Money

Over three million workers to get FREE takeaway delivery for a year – see the full list of jobs that qualify

MORE than three million workers are now able to get free takeaway delivery for a year.

Deliveroo and Blue Light Card have teamed up to offer free Deliveroo Plus Silver membership to essential workers in the UK.

In the scheme, Blue Light Card members – which is available to emergency service workers, NHS staff, teachers, social care workers and members of the armed forces – can get free delivery on all Deliveroo orders for 12 months as well as other deals and discounts.

Deliveroo Plus Silver normally costs £3.49 a month. That’s a saving of just under £42 for the entire year.

Under the terms of the deal, those who sign up get free Deliveroo Plus Silver membership for 12 months which gets them free delivery through the app on eligible orders worth £15 or more from restaurants and £25 from retail stores.

Exclusive discounts from major brands such as Nando’s, Wagamama, Pho, Giggling Squid, Kokoro, Gail’s Bakery, Waitrose, Wingstop, Sainsbury’s, Morrisons, Co-op, Boots, and others are also on offer.

Also on offer is access to localised deals and Deliveroo Rewards, where members can earn £8 off their 4th order when they make three orders at the same place within 30 days.

Members can also access exclusive Deliveroo Plus-only offers tailored to their local area all year round.

They’ll also join the Deliveroo Rewards programme, which means if they make three orders at the same place within 30 days, they’ll get £8 off their 4th order.

The scheme is designed to give a helping hand to essential workers, with many of those working unpredictable or long hours, and provides round-the-clock access to meals and essentials delivered right to their door or workplace.

In 2023, the 4.1million existing Blue Light Card members saved more than £330million through various offers and discounts.

Andy Collins, COO from Blue Light Card said: “By offering free Deliveroo Plus Silver, we’re proud to provide Blue Light members not only with a range of exclusive offers, but with greater convenience too – whether they’re ordering to their home or workplace.

“For many shift workers, being able to get their favourite meals or essentials delivered round-the-clock is a game-changer, so this unique partnership with Deliveroo is another way for us to show our hardworking and dedicated community that we’re there for them 24/7.”

Caroline Harris, VP of Marketing at Deliveroo, UKI, said “We are very excited to announce this first-of-a-kind partnership for Deliveroo with Blue Light Card, which aims to give back to their community members by offering them Deliveroo Plus Silver for free.

“We’re proud to reward Blue Light members with free delivery when they order from their favourite neighbourhood restaurants, grocers, and retailers, as well as exclusive members-only discounts.

Who is eligible to get the Blue Light Card?

Only those in certain emergency services or key worker roles can apply for a Blue Light Card.

In 2024, teachers were added to the list of workers who are allowed to join the discount scheme.

A full list of those who are eligible includes anyone in the following roles:

- Ambulance service

- Blood bikes

- Fire service

- Highways traffic officers

- HM armed forces

- HM armed forces veteran

- HM coastguard

- HM prison and probation service

- Home Office (Borders and Immigration)

- Independent lifeboats

- MoD civil servant

- MoD fire service

- MoD police

- NHS

- NHS Dental Practice

- Pharmacy

- Police

- Red Cross

- Reserved army forces

- RNLI

- Search and rescue

- Social care

- St Andrews ambulance

- St John ambulance

- Teachers

“This partnership with Blue Light Card and Deliveroo enables us to give back to essential workers from across the community and express our utmost appreciation for their incredible work every day.

“Whether placing an order to their home or place of work, we can’t wait to make it even more convenient for the UK’s essential service workers to get what they want and need delivered to their doorstep.”

Membership to Blue Light Card for access to market-leading discounts and rewards is quick and easy.

Those employed by organisations and non-government organisations that work directly on homelessness across the UK are also eligible.

Register online at www.bluelightcard.co.uk.

A card costs £4.99 and is valid for two years.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Three major energy suppliers handing out tens of thousands of free energy-saving gadgets worth up to £70 this winter

THREE major energy suppliers are giving out tens of thousands of energy-saving devices to households this winter.

Energy bills have risen for millions of households and winter fuel payments restricted to those on benefits.

But there is a host of help at hand if you’re struggling to cover bills.

Octopus Energy, OVO Energy and EDF have all launched multi-million pound schemes offering free energy-saving gadgets to households in need.

From air fryers, to electric blankets and mattress toppers, here is everything you might be eligible for.

Octopus Energy

Octopus Energy is offering 20,000 electric blankets in total to customers in need this winter.

Read more on Energy Bills

One of the UK’s largest energy firms has already distributed over 60,000 since January 2022 through its £30million Octo Assist Fund.

Octopus said customers with an electric blanket have saved an average £150 on their combined gas and electricity bills in previous winters.

The electric blankets are open to all customers, however Octopus said it is prioritising those in “particular circumstances”.

This includes those that are medically vulnerable, the elderly of people living alone.

The blankets provided to customers are made by Dreamland and usually cost £69.99 new.

To apply for an electric blanket, visit: http://octopusenergy/blog/octo-assist.

OVO Energy

OVO Energy has launched a £50million package of support for struggling customers.

Applications for the fund opened on October 1 with households eligible for payment holidays and direct debit reductions.

But some may be eligible for free energy-saving gadgets including electric throws and mattress toppers.

What you are entitled to depends on your personal circumstances although you do have to be an OVO Energy customer.

Find out if you’re eligible for help via https://www.ovoenergy.com/extra-support

EDF

EDF is pumping £29million into a range of support for hard-up households this winter.

Customers can get debt arrears wiped and free energy-saving gadgets such as air fryers, kettles and slow cookers.

EDF said it will replace any broken or in poor working order appliances with energy-efficient ones.

But not everyone qualifies for help. EDF said its team will identify eligible customers and refer them on for extra support.

You can find out more and apply via https://www.edfenergy.com/energywise/how-edf-are-supporting-their-customers-through-uks-cost-living-crisis

What other help is on offer

If you’re not eligible for free energy-saving gadgets through Octopus, EDF or OVO Energy’s funds, there is other support at hand.

You may be able to get free devices through the Household Support Fund between now and next March.

The fund is worth £421million and has been distributed among councils in England.

Each council gets to decide how to distribute its share of the fund but some are giving households free appliances and devices which could save you money on your energy bills.

Meanwhile, you might be able to get help paying for insulation or a new more energy-efficient boiler through the Energy Company Obligation.

You might even be able to get them for free depending on your circumstances.

It’s worth noting though that you are only eligible for help through the Energy Company Obligation if you are on benefits, classed as vulnerable or have a home with a low Energy Performance Certificate.

An Energy Performance Certificate is a document that shows how energy efficient your property is.

If neither of these two options are available, you might be able to save money on your bills by installing a heat pump, which you can get subsidised through the Boiler Upgrade Scheme.

The exact temperature to set your thermostat

ENERGY bills remain relatively high leaving many worrying over the thermostat.

Energy experts have revealed the exact temperature to set it at so that you can save cash and still keep warm.

When it comes to your thermostat, the Energy Saving Trust recommends you should set it to the “lowest comfortable temperature”.

For the majority of us, this is between 18 and 21 degrees Celsius.

It’s just the right balance between keeping your home warm, and keeping those energy bills as low as possible.

If you have your thermostat set at a higher temperature you can probably afford to turn it down and still keep cosy.

Of course, there are exceptions like anyone who is in ill health, and there is support available to cover extra costs.

Just by turning down the temp by a single degree, you could save as much as £100 a year.

If you cut it by more you will obviously make even bigger savings.

The Energy Saving Trust also says that you don’t need to turn your thermostat up when it is colder outside, the house will still heat up to the set temperature.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

I won £333k on People’s Postcode Lottery… I was ecstatic until call from my boss seconds later ruined everything

A MUM who won £333,000 on the People’s Postcode lottery was ecstatic – until a call from her boss ruined everything seconds later.

Angela Plant split the Millionaire Street Prize with a neighbour in the Hertfordshire village of Abbots Langley.

She wanted to go on a shopping spree after presenter Danyl Johnson knocked on her door with the huge cheque.

But just seconds later Angela’s boss rang her up asking if she could do a shift the next day at the old people’s home where she works.

Angela said: “I’m going to work tomorrow. I do their shopping, take them out for a coffee.”

She added: “I just chat to them. It keeps my mind buzzing and I love it.”

Angela said she would stick a “little bit” away – but plans to splash out on a string of exotic holidays.

The wish list of getaways includes a Greek wedding for her eldest son and a trip to Florida for her first grandchild, who is due in December.

She said: “I’m speechless. Oh my God! I was expecting about £10,000 or £15,000.

“I’m in shock. I just kept seeing threes and thought, ‘When are the threes going to end?’

“I would have been happy with £333, that could still get a bit these days.

“This year has been up and down. I’m just going to make sure all my close pals and family are looked after.

“I had a couple of knee replacements two or three years ago. Before that, I couldn’t walk down the garden path.”

She added: “You don’t want profit in the bank, you want to go out and spend it.

“We’ve got our first grandchild on the way, and she is going to be spoiled rotten.

“I’ve always, always wanted to be a grandmother. She is due on December 19. We’ll have a really good Christmas.”

Angela said: “It’s important to do things as a family. Good memories last forever.

“I’ve got good memories from the past of going with the children to Florida, so I would like to take my granddaughter there.”

CryptoCurrency

3 Reliable Dividend Stocks With Yields Above 5% That You Can Buy With Less Than $100 Right Now

There’s no wrong way to put your money to work on Wall Street, but some methods produce more reliable gains than others. If you’re looking for a relatively safe and easy way to grow the stream of income you’ll have to work with during your retirement years, buying dividend-paying stocks and holding them for long periods is a terrific option.

During the 50-year period that ended in 2023, dividend-paying stocks in the S&P 500 index returned 9.17% annually on average. That’s more than double the return produced by their non-dividend-paying cousins. During the same period, the average dividend non-payers in the benchmark index returned just 4.27% annually, according to Ned Davis Research and Hartford funds.

You don’t need to be rich to put your money to work for you. At the moment, shares of AT&T (NYSE: T), Hercules Capital (NYSE: HTGC), and Pfizer (NYSE: PFE) offer dividend yields of 5% or better, and you can buy a share of all three with less than $100. Adding them to a portfolio now gives you a good chance to outperform the market while they beef up your passive-income stream.

1. AT&T

AT&T lowered its dividend payout in 2022 to adjust for the sale of its unpredictable media assets. Now that it’s strictly a telecommunications business, the cash flows it uses to make dividend payments should be extra reliable. At recent prices, the stock offers a 5.2% dividend yield.

Traditional-wireline subscriptions are still shrinking, but this headwind is easily overcome by demand for services that run on its 5G network and a growing web of fiber-optic cables. In the second quarter, mobility-service revenue rose 3.4% year over year, and this isn’t the only operation driving growth.

The three-month period ended June 30 was the 18th consecutive quarter in which AT&T added over 200,000 new fiber-internet subscribers. Late last year, the company also launched a fixed-wireless service for folks who aren’t located next to fiber optic cables. As a result, Q2 consumer-broadband sales rose 7% year over year.

At $2.7 billion in Q2, consumer broadband is responsible for less than 10% of total revenue. AT&T is one of just three telecom companies with a nationwide 5G network, so investors can reasonably rely on its consumer-broadband business to drive growth for many years to come.

2. Hercules Capital

Hercules Capital is a business development company (BDC), which means it can avoid income taxes by giving nearly all of its earnings to shareholders as a dividend payment. At recent prices, the stock’s regular distribution offers a big 8% yield.

Hercules also offers a supplemental dividend that it set at $0.32 per share this year. If next year’s supplemental dividend remains unchanged, investors who buy this stock at recent prices will receive a 9.7% yield.

Most BDCs originate relatively high-interest loans to established mid-sized businesses that already earn money. Hercules Capital takes a riskier approach to financing by engaging start-ups in the life science and technology industries before they have any recurring revenues to report.

In isolation, the bets Hercules makes are extremely risky. The potential payoffs are so large, though, that the company can report strong-earnings growth if just a fraction of its investments succeed.

Hercules has raised or maintained its regular distribution since 2010, and continued movement in the right direction seems likely. In the first half of 2024, the BDC reported $1.07 billion in total-gross funding, which was 28% more than the previous-year period.

3. Pfizer

Sales of Pfizer’s COVID-19 vaccine and antiviral treatment broke records regarding its rate of growth and decline. Sales of Comirnaty and Paxlovid shot up to a combined $56.7 billion in 2022. Less than a year and a half later, sales of the same two drugs collapsed to an annualized $1.8 billion.

Don’t let its recent ups and downs confuse you. Pfizer is a reliable dividend payer that has raised its payout every year since 2009. At recent prices, it offers a 5.7% yield that will be easier to predict now that sinking sales of its COVID-19 products are responsible for less than 3% of total revenue.

Pfizer’s dividend payout is supported by one of the largest catalogs of drugs with patent-protected market exclusivity. In the first half of 2024, a dozen of its products grew sales by a double-digit percentage compared to the previous year period.

One of the investments Pfizer made with its pandemic-related earnings haul was the $43 billion acquisition of cancer drug developer Seagen. The purchase gave Pfizer access to four commercial-stage treatments, including Padcev. In late 2023, Padcev became a chemotherapy-free option for newly diagnosed bladder cancer patients. As such, sales are expected to reach $8 billion annually by 2030.

Padcev is one of several blockbuster drugs that could help Pfizer continue its dividend-raising streak. Adding some shares to a diverse portfolio now seems like the right move.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

3 Reliable Dividend Stocks With Yields Above 5% That You Can Buy With Less Than $100 Right Now was originally published by The Motley Fool

CryptoCurrency

1 Dividend Stock Yielding 8% to Buy in Case of a Bear Market

It might not seem like it today with market indexes rocketing to all-time highs, but bear markets do exist. They happen around once a decade and are defined as a period when an index such as the S&P 500 falls 20% or more from all-time highs.

One happened in 2022 (it seems so long ago) as well as briefly in 2020. Before that, there were bear markets in 2009, 2001, and 1990.

When stock prices are soaring, it can feel like the time to put your foot on the gas and get more aggressive with your portfolio. But counterintuitively, it is the best time to get more conservative and mix in some stocks that can weather any recession or bear market. You don’t want your entire portfolio in risky hypergrowth technology stocks that can fall 80% in a market downturn. Many investors made this mistake in 2022.

Dividend stocks with high yields can be great ballast in your portfolio when preparing for an upcoming bear market. One of the top-yielding stocks is Altria Group (NYSE: MO). Here’s why it is an ideal choice to balance out a portfolio of expensive hypergrowth stocks.

Legacy tobacco and pricing power

Altria Group is the corporate owner of Philip Morris USA, which owns brands such as Marlboro and Copenhagen. Cigarettes power the boat for the company, with Marlboro leading the way. However, smoking has been going down in the United States for many years.

Although this is a concern for tobacco companies, Altria has been able to counteract these volume declines with price increases. Revenue is up 13.1% in the last 10 years, while operating income is up 50% cumulatively over that time period.

This is why Altria has been able to consistently raise its dividend per share — most recently by 4.1% to $1.02, its 59th increase in 55 years.

At a current yield of 8%, Altria Group looks like an attractive income stock if it can keep raising prices — and therefore its dividend payout. The big questions are whether this party can continue, and whether management can switch customers over to nicotine alternatives.

Can the company switch customers to other product categories?

Pricing power is great, but it can’t sustain Altria Group indefinitely. Eventually — if the trends of the last few decades persist — cigarettes will be a minuscule part of consumer spending in the United States.

Replacing cigarettes are vaping devices and nicotine pouches. Altria Group has invested in both with its Njoy and on! brands.

Both brands are growing, but still are below direct competitors. On! nicotine pouches have 8.1% market share of the oral tobacco market (including legacy chewy tobacco and new nicotine-pouch brands), while Njoy held just 5.5% of the vaping market in the United States. Combined, the two brands still form just a small portion of Altria’s consolidated revenue.

Over the next five to 10 years, shareholders will need to keep track of the growth of these two brands. They can help replace sales volume lost from people quitting cigarettes.

Buy it for steady returns and low volatility

Altria Group is not a high-growth company. In fact, I wouldn’t expect its revenue to grow much over the next five years. Cigarette volumes will keep declining, which Altria can counteract with price increases and growth from on! and Njoy. But at current prices, I don’t think you need much revenue growth for the stock to do well.

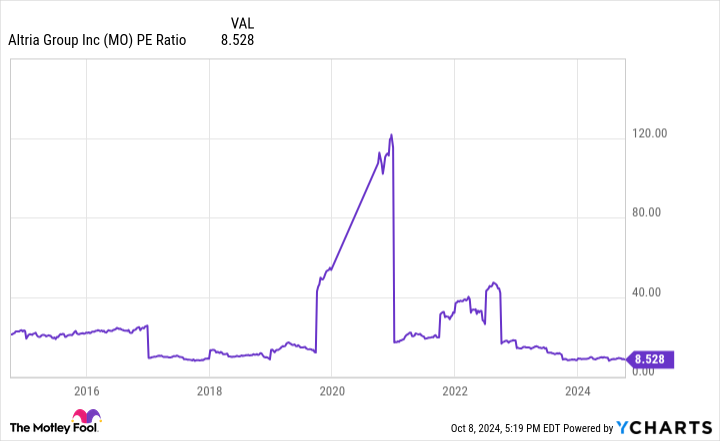

It has a price-to-earnings ratio of just 8.5. The company is repurchasing a ton of its stock, which means it can grow its dividend per share without growing its nominal dividend payout.

The starting yield is around 8% today, and the company has a long history of growing its dividend per share. This means that even if the stock price goes nowhere — or falls in a bear market — investors will be getting a consistent 8% yield.

For all these reasons, I think Altria Group is a cheap stock you would love to own during the next bear market, whenever it arrives.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $812,893!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

1 Dividend Stock Yielding 8% to Buy in Case of a Bear Market was originally published by The Motley Fool

CryptoCurrency

Factbox-China unveils fiscal stimulus measures to revive growth

BEIJING (Reuters) – China’s finance ministry on Saturday unveiled a fiscal stimulus package aimed at reviving the flagging economy and achieving the government’s growth target, though it did not disclose the size of the new measures.

The ministry said at a press conference that it would “significantly” increase government debt issuance to provide subsidies to low-income households, support the property market, and replenish state banks’ capital as part of efforts to jumpstart economic growth.

The much-anticipated briefing comes after the central bank and other regulators in late September announced the most aggressive monetary stimulus measures since COVID-19, including steps to revive the ailing property market such as mortgage rate cuts.

Reuters reported last month that China plans to issue special sovereign bonds worth about 2 trillion yuan ($283.02 billion) this year as part of fresh fiscal stimulus.

Below are the key measures announced by Finance Minister Lan Foan, at a news conference, where he was joined by Vice Finance Ministers Liao Min, Wang Dongwei, and Guo Tingting.

LOCAL DEBT RESOLUTION

China will increase support for local governments to address hidden debt risks, enhancing their capacity to support the economy. The government has allocated 1.2 trillion yuan ($169.81 billion) in local bond quotas this year to help resolve existing hidden debts and settle government arrears to firms.

China plans a large-scale debt swap program, alongside continued use of bond quotas for debt resolution, described as the “biggest” policy measure in recent years. Detailed policies will be announced after the necessary legal procedures are completed.

BANK RECAPITALISATION

China will expand the use of local government bond proceeds to support the property market and recapitalise large state-owned banks. Special treasury bonds will be issued to bolster the core Tier-1 capital of major state-owned commercial banks, improving their ability to withstand risks and provide credit to the real economy.

PROPERTY MARKET SUPPORT

Local governments will be allowed to use special bonds to purchase unused land, enhancing their ability to manage land supply and alleviating liquidity and debt pressures on both local governments and property developers.

China will also support the purchase of existing commercial housing for use as affordable housing and continue funding affordable housing projects.

The government is studying policies on value-added taxes that are linked to residential properties, and is looking at other tax policies to support the property market.

SUPPORT FOR LOW-INCOME HOUSEHOLDS AND STUDENTS

The government will increase support for low-income individuals and students to boost consumption. The number of national scholarships for undergraduates will be doubled from 60,000 to 120,000 annually, with the value of each scholarship rising from 8,000 yuan to 10,000 yuan per student per year.

Lan also noted that the central government has “relatively large room” to raise debt and increase the budget deficit, though he did not provide details.

China has set this year’s budget deficit at 3% of GDP, down from a revised 3.8% last year. The issuance of 1 trillion yuan in special ultra-long treasury bonds this year is not included in the budget. Local governments will issue 3.9 trillion yuan in special bonds in 2024, compared to 3.8 trillion yuan last year.

($1 = 7.0666 Chinese yuan renminbi)

(Reporting by Kevin Yao; Editing by Kim Coghill)

CryptoCurrency

Meet the Unstoppable Growth Stock That Could Join Apple, Nvidia, and Microsoft in the $3 Trillion Club by 2029

It’s amazing how much things can change in just 20 years. Two decades ago, industrial and energy stalwarts General Electric and ExxonMobil were the most valuable companies when measured by market cap, worth $319 billion and $283 billion, respectively. Jump ahead to 2024, and technology concerns are leading the way.

Topping the list are three of the world’s most recognizable tech companies. Apple leads the pack at $3.4 trillion (as of this writing). Nvidia and Microsoft are trailing close behind, with market caps of $3.1 trillion and $3 trillion, respectively.

With a market cap of just $1.9 trillion, it might seem premature to suggest that Amazon (NASDAQ: AMZN) has all the attributes necessary for membership in the $3 trillion club. However, the stock has gained 42% over the past year and 109% over the past five years, and its rebound appears poised to continue.

Recent improvements in the economy, the company’s strong market position, and its measured adoption of artificial intelligence (AI) could be the drivers needed to fuel Amazon’s membership in this elite fraternity.

Improving performance

The past several years have been rife with challenges, not the least of which was an economic downturn fueled by decades-high inflation. There’s been a vast improvement in recent months, however, as consumer sentiment in September reached its highest point in five months and the Federal Reserve Bank began its long-awaited campaign of interest rate cuts.

The improving economic conditions are favorably impacting Amazon’s results. In the second quarter, net sales of $148 billion climbed 10% year over year, while diluted earnings per share (EPS) of $1.26 nearly doubled.

Helping fuel the robust results were improvements from each of the company’s major operating segments. Online sales in the U.S. increased 9%, while international sales climbed 7%. Perhaps most important was a reacceleration from Amazon Web Services (AWS) — the company’s cloud computing business — which jumped 19%, its highest rate of growth since late 2022.

Equally important is advertising — the company’s fastest-growing business — which increased 20%, as Amazon is working to become a major player in the ad world.

An industry leader — in more ways than one

Amazon is the undisputed leader in the realm of e-commerce, which is an area it pioneered. The company accounted for 38% of U.S. digital retail sales last year, more than its next 15 largest rivals combined, according to data compiled by eMarketer. That dominance is expected to continue in 2024, with the company expected to nab 40% of online sales in the U.S. this year.

The company has long employed AI to maintain a competitive advantage over its rivals. Amazon uses AI to make product recommendations to customers and predict and maintain adequate inventory levels at its distribution centers and warehouses. The company also uses AI-powered robots to stock shelves and gather merchandise for shipping, and deploys these advanced algorithms to determine the most efficient delivery routes.

Amazon is also the leader in cloud computing, another business it pioneered. Amazon Web Services (AWS) is the top provider of cloud infrastructure services, with 33% of the market in the second quarter, with Microsoft Azure at No. 2 and Alphabet‘s Google Cloud at No. 3, with 20% and 10% of the market respectively, according to research firm Canalys. Amazon offers one of the largest repositories of AI models for its cloud customers, which has helped reaccelerate its cloud growth.

Last but certainly not least is Amazon’s digital advertising business. The company displays ads on its e-commerce website, Prime Video, Freevee, Amazon Music streaming services, its Twitch video game streaming platform, and more. The company uses AI to help ensure the advertising reaches its target market. The results are undeniable, as advertising has been Amazon’s fastest-growing business for several years running.

The path to $3 trillion

Amazon currently boasts a market cap of roughly $1.9 trillion, which means it will take stock price gains of roughly 57% to drive its value to $3 trillion. According to Wall Street, Amazon is expected to generate revenue of $635 billion in 2024, giving it a forward price-to-sales (P/S) ratio of roughly 3. Assuming its P/S remains constant, Amazon would have to grow its revenue to roughly $998 billion annually to support a $3 trillion market cap.

Wall Street is currently forecasting revenue growth for Amazon of 11% annually over the next five years. If the company achieves that benchmark, it could achieve a $3 trillion market cap as soon as 2029. It’s worth noting that Amazon has grown its annual revenue by nearly 400% over the past decade, so those expectations could well be conservative.

Furthermore, Amazon is currently selling for roughly 3.2 times sales, a slight discount compared to its average multiple of more than 3.3 over the past five years. That’s a pretty attractive price to pay for a company with so many ways to win.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,855!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,423!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $392,297!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Unstoppable Growth Stock That Could Join Apple, Nvidia, and Microsoft in the $3 Trillion Club by 2029 was originally published by The Motley Fool

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 weeks ago

Technology3 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment3 weeks ago

Science & Environment3 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

News4 weeks ago

the pick of new debut fiction

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNerve fibres in the brain could generate quantum entanglement

-

News3 weeks ago

News3 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum forces used to automatically assemble tiny device

-

Technology2 weeks ago

Technology2 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Business2 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

News4 weeks ago

News4 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News3 weeks ago

News3 weeks agoYou’re a Hypocrite, And So Am I

-

Sport3 weeks ago

Sport3 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News3 weeks ago

News3 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Business2 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

Technology2 weeks ago

Technology2 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Football2 weeks ago

Football2 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoRethinking space and time could let us do away with dark matter

-

News4 weeks ago

News4 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

News3 weeks ago

The Project Censored Newsletter – May 2024

-

Technology2 weeks ago

Technology2 weeks agoQuantum computers may work better when they ignore causality

-

MMA2 weeks ago

MMA2 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Sport2 weeks ago

Sport2 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

News3 weeks ago

News3 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Technology2 weeks ago

Technology2 weeks agoGet ready for Meta Connect

-

Business2 weeks ago

Ukraine faces its darkest hour

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Technology4 weeks ago

Technology4 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

News3 weeks ago

News3 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCardano founder to meet Argentina president Javier Milei

-

Politics3 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

MMA3 weeks ago

MMA3 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMeet the world's first female male model | 7.30

-

News3 weeks ago

News3 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Toning Workout for Women

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists have worked out how to melt any material

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoBeing in two places at once could make a quantum battery charge faster

-

News4 weeks ago

News4 weeks agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoEverything a Beginner Needs to Know About Squatting

-

TV3 weeks ago

TV3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Servers computers2 weeks ago

Servers computers2 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Technology2 weeks ago

Technology2 weeks agoThe best robot vacuum cleaners of 2024

-

News3 weeks ago

News3 weeks agoChurch same-sex split affecting bishop appointments

-

Politics3 weeks ago

Politics3 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Sport3 weeks ago

Sport3 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow one theory ties together everything we know about the universe

-

Business4 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMost accurate clock ever can tick for 40 billion years without error

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBlockdaemon mulls 2026 IPO: Report

-

Business3 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics3 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

News2 weeks ago

News2 weeks agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology2 weeks ago

Technology2 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Technology3 weeks ago

Technology3 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business3 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Travel3 weeks ago

Travel3 weeks agoDelta signs codeshare agreement with SAS

-

Politics2 weeks ago

Politics2 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology2 weeks ago

Technology2 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

You must be logged in to post a comment Login