Money

Weekend Essay: Confronting our biggest fear – public speaking

Do you remember all those awkward job interview questions?

I’m thinking of pearls such as: ‘Where do you see yourself in five years’ time?’ (Not here); ‘Why do you want to work in this industry?’ (I can’t get a job in my preferred field); and ‘Why should we hire you?’ (I desperately need the cash).

But, for me, the most annoying by far is, ‘What’s your greatest weakness?’

Of course, it’s not difficult to answer – I can reel off several weaknesses without breaking a sweat. But it can be hard to think of a weakness that doesn’t undermine your claim to the role. After all, who’s going hire someone who’s lazy, unpunctual and selfish (except maybe Donald Trump)?

However, when grumbling about this loaded question to a friend, she surprised me by coming up with the perfect answer: public speaking.

“It’s something everyone can relate to,” she pointed out. “No one will judge you negatively for it and you can use it as an example of personal growth (i.e. I’ve sought to tackle the fear by volunteering for speaking opportunities, training courses, etc).”

If public speaking was ever a fear when I was younger, it’s one I’ve had to confront in my professional life

You can’t fault the logic, and it got me thinking: have I ever been afraid of public speaking?

As a naturally shy person, the answer must be ‘yes’. I certainly remember being very nervous if I ever had to stand up in front of a class or in school assembly. But if public speaking was ever a fear when I was younger, it’s one I’ve had to confront in my professional life.

As a journalist, I’ve done countless speeches, presentations, panel discussions and onstage interviews. I’ve addressed rooms filled with people hanging on my every word (or at least pretending to). And I’ve had to deal with the terror of clamming up, forgetting my train of thought, making a faux pas – all in front of a packed audience.

Make no mistake, this can be a genuine terror. “Most people fear public speaking more than death,” says Dan Graham of NextGen Planners, whose Speaker & Influencer Programme has trained over 300 finance professionals to overcome this fear since its launch in 2019.

According to Graham, public speaking is a crucial and undervalued skill: “The majority of financial advisers are required to have an influence on their clients every day. By developing their message and their confidence, they can convey important ideas more succinctly.

“From those we have worked with on our programme, the increase in confidence has not only allowed them to deliver their key messages to the world, but also to come out of their shells and let their influence come to the surface.”

The results, claims Graham, have been transformational: “New friendships have been formed, new businesses have been found, client service has improved and those doubting their careers have stayed in the profession.”

By contrast, those who lack the confidence to speak in public miss the opportunity to make these connections. “It means their great ideas are, often, not being heard,” says Graham.

Most people fear public speaking more than death

All of this has been on my mind recently, with the Money Marketing Awards having taken place last month (I did the introductory speech) and MMI London and MMI Leeds coming up soon (I’m opening proceedings and chairing panels at both).

Admittedly, I don’t know how many of my ‘great ideas’ have been shared via public speaking at events such as these. But I do know that speaking in front of people has given me a better sense of myself – how I sound to others, how I communicate and how my personality comes across.

Stated another way, it puts my strengths and weaknesses up in lights for all to see. This can be daunting, but it’s also empowering. Becoming a better public speaker has definitely improved my one-on-one skills, which makes me a better interviewer and networker. It may even have improved my writing (although you, dear reader, can be the judge of that).

And on good days, it plays to the other side of my personality. The truth is, I’m a bit of a show off. As part of my am-dram group, in particular, I love playing to the crowd, making people laugh, feeding off an audience. Those backstage moments can be terrifying, but when it all goes well, it’s the best kind of validation and a huge confidence boost.

So, if public speaking is a step outside the comfort zone for you, don’t be afraid to take that step. In the words of the motivational speaker Rob Brown, “If you can speak, you can influence. If you can influence, you can change lives.”

Money

IPS moves closer to £1bn AUM with Greenwood acquisition

Investment and wealth management firm IPS Capital has moved closer to £1bn of assets under management with the acquisition of Greenwood Financial Planning.

The acquisition of Saffron Walden-based Greenwood bolsters IPS’s financial planning services and enhances Greenwood’s investment management offering.

It also boosts IPS’s AUM to £950m.

Mike Passfield and Richard Mumford will remain partners of Greenwood, with Passfield becoming a partner of IPS.

IPS managing partner, Jonathan Blain, said: “We are delighted to have joined forces with Mike, Richard and the team.

“They have a solid, well managed business, providing great client outcomes.

“This is another step towards the next milestone of £1bn AUM, delivering a professional well-rounded service offering to our clients.

“We are proud that the firm remains 100% in the hands of the working partners with the culture that this engenders, allowing us to make selective transactions such as this and adopting the best from both sides.”

Passfield said: “We’ve got to know Jonathan and the team at IPS over a couple of years and have been impressed with their business and culture, putting client needs at the absolute centre of their business, in a similar way to us.

“Richard and I consider this an ideal fit and are really looking forward to working closely with them and continuing the growth of Greenwood.”

Money

Little-known way Universal Credit households can get a one-off payment from DWP of up to £812 to help pay the bills

CHRISTMAS is an expensive season and if you’re on benefits it can be really tough financially.

However there is help available in the form of a Budgeting Advance, which pays up to £812 for any one-off expense.

You’re eligible to claim if you’re on certain benefits, including Universal Credit and while you do have to repay it, there are no interest charges on the money you borrow.

This means it’s more cost-efficient than a bank loan or buying on your credit card and could come in handy if your fridge freezer or oven fails in the run-up to the big day.

Payments are deducted directly from your benefit and spread over two years, with repayment amounts agreed when your application is accepted.

Who is eligible for a Budgeting Advance?

If you receive Universal Credit, Income Support, Employment and Support Allowance, Pension Credit, or Jobseeker’s Allowance, then you could be eligible for a Budgeting Advance.

Your earnings must not have been above £2,600 (£3,600 for couples) in the past six months. Additionally you need to have been in receipt of your benefit for at least six months.

If you already have a Budgeting Advance you have yet to pay back, then you cannot take out a new loan.

You must also confirm you are able to afford the repayments as they will be taken directly from your benefits.

A Budgeting Advance can be used for a number of unexpected costs, including:

- A broken appliance such as a fridge or cooker

- Repairs to your home

- Moving costs

- Essential items

- Maternity expenses

- Work-related costs such as travel, or buying a uniform or tools

- Funeral expenses

How much can you borrow?

You can borrow up to £812 if you have children, £464 if you’re a couple and up to £348 if you’re single.

The minimum amount you can borrow is £100, however the actual amount agreed depends on how much you need.

Loans also depend on how much capital – money, investment, savings and some types of property – you have.

If you have more than £1,000 then the Budgeting Advance will be reduced by the amount over £1,000.

So for example if you have £1,300 the amount you could borrow would be cut by £300.

How to repay the Budgeting Advance

Repayments will be taken directly from your future Universal Credit or other benefit payments and you will be told how much they will be when your application is accepted.

You have up to two years to repay the advance and you’re still liable for repayments even if you no longer receive benefits.

If you start work you will be expected to repay the loan through your salary.

How to apply for a Budgeting Advance

You can apply for the Budgeting Allowance through your Universal Credit account, via the Universal Credit helpline on 0800 328 5644, or through your local Jobcentre.

You will be asked if you have any existing debt as the advisor will need to make sure you can afford the repayments and you will also be asked about any savings.

You should receive a decision on your application the same day.

There is no appeal if you’re turned down, but Citizen Advice says you can ask for your application to be looked at again.

If you can show your circumstances have changed this could help.

What can I do if I’m not eligible?

If you haven’t received your first Universal Credit payment and you need help with bills you can apply for an Advance Payment.

This can be up to 100% of your estimated first payment and you have up to two years to pay it back.

For claims due to a change in circumstances the repayment term is generally six months.

Repayments will be deducted from your first benefit payment then taken from subsequent payments until the advance is cleared.

You can apply for the Advance Payment through your Universal Credit account or through your Jobcentre Plus work coach. The Universal Credit helpline can also assist with your application.

The Advance Payment is a loan and you will be liable to repay it even if you stop claiming benefits, for example through your wages.

Repayments can be delayed in certain cases for up to a month for change of circumstance applications and up to three months for new claimants.

If you fail to keep up with repayments the Department of Work and Pensions could take them at source from your wages or contract a debt collection agency to collect the money.

Are there any alternative kinds of support available?

Cost of living support can help with utility bills, housing costs and NHS prescriptions.

Citizens Advice can also help with information on benefits you might be entitled to as well as help with budgeting and managing bills.

Are you missing out on benefits?

YOU can use a benefits calculator to help check that you are not missing out on money you are entitled to

Charity Turn2Us’ benefits calculator works out what you could get.

Entitledto’s free calculator determines whether you qualify for various benefits, tax credit and Universal Credit.

MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto’s data.

You can use Policy in Practice’s calculator to determine which benefits you could receive and how much cash you’ll have left over each month after paying for housing costs.

Your exact entitlement will only be clear when you make a claim, but calculators can indicate what you might be eligible for.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

FCA charges two brothers for insider dealing

The Financial Conduct Authority has charged two brothers for insider dealing.

Matthew and Nikolas West are jointly charged with conspiracy to deal in four stocks while having inside information.

Matthew West, 45, has additionally been charged with insider dealing in relation to two stocks.

While Nikolas West, 43, has been charged with dealing in those same two stocks based on that insider information.

The alleged offending took place between 2016 and 2020, and the West brothers made a profit of around £110,000.

They will appear at Southwark Crown Court on 31 October.

Insider dealing is a criminal offence punishable by a fine and/or up to 10 years imprisonment.

Money

Cheapest place to buy heated airers this week so you can keep your heating off and avoid tumble dryers – it’s not Asda

HEATED airers are one of the best products you can use to dry your clothes over winter without hugely increasing your energy bills.

The gadgets work by heating up metal bars which you wrap your garments round – and they cost just pennies per hour to run.

But, like with any product nowadays, there are so many on the market and it can feel a daunting task to figure out which one to buy.

So, we’ve done some of the hard work for you to find the cheapest models out there.

Of course, make sure you do your own research as you might find a cheaper alternative, particularly as we only looked at winged heated airers.

Websites like Price Spy let you search the internet for a range of products, filtering from the cheapest to most expensive.

Read more on Deals and Sales

You can try having a quick scan of the internet using Google‘s Shopping/Product tab as well.

Always read product reviews too so you know what you are getting for your money.

Here are the cheapest heated airers we found this week.

Aldi – £34.99

Discount supermarket Aldi’s £34.99 heated airer is always welcomed back by customers with open arms, and it is the cheapest we could find this week.

The retailer started re-stocking the gadget on September 19, so you’ll want to be quick as it typically flies off shelves.

Aldi’s heater costs roughly 6p an hour to run and can hold 10kg of washing, including towels and bedding.

If you want to buy one of the heated airers, you’ll have to head to your nearest Aldi branch as the retailer doesn’t do home deliveries.

You can find your nearest Aldi store by using the branch locator tool on its website.

George at Asda – £40

George at Asda‘s heated airer comes in at £40 – £5 more expensive than Aldi’s.

It is made of aluminium, comes with a 100-day warranty and has plenty of five star reviews on the Asda website.

The airer also has foldable arms which make it easy to pack away when you’re done drying all your bits.

Click and collect is currently unavailable on the product online, while delivery costs from £3.75.

Dunelm – £40

Dunelm shoppers can snap up this heated airer for the same price as Asda’s – £40.

The retailer says it costs just 5p an hour to run as well, which is 1p cheaper than it costs to run Aldi’s winged airer.

The airer has a 10kg washing limit with a combined 12 meters worth of bar space to hang your pants, socks and other clothes.

You can click and collect one for free from your local branch or delivery costs from £3.95.

You can find your nearest Dunelm branch by using its store locator.

Homebase – £40

Homebase has slashed the price on this heated airer from £60 to £40 – a 33% discount.

One massive perk is that it comes with a cover included, which helps lock in any heat produced to dry your clothes quicker.

It comes with 10.9metres of drying space across all the bars and can hold up to 10kg of your garments.

Bear in mind delivery will set you back a whopping £6 – although click and collect is free.

You can find your nearest Homebase branch by using the store locator tool on its website.

The Range – £37.99

The Range has slashed the price of this winged heated airer from £44.99 to £37.99, or you can buy one with a cover for £47.99 – an extra tenner.

It comes with foldable wings so you can store it away easily after use plus delivery is also free as well as click and collect.

You can find your nearest The Range branch by using its online store locator tool.

Bear in mind though, if you do want free delivery, you may have to wait over a week for it to arrive.

Robert Dyas – £39.99

Robert Dyas has discounted this heated airer by £7, putting it just under the £40 mark.

One advantage to the airer compared to the others we found is that it can hold 15kg worth of clothes making it slightly sturdier.

It also comes with 18 heated bars and a foldable rack making it easy to stash away.

Robert Dyas’ website is offering shoppers who enter a specific code free delivery too.

Or, you can try finding it in your local Robert Dyas store, by using the retailer’s store locator tool.

How to bag a bargain

SUN Savers Editor Lana Clements explains how to find a cut-price item and bag a bargain…

Sign up to loyalty schemes of the brands that you regularly shop with.

Big names regularly offer discounts or special lower prices for members, among other perks.

Sales are when you can pick up a real steal.

Retailers usually have periodic promotions that tie into payday at the end of the month or Bank Holiday weekends, so keep a lookout and shop when these deals are on.

Sign up to mailing lists and you’ll also be first to know of special offers. It can be worth following retailers on social media too.

When buying online, always do a search for money off codes or vouchers that you can use vouchercodes.co.uk and myvouchercodes.co.uk are just two sites that round up promotions by retailer.

Scanner apps are useful to have on your phone. Trolley.co.uk app has a scanner that you can use to compare prices on branded items when out shopping.

Bargain hunters can also use B&M’s scanner in the app to find discounts in-store before staff have marked them out.

And always check if you can get cashback before paying which in effect means you’ll get some of your money back or a discount on the item.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

The Best Rewards Credit Cards of October 2024

The NatWest Reward Credit Card is an excellent option if you want to earn rewards quickly on everyday spending. It’s designed for shoppers who like to be rewarded for their purchases, whether it’s through cashback, vouchers, or even charitable donations.

Key Features

- Earn up to 15% in rewards: Take advantage of occasional personalised offers where you can get up to 15% back at selected retailers.

- Flexible redemption: Redeem your points as cash, e-vouchers, or donate them to charity.

1% back at supermarkets

1-15% back at selected retailers

0.25% back on all other purchases, including supermarket petrol stations

- Unlimited rewards: There’s no cap on the number of rewards you can earn, meaning you’ll continue to benefit from every pound spent.

You can easily track and redeem your points through the NatWest app, which also helps you manage your account and see where you can spend your rewards.

Fees and Restrictions

The card comes with an annual fee of £24, but if you already have a NatWest Reward current account, the fee is waived, giving you more value without extra cost.

Why We Recommend It

We chose this card for its high reward percentages, especially for supermarket shopping and selected retailers. The ability to earn rewards across various categories makes it a standout option for everyday use.

Cashback vs. Reward Credit Cards: What’s the Difference?

A cashback credit card gives you a percentage of your spending back in cash, which is usually credited to your account. This is great for those who want extra money going straight into their account, this helps with paying off any outstanding balances too.

A reward credit card, like this Natwest one offers more variety as instead of just cash, you can earn points for cash, vouchers or even airline miles. This gives you an option if you don’t want to choose just one. These cards often come with higher earning potential through special offers or retail partnerships, allowing you to get more than just cash back.

Money

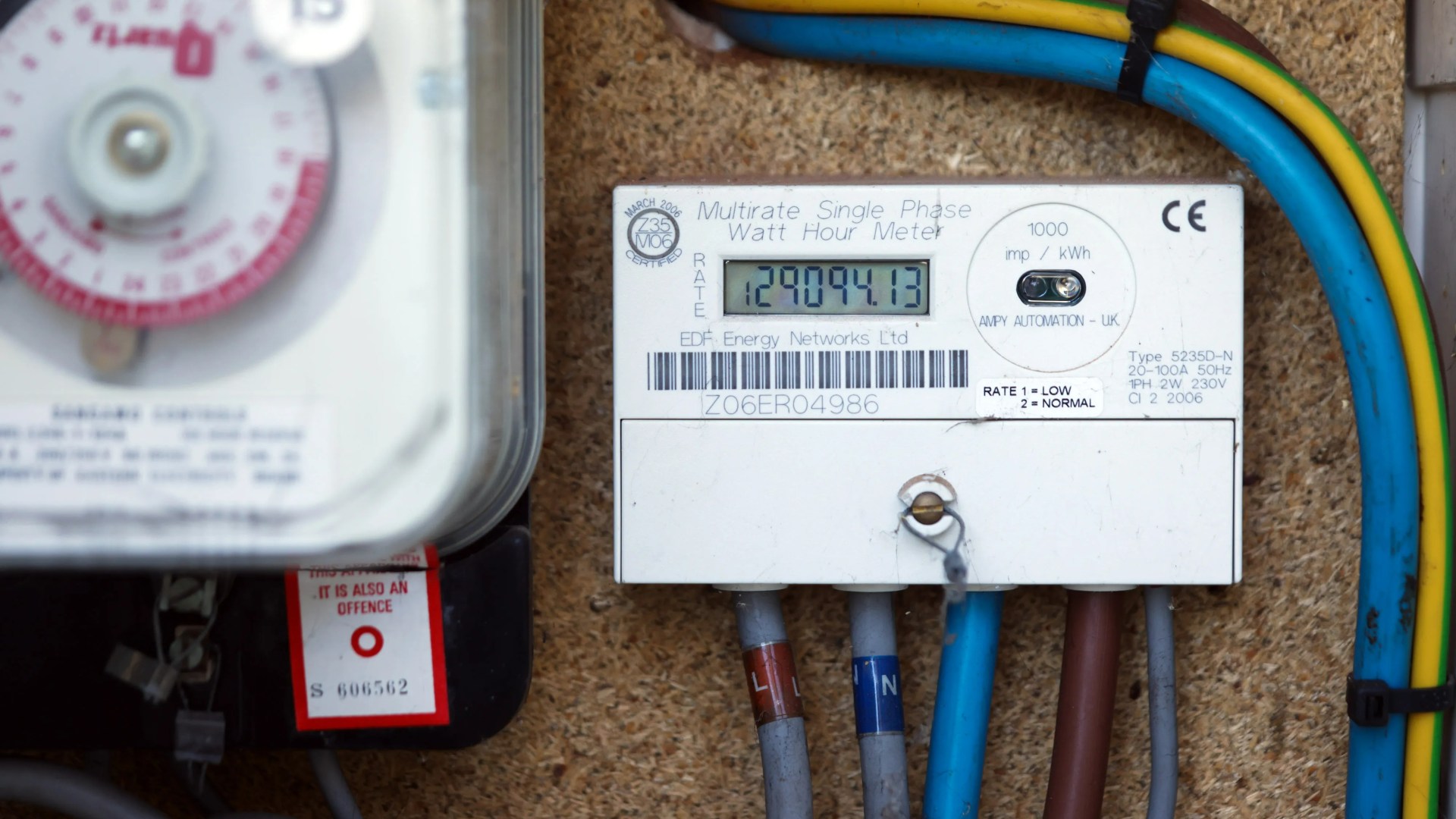

Major update for nearly 1million energy customers as meters set to go ‘dumb’

MORE than 800,000 households will have their energy meters replaced before the RTS network is switched off next summer.

Economy 7 and other multi-rate energy tariffs use these meters, which charge users different rates depending on the time of day.

These devices are operated through the Radio Teleswitch Service (RTS), which broadcasts a signal alongside the long-wave channel for BBC Radio 4.

This service is being turned off on June 30 2025 after the deadline was extended following coverage by The Sun last year.

The switch-off could lead to huge bill hikes for customers as they are no longer able to access cheaper energy rates.

Some homes, businesses and schools could even be left without heating or hot water.

Others may be unable to turn off their heating.

The only way to avoid facing these issues is for affected households to switch to a smart meter.

Customers who swap to a smart meter will still be able to access multi-rate energy tariffs including Economy 7.

What has been agreed?

Energy suppliers, Government and consumer groups have now pledged to work together to replace RTS meters before the switch off.

The ten energy companies who have signed up are British Gas, EDF, E.On, Octopus, Ovo, Scottish Power, So Energy, SSE, Total Energies, Utilita and Utility Warehouse.

Industry regulator Ofgem, trade association Energy UK, Distribution Network Operators, Smart Energy GB, Government and consumer groups will also be involved.

Through their Call To Action, the industry has pledged to:

- Focus their resources on regional “hot spots” where there are the most RTS customers

- Fast track RTS customers for meter upgrades

- Prioritise upgrades for customers who are known to be vulnerable

- Tackle any technical problems by sharing their knowledge and expertise

- Provide monthly updates on how many meters have been replaced

- Consider if further action is needed

The pledge will also speed up the rate at which RTS meters are replaced.

At the current pace, it would take until 2028 for all of the RTS meters across the UK to be upgraded.

How do I know if I have an RTS meter?

YOU’LL be able to tell if you have a meter that relies on the RTS quite easily.

The oldest RTS-powered meters have a switch box labelled “Radio Teleswitch” located next to the physical electricity meter.

Others may the RTS switch box included within the electricity meter as a single box on the wall.

If you’re unsure about the type of electricity meter in your home – call your supplier as they’ll usually have this information on hand.

What does it mean for me?

Customers who have an RTS meter, or those who are not sure if they have one, should contact their energy supplier for advice.

The supplier should then be able to make an appointment for an engineer to visit their home and check.

Energy companies have been contacting customers about the switch-off since 2023.

But under the new plans suppliers will contact all RTS customers by December 31 2024 to let them know that RTS will be shut down.

Households will also be told why it is important that their service is upgraded and they will be offered an appointment to have their meter upgraded.

It usually takes around two hours for an RTS meter to be upgraded but some cases may need more than one visit by an engineer.

Many properties with RTS meters are in rural areas or on islands.

What are the benefits of installing a smart meter?

Getting a smart meter does not cost anything as your supplier will install it for free.

Customers affected by the RTS switch-off will also not be charged.

Smart meters send readings to your energy supplier automatically, which means you do not need to do this yourself.

They can make your bills more accurate too as they are based on readings from your actual usage, rather than estimates.

The devices can help to track how much energy you use at night, during the day and at peak times.

You will be given an in-home display, which connects to your meter and shows your energy usage and the cost in pounds and pence.

Customers with RTS electricity meters that swap to a smart meter will still be able to access flexible electricity tariffs if they opt for one.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology2 weeks ago

Technology2 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 weeks ago

Science & Environment2 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

News2 weeks ago

News2 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum forces used to automatically assemble tiny device

-

News2 weeks ago

News2 weeks agoYou’re a Hypocrite, And So Am I

-

News3 weeks ago

the pick of new debut fiction

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy this is a golden age for life to thrive across the universe

-

Sport2 weeks ago

Sport2 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Technology6 days ago

Technology6 days ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNerve fibres in the brain could generate quantum entanglement

-

MMA6 days ago

MMA6 days agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Football6 days ago

Football6 days agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

News2 weeks ago

News2 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCardano founder to meet Argentina president Javier Milei

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMeet the world's first female male model | 7.30

-

Business6 days ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

News2 weeks ago

News2 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Business2 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoBest Exercises if You Want to Build a Great Physique

-

News2 weeks ago

News2 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Technology1 week ago

Technology1 week agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

News3 weeks ago

News3 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoEverything a Beginner Needs to Know About Squatting

-

News2 weeks ago

News2 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Toning Workout for Women

-

Travel1 week ago

Travel1 week agoDelta signs codeshare agreement with SAS

-

Servers computers1 week ago

Servers computers1 week agoWhat are the benefits of Blade servers compared to rack servers?

-

Science & Environment1 week ago

Science & Environment1 week agoX-rays reveal half-billion-year-old insect ancestor

-

Politics1 week ago

Politics1 week agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Business6 days ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

Technology6 days ago

Technology6 days agoThe best robot vacuum cleaners of 2024

-

Sport2 weeks ago

Sport2 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Technology2 weeks ago

Technology2 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoRethinking space and time could let us do away with dark matter

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBlockdaemon mulls 2026 IPO: Report

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Politics2 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News1 week ago

News1 week agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow one theory ties together everything we know about the universe

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business2 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Politics2 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoKeep Your Goals on Track This Season

-

TV2 weeks ago

TV2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News2 weeks ago

News2 weeks agoChurch same-sex split affecting bishop appointments

-

Politics2 weeks ago

Politics2 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology2 weeks ago

Technology2 weeks agoFivetran targets data security by adding Hybrid Deployment

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSingle atoms captured morphing into quantum waves in startling image

-

Politics2 weeks ago

Politics2 weeks agoLabour MP urges UK government to nationalise Grangemouth refinery

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

Business2 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

You must be logged in to post a comment Login