Money

Shoppers rush to Home Bargains to buy ‘bargain’ Gingerbread-themed gift perfect for Christmas scanning for just £15

SHOPPERS are rushing to Home Bargains to buy “bargain” Gingerbread-themed gift, scanning at tills for just £15.

As daylight reduces and Christmas approaches, the importance of making a room cosy with decorative lighting greatans so much more.

Home Bargain’s shoppers could not believe their eyes when they saw the online ad for this steal.

The Winter Charm LED Gingerbread Townhouse Ornament was selling online for as little as £15.

Standing at 40cm tall, the enchanting ornament features a gingerbread townhouse, with white frosting around the edges, candy decorations and a sprinkle of snow.

The LED lights shine through the little windows of the gingerbread town house, creating a warm and inviting glow.

Read more in Deals and Sales

Although it appears that the ornament has sold out online, there is an option to be notified as to when it’s back in stock.

To find your local Home Bargains store, simply head to the website and click Store Locator.

Then enter your postcode or town to find your nearest store.

How to shop for bargains

As always, we recommend shopping around to find the best deal.There are plenty of comparison websites out there that’ll check prices for you – so don’t be left paying more than you have to.

Most of them work by comparing the prices across hundreds of retailers.

For example, Google Shopping is a tool that lets users search for and compare prices for products across the web.

Just type in keywords, or a product number, to bring up search results.

Price Spy also logs the history of how much something costs from over 3,000 different retailers, including Argos, Amazon, eBay and the supermarkets.

Once you select an individual product you can quickly compare which stores have the best price and which have it in stock.

How to bag a bargain

SUN Savers Editor Lana Clements explains how to find a cut-price item and bag a bargain…

Sign up to loyalty schemes of the brands that you regularly shop with.

Big names regularly offer discounts or special lower prices for members, among other perks.

Sales are when you can pick up a real steal.

Retailers usually have periodic promotions that tie into payday at the end of the month or Bank Holiday weekends, so keep a lookout and shop when these deals are on.

Sign up to mailing lists and you’ll also be first to know of special offers. It can be worth following retailers on social media too.

When buying online, always do a search for money off codes or vouchers that you can use vouchercodes.co.uk and myvouchercodes.co.uk are just two sites that round up promotions by retailer.

Scanner apps are useful to have on your phone. Trolley.co.uk app has a scanner that you can use to compare prices on branded items when out shopping.

Bargain hunters can also use B&M’s scanner in the app to find discounts in-store before staff have marked them out.

And always check if you can get cashback before paying which in effect means you’ll get some of your money back or a discount on the item.

It comes after Home Bargain’s impressed fans once again with its L’Oreal Blemish Buster Gift Set.

This was marked down from £38.99 to just £7.99.

That’s over 80 per cent off meaning customers save £31.00.

Inside the set was:

- 1x Smooth Sugars Clearing Scrub 50ml.

- 1x Pure Clay Blemish Rescue Mask 50ml.

- 1x Hydra Genius Aloe Water 70ml.

Essentially, customers looking to exfoliate, treat and hydrate their skin for a good price, need look no further.

A Home Bargain’s representative posted a photo of deal to Facebook and wrote: “An ideal stocking filler. Just look at that saving.

“Available in store & online.”

Similarly, it appears this item is currently out of stock.

Debatably no wonder, as just one of these items usually costs around the price of the whole set.

Money

The three DWP deadlines coming before Christmas and why you need to act to secure up to £460

THREE major deadlines are coming up before Christmas which could open up payments worth hundreds of pounds.

The cost of living remains high with energy bills rising for millions of UK households at the start of this month.

Luckily, there is help at hand, including the Winter Fuel Payment, Warm Home Discount and Christmas Bonus.

But there are some crucial deadlines you need to be aware of if you want to snap up the payments worth potentially £460.

One is coming within weeks too so you should act as soon as possible.

November 10 – deadline to backdate Pension Credit to get the Warm Homes Discount

The Warm Homes Discount (WHD) is a discount on your energy bills worth £150 each winter.

The money is not paid to you but is a one-off deduction applied between October and March.

In most cases, it is made automatically although households in Scotland have to apply.

To qualify for the help, you need to have been in receipt of the guaranteed credit element of Pension Credit or a different qualifying benefit from the list below on August 11:

If you weren’t claiming any of the above benefits on August 11, 2024, you won’t be eligible for the WHD this year.

However, the same August date does not apply if you are receiving the guarantee credit element of Pension Credit.

This is because you can backdate a Pension Credit claim by up to three months while the other benefits in the list above can only be backdated by up to one month.

That means you have until the end of Sunday, November 10 to launch a claim and get the £150 rebate.

Pension Credit is a benefit that tops up your weekly income to a minimum amount if you are on a low income and of state pension age, currently 66.

There are two parts to the benefit – Guarantee Credit and Savings Credit.

Guarantee Credit tops up your weekly income to £218.15 if you are single or your joint weekly income to £332.95 if you have a partner.

Savings Credit is extra money you get if you have some savings or your income is above the basic full state pension amount – £169.50.

December 2 – deadline for Christmas Bonus

The Christmas bonus is a tax-free £10 payment made once per year to cover some of the additional costs associated with Christmas.

The payment is made by the DWP before December 25 and can come in handy.

However, the £10 payment is only made to those in receipt of certain qualifying benefits. The full list of benefits is:

- Adult Disability Payment

- Armed Forces Independence Payment

- Attendance Allowance

- Carer’s Allowance

- Carer Support Payment

- Child Disability Payment

- Constant Attendance Allowance (paid under Industrial Injuries or War Pensions schemes)

- Contribution-based Employment and Support Allowance (once the main phase of the benefit is entered after the first 13 weeks of claim)

- Disability Living Allowance

- Incapacity Benefit at the long-term rate

- Industrial Death Benefit (for widows or widowers)

- Mobility Supplement

- Pension Credit – the guarantee element

- Personal Independence Payment (PIP)

- State Pension (including Graduated Retirement Benefit)

- Severe Disablement Allowance (transitionally protected)

- Unemployability Supplement or Allowance (paid under

- Industrial Injuries or War Pensions schemes)

- War Disablement Pension at State Pension age

- War Widow’s Pension

- Widowed Mother’s Allowance

- Widowed Parent’s Allowance

- Widow’s Pension

You will need to have been receiving one of the above benefits in the qualifying week to receive the £10 payment.

This year, that week is the first full week of December, which starts on December 2, so you will need to claim one of the above benefits by this date to qualify for the £10 Christmas Bonus.

If you want to find out if you qualify for one of the above benefits, you can use a number of free calculators.

The three main online calculators you can use are:

December 21 – deadline for backdated Pension Credit to get the Winter Fuel Payment

The Government has made the Winter Fuel Payment means-tested which means only those on certain benefits qualify for the up to £300 payment this year.

Rather than it being open to anyone of state pension age, you now only receive it if you were receiving Pension Credit or one of the below benefits by September 22:

However, again, you can backdate your Pension Credit claim by up to three months meaning you still have time to qualify for this year’s Winter Fuel Payment.

That means the ultimate deadline to qualify for the Winter Fuel Payment is December 21, not September 22.

The Winter Fuel Payment, which is usually paid by Christmas, is worth up to £300 depending on your circumstances.

If you were born before September 23, 1944, you will get £300 while those born between September 23, 1944, and September 22, 1958, will receive £200.

Crucial to claim Pension Credit if you can

HUNDREDS of thousands of pensioners are missing out on Pension Credit.

The Sun’s Assistant Consumer Editor Lana Clements explains why it’s imperative to apply for the benefit..

Pension Credit is designed to top up the income of the UK’s poorest pensioners.

In itself the payment is a vital lifeline for older people with little income.

It will take weekly income up to to £218.15 if you’re single or joint income to £332.95.

Yet, an estimated 800,000 don’t claim this support. Not only are they missing on this cash, but far more extra support that is unlocked when claiming Pension Credit.

With the winter fuel payment – worth up to £300 now being restricted to pensioners claiming Pension Credit – it’s more important than ever to claim the benefit if you can.

Pension Credit also opens up help with housing costs, council tax or heating bills and even a free TV licence if you are 75 or older.

All this extra support can make a huge difference to the quality of life for a struggling pensioner.

It’s not difficult to apply for Pension Credit, you can do it up to four months before you reach state pension age through the government website or by calling 0800 99 1234.

You’ll just need your National Insurance number, as well as information about income, savings and investments.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

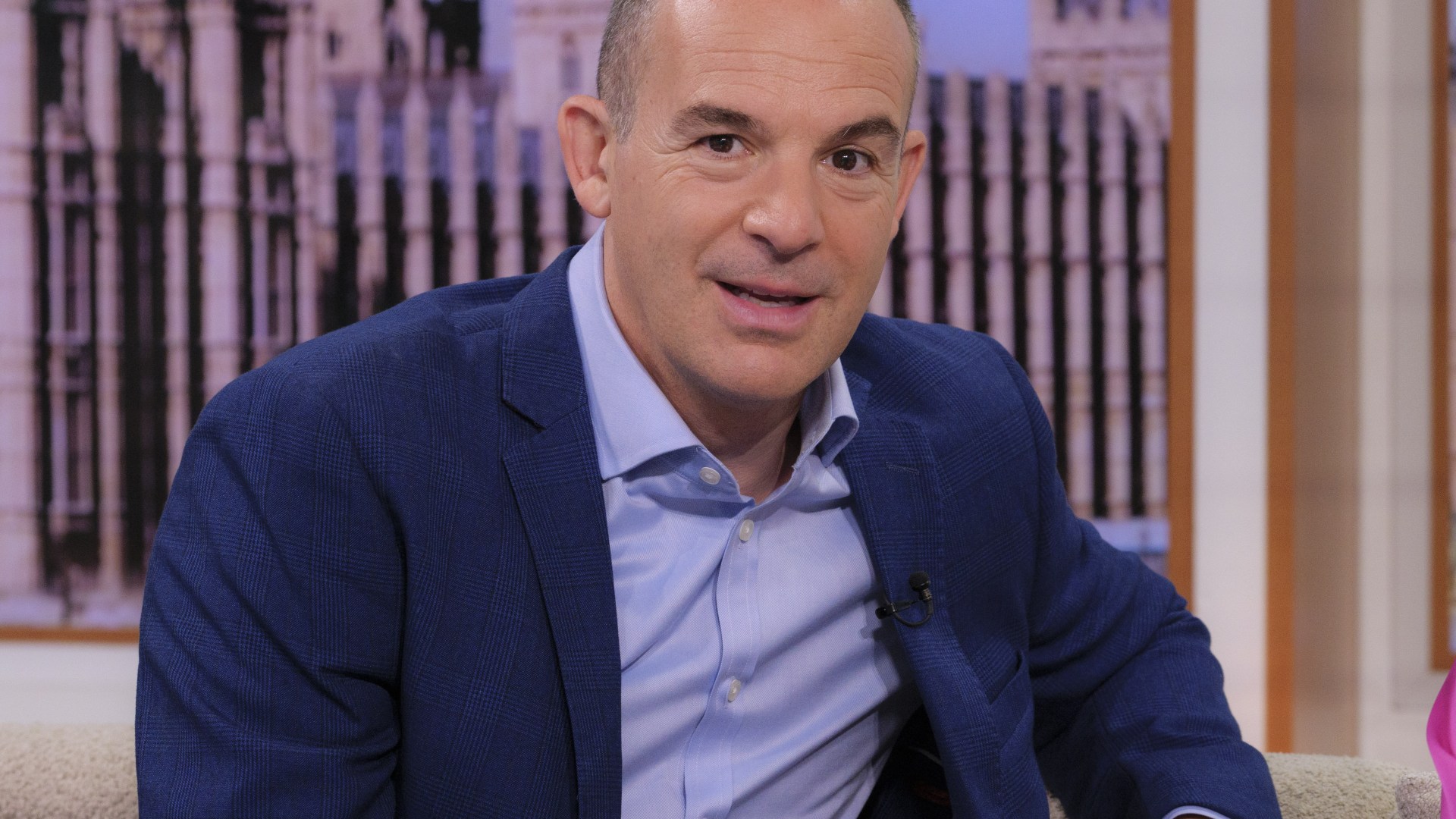

I got a £1,000 refund using easy Martin Lewis tip – I’m using the cash on a cheeky holiday

A MARTIN Lewis fan has shared how she managed to get a refund of £1,000 thanks to a handy MoneySavingExpert tip.

The MoneySavingExpert (MSE) reader got the cash boost by asking her supplier to repay what she owed in energy credit.

If you pay for your energy by direct debit, most firms take the annual cost of your bill and divide it by 12 which means some parts of the year you are in credit and others debt.

But because the monthly payments are estimated, it can mean you end up being in too much credit at certain times of the year.

You can ask for it to be repaid though, meaning you could get a giant lump sum back.

Martin Lewis’ MSE previously said the best time to ask for credit back is around May, when your energy debt is likely to have stopped rising after the colder months.

Some people choose to leave a bit of credit in their account in the run up to the winter months, when you spend more, but some prefer to have the cash.

In the latest MSE newsletter, a reader called Diane shared how she used the tip to claw back £1,000.

She said: “Thanks to you I checked and discovered I was £1,000 in credit with EDF.

“I am now looking forward to a cheeky little holiday, which I wouldn’t normally have been able to afford. Happy days, thank you again.”

How to ask your supplier for credit back

You will first want to make sure your energy firm has the most up-to-date meter reading for you.

If you’ve got a smart meter, this will likely be sending regular readings to your firm so you won’t have to take a meter reading.

If your meter readings are up-to-date and if you have been in credit for more than one month, ask your energy firm to reimburse you.

Each energy supplier has its own process for issuing customers with credit refunds.

For example, British Gas says it will issue you a refund if you have been billed in the last 14 days and you are not switching to another firm.

If these apply, it refunds you your credit balance within 10 working days.

Octopus Energy says if you’ve got more credit on your account than you need, you can request any excess back.

But you need to have had an energy bill based on real meter readings in the 14 days before requesting a refund.

How to challenge an unfair direct debit

If you pay your energy bill by direct debit, then it is assumed that this monthly amount should be “fair and reasonable”.

If you don’t think it is, you can complain directly to your supplier in the first instance.

If you’re not happy with the outcome you can take it to the independent Energy Ombudsman to dispute, but there are a few steps before you get to that stage.

Your supplier must clearly explain why it’s chosen that amount for your direct debit.

If you’ve got credit on your account, you have every right to get it back – although some experts recommend keeping it there through the summer, so your bills don’t go up in the winter when you use more energy.

Your supplier must refund you or explain exactly why not otherwise the regulator, Ofgem, can fine suppliers if they don’t.

If you are disputing a bill, taking a meter reading is a must.

If it’s lower than your estimate, you can ask your provider to lower your monthly direct debit to a more suitable amount.

But beware so you don’t end up in debt later on with a bigger catch-up bill at the end of the year from underpayments racking up.

If you don’t have success in negotiating a lower payment then you can put in a complaint to the Energy Ombudsman.

How do I calculate my energy bill?

BELOW we reveal how you can calculate your own energy bill.

To calculate how much you pay for your energy bill, you must find out your unit rate for gas and electricity and the standing charge for each fuel type.

The unit rate will usually be shown on your bill in p/kWh.The standing charge is a daily charge that is paid 365 days of the year – irrespective of whether or not you use any gas or electricity.

You will then need to note down your own annual energy usage from a previous bill.

Once you have these details, you can work out your gas and electricity costs separately.

Multiply your usage in kWh by the unit rate cost in p/kWh for the corresponding fuel type – this will give you your usage costs.

You’ll then need to multiply each standing charge by 365 and add this figure to the totals for your usage – this will then give you your annual costs.

Divide this figure by 12, and you’ll be able to determine how much you should expect to pay each month from April 1.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

I won £418,000 lottery prize but only took home FOURTEENTH when colleagues jumped in – phone call sent me into overdrive

EVERYONE wants to know how to beat the odds and win the lottery.

But unfortunately, the lottery is a game of luck and there are no tips or tricks that can guarantee you’ll take home a top prize.

The odds show how likely you are to win any particular prize – the lower the number, the better the odds.

For example, odds of 1 in 10 are better than odds of 1 in 100 or 1 in 1,000.

There are several major lottery games in the UK including Lotto by the National Lottery, Camelot’s EuroMillions and Thunderball.

Chances of winning the Lotto

Lotto by the National Lottery is a game where you pick six numbers from 1 to 59. You can play up to seven lines of numbers on each slip.

The game costs £2 to play per slip.

The odds of winning any prize on the Lotto are 1 in 9.3.

But to win the jackpot on the Lotto, the odds are considerably slimmer.

To bag the top prize, you need to have six matching balls. The odds of doing this and scooping the jackpot are currently 1 in 45,057,474.

The next highest prize of £1,000,000 is for getting five main matching balls plus the bonus ball.

The odds of taking home the million pound prize are 1 in 7,509,579 – far higher than the jackpot, but still unlikely.

The odds of taking home £1,750 for getting five main numbers without the bonus ball are 1 in 2,180, while you have a 1 in 97 chance of bagging £140 for getting four main numbers.

Your chances of taking home £30 for getting 3 main numbers are much better at 1 in 97.

And you have a roughly 1 in 10 chance of getting a free lucky dip for 2 matching numbers.

Chances of winning the EuroMillions

The EuroMillions costs £2.50 to play and is open on Tuesdays and Fridays.

To play, you must pick five numbers from 1-50 and two “Lucky Stars” from 1-12. Players with the most matching numbers win the top prizes.

Your chance of bagging the EuroMillions jackpot is even slimmer than winning the top Lotto prize.

This is because it generally has higher jackpots on offer, meaning it attracts more attention.

Currently, the odds of matching five numbers and two lucky stars – the top win – stand at 1 in 139,838,160.

The average jackpot prize is £57,923,499, according to EuroMillions.

The odds of winning the second top prize for matching 5 balls and a lucky star, which is typically around £262,346, are 1 in 6,991,908.

The chances of taking home the third prize for five matching balls, with an average payout of £26,277, are 1 in 3,107,515.

For four matching balls with two lucky stars, it’s 1 in 621,503, and for four balls with one lucky star, it’s 1 in 31,076. These come with an average prize of £1,489 and £95, respectively.

Chances of winning the Thunderball

Thunderball is another game run by National Lottery where you pick five numbers and one “Thunderball”. It costs just £1 to play and you can enter up to four times a week.

The jackpot of £500,000 for matching five balls plus the Thunderball is 1 in 8,060,598.

Your odds of bagging the next highest prize of £5,000 for matching five balls is currently 1 in 620,046, while the chances of winning £250 for four balls plus the Thunderball is 1 in 47,416.

You have the best chance of winning £3 for matching the Thunderball, with odds of 1 in 29.

Money

Huge outdoor retailer with more than 100 shops announces store closure within DAYS

A HUGE outdoor retailer has announced it will close one of its stores within days.

Decathlon is set to shut the doors on its shop in Forge Retail Park in Telford, Shropshire, on November 3.

The French sporting goods retailer has operated at the shopping centre since 2018.

The closure is said to be part of a “brand refresh” and a “broader review” of its store network.

Decathlon told customers they can use vouchers at its Wednesbury store until the end of the year.

The company also said that staff members were being supported to continue working at the company “where possible”.

Michael McHale, Regional Leader at Decathlon UK said: “We’re saddened to be closing our Telford store, which has served the local community for over six years.

“However, we’re excited to continue supporting our loyal customers by welcoming them to our Wednesbury location, just a short drive away.

“At Decathlon, we remain committed to bringing the wonders of sport to life and providing the same great products, services, and experiences that our customers have come to love.”

Local residents have been left disappointed at the news that their area is losing its Decathlon store.

One wrote on Facebook: “Great shop – sad to see it closing.”

Another said: “Sad. Great store. Useful to have on our doorstep.”

A third claimed: “All thanks to the blumming shoplifters!”

It comes as closures have rocked high streets across the UK in recent years.

Some retailers have closed a few branches here and there for various reasons, like when a store lease has come to an end.

Other examples of one-off rather than widespread closures is if there are changes in the area, like a shopping centre closing, and in some cases a shop will close to relocate to another area.

Some chains have faced tougher conditions though, forcing them to shut dozens of stores, or all of them in the worst case.

Elsewhere, a much-loved tea room is being forced to close having been in business for 34 “happy and successful” years.

The family-run Two Hoots Tea Room is situated in one of Wales’ most-visited tourist spots and they say they are devastated after they were ordered to pull down the shutters for good.

Why are retailers closing stores?

RETAILERS have been feeling the squeeze since the pandemic, while shoppers are cutting back on spending due to the soaring cost of living crisis.

High energy costs and a move to shopping online after the pandemic are also taking a toll, and many high street shops have struggled to keep going.

The high street has seen a whole raft of closures over the past year, and more are coming.

The number of jobs lost in British retail dropped last year, but 120,000 people still lost their employment, figures have suggested.

Figures from the Centre for Retail Research revealed that 10,494 shops closed for the last time during 2023, and 119,405 jobs were lost in the sector.

It was fewer shops than had been lost for several years, and a reduction from 151,641 jobs lost in 2022.

The centre’s director, Professor Joshua Bamfield, said the improvement is “less bad” than good.

Although there were some big-name losses from the high street, including Wilko, many large companies had already gone bust before 2022, the centre said, such as Topshop owner Arcadia, Jessops and Debenhams.

“The cost-of-living crisis, inflation and increases in interest rates have led many consumers to tighten their belts, reducing retail spend,” Prof Bamfield said.

“Retailers themselves have suffered increasing energy and occupancy costs, staff shortages and falling demand that have made rebuilding profits after extensive store closures during the pandemic exceptionally difficult.”

Alongside Wilko, which employed around 12,000 people when it collapsed, 2023’s biggest failures included Paperchase, Cath Kidston, Planet Organic and Tile Giant.

The Centre for Retail Research said most stores were closed because companies were trying to reorganise and cut costs rather than the business failing.

However, experts have warned there will likely be more failures this year as consumers keep their belts tight and borrowing costs soar for businesses.

The Body Shop and Ted Baker are the biggest names to have already collapsed into administration this year.

Meanwhile, customers were left devastated after a family-run clothing shop was forced to close after 144 years.

Dancers is run by the fourth and fifth generation of the Dancer family, but the rise in online shopping meant they had to let it go.

And, closures are affecting various industries across different sectors as a historic city brewery, with a legacy spanning 150 years, is also set to close.

The Carlsberg Marston’s Brewing Company (CMBC) has confirmed plans to close Wolverhampton’s Banks’s Brewery.

Money

M&S brings back retro crisps two years after disappearing from shelves

M&S has brought back an iconic retro crisps flavour two years after they disappeared from shelves.

The major retailer confirmed it has both listened and answered the prayers of its fans.

That’s right, M&S’s Prawn Cocktail Shells are back.

M&S insists the tasty snacks are made from the finest ingredients with a “top secret” exclusive spice blend.

If you’re a fan of Skips, the prawn cocktail crisps, chances are you’ll like these too.

According to Ocado, the six pack of Prawn Cocktail Shells are selling for £2.

They’re also suitable for vegeterians.

And the fun doesn’t stop there.

M&S also announced three-brand-new tortilla sharing bags will too be hitting shelves.

Each tortilla bag has been inspired by a classic Mexican dish.

Such as Tomatillo & Jalapeno Pepper and Lime & Coriander, and Feta & Pink Peppercorn Chickpea & Red Quinoa Tortillas.

Be warned, M&S say “these are nacho average sharing bags… you will NOT want to share.”

On October 16, an M&S representative shared the reveal of the tortilla flavours on Facebook.

One person commented on the post: “Yum! These sound delicious!”

According to Ocado, the tortilla packs are selling for £1.35.

Since we’re on the topic of surprises, M&S has one more to share.

It’s three totally new peanut snack packs, bursting with flavour, seasoned and not salted.

The flavours include Katsu Chicken Curry flavour, Smoky Chorizo flavour, and a Spicy Buffalo Wing flavour.

According to Ocado, the new peanut snack packs are selling for just £1.50.

To find your nearest M&S store visit their website and click Find your nearest store.

Put your postcode, or town or street name in and a list of local stores should come up.

It is also recommended to check in store and online product availability.

How to save on your supermarket shop

THERE are plenty of ways to save on your grocery shop.

save on your grocery shop.

You can look out for yellow or red stickers on products, which show when they’ve been reduced.

If the food is fresh, you’ll have to eat it quickly or freeze it for another time.

Making a list should also save you money, as you’ll be less likely to make any rash purchases when you get to the supermarket.

Going own brand can be one easy way to save hundreds of pounds a year on your food bills too.

This means ditching “finest” or “luxury” products and instead going for “own” or value” type of lines.

Plenty of supermarkets run wonky veg and fruit schemes where you can get cheap prices if they’re misshapen or imperfect.

For example, Lidl runs its Waste Not scheme, offering boxes of 5kg of fruit and vegetables for just £1.50.

If you’re on a low income and a parent, you may be able to get up to £442 a year in Healthy Start vouchers to use at the supermarket too.

Plus, many councils offer supermarket vouchers as part of the Household Support Fund.

Money

Amex customers’ fury over mystery payments as credit cards are frozen and fraud helpline ‘flooded’ with calls

A MAJOR credit card company has been inundated with calls from customers after mystery payments appeared on their accounts.

Customers of American Express said that since Sunday they have been unable to get through to its customer service helpline to query the payments.

American Express has millions of customers in the UK.

Others have said that they have been unable to resolve the issue by using the company’s live chat and have been told to call its helpline.

Many are unable to use credit cards which have been frozen.

Customers took to X, formerly known as Twitter, to complain about the tech issue and hundreds of comments have also appeared on Reddit.

One American Express user said: “I’ve been on hold for a call with your fraud alert team for close to two hours following a report of a rejected suspicious payment and 3 small (<£5 total with British Dressage?) pending payments that have appeared on my account.”

Another said: “after waiting 1 hr and 25 minutes to speak to you about fraud, you cut me off!

“As a good card holder I am not happy about this at all!”

The American firm replied to customers on social media and said that its team is “experiencing a high volume of inquiries and is actively looking into the issue”.

Among those affected by the issue is father-of-one Terry Pierce, 37.

The strategy director from Woodford, East London, was travelling to Manchester for work when he began to receive texts asking him to approve transactions he had not made.

Four payments totalling £18.92 were taken from his British Airways American Express Premium Plus Card to Airalo Singapore, a data roaming company.

A further two charges also appeared on his account as “pending”.

When Terry tried to contact American Express he was left on hold for four hours while watching new payments appear on his account.

Eventually he was forced to hang up so he could continue working.

Terry tried to use the live chat feature in the company’s app but it simply told him to call the customer service helpline.

How to check if your bank is down

THERE are a few different ways to find out if your bank is experiencing an outage.

Senior consumer reporter Olivia Marshall explains how you can check.

If you’re trying to send money to someone, or you just want to check if you have enough cash for a coffee, finding your online banking is down can be a real pain.

Most banks have a dedicated news page on their website to show service problems, including internet banking, mobile apps, ATMs, debit cards and credit cards.

You can also check on any future work they have planned and what it might mean for you.

Plus, you can check websites such as Down Detector, which will tell you whether other people are experiencing problems with a particular company online.

He said: “We all have busy lives and it’s just been so much additional stress.

“My card is frozen so I can’t use it. I have no idea of the source of these transactions or if I’ll be refunded.”

In the meantime, Terry has been forced to use his current account to pay for items, which has left him unable to collect rewards on his card.

This was one of the main reasons why he first applied for the card, which has a £300 annual fee.

Despite being an American Express customer for more than three years Terry is now considering changing credit card provider when he comes to renew later this month.

“This is my first time having an issue with my credit card and it has made me question American Express, which is known for its customer service,” he said.

We asked Amex about its helpline issues and whether it was aware of a bigger issue.

A spokesperson from Amex said: “The privacy and security of our customers is a priority for American Express.

“We have sophisticated monitoring systems and internal safeguards in place to help detect fraudulent and suspicious activity. If we identify unusual activity that may be fraud, we will take protective actions.

“We also recommend customers regularly review and monitor their account activity, and immediately contact us (using the number on the back of their Card) if they detect any suspicious activity.

“Our specialist Fraud Team thoroughly investigates all fraud claims and American Express Cardmembers are not liable for this kind of unauthorised charge on their accounts.”

It’s understood that Amex has added extra resource to its call centre to bring call wait times down.

How to report credit card fraud

If you think your credit card or personal information has been compromised then contact your bank immediately.

Ring the number on the back of your plastic card and explain what has happened.

You should also be able to find your provider’s customer service number in its banking app.

Your provider will be able to freeze your card so no further payments are made.

Usually you will be reimbursed for any charges that you did not make if you report the fraud quickly.

Keep a record of the fraudulent activity such as payments in your banking app and texts asking you to authorise transactions by taking a screenshot.

You can also report the crime to Action Fraud by using its online tool or by calling 0300 123 2040.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment4 weeks ago

Science & Environment4 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology3 weeks ago

Technology3 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLiquid crystals could improve quantum communication devices

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to wrap your mind around the real multiverse

-

News1 month ago

the pick of new debut fiction

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA slight curve helps rocks make the biggest splash

-

News4 weeks ago

News4 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists are grappling with their own reproducibility crisis

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News4 weeks ago

News4 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News4 weeks ago

News4 weeks agoYou’re a Hypocrite, And So Am I

-

Business3 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Sport4 weeks ago

Sport4 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Technology3 weeks ago

Technology3 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News1 month ago

News1 month agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoRethinking space and time could let us do away with dark matter

-

Technology3 weeks ago

Technology3 weeks agoQuantum computers may work better when they ignore causality

-

Sport3 weeks ago

Sport3 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Technology2 weeks ago

Technology2 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

News4 weeks ago

The Project Censored Newsletter – May 2024

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Business3 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

MMA3 weeks ago

MMA3 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Football3 weeks ago

Football3 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Technology3 weeks ago

Technology3 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Technology3 weeks ago

Technology3 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Business2 weeks ago

Business2 weeks agoWhen to tip and when not to tip

-

Sport2 weeks ago

Sport2 weeks agoWales fall to second loss of WXV against Italy

-

Technology2 weeks ago

Technology2 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Politics3 weeks ago

Robert Jenrick vows to cut aid to countries that do not take back refused asylum seekers | Robert Jenrick

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists have worked out how to melt any material

-

News4 weeks ago

News4 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoBeing in two places at once could make a quantum battery charge faster

-

Technology4 weeks ago

Technology4 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoCardano founder to meet Argentina president Javier Milei

-

Politics4 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

TV4 weeks ago

TV4 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News3 weeks ago

News3 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Toning Workout for Women

-

Technology3 weeks ago

Technology3 weeks agoGet ready for Meta Connect

-

Business2 weeks ago

Ukraine faces its darkest hour

-

Technology2 weeks ago

Technology2 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Business2 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Entertainment1 week ago

Entertainment1 week agoChristopher Ciccone, artist and Madonna’s younger brother, dies at 63

-

Sport4 weeks ago

Sport4 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

News1 month ago

News1 month agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Business4 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics4 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMeet the world's first female male model | 7.30

-

News3 weeks ago

News3 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Politics4 weeks ago

Politics4 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMost accurate clock ever can tick for 40 billion years without error

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoBlockdaemon mulls 2026 IPO: Report

-

MMA4 weeks ago

MMA4 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks agoEverything a Beginner Needs to Know About Squatting

-

Servers computers3 weeks ago

Servers computers3 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Business2 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

TV2 weeks ago

TV2 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

Technology2 weeks ago

Technology2 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

News2 weeks ago

News2 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

MMA2 weeks ago

MMA2 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Sport2 weeks ago

Sport2 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Sport2 weeks ago

Sport2 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Business2 weeks ago

Business2 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Sport2 weeks ago

Sport2 weeks agoLauren Keen-Hawkins: Injured amateur jockey continues progress from serious head injury

-

MMA2 weeks ago

MMA2 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Business2 weeks ago

LVMH strikes sponsorship deal with Formula 1

-

Business2 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

News2 weeks ago

News2 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

You must be logged in to post a comment Login