Business

More escape debt for free as bills keep mounting

BBC

BBCA woman who owed thousands of pounds on credit cards, catalogues and utility bills has praised staff at a money advice service for helping her to wipe her personal debts free of charge.

Karen, 60, from Sheffield, said she was left living “just like a hermit” after having to move house and building up sizeable debts following the end of a relationship.

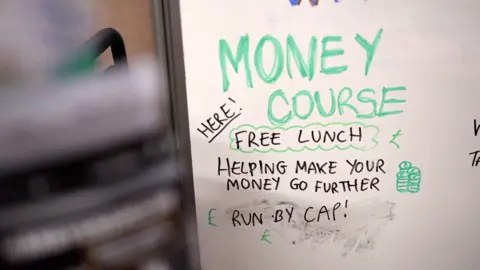

However, while visiting the S6 Foodbank in the city, she was referred to Sheffield Christians Against Poverty (CAP) whose staff helped her to apply for a Debt Relief Order, which can now be done for free.

Karen said freeing herself from all the money she had owed was “like a weight being lifted” and she had since learned how to budget better.

‘Burden of debt’

A £90 charge for applying for a Debt Relief Order was scrapped in April.

As a result, the number of applications in September 2024 was almost double the figure for the previous September, rising from 2,958 to a record high of 4,032.

Jayne Franklin, centre manager for Sheffield CAP, said the change had made a huge difference.

“It’s given us hope that we can get people debt-free quicker, so they haven’t got the burden of debt hanging around over them.”

Karen admitted that before she had sought advice over her debts she was “in a total mess” and she no longer even answered her door.

“I didn’t have anybody round, or my grandkids over for their tea, or anything like that, because I didn’t know what to feed them,” she said.

After getting help from Sheffield CAP and being told that she was able to apply for a Debt Relief Order at no charge, she said she now took much more care with her finances.

“I’ve never learned how to budget, but since I’ve been debt-free I’ve been on a budgeting course,” she said.

The scrapping of the £90 fee to apply for a Debt Relief Order has come at a time when an increasing number of people have continued to struggle with the cost of everyday bills.

New research for the Financial Inclusion Commission (FIC) carried out by Birmingham University suggests that one in five adults have increased their borrowing to cover higher living costs, while one in six families have no savings.

The FIC has called for what it describes as a National Inclusion Strategy to help people struggling with debts, and to give people support to access basics like a current account.

Meanwhile, debt advice service Money Wellness has warned that it was becoming increasingly easy to fall into the red.

In August 2023, staff at the service dealt with 408 people with buy now, pay later debts, but by August 2024 that number had risen to 1,258.

Sebrina McCullogh, director of external affairs at Money Wellness, said more and more people were “being forced into a position where they are using credit like buy now, pay later to just make it through to the end of the month”.

“They are using it for smaller transactions, as opposed to using it to spread the costs of those larger transactions which really is what buy now, pay later as a product is intended to be used for.”

Morgan, 25, from Liverpool, said he warned all his friends to steer clear of buy now, pay later.

He said that after he fell behind on a repayment to Klarna – the UK’s biggest buy now, pay later lender – he took out a credit card loan to pay it off.

Morgan said he had spent the past three years working his way out of that increasing spiral of debt.

“It just made me worse in life. I just wasn’t myself,” he said.

“I just turned to a closed shell, I was hot-headed, stressed, depressed.”

Morgan said it felt like all his friends had some kind of buy now, pay later loan, but added that he was determined never to take out another.

He said he had “learned my lesson now”, explaining that he considered himself lucky that he had managed to rent his current home for himself and his family despite his credit rating.

“I can just focus on getting my life back on track now,” he said.

In a statement, Klarna said it ran an eligibility check on every new purchase, adding that average customer debts were still well below that of credit cards.

The government has recently announced it planned to regulate the buy now, pay later sector.

The Treasury said it would introduce legislation to Parliament in early 2025, so the rules could take effect the following year.

Listen to highlights from South Yorkshire on BBC Sounds, catch up with the latest episode of Look North or tell us a story you think we should be covering here.

Business

Trump’s ex-chief of staff says he is a fascist and would govern as a dictator

Four-star US General John Kelly’s claims were reported in blockbuster comments to The New York Times

Money

Should You Buy or Lease an Electric Vehicle? Pros and Cons Explained

Should You Buy or Lease an Electric Vehicle (EV)?

The decision to buy or lease an electric vehicle (EV) has become increasingly relevant as the automotive landscape continues to evolve. Ten years ago, leasing was often seen as an option for affluent individuals who preferred to upgrade their cars regularly. However, the rapid pace of technological advancements in the auto industry has changed this dynamic. Cars are no longer just modes of transportation—they are complex technological devices. As a result, many consumers now seek to upgrade their vehicles more frequently to stay in sync with the latest developments, which has made leasing a popular alternative to purchasing.

This guide explores the benefits and drawbacks of both leasing and purchasing an EV, helping you make an informed decision that fits your financial situation and personal needs.

The Appeal of Leasing an Electric Vehicle

Leasing an EV has become more appealing for many reasons. When you lease, you essentially “rent” the car for a fixed term, making monthly payments over a period of two to four years. Once the lease is up, you return the vehicle to the dealer, with no long-term financial commitment. This is particularly advantageous in today’s rapidly evolving electric vehicle market, where advancements in battery technology, charging capabilities, and software are happening every year.

For instance, a 2027 model is likely to offer significant improvements over a 2024 model—including increased range, faster charging, and enhanced features. Leasing allows consumers to upgrade to these newer models without the long-term commitment of owning a vehicle that could quickly become outdated.

Benefits of Leasing

- Access to the Latest Technology: Leasing allows you to always drive a newer model with the most up-to-date technology. This is especially valuable in the EV space, where developments in battery life, charging infrastructure, and performance are constantly evolving.

- Lower Monthly Payments: Leasing typically requires less money upfront compared to purchasing, and monthly payments are often lower than loan payments. This makes leasing more accessible for people who want to drive a new car without making a large financial investment.

- Flexibility: After the lease term, you have the option to upgrade to a newer vehicle or even switch to a different brand. This flexibility is crucial as EV technology continues to advance rapidly.

Example Leasing Deals

To illustrate, leasing a Hyundai Ioniq 5 can be a highly affordable option. Currently, you can lease the Ioniq 5 SE Standard Range for $229 per month over a 33-month term, with an initial payment of $3,999 due at signing. This brings the total monthly cost to around $350, which is just 0.8% of the vehicle’s total price of $43,195—an excellent deal by most industry standards.

On the other hand, leasing a Rivian R1S would cost a minimum of $699 per month for a 36-month term with an upfront payment of $8,594. The total monthly cost, excluding taxes and fees, comes to about $938, representing 1.2% of the car’s value, which is still reasonable but not as competitive as the Ioniq 5 deal.

Drawbacks of Leasing

Despite its advantages, leasing has some significant downsides. The most notable is that you don’t own the vehicle at the end of the lease term. This means that after making years of payments, you have no asset to show for it. Additionally, there are several other factors to consider:

- Mileage Limits: Most leases come with annual mileage restrictions (typically between 10,000 and 15,000 miles). If you exceed this limit, you may face expensive per-mile charges, which can significantly increase the total cost of leasing.

- Wear and Tear Fees: Leasing contracts often include penalties for excessive wear and damage. If your vehicle accumulates significant dings, scratches, or interior damage, you could be liable for additional costs at the end of the lease.

- Lack of Ownership: Leasing means you’re always making payments and will have to lease again or buy a vehicle outright at the end of the term. If long-term ownership appeals to you, leasing may not be the best option.

The Case for Buying an Electric Vehicle

While leasing is a popular choice, buying an EV has its advantages, particularly for those who plan to keep their vehicle for the long term. If you find an EV that meets your needs—offering sufficient range, charging speed, and other desired features—purchasing might make more sense financially. Ownership allows you to avoid mileage restrictions and wear-and-tear fees, and once your loan is paid off, you will have no more monthly payments.

Related: Will Investing in Electric Vehicle Chargers Increase the Market Value of Your Home?

Financial Considerations of Purchasing

While buying requires a larger upfront investment and higher monthly payments, the long-term financial benefits can be substantial. For example, purchasing a Hyundai Ioniq 5 with a $10,000 down payment would result in monthly payments of around $555.70 over a 60-month financing period. If you put down the same $3,999 as in the leasing example, your payments would rise to $653.27 per month. Though higher than leasing, these payments allow you to eventually own the car outright.

Once the car is paid off, the savings become apparent. For instance, after five years of payments on the Ioniq 5, your average monthly cost over a 10-year period would drop to around $361. Similarly, buying a Rivian R1S would lead to payments of $1,537 per month for 60 months with an $8,594 down payment, but the long-term costs are reduced after the loan is paid off.

Potential for Resale Value

A significant benefit of purchasing is the potential resale value of the vehicle after you’ve paid off the loan. If the car is in good condition after 10 years, you can trade it in or sell it privately, recouping some of your investment and lowering your overall cost of ownership. Additionally, ownership eliminates the concern of exceeding mileage limits or incurring wear-and-tear fees.

Purchasing and Federal Tax Credits

For buyers, especially those purchasing EVs that qualify for the $7,500 federal tax credit, the financial advantages can be substantial. According to Joseph Yoon, a consumer insights analyst at Edmunds, if you qualify for the tax credit and plan to keep your vehicle for the long term, buying may be more beneficial than leasing.

Should You Buy or Lease an EV?

Ultimately, the decision to buy or lease an electric vehicle depends on your financial situation, driving habits, and desire for the latest technology. Leasing offers the advantage of lower upfront costs, access to the newest models, and flexibility, but comes with mileage restrictions and a lack of ownership. On the other hand, purchasing an EV allows you to own the vehicle outright, build equity, and avoid the fees and limitations associated with leasing.

If you expect to drive more than 15,000 miles per year or plan to keep the vehicle for a long time, buying may be the better option. If you prefer flexibility and staying current with the latest technology, leasing could be more appealing.

Whether you choose to lease or buy, always consider your long-term financial goals, current credit situation, and how much you’re willing to spend on the latest EV technology.

Business

Hyundai crosses 40 per cent bids on day 2 of India IPO; eyes EV crown in US- The Week

In the same year that Hyundai Motor Group overtook Ford to reach the second position in the US EV market, which is led by Twitter-owner Elon Musk’s Tesla, the Korean automaker’s India unit crossed 40 per cent in bids on the second day of its IPO. When market closed, subscriptions hit more than 4.17 crore equity shares out of 9.97 crore shares on offer— the country’s largest-ever initial public offering of Rs 27,780 crore. This includes retail investors, Non-Institutional Investors (NIIs), Qualified Institutional Buyers (QIBs), and employee reserved portion. Of the 4.95 crore shares available to retail individual investors (RIIs), 38 per cent received bids at market close on Tuesday.

ALSO READ: Hyundai Motor India IPO: Should you apply for India’s largest public offering?

Hyundai is expected to launch four new models in the mass-market EV sector in India, starting with Creta EV scheduled for January 2025. Other models include Inster EV to rival Tata’s Punch EV, and speculations for Grand i10 Nios EV and Venue EV. As of now, Hyundai sells its high-end EV IONIQ 5 in India.

In the US, Hyundai, Kia, and Genesis—which together form the Hyundai Motor Group—accounted for more than 10 per cent of the EV market, with market leader Tesla slipping 50 per cent market share for the first time.

ALSO READ: From Tesla to Toyota: Automakers race to embrace gigacasting technology

India’s EV market is touted to grow to a whopping Rs 318,000 crore by 2030 due to increasing affordability, launch of mass-market EVs, rising infrastructure, spiking fuel prices, and government support, according to a report by Grant Thornton Bharat and the Automotive Component Manufacturers Association. In September 2024, the Indian government issued new charging guidelines for EV charging stations and infrastructure, in a bid to attract more EV adoptions.

The India unit is a wholly owned unit of the global automaker Hyundai Motor Company (HMC), headquartered in Seoul, Korea. As of date, Hyundai India boasts a Credit Rating of CRISIL AAA for Packing Credie and CRISIL A1+ for Short Term Debt as per official information from the automaker’s India website.

Money

Regulation paves the way for the human-centric adviser

Some 20 years ago, it was common for a financial adviser to be product-centric, then, towards the end of 2010, they became customer-centric.

More recently, the industry is becoming human-centric.

I admit, this is a broad-brushed – and inevitably unfair – assessment of how advice has evolved over the course of the last 20 years. So, allow me to elaborate.

When advice was product-centric, earnings were often linked to commission-based remuneration. Training standards emphasised product knowledge. The aim was to ensure advisers were well-versed in the offerings available. Their primary role was to match clients with suitable financial products.

It is no longer good enough to be thinking of clients as ‘customers’, as in ‘the recipient of a service’ or ‘the recipient of a product’

Then financial services was nudged to become customer-centric. Here, the Retail Distribution Review played a pivotal role. It banned commission payments from product providers and aimed to ensure adviser recommendations aligned with clients’ best interests.

Advisers faced higher qualification requirements, enhancing their expertise in financial planning. Transparency improved with clearer fee disclosures and detailed service explanations.

Ongoing professional development further reinforced the focus on delivering customer-centric advice, as did the Treating Customers Fairly initiative.

“OK,” I hear you cry. “Where does human-centric come in?”

Well, Consumer Duty has been the major regulatory driver for advisers to become human-centric. It is no longer good enough to be thinking of clients as “customers”, as in “the recipient of a service” or “the recipient of a product.”

Advisers can distinguish themselves from more automated propositions, which can lead to referrals

Think about it for a moment. A “customer” is merely one of many people who bought a product or service. Speak of the customer and it highlights a rather transactional relationship: a connection between a service provider and, well, the customer.

This perspective emphasises the act of buying and selling. It doesn’t delve into the deeper, more personal aspects of the individual behind the transaction.

However, with the rise of behavioural science, psychology, neuroscience and other human-centred disciplines, we are learning to look beyond the generic customer to the individual human. Humans have instincts, emotions and vulnerabilities, and their decisions are influenced by a variety of contextual factors that either enable or hinder them.

Consumer Duty, with its strong emphasis on real-life outcomes, pushes advisers to consider these broader human elements. This marks a fundamental shift towards human-centric advice. The focus is on understanding and supporting the whole person, recognising that clients are not just customers but individuals with unique needs and life circumstances.

Think about it for a moment. A “customer” is merely one of many people who bought a product or service

There are many different aspects of human-centric advice, many of which will bring opportunity. This could be through human-centric communication – for example, in times of market volatility. Or in building trust by more systematically considering the non-technical components that contribute to it.

Overall, human-centricity can be a fundamental part of why people look for and select a financial adviser, bringing in emotional and often apparently ‘irrational’ reasons. Through a human-centric approach, advisers can distinguish themselves from more automated propositions, making the fact-find and client reviews more meaningful. All of which can lead to referrals.

The context we’re in nudges advisers to be ‘human-centric’. It’s a label worth embracing to capitalise on the opportunities that come with it.

Dr Thomas Mather is manager of Aegon’s Centre for Behavioural Research and Insights

Business

Cocaine-related fatalities surge as England and Wales report record drug deaths

Campaigners say falling prices and social acceptability have driven higher use

Money

Hundreds hit by DWP benefits error that could see payments STOP – are you affected?

HUNDREDS of households have been affected by a DWP benefits error, which could leave them out of pocket.

It comes as the government continues to move all two million claimants on legacy benefits to Universal Credit by the end of March 2025 through a process known as managed migration.

As part of this process, households on legacy benefits, including tax credits, receive “migration notices” by post.

These notices provide instructions on how to switch to Universal Credit, as the transition is not automatic.

Households must apply for Universal Credit within three months of receiving their managed migration letter.

Failing to do this can result in benefits being stopped.

However, a “small number” of the 800,000 on income-related employment and support allowance (ESA) have faced a stumbling block when applying for Universal Credit.

ESA provides financial support for those unable to work due to illness or disability.

According to Department for Work and Pension (DWP) rules, ESA claimants should not be required to provide fit notes during the migration process.

Furthermore, those in the ESA support group should not be asked to undertake any work-related activities, as their work capability status should carry over when they migrate to UC.

Despite these clear rules, some DWP staff have asked ESA claimants to obtain fit notes from their GPs.

Others have been incorrectly informed that they need to agree to new work commitments before making the switch.

Claimants have been told that failure to provide fit notes or agree to new work requirements would make them ineligible for limited capability for work and work-related activity (LCWRA) payments.

These extra payments are worth up to £416 a month.

Similar to Universal Credit, legacy ESA claims consist of a standard allowance and an additional component for incapacity for work.

This additional component – either the work-related activity component or the support component – is being replaced by Universal Credit’s LCWRA payments.

Therefore, if you were already receiving these extra components under ESA, you are not required to submit a new fit note or agree to new work requirements to be eligible for LCWRA payments.

Ayla Ozmen, director of policy & campaigns at anti-poverty charity Z2K, said: “It’s very concerning to hear that some disabled people on employment and support allowance who are being moved on to universal credit are being asked to look for work.

“Not only is this unlawful, but it puts disabled people at risk of being inappropriately sanctioned.”

A DWP spokesperson added: “We are aware of an issue where a small number of claimants are still being asked to attend a Claimant Commitment appointment and are currently working to resolve the situation.

“Anyone who thinks they have been affected should contact their work coach.”

Which benefits are stopping?

UNIVERSAL Credit is replacing six benefits under the old welfare system, commonly called legacy benefits. They are:

- Working tax credit

- Child tax credit

- Income-based jobseeker’s allowance

- Income support

- income-related employment and support allowance

- Housing benefit

If you’re on any of these benefits now, you can move over immediately or wait until you receive your migration notice.

You should carefully consider the financial implications of transitioning to Universal Credit before receiving a formal notice, as once you make the switch, there is no option to revert to your previous benefits.

An online benefits calculator, free and easy to use from charities such as Turn2Us and EntitledTo, can help you check.

You may also be moved to Universal Credit if your circumstances change, such as moving home, changing your working hours, or having a baby.

Ultimately, everyone will be transitioned to Universal Credit through the managed migration process, and all legacy benefits will be phased out by 2025.

A WORD OF WARNING

Since July 2022, the Department for Work and Pensions (DWP) has sent nearly 1.14million migration notices.

However, according to the latest figures from the DWP, 284,660 individuals lost their benefits after failing to respond to migration notices received between July 2022 and June 2024.

That’s why it’s vital to ensure that you switch to Universal Credit within three months of receiving your letter.

Failure to do this will stop your current benefit payment.

You will also forfeit transitional protection top-up payments designed to ensure you do not lose money when transitioning to Universal Credit under the managed migration process.

Some 623,310 individuals have since made successful claims for Universal Credit, and another 232,830 are still in the process of transitioning.

HELP CLAIMING UNIVERSAL CREDIT

As well as benefit calculators, anyone moving from tax credits to Universal Credit can find help in a number of ways.

You can visit your local Jobcentre by searching at find-your-nearest-jobcentre.dwp.gov.uk/.

There’s also a free service called Help to Claim from Citizen’s Advice:

- England: 0800 144 8 444

- Scotland: 0800 023 2581

- Wales: 08000 241 220

You can also get help online from advisers at citizensadvice.org.uk/about-us/contact-us/contact-us/help-to-claim/.

Will I be better off on Universal Credit?

ANALYSIS by James Flanders, The Sun’s Chief Consumer Reporter:

Around 1.4million people on legacy benefits will be better off after switching to Universal Credit, according to the government.

A further 300,000 would see no change in payments, while around 900,000 would be worse off under Universal Credit.

Of these, around 600,000 can get top-up payments (transitional protection) if they move under the managed migration process, so they don’t lose out on cash immediately.

The majority of those – around 400,000 – are claiming employment support allowance (ESA).

Around 100,000 are on tax credits, while fewer than 50,000 each on other legacy benefits are expected to be affected.

Those who move voluntarily and are worse off won’t get these top-up payments and could lose cash.

Those who miss the managed migration deadline and later make a claim may not get transitional protection.

The clock starts ticking on the three-month countdown from the date of the first letter, and reminders are sent via post and text message.

There is a one-month grace period after this, during which any claim to Universal Credit is backdated, and transitional protection can still be awarded.

Examples of those who may be entitled to less on Universal Credit include:

- Households getting ESA and the severe disability premium and enhanced disability premium

- Households with the lower disabled child addition on legacy benefits

- Self-employed households who are subject to the Minimum Income Floor after the 12-month grace period has ended

- In-work households that worked a specific number of hours (e.g. lone parent working 16 hours claiming working tax credits

- Households receiving tax credits with savings of more than £6,000 (and up to £16,000)

Either way, if these households don’t switch in the future, they risk missing out on any future benefit increase and seeing payments frozen.

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

MMA2 weeks ago

MMA2 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Technology4 weeks ago

Technology4 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

News1 month ago

the pick of new debut fiction

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

News3 weeks ago

News3 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

TV2 weeks ago

TV2 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists are grappling with their own reproducibility crisis

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Technology3 weeks ago

Technology3 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

Technology3 weeks ago

Technology3 weeks agoGmail gets redesigned summary cards with more data & features

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

News3 weeks ago

News3 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

Entertainment3 weeks ago

Entertainment3 weeks ago“Golden owl” treasure hunt launched decades ago may finally have been solved

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

Science & Environment1 month ago

Science & Environment1 month agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Business4 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Technology3 weeks ago

Technology3 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Sport1 month ago

Sport1 month agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

News1 month ago

The Project Censored Newsletter – May 2024

-

Technology4 weeks ago

Technology4 weeks agoArtificial flavours released by cooking aim to improve lab-grown meat

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Business3 weeks ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

News3 weeks ago

News3 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Technology3 weeks ago

Technology3 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Football3 weeks ago

Football3 weeks agoWhy does Prince William support Aston Villa?

-

MMA3 weeks ago

MMA3 weeks agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

You must be logged in to post a comment Login