Money

What the clocks going back mean for workers – and whether you’ll be working an extra hour for free

MILLIONS will enjoy an extra hour in bed as the clocks go back in the early hours of Sunday morning.

British Summer Time (BST) ends at 2am on October 27, when the time reverts back an hour to 1am.

When the clocks go back, we transition into Greenwich Mean Time (GMT).

This change results in more daylight in the mornings but also brings darker evenings.

Below, we outline the rules surrounding working hours during the clock change and clarify your rights in such situations.

Will I have to work an extra hour?

This will all depend on how your employment contract is worded.

For example, if it says you have to work specific times, such as 12am to 8am, you will likely have to work the extra hour.

However, if it states the number of hours you should work, for example, an eight-hour shift, you should be allowed to finish an hour early.

Will I get paid for working an extra hour?

If you’re among the unlucky few who have to work the extra hour, whether you’ll receive additional pay depends on how you are typically compensated.

If you’re paid by the hour, you should get some extra money for working longer.

However, if you are salaried or paid a day rate, your employer is not obligated to pay you more than usual.

The exception to this is if the extra hour pushes your equivalent hourly wage below the national living wage, which is £11.44 per hour for workers over 23.

To calculate this, divide the amount you’re being paid for the shift by the number of hours you’ve worked.

If you’re asked to work extra for no pay, double-check to ensure you won’t be dipping below the minimum legal requirement.

You can also report your employer to HMRC.

Even if you’re not entitled to extra pay, for instance, because you’re on a salary and earning more than minimum wage, it’s worth flagging the issue to your employer.

Your company might ask you to start an hour later or let you leave an hour earlier. Or it might offer to pay you overtime for the extra hour.

Why do the clocks change?

CLOCKS change twice a year, in Spring and Autumn, but why?

The concept of changing the clocks first arrived in Britain in 1907, when William Willett, the great-great-grandfather of Coldplay lead singer Chris Martin, self-published a pamphlet called “The Waste of Daylight”.

A year after Willett’s death, in 1916, Germany became the first country to adopt daylight saving time.

The UK did the same a few weeks later, along with other nations involved in the First World War.

British Double Summer Time was temporarily introduced during the Second World War, with clocks kept one hour in advance of Greenwich Mean Time to increase productivity.

Since the war, Britain has operated under British Summer Time except for between 1968 and 1971 when the clocks went forward but were not put back.

What are night workers’ rights?

You are already entitled to certain rights if you work night shifts, according to the Working Time Regulations.

You are classed as a night worker if you work at least three hours through the night, usually in the period between 11am and 6am.

If you do night work, you should not have to work more than eight hours in a 24-hour period. This is usually calculated over a 17-week period.

Regular overtime is included in this average, and workers cannot opt out of this limit.

Because of the health impacts of nighttime working, your employer must offer you a free health assessment regularly.

You also have a right to breaks.

You are allowed at least one uninterrupted 20-minute break if your shift is longer than six hours.

You must also have at least 11 consecutive hours’ rest in any 24-hour period and one day off each week or two consecutive days off in a fortnight.

Money

Marks and Spencer is making an incredible change across 180 stores that will revolutionise clothes shopping

MARKS and Spencer is kitting its changing rooms out with self-checkouts to prevent shoppers from having to queue twice.

The high-street giant is planning to roll-out self-service tills in 180 of its clothing stores by early 2028.

It comes despite warnings from M&S chairman Archie Norman that theft is “creeping” among middle-class shoppers due to faulty self-checkouts.

The retailer’s operations director Sacha Berendji insisted staff will be present in fitting areas to make sure customers don’t leave without paying for their items.

He told The Telegraph: “We’d like customers to be able to walk straight into the fitting room with no queue, try on what they’ve chosen, then pay there and just walk out…”

He added: “Shoplifting is a major problem in this country, but there are things that we’re all doing to mitigate some of those losses.”

The new kiosks have already been introduced in 28 recently revamped stores.

Similar such is used elsewhere in the world, including Australia.

Department store Kmart Southland in Melbourne is trialling technology which identifies clothes taken into a fitting room and displays them on a screen, reports the Sidney Morning Herald.

Customers can then scan a QR code for the details and the price.

It also allows customers to request different sizes or colours from their changing cubicle.

Over the last 18 months, M&S has opened 31 new stores, while also spending tens of millions of pounds refurbishing 45 existing in London and the South West.

Larger self-service conveyor belt checkouts operated by staff will also have self-scanning tech for trolley shops.

The Fosse Park store has already seen four of its 10 staff-operated conveyor belt checkouts replaced with six new self-service versions.

All across the high street, self-checkout stations are being installed at retail shops, with Marks & Spencer, Primark and Zara some of the earliest adopters, The Telegraph reported previously.

That’s despite supermarkets, including Waitrose, Morrisons and Asda, reigning in their usage.

In the US, self-service checkouts are removing them at Target stores amid shoplifting concerns.

M&S opening first-of-its-kind store as part of a new trial

MARKS and Spencer is making a huge change by opening a first-of-its-kind store as part of a new trial.

The iconic British retailer is opening its first-ever clothing-only shop in the Autumn.

For nearly 100 years, M&S has sold both clothing and fresh produce.

While M&S has operated standalone food stores since 1987, it has never sold clothes in standalone stores.

However, a recent boost in fashion sales has driven the company to trial its first clothing-only store.

The shop will be located in London’s Battersea Power Station and will open to shoppers in November.

The new store will feature a curated selection of women’s and men’s clothing, focusing on premium lines and beauty products.

M&S chief executive Stuart Machin said the trial store would “showcase the best of M&S clothing and beauty at outstanding value”.

The shop will include items like lingerie, £99 cashmere jumpers, and pieces from the trendy Autograph line.

The new M&S store at Battersea is expected to create an estimated 30 new jobs, and recruitment was due to start in September.

If this trial proves successful, M&S plans to open more clothing and beauty stores across the UK.

The new store will co-exist with M&S’s existing food hall at the Power Station, which opened in 2022.

Money

I’m giving away my £100,000 lottery win to ALL my work colleagues – people ask me why & I tell them the same thing

A LOTTERY winner has vowed to give his staff a bonus after scooping £100,000.

Kind-hearted Chris Dell broke down in tears as he pledged to handover £1,000 to each of his 10 employees from his People’s Postcode Lottery winnings.

The self-storage firm owner, from Chesterfield, Derbyshire, said: “I’m going to treat the staff at work, especially with that amount because we’re a close team and it would be nice to put a smile on their faces.

“We’ve got 10 people in the team and £10,000 of it will go to them.

“They’ll get £1,000 each. People might say, ‘Why would you do that?’ It’s because we are a team.

“The team that we have helps grow the business and I’d like to think if you look after the company, the company will look after you.”

Chris celebrated his windfall with 17 neighbours in Chesterfield after S41 8QT bagged the weekly Millionaire Street prize.

Every ticket is worth £50,000 but Chris and neighbour Tracey Moulton doubled their prizes with two tickets.

Stunned Chris said: “I don’t think I’m greedy – if I get lucky then I always think you should make someone else smile.

“Spread that love, spread that happiness. Let’s not be greedy and share it.

“It’s nice to know that local charities will be helped as well. With that amount that can mean such a lot to a lot of charities.

“I’m absolutely over the moon. I haven’t really slept since I got told I had won something.

“I’ll take a few friends out for a nice meal – an Indian or a steak and a bottle of champagne. I might have a headache tomorrow.”

Chris also plans to treat himself to a holiday “somewhere nice and warm”.

“Most probably Benidorm,” he said. “My best friend lives in France and he’ll be coming too.”

Meanwhile, Tracy explained she joined Postcode Lottery after husband Mark’s ex-wife won £25,000 seven years ago in nearby Hollingwood, Derbyshire.

And she signed up for a second ticket two years ago when the mother-in-law of one of Mark’s daughters doubled her £30,000 prize to £60,000 with two tickets in Old Whittington, less than three miles away.

Now the communications support worker, who works with the deaf, has completed the family golden triangle with her £100,000 windfall.

Excited Tracy said: “Oh my God… We can’t even win on a tombola.”

Tracy and Mark share seven children and two grandchildren.

The couple shared a kiss after being left gobsmacked when they pulled their cheque from their golden envelope.

Tracy said: “Our lives have just changed totally in five minutes because we’ve won.

“I kept saying to everyone that I was saving myself for a big win. This is once-in-a-lifetime.”

How to play the People’s Postcode Lottery?

For just £12 a month, players can sign up through the official website to have a chance of winning millions of pounds.

Once signed up, players are automatically entered into every draw and prizes are announced every day of each month.

Tickets play for the Daily Prize, worth £1000 and revealed every single day.

Tickets could also win a jackpot of £30,000 for Saturday and Sunday’s Street Prize draws.

People’s Postcode Lottery also offers a £3million Postcode Millions draw each month – where your ticket plays for a share of the cash prize fund.

Winners are notified by email, text, post, or phone call, depending on the prize they win.

Jackpot winners are visited by the lottery team in person.

Money

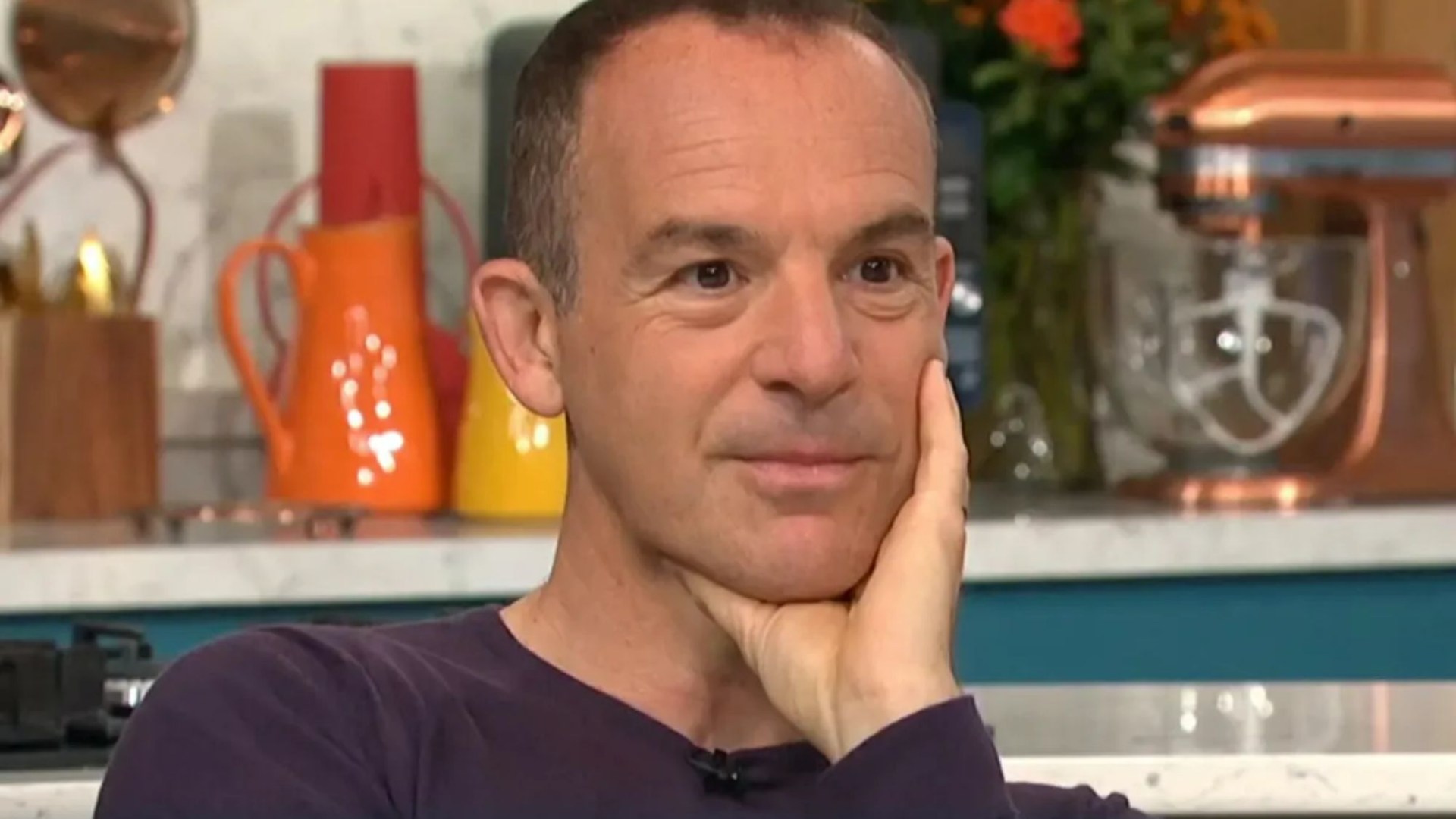

I slashed essential bill in HALF thanks to Martin Lewis tip – here’s 3-week deadline everyone should know

Brits could reduce essential bills by as much as half using an easy Martin Lewis “three-week deadline” trick.

Millions could save hundreds every year with a quick web search.

Car insurance premiums are at record levels amid the spiralling cost of living crisis.

Some motorists have reported massive year-on-year hikes in their bills, with some seeing costs bumped up two or three-fold.

And things could get even worse based on rumoured changes to insurance premium tax in the upcoming Budget.

Fortunately, Martin Lewis has shared a simple hack you can use to beat the price spikes and keep bills manageable.

Each year, thousands of drivers allow their insurance policies to renew automatically, rolling over to the next year with their current provider.

But Martin revealed that this is actually the worst way to handle a renewal and often leads to higher bills.

Instead, he urged car owners to manually renew – and explained exactly when to do so.

Speaking on his ITV show, the personal finance whizz said: “If you are near your renewal, getting quotes three weeks before may half the cost.

“We ran 18 million quotes, it starts to drop at around 30 days, you get into the sweet spot around three to four weeks before.

“It bottoms out on average at day 23, and then the prices just start to rise and rise and rise.

“Everyone needs to get in their diary that 23 days before renewal because that’s the sweet spot.”

This is largely due to the way that insurers assess risk in clients.

Drivers who take the time to renew and research the best quotes are generally seen as more organised and less risky than those who auto-renew, Martin explained.

And it seems to really work as fans flooded the MSE boss with success stories.

One said the trick had brought their quote down from £1,500 to £650.

And a second claimed that he had managed to take the sting out of an £800 increase to his premium by reclaiming £618.

Just bear in mind that Martin recommended shopping around as much as possible when you come to renew to find the best deal – even if it means changing insurer.

You can use the Compare+ tool on the MSE website to get an aggregate of the most attractive offers from major comparison sites.

Money

Iconic 90s chain with over 120 locations announces closure of ‘only toy shop within miles’ leaving shoppers gutted

AN iconic 90s chain with more than 120 sites in the UK has announced the closure of “the only toy shop within miles” as shoppers are left gutted.

Smyths Toys in Salisbury, Wiltshire, will close for good in January.

The branch, on the Churchill Way West Retail Park, will become a new Lidl supermarket.

HomeSense, which is based next door will also “vacate the site,” according to a planning application for the new Lidl outlet, who have confirmed plans for the supermarket.

Smyths posted a statement on social media, saying: “It is with deep regret that we announce the closure of our Smyths Toys Superstores location in Salisbury, effective January 2025.

“This decision was not made lightly, and we want to express our heartfelt gratitude to our dedicated staff and loyal customers who have supported us over the years.

“We understand the impact this may have on the community and will do everything possible to ensure a smooth transition for our employees.

“As we approach the closure date, we invite our customers to visit us this Christmas to enjoy our range of toys and games.

“Thank you for being a part of the Smyths Toys family in Salisbury.

“We appreciate your understanding during this difficult time.”

Fans of the toy brand were gutted to hear the news.

One person wrote on a local Facebook group page: “I hope not we need Smyths as it’s the only toy shop in Salisbury.”

Another said: “Great. Just great. The only toy shop within miles replaced by another supermarket.”

While a third added: “Noo! We use Smyths and HomeSense all the time!!!”

A fourth person simply posted: “No, no, no……!!!!!!!!!”

A planning application was previously submitted to Wiltshire Council to make changes to units 1 and 2 of the retail park in order to accommodate the Lidl store.

Urban Edge Architecture, on behalf of Schroders Real Estate Investment Management, said reconfiguring the units, along with work to the car parking areas and service yard at the back, were necessary to bring the budget store to the site.

Lidl has confirmed the plan, with the new supermarket being the chain’s second store in Salisbury with one already in Hatches Lane.

Lidl said the need for a second was “driven by growing local demand for the discounter’s high-quality, affordable products”.

How to bag a bargain

SUN Savers Editor Lana Clements explains how to find a cut-price item and bag a bargain…

Sign up to loyalty schemes of the brands that you regularly shop with.

Big names regularly offer discounts or special lower prices for members, among other perks.

Sales are when you can pick up a real steal.

Retailers usually have periodic promotions that tie into payday at the end of the month or Bank Holiday weekends, so keep a lookout and shop when these deals are on.

Sign up to mailing lists and you’ll also be first to know of special offers. It can be worth following retailers on social media too.

When buying online, always do a search for money off codes or vouchers that you can use vouchercodes.co.uk and myvouchercodes.co.uk are just two sites that round up promotions by retailer.

Scanner apps are useful to have on your phone. Trolley.co.uk app has a scanner that you can use to compare prices on branded items when out shopping.

Bargain hunters can also use B&M’s scanner in the app to find discounts in-store before staff have marked them out.

And always check if you can get cashback before paying which in effect means you’ll get some of your money back or a discount on the item.

A spokesperson said the store will feature a sales area of 1,453sq m, including a bakery and ‘Middle of Lidl’ aisle.

There will also be customer toilets with baby-changing facilities and ample parking.

A spokesperson added: “It will also create around 40 new jobs in the area with new starters benefiting from some of the highest pay rates in the sector.”

It comes after Smyths fans were raving after a savvy shopper spotted an amazing discount code that helps parents get £10 off Christmas presents.

Smyths has more than 100 stores across the UK and you can find your nearest one by using the locator tool on its website.

It comes after Aldi and Lidl have confirmed the relaunch of their popular wooden toy range with prices starting at just £1.99.

And shoppers will be pleased to know one of Britain’s favourite bargain stores will be extending its opening hours to help shoppers over the Christmas period.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

We live in UK’s ‘Hollywood Hills’ where homes cost £25MILLION – we bump into Premier League aces & rock stars at shops – The Sun

RESIDENTS living in the “Beverly Hills of Surrey” can buy Gucci sandals in their local charity shop and pheasant and partridge at the butchers.

The posh commuter town of Weybridge, just eight miles to the south west of London, is one of the most desirable places to live in Britain.

On average, houses in the leafy Surrey town cost an incredible £741,000, with the most expensive currently on the market for a whopping £25 million in the highly desirable private St Georges Hill area.

The gated estate, which is considered to be the most exclusive private residential address outside of London has been home to dozens of celebrities over the years.

Famous faces include the likes of John Lennon, Elton John, Cliff Richard, Tom Jones, Ringo Starr and John Terry.

Posh residents have manned security on the main gates, with the estate boasting its own golf course, pickleball courts and tennis club, which has a membership fee of around £1,728.

Grant Letts, manager of Curchods estate agents, based in part of 17th century Portmore House in the High Street, said the average cost of houses on his books is £8 to £10 million.

“My most expensive house at the moment is £25 million in St George’s Hill,” he said.

The town, which is popular because of its beautiful location in rolling hills next to the River Wey, yet just a 30 minute train ride to London, has plenty of luxurious boutiques to cater for its millionaire residents.

Mahyar Godwin opened beautiful clothing store, Piajeh, 26 years ago and imports impressive pieces from all over the world, including America and Europe.

One of the items she shows off is a stunning pink Camilla dress from Australia for £800. “I have lots of clients who keep coming back,” she says.

Even the Cancer Research shop in the High Street understands its clientele.

A pair of £110 Gucci sandals were spotted on display in the window, alongside a collection of Wedgewood Chester soup bowls and terrines for £250.

The local pawnbrokers is also ridiculously high end, with a collection of luxurious Chanel, YSL and Prada handbags in the window for thousands of pounds.

Prestige Pawnbrokers, which features in the Channel 4 documentary Posh Pawn, has an exclusive Hermes Mini Lindy handbag on sale for £6,995 and a Chanel handbag for £5,995.

Nearby, Daniel Mark has been running Hollywood Hair for 17 years and says he has a large number of “wealthy clients” on his books.

The beautiful art deco salon is decorated like an A-lister’s Hollywood dressing room and offers unique one-to-one hairdressing.

The town’s rich residents can also find plenty of posh nosh, with award-winning Bachmanns Patisserie selling boxes of 30 handmade chocolates for £42.50, large luxury cakes for £32 and chocolate champagne bottles for £26.

The shop, which has been in Church Street for 15 years, even offers luxury bread, with a Swiss Zopf loaf on sale for £5.

Nearby, Valentina Deli and Wines has an incredibly impressive selection of rare and unusual cheeses, including Buffalo Camembert for £9.95 and three types of truffle cheese.

Manager Carmine Macari keeps the deli well stocked with a huge variety of luxurious Italian foods and wines, including truffle Dijon mustard and £295 bottles of red Barolo wine.

The store even sells a special pan for roasting chestnuts over a fire.

“I love coming here in my lunch break and the sandwiches are delicious,” said Tom Hodges, who works for a pharmaceutical distributor in Weybridge.

“It’s nice to bring clients here when they come to visit. Weybridge has such a great high street, it’s got a lot to offer.”

Our streets are full of supercars worth £1.2MILLION driven by Premier League stars & celebs

BY IAN LEONARD

RESIDENTS in a posh village say their high street is crammed with so many expensive supercars it looks like a car showroom.

Alderley Edge is part of Cheshire’s ‘Golden Triangle’ – an affluent area of small towns and villages which also includes Wilmslow and Prestbury.

Luxury vehicles like the Ferrari F40 – with around £1.2million – are a common sight in Alderley.

Set in glorious countryside, the area is known for its expensive homes, high-end shops and upmarket bars and restaurants.

It is popular with wealthy Premier League footballers and celebrities, and has earned a reputation as a millionaire’s playground and a place to see and be seen.

London Road, running through the centre of Alderley Edge, is frequently lined with millions of pounds worth of Lamborghinis, Ferraris and Bugattis as well as luxury 4X4s and other cars.

Read the full story here.

Money

Huge update issued on legal fight which could see winter fuel payments return for millions – and it’s good news

THE likelihood of winter fuel payments returning for millions has increased following the approval of a legal challenge.

With the help of the Govan Law Centre (GLC), two Scottish pensioners have been allowed to continue their proceedings against the UK and Scottish government’s decision to cut the benefit.

If successful, more than 10 million households that have lost the annual top-up of up to £300 could see the help reinstated.

In the past, the winter fuel payment was available to everyone aged 66 and above.

However, after Labour’s election victory, Chancellor Rachel Reeves introduced cuts limiting winter fuel payment eligibility to those on pension credit or other means-tested benefits.

The decision led to the Scottish Government to follow suit.

In response, pensioners Peter and Florence Fanning raised a judicial review at Scotland’s highest court, the Court of Session, asking it to rule on whether the decision was unlawful last month.

Govan Law Centre said the permission to proceed, which was granted by Lady Hood in Edinburgh on Thursday, means the case has been assessed as having “a real prospect of success”.

If the cuts are found to be unlawful, the petitioners could ask the court to set aside the policy and restore the winter fuel payment to all.

However, there’s still no guarantee that such legal action will succeed.

A spokesperson for Govan Law Centre said: “Our clients are delighted that the court has granted permission for their judicial review challenge to proceed to a full hearing in early January.

“We await a decision on civil legal aid from the Scottish Legal Aid Board early next week in relation to the proceedings.

“If civil legal aid is granted we will then submit an urgent application for sanction for the employment of both junior and senior counsel and will announce our final legal team in early course.”

A procedural hearing has been assigned for December 4, with a substantive one-day hearing fixed for Wednesday, January 15.

A UK Government spokesperson said: “We are committed to supporting pensioners, with millions set to see their state pension rise by up to £1,700 this Parliament through our commitment to the triple lock.

“Over a million pensioners will still receive the winter fuel payment, and our drive to boost pension credit take-up has already seen a 152% increase in claims.

“Many others will also benefit from the £150 warm home discount to help with their energy bills over winter.”

What does the case argue?

The case rests on the accusation that both governments failed to adequately consult with those of pension age on the change and did not release an equality impact assessment on the changes.

The GLC claims that the government did not adhere to the requirements of the Equality Act 2010.

According to the Act, public bodies are obligated to consider how their decisions and actions will impact individuals with various “protected characteristics”, such as age and disability.

However, on September 13, the DWP did release its own equality impact assessment on target winter fuel payment, after receiving a Freedom of Information request on the matter.

In response to the request, the DWP said: “The government has followed its legal and statutory duties before introducing these changes and will continue to do so.”

But, GLC claims that there was no “proper assessment” and that the research included in the impact assessment was inadequate.

Separately, the GLC also argues that the government had a legal duty to consult people of state pension age about the changes but failed to do so.

Will it succeed?

These court battles can often take many months, if not years and the chances of reaching a verdict before the winter is very slim.

However, if the Court determines that the government failed to meet its obligations under the Equality Act 2010 or consult pensioners properly, the decision to limit the payments could be deemed unlawful.

In such a case, the Court could annul the regulations that implemented the changes and mandate the Government to conduct a comprehensive impact assessment.

This would revert the situation to its state before the policy was introduced, and winter fuel payments could be reinstated for all pensioners.

Again, the likelihood of this happening before winter is low.

It’s not the first time people have challenged benefit rules.

Back in April 2021, two Brits launched a claim against the DWP on behalf of the 1.9million households on legacy benefits who did not receive a £20 a week uplift given to those on Universal Credit during the pandemic.

They argued that those on legacy benefits should have been granted the same uplift.

However, the court ruling that followed in February 2022 dashed hopes of a payout that could have been worth £1,500 in backdated benefits.

How have winter fuel payments changed?

Winter fuel payments are now limited to retirees on pension credit or those receiving certain other means-tested benefits.

Only individuals claiming the following benefits will be eligible for a winter fuel payment this year:

- Pension credit

- Universal Credit

- Income support

- Income-based jobseeker’s allowance (JSA)

- Income-related employment support allowance (ESA)

- Child tax credit

- Working tax credit

To be eligible for this year’s payment, you must have an active claim for the benefits mentioned above during the “qualifying week,” which runs from 16 to 22 September (this week).

Most households automatically receive the winter fuel payment, including those on pension credit.

Over 800,000 households are thought to be missing out on pension credit, which unlocks their eligibility for this year’s winter fuel payment.

If you don’t apply for this year’s payment by the end of the week, you might assume that you won’t qualify.

However, thanks to a little-known loophole, this is not the case.

This is because new claims for pension credit can be backdated by up to three months.

This means that the absolute deadline to claim the benefit and qualify for this year’s winter fuel payment is December 21.

Of course, if you fail to apply for the benefit before this date, you won’t qualify for this year’s £300.

APPLY FOR PENSION CREDIT

PENSION credit tops up your weekly income to £218.15 if you are single or to £332.95 if you have a partner.

This is known as “guarantee credit”.

If your income is lower than this, you’re very likely to be eligible for the benefit.

However, if your income is slightly higher, you might still be eligible for pension credit if you have a disability, you care for someone, you have savings or you have housing costs.

Pension credit opens the door to other support, including housing benefits, cost of living payments, council tax reductions, the winter fuel payment and the Warm Home Discount.

You can start your application up to four months before you reach state pension age.

You can apply any time after you reach state pension age but your application can only be backdated by three months.

This means you can get up to three months of pension credit in your first payment if you were eligible during that time.

To apply, you’ll need the following information about you and your partner if you have one:

- National Insurance number

- Information about any income, savings and investments you have

- Information about your income, savings and investments on the date you want to backdate your application to

You’ll also need your bank account details. Depending on how you apply, you may also be asked for your bank or building society name, sort code and account number.

Applications can be made online by visiting gov.uk/pension-credit/how-to-claim.

If you’d prefer to apply over the phone, you can do so by calling the pension credit claim line on 0800 99 1234.

-

Technology1 month ago

Technology1 month agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Technology4 weeks ago

Technology4 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

MMA3 weeks ago

MMA3 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology4 weeks ago

Technology4 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Football3 weeks ago

Football3 weeks agoWhy does Prince William support Aston Villa?

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology4 weeks ago

Technology4 weeks agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

Technology1 month ago

Technology1 month agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Technology3 weeks ago

Technology3 weeks agoGmail gets redesigned summary cards with more data & features

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

Sport3 weeks ago

Sport3 weeks ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Technology3 weeks ago

Technology3 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

MMA3 weeks ago

MMA3 weeks ago‘I was fighting on automatic pilot’ at UFC 306

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Sport4 weeks ago

Sport4 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Technology4 weeks ago

Technology4 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Business3 weeks ago

Business3 weeks agoStark difference in UK and Ireland’s budgets

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Technology3 weeks ago

Technology3 weeks agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

Politics3 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

Money3 weeks ago

Money3 weeks agoPub selling Britain’s ‘CHEAPEST’ pints for just £2.60 – but you’ll have to follow super-strict rules to get in

-

News3 weeks ago

News3 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

TV3 weeks ago

TV3 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

News1 month ago

the pick of new debut fiction

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Business4 weeks ago

Business4 weeks agoStocks Tumble in Japan After Party’s Election of New Prime Minister

-

News3 weeks ago

News3 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

MMA3 weeks ago

MMA3 weeks agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

News3 weeks ago

News3 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

News3 weeks ago

News3 weeks agoReach CEO Jim Mullen: If government advertises with us, we’ll employ more reporters

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

Travel2 weeks ago

Travel2 weeks agoUK’s ‘happiest islands’ have white sand beaches and attractions older than the Egyptian pyramids

-

MMA4 weeks ago

MMA4 weeks agoHow to watch Salt Lake City title fights, lineup, odds, more

You must be logged in to post a comment Login