Money

Three tips cheap and fun tips for hosting an autumn games night

MAKE the most of the longer autumn evenings by hosting a games night.

It’s a great fun activity for friends or all the family and gets the grey matter and competitive juices going.

Plus, you can keep the evening cheap and cheerful with these tips.

GAME ON: Trying to explain complicated rules can quickly suck the fun out of an evening so stick to simple and easy to understand options.

Cards Against Humanity is a great group game, but if you’ve played that one too many times, try something new.

Herd Mentality is great fun. All players have to try to write down the same answer as others in the group — get it for £13.16 at onbuy.com.

READ MORE MONEY SAVING TIPS

Or Exploding Kittens, £18 from Argos, is a strategic game of Russian Roulette that is easy to learn.

And why not give an old-fashioned family game a new spin?

Download Charades! For Kids — the basic version is free — and a word will pop up on your phone screen through the app.

Each player holds the phone to their head so the others can see the word but they can’t and tries to guess it within a minute, based on clues from everyone else. The time limit can be changed

QUIZ-TASTIC: Putting together a quiz is a fab way to get the competitive spirit going in a group and you don’t need to buy any sets to get started.

Give each person coming a theme — say sport, or TV — and ask them to create five or ten questions on it, then everyone takes a turn as quizmaster for their round.

FOOD AND DRINK: To avoid being stuck in the kitchen all evening, ask your pals to bring a dish each to share, plus a drink.

Or throw a few pizzas in the oven for an easy catering option.

You can take turns to host among the group — this also gives everyone a chance to challenge any victors to a rematch.

- All prices on page correct at time of going to press. Deals and offers subject to availability.

Deal of the day

WHIP up the ultimate comforting dish with this Daewoo soup maker down from £79.99 to £39.99 at Robert Dyas.

SAVE: £40

Cheap treat

SERVE snacks with flair using this retro design side plate, £2.50, from Primark.

What’s new?

BREW a cuppa and enjoy a couple of these limited edition McVitie’s golden caramel flavour digestives, £1.50, from Asda.

Top swap

UPGRADE your style credentials with this green velvet blazer, £170, from Boden.

Or pick up a £28 version, below, at Tu from Sainsbury’s.

SAVE: £142

Little helper

LIGHT up your outdoor areas with 20 per cent off selected styles at Homebase. This wall light is down from £45 to £36 as part of the promotion.

Shop & save

BAG half-price newly published books at WH Smith. The offer makes Julia Donaldson’s Jonty Gentoo £6.49 instead of £12.99.

SAVE: £6.50

PLAY NOW TO WIN £200

JOIN thousands of readers taking part in The Sun Raffle.

Every month we’re giving away £100 to 250 lucky readers – whether you’re saving up or just in need of some extra cash, The Sun could have you covered.

Every Sun Savers code entered equals one Raffle ticket.

The more codes you enter, the more tickets you’ll earn and the more chance you will have of winning!

Money

The Sun launches interactive tool to check benefits – see if you get winter fuel payments or pension credit this winter

TODAY, The Sun launches a free tool to help you check whether you will get the Winter Fuel Payment this year.

The free benefits checker is in partnership with poverty charity Turn2Us. It quickly tells you if you’re missing out on any cash.

If you are unable to access the internet you could ask a friend or relative to help you do the check.

We were flooded with calls and emails earlier this week, with many readers asking whether they were entitled to pension credit or other benefits.

In her July statement, Chancellor Rachel Reeves announced that this winter only households in England and Wales that receive Pension Credit or certain means tested benefits will be entitled to the Winter Fuel payment.

Previously it was available to everyone aged over 66.

New government figures estimate that 770,000 pensioners are at risk of missing out this winter.

The benefit, which is worth up to £300, unlocks a host of other awards including a free TV licence and cheaper water bills worth up to £3,900.

Michael Clarke, from Turn2us: “It’s crucial that people are supported by friends and family to check they are getting all the support available to them.

“In just 10 minutes, the Turn2us Benefits Calculator will tell people if they are eligible.”

You will need some personal information to hand about your current income, including state and private pensions, and any benefits you currently receive.

If you are eligible to apply for Pension Credit you can call the DWP helpline on: 0800 99 1234

When you claim you will need your national insurance number and details of any savings and investments, plus information on housing costs such as mortgage interest, service charges or ground rent.

You must lodge a claim by December 21 to get the Winter Fuel Payment this year.

FIX YOUR ENERGY BILLS?

If you’re not on a fixed tariff then it may be worth considering one. Many of the top fixed tariffs are now cheaper than the price cap and could save you money. You can compare tariffs using uSwitch.com or Moneysavingexpert.com.

WARM HOME DISCOUNT

The Warm Home Discount is £150 one-off payment towards electricity bills. You will usually get it automatically – but you need to apply if you’re on a low income in Scotland.

You should check with your energy supplier if you’re on a low income and think you are eligible.

HOUSEHOLD SUPPORT FUND

You can apply to your local council for help if you’re on a low income. Search the name of your local council and ‘household support fund’ to find out details on how you can apply. Eligibility criteria and the amount you will get varies based on where you live – but some households have got up to £500.

ENERGY GRANTS

Many of the UK’s biggest energy suppliers have grants in place to help struggling customers. For example, British Gas offers grants of up to £2,000. .

Ask your supplier if there is anything they can offer

FREE INSULATION OR BOILERS

You may be able to get free or cheap insulation to help reduce your home’s energy bills. Check here: https://www.gov.uk/apply-great-british-insulation-scheme

GET FREE DEBT HELP

THERE are several groups which can help you with your problem debts for free.

- Citizens Advice – 0800 144 8848 (England) / 0800 702 2020 (Wales)

- StepChange – 0800138 1111

- National Debtline – 0808 808 4000

- Debt Advice Foundation – 0800 043 4050

Money

Martin Lewis issues warning to anyone aged under 22 – do you have £2,000 in a forgotten account?

MARTIN Lewis has issued a warning to anyone under 22 who could have £2,000 sitting in a forgotten account.

Child Trust Funds are long-term, tax-free savings accounts which were set up for every child born between September 2002 and January 2 2011.

The Money Saving Expert said on X that those aged 22 and under could have the Child Trust Fund set up and access it for free.

But he also warned that some firms are attempting to charge individuals to “get your own money” – but Lewis says “don’t pay.”

The Government deposited £250 for every child during that time period, or £500 if they came from a low income family earning around £16,000 a year or below.

An extra £250 or £500, depending on their families’ economic status, was deposited when the child turned seven.

read more on martin lewis

In 2010, this was reduced to £50 for better off households and £100 for those on a lower income.

The scheme was eventually scrapped in 2011 as part of cost-cutting measures following the 2009 financial crisis and was later replaced with Junior ISAs.

Currently, parents or friends can deposit up to £9,000 into the child’s account tax-free, with the money usually invested into shares.

The youngest children across Britian to have these accounts are about 13 years old, so have around five years before they can access the cash.

It is important to note that savings in these accounts are not held by the Government but are held in banks, building societies or other saving providers.

The money stays in the account until it’s withdrawn or re-invested.

Young people can take control of their Child Trust Fund at 16, but can only withdraw funds when they turn 18 and the account matures.

However, new figures released by the HMRC have found that more than 670,000 18-22 year olds are yet to claim their Child Trust Fund.

The tax office said that the average savings pot is worth £2,212.

Angela MacDonald, HMRC’s second permanent secretary and deputy chief executive, said the government wants to “reunite young people with their money and we’re making the process as simple as possible.”

She added: “You don’t need to pay anyone to find your Child Trust Fund for you, locate yours today by searching ‘find your Child Trust Fund’ on GOV.UK.”

How to track down a Child Trust Fund

If you were born in the UK between 2002 and 2006 it is worth checking to see if you have cash in a Child Trust Fund.

Parents were either given a voucher to set one up or HMRC set one up on a child’s behalf.

There are a number of third party groups offering to search for Child Trust Funds but it worth noting that they will charge a fee so you might loose a chunk of your money.

The Government has a free tool you can use online to help track down your fund.

You can find this by searching for “find a Child Trust Fund” on GOV.UK.

LOST CASH

By Charlene Young, pensions and savings expert at AJ Bell

MANY parents and children aren’t aware they even have the account, or don’t know who the money is with or how to track it down.

More than a quarter of CTF accounts were set up by the government because parents failed to do so within the 12-month window.

This highlights why so many are unclaimed – as the parents either weren’t aware or won’t remember that an account was even set up for their child, let alone where the money is now.

Any child born between 1 September 2002 and 2 January 2011 who hasn’t already got details of their account should track it down.

Once you’ve tracked down the money you can choose what to do with it. Your options are to transfer it to an adult ISA or withdraw the money. Until then your money will just sit in an account that no one else has access to, possibly paying very high charges.

Anything you transfer to an adult ISA at maturity will not count towards your annual ISA allowance, which is £20,000 for over 18s.

For many young people who have CTFs but are still under 18, it will make sense to transfer it to a Junior ISA, where the charges will likely be lower, and you’ll have a much bigger investment choice.

The money will still be locked up until you turn 18, but the tax-free benefits of ISA investing still apply. You can transfer the entire CTF into a Junior ISA and still add up to £9,000 to it in the same tax year.

You’ll need to have a few personal details to hand to do the search, including your date of birth and National Insurance (NI) number.

Your NI number remains the same for your entire life. It’s made up of two letters, six numbers and a final letter.

You can find this number on your payslips or by downloading the HMRC app, which can be downloaded on the Apple or Google Play Store.

When you’re done filling this out, HMRC will then send you a letter revealing what company has your Child Trust Fund.

What to do once you have claimed the money

Usually, people put the cash straight into a bank account, invest it, or transfer it into an ISA.

You can also ask your Child Trust Fund Provider to give you the money and get it cashed into your bank account.

This way you’ll need to share the bank account details you wish to transfer the cash into with HMRC.

But if you’d rather invest it, you can transfer it into an ISA.

The Sun recently broke down whether or not an ISA is right for you, which you can read here.

CryptoCurrency

CPI data to drive 'favorable impact' on Bitcoin prices — 21Shares

Consumer prices in the US rose by 2.4% in September, above market expectations but still in a negative trend compared to the past few years.

CryptoCurrency

Georgia opposition debuts civil blockchain project ahead of critical elections

Georgia’s political opposition wants to use blockchain technology to develop civil society and the country’s business landscape.

CryptoCurrency

Super Micro Computer stock continues wild ride as investors weigh AI hype against alleged DOJ probe

Super Micro Computer (SMCI) stock fell 2.5% Thursday after rallying as much as 9% the day before, continuing its rollercoaster ride of a week as investors swing between optimism over the company’s strong financials and cautiousness over its regulatory risks.

Super Micro is reportedly being investigated by the Department of Justice over allegations of shady business practices outlined in a scathing report by short seller firm Hindenburg Research in late August. That has pressured the stock, which has hovered under $50 per share since then.

This week, SMCI climbed on positive reports from the AI server maker. Super Micro surged 16% Monday after the company released numbers showing strong demand for its products. The stock was up 12% on Thursday from the prior week.

Super Micro makes servers using Nvidia’s (NVDA) AI chips for data centers that power artificial intelligence software. The company said it’s shipping servers containing over 100,000 Nvidia GPUs per quarter “for some of the largest AI factories ever built.”

Then on Tuesday, shares of SMCI fell 5% after a promising premarket rally that saw the stock jump as much as 7%. Daniel Newman, CEO of the Futurum Group, said investors’ euphoria over the company’s shipment data faded against the backdrop of Super Micro’s regulatory risk.

“I think one piece of good news hardly undoes multiple months of significant financial and regulatory scrutiny around a company like this,” Newman said.

The Hindenburg report in August accused Super Micro of shoddy accounting, undisclosed relationships between its CEO and companies it does business with, and violations of US export bans. For example, Hindenburg said Super Micro has shipped servers to sanctioned Russian firms through shell companies, some of which were likely used by its military for its war against Ukraine.

The day after Hindenburg released its report, Super Micro shares dropped 20%. The company also delayed filing its annual 10-K report to the US Securities and Exchange Commission. Super Micro’s woes continued with a Wall Street Journal report of an alleged DOJ probe, which sent shares tumbling in late September.

Super Micro CEO Charles Liang said the Hindenburg report contained “false or inaccurate statements” and “misleading presentations of information that we have previously shared publicly.” Liang said the company’s delayed 10-K filing would not affect the company’s fourth quarter financial results, adding that Super Micro would address Hindenburg’s allegations “in due course.”

Super Micro’s stock climb this week displays the tension between its potential as a key player in the AI boom and its regulatory hurdles.

“This is a high-risk reward,” Newman said. “If they get absolved of all of this, there’s a very good chance it’s going to see a pretty nice move to the upside.” Of the Wall Street analysts tracked by Bloomberg who are covering the stock, seven have a Buy rating on the stock, while 11 maintain a Hold rating. Only one analyst recommends selling the stock.

Analysts see shares rising to $66 over the next 12 months.

The company reported mixed results in its last earnings report. Super Micro’s most recent quarterly revenue of $5.3 billion for the three months ended June 30 barely missed Wall Street’s expectations, but was 143% higher than the prior year. On the other hand, Super Micro earnings per share for the company’s fiscal fourth quarter of $0.63 were far lower than analysts’ consensus forecast of $0.83, according to Bloomberg data.

Argus Research analyst Jim Kelleher told investors in a note on Oct. 3 to buy the dip, noting that Super Micro “has been growing sales and earnings much more rapidly than the Tech industry in recent years.” Wall Street expects Super Micro to report revenues of $6.5 billion for the period ended Sept. 30, up 206% from the previous year. The company has not yet confirmed a date for its next earnings release.

“At this point, we are assuming that any accounting irregularities should they exist are minor and can be addressed while requiring re-issued financial documents,” Kelleher said, adding that Super Micro’s recent 10-for-1 stock split on Oct. 1 “broadens the potential investor pool and should be a long-term positive.”

Despite his long-term optimism, Kelleher lowered his 12-month price target for the stock from $100 to $70.

Laura Bratton is a reporter for Yahoo Finance.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

CryptoCurrency

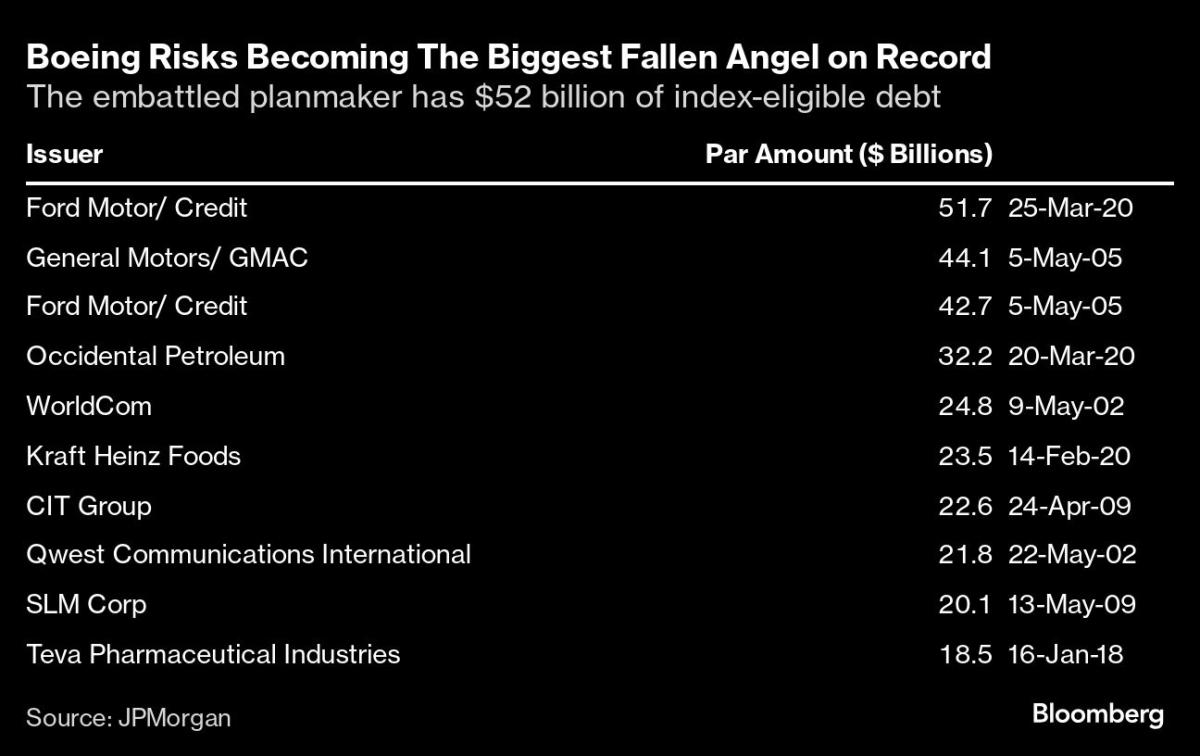

Boeing Would Be Biggest-Ever US ‘Fallen Angel’ If Cut to Junk

(Bloomberg) — If cut to junk status, Boeing Co. will be the biggest US corporate borrower to ever be stripped of its investment-grade ratings, flooding the high-yield bond market with a record volume of new bonds to absorb.

Most Read from Bloomberg

On Tuesday, S&P Global Ratings said it’s considering downgrading the planemaker to junk as strikes at its manufacturing sites persist, hurting production. Last month, Moody’s Ratings said it’s considering a similar move. Fitch Ratings has highlighted the growing risks but not yet announced a review.

Downgrades to junk from two of Boeing’s three major credit graders would leave much of its $52 billion of outstanding long-term debt ineligible for inclusion in investment-grade indexes. If that happens, Boeing would become the biggest ever fallen angel — industry parlance for a company that’s lost its investment-grade ratings — by index-eligible debt, according to JPMorgan Chase & Co. analysts.

“Boeing has worn out its welcome in the investment-grade index,” said Bill Zox, a portfolio manager at Brandywine Global Investment Management. “But the high-yield index would be honored to welcome Boeing and its many coupon step-ups.”

A spokesperson for Boeing declined to comment for this story.

‘Idiosyncratic Credit Situation’

JPMorgan isn’t taking a view on the likelihood of Boeing transitioning to junk or what such a transition would mean for its credit fundamentals, strategists led by Eric Beinstein and Nathaniel Rosenbaum wrote in a Thursday note.

There could be a relatively seamless transition, the strategists wrote. Credit spreads are tight trading conditions are relatively liquid trading in both the high-grade and high-yield markets, the strategists wrote. Much of of Boeing’s debt has a coupon step-up feature — where the interest rate increases by 0.25 percentage point for each step below investment-grade that each ratings firm downgrades by, which could make it more palatable to some investors, including insurers.

“Usually downgrades from high-grade to high-yield are clustered together around economic downturns or crisis,” the analysts wrote. “This is an idiosyncratic credit situation, should a downgrade occur. No other large fallen angel has ever transitioned at such tight spreads.”

The corporate bond market has swelled in recent years, so even if Boeing has more debt than other borrowers have had historically, it takes up a smaller part of the investment-grade universe. The company makes up just 0.7% of Bloomberg’s US corporate investment-grade bond index. When Ford Motor Co. and General Motors Co. were downgraded in 2005, they took up 8.3% and 3% of the high-grade market respectively, according to JPMorgan.

But there are also reasons for the transition to potentially result in big price moves for the company’s debt. Boeing’s $52 billion debt load is big by junk issuer standards. And it has a relatively high proportion of longer-dated debt, while most high-yield investors focus on shorter- and intermediate-term securities to help manage credit risk.

High-grade and high-yield funds, which pool together bonds according to factors like credit quality and maturity to pay regular returns to investors, could also be impacted. More passive fund investors have piled into the high-grade market over the years, which would mean a higher volume of “forced sellers” if Boeing is downgraded, according to JPMorgan.

“I would expect a fair amount of index-related selling as the debt changes hands between the investment-grade and high-yield markets,” said Scott Kimball, chief investment officer at Loop Capital Asset Management. “It wouldn’t surprise me if things got ugly as high-yield investors aren’t as beholden to benchmarks, generally.”

Since active high-yield managers are not going be “forced buyers,” they will have a greater degree of price-setting power, according to Kimball.

“The liquidity transfer costs are real,” he said. “High-yield buyers, being less index-focused, are the ones setting the price. It’s the opposite of upgrades where passive money is more prevalent.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology3 weeks ago

Technology3 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment3 weeks ago

Science & Environment3 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

News3 weeks ago

the pick of new debut fiction

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLiquid crystals could improve quantum communication devices

-

News3 weeks ago

News3 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Business2 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

News4 weeks ago

News4 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News3 weeks ago

News3 weeks agoYou’re a Hypocrite, And So Am I

-

Sport3 weeks ago

Sport3 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA slight curve helps rocks make the biggest splash

-

News3 weeks ago

News3 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Technology2 weeks ago

Technology2 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Football2 weeks ago

Football2 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

News3 weeks ago

News3 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoRethinking space and time could let us do away with dark matter

-

Business2 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

MMA2 weeks ago

MMA2 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Technology2 weeks ago

Technology2 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

News3 weeks ago

News3 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Technology2 weeks ago

Technology2 weeks agoQuantum computers may work better when they ignore causality

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCardano founder to meet Argentina president Javier Milei

-

News3 weeks ago

The Project Censored Newsletter – May 2024

-

News3 weeks ago

News3 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMeet the world's first female male model | 7.30

-

News3 weeks ago

News3 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Toning Workout for Women

-

Technology2 weeks ago

Technology2 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Technology2 weeks ago

Technology2 weeks agoGet ready for Meta Connect

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Sport2 weeks ago

Sport2 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Technology3 weeks ago

Technology3 weeks agoThe ‘superfood’ taking over fields in northern India

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe maps that could hold the secret to curing cancer

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Politics3 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoEverything a Beginner Needs to Know About Squatting

-

TV3 weeks ago

TV3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Servers computers2 weeks ago

Servers computers2 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Technology2 weeks ago

Technology2 weeks agoThe best robot vacuum cleaners of 2024

-

Business1 week ago

Ukraine faces its darkest hour

-

Business3 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow one theory ties together everything we know about the universe

-

News3 weeks ago

News3 weeks agoChurch same-sex split affecting bishop appointments

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTiny magnet could help measure gravity on the quantum scale

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBlockdaemon mulls 2026 IPO: Report

-

Sport3 weeks ago

Sport3 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

News2 weeks ago

News2 weeks agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Politics3 weeks ago

Politics3 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists have worked out how to melt any material

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

Business3 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Business3 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Politics3 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

Technology3 weeks ago

Technology3 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

MMA3 weeks ago

MMA3 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Travel2 weeks ago

Travel2 weeks agoDelta signs codeshare agreement with SAS

-

Politics2 weeks ago

Politics2 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

News4 weeks ago

News4 weeks agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoTelegram bot Banana Gun’s users drained of over $1.9M

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMost accurate clock ever can tick for 40 billion years without error

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoSEC asks court for four months to produce documents for Coinbase

You must be logged in to post a comment Login