Money

One Four Nine kickstarts next phase of growth with 10th acquisition

Financial advice and investment management firm One Four Nine Group has acquired Nottingham-based Castlegate Capital, marking a “crucial step” in its growth journey.

The deal is the 10th acquisition for One Four Nine Group and the first of 2024 following a significant period of focus to integrate all firms into the business fully.

The launch in late 2023 of One Four Nine Wealth was an important moment for the evolution of the business.

It provided a “robust platform” to begin uniting all regional locations under one brand identity and to ensure the delivery a consistent client service proposition across the UK.

One Four Nine Wealth is the financial planning arm of the business, operating alongside One Four Nine Portfolio Management.

Castlegate is an independent chartered financial planning business established in 2016 catering to private and corporate clients across the UK.

It will rebrand to One Four Nine Wealth upon completion of the transaction taking the group’s client assets to over £1.6bn with over 30 financial planners and around 5,000 clients.

One Four Nine Group, chief executive Gabrielle Beaumont said: “This is an exciting time of growth for One Four Nine Group.

“Investing heavily in the last 12 months in people, integration and client proposition across our regional locations has put us in a strong position to continue to attract some of the best firms in the market as part of our continued acquisition strategy.”

She said the Castlegate team was a “natural fit” for One Four Nine Group and shares its vision of building an “energetic, forward-thinking” financial planning business with a “clear focus on delivering excellent lifetime financial planning to clients”.

One Four Nine Group corporate development director Sanjay Lukka added: “The acquisition of Castlegate Capital is an important milestone for One Four Nine Group.

“Having joined the Group in August, I’m delighted that my first acquisition marks such a crucial step in our growth journey.

“This acquisition reinforces our commitment to expanding One Four Nine Group’s footprint in the Midlands and beyond.

“Castlegate Capital’s expertise and strong client focus aligns fully with our own, and I look forward to working alongside their talented team to continue to deliver more value to our clients.”

One Four Nine launched in October 2021 with the acquisition of two advisory firms – Charter Financial Planning and Rice Whatmough Crozier.

The group primarily targets accountancy firms and other professional services firms which own or have a joint venture with financial advice firms.

It also considers standalone advisory firms which reflect its “collaborative, innovative and professional values”.

This includes advice firms either already or wanting to become experienced in recommending tax efficient alternative investments.

Money

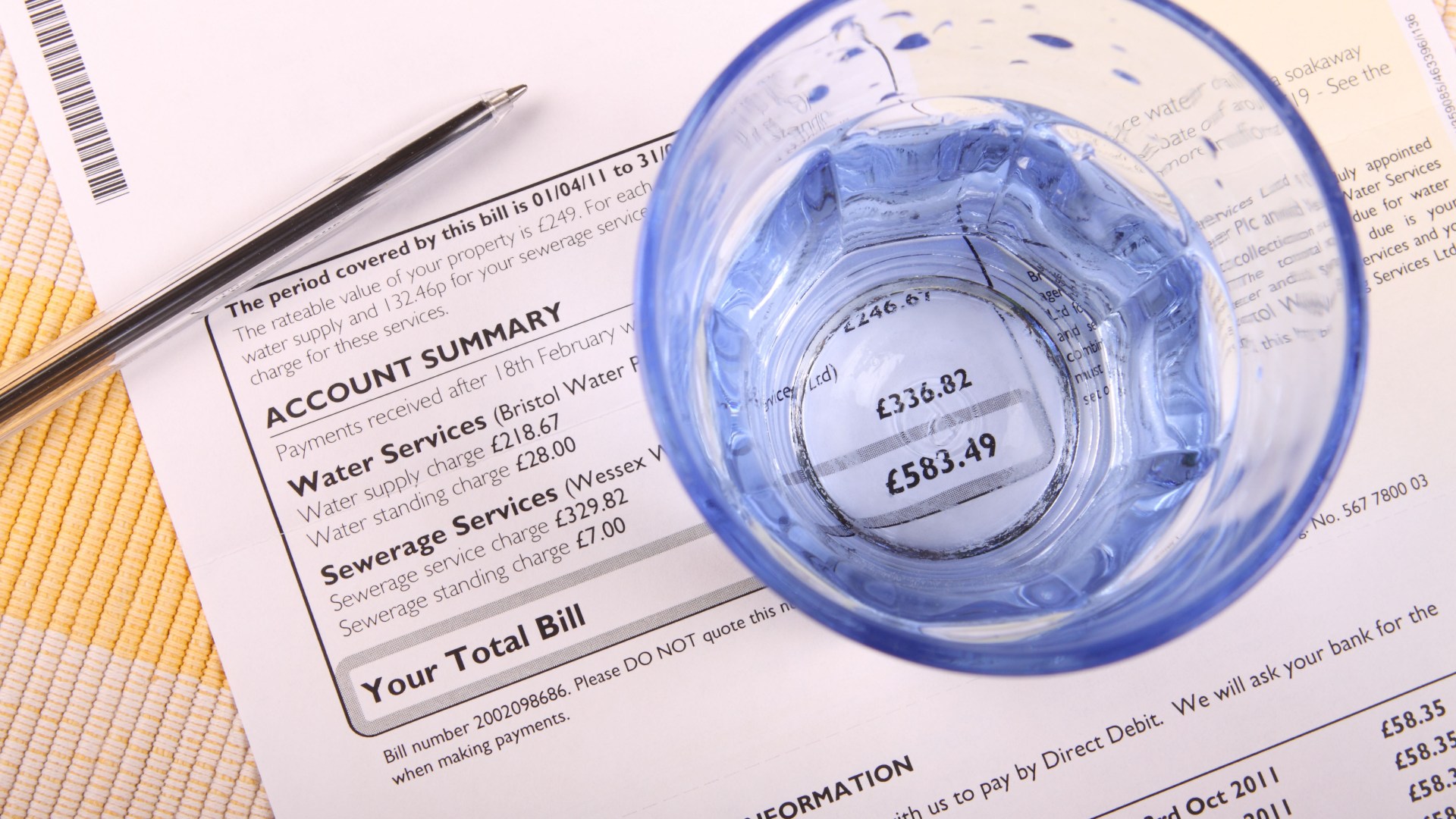

Six ways to save water and slash energy bills by £200 a year including money-guzzling device to switch off

MILLIONS of households could save money on their water bills by making just six simple changes to how they use water.

Annual water bills are set to rise by about £27.40 to £473 from next year, according to water regulator Ofwat.

Between 2025 and 2030 they are forecast to rise again by an average of £19 a year.

The increases will put pressure on households already finding it difficult to make ends meet.

Around 18% of households are already struggling to pay their bills but this will climb to 40% if the changes go ahead, according to the Consumer Council for Water.

But experts at bathroom supplier Wholesale Domestic say a family of four who make small changes to their home could save more than £200 a year.

Read more on household bills

Switch to water-efficient fixtures – £50

“One of the simplest and most effective ways to save money on your energy bills is to use water-efficient fixtures,” said Brian Toward from Wholesale Domestic.

“Modern showers and taps come with aerators and flow restrictors that reduce water usage without compromising on pressure.”

The devices are very easy to install and can be fitted either inside the spout of a tap or attached to the end of it.

Prices start at around £6.50 for four.

Meanwhile, a shower head aerator is installed in the same way as a basic shower head, which means they are one of the easiest ways to reduce your water consumption.

You can pick up one of the devices for about £8.

Switching to a water-saving shower head could reduce the water you use by up to 40%.

Overall, a family of four could save around £50 a year by cutting down their water consumption with these efficient fixtures.

Lower the temperature of your water heater – £50

Your water heater temperature controls how hot water will be when it comes out of your tap or shower head.

But most households have it set far higher than needed explains Mr Toward.

How to save on your energy bills

SWITCHING energy providers can sound like a hassle – but fortunately it’s pretty straight forward to change supplier – and save lots of cash.

Shop around – If you’re on an SVT deal you are likely throwing away up to £250 a year. Use a comparion site such as MoneySuperMarket.com, uSwitch or EnergyHelpline.com to see what deals are available to you.

The cheapest deals are usually found online and are fixed deals – meaning you’ll pay a fixed amount usually for 12 months.

Switch – When you’ve found one, all you have to do is contact the new supplier.

It helps to have the following information – which you can find on your bill – to hand to give the new supplier.

- Your postcode

- Name of your existing supplier

- Name of your existing deal and how much you payAn up-to-date meter reading

It will then notify your current supplier and begin the switch.

It should take no longer than three weeks to complete the switch and your supply won’t be interrupted in that time.

“By reducing your water heater temperature to around 55°C you can still have hot showers without wasting excess energy,” he said.

“Lowering the thermostat even slightly can make a significant difference over time and save you around £45-50 a year.

Most water heaters will have a knob on the front which controls the water temperature.

Turn this to the left to reduce its flow temperature.

Do not turn your temperature down too much as this could cause harmful bacteria to grow in the water.

Take shorter showers – £20

It’s an age old tip but reducing the length of your shower can help you to save significantly on your water bills.

Heating accounts for a large part of every household’s energy consumption.

“If every member of your household reduces their shower time by just one minute, you could save hundreds of litres of water each month,” Mr Toward suggests.

“Based on a family of four this could be a saving of around £20 a year in energy bills.”

Fix dripping and leaking fixtures – £35

Although the amount of water coming out of a leaking tap may look small, it can slowly add up over the course of a year.

“A slow-dripping tap can waste up to 5,500 litres of water a year,” Mr Toward warns.

“Not only is it a waste of water but it’s a direct hit to your energy bills if it’s a hot tap.”

If you get it fixed you could save up to £35 a year based on UK water heating costs.

Leaking toilets are another culprit.

Toilets take up about 30% of the total water used in a household according to water saving organisation Save Water Save Money.

A constantly running toilet can waste over 200 litres of water a day.

Install a thermostatic mixer shower – £30

If you have an electric shower, consider changing to a thermostatic mixer shower.

These showers mix hot and cold water more precisely than an electric shower which can prevent overheating and wasted energy.

By doing so they can help to regulate water temperature more effectively and reduce the energy needed to heat the water.

Prices start from around £75.

Swapping to a thermostatic shower can shave around £30 a year off your energy bill, especially if combined with a more efficient boiler.

Use your towel dryer wisely – £20

Towel radiators and heated towel rails have become popular in many bathrooms but they can waste energy if not used wisely.

Mr Toward advises: “Limit the time you have your towel rail on as many are left running for far longer than necessary, which can eat up electricity.”

Instead, set a timer or use a programmable rail to save between £15 and £20 annually.

How else can I save on my household bills?

You could apply for a water meter to shave hundreds of pounds off your water bill every year.

Water meters charge you for the amount of water you use, so consider your household use before you get one.

If you get through a lot of water then it may not be worth getting one.

The Consumer Council for Water has a free water meter calculator which will tell you how much you could save.

Meanwhile, you could get water-saving devices from your water company.

Get in touch with your supplier for more information or visit savewatersavemoney.co.uk.

Companies also cap the bills of households who are struggling through the WaterSure scheme.

To apply you must be on benefits and need to use lots of water for medical reasons or because your household has a certain number of children.

You must have a water meter or be waiting to get one installed.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

PLP appoints William Sprott as head of investment management

He will manage the industrial and logistic company’s relationships with its capital partners and the formation of new managed vehicles.

The post PLP appoints William Sprott as head of investment management appeared first on Property Week.

Money

Integrating Diagrams in Business Financial Planning – Finance Monthly

Financial planning is of utmost importance in the constantly evolving business landscape. Some innovative companies are engaging diagrams and other visual tools to connect complicated financial data with clear, actionable insights.

Effective utilization of diagrams allows these businesses to spot trends, optimize budgeting allocations, and forecast more accurately.

This article will elaborate on how companies can use diagrams to ensure financial success.

Visualizing Data Trends

Data trends hold lots of insight into the company’s growth trajectory, market performance, and emerging risks or opportunities. While traditional tables and spreadsheets inform, spotting trends instantly takes time.

Diagrams such as line charts, heat maps, and waterfall charts turn such numbers into easily interpretable visuals, making it easier for businesses to identify patterns and plan their strategy.

Line charts convey trends in revenue or costs over various points in time. You can choose heat maps on Miro’s diagram templates to visualize a set of performance measures over any management aspect, helping your organization put together a rough analysis of which set of departments and product lines require attention and which are thriving.

Waterfall charts are becoming increasingly popular among financial analysts to show incremental effects contributing to profit and those drawing resources from profit.

Waterfall charts let one label income and expense categories as they contribute or detract to profitability step by step. This helps set more targeted budgets and operational shifts.

Enhancing Budget Allocation

Diagrams provide a more visual way of dispersing resources based on need, performance, or return on investment (ROI).

Pie charts, tree maps, and bar graphs are examples of diagrams that make it easier for organizations to see where budget money is allocated to analyze whether it is being appropriately distributed among various projects or departments.

- Pie Chart and TreeMap Displays of Departmental Budgets: Some organizations use pie charts to allocate and overview department budgets and clearly show which departments incur the highest costs or investments.

Then, there are tree maps that visualize the nested subcategories inside significant categories so that companies can track spending from both macro and micro perspectives.

- Comparative Bar Graphs for Tracking ROI: Comparative bar graphs for ROI analysis across departments or campaigns allow finance teams to see which investments quickly deliver the most significant returns.

This attachment of value is handy for companies with multiple product lines or initiatives because such products allow for prioritizing high-ROI projects to minimize expenditure on something that does not return value.

Creating Financial Projections and Scenarios

Forecasting diagrams, like predictive graphs and sensitivity analysis charts, enable businesses to visualize different possible futures. Such visualization allows companies to make moves beforehand to remediate variances of expected value.

Sensitivity analysis diagrams allow businesses to adjust the variables and visualize the underlying financial template.

For example, through changes in sales growth rates or interest, finance teams can prepare for best-case, worst-case, and moderate cases to support an adaptive approach to budgeting.

In predicting revenue growth and cost changes over time, tech-based companies increasingly use predictive modelling and multi-line graphs based on historical data. Using such tools helps with a more precise revenue forecast, which allows for appropriate scaling of content investments or subscriber acquisition costs.

Advanced Reporting and Real-Time Dashboards

Companies increasingly turn to interactive dashboards and real-time reporting to make rapid decisions. Interactive charts allow users to easily interact with the data, making it exceedingly easy to focus on specific areas. Live and dynamic reporting helps the financial roles recognize and act upon issues as they arise, maintaining flexibility in financial planning.

Real-time dashboards allow companies to track KPIs, for example, cash flows, revenues, and expenses, with the help of dynamic bar graphs, pie charts, and gauges. Companies can update operational budgets and marketing spending in real time because the information is continuously updated based on live data.

The Role of AI in Automated Diagram Creation for Financial Planning.

Artificial Intelligence (AI) is bringing a sophisticated new dimension to financial planning by providing functions for automatic diagram creation from live data feeds. An AI algorithm can identify patterns in the data, automatically generate predictive models, and recommend the most appropriate visualizations.

AI-powered financial planning tools can analyze historical data to build automated forecasting diagrams so that businesses visualize future revenue, costs, and cash flow. For instance, AI-anchored facilitates real-time forecasting updates, furthering financial planning accuracy and freeing the finance team from other resource-consuming manual functions.

Some machine learning algorithms can spot variations from a given pattern in financial information and present this using colour-coded visuals and alerts. Companies such as Walmart employ these kinds of tools, indicating specific trends in sales data that allow finance teams to make prompt corrective changes.

Endnote

Innovative companies can leverage diagrams to turn complex financial data into easy-to-understand visuals that enhance data comprehension, budgeting accuracy, and strategic planning.

From predicting the future to tracking KPIs in real-time, these visual tools bring the financial health of organizations into clear view and permit well-informed and timely decision-making.

Introducing AI and real-time dashboards into financial planning allows for an even more sophisticated and dynamic application of diagrams, giving businesses the insight needed to thrive in a highly competitive market.

Money

Wetherspoons boss Tim Martin warns of price rises after Budget tax blow to businesses

THE chairman of Wetherspoons has issued a warning regarding impending price increases following Rachel Reeves’ Autumn Budget.

Tim Martin revealed that the pub chain’s tax bill is projected to rise by two-thirds next year.

Martin said: “Cost inflation, which had surged to high levels in 2022, gradually diminished over the subsequent two years.

“However, it has now significantly increased again following the budget.

“All hospitality businesses, we believe, plan to increase prices, as a result.

“Wetherspoon will, as always, make every attempt to stay as competitive as possible.”

Wetherspoons anticipates that tax and business costs will increase by approximately £60 million over the next fiscal year, including an estimated 67% rise in national insurance contributions.

Last week, Rachel Reeves said she was raising the headline employer rate of National Insurance (NI) from 13.8% to 15%.

She also announced a reduction to the threshold at which businesses start paying NI contributions from £9,100 to £5,000.

The group, which runs nearly 800 pubs across the UK, said its sales grew by about 6% in the 14 weeks to November 3, compared with the same period last year.

Money

I’ve made £1,200 extra cash for Christmas – it’s so quick and I can do it from my sofa watching telly

With the cost-of-living crisis still hitting families hard, many people are picking up side hustles to make a bit of extra cash for Christmas.

Single mum Kate Propert, who lives in Bristol with her daughter, is one savvy saver who has done just that – and now she’s earning hundreds of pounds from her sofa.

The 39-year-old, who works as a surgical care practitioner, has raked in £1,200 in the past year by selling old clothes on eBay.

She told The Sun: “This is the perfect way to help save for Christmas. I put some of my earnings from the marketplace into savings across the year, and this means I build up a pot to help fund the festive period.”

Having a little more money on top of her monthly salary helps take a bit of pressure off her squeezed family budget.

“My energy bills went up again from the start of October, and my weekly food shop has gone up too,” said Kate.

“That’s why selling on eBay is so great – as it means I can make some extra cash. As a single parent, every little helps.”

The entrepreneurial mum is a long time eBay lover. For almost a decade, she has been boosting her bank balance by selling stuff, but on a smaller scale.

She told The Sun: “I began my eBay journey back in 2015. My earliest sales were items from my wedding, including my dress, veil, shoes – as well as some bridesmaid dresses.”

In the beginning, Kate’s motivation was the desire to declutter and free up more space at home, but now she’s earning around £100 extra a month selling old bits and bobs.

“All the items I list are things from around the house that we longer use or need,” she said.

“Over the years, I’ve listed a huge variety of bits and pieces including home-ware, garden tools and children’s stuff.

“Recent sales include an unused professional make-up kit for £135, a Zeta Citi stroller pushchair for £80, an IKEA desk for £35, a Golf Wang ‘save the bees’ hoody for £35, and a riding helmet for £25,” she added.

“I’ve also just sold a Frozen puzzle and a wooden spelling game. The run-up to Christmas is a great time for selling kids clothes and toys.”

The resourceful mum is always willing to have a go at finding a buyer for things she no longer uses.

“I’ve even listed dog bowls, mudguards and artificial plants,” she said. “I’ve found new homes for all these things – and they’ve all helped me make some extra cash.

“You really can sell anything on eBay. One really unexpected profit was getting £5 for a bulk of old hair pins.”

The busy mum is able to do her listings from her sofa and they take just minutes each.

“I often put the time in when I’m sitting in front of the TV in the evening,” she said.

Recent changes by eBay

eBay recently announced (October 1), that it is now free for people to sell across all categories on the platform (with the exclusion of motor listings, including the sale of cars, motorcycles and vehicles.)

Prior to this, private sellers have had to pay a fee of more than 13%. Read more with ‘Massive change to eBay selling fees could save you serious cash – how does it compare to Depop and Vinted?’

“This has been a game-changer for me,” said Kate.

“I’ve already sold so much on the platform, but this makes me even more keen to do so. I’m really excited to see how the new features will help improve my sales – and boost my selling journey.”

The savvy mum has been sorting through every room in the house to see what else she can list and sell including a custom-made opal ring made, which cost Kate around £200.

“I’m planning to list this in the next few weeks – and will look to price it at around £180,” she said.

“This would free up a nice extra bit of cash for Christmas – plus the ring will make a fantastic gift for someone else. November is a great time to list items you know will make for great presents.”

Kate says eBay’s change to ‘free listings’ for sellers might see more individuals give eBay a try.

“This change could encourage others to do what I do – and sell unused items they have in their homes.”

Kate’s top tips for selling on eBay

Kate has urged sellers to take care to list your item accurately using relevant keywords. This will increase the chances of buyers finding your items.

Be sure to communicate clearly and responsively with the buyers throughout the process, she added.

“Try selecting the ‘Use AI description’ option for a helping hand when writing descriptions for your listings,” she explained.

“The tool automatically creates attention-grabbing captions which can make it easier for buyers to make a decision.

“Remember that there are protections in place when using eBay, such as the Money Back Guarantee. With this program, if a buyer has any issue with their purchase, eBay will support them to get a refund.”

Don’t fall foul of the tax rules

Under a recent crackdown, digital platforms such as eBay – as well as the likes of Etsy and Vinted – are now required to share seller information with HM Revenue & Customs.

Data must be passed to HMRC if you sell 30 items or more a year – or if you earn more than £1,700.

This is because individuals selling items online may be liable to pay tax if they earn £1,000 or more.

This isn’t a new tax. The rules have always stated that sellers who earn over £1,000 in 12 months must declare that income – and pay income tax on it. This is done by filling out a self-assessment tax return.

The crackdown is about ensuring that people who boost their income with a side hustle pay up what they owe. It also gives the taxman more visibility over the amount you’re earning.

Money

Christmas adverts 2024: All the festive TV films released so far rated including M&S, Debenhams and Shelter

THE festive season has kicked off with a bang. There are now so many Christmas adverts on TV in early November that you need both hands to count them.

Whether you love them or aren’t a fan, the commercials are the true sign that the big day is not far around the corner.

While we eagerly await the big reveal of the John Lewis ad, lots of other retailers have already aired their seasonal offerings.

Elizabeth Hurley shows us how to have a stress-free Debenhams Christmas, while Dawn French returns for M&S Food.

Here, we review 11 of these festive mini-blockbusters, giving each a rating out of five for entertainment value.

Debenhams – 4/5

THE 2024 “Duh, Debenhams” advert is a playful take on the festive madness we know all too well.

READ MORE ON FESTIVE ADVERTS

Featuring a star-studded cast including Elizabeth Hurley, Leomie Anderson, Ellie Taylor, and Hannah Cooper-Dommett, this ad suggests how easy festive online shopping can be.

With cheeky nods to the usual Christmas chaos, the celebs hilariously answer the question: “Why does Christmas shopping have to be so hard?” with a sassy, “Duh, Debenhams”.

This ad is sure to bring a smile to your face and remind you that Christmas shopping does not have to be so stressful.

Aldi – 3/5

KEVIN the Carrot is back for the ninth year running, and this time he is on a mission to save Christmas.

In a new adventure, Kevin and pal Katie navigate perilous situations and dodge booby traps to free the Spirit of Christmas and show the humbugs that “Christmas is better when goodwill is returned”.

It’s still a fun watch for the kids, but alas I fear Kevin is fast approaching his expiry date.

Morrisons – 2/5

MORRISONS has brought back its singing oven gloves. Only this time, there’s more of them.

Set to the catchy tune of Bugsy Malone track You Give A Little Love, the music is performed by a choir of 26 Morrisons staff.

The gloves, now fully animated, sing in support of the nation’s family chefs as they prepare an array of indulgent Christmas dishes.

It’s on the mark, but I worry this jingle will become grating.

Greggs – 5/5

GREGGS has set the bar high with its first Christmas advert, which features celebrity chef Nigella Lawson.

Set to an instrumental version of Carol Of The Bells, the ad opens with Nigella in her festive London townhouse.

She calls Christmas her “favourite time of year” and enjoys a Greggs Festive Bake, describing it as a “rapturous riot of flavour” with a “succulent filling”, playfully mimicking her saucy TV style.

Lidl – 3/5

THE Lidl Christmas advert tells a heartwarming tale of a little girl who, after helping an elderly woman, makes a wish to share her Lidl woolly hat with a boy she noticed earlier, who looked cold.

This touching gesture embodies Lidl’s message of sharing the magic this Christmas.

It also highlights the return of Lidl Toy Banks, with the aim of collecting and distributing more than 100,000 toys donated by customers to needy children.

Argos – 3/5

THE Argos Christmas advert features brand mascots Connie the doll and Trevor the dinosaur.

Seen in a dazzling dreamscape, Trevor lives out his rock star fantasy, belting out T-Rex’s classic 20th Century Boy atop a mountain of Marshall speakers.

The scene is electric as Trevor headlines for a crowd of adoring fans, all of whom are his best friend Connie.

This whimsical promo will charm audiences of all ages.

Sainsbury’s – 4/5

THE star here is the Big Friendly Giant from Roald Dahl’s beloved book, voiced by Stephen Fry.

The BFG asks: “Hey Sainsbury’s – how can we make this Christmas a bit more . . . phizz-whizzing?”

Enter Sophie, a Sainsbury’s staffer, who helps him gather food from the supermarket’s trusted suppliers.

The heart-warming promo ends with Fry inviting viewers to, “ask Sainsbury’s” for a truly spectacular festive feast.

M&S Food – 4/5

AUDIENCES are in for a treat as Dawn French and her fairy alter-ego from past ads share the screen for the first time.

As Fairy sprinkles her magic across Dawn’s home, Christmas comes alive with M&S treats, twinkling lights and Christmas cheer.

Six variations will air, with a special cameo by Katherine Jenkins on December 17.

But a second year without Jennifer Saunders does take away some of the magic.

Asda – 3/5

THE ad opens with Asda staff Maggie and Bill gazing out at a massive snowstorm.

Maggie frets: “Every road is closed between here and Sheffield – how are we going to get the store ready for Christmas?”

Enter a team of ceramic gnomes who transform the store into a Christmas wonderland, all set to The A-Team theme tune.

While delightful, it doesn’t top Asda’s previous ads featuring Will Ferrell and Michael Buble.

Shelter – 5/5

GET your tissues ready because Shelter has done it again with its heart-wrenching Christmas ad.

The film opens in an imaginary world where little Mia and her dad are walking across an alien landscape.

They wave to Father Christmas and high-five an alien octopus.

But reality intrudes, revealing their actual life in temporary accommodation and the dad’s efforts to shield Mia from the harsh conditions through make-believe.

-

Science & Environment2 months ago

Science & Environment2 months agoHow to unsnarl a tangle of threads, according to physics

-

Technology1 month ago

Technology1 month agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 months ago

Science & Environment2 months agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 months ago

Science & Environment2 months ago‘Running of the bulls’ festival crowds move like charged particles

-

Technology2 months ago

Technology2 months agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoX-rays reveal half-billion-year-old insect ancestor

-

Money1 month ago

Money1 month agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Science & Environment2 months ago

Science & Environment2 months agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 months ago

Science & Environment2 months agoSunlight-trapping device can generate temperatures over 1000°C

-

Sport1 month ago

Sport1 month agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Science & Environment2 months ago

Science & Environment2 months agoPhysicists have worked out how to melt any material

-

Technology1 month ago

Technology1 month agoGmail gets redesigned summary cards with more data & features

-

Football1 month ago

Football1 month agoRangers & Celtic ready for first SWPL derby showdown

-

MMA1 month ago

MMA1 month ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

News1 month ago

News1 month agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Technology1 month ago

Technology1 month agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment2 months ago

Science & Environment2 months agoLaser helps turn an electron into a coil of mass and charge

-

Sport1 month ago

Sport1 month agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Technology1 month ago

Technology1 month agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Science & Environment2 months ago

Science & Environment2 months agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment2 months ago

Science & Environment2 months agoLiquid crystals could improve quantum communication devices

-

Business1 month ago

how UniCredit built its Commerzbank stake

-

News1 month ago

News1 month ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Technology1 month ago

Technology1 month agoSamsung Passkeys will work with Samsung’s smart home devices

-

Technology1 month ago

Technology1 month agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum ‘supersolid’ matter stirred using magnets

-

MMA1 month ago

MMA1 month agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology1 month ago

Technology1 month agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

MMA1 month ago

MMA1 month ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Science & Environment2 months ago

Science & Environment2 months agoWhy this is a golden age for life to thrive across the universe

-

News1 month ago

News1 month agoNavigating the News Void: Opportunities for Revitalization

-

News1 month ago

News1 month agoMassive blasts in Beirut after renewed Israeli air strikes

-

Technology1 month ago

Technology1 month agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

Sport1 month ago

Sport1 month ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Entertainment1 month ago

Entertainment1 month agoBruce Springsteen endorses Harris, calls Trump “most dangerous candidate for president in my lifetime”

-

News1 month ago

News1 month agoRwanda restricts funeral sizes following outbreak

-

MMA1 month ago

MMA1 month agoPereira vs. Rountree prediction: Champ chases legend status

-

TV1 month ago

TV1 month agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Technology1 month ago

Technology1 month agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology1 month ago

Technology1 month agoMicrophone made of atom-thick graphene could be used in smartphones

-

Business1 month ago

Business1 month agoWater companies ‘failing to address customers’ concerns’

-

News1 month ago

News1 month agoCornell is about to deport a student over Palestine activism

-

Business1 month ago

Business1 month agoWhen to tip and when not to tip

-

Business1 month ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

News1 month ago

News1 month agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Sport1 month ago

Sport1 month agoWXV1: Canada 21-8 Ireland – Hosts make it two wins from two

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum forces used to automatically assemble tiny device

-

News2 months ago

News2 months ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

MMA1 month ago

MMA1 month agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Technology1 month ago

Technology1 month agoSingleStore’s BryteFlow acquisition targets data integration

-

Football1 month ago

Football1 month ago'Rangers outclassed and outplayed as Hearts stop rot'

-

Science & Environment2 months ago

Science & Environment2 months agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment2 months ago

Science & Environment2 months agoA slight curve helps rocks make the biggest splash

-

Technology2 months ago

Technology2 months agoMeta has a major opportunity to win the AI hardware race

-

Science & Environment2 months ago

Science & Environment2 months agoNuclear fusion experiment overcomes two key operating hurdles

-

Sport1 month ago

Sport1 month agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Football1 month ago

Football1 month agoWhy does Prince William support Aston Villa?

-

News1 month ago

News1 month ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Technology1 month ago

Technology1 month agoMusk faces SEC questions over X takeover

-

Sport1 month ago

Sport1 month agoPremiership Women’s Rugby: Exeter Chiefs boss unhappy with WXV clash

-

Technology1 month ago

Technology1 month agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

-

Sport1 month ago

Sport1 month agoShanghai Masters: Jannik Sinner and Carlos Alcaraz win openers

-

Sport1 month ago

Sport1 month agoCoco Gauff stages superb comeback to reach China Open final

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology1 month ago

Technology1 month agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Business1 month ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Sport1 month ago

Sport1 month agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

MMA1 month ago

MMA1 month agoPennington vs. Peña pick: Can ex-champ recapture title?

-

MMA1 month ago

MMA1 month ago‘I was fighting on automatic pilot’ at UFC 306

-

News1 month ago

News1 month agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Sport1 month ago

Sport1 month agoWales fall to second loss of WXV against Italy

-

Business1 month ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Business1 month ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

TV1 month ago

TV1 month agoTV Patrol Express September 26, 2024

-

Money4 weeks ago

Money4 weeks agoTiny clue on edge of £1 coin that makes it worth 2500 times its face value – do you have one lurking in your change?

-

Science & Environment2 months ago

Science & Environment2 months agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment2 months ago

Science & Environment2 months agoNerve fibres in the brain could generate quantum entanglement

-

Travel1 month ago

World of Hyatt welcomes iconic lifestyle brand in latest partnership

-

Technology1 month ago

Technology1 month agoQuoroom acquires Investory to scale up its capital-raising platform for startups

-

MMA1 month ago

MMA1 month agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

Technology1 month ago

Technology1 month agoThe best shows on Max (formerly HBO Max) right now

-

Technology1 month ago

Technology1 month agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

MMA1 month ago

MMA1 month agoHow to watch Salt Lake City title fights, lineup, odds, more

-

Technology1 month ago

Technology1 month agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

Technology1 month ago

Technology1 month agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Business1 month ago

Italy seeks to raise more windfall taxes from companies

-

Business1 month ago

‘Let’s be more normal’ — and rival Tory strategies

-

Business1 month ago

The search for Japan’s ‘lost’ art

-

Sport1 month ago

Sport1 month agoURC: Munster 23-0 Ospreys – hosts enjoy second win of season

-

Sport1 month ago

Sport1 month agoNew Zealand v England in WXV: Black Ferns not ‘invincible’ before game

-

Sport1 month ago

Sport1 month agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

News2 months ago

News2 months ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 months ago

Science & Environment2 months agoHow to wrap your mind around the real multiverse

-

MMA1 month ago

MMA1 month agoUFC 307’s Ketlen Vieira says Kayla Harrison ‘has not proven herself’

-

News1 month ago

News1 month agoTrump returns to Pennsylvania for rally at site of assassination attempt

-

MMA1 month ago

MMA1 month agoKevin Holland suffers injury vs. Roman Dolidze

-

Technology4 weeks ago

Technology4 weeks agoThe FBI secretly created an Ethereum token to investigate crypto fraud

-

Business1 month ago

Business1 month agoStocks Tumble in Japan After Party’s Election of New Prime Minister

-

Technology1 month ago

Technology1 month agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Technology1 month ago

Technology1 month agoOpenAI secured more billions, but there’s still capital left for other startups

You must be logged in to post a comment Login