Hello everyone. This is Cissy from Hong Kong. It’s been a hectic week for the tech industry. Asian tech giants have started to report their July-September quarterly earnings even as they absorb the shock re-election of Donald Trump as US president.

It’s also been a busy time for Asian media outlets, including us, covering what Trump’s second term will mean for trade, defence, markets and more. It appears the consensus is that first and foremost his return to the White House will bring uncertainty for the region, although there are a few voices arguing that Trump won’t take the world by surprise this time.

One of his biggest impacts will likely be on immigration. Chinese citizens, many of them middle class, who made the risky Darién Gap crossing to reach the US during the pandemic years are now worried about being deported under Trump. Parents in China, meanwhile, some of whom have even sold their property in order to send their sons and daughters to study in the US, are increasingly worried their children will not be allowed into the country.

With the Republicans clinching control of the House as well as the Senate, Trump is set to become one of the most powerful US presidents in the modern era. Let’s embrace the changes that the next four years will surely bring, whatever they might be.

I am sure many of you are particularly interested in how Trump’s return as US president will affect the global chip industry and the tech supply chain. Please join us on November 28 for a webinar with Chris Miller, author of Chip War, Yeo Han-koo, former trade minister of South Korea, and our own chief tech correspondent Cheng Ting-Fang as we delve into this ever-changing industry. Register here and be sure to submit your questions for the panel ahead of time.

Closing the door

Trump will not be sworn in as president until January, but the world’s biggest contract chipmaker is making sure it stays on the right side of US export control rules no matter who is in the White House. Sources told Nikkei Asia’s Cheng Ting-Fang and Lauly Li that Taiwan Semiconductor Manufacturing Co is suspending production of AI and high-performance computing chips for several Chinese customers.

The Chinese chip design clients that will be affected are those working on high-performance computing, GPUs and AI computing applications that use 7nm or more advanced chip production technologies. These chip developers need to obtain a licence from the US government to continue working with top chipmakers such as TSMC.

Companies making mobile, communication, and connectivity chips with the same technology won’t be impacted, and sources say the effect on TSMC’s revenue will be minimal. But the move highlights the Taiwanese chipmaker’s push to have clients shoulder more of the burden for ensuring compliance with US regulations.

Wearable AI

A race is heating up between the major Chinese tech giants to be the leading provider of AI-integrated hardware, writes the Financial Times’ Eleanor Olcott.

Baidu, which operates China’s largest search engine, unveiled smart glasses on Tuesday, which run on its large language model (LLM) Ernie. The glasses, which will hit stores next year, have been developed by the internet company’s hardware brand Xiaodu, which has pitched them as a “private assistant” for users. It enables wearers to track calorie consumption, ask questions about their environment, play music and shoot videos.

While Washington’s chip restrictions mean Chinese companies lag behind US rivals in developing the most powerful LLMs, experts say they can still leverage the country’s world-class electronics sector to develop competitive AI consumer hardware.

Baidu’s glasses will initially only retail in China, while US tech groups Meta and Snap are competing to dominate the market outside of the country.

A new target

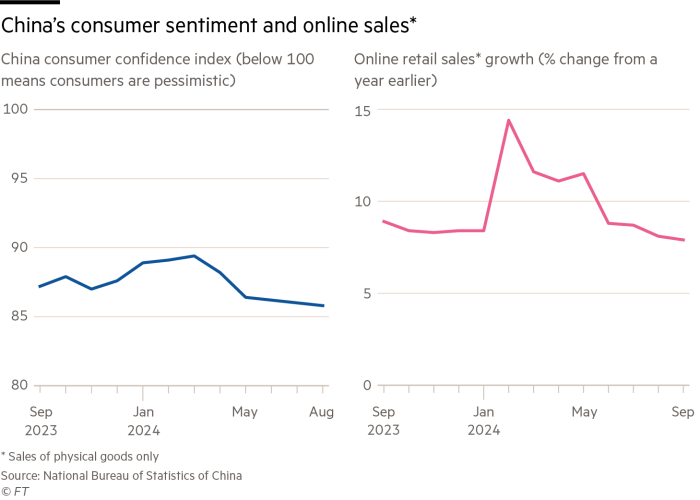

China’s biggest annual shopping festival is getting longer and longer and, for many shoppers, more tedious. As domestic consumption continues to be weak, ecommerce platforms this year are ramping up efforts to tap a potentially lucrative group: the 100mn or so Chinese living overseas, writes Nikkei Asia’s Cissy Zhou.

Alibaba, which pioneered the sales campaign back in 2009, spent around $200mn filling subway stations in Hong Kong and Taiwan with ads for free shipping on orders over Rmb99 among other offers. Rivals JD.com and Pinduoduo were less aggressive in their marketing campaigns but invested big to give Hong Kong shoppers reduced prices on items and cheaper shipping.

Alibaba said the company achieved “robust” GMV (gross merchandise value) growth and a “record number” of active buyers during this year’s Singles Day. The company, along with JD, may reveal more meaningful data in their upcoming third-quarter earnings calls.

Battle of the batteries

CATL, the world’s largest supplier of electric vehicle batteries, is seeking to capture growing demand for plug-in hybrids with a new compound battery pack that promises a range of 400km, writes Nikkei’s Shizuka Tanabe.

The move comes as the battery maker faces intense competition from rival BYD, China’s leading seller of midmarket plug-in hybrids.

BYD in May overhauled its proprietary plug-in hybrid platform to improve its range. The updated DM-i boasts a combined fuel and electric range of 2,100km. However, the automaker has focused more on improving the efficiency of its engine, and the platform’s electric range is between 80km and 120km.

Sales of plug-in hybrids are surging in China, hitting 3.33mn units between January and September, up 84 per cent from the same period last year. CATL is betting that a longer electric range will appeal to buyers looking for “the EV experience”.

Suggested reads

-

Vietnam weighs new tech law that risks irking US under Trump (Nikkei Asia)

-

SoftBank returns to profit as Indian IPOs boost Vision Fund gains (FT)

-

Kakao: Can South Korea’s symbol of innovation regain its shine? (Nikkei Asia)

-

Nintendo and Sony head into ‘grim’ holiday season with old consoles and no big releases (FT)

-

SoftBank taps Nvidia for Japanese ‘AI grid’ project (Nikkei Asia)

-

Tencent’s quarterly results fall short on weak China consumption (Nikkei Asia)

-

Singapore’s Sea stock jumps 21% as online retail arm returns to black (Nikkei Asia)

-

SoftBank performance strengthens credibility of its AI vision (FT)

-

FTX sues Binance and former chief Changpeng Zhao for $1.8bn (FT)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp.

You must be logged in to post a comment Login