Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Subscribers can sign up here to get it delivered every Monday. Explore all of our newsletters here.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

One event to start: I’m in New York this week and I hope to see lots of you on Wednesday and Thursday at our Future of Asset Management North America event at etc.venues 360 Madison. We have a great line-up of speakers, including Salim Ramji, the new CEO of Vanguard, Neuberger Berman’s George Walker, and Franklin Templeton’s Jenny Johnson. Register here and use the code AMNL10 for a 10 per cent discount.

And one scoop: Sandra Robertson, who has run Oxford university’s £6.5bn endowment fund since it was founded almost two decades ago, is stepping back as chief investment officer of Oxford University Endowment Management and will be replaced by deputy-CIO Neamul Mohsin.

In today’s newsletter:

-

Steve Cohen steps back from trading at hedge fund Point72

-

BlackRock and Microsoft plan $30bn fund to invest in infrastructure

-

Nuclear fuel prices surge as west rues shortage of conversion facilities

How Steven Cohen ran a hedge fund like a baseball team

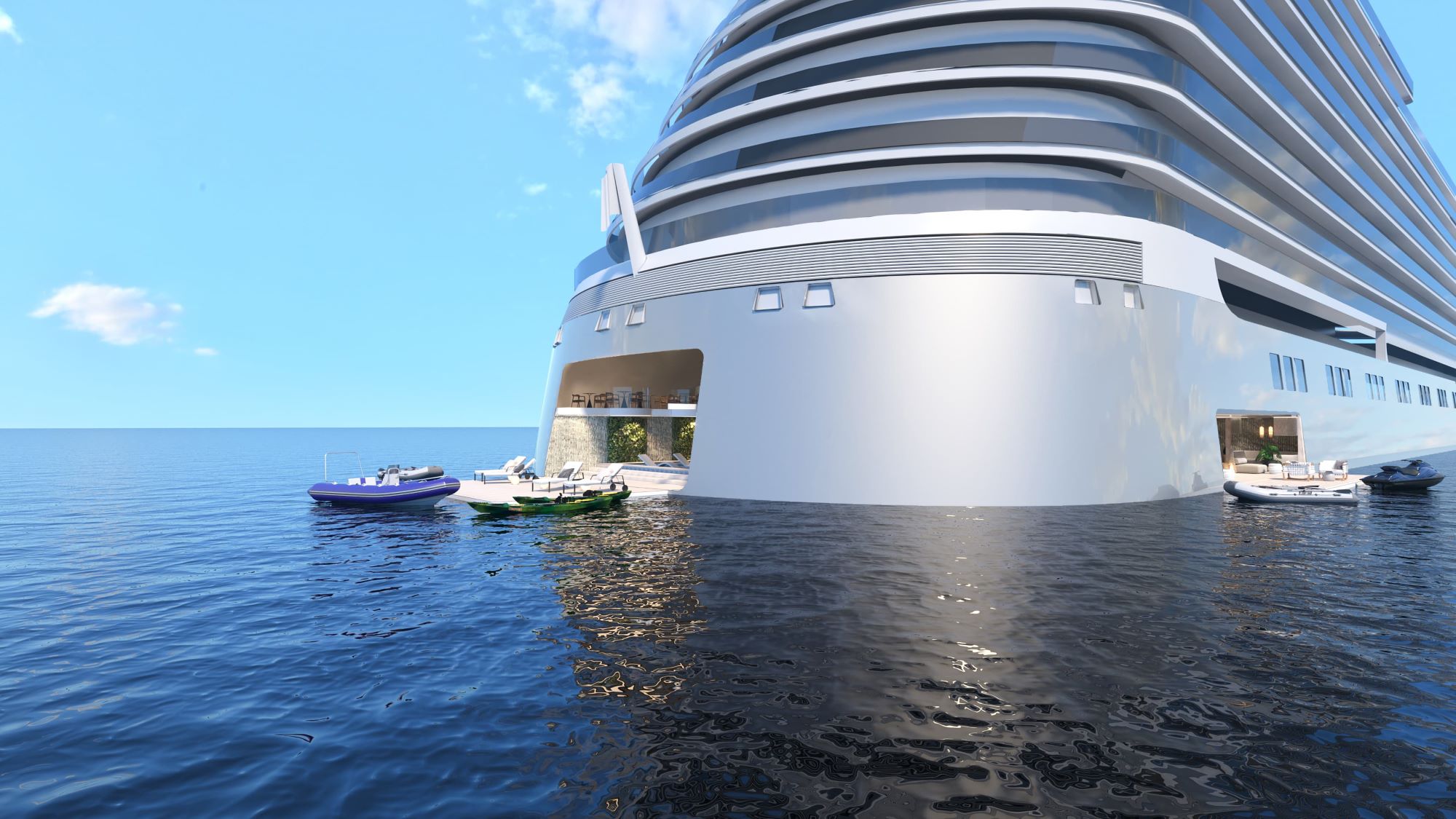

Steve Cohen used to charter a yacht in the Mediterranean with friend and art dealer Larry Gagosian. But he never really switched off.

“We’d be in the middle of a wonderful dinner in Italy and he’d have to race back to the boat to trade,” said Gagosian, recalling how the hedge fund billionaire would have screens installed below deck to create a de facto trading floor.

“I said, Steve, I love you, and I love taking trips with you, but it’s not the most relaxing.”

However, after an investment career spanning almost half a century, Cohen, 68, announced last week he was stepping back from trading at Point72, the hedge fund he set up a decade ago, to focus on running the firm.

Point72 rose from the ashes of an insider trading scandal at its predecessor SAC Capital that cost $1.8bn to settle — the largest ever for insider trading — with Cohen subsequently barred for two years from managing external investors’ money.

In this profile, Costas Mourselas and I explore one of the hedge fund industry’s great comeback stories, from the cut and thrust atmosphere at SAC, where the returns seemed to good to be true (they were) to the Point72 of today, a business employing 2,800 people and running over $35bn in assets.

“Steve treated the business like a baseball team — if your shortstop is not performing then you trade him for someone else,” says one person who worked with him at SAC. “There’s no personal relationship, it’s just business.”

Cohen is as known for his ownership of the New York Mets and his world-renowned art collection as he is for his trading prowess. The collection is worth more than $1bn and includes works by Pablo Picasso, Andy Warhol and Alberto Giacometti. What distinguishes Cohen as a collector, says Gagoisan, is that he “is just as interested in seeing a new artist as going after a trophy. That’s not always the case.”

For Gagosian, his friend’s shift from player to coach may mean their holidays can resume. “We stopped chartering boats together,” he said. “Maybe now we’ll do it again.”

Read our full story here. And don’t miss this 2006 New Yorker article on the “$40mn-elbow”, one of the more bonkers tales I’ve ever heard. Casino magnate Steve Wynn had agreed to sell Le Rêve,” Picasso’s 1932 portrait of his mistress, Marie-Thérèse Walter, to Cohen and had worked out a deal. But as Wynn was showing the painting to friends the night before the exchange, he accidentally put his elbow through it . . .

BlackRock and Microsoft plan $30bn fund to invest in AI infrastructure

Energy is emerging as one of the biggest barriers for companies looking to exploit the recent advances in artificial intelligence, writes Brooke Masters in New York. The biggest digital companies are already warning of severe capacity bottlenecks in coming years because AI computing power requires far more energy than previous technological innovations.

BlackRock announced last week that it is joining forces with Microsoft and MGX, the Abu Dhabi-backed investment company, to address that problem with one of the biggest investment vehicles ever raised on Wall Street. The three groups will serve as general partners on the Global AI Investment Partnership, which will invest in data centres and the energy infrastructure needed to support them.

The partnership seeks to raise up to $30bn in equity investments and leverage to support up to an additional $70bn in debt financing. Nvidia, the fast-growing chipmaker, will advise on AI factory design and integration.

The fund will be managed by Global Infrastructure Partners and marks its first big fund since the private infrastructure investment group agreed to be acquired by BlackRock for $12.5bn earlier this year. That deal is due to close next month.

“The country and the world are going to need more capital investment to accelerate the development of the AI infrastructure needed,” Brad Smith, Microsoft’s president, told Brooke. “This kind of effort is an important step.”

The fund marks the latest vehicle created by a large asset manager to meet the ever-growing demand for energy to power generative AI and cloud computing. Earlier this year Microsoft agreed to back $10bn in renewable electricity projects built by Canada’s Brookfield Asset Management.

“Mobilising private capital to build AI infrastructure like data centres and power will unlock a multitrillion-dollar long-term investment opportunity,” says Larry Fink, BlackRock chief executive.

Nuclear fuel prices surge

The price of fuel for nuclear reactors has surged much faster than that of raw uranium since the start of 2022, in a sign of the bottlenecks that have built up in the west following Russia’s invasion of Ukraine, writes Harry Dempsey in London.

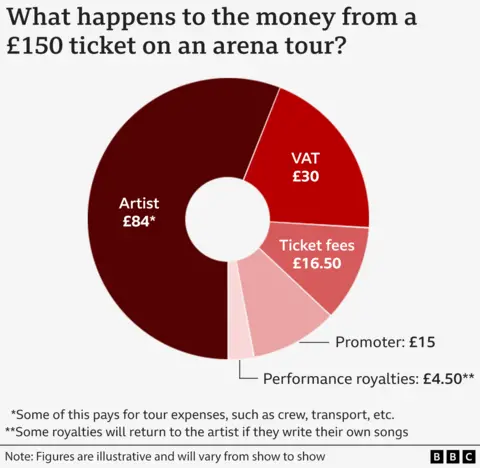

Enriched uranium has more than tripled in price to $176 per separative work unit — the standard measure of the effort required to separate isotopes of uranium — since the start of 2022, according to UxC, a data provider.

Demand for uranium has been driven by a revival in atomic power in recent years. However, Russia plays a significant role in the multi-stage process of turning mined uranium into the fuel for a nuclear reactor. This includes converting yellowcake — uranium concentrate — into uranium hexafluoride gas, enriching it to increase the concentration of the type of uranium used for fission, and then turning the enriched uranium into pellets that go into reactors.

Uranium hexafluoride has jumped fourfold in price to $68 per kilogramme in the same period, indicating that conversion is the biggest bottleneck in the nuclear fuel supply chain, analysts said. In contrast, uranium ore has only doubled in price.

“The conversion and enrichment prices are reflecting a much bigger supply squeeze due to the Russia-Ukraine war and other factors,” said Jonathan Hinze, chief executive of UxC.

“Uranium alone does not tell the whole story when it comes to price impacts in the nuclear fuel supply chain.”

Five unmissable stories this week

Steven Eisman, best known for betting on the collapse of the US housing market, has been put on indefinite leave of absence by his employer Neuberger Berman after saying he was “celebrating” the destruction of Gaza.

Billionaire hedge fund manager John Paulson has brushed aside Wall Street worries that Donald Trump’s plans to raise tariffs will harm the economy, calling for the US to “decouple” from China.

Vanguard gave investors in a handful of its funds the chance to vote their shares last year, part of a revolutionary push to give people a say in the governance of America’s largest companies. Almost half of investors opted to let Vanguard do it for them after all.

Private equity is doing badly — however you measure it, writes Lex. Undeterred, private equity firms are aggressively pushing to include language in loan documents to increase payouts on deals.

The UK’s state-backed pension scheme Nest has agreed a tie-up with insurer Legal & General and Dutch pension fund manager PGGM to invest up to £1bn in build-to-rent properties.

And finally

The latest FT Magazine is a must-read Guide to the Business Lunch. It features our favourite business lunch restaurants in London, why lunchtime gossip is ripe for a comeback, and a review of Sweetings, the City’s last canteen. Plus I interviewed Jesus Adorno, the maître d’ at the legendary Le Caprice, on his memories from almost four decades of ego management, extreme discretion and Diana, Princess of Wales.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

You must be logged in to post a comment Login