Business

Top Trump fundraiser lines himself up for Treasury secretary

Billionaire hedge fund manager Scott Bessent canvasses for deputies

Business

Bank of England expected to cut interest rates

Getty Images

Getty ImagesInterest rates are widely expected to be cut by the Bank of England on Thursday, in a move closely watched by businesses and consumers.

Most analysts predict that the benchmark rate will fall from its current level of 5% to 4.75% when the decision is announced at 12:00 GMT.

That would make borrowing money cheaper, but is likely to reduce the returns available to savers.

The Bank’s Monetary Policy Committee (MPC) meets eight times a year to set rates.

Bank of England expectation

The Bank of England cut interest rates from 5.25% to 5% in August, which was the first drop in more than four years following a string of increases.

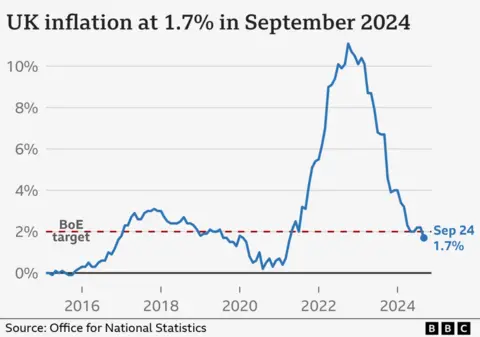

Since then, official figures have revealed that the UK inflation rate – which charts the rising cost of living – dropped unexpectedly to 1.7% in September.

That was the lowest rate for three-and-a-half years and below the 2% target set by the government. Interest rates are the main tool for the Bank to control the level of inflation.

Subsequent figures from the Office for National Statistics (ONS) showed that wage growth slowed to its lowest pace for more than two years.

That gave more impetus to the likelihood of a Bank rate cut.

Bank Governor Andrew Bailey also told the Guardian last month that it could be a “bit more aggressive” at cutting borrowing costs, depending on the rate of inflation.

How it affects borrowers and savers

The Bank’s base interest rate heavily influences the rates High Street banks and other money lenders charge customers for loans, as well as credit cards.

Lenders have mostly “priced in” the impact of a base rate cut when making decisions on their own interest rates.

Mortgage rates are still much higher than they have been for much of the past decade. The average two-year fixed mortgage rate is 5.4%, according to financial information company Moneyfacts. A five-year deal has an average rate of 5.11%.

However, more than one million borrowers on tracker and variable deals could see an immediate fall in their monthly repayments if the Bank cuts rates.

Savers would likely see a reduction in the returns offered by banks and building societies. The current average rate for an easy access account is about 3% a year.

Rachel Springall, of Moneyfacts, said: “Savers are the ones who feel the force of cuts to interest rates. Those savers who use their interest to supplement their income will feel overlooked if rates plummet.”

Budget and US election impact

Political events will feed into the Bank’s decision on Thursday, specifically last week’s Budget delivered by Chancellor Rachel Reeves, and Donald Trump’s sweep to victory.

The government’s official, but independent, forecaster – the Office for Budget Responsibility – said, in the short term, measures announced in the Budget would push inflation and interest rates higher than they would otherwise have been.

This has created more doubt about whether the Bank of England will cut interest rates again following its meeting in December.

Meanwhile, analysts’ forecasts suggest US inflation will be higher under the expectation that Trump will introduce higher tariffs on all imports next year.

This would give the Federal Reserve less scope to ease interest rates, and could affect decisions made around the world, they said.

What are my savings options?

- As a saver, you can shop around for the best account for you

- Loyalty often doesn’t pay, because old savings accounts have among the worst interest rates

- Savings products are offered by a range of providers, not just the big banks

- The best deal is not the same for everyone – it depends on your circumstances

- Higher interest rates are offered if you lock your money away for longer, but that will not suit everyone’s lifestyle

- Charities say it is important to try to keep some savings, however tight your budget, to help cover any unexpected costs

There is a guide to different savings accounts, and what to think about on the government-backed, independent MoneyHelper website.

What are interest rates? A quick guide.

Money

Martin Lewis reveals ‘unbeatable’ account for anyone on Universal Credit offering up to £1,200 free cash from DWP

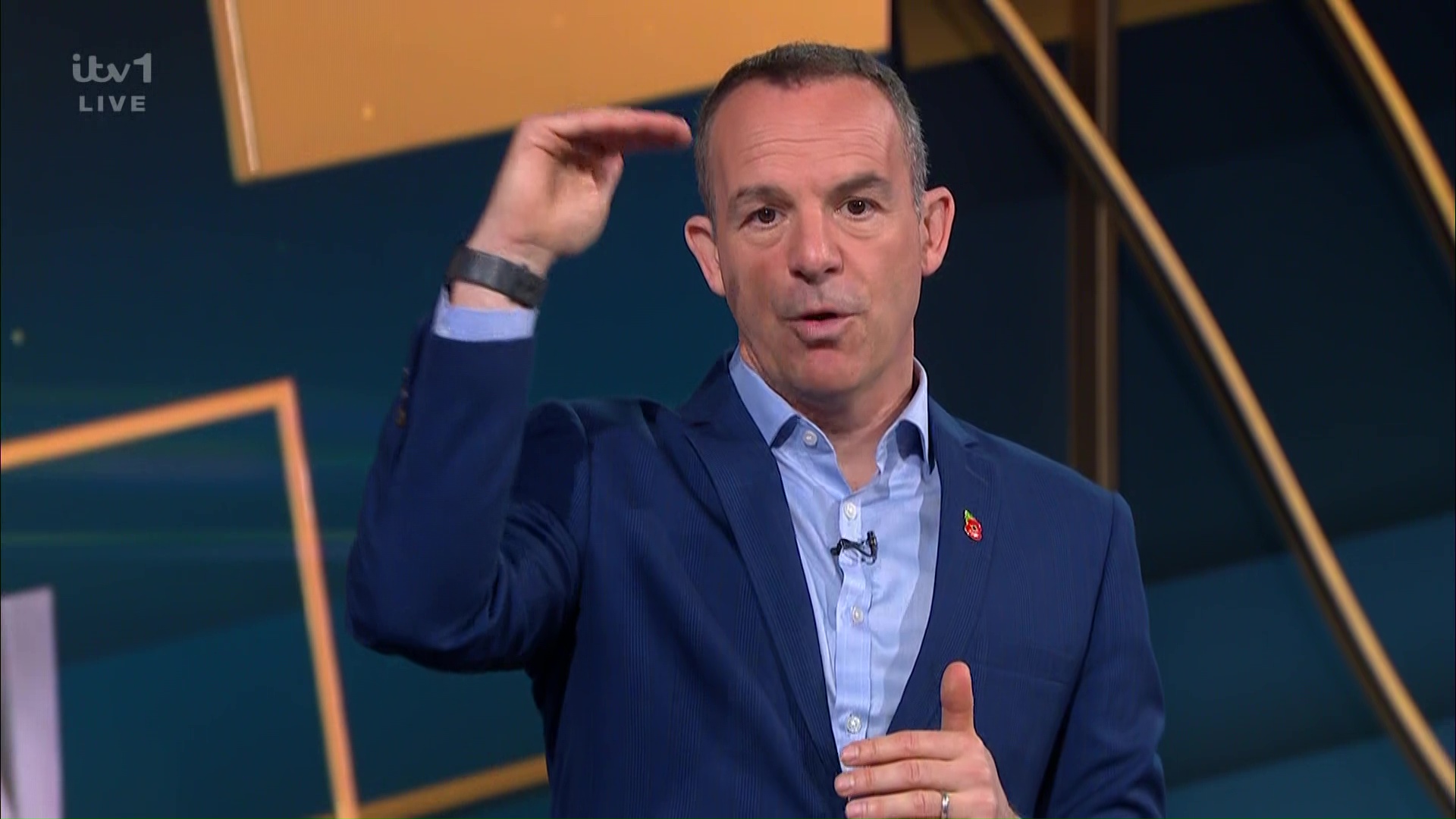

MARTIN Lewis has revealed how thousands on Universal Credit can access an “unbeatable” savings account that pays a 50% bonus.

The MoneySavingExpert website founder told viewers of his ITV Money Show last night you can earn £1,200 in free cash with a Help to Save account.

Those on tax credits or Universal Credit and earning a certain amount can open one of the accounts.

You can put in between £1 and £50 each calendar month and receive a 50% bonus on any cash saved.

Martin explained: “Totally unbeatable is Help to Save via gov.uk.

“It’s amazing. You put in up to £50 a month and then you get a 50% bonus.”

Read more on Martin Lewis

Jeanette Kwakye, who also co-hosts the Money Show alongside Martin, went on to share the story of a viewer who got a £500 bonus after opening one of the accounts.

What is Help to Save?

Help to Save is a type of savings account available to those on tax credits and Universal Credit.

It is a Government-backed scheme which means your money is protected and you won’t lose any put in.

You can save between £1 and £50 each calendar month and get a 50p bonus for every £1 saved.

You can save into one of the accounts for a maximum of four years, with bonuses paid out at the end of the second and fourth year.

That means if you put in the maximum £50 a month for four years, you could get £1,200 in free money overall.

One major benefit to a Help to Save account is that you get a bonus at the end of the second or fourth years regardless of what your final balance is.

So, if for example you had £600 in your account and then took £300 out for an emergency and had £300 left at the end of the first two years, you would still get a £300 bonus – 50% of £600.

Currently, you can only open a Help to Save account if you are on Universal Credit and you, or you and your partner, had take home pay of £793.17 or more in your last monthly assessment period.

Take home pay is what your pay is after deductions such as National Insurance.

However, Budget documents revealed the scheme will be rolled out to all Universal Credit claimants who work from April 6 next year.

It’s worth bearing in mind, if the savings you have stashed away in a Help to Save account mean you breach £6,000 it could see your Universal Credit payments reduced.

This does not apply to those on working tax credits who have opened an account.

Other help you can get if you’re on Universal Credit

It’s worth checking you can claim Universal Credit as not only will you get payments on a regular basis, it can unlock other perks.

The Household Support Fund is a giant pot of cash worth £421million that has been shared between councils in England.

They then decide how to distribute their share of the cash, and who to distribute it to.

But, in most cases you will get help if you are on a low income or benefits, like Universal Credit.

The eligibility criteria varies from council to council but if you are on a low income or benefits it’s worth checking if you qualify for help.

You can find out what council area you fall under by using the Government’s council locator tool via gov.uk.

You can also get 85% of the cost of your childcare covered if you’re on Universal Credit.

The most you can get each month is £1,015 for one child and £1,739 for two or more kids.

And new or expectant mothers on Universal Credit can get one-off payments worth £500 through Sure Start Maternity Grants too.

Are you missing out on benefits?

YOU can use a benefits calculator to help check that you are not missing out on money you are entitled to

Charity Turn2Us’ benefits calculator works out what you could get.

Entitledto’s free calculator determines whether you qualify for various benefits, tax credit and Universal Credit.

MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto’s data.

You can use Policy in Practice’s calculator to determine which benefits you could receive and how much cash you’ll have left over each month after paying for housing costs.

Your exact entitlement will only be clear when you make a claim, but calculators can indicate what you might be eligible for.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Business

UK Christmas advertising attracts record spending but brands shun television

Online display to enjoy biggest increase as advertisers prepare to splash out £10.5bn

Money

Cost of living payments worth up to £500 available to thousands living with specific illness

PEOPLE living with a specific illness are eligible for a whopping £500 worth of cost of living payments.

The MND Association – a charity which supports people affected by motor neurone disease – has announced that the value of its Cost of Living Support Fund is increasing to a maximum of £500 from £350.

This is an uplift of £150.

MND affects up to 5,000 adults in the UK at any one time.

The fund can be applied for by those with a confirmed diagnosis or suspected diagnosis of MND or Kennedy’s disease.

The scheme was set up in 2023 for those who are struggling with household bills, food or shopping costs.

READ MORE ON COST OF LIVING

It’s not means tested, so you will not be required to provide proof of income, and no quotes or receipts are required as part of

the application process.

With many people living with MND experiencing their bills rise, the charity made the changes to the fund on 1 November.

It was partly in response to the latest survey from the charity which revealed that over 80% of carers of people with MND have used savings or retirement plans to cover household costs.

Furthermore, research in 2023 found households affected by MND spend an average of £14,500 a year on costs associated with living and managing the condition – a clear indication that the financial impact of the disease has never been higher.

Those who have already received the previous amount can still apply for the difference, should they need to.

Sally Hughes, director of services and partnerships at the MND Association, said: “We know many people living with and affected by MND will be anxious and worried as household costs continue to rise.

“As we head into the colder months, we want to ease the financial burden on people with MND. People shouldn’t have to worry about whether to eat, heat their home or turn on vital equipment.

“It is once again another example of charities stepping up where statutory services have failed to do so.

“What we really need is for the Government to do more to help vulnerable people rather than take away support, as they have with the recent changes to the Winter Fuel Payment.”

How can I apply?

If you would like to apply, a simple form asks you to outline why the Cost of Living fund is required and how it will be used.

You can download the application form from The MND Association’s website.

Once you have completed the form, you will need to email it to support.services@mndassociation.org and your application will be considered.

If you are awarded the fund, the MND Association will arrange for the payment to be made to you.

What other cost of living payments are available?

The current economic climate is seeing more charities step in to fill the gap left by a lack of support from the Government and statutory services.

For those living with cancer, Macmillan’s Financial Grants Scheme was established to help support those who are struggling to cover essential living costs.

So anyone living with cancer and who needs help with bills and other essentials can apply for the grant.

It’s worth up to £350 and is a one-off payment and can be used to help with things like:

- Energy bills

- Home adaptions

- The cost of travel to and from hospital

- Any extra costs you might have because of cancer

However, unlike the MND Association fund, it is means-tested.

This means both the following need to apply to become eligible:

You must have no more than £6,000 in savings for a household of one person or no more than £8,000 for a household of two or more people

You must have a weekly income of no more than £323 per week for a household of one person or no more than £442 per week for a household of two or more people.

Benefits like personal independence payments (PIP), disability living allowance (DLA) or attendance allowance (AA) do not count towards income for this.

To apply you can call 0808 808 00 00 or you can speak to one of your healthcare team, like a district nurse or Macmillan nurse, care professional or benefits adviser who can fill in the form with you online.

The British Legion has also set up a Cost of Living grant, which can be applied for here using the Lightning Reach portal.

You can also find out what grants may be available to you using Turn2Us’s grant search on the charity website.

There are a huge range of grants available for different people – including those who are bereaved, disabled, unemployed, redundant, ill, a carer, veteran, young person or old person.

What is the Household Support Fund?

You may also be eligible for up to £500 worth of cost of living payments from the government’s Household Support Fund (HSF) which is worth £421 million in total.

It’s available to support those who are struggling to afford household basics including food, energy, wider essentials, and exceptional costs.

The fund has been split up between councils in England who are in charge of distributing their allocation.

It was set up in 2021, however, it has been extended by the UK government a number of times.

How much you are eligible for is usually based on what benefits you already receive and your financial circumstances.

To be eligible for help, you usually have to be in receipt of a council tax reduction or show proof of being in financial difficulty.

Each council has a different application process – so you’ll have to ask your local authority or find out via your council’s website.

To find out how to contact your local authority, use the gov.uk authority tool checker.

In the last round of funding, some residents received their share automatically, while others had to apply.

For example, Haringey London Council is issuing automatic payments to eligible residents, as well as a support fund which can be applied to.

It is also issuing payments to schools, which means they can distribute free school vouchers.

Household Support Fund explained

Sun Savers Editor Lana Clements explains what you need to know about the Household Support Fund.

If you’re battling to afford energy and water bills, food or other essential items and services, the Household Support Fund can act as a vital lifeline.

The financial support is a little-known way for struggling families to get extra help with the cost of living.

Every council in England has been given a share of £421million cash by the government to distribute to local low income households.

Each local authority chooses how to pass on the support. Some offer vouchers whereas others give direct cash payments.

In many instances, the value of support is worth hundreds of pounds to individual families.

Just as the support varies between councils, so does the criteria for qualifying.

Many councils offer the help to households on selected benefits or they may base help on the level of household income.

The key is to get in touch with your local authority to see exactly what support is on offer.

And don’t delay, the scheme has been extended until April 2025 but your council may dish out their share of the Household Support Fund before this date.

Once the cash is gone, you may find they cannot provide any extra help so it’s crucial you apply as soon as possible.

Business

Moldova cleans up it act to attract foreign businesses

Luc Vocks

Luc VocksThe Eastern European country of Moldova is continuing efforts to attract overseas firms, as it tries to move past political uncertainty.

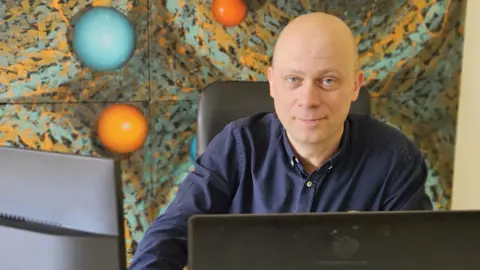

“I went with a backpack, and set up a business,” says Dutch entrepreneur Luc Vocks, recalling how he moved to Moldova in 2007.

Mr Vocks had first visited the former Soviet republic three years earlier, and recalls experiencing “the cliché that one would have of Eastern Europe at that time”.

“Everything was dirt cheap, and if you were a foreigner you’d get attention,” he says.

Today, Mr Vocks is the owner of a Moldovan company called DevelopmentAid. Based in the capital Chisinau, it employs 180 people in the country, and runs a website that lists job vacancies in the international development community.

Mr Vocks is one of a growing number of foreign entrepreneurs in Moldova. The government wants to attract more like him and hopes that low business tax rates will help.

The country’s standard corporation tax rate – the amount that firms have to pay on their profits – is just 12%. This compares with 25% in the UK, and 25.8% in the Netherlands where Mr Vocks had initially launched his company before relocating it to Moldova.

There’s an even better deal for tech firms. In 2018 the Moldovan government launched an initiative to grow the country’s IT sector – the Moldova IT Park (MITP).

This isn’t a physical business park. Instead it is virtual scheme open to all IT firms in the country – and those that wish to move there from overseas. Firms that sign up only have to pay a corporation tax rate of 7%.

The MITP is part of a wider effort by the Moldovan government to modernise and expand its economy ahead of a bid to join the European Union in 2030.

This drive is being led by Moldova’s pro-EU President Maia Sandu, who this week was re-elected for a second term. And last month Moldovans voted “yes” on pro-EU constitutional changes.

However, the vote was extremely close, with Yes getting 50.46% and No receiving 49.54%. Although Russia denied interfering in the vote, Moldova’s authorities said attempts had been made to buy up to 300,000 votes in what Maia Sandu described as an “unprecedented assault on freedom and democracy”.

Moscow is opposed to Moldova joining the EU, and supports Moldova’s breakaway region of Transnistria economically, politically and militarily.

Getty Images

Getty ImagesDumitru Alaiba, Moldova’s deputy prime minister and minister for economic development and digitalisation, is positive about where Moldova is heading.

“Moldova in the past 10 to 15 years has really proven that it’s a country that can change very fast,” he tells the BBC.

“This used to be a highly corrupt country, a country where, exactly 10 years ago, a billion dollars from our central banks just disappeared.”

“We are moving very fast towards joining the EU, and we are reforming our economy at top speed. Of course, we have a long way to go.”

He pointed to Moldova’s rise on the global Corruption Perceptions Index, produced by anti-corruption watchdog Transparency International.

Out of 180 countries – with a lower placing meaning that a country is less corrupt – Moldova is now in 76th place, up from 91st a year earlier.

“Now entrepreneurs can breathe freely without fear of repercussion, without fear of corrupt inspectors, without fear of a filthy justice sector that commits crazy abuses.”

Mr Vocks agrees that Moldova is now a much easier place in which to do business than when he first set up his company there back in 2007.

“Back then, it was extremely bureaucratic. It was hard to get a residence permit. It was painful to register a company, especially as a foreigner.

“It was painful intersecting with the tax agency. The banks were rough to work with.”

Getty Images

Getty ImagesMember companies of the MITP don’t just benefit from the 7% corporation tax rate. They also don’t need to make employer social security contributions, and staff don’t have to pay income tax. Mr Volks signed up DevelopmentAid almost immediately.

The MITP has also simplified immigration procedures through the IT Visa program.

More than 2,000 companies are now registered with the MITP, 300 of which have come from overseas. The most common countries these have moved from being the US, UK, Germany, Netherlands, and Ukraine.

In the first half of 2024, MITP firms generated a combined €365m ($397m; £308m) in revenues, according to official figures. And now employing 22,000 people in general, they are said to contribute around 6% of the country’s GDP.

While the MITP scheme has worked to boost Moldova’s IT sector, the influx of foreign tech companies has driven up salaries in the industry considerably.

Sven Wiese, a German expat who has set up a small IT services business in the country called Trabia, says he is now finding himself priced out when it comes to employee pay.

He says that the biggest firms signed up to the MITP can offer IT specialists more than €100,000 a year, “because that is still cheaper than hiring people within a bigger country like the US or Germany”.

Dumitru Alaiba

Dumitru AlaibaAt the same time he says that many Moldovan IT sector workers still want to leave the country. “Fewer people are now leaving Moldova, but emigration is still high.”

Another negative issue is the continuing war in neighbouring Ukraine, which is likely making some Western IT firms think twice about investing in Moldova. Mr Alaiba says is confident that Moldova is safe “as long as the free world is supporting Ukraine”.

Marina Bzovii, MITP’s administrator and an assistant professor at the Technical University of Moldova, already sees Moldova as a regional business hub. “Moldova is connecting even Central Asia, countries like Kyrgyzstan, Tajikistan and Uzbekistan, who are culturally much further from Europe.

“However, Moldova understands both of the cultures. So it’s the kind of business hub that Europe needs… and Chisinau is now really vibrant.”

Money

Amazon reveals its top ten must-have toys for Christmas including family favourite Lego and Play-Doh

AMAZON has revealed its top 10 toys for Christmas this year including iconic brands like Play-Doh and Lego – but they come with a hefty price tag.

The online giant has tipped a £60 Play-Doh pizza delivery scooter set as being one of the top gifts for kids this year.

As well as a £149.99 LEGO Star Wars Imperial Star Destroyer Starship Building Toy set, which includes seven Lego Star Wars minifigures, including Darth Vader.

The wishlist was handpicked by Amazon experts and it does include cheaper options, including a £7.99 Snackles Surprise Capsule plush soft toy.

Matthew Redfearn, toys category leader at Amazon UK said: “Our Top Ten Toys list has something for all ages, interests and budgets, making it easier to find that perfect gift this holiday season.

“With thousands of glowing customer reviews, people can shop with confidence, knowing that our Top Ten Toys list offers the latest in fun and entertainment.”

Shoppers can get 10% off any toy in the list by visiting – amazon.co.uk/toptentoys2024.

Although, you only have until November 12 to take advantage of the deal.

It’s worth keeping an eye out on Amazon though because prices may drop on Black Friday, which this year takes place on November 25.

Before splashing your cash on these toys, remember to check sites such as Price Spy and Idealo to find out if you can buy items cheaper at another store.

Free online price trackers like Price History and CamelCamelCamel will also give you an idea of whether you can save cash by buying it later in the year.

Here are the top toys Amazon reckons your children will want under the tree this year, in price order starting with the cheapest.

Snackles – £7.99

This ultra-squeezable 12.7cm plush is made from cotton and is bound to but a smile on any kids’ face.

The soft plush is perfect to snuggle with while relaxing at home, watching a movie, or taking a long car or plane ride.

There are 11 Snackles to chose from and each one comes with its own snack including a Krispy Kreme doughnut, Mentos and a tub of Baskins Robins ice cream.

It’s the cheapest item on Amazon’s Christmas list.

We did find this item for sale at Argos for £8, which is just a penny more than at Amazon.

If you chose to visit your local branch of Argos, you could save cash by buying it there instead of Amazon and save on delivery.

Blue Orange Taco Cat Goat Cheese Pizza Card Game – £10

Blue Orange has launched the perfect card game for kids and parents to enjoy on Christmas Day.

This card and word game is a race to see who can slap their hand on the pile of cards in the middle first once there’s a match.

The last one to do so must take them all, so players will want quick to be the first to get rid of all their cards.

Amazon describes the game as “addictive” and “unique”.

We also found this game for sale in Argos and John Lewis for £10, so you could save yourself on delivery by visiting one of these stores.

Simba SCREAMERZ Babbling Bear – £11.99

The ScreamerZ bear has fluffy blue fur, sticking-up ears and crazy big round eyes – but don’t get draw in by his cuteness.

All you have to do is press the toy’s belly gently to hear him let out a little scream.

If you press his belly harder, he will let out a scream at the top of his lungs.

But if you shake it, the ScreamerZ lets out a funny, shaky scream.

Amazon’s price is the lowest on the market, we could only find it on sale at The Entertainer for £15.

Rainbow High Watercolour and Create DIY Fashion Doll – £24.99

Rainbow High Water Colour and Create Brown Eyes Fashion Doll lets you custom your own Rainbow High doll in so many different ways, even with Tie-Dye.

Just add water to the six rainbow-coloured powders to create watercolours, then dip her clothes and hair using the included dual end application sponge.

You can even use the washable watercolours on your own hair.

Repeat play, just wash in soap and water, let dry and start creating again.

We found the same doll on sale for exactly the same price at The Entertainer.

However, we did find it slightly cheaper at Very for £21.99.

Lexibook Disney Stitch, Electronic Diary – £39.99

This beautiful Disney Stitch Electronic Secret Diary is perfect for any stitch fan who wants to closely guard their secrets.

The electronic diary can be locked with a four-digit password and hidden in the diary is a secret compartment with an adorable notebook to store notes away from curious eyes.

With lots of fun features like voice recorder, voice changer, photo frame, or magical sound effects this is a perfect place to store memories.

The only other retailer we could find selling this toy was The Entertainer, and it was marked at the same price as on Amazon.

Hape Marble Run – £48.44

Get ready for some marble madness with this do-it-yourself block set.

You children can build the towers and tracks then send the marbles rolling down through all the tricks, twists and surprises.

The set includes blocks, tracks, slides, marbles, marble trays, a jump, a bell-bucket, a spiral funnel, a ringing bell and a sliding track for your marbles to get through.

But do note that it is only suitable for children aged three and above.

HATCHIMALS Alive, Mystery Hatch Pufficorn – £49.99

This Hatchimals Mystery Egg needs love to hatch.

Cuddle, tap, lift and rock the egg to encourage your character to hatch — the egg lights up and rocks and you’ll even hear the Hatchimal reacting from inside.

Once the egg has been given enough love, it will be ready to hatch.

Magical mist will appear and the egg will glow rainbow colours, building the anticipation.

Inside every Mystery Hatch Hatchimals egg is one of two characters, so the hatching will will be an exciting surprise to see which is revealed.

The Entertainer and Argo are also selling this toy for the same price as Amazon.

Gabby’s Dollhouse – £54.99

The Rainbow Celebration Dollhouse is two-foot-tall and rainbow-themed.

It also comes with a 3.5-inch Gabby Girl figure, dollhouse furniture, and 10 accessories, like a kitty-themed Toilet and a Piano/DJ Table.

You can also Drop deliveries in the delivery tower and press the button to discover secret treasures hidden in the house.

You can also buy separate accessories and dollhouse furniture for the house too, but of course these come separately.

Play-Doh Pizza Delivery Scooter Playset – £59.99

This isn’t just a scooter for children, it’s also a Play-Doh pizza toy that lets them make and deliver their own kitchen creations on wheels.

The stamp and spin action in the toy oven at the back of the scooter makes it fun to make pretend pizza creations again and again.

Box them up and put them in the slot on the side of the scooter for delivery, then sound the horn when it arrives.

The checkout station on the side of the toy scooter has a make-believe credit card reader and moulds to make Play-Doh money.

This toy is also suitable for children aged three and over.

Lego Star Wars Imperial Star Destroyer Starship Building Toy – £149.99

Dominate the galaxy with this Lego Star Wars Imperial Star Destroyer buildable toy starship playset for kids.

Lego said it would make a great Christmas presents for boys, girls and fans aged 10 and up.

The Star Wars starship building toy features a hidden foldout carry handle for flying and two spring-loaded shooters, with a lift-off top panel and foldout side panels for easy access to the detailed interior.

Playful details inside include the bridge, command room, break room, armory, control panels and cargo box with thermal detonator elements.

It also comes with seven Lego Star Wars minifigures, including Darth Vader, Commander Praji and a special Lego Star Wars 25th anniversary minifigure of Cal Kestis.

Hundreds of toys from the must-have list will be donated to families in need in time for Christmas, as part of The Multibank charity initiative, co-founded by former Prime Minister Gordon Brown and Amazon.

The Multibank initiative was initially created to meet the needs of families and individuals living in poverty by taking surplus products donated by businesses and giving them to families in need.

To date, the initiative has donated more than three million items to help over 400,000 families experiencing poverty.

The toys will be delivered on the back of another iconic childhood toy – a life-size toy train, which is on track to tour the UK in the lead up to Christmas, stopping off at Multibank sites including:

- Felix’s Multibank in London

- The Big House Multibank in Scotland

- Cwtch Mawr Multibank in Swansea

- Brick-by-Brick Multibank in Wigan.

How to save money on Christmas shopping

Consumer reporter Sam Walker reveals how you can save money on your Christmas shopping.

Limit the amount of presents – buying presents for all your family and friends can cost a bomb.

Instead, why not organise a Secret Santa between your inner circles so you’re not having to buy multiple presents.

Plan ahead – if you’ve got the stamina and budget, it’s worth buying your Christmas presents for the following year in the January sales.

Make sure you shop around for the best deals by using price comparison sites so you’re not forking out more than you should though.

Buy in Boxing Day sales – some retailers start their main Christmas sales early so you can actually snap up a bargain before December 25.

Delivery may cost you a bit more, but it can be worth it if the savings are decent.

Shop via outlet stores – you can save loads of money shopping via outlet stores like Amazon Warehouse or Office Offcuts.

They work by selling returned or slightly damaged products at a discounted rate, but usually any wear and tear is minor.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

-

Science & Environment2 months ago

Science & Environment2 months agoHow to unsnarl a tangle of threads, according to physics

-

Technology1 month ago

Technology1 month agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 months ago

Science & Environment2 months agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 months ago

Science & Environment2 months ago‘Running of the bulls’ festival crowds move like charged particles

-

Technology2 months ago

Technology2 months agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment2 months ago

Science & Environment2 months agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Money1 month ago

Money1 month agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Sport1 month ago

Sport1 month agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Science & Environment2 months ago

Science & Environment2 months agoPhysicists have worked out how to melt any material

-

Science & Environment2 months ago

Science & Environment2 months agoSunlight-trapping device can generate temperatures over 1000°C

-

News1 month ago

News1 month agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Football1 month ago

Football1 month agoRangers & Celtic ready for first SWPL derby showdown

-

MMA1 month ago

MMA1 month ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

Technology1 month ago

Technology1 month agoGmail gets redesigned summary cards with more data & features

-

Technology1 month ago

Technology1 month agoUkraine is using AI to manage the removal of Russian landmines

-

Business1 month ago

how UniCredit built its Commerzbank stake

-

Science & Environment2 months ago

Science & Environment2 months agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment2 months ago

Science & Environment2 months agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Sport1 month ago

Sport1 month agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Technology1 month ago

Technology1 month agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

News1 month ago

News1 month ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Science & Environment2 months ago

Science & Environment2 months agoLiquid crystals could improve quantum communication devices

-

Technology1 month ago

Technology1 month agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Technology1 month ago

Technology1 month agoSamsung Passkeys will work with Samsung’s smart home devices

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment2 months ago

Science & Environment2 months agoWhy this is a golden age for life to thrive across the universe

-

MMA1 month ago

MMA1 month agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Entertainment1 month ago

Entertainment1 month agoBruce Springsteen endorses Harris, calls Trump “most dangerous candidate for president in my lifetime”

-

Technology1 month ago

Technology1 month agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

News1 month ago

News1 month agoMassive blasts in Beirut after renewed Israeli air strikes

-

News1 month ago

News1 month agoNavigating the News Void: Opportunities for Revitalization

-

MMA1 month ago

MMA1 month ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Sport1 month ago

Sport1 month ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

MMA1 month ago

MMA1 month agoPereira vs. Rountree prediction: Champ chases legend status

-

Technology1 month ago

Technology1 month agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

News1 month ago

News1 month agoRwanda restricts funeral sizes following outbreak

-

Technology1 month ago

Technology1 month agoMicrophone made of atom-thick graphene could be used in smartphones

-

Business1 month ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

TV1 month ago

TV1 month agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Sport1 month ago

Sport1 month agoWXV1: Canada 21-8 Ireland – Hosts make it two wins from two

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum forces used to automatically assemble tiny device

-

Technology1 month ago

Technology1 month agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Business1 month ago

Business1 month agoWater companies ‘failing to address customers’ concerns’

-

News1 month ago

News1 month agoCornell is about to deport a student over Palestine activism

-

Technology1 month ago

Technology1 month agoSingleStore’s BryteFlow acquisition targets data integration

-

Business1 month ago

Business1 month agoWhen to tip and when not to tip

-

News1 month ago

News1 month agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Science & Environment2 months ago

Science & Environment2 months agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Technology2 months ago

Technology2 months agoMeta has a major opportunity to win the AI hardware race

-

Science & Environment2 months ago

Science & Environment2 months agoA slight curve helps rocks make the biggest splash

-

News2 months ago

News2 months ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

MMA1 month ago

MMA1 month agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Football1 month ago

Football1 month ago'Rangers outclassed and outplayed as Hearts stop rot'

-

Science & Environment2 months ago

Science & Environment2 months agoNuclear fusion experiment overcomes two key operating hurdles

-

Sport1 month ago

Sport1 month agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Football1 month ago

Football1 month agoWhy does Prince William support Aston Villa?

-

MMA1 month ago

MMA1 month agoPennington vs. Peña pick: Can ex-champ recapture title?

-

Sport1 month ago

Sport1 month agoPremiership Women’s Rugby: Exeter Chiefs boss unhappy with WXV clash

-

Technology1 month ago

Technology1 month agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

-

News1 month ago

News1 month ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Sport1 month ago

Sport1 month agoShanghai Masters: Jannik Sinner and Carlos Alcaraz win openers

-

Technology1 month ago

Technology1 month agoMusk faces SEC questions over X takeover

-

Sport1 month ago

Sport1 month agoCoco Gauff stages superb comeback to reach China Open final

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology1 month ago

Technology1 month agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Business1 month ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Sport1 month ago

Sport1 month agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

MMA1 month ago

MMA1 month ago‘I was fighting on automatic pilot’ at UFC 306

-

Money4 weeks ago

Money4 weeks agoTiny clue on edge of £1 coin that makes it worth 2500 times its face value – do you have one lurking in your change?

-

Travel1 month ago

World of Hyatt welcomes iconic lifestyle brand in latest partnership

-

News1 month ago

News1 month agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Sport1 month ago

Sport1 month agoWales fall to second loss of WXV against Italy

-

Science & Environment2 months ago

Science & Environment2 months agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment2 months ago

Science & Environment2 months agoNerve fibres in the brain could generate quantum entanglement

-

Business1 month ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Business1 month ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

TV1 month ago

TV1 month agoTV Patrol Express September 26, 2024

-

Sport1 month ago

Sport1 month agoURC: Munster 23-0 Ospreys – hosts enjoy second win of season

-

MMA1 month ago

MMA1 month agoHow to watch Salt Lake City title fights, lineup, odds, more

-

Technology1 month ago

Technology1 month agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

Technology1 month ago

Technology1 month agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Technology1 month ago

Technology1 month agoQuoroom acquires Investory to scale up its capital-raising platform for startups

-

Business1 month ago

Italy seeks to raise more windfall taxes from companies

-

MMA1 month ago

MMA1 month agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

Technology1 month ago

Technology1 month agoThe best shows on Max (formerly HBO Max) right now

-

Technology1 month ago

Technology1 month agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

Sport1 month ago

Sport1 month agoNew Zealand v England in WXV: Black Ferns not ‘invincible’ before game

-

Science & Environment2 months ago

Science & Environment2 months agoHow to wrap your mind around the real multiverse

-

News2 months ago

News2 months ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Business1 month ago

‘Let’s be more normal’ — and rival Tory strategies

-

Business1 month ago

The search for Japan’s ‘lost’ art

-

MMA1 month ago

MMA1 month agoKevin Holland suffers injury vs. Roman Dolidze

-

Sport1 month ago

Sport1 month agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

MMA1 month ago

MMA1 month agoUFC 307’s Ketlen Vieira says Kayla Harrison ‘has not proven herself’

-

News1 month ago

News1 month agoTrump returns to Pennsylvania for rally at site of assassination attempt

-

Technology4 weeks ago

Technology4 weeks agoThe FBI secretly created an Ethereum token to investigate crypto fraud

-

Business1 month ago

Business1 month agoStocks Tumble in Japan After Party’s Election of New Prime Minister

-

Technology1 month ago

Technology1 month agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Technology1 month ago

Technology1 month agoOpenAI secured more billions, but there’s still capital left for other startups

You must be logged in to post a comment Login