Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Subscribers can sign up here to get it delivered every Monday. Explore all of our newsletters here.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

One thing to start: Meet the non-doms fighting Rachel Reeves’s tax raid on wealthy foreigners. Are you a non-dom and caught by the UK’s proposed changes? I’d love to hear from you: harriet.agnew@ft.com

And one hire: Murray Roos, the former group head of capital markets at the London Stock Exchange Group, is joining alternatives investment house Ocean Wall as chair next month.

In today’s newsletter:

-

Nicolai Tangen on the geopolitical risks facing the chip industry

-

Harvard donations drop sharply in wake of criticism over Israel protests

-

Yen resumes decline on doubts over Japan interest rate rises

Norway’s $2tn man

Norges Bank Investment Management, also known as Norway’s oil fund, is the largest single sovereign wealth fund on Earth. It contains approaching $2tn in assets, based on money earned from the country’s oil reserves, and owns on average about 1.5 per cent of every listed company.

In the latest episode of the FT’s Unhedged Podcast, markets columnist Katie Martin talks to Nicolai Tangen, the man in charge of making this supertanker run smoothly. In a wide-ranging discussion, Tangen outlines why he’s worried that a toxic mix of investor concentration in Big Tech and geopolitical risks in Taiwan leave global stock markets vulnerable to a large correction and means “we are heading for a period of low returns”.

The stock market dominance of companies with links to artificial intelligence — such as Nvidia, which designs the chips powering the AI revolution, or the likes of Amazon, Meta and Microsoft that buy them — is “absolutely worrying”, he says.

Taiwan is at the epicentre of the global semiconductor supply chain, leaving the chip industry vulnerable to tensions in China-Taiwan relations.

On the geopolitical front, Tangen says:

“I think the main thing to watch is the relationship between the US and China, because that has implications for Taiwan and it has implications for what’s happening with the microchips and the supply chains, which involves pretty much everything we do, you know. Chips into everything: phones, toasters, cars, dishwashers. Just everything.”

Tangen also had some tough love for Europe, which he said “has not been a great place to invest” in comparison to the US. Why?

“Because the economies are much slower, it’s more difficult to innovate, it’s more regulated, the labour market is less flexible, just a lot of things which make it more difficult to operate. And that’s not something that I think — that’s something that we hear from the CEOs of the largest companies in Europe and in the US. So it means that returns in Europe have been half of what they’ve been in America over the last 10 years, right? This has important implications.”

Listen to the podcast or read the full transcript here. Meanwhile, Tangen has his own podcast series called In Good Company, one of a growing number of business-focused podcasts that have sprung up to showcase top-flight chief executives as hosts, interviewees or both. Look out this week for his podcast interview with Schroders chief executive Peter Harrison.

Harvard donations drop sharply

Student protests over Israel’s war in Gaza have roiled the Harvard University campus for much of the past academic year, and wealthy alumni including Pershing Square founder Bill Ackman and Citadel founder Ken Griffin criticised the university for its handling of the demonstrations.

Last week, the first sign of the economic toll on the Cambridge, Massachusetts, institution emerged. Donations to Harvard fell 14 per cent in the fiscal year ending June 30, as large donors cut ties, report Brooke Masters and Sun Yu in New York.

Overall gifts, including grants and loans, to the western world’s wealthiest university dropped to $1.18bn from $1.38bn a year ago, as outrage over campus protests led to the resignation of president Claudine Gay.

The drop was a result of lower donations to the university’s endowment, where the very largest gifts tend to be concentrated. Those gifts fell by one-third, while donations to the operating fund, which covers day-to-day expenses, rose 9 per cent year on year to $528mn.

US endowments such as Harvard’s are also closely watched for another reason: their performance is seen as a proxy for the health of the private equity industry.

Since Narv Narvekar in 2016 took over as chief executive of Harvard Management Company, which manages the endowment, its private equity allocation has more than doubled to 39 per cent of its assets to become the biggest component of HMC’s investment portfolio.

Private equity lagged behind public equity for the second year in a row as a slump in stock listings as well as mergers and acquisitions put the asset class under stress.

Narvekar said in the letter that HMC’s private equity portfolio underperformed in part because portfolio managers who had not marked down their holdings sharply during the 2022 market crash then also refrained from valuing their investments upward “in the context of rising public equity markets” in 2023 and 2024.

Overall, the endowment generated gains, returning 9.6 per cent and pushing total holdings back up to $53.2bn.

Chart of the week

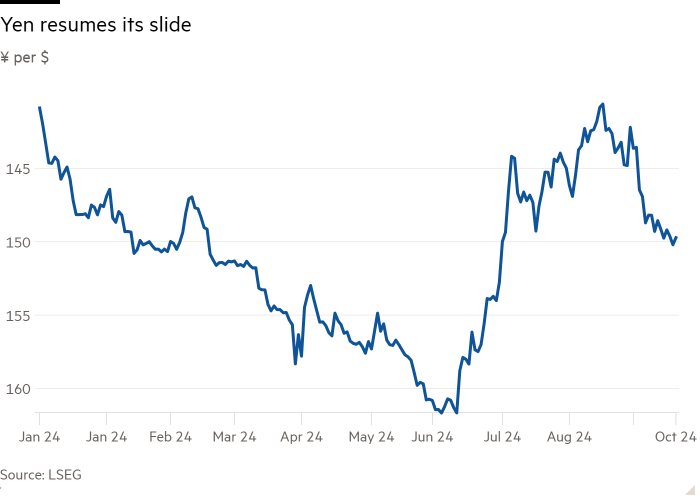

The Japanese yen has fallen sharply in recent weeks, hitting levels not seen since before a sudden surge in the summer that reverberated across global markets, writes Ian Smith in London.

The yen last week sank below ¥150 to the US dollar, and has lost about 5 per cent over the past month as investors bet on a slower pace of interest rate rises from the Bank of Japan, at a time when the US Federal Reserve is also expected to cut rates more slowly than previously thought. Dovish comments from Japan’s new Prime Minister Shigeru Ishiba, who had previously been critical of the BoJ’s very loose monetary policy, have helped the currency resume a slide that carried it to 34-year lows earlier in the year.

The shift, investors said, has rekindled interest in the so-called yen carry trade, where investors borrow in yen to fund bets in higher-yielding currencies, a bet that blew up spectacularly in August after the BoJ raised borrowing costs.

Hiroki Hashimoto, a senior fund manager at Royal London Asset Management, said the recent weakness could “likely be explained by the recent widening interest rate differentials between the US and Japan”. He said the risk that the governing party loses its lower-house majority at a snap election this month “could have led to the less hawkish comments” from the new prime minister.

Ishiba said this month that the economy was “not in an environment” for further interest rate rises by the BoJ.

Five unmissable stories this week

Klarna is offloading most of its UK “buy now, pay later” portfolio to US hedge fund Elliott, in a deal that will free up as much as £30bn for new loans. Deputy editor Patrick Jenkins suggests that there is problem borrowing in the area nicknamed “buy now, pain later”.

Forcing UK pension funds to buy British assets as a way of increasing domestic investment would be a “huge mistake” that could reduce payouts to pensioners, some of the country’s biggest investors have warned.

Blackstone plans to list some of its largest investments, according to its president Jonathan Gray, after sluggish asset sales hit third-quarter profits at the world’s biggest private capital group.

Private equity investors are selling second-hand stakes in ageing funds at a blistering pace this year, as pensions and endowments find ways to get out of unlisted investments amid a slump in deal activity that has curtailed cash payouts.

Michael Summersgill, chief executive of investment site AJ Bell has warned that uncertainty over potential tax changes in this month’s Budget has led to customers taking money out of their pension pots.

And finally

The Neue Galerie is one of my favourite galleries in New York, located in a magnificent townhouse on Museum Mile in the Upper East Side that was originally constructed for the industrialist William Starr Miller. Among the treasures in the permanent collection of early 20th-century German and Austrian art is Gustav Klimt’s Portrait of Adele Bloch-Bauer. From now until January a temporary exhibition, Egon Schiele: Living Landscapes investigates the importance of landscape in the Austrian artist’s work. Don’t miss the Wiener schnitzel in the museum’s Café Sabarsky.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

You must be logged in to post a comment Login