Money

Warning for 700,000 on state pension as letters hit doormats with £665 tax demand – will you get a surprise bill?

TENS of thousands of pensioners are set to get tax demands this year for the first time since they retired.

A new freedom of information request by LCP Partners, reveals that nearly 700,000 people received a bill in the post last year, for an average of £665 each.

This was an increase of over 120,000 people compared with two years earlier.

One reason given for the rise is the year-on-year freeze in the value of personal allowance, coupled with a steady increase in the value of the state pension.

The personal allowance threshold, which is the rate at which people start paying tax, has been frozen at £12,570 since April 2021.

The government freezes tax thresholds as a way to raise extra cash without directly increasing taxes.

But as wages or income from pensions rises each year, more people are being dragged into paying tax, or into higher tax brackets.

Steve Webb, partner at pension consultants LCP, told The Sun the “long-term freeze” in the value of the tax-free personal allowance could be financially damaging for pensioners.

He said: “Although an average bill of £665 may not sound very large, it could be the equivalent of about three weeks’ pension and a pensioner whose income is only just above the tax threshold may not have such a sum readily available”.

It is possible that the number of pensioners set to receive tax demands could rise over the coming years.

This is due to the triple lock, which means the payment made to those aged 66 and over rises every April by the highest out of inflation, the average UK wage increase, or 2.5%.

We don’t know yet what the rise will be but the ONS is set to release its inflation figures next week which should give us an indication.

Internal Treasury calculations, previously published by BBC, show that changes would take the state pension to around £12,000 in 2025/26, from £11,501 currently.

This could lead more and more elderly people into paying tax on their pensions.

What to do if you get a letter?

HMRC is sending out letters to thousands of pensioners as part of its “simple assessment” process which assesses who needs to pay what tax.

HMRC previously said that the letters going out will include a detailed calculation of any tax due for income they received between April 2023 and April 2024.

They’ll need to pay what they owe using Simple Assessment.

If you do get one of the letters, don’t stress, as you have until January 2025 to pay the bill.

You can even pay the fee using instalments as long as it’s fully paid by the deadline.

There is an online guide Simple Assessment guide for pensioners with more information for pensioners who receive a demand.

Is there anything I can do to avoid it?

Laura Suter, director of personal finance at AJ Bell, previously told The Sun that pensioners “looking to reduce their tax bill need to think about how they can maximise their tax-free income”.

“For example, any withdrawals made from their ISAs will be free of any tax. so they can use that pot of money to boost their income without impacting their tax bill.”

An ISA is a type of savings account in which you can save up to £20,00 a year tax-free.

Ms Suter also suggested that couples can organise their finances so they ensure they are each making use of their tax-free allowances, which might involve moving money or assets between themselves.

Helen Morrisey, head of retirement analysis at Hargreaves Lansdown, added that pensioners might want to use some of their pension to top up their income.

She said: “Most people can access 25% of their pension as a tax-free lump sum so they may decide to use this to top up their income without pushing up their tax bill.”

However, she also warned that pensioners below the personal allowance are going to find it increasingly difficult to avoid paying income tax in the coming years.

The finance expert added: “A full new state pension hits just over £11,500 per year and even relatively modest 3.5% annual increases would see people pushed over the threshold by the time the threshold freeze ends.”

How does the state pension work?

AT the moment the current state pension is paid to both men and women from age 66 – but it’s due to rise to 67 by 2028 and 68 by 2046.

The state pension is a recurring payment from the government most Brits start getting when they reach State Pension age.

But not everyone gets the same amount, and you are awarded depending on your National Insurance record.

For most pensioners, it forms only part of their retirement income, as they could have other pots from a workplace pension, earning and savings.

The new state pension is based on people’s National Insurance records.

Workers must have 35 qualifying years of National Insurance to get the maximum amount of the new state pension.

You earn National Insurance qualifying years through work, or by getting credits, for instance when you are looking after children and claiming child benefit.

If you have gaps, you can top up your record by paying in voluntary National Insurance contributions.

To get the old, full basic state pension, you will need 30 years of contributions or credits.

You will need at least 10 years on your NI record to get any state pension.

Money

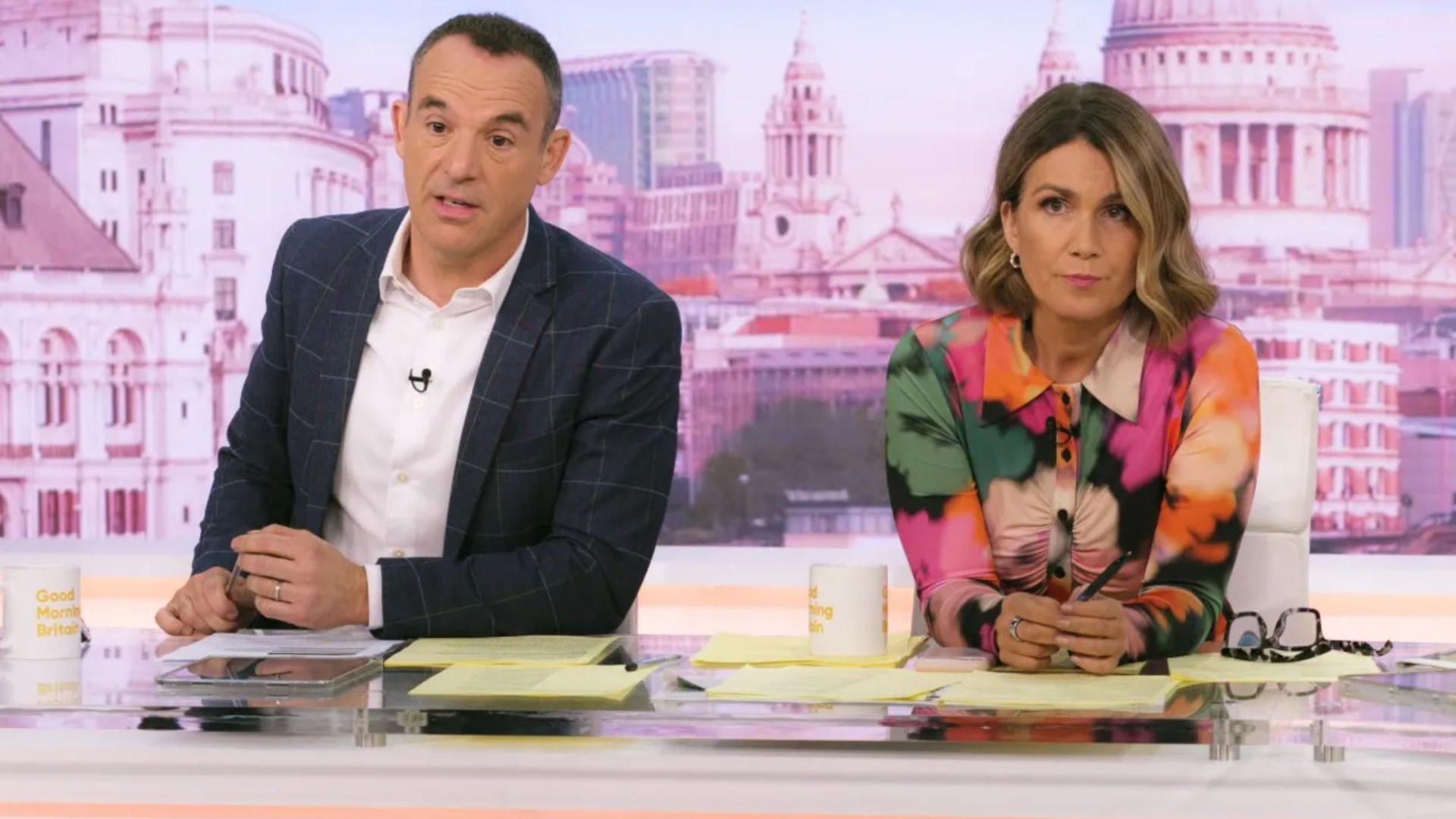

Moment Martin Lewis slams ‘you’re taking money from pensioners’ in clash with cabinet minister over Winter Fuel Payments

MARTIN Lewis has clashed with government minister Lisa Nandy over the decision to scrap the £300 Winter Fuel Payments for millions of pensioners.

The fiery exchange on Good Morning Britain today saw the Money Saving Expert founder slam the move as “indefensible” and call out the government for failing to reach the poorest pensioners.

Speaking directly to the Culture Secretary, Lewis didn’t hold back.

The money-saving guru said: “Why are you defending this?

“You’ve been a campaigner for the poorest in society for so long, yet you’re sitting there defending a policy that charities like Age UK are pulling their hair out about.”

The row comes after AgeUK urged the government to scrap the policy, warning that the poorest pensioners, some earning under £11,000 a year, will be left without support.

Read more on martin lewis

Lewis was especially concerned that many of the elderly eligible for pension credit wouldn’t apply for it – and therefore miss out on the vital £300 Winter Fuel Payment.

The argument heated up as Lewis continued to press Nandy on the government’s failure to reach those most in need, describing the policy as a “huge flaw.”

He said: “You believe they should get pension credit and the Winter Fuel Payment, but you’re not doing enough to make sure they do.

” You’re not writing individual letters to the hardest-to-reach pensioners.

“‘There’s lots you could do. So to try and talk about it, ‘we’re targeting the poorest’… The truth is you’re not targeting them. Why aren’t you writing them bloody letters?’

“You have to accept that there are hundreds of thousands of pensioners earning under £11,400 who will not get this payment this year.”

In response, Nandy defended the government’s efforts, pointing to the rise in pension credit claims, claiming that a “huge drive” had resulted in a 115 per cent increase in applications.

But Lewis wasn’t convinced, he added: “It will take four years for everyone to be signed up. And what’s the solution now? Why aren’t you writing them bloody letters?”.

Despite the tension, Nandy stuck to her guns, stressing that the government was writing letters to eligible pensioners, but acknowledged the frustration from campaigners like Lewis.

The Sun’s Winter Fuel S.O.S Campaign

WORRIED about energy bills? The Sun’s Winter Fuel SOS crew are taking calls on Wednesday.

We want to help thousands of pensioners worried about energy bills this winter, with tips and advice on how to make cash go further.

Our Winter Fuel SOS crew will be able to help answer your questions on whether you can get Pension Credit and the Winter Fuel Payment.

Ten million OAPs are set to lose the £300 Winter Fuel Payment due to government cutbacks.

It comes in the same month that millions of households are hit by a ten per cent rise in bills as the Energy Price Cap shoots up.

We can help with advice on how else to save money.

Our phone line is open 7am to 7pm Wednesday October 9 – you can call us on 0800 028 1978.

Or you can email now: WinterfuelSOS@the-sun.co.uk

Nandy said: “We are working with a wide range of people to reach those who need help.

“I just want to make it clear, we are not leaving anyone high and dry.”

What’s at stake for pensioners?

With changes announced in July, the government confirmed that from this winter, only pensioners who claim pension credit or certain other means-tested benefits will be eligible for the Winter Fuel Payment.

Previously it went to around 11million of state pension age regardless of income.

But around 880,000 eligible pensioners on the lowest incomes may miss out on the energy help because they haven’t claimed pension credit.

Lewis pressed further, saying: “You’re taking money out of their hands.

“Are you willing to accept the collateral damage of pensioners, many with dementia, not getting the Winter Fuel Payment?”

Nandy responded, insisting the cut-off point for pension credit applications had been extended to April 2025.

This means pensioners who are eligible, but have yet to apply, can still receive backdated payments.

Typically claims for pension credit can be backdated up to three months.

As the qualifying week for the payment is September 16 to 22, It means the last date for claiming the benefit is December 21.

We’ve asked the government which date applies and will update when we hear back.

DON’T MISS OUT

The message is clear: if you’re eligible for pension credit, it’s crucial to act fast.

Applications are still being accepted, but pensioners must apply by December 21 to receive this year’s Winter Fuel Payment.

Lewis, however, remains sceptical that many of the most vulnerable will get the help they need.

With Christmas just around the corner, time is running out, and the pressure is on for the government to ensure no one is left out in the cold.

How to apply for pension credit

YOU can start your application up to four months before you reach state pension age.

Applications for pension credit can be made on the government website or by ringing the pension credit claim line on 0800 99 1234.

You can get a friend or family member to ring for you, but you’ll need to be with them when they do.

You’ll need the following information about you and your partner if you have one:

- National Insurance number

- Information about any income, savings and investments you have

- Information about your income, savings and investments on the date you want to backdate your application to (usually three months ago or the date you reached state pension age)

You can also check your eligibility online by visiting www.gov.uk/pension-credit first.

If you claim after you reach pension age, you can backdate your claim for up to three months.

Money

Mortgage lenders hike interest rates and pull lowest deals amid market uncertainty

BORROWERS could face a surge in mortgage costs as rates increase and lenders withdraw their cheapest deals.

Coventry Building Society, Co-operative Bank, Molo, and LiveMore have all announced plans to raise their rates in the coming days.

It follows an increase in swap rates, which are used to price fixed rate mortgage deals.

As swap rates rise, mortgage lenders tend to increase their rates to avoid financial losses.

The two-year swap rate was 4.06% as of 7 October, while the five-year swap rate was 3.81%, according to Chatham Financial.

These figures are higher than the respective rates of 3.91% and 3.56% recorded in September.

At Coventry Building Society, all fixed rates offered at 65-75% loan-to-value (LTV) for new borrowers, as well as all two and five year fixed remortgage rates at 80% LTV, will rise at on Friday.

Prior to these latest changes, Coventry offered a 3.69% five-year fixed-rate mortgage, one of the lowest rates on the market.

Co-operative Bank will withdraw some of its lowest rates Thursday night.

Experts predict other lenders will soon follow suit.

David Hollingworth, associate director at L&C Mortgages, said: “The mortgage market has seen rates fall in recent months, but that may be coming to an abrupt halt.

“Fixed rate pricing depends on what the market anticipates may happen to interest rates and uncertainty over the forthcoming budget, mixed messages from the Bank of England and global unrest is pushing costs back up for lenders.”

HSBC, Metro Bank, Santander, and Yorkshire Building Society told The Sun they are keeping their fixed rates under review.

Why is this happening?

A variety of factors have unsettled market expectations, causing an increase in both gilt yields and swap rates, according to Nicholas Mendes, mortgage technical manager at John Charcol.

He said: “First, Andrew Bailey’s recent comments, in which he indicated expectations for larger or more frequent interest rate reductions, have introduced some uncertainty.”

Currently, interest rates stand at 5%.

The rate, which banks use to determine the interest on mortgages and loans, was last reduced from 5.25% in August.

Nicholas added: “Markets had been pricing in interest rate cuts for November and December, but expectations for December have softened slightly.”

This shift has occurred because various members of the Bank of England Monetary Policy Committee (MPC) have expressed views contrary to those of Andrew Bailey.

Last week, MPC member Huw Pill indicated that rates should be reduced “gradually,” citing caution over the long-term trajectory of inflation.

A similar situation arose at the beginning of the year when mortgage rates initially fell below 4%, only to be increased again as it became apparent that the Bank of England would not reduce rates as swiftly as anticipated.

The Bank of England will decide whether or not to cut interest rates on November 7.

What are the different types of mortgages?

We break down all you need to know about mortgages and what categories they fall into.

A fixed rate mortgage provides an interest rate that remains the same for an agreed period such as two, five or even 10 years.

Your monthly repayments would remain the same for the whole deal period.

There are a few different types of variable mortgages and, as the name suggests, the rates can change.

A tracker mortgage sets your rate a certain percentage above or below an external benchmark.

This is usually the Bank of England base rate or a bank may have its figure.

If the base rate rises, so will your mortgage but if it drops then your monthly repayments will be reduced.

A standard variable rate (SVR) is a default rate offered by banks. You usually revert to this at the end of a fixed deal term, unless you get a new one.

SVRs are generally higher than other types of mortgage, so if you’re on one then you’re likely to be paying more than you need to.

Variable rate mortgages often don’t have exit fees while a fixed rate could do.

What does this mean for mortgage holders?

Swap rates primarily influence fixed-rate mortgages.

As a result, these are the main products that lenders are currently increasing.

Those on standard variable and tracker deals remain unaffected, as these mortgages are tied to the Bank of England’s base rate, which has not changed.

If you are already locked into a fixed-rate deal, you will also be unaffected.

However, the rise in fixed rates will be a significant blow to prospective homebuyers and those looking to remortgage.

According to the banking trade body UK Finance, approximately 1.6 million mortgage deals are set to expire in 2024.

This means that over a million households also face the prospect of their monthly payments increasing by hundreds of pounds.

According to moneyfactscompare.co.uk, the average two year fixed rate homeowner mortgage stands at 5.37%.

This is down from an average rate of 5.56% last month.

Meanwhile, the average five-year fixed residential mortgage rate is 5.21%, a decrease from 5.37% the previous month.

How to get the best deal on your mortgage

IF you’re looking for a traditional type of mortgage, getting the best rates depends entirely on what’s available at any given time.

There are several ways to land the best deal.

Usually the larger the deposit you have the lower the rate you can get.

If you’re remortgaging and your loan-to-value ratio (LTV) has changed, you’ll get access to better rates than before.

Your LTV will go down if your outstanding mortgage is lower and/or your home’s value is higher.

A change to your credit score or a better salary could also help you access better rates.

And if you’re nearing the end of a fixed deal soon it’s worth looking for new deals now.

You can lock in current deals sometimes up to six months before your current deal ends.

Leaving a fixed deal early will usually come with an early exit fee, so you want to avoid this extra cost.

But depending on the cost and how much you could save by switching versus sticking, it could be worth paying to leave the deal – but compare the costs first.

To find the best deal use a mortgage comparison tool to see what’s available.

You can also go to a mortgage broker who can compare a much larger range of deals for you.

Some will charge an extra fee but there are plenty who give advice for free and get paid only on commission from the lender.

You’ll also need to factor in fees for the mortgage, though some have no fees at all.

You can add the fee – sometimes more than £1,000 – to the cost of the mortgage, but be aware that means you’ll pay interest on it and so will cost more in the long term.

You can use a mortgage calculator to see how much you could borrow.

Remember you’ll have to pass the lender’s strict eligibility criteria too, which will include affordability checks and looking at your credit file.

You may also need to provide documents such as utility bills, proof of benefits, your last three month’s payslips, passports and bank statements.

Money

Will insurance cover the cost of repairs after a Storm?

The economic impact of natural disasters in the US

For those living in vulnerable areas to extreme weather disasters, recent years have seen some of the worst disasters. In 2024, we have seen severe weather disasters such as, the floods in Afghanistan- Pakistan, typhoon in Japan, the recent hurricane in Florida and more. Now, hurricane Milton is causing severe warnings and evacuations in Florida as they still face the outcome of their last hurricane, Helene.

These disasters cause destruction to lives, families, property and more and the cost of repairing this once they can is substantial. We have taken a dive into the cost to the US economy, businesses and individuals when they are hit by a natural disaster

The cost of weather disasters in the US

Between 2020-2022 there were 60 natural disasters which cost over $1 billion in losses. With the worsening climate change, 2023 saw a record number of weather and climate disasters. In 2023, flooding events alone caused a total of almost $7 billion in damages in the U.S.

The cost of property damage and destruction of infrastructure are often the most clear and immediate impacts, as homes, buildings, roads and more are damaged or destroyed. The economic impact also extends to business interruption, loss of jobs, reduced tourism and more which lead to further financial strain.

The costs of repairing and rebuilding

Hurricane Katrina in 2005 caused an estimated $125 billion in damage, with widespread destruction to property and infrastructure across New Orleans. The storm crippled businesses and left thousands without jobs, contributing to long-term economic stagnation in the region. Housing markets are heavily impacted by property damage. After Hurricane Katrina, housing prices in New Orleans dropped significantly as many properties were either destroyed or made uninhabitable.

Not only did the storm Katrina impact infrastructure but also the essential businesses were halted. Katrina impacted up to 19% of the total US oil production as 24% of the country’s natural gas supply is housed in or around areas impacted by the storm. 20 offshore rigs underwent significant damage causing refineries to halt production. This was the first time in the country’s history that the national average gas price went over $3.

Who pays for repairs?

Contributions from the government

Federal as well as local government are often the first to respond after a disaster, they will allocate money for emergency relief and reconstruction. Agencies like FEMA (Federal Emergency Management Agency) provide financial assistance to individuals, municipalities, and states to cover the cost of rebuilding infrastructure and homes. In 2027, the hurricane season brought 3 large disasters, the federal relief packages amounted to $130 billion.

At the state and local levels, additional funds are provided, though these governments often struggle to meet the demands of large-scale recovery due to budget limitations. This has led to calls for increased federal support and better pre-disaster planning.

Insurance Companies

If you are a homeowner and you have property insurance you can file claims to cover damage to homes, cars, and other possessions. Unfortunately, not all areas of the US are equally insured, such as those areas prone to specific types of disasters e.g. hurricanes and wildfires. Insurance premiums have increased the prices due to the heightened risk.

For example, after Hurricane Katrina, insurance premiums in coastal areas of the Gulf and Atlantic soared by as much as 20-30% in some regions.

Some homeowners may not be able to afford sufficient coverage, leaving them vulnerable to significant financial losses after a disaster. Additionally, many policies don’t cover flooding unless a separate policy is purchased, as seen in the extensive uninsured losses from Hurricane Harvey, where only about 20% of homeowners in the Houston area had flood insurance.

The impact on small businesses

A 2017 FEMA report highlighted that 40% of small businesses never reopen after a disaster. In these cases, both individuals and businesses are forced to rely on personal savings, loans, or government assistance, which may not be sufficient to cover the full extent of the damage.

Some of the hidden costs of weather disasters

Employment: Natural disasters can have various effects on the economy of the local area which ripple through multiple sectors. With productivity down, businesses begin to struggle and even more so if their property has been damaged or destroyed. The money to restore the business may not be immediately available, causing the owners and all staff to be without employment for a prolonged amount of time.

Housing market: When disasters hit, and if the area has been hit multiple times, it is likely to deter future residents. Currently, Florida is facing its second large hurricane within a month, this will likely persuade many to relocate and others to delay or cancel their move into the area. This will have a substantial impact on the housing market.

Investments: For investors, an area prone to natural disasters will likely deter any development in the area. This can include property investment as well as developing the area with more businesses.

Money

What do advisers want to see when they switch platforms?

Selecting the right platform is a bit like building a house: if the foundations aren’t stable then you’re in serious trouble further down the line.

Selecting the right platform is a bit like building a house: if the foundations aren’t stable then you’re in serious trouble further down the line.

I’m increasingly seeing advisers considering switching platforms looking to financial stability as that key foundation stone from which to build.

Today’s advice platform market is characterised by oversupply and frequent regulatory change, leaving a key problem for advisers to overcome – long-term stability.

A financially robust platform reassures advisers their chosen provider will endure market consolidation, invest in continuous innovation and maintain high service levels, while being able to adequately adapt to the pace of regulatory change.

Financial stability is about more than survival; it’s about thriving in a competitive market

Consumer Duty further underscores the need to take a more long-term approach. Advisers must ensure their platform partners can consistently meet these regulatory expectations, safeguarding consistency in service quality and good client outcomes.

Financial stability is about more than survival; it’s about thriving in a competitive market.

A stable platform is not a static platform. Instead, it’s a reliable partner that adapts, supports advisers’ evolving needs and provides the infrastructure to keep pace with technological advancements.

Without assessing a platform’s financial stability and ability to invest in development, advisers risk partnering with a platform that could struggle to sustain service quality or keep up with industry innovations, potentially putting their client relationships and business growth at risk.

Contrary to some opinions, advisers are open to exploring new platforms, but they generally need a trigger to make such a significant switch

Contrary to some opinions, advisers are open to exploring new platforms, but they generally need a trigger to make such a significant switch.

Realistically, a firm will only shift large volumes of business when there’s a compelling reason — which are often realised by concerns about their current platform’s financial health and levels of investment.

Consistency of service, back-office connectivity, and digital automation and experience give advisers an edge in an industry where marginal gains can make a real difference.

If doubts arise about a platform’s financial security, advisers should question whether they will continue to see these cornerstones of platform efficiency maintained.

Switching usually requires significant push factors that prompt advisers to consider their options. These can include long call wait times, processing delays, transaction errors and lack of accountability, all problems that damage client relationships and erode trust.

Platform charges have increasingly become a secondary consideration

Platform charges have increasingly become a secondary consideration. Charges across the industry are highly competitive, and advisers now view them as relatively uniform. Instead of focusing solely on costs, advisers weigh charges against a broader range of factors, like digital experience, investment choice, service model and overall value for money.

Platform charges represent only a small portion of the total cost of advice, which includes adviser fees and investment management costs. So, with cost differences between platforms generally minimal and one eye on Consumer Duty, advisers are beginning to prioritise the long-term viability of a platform over short-term savings.

With a focus on value mandated by Consumer Duty, advisers are gravitating towards platforms that have greater resources at their disposal. These are more capable of investing in reliable service and support, which ultimately benefits clients and helps advisers to scale their businesses.

Why onboarding matters

A seamless onboarding experience is essential for affirming advisers’ confidence in their decision to switch platforms. This process is their first impression of the new platform and sets the tone for their platform experience.

A well-designed onboarding process should be efficient, transparent and supportive, according to the individual needs of advice firms. This process involves not just the technical aspects of transferring data and setting up accounts but also clear communication, training and ongoing support.

Delivering all this requires investment, not just at the start, but as part of a continuous review process.

Effective onboarding can transform what is seen as a daunting process into a smooth, positive experience

By minimising the friction involved in switching and providing comprehensive assistance during the transition, platforms can reduce perceived barriers to change.

This proactive approach instils a sense of trust and reliability, which fosters long-term loyalty, making advisers more likely to stay with the platform and recommend it to others. Effective onboarding can transform what is seen as a daunting process into a smooth, positive experience.

While multiple factors influence platform selection and switching, we are seeing the emergence of financial stability as a critical element.

In an era of market oversupply and rapid technological change, advisers are increasingly recognising and seeking out platforms that are operationally efficient and financially secure.

Understanding these dynamics allows platforms to better position themselves to meet the evolving needs of advice firms and their clients to deliver mutual future success.

Ranila Ravi-Burslem is intermediary distribution director at Scottish Widows

Money

Wood burning stove winter rules could see you slapped with £300 fine and criminal record – avoid getting caught out

HOUSEHOLDS should be aware of rules surrounding this common item which could land you a £300 fine or even a criminal record.

Local authorities can issue fines for illegal log burner use in England.

This rule was introduced by the Department for Environment and Rural Affairs (DEFRA) to reduce air pollution and has been in place for over two decades.

But councils can issue fines under new rules brought in last year.

Last year, the government instructed local authorities to consider using powers in the 2021 Environment Act to issue on-the-spot civil penalties.

Local authorities can issue financial penalties of between £175-£300 for smoke emissions from chimneys in smoke control areas in England.

You could also get a fine of up to £1,000 for using unauthorised fuel in an appliance that’s not on the exempt list.

In some cases, if the situation goes to court, then fines could be as high as £5,000 for repeat offenders, as well as an additional £2,500 for every day the breach continues.

If you are confused about what types of appliances you can use it is always worth ringing your local council and asking for help.

How to avoid being fined

It is not against the law to use one of these heating devices, but there are certain regulations in place for households.

For example, if you live in a smoke control area, wood burners can not emit more than three grams of smoke per hour.

A smoke control area is a place where people and businesses are not allowed to emit a large amount of smoke from a chimney.

This rule was introduced by DEFRA to reduce air pollution and has been in place for over two decades.

You can find out if you live in a smoke control area by using an online map created by the department, this can be found by searching https://uk-air.defra.gov.uk/data/sca/.

For example, people who live in Slough with the SL16 postcode are in a smoke control area meaning how much fumes their appliances can emit is limited.

Residents who live in these types of areas can use log burners, but the appliance must first be approved by DEFRA.

You can find a full list of appliances and fuel which are safe to use by visiting, https://smokecontrol.defra.gov.uk/fuels-php/.

For example, it is safe to use some kinds of smokeless logs such as Aimcor Excel briquettes.

Families who use logs for fire should look for the ‘Ready to Burn’ logo on fuel packaging.

This means the fuel has less than 20% moisture and complies with DEFRA’s regulations.

If you buy a new log burner then it must adhere to Ecodesign rules to reduce smoke and pollutant emissions.

It is always worth checking with your manufacturer if a wood burner adheres to new ecodesign rules.

The reminder comes as many Brits look for alternative ways to heat their home this winter.

Energy costs have risen by £149 for the average household this month after Ofgem’s new price cap came into force.

Cuts to the Winter Fuel Payment also mean that around 10million pensioners are set to miss out on up to £300 in fuel support.

What energy bill help is available?

THERE’S a number of different ways to get help paying your energy bills if you’re struggling to get by.

If you fall into debt, you can always approach your supplier to see if they can put you on a repayment plan before putting you on a prepayment meter.

This involves paying off what you owe in instalments over a set period.

If your supplier offers you a repayment plan you don’t think you can afford, speak to them again to see if you can negotiate a better deal.

Several energy firms have grant schemes available to customers struggling to cover their bills.

But eligibility criteria varies depending on the supplier and the amount you can get depends on your financial circumstances.

For example, British Gas or Scottish Gas customers struggling to pay their energy bills can get grants worth up to £2,000.

British Gas also offers help via its British Gas Energy Trust and Individuals Family Fund.

You don’t need to be a British Gas customer to apply for the second fund.

EDF, E.ON, Octopus Energy and Scottish Power all offer grants to struggling customers too.

Thousands of vulnerable households are missing out on extra help and protections by not signing up to the Priority Services Register (PSR).

The service helps support vulnerable households, such as those who are elderly or ill, and some of the perks include being given advance warning of blackouts, free gas safety checks and extra support if you’re struggling.

Get in touch with your energy firm to see if you can apply.

Money

Exact date millions should automatically receive winter fuel payment by – and what to do if you don’t get it

MILLIONS of pensioners will want to mark a key date in their diary for when they will receive the Winter Fuel Payment.

For the first time this year, the benefit, which is worth up to £300, will not be universal and only available to people claiming certain support.

Previously anyone over State Pension age qualified for the payment designed to soften the pinch of energy bills during the colder months.

Most households do not need to apply for The Winter Fuel Payment and will automatically be paid the cash.

If you qualify, you’ll get a letter telling you:

- How much you’ll get

- Which bank account it will be paid into

Payments are £200 for eligible households or £300 for eligible households where someone is aged over 80.

If you do not get a letter or the money has not been paid into your account by January 29, 2025, contact the Winter Fuel Payment Centre.

The deadline for you to make a claim for winter 2024 to 2025 is 31 March 2025.

By this date, the payments will be processed for those who qualify, with most receiving the money directly in their bank accounts.

For the vast majority of pensioners, the money will land in their bank accounts without the need for action, as long as they have been receiving certain benefits such as Pension Credit, Income Support, or Universal Credit.

If you do not receive your Winter Fuel Payment by the January 29 deadline, it’s important to act promptly.

You will need to contact the Winter Fuel Payment Centre on 0800 731 0160 to make a claim.

Keep in mind, the deadline for submitting a claim for winter 2024-2025 is March 31, 2025.

The payment is now restricted to pensioners who are claiming certain means-tested benefits. This includes:

- Pension Credit (a key qualifier)

- Universal Credit

- Income Support

- Income-related Employment and Support Allowance (ESA)

- Income-based Jobseeker’s Allowance (JSA)

In particular, those claiming Pension Credit should make sure to apply for it, as this benefit is the gateway to receiving the Winter Fuel Payment.

Pension Credit can top up your weekly income to £218.15 if you’re single or £332.95 for couples.

Notably, over 800,000 pensioners are missing out on this benefit, and without it, they won’t qualify for the Winter Fuel Payment.

Crucial to claim Pension Credit if you can

HUNDREDS of thousands of pensioners are missing out on Pension Credit.

The Sun’s Assistant Consumer Editor Lana Clements explains why it’s imperative to apply for the benefit..

Pension Credit is designed to top up the income of the UK’s poorest pensioners.

In itself the payment is a vital lifeline for older people with little income.

It will take weekly income up to to £218.15 if you’re single or joint income to £332.95.

Yet, an estimated 800,000 don’t claim this support. Not only are they missing on this cash, but far more extra support that is unlocked when claiming Pension Credit.

With the winter fuel payment – worth up to £300 now being restricted to pensioners claiming Pension Credit – it’s more important than ever to claim the benefit if you can.

Pension Credit also opens up help with housing costs, council tax or heating bills and even a free TV licence if you are 75 or older.

All this extra support can make a huge difference to the quality of life for a struggling pensioner.

It’s not difficult to apply for Pension Credit, you can do it up to four months before you reach state pension age through the government website or by calling 0800 99 1234.

You’ll just need your National Insurance number, as well as information about income, savings and investments.

HOW TO CLAIM

If you think you are eligible, it’s essential to claim Pension Credit as soon as possible.

The latest claims can be backdated for up to three months, with the final date to claim for the 2024-2025 Winter Fuel Payment being December 21, 2024.

If you’re already receiving Pension Credit or another qualifying benefit, the Winter Fuel Payment will be paid to you automatically.

With over 800,000 pensioners potentially missing out on Pension Credit, it’s critical for those eligible to act now.

Not only will this ensure you get the Winter Fuel Payment, but it can unlock additional support throughout the year.

If you don’t get your Winter Fuel Payment by January 29, 2025, don’t delay – contact the Winter Fuel Payment Centre and make your claim before the deadline.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 weeks ago

Technology3 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment3 weeks ago

Science & Environment3 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

News2 weeks ago

News2 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

News3 weeks ago

the pick of new debut fiction

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy this is a golden age for life to thrive across the universe

-

News3 weeks ago

News3 weeks agoYou’re a Hypocrite, And So Am I

-

Sport3 weeks ago

Sport3 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Business2 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNerve fibres in the brain could generate quantum entanglement

-

News3 weeks ago

News3 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology2 weeks ago

Technology2 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Football2 weeks ago

Football2 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoRethinking space and time could let us do away with dark matter

-

News3 weeks ago

News3 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

MMA2 weeks ago

MMA2 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Business2 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA slight curve helps rocks make the biggest splash

-

News3 weeks ago

News3 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

News3 weeks ago

News3 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Technology2 weeks ago

Technology2 weeks agoQuantum computers may work better when they ignore causality

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCardano founder to meet Argentina president Javier Milei

-

News2 weeks ago

News2 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMeet the world's first female male model | 7.30

-

Technology2 weeks ago

Technology2 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Technology2 weeks ago

Technology2 weeks agoGet ready for Meta Connect

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Sport2 weeks ago

Sport2 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe maps that could hold the secret to curing cancer

-

Technology3 weeks ago

Technology3 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

News3 weeks ago

The Project Censored Newsletter – May 2024

-

Politics3 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoEverything a Beginner Needs to Know About Squatting

-

News2 weeks ago

News2 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Toning Workout for Women

-

Sport3 weeks ago

Sport3 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Business3 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBlockdaemon mulls 2026 IPO: Report

-

TV2 weeks ago

TV2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Servers computers2 weeks ago

Servers computers2 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Technology2 weeks ago

Technology2 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

News2 weeks ago

News2 weeks agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology2 weeks ago

Technology2 weeks agoThe best robot vacuum cleaners of 2024

-

Business1 week ago

Ukraine faces its darkest hour

-

News3 weeks ago

News3 weeks agoChurch same-sex split affecting bishop appointments

-

Politics3 weeks ago

Politics3 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow one theory ties together everything we know about the universe

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business3 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Business3 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Politics3 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

MMA3 weeks ago

MMA3 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Travel2 weeks ago

Travel2 weeks agoDelta signs codeshare agreement with SAS

-

Politics2 weeks ago

Politics2 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology3 weeks ago

Technology3 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoKeep Your Goals on Track This Season

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists have worked out how to melt any material

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSingle atoms captured morphing into quantum waves in startling image

You must be logged in to post a comment Login