Money

‘This is a crime’ cry shoppers as M&S axes popular drink just months before Christmas

SHOPPERS have shared their devastation after noticing a popular M&S drink has vanished just months before Christmas.

Eagle-eyed customers have raised concerns after its pre-mixed cans of Pink Gin and Tonic have been removed from stores.

Taking to X, formally known as Twitter, an upset customer said the news was a “crime“.

They wrote: “Discontinuing its tinned pink G&T’s is a crime against all the beautiful and fun-loving people.”

The alcoholic beverage has been a hit with shoppers for over a decade but was quietly axed from stores at the end of last year.

The 25cl tin contained 8% gin and was infused with cranberries.

One shopper described it as their “go-to” tipple on social media.

Meanwhile, another said it tasted like “strawberry jelly” and was their “favourite thing ever”.

But now an M&S spokesperson has confirmed to The Sun that the pre-mixed cans are no more.

M&S Spokesperson said - ‘At M&S Food we are constantly innovating and refreshing our range, reacting to trends, and customer feedback.

“We are famous for offering a great selection of cocktails in a can, with new flavours including the delicious Blood Orange Margarita and Cherry Mai Thai, with more exciting launches in the pipeline. ”

They added: “Although the Pink Gin & Tonic is currently not available, we always listen to customer feedback when reviewing future ranges”.

It is not unusual for M&S to switch up its product ranges.

Last week, The Sun revealed its vegan range was undergoing a major revamp, which would see meat alternatives sold alongside traditional meat products.

As part of the change, products such as the Plant Kitchen Margherita Sourdough Pizza will not return to stores until January.

This has not impressed some customers with one describing it as a “terrible” idea in a Reddit post.

Earlier this year the store said it would axe some of the treats from its Colin and Connie sweet range as part of a product relaunch.

Over the summer, M&S scrapped its Colin and Connie “Together Forever” sweets.

M&S also confirmed that it is quietly axing the Colin The Caterpillar Fizzy Rainbow sweets.

The sweets were rainbow in colour with a sour sugary coating.

What else is new at M&S?

Thankfully, it is not all doom and gloom for M&S shoppers as the retailer confirmed it will bring back an iconic drink this Christmas.

The supermarket’s original snow globe gin liqueur will make a return for the holidays after a hiatus.

Previously, the gin came in two flavours – Clementine and Spiced Sugar Plum – but this year, only the Clementine one will be sold.

The store has started rolling out its entire Christmas range to shoppers, which includes hot honey over halloumi in blankets brie brulee, and Turkey Feast dip.

M&S’s food-to-order range for the holidays is also now open for online orders and collection between December 22 and December 24.

Why are products axed or recipes changed?

ANALYSIS by chief consumer reporter James Flanders.

Food and drinks makers have been known to tweak their recipes or axe items altogether.

They often say that this is down to the changing tastes of customers.

There are several reasons why this could be done.

For example, government regulation, like the “sugar tax,” forces firms to change their recipes.

Some manufacturers might choose to tweak ingredients to cut costs.

They may opt for a cheaper alternative, especially when costs are rising to keep prices stable.

For example, Tango Cherry disappeared from shelves in 2018.

It has recently returned after six years away but as a sugar-free version.

Fanta removed sweetener from its sugar-free alternative earlier this year.

Suntory tweaked the flavour of its flagship Lucozade Original and Orange energy drinks.

While the amount of sugar in every bottle remains unchanged, the supplier swapped out the sweetener aspartame for sucralose.

Money

I received a message out the blue saying I’d won £1MILLION in the lottery – I was convinced it was a mistake

A MARRIED couple has revealed they discovered their £1 million jackpot lottery win from a message they were sent completely out of the blue.

Bill and Cath Mullarkey received the life changing news after returning to their Coventry home from a holiday in St Lucia.

The 2017 National Lottery win has since allowed them to build a home and restaurant on the Caribbean island.

Bill, 64, and Cath, 63, decided to pursue their dream after the shock draw.

Mr Mullarkey said: “We feel so blessed. It has changed our life and the lives of other people that we’ve helped as well.”

The couple played the National Lottery “many, many times” and dreamed of owning a restaurant on St Lucia, where they first met and holidayed frequently, after returning to the UK and working in corporate catering.

Returning from a trip in 2017, the couple were shocked to receive a message telling them that they had won £1 million in the National Lottery.

The couple added: “I thought it must be something like, ‘this could be you if you play tonight.

“[Instead it read] congratulations, you’re the proud winner of the EuroMillions, £1 million’ and that was it.

“It was life-changing, but it took time to sink in. Even for a day or two, it was surreal. I’m thinking maybe we’ll get a call back saying it’s a mistake, but no.

“When you see it’s all signed, sealed, delivered and then that’s reality when you see your bank account with zeros, wow.

“We always thought of having our own place and ideally open our own little restaurant. We never thought it would happen but we dreamed and then that was the priority, that and help family members.

“We had got to that age in life where we thought it’d never be possible or we would be fortunate enough to think, ‘where do we really want to settle down’, and for me, it was a no brainer.”

The couple had bought a plot of land a few minutes from the beach before winning the EuroMillions and, now they they were £1 million richer, they knew this was their chance.

They set to work building their house with mountain views, a swimming pool and a restaurant on the ground floor called Brigands Hideaway, which serves St Lucian food and opened last November.

“It’s doing quite well, and it’s nice working for ourselves, and Cath is very good with the local food, and it’s going down well with both locals and tourists,” Mr Mullarkey said.

“There is so much fresh produce here and we get on well with the local suppliers and farmers, and Cath’s brothers are fishermen so we get fresh fish.”

Mr Mullarkey admitted the couple do miss “beautiful” Coventry but that their lives have been changed for the better by winning the National Lottery.

“We were happy before, but we are even happier now, knowing that we have this. I’m grateful every day of my life and so is Cath, for the change that it’s managed to bring us.

“What we’re doing now is for ourselves and living our dream, doing our thing, which we dreamt of, but never thought would be possible, so it has changed our life for the better.”

How to enter the National Lottery?

SOME may find they are inspired to enter the lottery after hearing about the couple’s incredible win. Here’s how you can get involved

All you need to do is pick six numbers between one and 59. If you’re unsure you can always opt for a Lucky Dip which randomly selects your numbers.

You can play up to seven lines on each play slip and buy up to ten slips at one time.

Then you need to decide whether you want to play on Wednesday or Saturday.

If you’re undecided you could choose to play both and then all that’s left to choose if the number of weeks you’d like to play.

CryptoCurrency

China Moves to Support Markets After Data Showing Economy Slowed

(Bloomberg) — China’s central bank moved to support markets just as data showed the economy expanding the least in six quarters, signaling the government’s intent to continue a stimulus push to draw a line under the slowdown.

Most Read from Bloomberg

The People’s Bank of China disclosed more details of its measures to boost capital markets minutes after authorities released figures showing China’s slowdown deepened in the third quarter. At a separate event in Beijing, PBOC Governor Pan Gongsheng flagged the real estate and stock markets as key challenges in the economy that require targeted policy support.

Coordinated or not, the moves by the PBOC and its governor appeared to bolster hope that Beijing would do what it takes to ensure the country reaches its 2024 growth target of around 5%. Although the expansion was slower than in previous quarters, better-than-expected data for September offered tentative signs the economy has bottomed out.

The probability of China achieving its growth goal “now looks very high,” said Jacqueline Rong, chief China economist at BNP Paribas SA. “Only a mild rebound in the fourth quarter will get the job done.”

China’s benchmark CSI 300 Index of onshore stocks rebounded from earlier losses to close up 3.6% higher, after the central bank kicked off a re-lending facility for listed companies and major shareholders to buy back shares. Stocks also got a boost from President Xi Jinping’s call for efforts to achieve the year’s economic goals and financial support for technology, with chipmaker Semiconductor Manufacturing International Corp. gaining 20%.

What Bloomberg Economics Says…

“Given the force and breadth of the policy response in recent weeks, the economy has likely bottomed out. The government will probably now concentrate on implementation, with a particular focus on ensuring local officials deliver fiscal spending that’s been budgeted for the year.”

— Chang Shu and Eric Zhu

Read the full note here.

The Friday data painted a mixed economic picture for the last quarter.

Gross domestic product increased 4.6% in the July-to-September period from a year prior, data released by the National Bureau of Statistics showed, bringing growth for the first nine months to 4.8% — the lower end of China’s annual growth goal.

Things appeared to take a turn for the better during the last stretch of the period, with retail sales accelerating in September to grow 3.2% after expanding 2.1% the prior month.

The better-than-expected consumption gauge likely received a boost from government subsidies for upgrading consumer goods. Home appliances saw a 21% surge in sales from a year ago, picking up from a 3% gain in the previous month. Increased subsidies for car purchases also paid off, with auto sales snapping a six-month declining streak.

“The economy will perform better in the fourth quarter given the new stimulus measures,” said Larry Hu, head of China economics at Macquarie Group Ltd.

The appliance and goods trade-in program is part of China’s stimulus measures including interest rate cuts, with the elite Politburo led by Xi supercharging the push with a vow to stabilize the beleaguered real estate sector.

The slate of measures prompted a historic stock rally and led banks including Goldman Sachs Group Inc. to upgrade their forecasts for China’s growth. But skepticism has grown over whether authorities are willing to deploy greater fiscal firepower to turn around the economy and markets.

Investors now expect Chinese lawmakers to approve additional budget or debt sales to fund public spending in a meeting as soon as this month after authorities promised fiscal support.

At a Beijing forum, PBOC’s Pan reiterated that the monetary authority will make a reasonable rebound in prices a key policy consideration. A broad measure of prices fell for a sixth quarter, data showed Friday, extending the economy’s deflation streak, the longest since 1999.

Apart from retail sales, industrial production and fixed-asset investment also picked up in September, and jobless rate fell to 5.1%, the lowest since June.

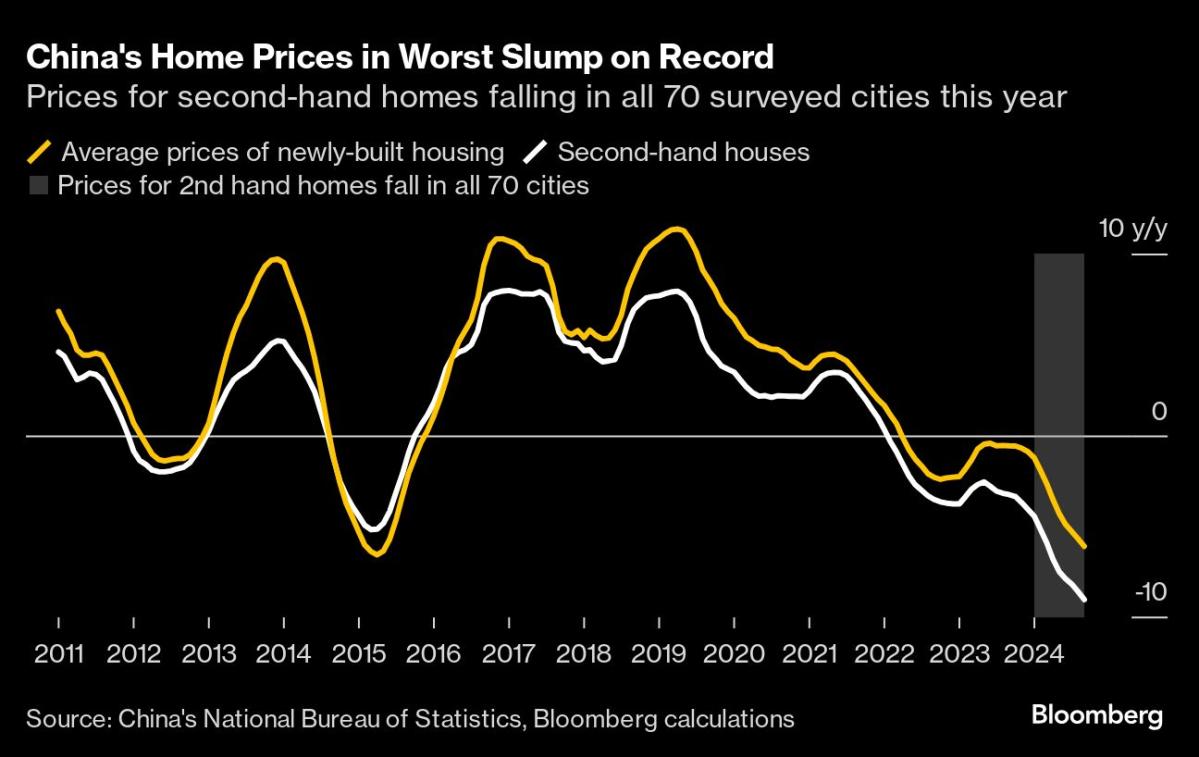

New home prices, however, fell for a 16th month, dropping at almost the same pace as in August.

“There is still a lack of stabilization in the property market yet, indeed indicating the needs for continued policy easing,” said Xiaojia Zhi, chief China economist at Credit Agricole.

The NBS said there’s reason for caution despite improvements in the main indicators as the stimulus measures are rolled out, citing an “increasingly complex and grim” external environment and a need to strengthen the economy’s foundation.

Data released before Friday underscored those challenges. Exports in September slowed sharply, curbing a trade rebound that has been a highlight for the economy. Deflationary pressures continued to build, with consumer prices still weak and factory gate prices falling for 24 straight months.

Economists have urged Beijing to boost consumer spending to avoid a spiral of falling prices, which could risk a self-reinforcing cycle of declining spending, shrinking business revenues and job losses. But authorities have shown little urgency to ramp up consumption with any direct stimulus or large-scale handouts, which Xi has long resisted due to concerns over what he calls “welfarism.”

What’s Wrong With China’s Economy? What’s Xi Doing?: QuickTake

China has so far appeared to be focusing its fiscal policy on reining in local debt risks, with Finance Minister Lan Fo’an promising what he described would be the biggest effort in years to bring hidden debt onto local governments’ balance sheet.

The strategy is aimed at easing the debt servicing burden for the authorities by bringing down interest costs and delaying loan repayment. This frees up cash and gives local governments greater scope to drive economic growth.

“The improvement in the growth momentum of the key monthly indicators may provide some comfort to policymakers,” said Louis Kuijs, chief Asia-Pacific economist at S&P Global Ratings. “Yet I don’t think that one month of slightly better activity data can justify reducing policy support to growth, especially not at a time when deflation risks have increased.”

–With assistance from Tian Chen, James Mayger and Jing Li.

(Updates with market close and Xi Jinping comments in fifth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

CryptoCurrency

Meet the Newest Addition to the S&P 500. The Stock Has Soared 575% Since Early Last Year, and It’s Still a Buy Right Now, According to 1 Wall Street Analyst

The S&P 500 is regarded as the best overall benchmark of the U.S. stock market and consists of the 500 largest publicly traded companies in the country. Given the range of its member companies, it is considered to be the most dependable gauge of overall stock market performance. To become part of the S&P 500, a company must meet the following prerequisites:

-

Be a U.S.-based company.

-

Have a market cap of at least $8.2 billion.

-

Be highly liquid.

-

Have a minimum of 50% of its outstanding shares available for trading.

-

Be profitable according to GAAP in the most recent quarter.

-

Be profitable over the preceding four quarters in aggregate.

Palantir Technologies (NYSE: PLTR) is one of the most recent additions to the S&P 500, being added to the fold on Sept. 23. It’s also one of only 11 companies to make the grade so far this year. Since the advent of generative AI in early 2023, Palantir stock has surged 575%, its gains fueled by robust sales and profit growth.

Even after gains of that magnitude, some on Wall Street believe there’s more to come. Let’s review what has driven the stock higher and whether its lofty price has simply made it too risky.

AI solutions for the masses

Palantir made a name for itself serving the U.S. intelligence and law enforcement communities. The company’s first-of-their-kind algorithms could sift through mounds of data and connect seemingly disparate bits of information to track down would-be terrorists.

In more recent years, Palantir has applied its sophisticated algorithms to give enterprises a competitive edge by providing actionable business intelligence. Thanks in part to its decades of experience, the company quickly recognized the opportunity represented by generative AI and developed timely solutions to meet the need. Palantir’s Artificial Intelligence Platform (AIP) was born of those efforts. By leveraging existing company data, AIP can provide businesses with solutions tailored to specific needs.

The proof is in the pudding

Palantir’s go-to-market strategy for AIP is what helped set the company apart. The company offers boot camps that pair customers with Palantir engineers to help them fashion solutions to their unique challenges. This strategy has proven to be wildly successful.

Just last month, Palantir announced a new multi-year, multi-million-dollar contract with Nebraska Medicine, which used AIP to improve healthcare by harnessing technology. After what it describes as “a series of targeted bootcamps,” the health system was able to implement a new workflow that resulted in a more than 2,000% increase in its Discharge Lounge utilization, which freed up beds earlier and decreased the time needed to discharge a patient by one hour (on average).

This is just one example of dozens of customer testimonials that show that AIP is saving customers time and money — which in turn boosts Palantir financial results. In the second quarter, it closed 96 deals worth at least $1 million. Of those, 33 were worth $5 million or more, while 27 were worth at least $10 million. Furthermore, many of these deals were inked within just weeks of a successful boot camp session.

Taking a step back helps illustrate the impact on the company’s overall results. In the second quarter, Palantir’s revenue grew 27% year over year to $678 million while also climbing 7% quarter over quarter. This also marked the company’s seventh successive quarter of profit generation. Consistent profitability was the final hurdle needed to secure its admission to the S&P 500. Furthermore, Palantir’s U.S. commercial revenue, fueled by the success of AIP, grew 55% year over year, while the segments customer count grew by 83%. Even more impressive was the segment’s remaining deal revenue (RDV) which soared 103%. When RDV is growing faster than revenue, it shows that future revenue growth is accelerating.

Most experts suggest this is still the early innings for the adoption of AI software. In Ark Invest’s Big Ideas 2024, Cathie Wood calculates the opportunity for generative AI software could balloon to $13 trillion by 2030. The bull case is even more eye-catching, at $37 trillion.

Given Palantir’s unique take on AI implementation and the magnitude of the opportunity, it’s clear the company can continue to prosper in an increasingly AI-centric world.

Wall Street’s biggest Palantir bull

I’m not the only one who thinks so. On the heels of its admittance into the S&P 500, Greentech Research analyst Hilary Kramer posited that Palantir “easily can be” a $100 stock. That represents potential upside of 130% compared to Monday’s closing price.

Kramer believes that given the company’s strong revenue and profit growth and increasing backlog, investment banks will eventually have to get on board and increase their estimates, which will cause others to look at the stock, fueling a virtuous cycle.

Despite the massive opportunity and stellar execution, some investors will be put off by Palantir’s frothy valuation. The stock is currently selling for 122 times forward earnings and 29 times forward sales. However, using the forward price/earnings-to-growth (PEG) ratio — which considers the company’s impressive growth rate — clocks in at 0.4, when any number less than 1 signals an undervalued stock.

In a case like this, when valuation is a stumbling block, dollar-cost averaging allows investors to ease into the stock over time, picking up more shares when the price is more reasonable.

Make no mistake: Palantir is positioned to profit from the AI revolution. Investors with a stomach for some volatility and a bit more risk should consider a position is this cutting-edge AI stock.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Danny Vena has positions in Palantir Technologies. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Meet the Newest Addition to the S&P 500. The Stock Has Soared 575% Since Early Last Year, and It’s Still a Buy Right Now, According to 1 Wall Street Analyst was originally published by The Motley Fool

CryptoCurrency

SEC’s Ripple appeal doesn’t challenge XRP non-security status

Ripple’s chief legal officer, Stuart Alderoty, emphasized that the SEC’s Form C doesn’t appeal the ruling that XRP is not a security.

CryptoCurrency

Lisa Su Just Delivered Incredible News for Advanced Micro Devices Stock Investors

Developing artificial intelligence (AI) software wouldn’t be possible without data centers and the powerful graphics processing chips (GPUs) inside them. For the past 18 months, Nvidia (NASDAQ: NVDA) has dominated the GPU industry with a staggering market share of up to 98%.

But competition was bound to emerge, and Advanced Micro Devices (NASDAQ: AMD) has stepped up to the plate with an exciting GPU roadmap. The company hosted its “Advancing AI” event on Oct. 10, where its CEO Lisa Su provided an update on its next-generation chips.

Although Advanced Micro Devices is still trailing Nvidia in the market for AI GPUs, Su’s comments suggest the company is catching up at a rapid clip. Here’s why investors should be excited.

Advanced Micro Devices was more than a year behind Nvidia in the AI GPU race

Nvidia’s H100 GPU set the benchmark for AI training and AI inference. The chip went into full production in September 2022, although sales didn’t ramp up until 2023, when AI fever gripped the tech sector. The H100 is still a hot product today, and Nvidia continues to struggle with supply constraints because demand is so high from leading AI companies like OpenAI, Amazon, Microsoft, and more.

Those supply challenges have opened the door for competitors like Advanced Micro Devices to steal some market share. The company announced its own data center GPU called the MI300X at the end of 2023, which was specifically designed to compete with the H100. So far, it has attracted some of Nvidia’s top customers, including Microsoft, Oracle, and Meta Platforms.

In fact, Advanced Micro Devices says some of those customers are seeing performance and cost advantages by using the MI300X compared to the H100. Despite being more than a year behind in terms of a launch date, the challenger delivered a very worthy product. It forecasts the MI300 series will propel its GPU revenue to a record $4.5 billion in 2024 — an estimate that has already been raised twice.

But Nvidia still has the edge. It started shipping its new H200 GPU earlier this year, which is capable of performing AI inference at nearly twice the speed of the H100. It meant Advanced Micro Devices was still a step behind. However, at the Advancing AI event, Lisa Su offered fresh details on her company’s new MI325X, which will deliver 80% more high-bandwidth memory than the H200 and 30% better inference performance.

That’s great news, but it isn’t expected to ship until the first quarter of 2025.

The race to catch up doesn’t stop there. Nvidia is now focused on its latest Blackwell chip architecture, which paves the way for the biggest leap in performance so far. The new GB200 NVL72 system is capable of performing AI inference at a whopping 30x the pace of the equivalent H100 system. Each individual GPU will be priced comparably to the H100 (when it was first launched), so Blackwell is going to deliver an incredible improvement in cost efficiency.

In other words, even though Advanced Micro Device’s MI325X might be a superior product to the H200, it’s going to be significantly behind Nvidia’s newest hardware.

Advanced Micro Device’s Blackwell competitor is right around the corner

Here’s where things get exciting. Lisa Su told the audience at Advancing AI that the company is preparing to ship another new GPU next year called the MI350X. It’s based on its new CDNA (compute DNA) 4 architecture, which offers a staggering leap in performance of 35x, compared to CDNA 3 chips like the original MI300X.

Advanced Micro Devices has explicitly said the MI350X will compete directly with Nvidia’s Blackwell chips.

Nvidia plans to ramp up shipments of Blackwell GPUs during its fiscal 2025 fourth quarter (which runs from November to January), whereas Su said Advanced Micro Devices will start shipping the MI350X in the second half of calendar 2025. That means after lagging behind Nvidia by more than a year with the MI300X, Advanced Micro Devices has an opportunity to reduce Nvidia’s lead to just months with the MI350X.

Advanced Micro Devices will report its latest financial results in a few weeks

The company could provide further updates on its new chips when it releases its financial results for the third quarter of 2024 (ended Sept. 30), which is expected to happen on or around Oct. 29.

During the second quarter, Advanced Micro Devices generated a record $2.8 billion in data center revenue, which was a 114% increase from the year-ago period. Another strong result could prompt management to lift its full-year GPU sales forecast beyond $4.5 billion. Given the company’s track record on that front, there’s a good chance it will happen.

Advanced Micro Devices stock currently trades at a very expensive price-to-earnings ratio (P/E) of 200.3 because it has generated modest earnings per share (EPS) of $0.82 over the past four quarters. For perspective, the Nasdaq-100 technology index currently trades at a P/E of 32.1.

However, Wall Street analysts estimate the company could deliver $5.43 in EPS during 2025, placing the stock at a more reasonable forward P/E of 30.6:

That means Advanced Micro Devices stock could be a great buy right now for investors who are willing to hold onto it for at least a couple of years — especially with the MI325X and MI350X rolling out in 2025.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Lisa Su Just Delivered Incredible News for Advanced Micro Devices Stock Investors was originally published by The Motley Fool

CryptoCurrency

FedEx founder says corporate data predicted the rise of Tesla and Nvidia—and can flag new trends

Long before Fred Smith was the billionaire founder of FedEx, he was a Vietnam veteran with a love of flying and a small fleet of planes for hire. “I would be flying these parts and pieces from Xerox in Rochester to Pittsburgh or wherever the case may be,” he told a gathering of 200 Goldman Sachs executives and entrepreneurs on Thursday. “And I would sort of sit in amazement there and say, ‘They’re hiring me and this whole damn airplane to carry this little part.’”

It didn’t take long for the likes of early tech giants Burroughs, Sperry, UNIVAC and IBM to hire him and his growing fleet to fly parts from the burgeoning Asian manufacturing market to the rest the world. “What I was actually seeing was the beginning of the automation of society,” he said.

It was the first time his logistics company found itself at the extreme forefront of tech trends that would change the world.

Speaking at Goldman’s annual Builders and Innovators Summit in Healdsburg, California, Smith explained how data from the logistics giant that now moves about $2 trillion worth of goods a year in every industry in nearly every country predicted the rise of Tesla and Nvidia and is now seeing into the future of geopolitical tensions and more.

“We just have this kaleidoscope of what’s going on in the economy,” he said. “And so we’re able to think we see trends.”

Smith founded FedEx in 1971 in Little Rock, Arkansas to solve business logistics problems. Since those days when he personally made delivery runs, Smith says the company’s greatest technological breakthrough was software that let it track goods in motion.

“We had gotten to the point where we were buying more PCs than any entity in the world,” said Smith. “And we were putting them in our customers’ offices so the shipping managers could track and trace and prepare the shipping labels.”

The company now operates more than 700 aircraft and more than 200,000 motorized vehicles, generating $87.7 billion revenue in fiscal year 2024, and $21.6 billion last quarter. But it’s the data provided by that software that lets FedEx track goods that provides the company with the trend-spotting super-power.

For example, Smith says the company is currently shipping Nvidia chips from Guadalajara up the west coast of the United States and pallets from John Deere to Europe. Last year, FedEx added a Danone S.A. executive focused on Mexico to its board of directors, and earlier this year expanded service between the U.S. and Europe, specifically to open up opportunities to China.

In fact, Smith highlighted China obstacles and opportunities as another example of a trend FedEx data reveals. “What has happened, more than anything else,” he said, “is supply chains have regionalized on a China Plus One basis.” China Plus One is an increasingly popular business strategy which dictates that investors looking to capitalize on China’s booming economy should also invest in another market.

For example, he says FedEx is seeing spikes in activity in Eastern Europe, particularly in Hungary and Poland. In southern Mexico, there are 1,000 properties that are either manufacturing plants under construction or fulfillment and distribution centers where there’s land in reserve—many of which are owned by Chinese entities.

Such interconnectedness that blurs the lines separating nations, complicates the whole idea of imposing sanctions on one nation or another. As a result, Smith is skeptical that the tariffs imposed on imports by both Biden and Trump before him will resolve the geopolitical tension. To support his skepticism, he cites research by the Financial Times that he says shows tariffs slow trade for everyone. Instead, he thinks properly recognizing the interconnectedness of global markets might lead to more measured solutions.

“Everybody looks at China as a monolithic entity,” he said. “There’s a business class in China that doesn’t want to be wiped out either, as China has become more protectionist. And if you go into a FedEx hub today, you’ll be amazed at the choreography of stuff going from every part in the world to every other part in the world.”

This story was originally featured on Fortune.com

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Business2 weeks ago

Business2 weeks agoWhen to tip and when not to tip

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

News1 month ago

the pick of new debut fiction

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

News2 weeks ago

News2 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

News2 weeks ago

News2 weeks agoNavigating the News Void: Opportunities for Revitalization

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

News4 weeks ago

News4 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Technology4 weeks ago

Technology4 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

TV2 weeks ago

TV2 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

Sport2 weeks ago

Sport2 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

MMA2 weeks ago

MMA2 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Sport2 weeks ago

Sport2 weeks agoWales fall to second loss of WXV against Italy

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

News2 weeks ago

News2 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

News2 weeks ago

News2 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists are grappling with their own reproducibility crisis

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

MMA2 weeks ago

MMA2 weeks agoPereira vs. Rountree preview show live stream

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Sport2 weeks ago

Sport2 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Business3 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

News1 month ago

News1 month agoYou’re a Hypocrite, And So Am I

-

Sport1 month ago

Sport1 month agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment1 month ago

Science & Environment1 month agoRethinking space and time could let us do away with dark matter

-

Science & Environment1 month ago

Science & Environment1 month agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Technology3 weeks ago

Technology3 weeks agoArtificial flavours released by cooking aim to improve lab-grown meat

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Technology3 weeks ago

Technology3 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

-

Money2 weeks ago

Money2 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Technology2 weeks ago

Technology2 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

MMA2 weeks ago

MMA2 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Money2 weeks ago

Money2 weeks agoWhy thousands of pensioners WON’T see State Pension rise by full £460 next year

-

Technology2 weeks ago

Technology2 weeks agoA very underrated horror movie sequel is streaming on Max

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

News3 weeks ago

News3 weeks agoHungry customer left gobsmacked as two blokes riding giant HORSES stroll into local chip shop

-

Technology3 weeks ago

Technology3 weeks agoUlefone Armor Pad 4 Ultra is now available, at a discount

-

News3 weeks ago

News3 weeks agoReach CEO Jim Mullen: If government advertises with us, we’ll employ more reporters

-

Politics3 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

News2 weeks ago

News2 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Technology2 weeks ago

Technology2 weeks agoHow to disable Google Assistant on your Pixel Watch 3

-

Technology2 weeks ago

Technology2 weeks agoThe best budget robot vacuums for 2024

-

News2 weeks ago

News2 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

Health & fitness1 month ago

Health & fitness1 month agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment1 month ago

Science & Environment1 month agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News1 month ago

The Project Censored Newsletter – May 2024

-

Technology3 weeks ago

Technology3 weeks agoQuantum computers may work better when they ignore causality

-

Technology3 weeks ago

Technology3 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

News1 month ago

News1 month agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Football1 month ago

Football1 month agoMike Williamson: Carlisle United appoint MK Dons boss as head coach

-

MMA3 weeks ago

MMA3 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Sport3 weeks ago

Sport3 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

News3 weeks ago

News3 weeks agoDisguised Sunderland GP poisoned man in will row, court hears

You must be logged in to post a comment Login