Money

Thousands of Vinted users issued warning ahead of October tax deadline – what you can do now

THOUSANDS of Vinted users have been warned of an upcoming tax deadline that could land them with a big bill if missed.

Those who make money selling items online must report their earnings to HMRC if they make a profit.

Firms like Vinted now have to pass on customer data to HMRC if a user sells 30 or more items a year, or earns over £1,700.

The new rules were brought in from the start of this year. Before that anyone making extra income still had to report their profits.

But now Vinted and other selling platforms and marketplaces share data directly with the taxman.

It is part of a wider tax crackdown to help ensure that those who boost their income via side hustles pay up what they owe.

Anyone online might have to pay tax if they earn £1,000 or more.

If the money a member makes on online marketplaces over a year is less than the amount they paid for the items they are selling, then there is no tax to pay.

But those trading for profit might need to pay tax.

It is worth noting that this isn’t a new tax.

Those who earn over £1,000 have always had to declare income and fill in a self-assessment tax return, but it gives the taxman greater visibility over what you earn.

Now Vinted is messaging users direclty to remind them they must report their income.

Sellers have just one week to go to see if they need to register to file a Self Assessment tax return if they haven’t done so before.

The tax return is used by the HMRC to collect income tax.

The deadline for new sellers to check if they need to submit a Self Assessment and register is October 5.

The deadline to submit the return – and pay any tax you owe – is January 31, 2025 online.

But there’s an earlier deadline of October 31 this year if you file via post.

Do I have to pay tax on my second-hand sales?

Around 18million people across the UK use Vinted to buy and sell clothes and other items online.

However, if you start earning more than a certain amount you may have to pay tax.

A Vinted spokesperson told The Sun: “If you sell an item for less than you bought it for, then there’s no tax to pay because you’ve made no profit from selling it.”

For example, if you bought a shirt for £30 and sold it for £29 – you’ve made no profit, so there is no tax to pay.

Even if you do make a profit, you still won’t have to pay any tax on it unless you sell that item for £6,000 or more.

How does Vinted work?

VINTED is an app where you can buy and sell second-hand clothes and accessories.

Sellers can list items on the app for free and there are no fees for selling items either.

Instead, buyers pay a buyer protection fee on every transaction, worth between 3% and 8% of the sale price before postage, plus 30p to 80p depending on the item’s value.

This fee contributes towards protecting buyers if they have a problem with their order.

Any money you earn as a seller goes into your Vinted Wallet, which you can then withdraw out to your bank account as cash.

Even then, members can use a Capital Gains tax-free allowance, which is £3,000 for all yearly profits.

Vinted added: “Generally, only business sellers trading for profit might need to pay tax and provide proof of their transactions.

“This includes sellers who buy items to resell at a higher price than they were purchased for.”

Submitting an HMRC seller form

If you have made 30 sales or £1,700 this year you will be contacted by Vinted and asked to submit the seller report form on the app.

This year, the company said it will only approach new sellers who registered in 2024.

If you do not hear from Vinted then you don’t need to do anything.

However, members who meet the criteria will be asked to add their National Insurance Number to a pre-filled form and check the details are correct before submitting it.

You don’t need to calculate or count anything yourself.

Some members may be asked to submit a Self-Assessment tax return if they earn over £6,000 in profit.

The process is separate to the HMRC reporting requirement, and members are responsible for handling this themselves.

You can check your tax status by visiting the taxpayer centre on the Vinted app or website.

How do you know if you have to submit a tax return?

Self-assessment is a system HMRC uses to collect income tax.

Tax is usually deducted automatically from wages, pensions and savings, but people and businesses with other incomes must report it in a tax return.

This applies to the following:

- Your income from self-employment was more than £1,000

- Earned more than £2,500 from renting out property

- You or your partner received high-income child benefits and either of you had an annual income of more than £50,000

- Received more than £2,500 in other untaxed income, for example from tips or commission

- Are limited company directors

- Are shareholders

- Are employees claiming expenses over £2,500

- Have an annual income over £100,000

Before you submit your tax return, you’ll need to have a unique taxpayer reference code (UTR) and activation code from the HMRC.

You get a UTR when you register for a Self Assessment return or set up a limited company.

It’s a 10-digit number and it might just be called a tax reference.

You’ll get your UTR by post 15 days after you register but this may take longer if you live overseas.

You can file a Self-Assessment tax return online via the GOV.UK website or by post.

If you file by post the deadline is October 31 2024.

However, if you file online you have up to January 31, 2025.

Check out our step-by-step guide on filling a tax return here.

Money

I built my three-bed dream home for £180k – how to do up a house on a budget

SAM Jackman would never have been able to afford to build her own home had she not inherited a derelict bungalow and plot.

Back in 2014, the 41-year-old was extremely lucky to have the run-down property in Calstock, Cornwall, where she grew up, gifted to her by her parents.

When Sam was given the plot of land by her father as an early inheritance, it had a run-down prefab bungalow on it, along with a dilapidated workshop space.

The former teacher and art museum worker, who now owns her own business, We Wear Boost, told The Sun: “My father was not keen on doing up a property himself, given the effort required, so wanted to pass it on.

“As I’m an only child, he gave me the opportunity to do it instead.

“As I didn’t have to purchase the plot, this saved me a major expense, meaning all money could be channelled into the self-build.”

Sam’s original plan had been to completely gut the bungalow and renovate it.

But, once she discovered there were asbestos issues and after speaking to some experts, she realised it would cost roughly the same to tear it down and build a new home from scratch.

It took Sam around 12 months to build her own home on a budget after planning permission was granted, costing around £180,000 in total.

She has now lived there for just under a decade along with her partner, David, and their son, Charlie, 14 – and she absolutely loves it.

Financing the project

But financing the project was no mean feat.

“Initially, I thought I’d just get a self-build mortgage,” she said. “But trying to get this over the line turned out to be really difficult.”

The couple also contemplated selling their home to release equity. At the time, Sam, her partner and son were living near Callington, just a few miles away from Calstock.

“I soon realised that I’d need to sell our home to help fund the build, because the mortgage kept falling through,” she said.

“I put it on the market expecting it to take a few months to sell, but we received a full asking price offer within two days – and were asked to move out within a week.”

As Sam needed the money from the house sale, she agreed.

“But I’d effectively made us homeless,” she said. “Then suddenly, the stars aligned, and we found out my aunt had a rental property nearby that we could move into.”

This allowed Sam to sell her home and release around £30,000 in equity. In addition, she then took out a bridging loan for around £100,000.

“The rate on this was quite expensive, but it was only temporary, so it was affordable in the short term,” she said.

“Fortunately, as the self-build took shape, getting finance became easier.

“Once the property had bathrooms and a kitchen it became possible to get a ‘normal’ residential mortgage with a much more competitive rate.”

Breaking down the costs

One of the biggest expenses for Sam’s project was site clearance.

“I reckon I paid out about £45,000 on the preparatory work,” she said.

“This included things such as asbestos surveys, which came in at around £6,000, and landscaping, which cost around £20,000. Then, once the actual build began, things felt as though they were progressing.”

Specialists had to be brought in for jobs such as the electrics and plumbing, too.

How Sam saved money on her build

But, Sam was very efficient when it came to buying fixtures and fittings, which massively brought down her costs.

And a key part of Sam’s success in keeping costs down throughout the build was budgeting very carefully.

She said: “I was very honest with myself about the amount I had to spend in total, and therefore very disciplined about only choosing fixtures and fittings that were affordable.

“I decided not to go for high-end, and instead, opted for things like a ‘ready-made’ Howdens kitchen and Karndean vinyl flooring, which is easy to install and really hard-wearing too.”

She also focused on making it energy-efficient from the get-go to save money on her bills once she started living there.

“We opted for an air source heat pump,” she explained.

“As the property didn’t have gas, I thought the pump was worth investing in.

“We got solar panels installed, too, which have helped us save on our electricity bills.”

Another of Sam’s clever money-saving ideas was to host ‘painting parties,’ where friends and neighbours came to help with the decorating.

“When you’ve got to paint a large three-bed property entirely from scratch, you realise it’s going to take ages,” she said. “But with everyone chipping in, the job got done far more quickly and cheaply.”

She also opted to just have three larger bedrooms rather than more smaller bedrooms, which was actually more cost-efficient.

Instead, she spent that money on things she really wanted.

“The house also has a beautiful fireplace, underfloor heating and huge windows to enjoy the far-reaching views,” she explained.

Having land around the property has meant Sam has had room to expand over time, too.

How to keep costs down on a self-build

Marc von Grundherr, director of property firm Denham and Reeves, said it’s important to prioritise spending money on more difficult tasks, while tackling easier tasks yourself to cut costs.

“Painting, clearing, even basic landscaping of the garden are all achievable tasks that can be accomplished with time and effort,” he said.

“The more important aspects of a home, such as gas, electric and plumbing are always best left to a professional.”

Meanwhile, Tarquin Purdue, CEO of HaMuch.com, said materials can make a huge difference to how much a build costs.

“Materials make a huge difference to cost, especially during a property renovation, and the professionals will always ensure they use the right materials based on the budget they are given – so why wouldn’t you do the same?

“Researching local suppliers, compare prices and look for deals, discounts and sales. It all adds up and it will give you a comprehensive view of what you can get from where and for the lowest price.

“If you are tight for cash, consider the next best alternative. Laminate flooring over hardwood, tiles flooring over marble, granite kitchen tops instead of quartz, composite decking over real wood or matte paint over expensive wallpaper.”

Inside the ‘saddest’ Grand Designs house

Savills’s listing reads: “The property represents a once-in-a-lifetime opportunity to take on and finish the specification and fit out of one of the UK’s most spectacularly situated coastal homes.

“The bespoke design has been brought to life through impressive engineering, with the building being anchored to the bedrock, blending whitewashed elevations with steel and glass, culminating with a lighthouse feature at one end giving almost 360-degree views of the coastline.

“The position combines privacy with a diverse range of breath-taking views, all set in around 3 acres, which includes a large area of foreshore, a private tidal beach area and coves.”

The property is set in three acres of land and is equipped with an infinity pool and a hot tub as well as a spacious driveway.

Nic Chbat, director of Match Property estate agents in North Devon, who previously assisted with finding a buyer last year said at the time the sale stalled after the timeframe for the sale “expired”.

He added the previous buyer was “still wanting to buy the property,” and the sale was still expected to proceed.

The new listing though would suggest the purchase was never made with the sale now being handled by London-based estate agents Savills.

A spokeswoman for both Savills and the receivers Bellevue Mortlakes said: “The sale represents a once-in-a-lifetime opportunity to purchase one of the UK’s most spectacularly situated coastal homes and for the buyer to put the finishing touches to the property’s interior to their own specification.

“The current sale price (offers in excess of £5.25m) represents fair value noting the prevailing economic and heterogeneous nature of this opportunity.

“The property has panoramic sea views and is set in grounds of over three acres, including foreshore and a tidal beach, with accommodation extending to over 6,260 sq ft.

“The detached guest lodge/holiday let accommodation extends to about 1,270 sq ft and is included in the sale price.

“Subject to registration with the agents, the receiver has provided an extensive suite of information and supporting documentation relating to the building’s history, construction and title, which are available via an online data room.”

Money

First-time buyer schemes that could give you up to 50% discount on your ideal home – check if you’re eligible

THOUSANDS of Brits across the UK are eligible to receive up to 50% off their first home – but may not even realise it.

With house prices steadily rising again, it’s more important than ever that first time buyers take advantage of whatever support is available to help them get on the housing ladder.

Yet, thousands of young people could be missing out because they simply don’t realise they’re eligible.

Fiona Peake, personal finance and consumer expert at Ocean Finance, said: “Many UK residents may not realise they’re eligible for first-time buyer schemes, which can be a real game-changer for getting on the property ladder.

“Based on our [recent] survey, an estimated 50% of first-time buyers could be missing out on these government initiatives, simply because they’re unaware of them or assume they wouldn’t qualify.”

There are a number of schemes that give people a discount on their first home.

But one particular scheme, the First Homes Scheme, allows first-time buyers to pick up a new-build home built by a developer for a whopping 30% to 50% off the asking price.

The scheme, which launched back in June 2021, also allows a buyer to purchase a home through an estate agent, provided that the home was previously acquired through the scheme.

But who is eligible and how do they apply?

Who is eligible for the First Homes Scheme?

The First Homes scheme is eligible for first-time buyers across England who meet certain criteria.

In order to qualify, a buyer must be able to get a mortgage for at least half the price of the home.

The new home also needs to cost less than £250,000 after the discount has been applied, or £420,000 in London.

And the collective household income of the buyer, or buyers, purchasing the home must not exceed £80,000 a year before tax, or £90,000 if they are buying in London.

In some cases, local councils may prioritise giving First Homes discounts to key workers, people who already live in the purchase area, or those on lower incomes.

For those in the armed forces and their relatives, exemptions do apply.

How do you apply?

In order to access the scheme, typically a first-time buyer will need to contact a new-build developer and tell them they would like to buy through the housing scheme.

If you’re purchasing from a previous First Homes buyer, you will need to contact their estate agent and say you intend to buy through the scheme.

Once you have been confirmed as having passed the eligibility criteria, they will help you complete your application.

In some cases, you may need to pay a reservation fee if the property is a new build. Don’t worry though, you will get the fee back if your application isn’t successful.

Developers may also offer you incentives such as free goods or cash back, but these are unlikely to be worth more than 5% of the discounted purchase price.

How does the First Homes scheme work?

The First Homes scheme is designed to assist first-time buyers onto the housing ladder in an increasingly difficult market.

The average house price in the UK is £287,924, according to the latest data from Land Registry.

This means that through the First Homes scheme, a buyer could expect to save between £86,377 and £143,962 on their first home.

However, there are some pros and cons to consider before buying through the scheme:

Pros

- You don’t need such a big deposit

- You can take out a smaller mortgage, meaning smaller monthly repayments

Cons

- When you sell the home, you must pass the discount onto the buyer

- You can typically only sell to someone else who is eligible for the scheme

- You can only find eligible properties by checking with local developers

Must knows about the First Homes scheme

Here is a list of what you must know about the First Homes scheme

Discount

The scheme offers a minimum discount of 30% off the market value, but local areas can set a discount of up to 50%.

Price cap

The first sale of a home bought through the scheme must be at a price no higher than £250,000, or £420,000 in London.

Eligibility

The scheme is restricted to first-time buyers with a household income of no more than £80,000, or £90,000 in London. They must also use a mortgage for at least 50% of the purchase price.

Selling

To sell a First Homes property, the seller must try to find another first-time buyer who is using the scheme. The seller must also apply the same percentage discount to the new valuation as they received when they bought their home.

Local authority involvement

When selling a First Homes property, the seller must notify the local authority who will provide instructions on marketing and eligibility requirements.

What other schemes are available?

The mortgage guarantee scheme

The mortgage guarantee scheme has encouraged more banks and building societies to offer 95% loan-to-value (LTV) mortgages, meaning you only need a 5% deposit.

This scheme is available for both first-time buyers and second steppers across the UK. One caveat is the property must not cost more than £600,000 and it must be your only home.

We recently revealed how this scheme is very under-utilised, accounting for just 3.8% of transactions for 18-30-year-olds between 2021 and 2023.

The Shared Ownership scheme

Shared ownership is designed to help people on low incomes in England through purchasing part of the property and renting the rest.

You can start with as little as 10% and increase the part you own when you can afford to, which is known as ‘staircasing’.

The other benefit here is that you only pay a deposit on the share of the property you are buying.

To be eligible for the scheme you must have a total household income of less than £80,000 a year, rising to £90,000 in London.

The Lifetime ISA

The Lifetime ISA is there to help first-time buyers save for a deposit by topping up their savings by 25%, or to aid in retirement.

As part of the terms, an account holder can save up to £4,000 a year, which the government will add a 25% bonus to.

In more good news, any interest an account holder incurs is tax free.

In order to be eligible to receive the bonus, you must use the money to buy your first house up to a maximum £450,000 purchase price, or to aid your retirement.

Interested parties can only open the account between 18 and 39, but you can keep paying into it until 50.

Help to Build: Equity loan

The Help to Build: Equity loan scheme is a government initiative for those who wish to build their own home or convert a commercial property into one.

This option is for both first-time buyers and those looking for their second home.

The Government will top up a buyer’s deposit with a loan that is interest free for five years.

The equity loan amount of the total estimated cost can vary however, ranging from 5% to 20%, and rising to 40% in London.

To access the initiative, you must apply for a self-build mortgage from an approved lender first, and then apply for a Help to Build loan.

As you progress through the build you will receive parts of the mortgage to cover the costs, and the build must be complete within three years.

Expert view on low take-up of schemes

By Pete Mugleston, managing director and mortgage expert at Online Mortgage Advisor

It’s concerning to see how many first-time buyers in the UK are either unaware of, or unable to access government schemes specifically designed to support them.

Schemes like Help to Buy, Shared Ownership, and the First Homes initiative were introduced to address the challenges young people face in getting on the property ladder, especially with rising house prices and the cost-of-living squeezing affordability even further.

As Help to Buy ended in 2023, many first-time buyers are left feeling stranded, with fewer options to bridge the gap between their deposit and what lenders will offer. It’s a missed opportunity for those who could have benefited.

The Lifetime ISA remains a solid tool for saving towards a deposit, but it requires early planning, something not everyone is prepared for.

Money

Major supermarket makes change to 53 stores ahead of nationwide expansion next month

A MAJOR supermarket is set to make a change to 53 of its stores ahead of a nationwide expansion next month.

Iceland has partnered with the food delivery service Deliveroo as part of the latest expansion of its rapid delivery offer.

And the frozen food retailer is now offering the service at 53 of its UK stores.

Under the plan, the supermarket chain will expand to its 800 Iceland and Food Warehouse stores by the end of October.

More than 3,000 Iceland products are understood to be available to buy through Deliveroo.

You can nab Iceland’s full range of essentials, frozen and fresh groceries from the click of a button.

Iceland says shoppers will be able to receive their orders within 25 minutes under the new partnership.

Products from the retailer’s brand connections such as Greggs and Myprotein are also available to order.

Amazon Prime customers in Manchester and London can also have Iceland food delivered through its third-party deal with Amazon.

Iceland and Food Warehouses already offer deliveries through Just Eat and Uber Eats and also offer a next day and same day delivery service itself.

Justin Addison, Iceland Foods international and partnerships director said: “We’re dedicated to making sure our customers can enjoy our innovative, value-driven range of products, no matter where they are.

“This past year has been a real moment of growth for Iceland and The Food Warehouse, and we’re thrilled to add Deliveroo to our list of partners.

“More customers across the UK will now be able to easily access their favourite Iceland products from the comfort of their own homes.”

Suzy McClintock, Deliveroo VP of new verticals added: “We’re delighted to announce our partnership with Iceland, bringing thousands of fantastic products to customers across the UK in as little as 25 minutes.

“As demand for convenient grocery delivery grows, this partnership means even more households can access their Iceland favourites quickly and easily via our app, including thousands of great value products.”

It comes as Iceland revealed its Christmas 2024 range and it includes a pigs in blankets Yorkshire pudding.

The big day is still a while away, but it’s always good to plan ahead for the merry season.

Luckily, Iceland has unveiled its Christmas menu which will be available in stores and online from November 12.

The items will also be available to buy at Iceland’s The Food Warehouse.

Iceland‘s menu this year offers customers everything they’ll need for Christmas lunch or dinner, but there are some quirky items included as well in case you’re after something a bit different.

Shoppers will be able to feast on mini fish, chip and ketchup sarnies, prawn tacos and an unbelievable XXL pigs in blankets Yorkshire pudding.

The supermarket is also launching battered lobster tails, mini garlic and herb kievs and even some exclusive brand items like Harry Ramsden’s battered mini sausages.

Also returning are familiar favourites such as the turkey crown, mince pies, Christmas pudding and of course all the trimmings like roast potatoes and veg.

Those who want to feast on the exclusive brand’s range like Galaxy, TGI Fridays and Harry Ramsden’s can do so with the mix-and-match deals like three items for £10.

Iceland’s head of development David Lennox said: “We’ve focused on perfecting the classics and making them the best and most delicious yet, as well as offering our customers a range of innovative and affordable new Christmas products which are sure to delight everyone at the dinner table.

“Iceland has some extra special products on offer this festive season.”

How to save money on your food shop

Consumer reporter Sam Walker reveals how you can save hundreds of pounds a year:

Odd boxes – plenty of retailers offer slightly misshapen fruit and veg or surplus food at a discounted price.

Lidl sells five kilos of fruit and veg for just £1.50 through its Waste Not scheme while Aldi shoppers can get Too Good to Go bags which contain £10 worth of all kinds of products for £3.30.

Sainsbury’s also sells £2 “Taste Me, Don’t Waste Me” fruit and veg boxes to help shoppers reduced food waste and save cash.

Food waste apps – food waste apps work by helping shops, cafes, restaurants and other businesses shift stock that is due to go out of date and passing it on to members of the public.

Some of the most notable ones include Too Good to Go and Olio.

Too Good to Go’s app is free to sign up to and is used by millions of people across the UK, letting users buy food at a discount.

Olio works similarly, except users can collect both food and other household items for free from neighbours and businesses.

Yellow sticker bargains – yellow sticker bargains, sometimes orange and red in certain supermarkets, are a great way of getting food on the cheap.

But what time to head out to get the best deals varies depending on the retailer. You can see the best times for each supermarket here.

Super cheap bargains – sign up to bargain hunter Facebook groups like Extreme Couponing and Bargains UK where shoppers regularly post hauls they’ve found on the cheap, including food finds.

“Downshift” – you will almost always save money going for a supermarket’s own-brand economy lines rather than premium brands.

The move to lower-tier ranges, also known as “downshifting” and hailed by consumer expert Martin Lewis, could save you hundreds of pounds a year on your food shop.

Money

Four ways over-60s can save on travel, cinema, food and shopping this winter

WITH nearly ten million pensioners losing out on the winter fuel allowance, every penny counts right now.

But there are ways over-60s can save on travel, the cinema, food and other shopping. Here are a few ideas . . .

RIDE THE RAILS: Make sure you have a Senior Railcard. It costs £30 a year or £70 for three years and offers a third off tickets.

There are occasionally offers that bring down the cost of the railcard.

Or a National Express Senior Coach Card is £15 per year, for a third off tickets.

SILVER SCREEN: Love films? You’ll love them even more with cinema offers.

The Odeon holds a day-time screening for the over-60s, with Silver tickets costing £3.50 if you buy online as a myODEON member. Price includes tea, coffee and biscuits before the film.

The price rises to £5 for non-members who don’t pre-book.

Check if other cinema chains, and independents, offer similar.

FOOD FOR THOUGHT: With the price of groceries soaring in recent years, any savings are welcome.

Iceland and The Food Warehouse offer ten per cent off for over-60s with a Bonus Card every Tuesday.

You just need to show proof of age. You can also save ten per cent in Asda cafes on Wednesdays.

SHOPPING PERKS: Other high street stores also offer deals to shoppers aged 60 and over.

The Original Factory Shop has a ten-per-cent discount for cust-omers on the first Wednesday of every month, which falls next week.

To claim, you need to be a member of the TOFS club and show age ID at the till.

If you have a Boots Advantage Card, sign up for the Over 60s Rewards to get eight points for every £1 you spend on the chemist chain’s own-brand products, as well as other exclusive offers.

At Specsavers, you can get 20 per cent off when you buy glasses from the store’s £70-plus range.

- All prices correct at time of going to press. Deals and offers subject to availability.

Deal of the day

CHECK out the Lego deals at Asda including this red double-decker sightseeing bus set, now reduced from £25 to £15.

SAVE: £10

Cheap treat

FILL your cup with Costa Gingerbread Latte, down from £2.30 to £1.75 for a pack of six sachets for Tesco Clubcard holders.

SAVE: 55p

What’s new

SEARCH the Too Good To Go app to buy a Surprise Bag of cut-price food.

Then keep the bag and register at contest.tgtg.to/ win-groceries before midnight on Monday for the chance to win a year’s worth of Aldi groceries.

Top swap

KEEP your gems in the Hexagon Glass Brass Jewellery Box, above, £18 from Accessorize, or lift the lid on the Hexagonal Jewellery Box, below, from Primark, £7.

SAVE: £11

Little helper

MENTAL health app Calm has a new back-to-school collection for students, and they can now sign up to the app for £23.99 a year instead of the usual £39.99, saving £16. See cal.mn/backtoschool

Shop & save

FOR a meaty deal, Aldi has cut the price of a British Pork Crackling Leg Joint, 1.5kg, from £7.94 to £5.24.

SAVE: £2.70

Hot right now

SEND a personalised gift from Moonpig with up to 16.5-per-cent cashback for Topcashback members until October 7.

PLAY NOW TO WIN £200

JOIN thousands of readers taking part in The Sun Raffle.

Every month we’re giving away £100 to 250 lucky readers – whether you’re saving up or just in need of some extra cash, The Sun could have you covered.

Every Sun Savers code entered equals one Raffle ticket.

The more codes you enter, the more tickets you’ll earn and the more chance you will have of winning!

Money

Lidl brings back sell-out winter gadget for drying clothes without putting the heating on

LIDL has brought back its sell-out winter gadget which dries clothes without you having to put the heating on.

The supermarket says the appliance can dry your clothes out using “less energy” than a tumble dryer and “quicker” than a conventional indoor airer.

Lidl has listed the Addis Heated Wing Clothes Airer on its website and claims it will cost just pennies to run per hour.

It comes as many homes across the UK are bracing themselves for another winter of misery, with energy bills set to rise by £149 annually.

Typically, heated airers are cheaper to run than tumble dryers and don’t require you to turn on your expensive heating.

A tumble dryer using a 2.5kWh per cycle would cost you 68p per cycle, according to uSwitch.

However, the cost of running a heated air dryer is estimated to be 6p per hour for 200W dryers and 9p per hour for 300W dryers, according to the Telegraph.

This is based on the energy price cap of 22p per kWh since July 1 2024, although prices will vary according to your tariff.

The Addis heated airer claims to cost around 7p an hour to run and can hold up to 10kg of laundry.

It’s made of “lightweight” aluminium and is “durable and easy to manoeuvre” according to Lidl’s website.

The gadget has fold-out wings that help create a total drying space of 12m.

Lidl’s website added that it is “quick and easy to assemble” and that it can also be folded down when not in use for “easy storage.”

The product also comes with a three year warranty.

It’s currently listed on the supermarket’s website for £34.99.

The folded out dimensions of the product make it 55cm wide and 146cm deep.

Its height can vary between 72 and 91cm tall.

Supermarket rival Aldi also launched the return of its own sell-out heated airer this month which costs just 6p to run per hour.

Costing the exact same as Lidl’s offering, Aldi’s boasts an even larger 18m of drying space and 230W of power.

It also comes with a three year warranty and can carry up to 10kg of laundry.

Money

Major clothing store with over 400 shops nationwide confirms closing down sale as it announces its shutting loved branch

A MAJOR clothing store with over 400 shops nationwide has confirmed it will shut down one of its much loved branches.

The store in Consett, County Durham is set to close its doors for the final time next month, prompting concern from residents of the town.

Peacocks has announced a closure date of October 19 for its store in the town.

Notices of the closure have been plastered all over the shop front.

In light of the closure announcement, the store is offering a 30% discount on all goods in a possible bid to clear stock before the final day.

For those who still want to shop at Peacocks after the closure, their nearest outlet can be found in Bishop Auckland.

Read More on Shop Closures

The news of the shutdown has drawn a collection of dismal responses from local residents, who took to social media to share their unhappiness at the store’s closure.

One member of the Facebook group ‘The Consett Chatterbox’ stated: “Absolutely gutted loved Peacock’s especially with Christmas coming up.

“They always had lovely stock in, ridiculous that Consett’s losing yet another good shop.”

Another local questioned the decision saying: “Absolutely crazy it’s been there forever, love Peacocks, why can’t they just move somewhere else in Consett?

“There’s plenty of empty shops?”

Another member of the group said: “Nothing going to be left. Our high street now is so very run down.”

In agreeing with the sentiment, one member of the group said: “Unfortunately another retailer going.

“‘Use it or Lose it’ springs to mind.”

High streets across the UK have suffered from decline over the past decade.

Since 2018, 6,000 retail outlets have brought down the shutters, according to the British Retail Consortium.

The trade association’s chief executive Helen Dickinson OBE blamed the closures on “crippling” business rates and the impact of coronavirus lockdowns.

This closure, thankfully, is an isolated one for Peacocks and is not part of a trend for the chain nationwide.

In fact in March, the parent company of Bonmarché, Edinburgh Woollen Mill (EWM) and Peacocks was looking to open 100 new UK stores.

The new store openings are expected to create over 500 jobs.

It came just three years after the investment consortium, Purepay Retail Limited, bought all three brands out of administration.

Why are retailers closing stores?

RETAILERS have been feeling the squeeze since the pandemic, while shoppers are cutting back on spending due to the soaring cost of living crisis.

High energy costs and a move to shopping online after the pandemic are also taking a toll, and many high street shops have struggled to keep going.

The high street has seen a whole raft of closures over the past year, and more are coming.

The number of jobs lost in British retail dropped last year, but 120,000 people still lost their employment, figures have suggested.

Figures from the Centre for Retail Research revealed that 10,494 shops closed for the last time during 2023, and 119,405 jobs were lost in the sector.

It was fewer shops than had been lost for several years, and a reduction from 151,641 jobs lost in 2022.

The centre’s director, Professor Joshua Bamfield, said the improvement is “less bad” than good.

Although there were some big-name losses from the high street, including Wilko, many large companies had already gone bust before 2022, the centre said, such as Topshop owner Arcadia, Jessops and Debenhams.

“The cost-of-living crisis, inflation and increases in interest rates have led many consumers to tighten their belts, reducing retail spend,” Prof Bamfield said.

“Retailers themselves have suffered increasing energy and occupancy costs, staff shortages and falling demand that have made rebuilding profits after extensive store closures during the pandemic exceptionally difficult.”

Alongside Wilko, which employed around 12,000 people when it collapsed, 2023’s biggest failures included Paperchase, Cath Kidston, Planet Organic and Tile Giant.

The Centre for Retail Research said most stores were closed because companies were trying to reorganise and cut costs rather than the business failing.

However, experts have warned there will likely be more failures this year as consumers keep their belts tight and borrowing costs soar for businesses.

The Body Shop and Ted Baker are the biggest names to have already collapsed into administration this year.

-

Womens Workouts4 days ago

Womens Workouts4 days ago3 Day Full Body Women’s Dumbbell Only Workout

-

News6 days ago

News6 days agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Technology1 week ago

Technology1 week agoWould-be reality TV contestants ‘not looking real’

-

News1 week ago

News1 week agoYou’re a Hypocrite, And So Am I

-

Science & Environment1 week ago

Science & Environment1 week agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 week ago

Science & Environment1 week ago‘Running of the bulls’ festival crowds move like charged particles

-

Sport1 week ago

Sport1 week agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment1 week ago

Science & Environment1 week agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment1 week ago

Science & Environment1 week agoHow to wrap your mind around the real multiverse

-

Science & Environment1 week ago

Science & Environment1 week agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 week ago

Science & Environment1 week agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 week ago

Science & Environment1 week agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 week ago

Science & Environment1 week agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment1 week ago

Science & Environment1 week agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 week ago

Science & Environment1 week agoQuantum ‘supersolid’ matter stirred using magnets

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCardano founder to meet Argentina president Javier Milei

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment1 week ago

Science & Environment1 week agoWhy this is a golden age for life to thrive across the universe

-

News1 week ago

News1 week agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Womens Workouts1 week ago

Womens Workouts1 week agoBest Exercises if You Want to Build a Great Physique

-

Science & Environment1 week ago

Science & Environment1 week agoQuantum forces used to automatically assemble tiny device

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Womens Workouts1 week ago

Womens Workouts1 week agoEverything a Beginner Needs to Know About Squatting

-

Science & Environment6 days ago

Science & Environment6 days agoMeet the world's first female male model | 7.30

-

Science & Environment1 week ago

Science & Environment1 week agoNuclear fusion experiment overcomes two key operating hurdles

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBlockdaemon mulls 2026 IPO: Report

-

News1 week ago

News1 week agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

News6 days ago

News6 days agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts4 days ago

Womens Workouts4 days ago3 Day Full Body Toning Workout for Women

-

Science & Environment1 week ago

Science & Environment1 week agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 week ago

Science & Environment1 week agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

News1 week ago

News1 week ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment1 week ago

Science & Environment1 week agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 week ago

Science & Environment1 week agoQuantum time travel: The experiment to ‘send a particle into the past’

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoSEC asks court for four months to produce documents for Coinbase

-

Sport1 week ago

Sport1 week agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Business1 week ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Technology1 week ago

Technology1 week agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News1 week ago

News1 week agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts1 week ago

Womens Workouts1 week agoKeep Your Goals on Track This Season

-

Travel4 days ago

Travel4 days agoDelta signs codeshare agreement with SAS

-

Science & Environment1 week ago

Science & Environment1 week agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Science & Environment1 week ago

Science & Environment1 week agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

News1 week ago

News1 week agoChurch same-sex split affecting bishop appointments

-

Science & Environment1 week ago

Science & Environment1 week agoTiny magnet could help measure gravity on the quantum scale

-

Technology1 week ago

Technology1 week agoFivetran targets data security by adding Hybrid Deployment

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

Business1 week ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics1 week ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

Womens Workouts1 week ago

Womens Workouts1 week agoHow Heat Affects Your Body During Exercise

-

News6 days ago

News6 days agoWhy Is Everyone Excited About These Smart Insoles?

-

Politics1 week ago

Politics1 week agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology1 week ago

Technology1 week agoCan technology fix the ‘broken’ concert ticketing system?

-

Health & fitness1 week ago

Health & fitness1 week agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment1 week ago

Science & Environment1 week agoBeing in two places at once could make a quantum battery charge faster

-

Science & Environment1 week ago

Science & Environment1 week agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 week ago

Science & Environment1 week agoHow one theory ties together everything we know about the universe

-

Science & Environment1 week ago

Science & Environment1 week agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

News1 week ago

News1 week agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

Womens Workouts1 week ago

Womens Workouts1 week agoWhich Squat Load Position is Right For You?

-

News7 days ago

News7 days agoBangladesh Holds the World Accountable to Secure Climate Justice

-

Health & fitness1 week ago

Health & fitness1 week agoThe maps that could hold the secret to curing cancer

-

Science & Environment1 week ago

Science & Environment1 week agoSingle atoms captured morphing into quantum waves in startling image

-

Science & Environment1 week ago

Science & Environment1 week agoHow Peter Higgs revealed the forces that hold the universe together

-

Science & Environment1 week ago

Science & Environment1 week agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoHelp! My parents are addicted to Pi Network crypto tapper

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

-

Fashion Models1 week ago

Fashion Models1 week agoMixte

-

Politics1 week ago

Politics1 week agoLabour MP urges UK government to nationalise Grangemouth refinery

-

Money1 week ago

Money1 week agoBritain’s ultra-wealthy exit ahead of proposed non-dom tax changes

-

Womens Workouts1 week ago

Womens Workouts1 week agoWhere is the Science Today?

-

Womens Workouts1 week ago

Womens Workouts1 week agoSwimming into Your Fitness Routine

-

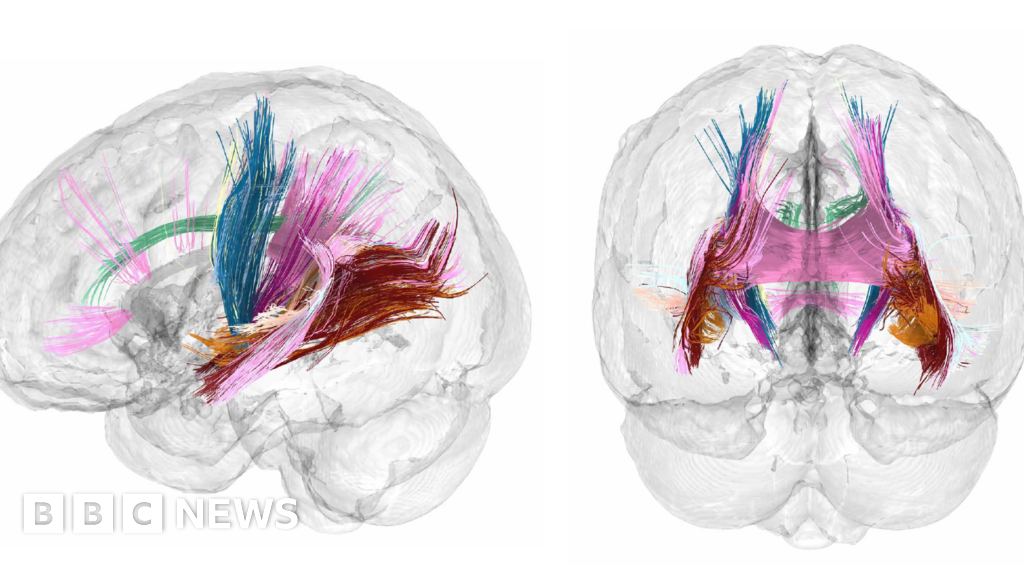

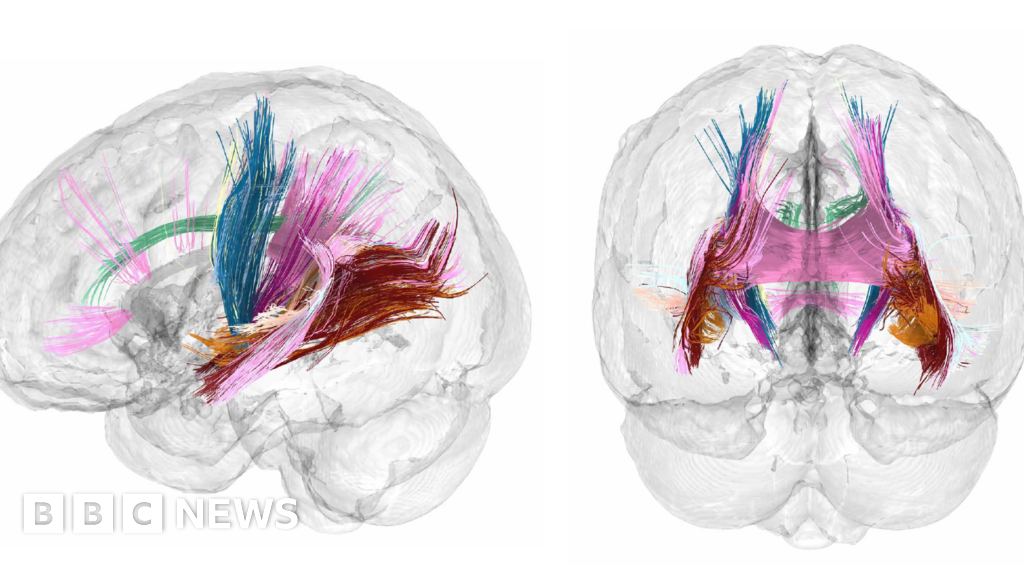

News2 weeks ago

News2 weeks agoBrain changes during pregnancy revealed in detailed map

-

Science & Environment1 week ago

Science & Environment1 week agoA slight curve helps rocks make the biggest splash

-

News1 week ago

News1 week agoRoad rage suspects in custody after gunshots, drivers ramming vehicles near Boise

-

Science & Environment1 week ago

Science & Environment1 week agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

News2 weeks ago

News2 weeks agoToolkit to help journalists overcome ‘unspoken power dynamic’ in sensitive interviews

You must be logged in to post a comment Login