Money

What is Fintech?

What is Fintech?

Fintech is short for Financial Technology, a term which describes the technology used to simplify and improve financial services. This includes mobile banking, investing apps, cryptocurrency and more. Fintech was created to bring convenience to your everyday financial processes for businesses and consumers. Without knowing it, you have and are using fintech in your everyday finance management.

What does Fintech do?

Fintech is useful for businesses and consumers alike.

From payment solutions to investment platforms, fintech also makes financial services more inclusive by lowering barriers to access. For instance, many fintech applications offer no-fee bank accounts, fractional share investing, and peer-to-peer lending platforms, giving consumers more opportunities to grow their wealth.

For businesses

fintech tools can improve operational efficiency by automating payroll, invoicing, tax filing, and even financial forecasting. It enables companies to streamline their financial workflows, reduce administrative costs, and free up time for more strategic tasks.

For Consumers

Consumers benefit from fintech by having more control over their financial lives. With the rise of personal finance apps, users can track spending, set savings goals, and monitor investments in real-time. The tools provide a complete view of personal finances, helping individuals make informed decisions based on data-driven insights.

What is Fintech used for?

Fintech operates through apps on computers and phones, bringing financial services to us. This is used in various ways including…

Robo-Advisors – Helping people create investment portfolios based on their personal goals and risk tolerance. This offers affordable and simple wealth management solutions for consumers

Payment apps – Such as, PayPal, Venmo and Apple pay make it possible and easy for every to send, receive and manage money from our phones. There are various advantages of using PayPal. They eliminate the need for cash and checks for any payments including international.

Peer-to-peer lending – Platforms such as, LendingClub allow consumers to lend money to others without using banks as intermediaries. This can often provide both parties more favourable rates.

Investment apps – These platforms make is accessible for more people to start investing. They offer resources and advice for novice investors so that more people can grow their wealth. Find trading platforms you can use to start.

Cryptocurrency Apps – Blockchain, the primary technology for most cryptocurrencies, is a significant aspect of fintech, representing a reorganised way to conduct financial transactions outside traditional banking systems.

Examples of Fintech in Everyday life

Fintech has become a part of daily life for many consumers, even if they’re not aware of it. Here are a few common ways consumers interact with fintech:

- Mobile Banking – This convenience has transformed the way people interact with their banks, minimising the need for physical branches. These apps allow us to send, receive and manage our money instantly from our phones.

- Budgeting –. Budgeting apps have become a popular way to track your money and set saving goals you can stick to setting your priorities in place. These apps sync with your bank accounts and credit cards, offering a broad view of your financial health in one place. You can find free budgeting apps to help.

- Credit monitoring – Tools like Experian allow users to monitor their credit scores and reports so that they can keep on top of their records and know where they need to improve. With this you can find out the average score and where you fall within it.

Impact of Fintech on personal finances

Whether you’re using a simple payment app or diving into cryptocurrency trading, fintech brings the tools for managing your finances right to your device. Consumers now have access to tools that explain investment options, track spending habits, and create budgeting plans.

Money

‘Welcome move’ by government to end ‘double count costs’ for investment trusts: reaction

The investment sector has welcomed the news that that cost disclosure requirements for investment trusts will be temporarily banned.

The announcement, by the Treasury and the Financial Conduct Authority yesterday (20 September), comes following years of investment companies calling for change.

These rules were inherited by the European Union (EU) and made it appear that investment trusts were more costly to put money into than they were.

This is because the disclosure rule requires trusts to publish the costs of financing, operating and maintaining real assets.

However, many of these costs are already published in regular company updates and reflected in the value of the share price for all investment companies.

This created a “double counting of costs”, which investment trusts have long been saying has put investors off.

Although £15bn of new money went into investment trusts in 2021 alone, it is estimated the double counting rule was seeing £7bn a year in income being lost.

The Treasury said it will lay out legislation to provide the FCA with the appropriate powers to deliver reform – the new Consumer Composite Investments (CCI) regime.

It said the new CCI regime will deliver more tailored and flexible rules to “address concerns across industry with current disclosure requirements, including for costs.”

The UK’s new retail disclosure regime is expected to be in place in the first half of 2025, subject to Parliamentary approval and following a consultation from the FCA.

The FCA intends to consult on proposed rules for the CCI regime this Autumn.

The Association of Investment Companies (AIC) chief executive Richard Stone described it as “great news”.

He said the AIC has lobbied tirelessly on the issue and praised the Labour government for “acting so swiftly”.

Stone added: “Investment companies are a great UK success story and have a vital role in bridging the gap between private assets and public markets.

“Ending misleading cost disclosures will enable us to continue delivering for investors and make a critical contribution to the economy as the government drives forward its ambitions for growth, investment and wealth creation.”

Abrdn head of closed-end funds Christian Pittard said: “We welcome this move by government and the FCA to address unfair and distortive rules that have crippled investment trusts.

“With the FCA confirming that it will not take supervisory or enforcement action if a fund chooses not to follow the cost disclosure requirements, all eyes will now be on data publishers at a time when what the industry and investors really need is consistency.”

Pittard also labelled the UK investment trust sector “one of the jewels in the crown of the financial services industry.

This announcement came following research from Abrdn that revealed London listed closed-end infrastructure investment companies are on track for their first ever three-year gap with no primary capital raised.

Abrdn blamed this on a higher interest rate environment and the cost disclosure rules, with 2023 and 2022 both being fallow years for primary fundraising.

AJ Bell interim investments managing director Ryan Hughes agreed that this news will be “warmly welcomed by both the investment trust industry and broader market participants”.

Hughes added: “Investment trusts play a hugely important role both in the financial services sector and the wider economy as a provider of capital and the unintended consequences of the current legislation created an unequal playing field that put investment trusts at a disadvantage and threatened, in some cases, their very existence.

“The removal of this unnecessary barrier will help the investment trusts sector regain its footing and allow them to compete equally against other investment structures, which will put them back on the radar for investors who have been reluctant to use them given the cost disclosure requirements.”

In the week before the Treasury and the FCA made this announcement,

Money

Here's what the top 0.01% pay in taxes

CNBC’s Robert Frank reports on the ultra-wealthy’s tax bill.

Money

Family offices are the most bullish they’ve been in years, survey says

A version of this article first appeared in CNBC’s Inside Wealth newsletter with Robert Frank, a weekly guide to the high-net-worth investor and consumer. Sign up to receive future editions, straight to your inbox.

Family offices are the most bullish they’ve been in years, putting their cash to work in stocks and alternatives as the Fed starts to cut interest rates, according to a new survey.

Nearly all family offices, 97%, expect positive returns this year, and nearly half expect double-digit gains, according to Citi Private Bank’s 2024 Global Family Office Survey.

“This is the most optimistic outlook we’ve seen,” said Hannes Hofmann, head of the family office group at Citi Private Bank, which has been conducting the survey for five years. “What we’re clearly seeing is an increase in risk appetite.”

The survey is the latest sign that family offices — the private investment arms of wealthy families — are emerging from two years of hoarding cash and bracing for recession to start making more aggressive bets on market and valuation growth.

They especially like private equity. Nearly half, 47%, of family offices surveyed say they plan to increase their allocation to direct private equity in the next 12 months, the largest share for any investment category. Only 11% plan to reduce their PE holdings. Private equity funds ranked second, with 41% planning to increase their allocation.

With interest rates heading down, family offices are also regaining their appetite for stocks. More than a third, 39%, of family offices plan to increase their allocation to developed-market equities, mainly the U.S., while only 9% plan to trim their equity exposure. That comes after 43% of family offices increased their exposure to public stocks last year.

Public equities remain their largest holding by major asset class, with stocks making up 28% of their typical portfolio — up from 22% last year, according to the survey.

“Family offices are taking money out of cash, and they’ve put money into public equities, private equity, direct investments and also fixed income,” Hofmann said. “But primarily it’s going into risk-on investing. That is a very significant development.”

Fixed income has become another favorite of family offices, as rates start to decline. Half of family offices surveyed added to their fixed-income exposure last year — the largest of any category — and a third plan to add even more to their fixed-income holdings this year.

With the S&P 500 up nearly 20% so far this year, family offices are looking for 2024 to end with strong returns. Nearly half, 43%, expect returns of more than 10% this year. More than 1 in 10 large family offices — those with over $500 million in assets — are banking on returns of more than 15% this year.

There are risks to their optimism, of course. When asked about their near-term worries about the economy and financial markets, more than half cited the path of interest rates. Relations between the U.S. and China ranked as their second-biggest worry, and market overvaluation ranked third. The survey marked the first time since 2021 that inflation wasn’t the top worry for the family offices surveyed, according to Citi.

One of the big differences that sets family offices apart from other individual investors is their appetite for alternatives. Private equity, venture capital, real estate and hedge funds now account for 40% of the portfolios of the family offices surveyed. That number is likely to keep growing, especially as more family offices make direct investments in private companies.

“It’s a significant allocation that shows family offices are asset allocators who are long-term investors, highly sophisticated and taking a long-term view,” Hofmann said.

One of the biggest themes for their private investments is artificial intelligence. The family offices of Jeff Bezos and Bernard Arnault have both made investments in AI startups, and repeated surveys show AI is the No. 1 investment theme for family offices this year. More than half of family offices surveyed by Citi have exposure to AI in their portfolios through public equities, private equity funds or direct private equity. Another 26% of family offices are considering adding to their AI investments.

Hoffman said AI has already proven to be different from previous investment innovations such as crypto, and environmental, social and governance, or ESG. Only 17% of family offices are invested in digital assets, while a vast majority say they’re not interested.

“AI is a theme that people are interested in and they’re putting real money into it,” Hofmann said. “With crypto people were interested in it, but at best, they put some play money into it. With ESG, we’re finding a lot of people are saying they’re interested in it, but a much smaller percentage of family offices are actually really putting money into it.”

Money

Podcast: The art of putting things right

In this Weekend Essay, Amanda Newman Smith shares a personal story highlighting the importance of excellent customer service, especially when dealing with vulnerable clients. She contrasts negative experiences with a paint company and a clock supplier against a positive resolution with NatWest bank when assisting her elderly mother. This episode underscores the significance of empathy, clear communication, and proactive problem-solving in building trust and loyalty.

Money

Weekend Essay: The art of putting things right

I’ve always got a DIY project going on at home, so I’m a bit of a nerd when it comes to paint. There’s a textured paint that looks like stone, which I bought a while back to revamp my fireplace. This paint is fantastic, but pretty expensive. So when the company I ordered if from threw in the recommended natural bristle brush as a freebie, I was happy.

But when the paint arrived, there was no brush. Thinking it had been overlooked, I called the firm. I got through to one of the business owners who told me they’d run out. Fair enough, but it would have been nice to have been told. A simple ‘out of stock’ on the dispatch note would have done.

The free brush offer was also still listed on the website but when I pointed this out to the owner, she became defensive. This was just a small family-run business, I was told. The technology used to run the website couldn’t update these things automatically and they couldn’t afford an upgrade. They didn’t have the time to update these things manually either.

I love small businesses and I understand they don’t have it easy, but all this put me off as a customer. I tried to explain how this hadn’t created a good impression on me, a first-time customer, but it fell on deaf ears. I haven’t used this company since.

My experience with another small firm – an online business from which I’d ordered a glass clock – was so different. The owner had been let down on this by her European suppliers and was so apologetic and friendly that I was happy to wait for my order. I waited three months but in the end it needed to be cancelled due to the ongoing supply issues. I was disappointed, of course, but I was offered a discount on anything else I wanted from the website.

I mention those two contrasting experiences because of an experience I had recently while trying to help my mum with her banking. My mum is a younger pensioner and though still in the active retirement phase, she does have a few health issues that clip her wings. Like the hip pinning she had several years ago after slipping on some leaves. Walking long distances has got harder and she doesn’t drive.

When it comes to financial matters, the big problem is that my mum has never been comfortable talking on the phone about ‘official’ things. She gets nervous about what to say and doesn’t know how best to put things. And because she’s focusing on that, she doesn’t always take in what’s being said to her.

My dad used to deal with all that stuff and when he died, I started stepping in as I realised my mum needed a bit of help.

Requesting a new debit card for my mum from NatWest to replace one that had worn out should have been quick and easy. With mum and I both in the same room, GDPR should have been no problem to navigate. But everything about this call was painful and it took about 40 minutes.

My mum had lost her glasses and struggled when NatWest’s customer services agent insisted she read out her debit card number herself, as that was the required procedure. To tick that box, I had to read the number out to my mum, who then repeated it down the phone to the agent.

Then the agent discovered my mum’s phone number was out of date on the system and without that, she said there was nothing she could do. It was only when I asked whether the agent was aware of the Consumer Duty – to which I got no answer – and NatWest’s responsibilities towards vulnerable clients that we were passed to the over-60s helpline.

The agent there was brilliant but was still unable to send my mum a new debit card due to the out-of-date phone number. For that, mum was to visit a branch with some ID. It wasn’t ideal – the local branch has permanently closed and I’ve already explained mum’s difficulty with longer distances. Mum would potentially be left without access to cash because her debit card was unreliable. But at least we knew what to do.

When I got home, I decided to tell NatWest what had happened in an email. I was worried how my mum would have fared if she hadn’t had someone with financial services knowledge to speak up and get transferred to the over-60s helpline.

At this point, I have to give credit to NatWest. They swiftly apologised and started to investigate. Neil Wainwright, the firm’s customer protection manager, was amazing. He spoke to mum and me to get everything sorted without mum having to get to a physical branch. NatWest also gave mum some cash as a goodwill gesture and if we need anything else we just need to ask.

I told NatWest I was writing about our experience and asked for a response. A spokesman told me its staff are trained to recognise the differing needs of customers including vulnerabilities that may be present. “They have access to supportive guidance on how to help and can refer to the specialist teams we have available to support customers with more complex needs,” he said.

Customers can also tell the bank about any support they need through “Banking My Way”, a free service that can be used within its mobile app, online banking or by speaking to a member of staff.

But after listening back to our calls, NatWest acknowledged it let us down. “We had several opportunities throughout the discussion to give you both a better experience, including a missed opportunity to handover the call to Neil’s team,” the spokesman said. “As a result of your email we have arranged additional training to be given to the colleagues involved.”

All of us get it wrong sometimes – it’s the care and effort we take to put things right that really counts.

Money

As government plans Budget tax raids, remember AIM is more than just an IHT play

Ever since Labour stormed to victory in the general election, it has been making the case it has inherited a sluggish economy and a set of public finances in tatters.

Now, the latest GDP figures for the UK suggest the former isn’t strictly true, while the latter is arguably being used to lay the groundwork for potentially unpopular tax rises to be announced at the upcoming Budget in October in order to bolster those public finances.

Already Labour has tightened the belt with various allowances either being scrapped or put under consultation. This has led to much speculation about what could be next, with inheritance tax (IHT) being touted as one area ripe for raiding.

Removing this relief could raise £1.1bn in the current tax year, with this rising to £1.6bn by the end of the decade

In particular, some are suggesting business relief on AIM shares should be removed to help raise revenue. Currently, if you hold investments in qualifying AIM companies for at least two years before you pass away, the assets are passed on free of IHT.

The Institute for Fiscal Studies estimates removing this relief could raise £1.1bn in the current tax year, with this rising to £1.6bn by the end of the decade. Not a huge amount and won’t help too much in addressing the chancellor’s £22bn ‘black hole’ but sizeable nonetheless.

That said, in the lead up to the election and soon after, Labour made economic growth a priority. Given AIM’s bias towards UK small- and medium-sized growth companies, removing the IHT benefits would somewhat go against this.

Firstly, any changes would likely be consulted on, giving people time to shift strategies and move assets away from AIM and into other investments or vehicles for mitigating IHT.

Over the past 29 years, more than £135bn has been raised by over 4,000 companies on AIM

This would have the subsequent effect of dragging share prices of these growth companies lower and eroding value in the UK stock market – hardly a positive incentive at a time when UK capital markets are already under intense pressure.

AIM has been a fantastic proving ground for a number of companies and there are a number of success stories, despite recent performance struggles. Over the past 29 years, more than £135bn has been raised by over 4,000 companies on AIM. It may be home to small-caps, but it has been a mighty contributor to UK GDP growth, innovation and employment over the years.

You have companies such as Breedon Group, a construction company based in Leicestershire, which listed on AIM in 2010 before moving to the main market last year. There are household names, such as Jet2 and YouGov, which have flown the flag for AIM over the years. Meanwhile, we are seeing a spate of acquisitions of AIM companies as private equity and corporates recognise their value at what are fairly depressed levels.

Any removal of investor incentives could harm these companies providing popular and vital services but which remain at an early stage in their growth.

Quality companies, regardless of their size, have enduring characteristics

We are also at a juncture in markets where small-cap stocks have a great opportunity to outperform. Rate cuts are beginning to be implemented, inflation is seemingly under control and AIM is coming off a tough couple of years. The companies of the future need to be nurtured, and while not every company in AIM benefits from an IHT premium, the whole market will be hit indiscriminately as a result of any changes.

Given investing is for the long term, and business relief comes in after just two years, it reasons that a number of people are not invested in AIM solely for the purpose of mitigating an IHT bill. It is important the government remembers that when deciding its next steps.

For advisers and investors with exposure to AIM, the best thing to do right now is keep calm and carry on. AIM has its IHT benefits and these will not be taken away overnight, but careful planning will still be needed to mitigate the tax implications for clients.

Let’s hope the government agrees and gets behind its own growth agenda

Most importantly, though, investing in AIM should not be considered solely as an IHT play. It remains an exciting and intriguing investment opportunity, particularly for clients with longer time horizons, giving them access to quality and well known companies that have the potential to grow and perhaps join the main market one day.

Quality companies, regardless of their size, have enduring characteristics. AIM is home to a number of these companies, so it is important growth is not stifled but embraced. Let’s hope the government agrees and gets behind its own growth agenda.

Amisha Chohan is head of small-cap strategy at Quilter Cheviot

-

Sport1 day ago

Sport1 day agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

News2 days ago

News2 days agoYou’re a Hypocrite, And So Am I

-

Science & Environment1 day ago

Science & Environment1 day ago‘Running of the bulls’ festival crowds move like charged particles

-

News1 day ago

News1 day agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

CryptoCurrency24 hours ago

CryptoCurrency24 hours agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment1 day ago

Science & Environment1 day agoSunlight-trapping device can generate temperatures over 1000°C

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoCardano founder to meet Argentina president Javier Milei

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Science & Environment1 day ago

Science & Environment1 day agoQuantum ‘supersolid’ matter stirred using magnets

-

Sport1 day ago

Sport1 day agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Technology23 hours ago

Technology23 hours agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

Science & Environment1 day ago

Science & Environment1 day agoHow one theory ties together everything we know about the universe

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency1 day ago

CryptoCurrency1 day ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoBlockdaemon mulls 2026 IPO: Report

-

CryptoCurrency22 hours ago

CryptoCurrency22 hours agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Politics23 hours ago

Politics23 hours agoLabour MP urges UK government to nationalise Grangemouth refinery

-

News23 hours ago

News23 hours agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment2 days ago

Science & Environment2 days agoHow to wrap your mind around the real multiverse

-

Science & Environment2 days ago

Science & Environment2 days agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment1 day ago

Science & Environment1 day agoNuclear fusion experiment overcomes two key operating hurdles

-

CryptoCurrency1 day ago

CryptoCurrency1 day ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency1 day ago

CryptoCurrency1 day ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

CryptoCurrency1 day ago

CryptoCurrency1 day ago‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoMemecoins not the ‘right move’ for celebs, but DApps might be — Skale Labs CMO

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

Business24 hours ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Science & Environment2 days ago

Science & Environment2 days agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment2 days ago

Science & Environment2 days agoElon Musk’s SpaceX contracted to destroy retired space station

-

MMA1 day ago

MMA1 day agoUFC’s Cory Sandhagen says Deiveson Figueiredo turned down fight offer

-

MMA1 day ago

MMA1 day agoDiego Lopes declines Movsar Evloev’s request to step in at UFC 307

-

Football1 day ago

Football1 day agoNiamh Charles: Chelsea defender has successful shoulder surgery

-

Football1 day ago

Football1 day agoSlot's midfield tweak key to Liverpool victory in Milan

-

Science & Environment1 day ago

Science & Environment1 day agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 days ago

Technology3 days agoCan technology fix the ‘broken’ concert ticketing system?

-

Fashion Models24 hours ago

Fashion Models24 hours agoMiranda Kerr nude

-

Science & Environment2 days ago

Science & Environment2 days agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment1 day ago

Science & Environment1 day agoOdd quantum property may let us chill things closer to absolute zero

-

Science & Environment1 day ago

Science & Environment1 day agoRethinking space and time could let us do away with dark matter

-

Technology2 days ago

Technology2 days agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 days ago

Science & Environment2 days agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment2 days ago

Science & Environment2 days agoX-ray laser fires most powerful pulse ever recorded

-

Science & Environment2 days ago

Science & Environment2 days agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment1 day ago

Science & Environment1 day agoBeing in two places at once could make a quantum battery charge faster

-

Science & Environment1 day ago

Science & Environment1 day agoWe may have spotted a parallel universe going backwards in time

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoArthur Hayes’ ‘sub $50K’ Bitcoin call, Mt. Gox CEO’s new exchange, and more: Hodler’s Digest, Sept. 1 – 7

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoTreason in Taiwan paid in Tether, East’s crypto exchange resurgence: Asia Express

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoLeaked Chainalysis video suggests Monero transactions may be traceable

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoAre there ‘too many’ blockchains for gaming? Sui’s randomness feature: Web3 Gamer

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoCrypto whales like Humpy are gaming DAO votes — but there are solutions

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoHelp! My parents are addicted to Pi Network crypto tapper

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment1 day ago

Science & Environment1 day agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Science & Environment1 day ago

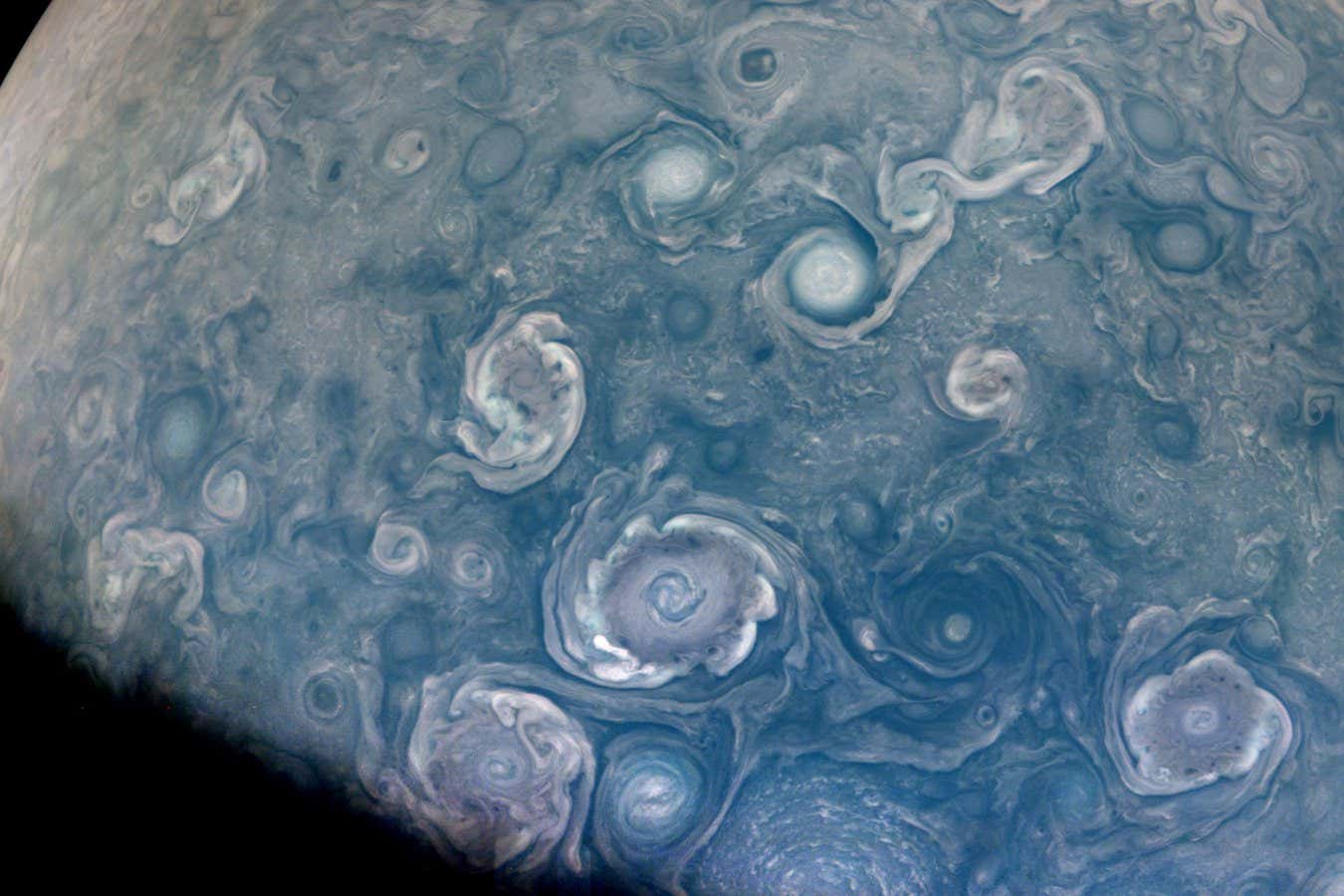

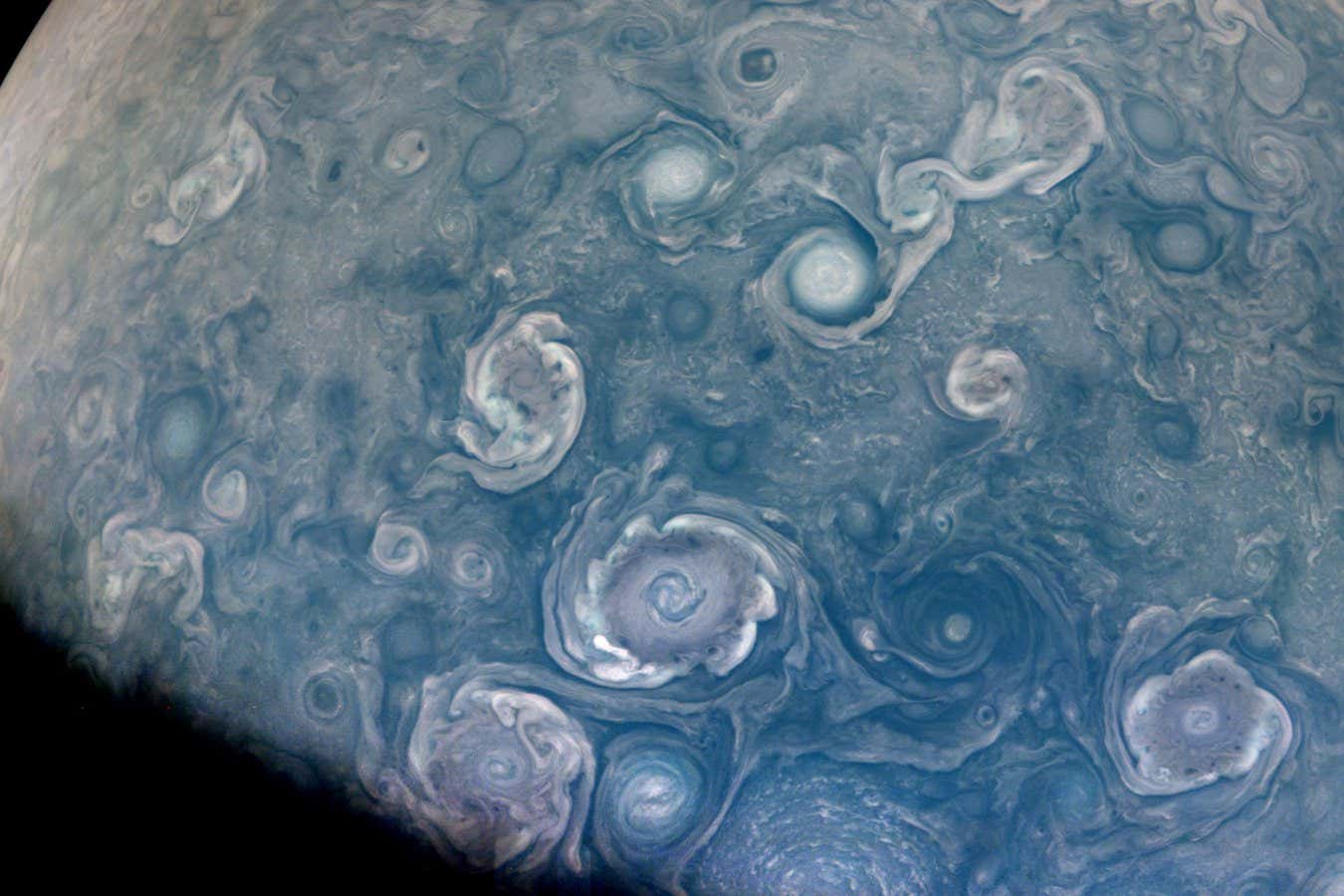

Science & Environment1 day agoJupiter’s stormy surface replicated in lab

-

Science & Environment1 day ago

Science & Environment1 day agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoFed rate cut may be politically motivated, will increase inflation: Arthur Hayes

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoBinance CEO says task force is working ‘across the clock’ to free exec in Nigeria

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoElon Musk is worth 100K followers: Yat Siu, X Hall of Flame

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency1 day ago

CryptoCurrency1 day agoBitcoin bull rally far from over, MetaMask partners with Mastercard, and more: Hodler’s Digest Aug 11 – 17

-

CryptoCurrency1 day ago

CryptoCurrency1 day ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

Business1 day ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics1 day ago

The Guardian view on 10 Downing Street: Labour risks losing the plot | Editorial

-

Politics24 hours ago

Politics24 hours agoI’m in control, says Keir Starmer after Sue Gray pay leaks

-

Politics24 hours ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News23 hours ago

News23 hours ago“Beast Games” contestants sue MrBeast’s production company over “chronic mistreatment”

-

News23 hours ago

News23 hours agoSean “Diddy” Combs denied bail again in federal sex trafficking case in New York

-

News23 hours ago

News23 hours agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

News23 hours ago

News23 hours agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency22 hours ago

CryptoCurrency22 hours agoBitcoin options markets reduce risk hedges — Are new range highs in sight?

-

News1 day ago

News1 day agoChurch same-sex split affecting bishop appointments

-

Politics3 days ago

Politics3 days agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Politics2 days ago

Politics2 days agoKeir Starmer facing flashpoints with the trade unions

-

Health & fitness3 days ago

Health & fitness3 days agoWhy you should take a cheat day from your diet, and how many calories to eat

-

Technology1 day ago

Technology1 day agoFivetran targets data security by adding Hybrid Deployment

-

News1 day ago

Freed Between the Lines: Banned Books Week

-

Science & Environment1 day ago

Science & Environment1 day agoHow to wrap your head around the most mind-bending theories of reality

-

Fashion Models24 hours ago

Fashion Models24 hours ago“Playmate of the Year” magazine covers of Playboy from 1971–1980

-

News4 days ago

News4 days agoDid the Pandemic Break Our Brains?

-

Science & Environment1 day ago

Science & Environment1 day agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Health & fitness2 days ago

Health & fitness2 days ago11 reasons why you should stop your fizzy drink habit in 2022

-

Science & Environment1 day ago

Science & Environment1 day agoHow Peter Higgs revealed the forces that hold the universe together

-

Science & Environment1 day ago

Science & Environment1 day agoQuantum forces used to automatically assemble tiny device

-

Entertainment23 hours ago

Entertainment23 hours ago“Jimmy Carter 100” concert celebrates former president’s 100th birthday

-

Business3 days ago

Business3 days agoDangers of being a FOMO customer as rates fall

You must be logged in to post a comment Login