Money

You’ve been using your fridge all wrong and it’s adding £1,000 to household bills – exact way to store food correctly

HOUSEHOLDS could save up £1,000 by better organising the contents of their fridge.

Unpacking after a grocery shop can be a huge chore, so it’s likely you’re paying little attention to where you’re placing items in the fridge.

But where you put your food in the fridge can make a big difference as to how long it lasts and can mean you end up throwing less away.

By cutting food waste, the average four-person household in the UK could save approximately £1,000 a year, according to the Waste and Resources Action Programme.

As well as this, organising your fridge can also help you to save on your energy bills by helping it to run more efficiently.

And with bills rising by £149 a year for the average household, many households are looking for ways to save cash.

To help you save cash, experts at the home appliance brand Beko have share exactly which foods should be stored where in your fridge.

Beko’s Salah Sun said: “You will be surprised by how much you can reduce your food waste by storing food properly.

“From avoiding cross-contamination of products to rotating soon-to-expire food items to the front of the fridge, there’s a lot you can do to help.”

Here’s what you need to know about the exact way to store food correctly to make your appliance more energy efficient and prevent food waste.

Top shelf

Typically the top shelf of your fridge is less cold than other compartments, so should be reserved for foods that don’t need to be kept too chilled and are ready to eat.

This could include foods such as deli meats, desserts and dips.

You could also store sweeter treats like trifles and desserts on the top shelf.

Middle Shelf

The middle shelf of your fridge is cooler than the top shelf but not as cold as the bottom shelf, making it the ideal place to store your dairy products.

Cheese, yoghurt, butter, eggs and milk should all be placed here.

Some fridge freezers even feature a dedicated dairy compartment.

This drawer is specially designed to keep these items fresh by maintaining an optimal temperature of 0 degrees Celsius, Beko said.

If you’ve still got some room on the middle shelves, this is where you should place your chilled drinks, which ideally should be placed near the centre.

Bottom shelf

As the coldest part of a fridge, food stored here has it’s freshness locked in, which helps prevent dripping and keeps bacteria at bay.

This makes it an ideal place to store fussier ingredients like raw meat, poultry and fish.

Meat items can be quite costly, so it’s well worth making sure they are stored properly.

Drawers

The drawers in your fridge are designed to increase humidity and alter airflow.

This creates ideal conditions for storing fruit and vegetables, but these two types of produce should be kept separate.

This is because certain fruits emit ethylene which can speed up the ripening of vegetables, causing them to decay prematurely.

Fruits, vegetables, salads and fresh herbs should all be stored in the drawers.

Door

The warmest part of the fridge is the door, which is also the most inconsistent area of the appliance in terms of temperature due to frequent openings and closings.

This is where you should store preserved food items that are less likely to spoil.

Condiments, jam, juice, soda drinks and water should all be kept here.

Hacks for Keeping Food Fresh in Your Fridge

IF you want your food to stay fresh, you’ll need to try out this useful hacks…

- Herbs in Water: Store fresh herbs like parsley and coriander in a glass of water, then cover with a plastic bag to keep them fresh for weeks.

- Wrap Greens in Paper Towels: Wrap leafy greens in paper towels before placing them in a plastic bag. The towels absorb excess moisture, preventing wilting.

- Use Mason Jars: Store salads, chopped vegetables, and even leftovers in mason jars. They are airtight and keep food fresher for longer.

- Revive Stale Bread: Sprinkle a bit of water on stale bread and pop it in the oven for a few minutes to make it fresh again.

- Baking Soda for Odours: Place an open box of baking soda in your fridge to absorb odours and keep food tasting fresh.

- Freeze Herbs in Olive Oil: Chop herbs and freeze them in olive oil using an ice cube tray. This preserves their flavour and makes them easy to use.

- Keep Cheese Fresh: Wrap cheese in wax paper instead of plastic wrap. Wax paper allows the cheese to breathe, preventing it from becoming slimy.

- Store Avocados with Onions: Place a cut avocado in an airtight container with a slice of onion. The sulphur compounds in the onion slow down oxidation, keeping the avocado fresh.

- Use Vinegar Wash for Berries: Rinse berries in a mixture of water and vinegar (one cup of vinegar to three cups of water) before storing. This kills bacteria and mould spores, extending their shelf life.

- Egg Freshness Test: To check if eggs are still fresh, place them in a bowl of water. Fresh eggs will sink, while old ones will float.

Implement these clever hacks to maximise the freshness of your food and make the most of your groceries.

How else can I save money on energy bills?

There are plenty of other tips available to save money on energy.

For example, it is proven by the Energy Saving Trust that reducing the thermostat temperature by 1 degree can reduce your fuel bill by 10%.

Uswitch has previously explained that households could make potential savings of up to £127.70, by turning down the temperature of the thermostat just one degree.

Additionally, adding loft insulation to your home could save you up to £300 a year.

Setting up draught excluders around your home to block out any unwanted cool air is a cheap solution to slashing down your energy bills.

And keeping your fridge-freezer clean could save you £45 a year, because dust on the condenser coils can reduce the efficiency by as much as 25% according to Which?.

Money

Primark boss slams Rachel Reeves’ Budget after it added ‘tens of millions’ to staffing costs

THE boss of Primark blasted Chancellor Rachel Reeves’ Budget yesterday — claiming it had added “tens of millions” to staffing costs.

George Weston, chief executive of its owner, Associated British Foods, told The Sun that it will be forced to respond by rolling out more self-checkouts.

He said: “It’s a tough Budget for the high street and those in the food service industry. We knew taxes were going up, but I think the burden and where they’ve fallen is disproportionate.”

His comments came after Reeves said she would raise £25.7billion from hiking employers’ National Insurance contributions, a move the budget watchdog says is likely to see firms shrink workforces, hike prices and lower future earnings for staff.

He said “We’ll redouble our efforts to keep costs down and protect profit margins and one way we can do that is using more self-checkouts.”

He said Primark’s aim would be to “hold prices” rather than cut them as fast as it had hoped.

He reasoned, however, that the budget fashion retailer could benefit from the minimum wage hike as low earners would have more to spend.

He said: “If money is transferred to less affluent shoppers, Primark tends to benefit disproportionately”. He branded “ill-judged” the Chancellor’s plans to increase business rates on those with the most expensive properties to afford reductions for smaller shops and pubs.

He said: “It’s a curious move to increase the tax burden on the anchors of the high street and shopping centres who drive footfall to towns.”

Despite the tough choices, Primark is one of retail’s strongest names.

Total sales lifted 6 per cent to £9.4billion in the year to September 14, while operating profits jumped 53 per cent to £1.1billion.

UK sales grew only 2 per cent due to the washout summer.

The results vindicated Primark’s resistance to joining the online bandwagon.

Instead, it is rolling out click and collect counters. It said digital orders had the benefit of driving more shoppers to its stores.

ASTRA £15BN FALL

SOME £15billion was wiped off the value of drug giant Astrazeneca yesterday amid claims its top bosses in China are being investigated over medical insurance fraud.

Shares slumped by 8 per cent to £101.38, its biggest fall since March 2020.

The drop prompted the firm to issue a stock market statement saying it will not comment on “speculative media reports”.

Last week it admitted its Chinese division president was helping with an investigation. It was yesterday suggested the probe has widened.

PAIN IN THE ASOS

LOSSES at Asos have widened by almost a third to £379.3million as the online retailer continues to grapple with the hangover from its lockdown binging.

Asos is writing off £100million-worth of unwanted clothing.

The company was left with a £1.1billion stock mountain after being over-optimistic that rapid growth would continue once Covid restrictions ended.

Its core base of young shoppers do not want last season’s fashion trends, meaning Asos has had to discount heavily to reduce the stockpile to £520million.

Boss Jose Antonio Ramos Calamonte said the troubled business was taking “the medicine needed to put Asos on the right path”.

Annual sales slumped by 16 per cent to £2.9billion.

Mr Calamonte also confirmed Asos is launching a Topshop website and considering opening standalone stores after selling a majority stake in the brand.

ELECTRIC IN LEAD

ELECTRIC vehicles were the only area of growth for the car industry last month — but the jump is still not enough to hit this year’s net zero target.

Hefty discounting saw 29,800 sold in October, 24.5 per cent up on last year.

But annual electric car sales were at 18.1 per cent of the market, shy of the Government’s 22 per cent target.

Meanwhile diesel sales slumped by 20.5 per cent and petrol fell by 14.2 per cent.

The overall six per cent fall in sales represents a £350million hit to the industry.

VODA AND THREE ‘TO BE ONE’

AN £18BILLION mobile merger between Vodafone and Three could finally go ahead if they agree to pegging prices for three years and rapidly rolling out more 5G networks.

The competition watchdog yesterday cleared the path for the deal, 17 months after the merger was first announced in June 2023. It comes after the Government said the competition regulator should be more mindful of how it impacts economic growth.

Kester Mann, telecoms analyst at CCS Insight, said: “Vodafone and Three can tentatively order in the champagne.” Stuart McIntosh, of the Competition and Markets Authority, said: “We believe this deal has the potential to be pro-competitive if our concerns are addressed.”

In September the CMA had warned it was worried consumers could be harmed by higher prices from the deal, which reduces the number of mobile players from four to three.

TICK FOR LINK-UP

MIDDLE-class favourite John Lewis has announced a partnership with buy now, pay later firm KLARNA.

John Lewis homeware sales were hit after the cost of living crisis made many shoppers put off big purchases.

It said the deal would “make it easier for customers to manage their budgets and help attract a new customer that may have not traditionally shopped with us”.

Charities have warned buying on “tick” can encourage people to spend too much.

Money

Greggs threatens to make major change to how customers are served

GREGGS has declared war on “zombie” customers who keep their headphones on while at the counter.

Staff at the bakery giant have threatened to not serve punters listening to calls or music when they are meant to be ordering.

A sign at one branch warns discourteous diners they could miss out on their favourite sausage roll or steak bake if they refuse to pay attention.

As well as using noise cancelling tech such as AirPods, punters glued to their phones are also in the firing line.

The notice at a Greggs in Croydon, South London, says: “When in queue, remove your headphone/AirPods and come off phones or we may have to refuse service.”

A staff member at the branch told The Sun: “We get more and more customers coming in who seem to be lost in another world.

“We try to be helpful and get everyone served quickly during busy times but it’s impossible if customers can’t hear a word you’re saying.

“The sign is pretty blunt but we have no option.”

Another worker went on a rant online about customers’ treatment of Greggs staff.

They wrote: “Can people please stop talking on the phone when placing an order! It’s rude to workers because we have to wait until you stop.

“I have got to the point where I will just ask what we are required to. I do not care if it interrupts your call, I am not going to wait for you to finish when there are people behind you. Stop doing it.”

Greggs did not comment but a source at the firm yesterday said the headphone crackdown is not company policy.

Money

The savings mistake costing £636 a year as best and worst bank accounts revealed

MILLIONS of savers are missing out on £636 of free cash because of one simple mistake.

Experts have warned that fixing it could be an easy way to make the most of your money.

Savers could earn hundreds of pounds by moving their nest egg out of an account which pays a high interest rate, according to credit company TotallyMoney.

It comes as the Bank of England looks set to cut interest rates this week, and this could cause banks to reduce the interest rate they offer to savers.

One in three people have not switched their savings account for five years, TotallyMoney found.

While more than a quarter of savers have never swapped their accounts, which could mean they are missing out on getting the best interest rate.

According to the team, the average saver has £17,365 squirrelled away, if this was paid into the top savings account, which has a rate of 4.86%, then they could earn £844 in interest each year.

But research shows that if they left it languishing in one of the 20 easy-access accounts with the lowest rates then they would get a return of just 1.2% on their nest egg.

After a year they would have earned just £208 in interest, which would leave them £636 worse off.

If the same saver had just £5,000 squirrelled away then they would still be £183 worse off by not switching their account.

Alastair Douglas, CEO of Totally Money, said: “If you are looking to make more of your money, shop around for the best offers and consider all your options.

“You might be better off putting part, or all of your money in an ISA, or an account which requires 90 days notice. Just make sure it’s right for you, and your needs.”

It’s important to choose an account which has a higher rate than inflation, which is currently at 1.7%.

This is because many savers might still be seeing their savings being eaten away by inflation.

The Bank of England also predicts that inflation will creep back up to 2.5% before the end of the year.

That’s why it’s more important than ever to shop around for the best rate and lock in now to avoid missing out on the top accounts.

Best and worst easy access accounts revealed

Totally Money has rounded up 20 of the poorest savings accounts for people who want to deposit and withdraw money without restrictions.

It’s also had a look at the accounts which will pay inflation-busting rates, meaning people can earn money from their savings while seeing it rise faster than inflation.

At the top of the best-buy ranking is Chetwood Bank Easy Access Savings, which currently pays 4.86%.

There is no minimum amount needed to open the account and you can make unlimited deposits.

All interest is calculated daily and is paid monthly.

Meanwhile, Tandem Bank’s Instant Access Saver pays 4.65% and Yorkshire Building Society Easy Access Saver Issue 2 pays 4.6%.

At the other end of the scale is TSB’s Save Well account, which has a return of just 0.5%.

Savings A/C from Punjab National Bank pays 0.75%, Barclays Reward Saver has a rate of 1% and Union Bank of India Savings A/C pays 1%.

Best and worse accounts revealed

Here we reveal the best and worst savings accounts on the market at the moment.

Best accounts

- Chetwood Bank – Easy Access Savings – 4.86%

- Tandem Bank – Instant Access Saver – 4.65%

- Yorkshire Building Society – Easy Access Saver Issue 2 – 4.60%

Worst accounts

- TSB – Save Well – 0.50%

- Punjab National Bank – Savings A/C – 0.75%

- Barclays – Reward Saver – 1.00%

- Union Bank of India – Savings A/C – 1.00%

- NS&I – Investment Account – 1.00%

- Barclays – Everyday Saver – 1.16%

- Santander – Limited Access – 1.20%

- Halifax – Reward Saver – 1.20%

- Halifax – Bonus Saver – 1.20%

- Bank of Scotland – Advantage Saver – 1.20%

- Lloyds Bank – Club Lloyds Advantage – 1.20%

- Co-Op Bank – Select Access – 1.25%

- Sainsbury’s Bank – Extra Saver – 1.30%

- Sainsbury’s Bank – Defined Access Saver – 1.30%

- Bank of Scotland – Access saver – 1.35%

- Lloyds Bank – Easy Saver – 1.35%

- Halifax – Reward Saver – 1.35%

- Metro Bank – Instant Access – 1.40%

- Paragon Bank – Double Access Saver – 1.50%

- Paragon Bank – Triple Access Saver – 1.50%

- TSB – Easy Saver – 1.50%

How to find the best savings rates

You should check best buy savings tables every few months to make sure that you are getting the best rate on offer.

You can use a comparison website such as Moneyfactscompare.co.uk or Go Compare to do this.

These websites let you filter your search to an account type that suits you.

There are four types of savings accounts: fixed, easy access, regular saver and Individual Savings Account (Isa).

A fixed-rate savings account pays you a high interest rate if you lock your money away for an agreed period.

Some accounts will let you make a certain number of withdrawals during the term, while others will not let you withdraw your money.

Some banks will charge you a hefty fee to access your cash.

This means that even if interest rates increase you cannot withdraw your money and put it in a better account.

An easy-access account gives you immediate access to your cash and usually allows unlimited cash withdrawals.

These accounts often pay a lower rate than fixed-rate ones but they are a good option if you need to move your money, for example if your car breaks down or a pipe bursts.

With a regular saver account you put away a certain amount of money each month for a set period.

They usually pay a decent return but the amount you can save each month is often quite low.

Lastly, an Isa is a tax-free savings account in which you can save up to £20,000 each year.

There are four types of Isa: a cash Isa, stocks and shares Isa, innovative finance Isa and Lifetime Isa.

These accounts can be helpful for people who are at risk of needing to pay tax on any interest they earn from their savings.

If you are a basic-rate taxpayer then you can earn up to £1,000 in interest from your savings each year tax-free.

This falls to £500 if you are a higher-rate taxpayer and disappears entirely for additional-rate taxpayers.

Maximise your earnings

Advice from Sarah Coles, head of personal finance at Hargreaves Lansdown:

You worked hard to earn it, so now your money should be working just as hard for you.

There’s no excuse for it to be lying around gathering dust in a current account.

It’s easy to fall into the habit of leaving your cash lying dormant in your current account, but this is a terrible idea.

In many cases, you won’t make a penny in interest, so you’re missing out on a huge amount of money.

You can usually make far more interest from an online bank than you can in the same kind of account with one of the high street giants.

A savings comparison site will help you track down the best rates.

If you leave your savings languishing because it feels like too much effort to find an alternative, a cash savings platform might appeal.

You just open one account, then you can switch between accounts with loads of different banks, and see everything in one place.

They have apps, so making the most of your savings is no harder than just shoving it in a current account and missing out on all this interest.

How to swap savings account

Most banks will let you open a savings account online, in branch, by telephone or using its app.

Once your account is open simply withdraw your cash from your existing account and pay it into your new one.

Consider any penalties for taking out your cash before you transfer your money.

Never withdraw money from one Isa and pay it into another as you will not be able to reinvest that part of your tax-free allowance again.

Instead, contact the Isa provider you want to move to and fill out an Isa transfer form.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

McDonald’s is bringing back a fan-favourite burger in latest menu shake-up – exact date you can get it

McDONALD’S is bringing back an iconic burger but customers will have to be quick if they want to give it a go.

The Double Big Mac is returning to restaurants after nearly two months.

It was last seen on menus back in September when it was brought back as a special item to celebrate Maccies’ 50th birthday in the UK.

The hefty burger features four beef patties, double the iconic sauce and lettuce, cheese, pickles, and onions on a sesame seed bun.

This is unlike the original Big Mac, which just features two patties, alongside the buns, sauce and dressings.

The limited edition menu item will be hitting restaurants from tomorrow, November 6.

The Double Big Mac will be available at all 1,400 McDonald’s. You can find your nearest site using the locator tool on the chain’s website.

If you’re keen to give one a go you need to act quickly as the burger will be vanishing on November 19.

That means customers have around two weeks to get their hands on one.

Prices start from £5.39 for a single item and if you want to add a drink and chips it will cost £7.19.

But it is worth bearing in mind that prices can vary from site to site.

Tomorrow also marks the launch of McDonald’s chilli double cheeseburger.

The never-before-seen snack will feature two 100% British and Irish beef patties, two slices of cheese, onions, jalapenos, pickles and spicy relish in a toasted bun.

Better yet, it will cost just £2.49 and sit on the fast food giant’s saver menu.

What else is new to McDonald’s?

Fans of the fast food joint have been treated to a number of new items in recent weeks.

This includes the McRib which landed in stores back in October after much speculation online.

Prior to this, the pork sandwich had not been in British stores in nearly a decade.

While customers were eager to get their hands on one, it has been met with mixed reviews.

Alongside this, McDonald’s has launched new mini hashbrowns to rival its original fried potato breakfast snack.

They are still available to buy in portions of five or 15 between 6am-11am.

The fast food giant regularly switches up its menu to make way for new menu items.

October also saw the launch of a new selection of cheese bites and a Toasted Marshmallow Hot Chocolate and Latte.

Maccies also usually launches a new range of items for Christmas and the festive season.

How to save money at McDonald’s

Did you know that you can end up being charged more based just on the McDonald’s you choose to eat at?

The Sun previously found that a Big Mac meal can be 30p cheaper at restaurants which are two miles away from each other.

Another way to cut back spending at McDonald’s is by ordering from the Savers menu or by taking advantage of its ‘3 for £3’ deal when it lands in stores.

It is also worth bearing in mind that McDonald’s offers a discount on your next order if you fill out a survey online after visiting its stores.

These can be found on the back of any receipt you get at McDonald’s.

How do I find my nearest McDonald’s?

If you’re planning on taking a trip to McDonald’s, you’ll want to know where your nearest branch is.

The chain has a restaurant locator tool on its website you can use to find your nearest one – and check what time it opens.

Bear in mind that McDonald’s serves breakfast every day until 11am.

After that, the menu switches to the normal menu serving meals such as burgers, chicken nuggets and more.

All you need to know about McDonald’s

HERE’S all the crucial information about McDonald’s you’ve always wanted to know…

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

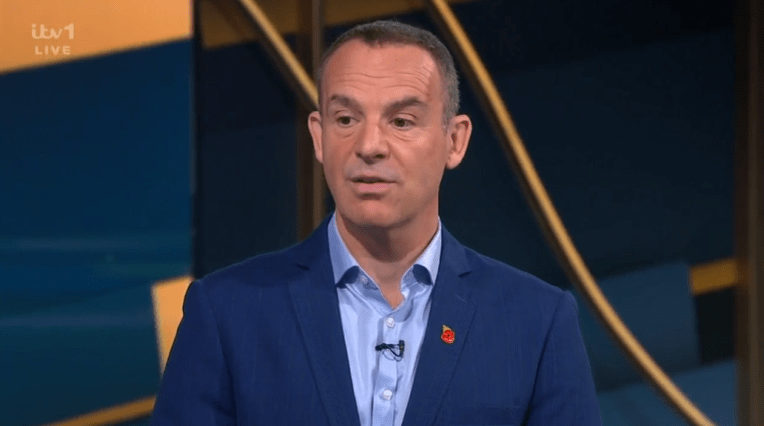

Martin Lewis issues warning that a MILLION have been overpaying student loans – check if you can get a refund of £100s – The Sun

MARTIN Lewis has warned that a million people have been overpaying their student loans – and could be owed a refund.

In the last tax year, more than one million university leavers overpaid their student loans, according to figures released by the Student Loans Company (SLC).

Speaking on The Martin Lewis Money Show Live, on ITV on Tuesday, the show host said graduates were able to claim money back if they had overpaid, which was “very easy to do”.

There were four main reasons you may have overpaid your student loan.

Martin said: “The first, and the biggest by a mile, over a million people overpaid this way, is you should only repay if you earn over the annual threshold.”

He added: “For Plan 2, which has the most number of people on it, 2012 to 2022 English starters, you’ve got to understand, if you earn less than that [£27,295] you shouldn’t repay the student loan but because it’s taken via the payroll your student loan is taken monthly.

“A twelfth of that is £2,274 per year, so if you earn more than that in a month, you’re gonna have student loan contributions taken from you.”

He explained that because repayments are taken from your payroll monthly, if your earnings vary through the year, you may be assumed to be over the yearly limit in one month of decent earnings.

This is despite you not earning above the total threshold for the year when earnings are taken as a whole – meaning the money is taken from you despite not being eligible.

A second reason was people were on the wrong student loan repayment plan – in which case you should talk to your employer and tell them what plan you’re on.

The third reason is that you started repaying too early.

If you started university from 1998 onwards and were a full-time student, you should not have begun paying your loan back until the April after finishing your course.

But the latest figures from SLC reveals that 59,251 students had loan repayments taken before they were due to start repayments in 2023/24, according to MoneySavingExpert.com.

The fourth reason is that the loan was wiped – which typically happens after 30 years – but a number were still left paying in error.

A number of case studies of those who overpaid were revealed in an article for Martin’s Money Saving Expert website, published on November 4.

Fiona wrote in during October 2023 saying: “I knew something wasn’t right when I lodged my tax returns and reading Martin’s article was the catalyst for a sustained attempt to work out what had happened. I received £3,773 back.”

Lyndsey said: “Thanks to watching Martin Lewis’s programme last night I contacted the SLC and have got a refund of £706 as I had started paying straightaway. Great just before Christmas.”

Melissa said: “Just wanted to say a massive thank you as I read your article on overpaying on student loan repayments and realised there was a chance I had overpaid.

“Turns out I had and I’ve since received a refund of £900! I’ve been doing house renovations this year so this money has been incredibly handy in going towards them.”

Lisa added: “I spent 15 minutes on the phone and got £555 back for overpayments on my student loan.

MAXIMUM MAINTANCE LOANS

THE maintenance loan you qualify for is determined by your household income at the time of application, as well as whether you will be studying from home or away.

Here’s how the maximum borrowing rates will be adjusted starting April 2025:

- Studying at home (outside of London): Up from £8,610 to £8,877 a year (a £267 increase)

- Studying away from home (in London): Up from £13,348 to £13,762 a year (a £414 increase)

- Studying away from home (outside of London): Up from £10,227 to £10,544 a year (a £317 increase)

- Studying abroad as part of a UK course: Up from £11,713 to £12,076 a year (a £363 increase).

“Most was because of my maternity leave. Thanks so much, couldn’t have come at a better time.”

It comes after the Health Secretary defended the Government’s decision to increase university tuition fees, saying it is a “proportionate and reasonable thing” to do.

The Labour Party has faced criticism for raising fees to £9,535 in England next year after Sir Keir Starmer supported abolishing them during his leadership campaign in 2020.

Education Secretary Bridget Phillipson announced on Monday that undergraduate tuition fees – which have been frozen at £9,250 since 2017 – would rise in line with inflation from 2025/26.

She said maximum maintenance loans would also rise to help students with living costs.

How do tuition fees work?

Tuition fees are usually covered by a tuition fee loan from Student Finance.

This loan is paid directly to the university or college on your behalf.

Repayments start from the first April after you finish or leave your course, but only if your income exceeds a certain threshold.

You repay 9% of your income above the repayment threshold.

This means that the majority or basic-rate taxpayers lose 37p for every £1 they earn above the threshold – 20p as income tax, 8p as national insurance and 9p for a student loan.

Your repayment threshold will vary depending on when you studied at University.

Interest is charged on your loan from the day you receive the first payment until it is repaid in full.

However, it’s important to note that any remaining debt can be written off after a set number of years, even if you haven’t repaid the total amount.

How have student loan repayments changed?

STUDENT loan repayments are based on your earnings and not the size of the debt.

However, when you start making repayments or when your student loan amount is written off will depend on when you went to University.

Plan 1 – 1998-2012

If you took out a student loan between 1998 and 2012, you’ll be bound by the Plan 1 repayment rules.

These students only start repaying their loans when their salary breaches the threshold of £24,990 a year.

You’ll pay 9 per cent back once your salary breaches this threshold.

The interest rate charged on these loans is based on either RPI or the Bank of England rate – whichever is lower – plus one percentage point.

These loans are written off after 25 years.

Plan 2 – 2012-2023

If you took out a student loan between 1998 and 2012, you’ll be bound by the Plan 2 repayment rules.

These students only start repaying their loans when their salary breaches the threshold of £27,295 a year.

You’ll pay 9 per cent back once your salary breaches this threshold.

The interest rate charged on these loans is based on RPI plus up to three percentage points – dependant on your income.

These loans are written off after 30 years.

Plan 5 – 2023-present

If you took out a student loan from 2023 onwards, you’ll be bound by the Plan 5 repayment rules.

These students only start repaying their loans when their salary breaches the threshold of £25,000 a year.

You’ll pay 9 per cent back once your salary breaches this threshold.

The interest rate charged on these loans is based on RPI only.

These loans are written off after 40 years.

Money

Tesco reveals early Black Friday deals with up to 69% off including energy saving gadgets – see the full list

TESCO has rolled out a host of early Black Friday deals with shoppers able to bag discounts worth up to 69%.

The UK’s biggest supermarket has joined other retailers in slashing prices on products ahead of the mega sales event on November 29.

Shoppers can pick up everything from electricals, to homeware, cooking and luggage in stores.

However, Tesco said not every product will be available across all its stores, they’re not available online and it’s while stocks last, so you’ll want to be quick.

You can find your nearest Tesco store by using the retailer’s branch locator tool on its website.

There’s a Bakers Secret Four-Piece Cookware Set on offer for £30 instead of £70 – a 57% saving.

Read more on Black Friday

Meanwhile, shoppers can pick up an F&F Home Teddy Cuddle Cushion set for £14 instead of £30 – a 53% discount.

Plus bargain hunters can snap up a Silentnight fleece bedding bundle for £22 down from £44 – that’s 50% off.

Techies can save up to 37% on three different Sharp TV’s, with prices starting from £119 and ranging up to £279.

And caffeine addicts can bag a L’or Barista coffee machine or Nescafé Dolce Gusto Picollo coffee machine for £50 or £29 respectively, with shoppers getting up to 52% off.

It’s worth bearing in mind, you can only get the early Black Friday deals if you’re a Tesco Clubcard customer.

However, the rewards scheme is free to sign up to on the retailer’s website or via its app which you can download off the Apple Store or Google Play.

Tesco’s early Black Friday deals

Check out the 17 early Black Friday deals on offer at Tesco stores…

- Bakers Secret 4 Piece Cookware Set – was £70, now £30 (57% discount)

- Tefal Titanium Force Piece Cookware Set – was £70, now £35 (50% discount)

- F&F Home Teddy Cuddle Cushion – Oatmeal or Grey – was £30, now £14 (53% discount)

- Silentnight Grey Check Fleece Bedding Bundle Double / King – was £44/£53, now £22/£27 (50% discount)

- Silentnight Green Woodland Fleece Bedding Bundle Double / King – was £44/£53, now £22/£27 (50% discount)

- Sharp 32″ TV 1T-C32GD2025K – was £189, now £119 (37% discount)

- Sharp 40″ TV 2T-C40GD2025K – was £259, now £169 (35% discount)

- Sharp 55″ TV 4T-C55GJ4025K – was £399, now £279 (30% discount)

- Tefal 8.3L Dual Drawer Air Fryer – was £150, now £60 (52% discount)

- Tefal Turbo Cuisine – was £150, now £60 (60% discount)

- L’or Barista – was £105, now £50 (52% discount)

- Nescafé Dolce Gusto Picollo Coffee Machine – was £56, now £29 (47% discount)

- Yankee Candle Mega Buy – was £40, now £20 (50% discount)

- F&F Home XL Bath Sheet Navy – was £12, now £6 (50% discount)

- Joie Roomie Glide Co-Sleeping Crib – was £160, now £50 (59% discount)

- Constellation Cabin Bag – Black or Silver – was £55, now £37 (33% discount)

- IT Luggage 3-piece Set – was £160, now £80 (50% discount)

It’s also worth shopping around before buying any Black Friday deal as it might not actually be that good a deal.

Shoppers have previously been warned to take the sales event with a “pinch of salt” by Which?.

The consumer group found just 2% of offers were at their cheapest price on the day in 2022.

The best way to make sure you’re getting the best deal is by avoiding impulse buys and making sure you’ve compared the price on offer to other retailers.

You can do this through price comparison websites like Price Spy, Price Runner and Trolley which will give you an indication on whether what you are buying is well-priced.

Tesco joins a host of other retailers who have launched Black Friday deals ahead of the official sale event later this month.

Boots, Currys, Argos, Superdrug and John Lewis have all dropped prices on thousands of products.

Shoppers can pick up discounts worth up to 71% on perfumes, board games, laptops and hoovers.

Check out some of the best deals we spotted in our round-up piece.

HOW TESCO CLUBCARD WORKS

You earn points as you shop, which can then be turned into vouchers for money off food or with Tesco’s partners.

You earn one point for each £1 spent, and each point is then worth 1p.

So 150 points gets you £1.50, and you would have to spend £150 to get 150 points.

You need a minimum of 150 points to request a voucher.

Any vouchers are worth their face value when used in-store at Tesco.

But you can double their worth by spending them at one of the supermarket chain’s partners.

There are over 100 partners you can spend your Clubcard points with, including the RAC, Disney+ and Virgin Atlantic Flying Club.

Points spent with partners used to be worth triple value, but Tesco changed this to double last year.

Any vouchers transferred into Reward Partner codes expire after six months.

Loyalty card holders also get access to over 8,000 items for less through Clubcard Prices.

How to get the best deals on Black Friday

Consumer reporter Sam Walker reveals a few ways you can get the best deals this Black Friday...

Buy the right products – there are literally thousands of products to choose from every Black Friday, but some are worth going after more than others.

Dan Evans, editor at HotUKDeals, previously told The Sun five particular brands or themes are worth pursuing – Lego, fashion, video games or consoles, Shark and Ring doorbell.

Create a wish list – don’t get sucked in to promises of massive discounts and offers.

Make a wish list of items you actually want to buy so you don’t end up getting something you don’t need.

Earn as you spend – it’s worth checking if any Black Friday deals can be bought through cashback sites like Quidco or Topcashback.

It’s free to sign up and you could get what is effectively free money just for buying something you would have any way.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

-

Science & Environment2 months ago

Science & Environment2 months agoHow to unsnarl a tangle of threads, according to physics

-

Technology1 month ago

Technology1 month agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 months ago

Science & Environment2 months ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment2 months ago

Science & Environment2 months agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology2 months ago

Technology2 months agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment2 months ago

Science & Environment2 months agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Money1 month ago

Money1 month agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Science & Environment2 months ago

Science & Environment2 months agoSunlight-trapping device can generate temperatures over 1000°C

-

Sport1 month ago

Sport1 month agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Science & Environment2 months ago

Science & Environment2 months agoPhysicists have worked out how to melt any material

-

Technology1 month ago

Technology1 month agoGmail gets redesigned summary cards with more data & features

-

Technology1 month ago

Technology1 month agoUkraine is using AI to manage the removal of Russian landmines

-

Football1 month ago

Football1 month agoRangers & Celtic ready for first SWPL derby showdown

-

MMA1 month ago

MMA1 month ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

Science & Environment2 months ago

Science & Environment2 months agoLaser helps turn an electron into a coil of mass and charge

-

News1 month ago

News1 month agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Sport1 month ago

Sport1 month agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Technology1 month ago

Technology1 month agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Science & Environment2 months ago

Science & Environment2 months agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Technology1 month ago

Technology1 month agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Technology1 month ago

Technology1 month agoSamsung Passkeys will work with Samsung’s smart home devices

-

MMA1 month ago

MMA1 month agoDana White’s Contender Series 74 recap, analysis, winner grades

-

News1 month ago

News1 month ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment2 months ago

Science & Environment2 months agoLiquid crystals could improve quantum communication devices

-

Business1 month ago

how UniCredit built its Commerzbank stake

-

Technology1 month ago

Technology1 month agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

MMA1 month ago

MMA1 month ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Technology1 month ago

Technology1 month agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

News1 month ago

News1 month agoNavigating the News Void: Opportunities for Revitalization

-

Science & Environment2 months ago

Science & Environment2 months agoWhy this is a golden age for life to thrive across the universe

-

News1 month ago

News1 month agoRwanda restricts funeral sizes following outbreak

-

Sport1 month ago

Sport1 month ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Entertainment1 month ago

Entertainment1 month agoBruce Springsteen endorses Harris, calls Trump “most dangerous candidate for president in my lifetime”

-

TV1 month ago

TV1 month agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

MMA1 month ago

MMA1 month agoPereira vs. Rountree prediction: Champ chases legend status

-

News1 month ago

News1 month agoMassive blasts in Beirut after renewed Israeli air strikes

-

Technology1 month ago

Technology1 month agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology1 month ago

Technology1 month agoMicrophone made of atom-thick graphene could be used in smartphones

-

Business1 month ago

Business1 month agoWater companies ‘failing to address customers’ concerns’

-

News1 month ago

News1 month agoCornell is about to deport a student over Palestine activism

-

Business1 month ago

Business1 month agoWhen to tip and when not to tip

-

Sport1 month ago

Sport1 month agoWXV1: Canada 21-8 Ireland – Hosts make it two wins from two

-

News2 months ago

News2 months ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum forces used to automatically assemble tiny device

-

Science & Environment2 months ago

Science & Environment2 months agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

MMA1 month ago

MMA1 month agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Football1 month ago

Football1 month ago'Rangers outclassed and outplayed as Hearts stop rot'

-

News1 month ago

News1 month agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Business1 month ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

Technology1 month ago

Technology1 month agoSingleStore’s BryteFlow acquisition targets data integration

-

Sport1 month ago

Sport1 month agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Football1 month ago

Football1 month agoWhy does Prince William support Aston Villa?

-

News1 month ago

News1 month ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Science & Environment2 months ago

Science & Environment2 months agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment2 months ago

Science & Environment2 months agoA slight curve helps rocks make the biggest splash

-

Technology2 months ago

Technology2 months agoMeta has a major opportunity to win the AI hardware race

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology1 month ago

Technology1 month agoMusk faces SEC questions over X takeover

-

Sport1 month ago

Sport1 month agoPremiership Women’s Rugby: Exeter Chiefs boss unhappy with WXV clash

-

Sport1 month ago

Sport1 month agoShanghai Masters: Jannik Sinner and Carlos Alcaraz win openers

-

Sport1 month ago

Sport1 month agoCoco Gauff stages superb comeback to reach China Open final

-

Business1 month ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Sport1 month ago

Sport1 month agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Technology1 month ago

Technology1 month agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

-

MMA1 month ago

MMA1 month ago‘I was fighting on automatic pilot’ at UFC 306

-

Technology1 month ago

Technology1 month agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

News1 month ago

News1 month agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Sport1 month ago

Sport1 month agoWales fall to second loss of WXV against Italy

-

Business1 month ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Business1 month ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

TV1 month ago

TV1 month agoTV Patrol Express September 26, 2024

-

MMA1 month ago

MMA1 month agoPennington vs. Peña pick: Can ex-champ recapture title?

-

Money4 weeks ago

Money4 weeks agoTiny clue on edge of £1 coin that makes it worth 2500 times its face value – do you have one lurking in your change?

-

Science & Environment2 months ago

Science & Environment2 months agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

MMA1 month ago

MMA1 month agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

Technology1 month ago

Technology1 month agoThe best shows on Max (formerly HBO Max) right now

-

Technology1 month ago

Technology1 month agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

Technology1 month ago

Technology1 month agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

Travel1 month ago

World of Hyatt welcomes iconic lifestyle brand in latest partnership

-

Technology1 month ago

Technology1 month agoQuoroom acquires Investory to scale up its capital-raising platform for startups

-

Business1 month ago

The search for Japan’s ‘lost’ art

-

Sport1 month ago

Sport1 month agoNew Zealand v England in WXV: Black Ferns not ‘invincible’ before game

-

Sport1 month ago

Sport1 month agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

News2 months ago

News2 months ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 months ago

Science & Environment2 months agoNerve fibres in the brain could generate quantum entanglement

-

Technology1 month ago

Technology1 month agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Business1 month ago

‘Let’s be more normal’ — and rival Tory strategies

-

News1 month ago

News1 month agoTrump returns to Pennsylvania for rally at site of assassination attempt

-

Sport1 month ago

Sport1 month agoURC: Munster 23-0 Ospreys – hosts enjoy second win of season

-

Technology4 weeks ago

Technology4 weeks agoThe FBI secretly created an Ethereum token to investigate crypto fraud

-

Science & Environment2 months ago

Science & Environment2 months agoHow to wrap your mind around the real multiverse

-

Business1 month ago

Business1 month agoStocks Tumble in Japan After Party’s Election of New Prime Minister

-

MMA1 month ago

MMA1 month agoHow to watch Salt Lake City title fights, lineup, odds, more

-

Business1 month ago

Italy seeks to raise more windfall taxes from companies

-

Technology1 month ago

Technology1 month agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Technology1 month ago

Technology1 month agoOpenAI secured more billions, but there’s still capital left for other startups

-

News1 month ago

News1 month agoHarry vs Sun publisher: ‘Two obdurate but well-resourced armies’

-

News1 month ago

News1 month agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

You must be logged in to post a comment Login