splash

-

News3 weeks ago

News3 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

News3 weeks ago

News3 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Technology2 weeks ago

Technology2 weeks agoQuantum computers may work better when they ignore causality

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCardano founder to meet Argentina president Javier Milei

-

News3 weeks ago

The Project Censored Newsletter – May 2024

-

News2 weeks ago

News2 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMeet the world's first female male model | 7.30

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Toning Workout for Women

-

Technology2 weeks ago

Technology2 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Technology2 weeks ago

Technology2 weeks agoGet ready for Meta Connect

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Sport2 weeks ago

Sport2 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe maps that could hold the secret to curing cancer

-

Technology3 weeks ago

Technology3 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Politics3 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoEverything a Beginner Needs to Know About Squatting

-

News2 weeks ago

News2 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

News3 weeks ago

News3 weeks agoChurch same-sex split affecting bishop appointments

-

Sport3 weeks ago

Sport3 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Business3 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBlockdaemon mulls 2026 IPO: Report

-

TV2 weeks ago

TV2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Servers computers2 weeks ago

Servers computers2 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Technology2 weeks ago

Technology2 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

News2 weeks ago

News2 weeks agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology2 weeks ago

Technology2 weeks agoThe best robot vacuum cleaners of 2024

-

Business1 week ago

Ukraine faces its darkest hour

-

Politics3 weeks ago

Politics3 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow one theory ties together everything we know about the universe

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business3 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Business3 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Politics3 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

MMA3 weeks ago

MMA3 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Travel2 weeks ago

Travel2 weeks agoDelta signs codeshare agreement with SAS

-

Politics2 weeks ago

Politics2 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology3 weeks ago

Technology3 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoKeep Your Goals on Track This Season

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists have worked out how to melt any material

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSingle atoms captured morphing into quantum waves in startling image

You must be logged in to post a comment Login